Knowledge Center Technical Analysis

Candlestick Patterns

Dark Cloud Cover and Piercing pattern

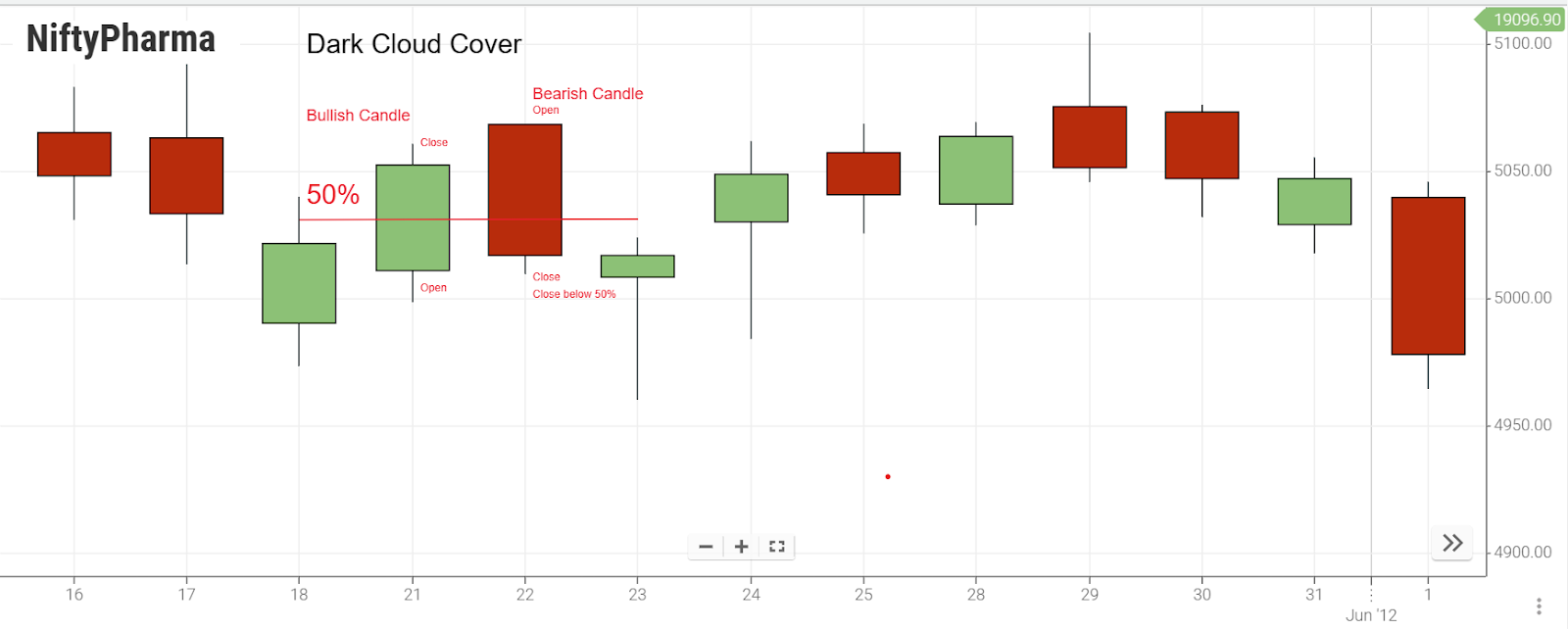

Dark Cloud Cover Candlestick Pattern

The Dark Cloud Cover is identified by a two-candle formation during an upward market trend. The initial candle reflects bullish momentum with a significant body, suggesting robust buying activity. However, the subsequent candle reveals a change in sentiment. It opens at a price higher than the previous bullish candle, creating a gap, but closes below the midpoint of the first candle’s body. This shift indicates that sellers have gained control over buyers in that period, potentially foreshadowing a decline in prices in the subsequent periods.

How is the Dark Cloud Cover candlestick pattern formed?

The dark cloud cover candlestick pattern emerges when a bullish candle is succeeded by a bearish candle the following day, accompanied by a 'gap up'—an abrupt shift in the stock price chart without any intervening trades.

Traders assess the formation of the dark cloud cover based on the following criteria:

-

Presence of an existing uptrend initially.

-

The bullish candle should have a significant length, indicating the potential strength of the reversal.

-

A gap appeared in the bearish candle on the subsequent day.

-

Formation of the bearish candle.

-

Closure of the bearish candle below the midpoint of the preceding bullish candle.

Additionally, both candles should feature large bodies and minimal or no shadows. Large candles signify increased trader participation, while small candles diminish the pattern's significance. Confirmation of the pattern occurs when a third-day bearish candle follows the initial bearish candle. If the price doesn't decline further on the third day, the pattern may fail.

