Sensex, Nifty sink nearly 2 pc on surging crude oil prices, West Asia

Ponmudi R, CEO of Enrich Money, an online trading and wealth tech firm, said. Advt. In Asian markets, South Korea's Kospi tumbled 5.96 per cent, and Japan's

Nifty at 22,900? How deep can the index fall if US-Iran war persists

Ponmudi, CEO of Enrich Money, said the Nifty is currently showing a classic ... (What's moving Sensex and Nifty Track latest market news, stock tips

TThe Economic Times

March 9, 2026 at 08:07 PM

Sensex, Nifty Plunge on Oil Surge, West Asia Turmoil - BSE - Rediff

Ponmudi R, CEO of Enrich Money, an online trading and wealth tech firm, said. In Asian markets, South Korea's Kospi tumbled 5.96 per cent, and Japan's

RRediff

March 9, 2026 at 08:07 PM

Nifty at 22,900? How deep can the index fall if US-Iran war persists

Ponmudi, CEO of Enrich Money, said the Nifty is currently showing a classic ... (What's moving Sensex and Nifty Track latest market news, stock tips

TThe Economic Times

March 9, 2026 at 08:07 PM

Sensex, Nifty sink nearly 2 per cent on surging crude oil prices, West

Ponmudi R, CEO of Enrich Money, an online trading and wealth tech firm, said. In Asian markets, South Korea's Kospi tumbled 5.96 per cent, and Japan's

TThe Tribune

March 9, 2026 at 09:07 PM

Stock market today: Which are the top gainers and losers on March

Ponmudi R, CEO of Enrich Money, an online trading and wealth tech firm. The weakness was also reflected across Asian markets. South Korea's Kospi plunged

TThe Times of India

March 9, 2026 at 08:55 PM

Stock Market Crashes: 2,400 Points Plunge in Brutal Sell-Off

Ponmudi R, CEO of Enrich Money, echoed similar views, advising investors to ... Latest News · Powerful Women's Day 2026: 5 Equality Gaps Remain. Post

AAsom Barta

March 9, 2026 at 11:02 AM

Sensex Nifty Dive: Crude Oil Surge & West Asia Tension Hit

Ponmudi R, CEO of Enrich Money, an online trading and wealth tech firm ... Latest News · US, Israel strike Iran Live Updates | Putin offers 'unwavering

DDeccan Herald

March 9, 2026 at 08:52 PM

Nifty at 22,900? How deep can the index fall if US-Iran war persists

Ponmudi, CEO of Enrich Money, said the Nifty is currently showing a classic ... (What's moving Sensex and Nifty Track latest market news, stock tips

TThe Economic Times

March 9, 2026 at 08:52 PM

Stock Market Today March 9, 2026: Sensex tanks 1,353 points - Rediff

Ponmudi R, CEO of Enrich Money, an online trading and wealth tech firm, said. ... More News Coverage. sensexniftystock marketcrude oil pricesgeopolitical

Wwww.rediff.com

March 9, 2026 at 09:01 PM

Today Forecast

Pre-Market Outlook

2026-03-0907:01 AM

Indian equity markets are expected to open on a cautious note as persistent geopolitical tensions in the Middle East continue to keep crude oil prices elevated and global risk sentiment fragile. Investor confidence remains guarded following last week’s sharp correction across global and domestic equity markets. While steady inflows from Domestic Institutional Investors (DIIs) are providing a key support base and partially offsetting selling pressure from Foreign Portfolio Investors (FPIs), the broader market mood remains defensive.

Gift Nifty is signaling a potential gap-down opening for the Nifty, tracking sharp declines across Asian markets. Japan’s Nikkei 225 has fallen more than 6%, while South Korea’s Kospi is also down over 6%, reflecting a strong risk-off sentiment across the region. This broad weakness in Asian equities could weigh on Indian markets at the opening bell and keep volatility elevated in the early part of the session.

In the near term, the market is likely to remain volatile and range-bound with a downside bias unless geopolitical tensions ease, crude oil prices stabilize, or supportive macroeconomic triggers emerge to restore investor confidence.

Nifty 50

The Nifty 50 continues to remain in a short-term corrective phase following last week’s breakdown and is currently trading below its key short-term moving averages, including the 20-day, 50-day and 100-day EMAs. The index is still struggling to reclaim the important psychological level of 25,000, indicating that selling pressure continues to dominate near higher levels. Immediate support for the index is placed in the 24,300–24,200 zone, which has historically attracted buying interest. A decisive breakdown below this range could open the door for a further decline toward the 23,800 region. If selling pressure intensifies further, the next major horizontal support level is seen near the 22,000 mark, which may act as a broader structural support for the index.

On the upside, near-term resistance is placed in the 24,600–24,700 range, while a stronger resistance zone remains near 24,900–25,000. A sustained move above this region would be required to improve the short-term technical structure and signal the possibility of a meaningful recovery.