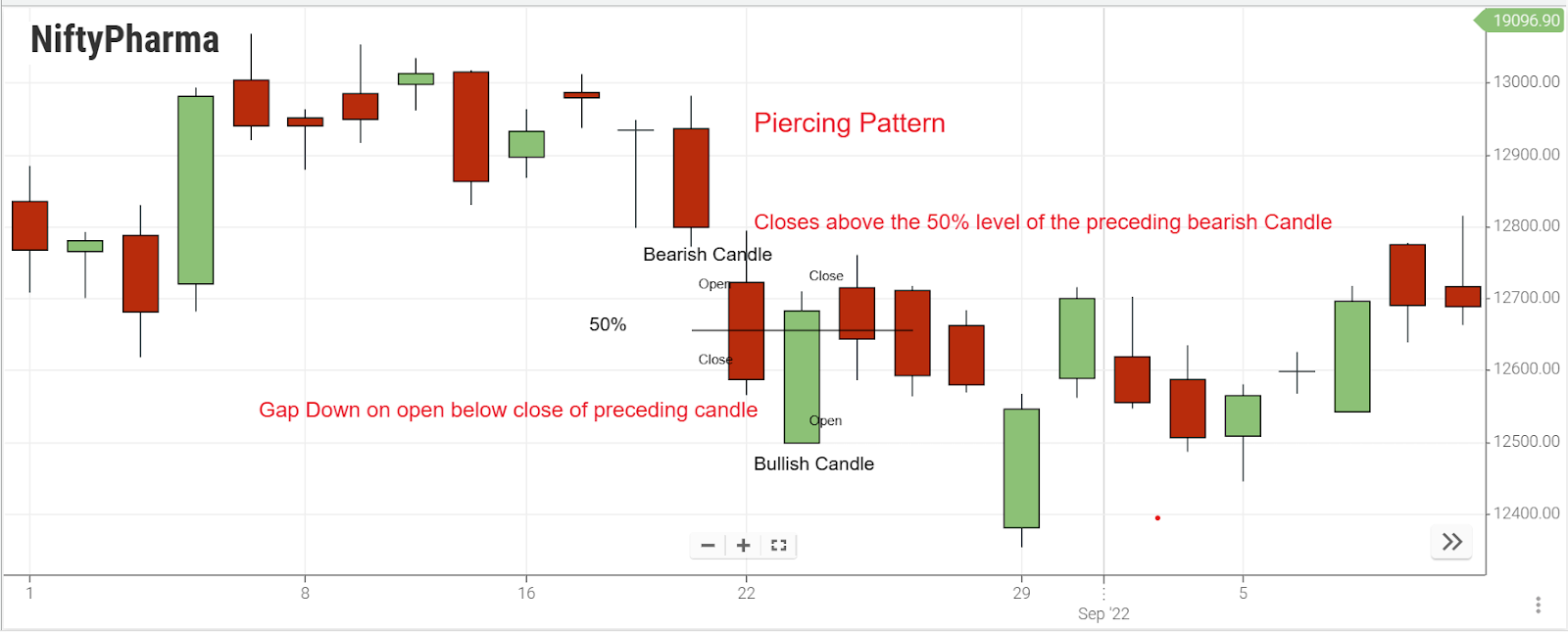

Piercing Candlestick Pattern

The piercing line candlestick pattern, a bullish formation, emerges following an extended bearish trend, often signaling a potential uptrend continuation. It denotes market indecision at support levels, with bulls eventually overpowering bears to drive prices higher.

Formation Criteria:

-

First Candle: Significantly longer than the second, ranging from 1/3rd to 2/3rds of its predecessor or successor candles.

-

Second Candle: The body either fully overlaps or nearly overlaps with the first candle's body.

-

The third Candle: The candle forms between the two and features a large real body, closing well into or just above its real body. Ideally, has an upper shadow halfway through the session.

Analyzing Dark Cloud Cover and Piercing Patterns

Traders should exercise patience and observe the upcoming price movement:

-

Exit Point: Consider exiting if the subsequent candlestick is bearish.

-

Entry Point: Look for entry opportunities if the succeeding candlestick is bullish.

For an effective trading strategy, it is advisable to blend various patterns and indicators to enhance decision-making.

Key Takeaways: Dark Cloud Cover and Piercing Pattern

Dark Cloud Cover:

-

Two-candle formation in an uptrend.

-

Initial bullish candle with a strong body.

-

The subsequent bearish candle opens higher, creating a gap, and closes below the first candle.

-

It indicates a shift to seller control, suggesting a potential price decline.

Piercing Pattern:

-

Bullish formation after a bearish trend.

-

Shows market indecision at support, with bulls prevailing.

-

Criteria include a significantly longer first candle and a second candle overlapping the first.

-

Effective trading involves patience, monitoring for bearish or bullish signals, and combining patterns for informed decisions.

Frequently Asked Questions

-

How do I trade the Dark Cloud Cover formation?

-

Identify an uptrend.

-

Look for a red bearish candle gapping above the previous green one.

-

Confirm bearish sentiment with the bearish candle closing below the midway point of the bullish one.

-

Place a sell order at the next candle's opening after the setup.

-

Set a stop loss above the recent swing high.

-

Target key levels or recent support areas.

-

What is the Piercing Line Candlestick Pattern?

The Piercing Line is a bullish candlestick pattern formed after a bearish trend. It consists of two candles, with the second opening lower than the first and closing higher, piercing the top of the initial candle's body. This pattern suggests a potential uptrend continuation.

-

What is the dark cloud cover pattern?

The Dark Cloud Cover is a bearish candlestick pattern occurring during an uptrend. It consists of two candles. The first is bullish, showing strong buying activity. The second opens higher, creating a gap, and closes below the midpoint of the first candle. This signals a potential reversal, indicating sellers are gaining control and increasing the likelihood of a price decline.

-

What is a bullish piercing line?

The bullish piercing line is a two-candlestick pattern observed after a downtrend. It indicates a potential trend reversal and is characterized by a bearish candle followed by a bullish one. The bullish candle opens below the previous candle's close but closes above its midpoint, signaling a shift toward a bullish trend.

-

How do the piercing line and dark cloud cover patterns differ?

The piercing line indicates bullish sentiment within a downtrend, while the dark cloud cover signals bearish sentiment within an uptrend. They represent opposing market conditions.