Momentum indicators continue to reflect weakness. The Relative Strength Index (RSI) is currently hovering near 33, approaching oversold territory but not yet showing a clear reversal signal. At the same time, the MACD remains in negative territory, indicating that bearish momentum continues to dominate the current trend. The index is expected to trade with a cautious bias in the near term unless it manages to decisively reclaim its immediate resistance levels.

Bank Nifty

Bank Nifty is also displaying relative weakness amid prevailing market pressure and cautious investor positioning in the financial sector. A breakdown below the 57,700 level could expose the index to further downside toward the 57,000 support region. If this support fails to hold, the next significant horizontal support level is seen near the 54,000 mark, which could act as a broader demand zone.

On the upside, immediate resistance is placed in the 58,300–58,500 range, while the key psychological level of 59,000 continues to act as a strong overhead barrier. A decisive reclaim of this zone would be necessary to signal a stronger recovery in the banking index and improve the near-term outlook.

Momentum indicators remain subdued. The RSI is hovering around 32, indicating that the index is approaching oversold territory but still lacks clear reversal confirmation. Meanwhile, the MACD remains in negative territory, reflecting persistent bearish undertones. Overall, Bank Nifty is likely to remain range-bound with a mild negative bias in the near term, with any recovery attempts dependent on sustained buying above key support levels.

Ponmudi R, CEO of Enrich Money

Today Nifty Outlook

NIFTY50

Today Bank Nifty Outlook

BANK NIFTY

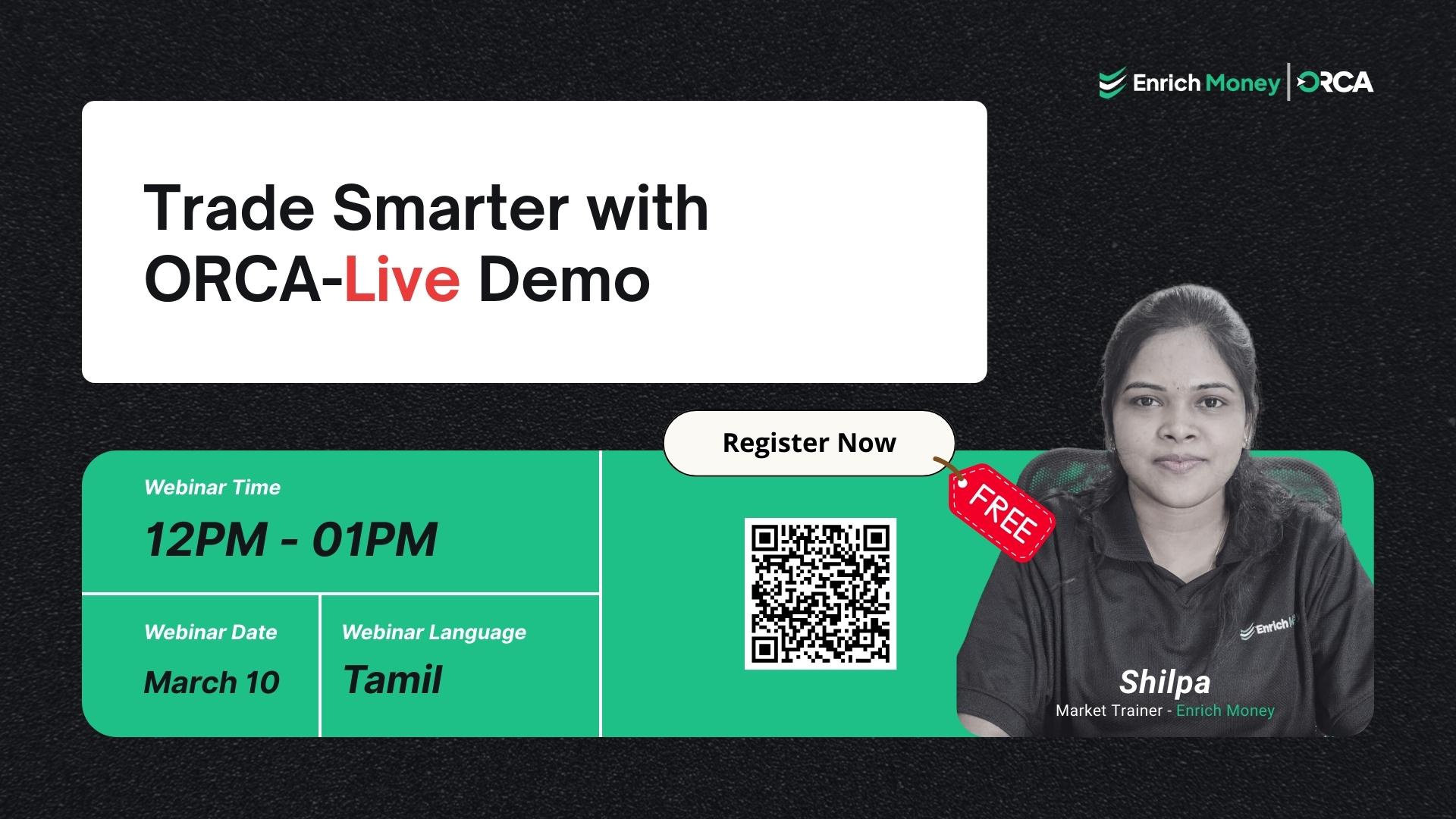

Upcoming Webinars

View All

Trade Smarter with ORCA – Live Demo

Free

Tamil

10 Mar 202612:00PM

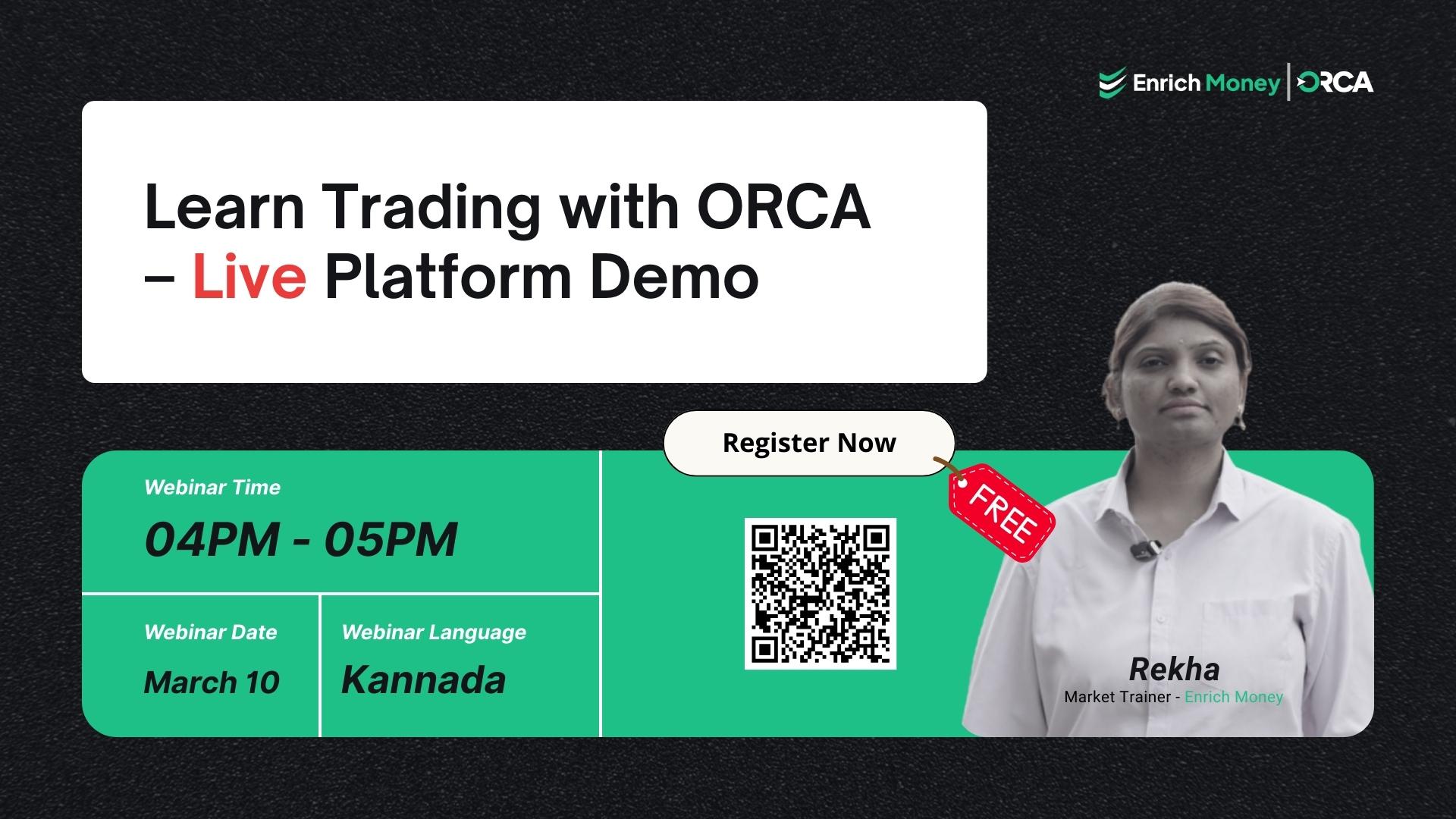

Learn Trading with ORCA – Live Platform Demo

Free

Kannada

10 Mar 20264:00PM

Market Trend Analysis – എങ്ങിനെ trend മനസ്സിലാക്കി Buy & Sell ചെയ്യാം?

Free

Malayalam

10 Mar 20265:00PM

Trade Smarter with ORCA – Live Demo

Free

Tamil

11 Mar 20263:00PM

Send all media enquiries to

digitalmarketing@enrichmoney.in