-1773375585189.webp)

-1773375585189.webp)

Stock Market Continues Losing Streak On High Crude Price

Latest NewsIndiaWorldEntertainment · News · Movie Reviews · OTT · Lifestyle ... Ponmudi R, CEO of Enrich Money. Also In News

Gold Slides Below 1.60 Lakh, Silver Dips Marginally Amid Crude

Ponmudi R, CEO of Enrich Money. Gold and Silver Rates In International Market. The bullion prices saw a marginal decline in the international market as well

TThe Daily Jagran

March 13, 2026 at 10:45 AM

Rupee Hits Record Low Of 92.37 Against Dollar: How It May Impact

Ponmudi R, CEO of Enrich Money, said the rupee continues to face pressure ... Latest News · India · Movies · World · Politics · Viral · Auto · Tech · Videos

NNews18

March 13, 2026 at 11:45 AM

Explained: Why traders aren't holding onto gold since Middle East

Ponmudi R, CEO of Enrich Money. Tired of too many ads? Remove Ads. Second ... Latest News. MORE; Quote of the day by Albert Einstein: 'Man invented the

TThe Economic Times

March 13, 2026 at 09:35 AM

Friday the 13th haunts Nifty bulls again! What's the link between

Ponmudi R, CEO of Enrich Money, said. On the downside, 23,300 emerges as the ... (What's moving Sensex and Nifty Track latest market news, stock tips

TThe Economic Times

March 13, 2026 at 10:30 AM

Stock market: Sensex plunges 698 pts, Nifty ... - BusinessToday.In

Ponmudi R, CEO of Enrich Money ... Disclaimer: Business Today provides stock market news for informational purposes only and should not be construed as investment

BBusiness Today

March 13, 2026 at 09:22 AM

Gold rate today in India above ₹1.60 lakh amid no signs of de

Outlook for gold price today. On a suggestion to gold investors, Ponmudi R, CEO of Enrich Money, said that after recently touching record highs, the metal has

Mmint

March 13, 2026 at 09:36 AM

Stock market today: Trade setup for Gift Nifty, US-Iran war to oil, gold

By 7:30 AM, the Gift Nifty index is trading 70 points upside at 23,564. Decoding the Gift Nifty Live chart and other triggers, Ponmudi R, CEO of Enrich Money,

Mmint

March 13, 2026 at 07:40 AM

Nifty may shed another 150 points at open - The HinduBusinessLine

According to Ponmudi R, CEO of Enrich Money, the deepening crisis in West ... News. Business News Companies News Markets News Economy News Forex News

BBusinessLine

March 13, 2026 at 07:19 AM

West Asia conflict continues to weigh down India's stock indices

Ponmudi R, CEO of Enrich Money, a SEBI - registered online trading and wealth tech firm, said Indian equity markets traded in a cautious range during the

IIndia's News

March 12, 2026 at 11:00 PM

Today Forecast

Pre-Market Outlook

2026-03-1307:28 AM

Indian equity markets are expected to open with a sharp gap-down and trade with a weak undertone, reflecting heightened global risk aversion and growing geopolitical uncertainty. The deepening crisis in the Middle East, with no clear signs of de-escalation from any of the parties involved, has intensified concerns over potential disruptions to crude oil supply routes if the conflict persists, particularly through the Strait of Hormuz, one of the world’s most strategically important energy corridors. These developments have pushed energy prices higher and driven the Indian rupee to a record low against the US dollar.

Crude oil prices have surged sharply, with Brent crude once again approaching the $100 per barrel mark, as markets begin pricing in the possibility of supply disruptions. For India, which imports more than 85% of its crude oil requirements, sustained strength in oil prices poses a significant macroeconomic challenge. Higher oil prices typically widen the current account deficit, increase inflationary pressure, weaken the Indian rupee, and raise operating costs for sectors heavily dependent on energy such as aviation, logistics, chemicals, and manufacturing.

Global markets have also reflected the risk-off sentiment. U.S. equities closed sharply lower overnight, with the Dow Jones falling 1.56%, the S&P 500 declining 1.52%, and the Nasdaq losing 1.78% as investors shifted toward safer assets amid geopolitical uncertainty and inflation concerns linked to rising energy prices.

European markets also ended in negative territory, while early Asian trade remains weak with Japan’s Nikkei declining around 1.4–1.5% and South Korea’s Kospi trading lower, indicating broad caution across global markets.

Foreign Institutional Investors have remained consistent net sellers in the Indian market during March, reflecting global portfolio rebalancing and a shift toward safer assets. While Domestic Institutional Investors continue to provide partial support through steady buying, persistent FII outflows continue to weigh on overall market sentiment.

The near-term outlook for Indian equities remains closely tied to geopolitical developments, crude oil price trends, and institutional investor flows, which are expected to keep market volatility elevated and maintain a cautious to bearish bias in the short term.

Strait of Hormuz Crisis: What It Means for India’s Oil Supply

While global markets are reacting sharply to the geopolitical tensions around the Strait of Hormuz, it is important to understand how India’s oil supply chain functions before assuming any immediate fuel shortage risk.

India currently consumes around 5.5–5.6 million barrels of crude oil per day, and approximately 85–89% of this requirement is imported. To meet this demand, large crude oil tankers regularly arrive at Indian ports such as Mumbai, Kandla, Paradip, Kochi, and Visakhapatnam.

Under normal circumstances, India receives around 2–4 large crude oil tankers every day, with each vessel typically carrying 1–2 million barrels of crude oil depending on its size.

Oil marketing companies such as Indian Oil, BPCL, HPCL, and Reliance place long-term supply contracts and spot orders months in advance. As a result, India usually receives around 60–80 tanker cargoes every month, with roughly half arriving from Middle Eastern producers through the Strait of Hormuz, while the remainder comes from Russia, Africa, and the United States through alternative routes.

Currently, shipping movement around the Strait of Hormuz has slowed due to security concerns, which has triggered a sharp reaction in oil prices. However, if vessels are allowed safe passage, ships that are already near the strait can reach Indian ports within 1–3 days, while newly loaded cargoes from Gulf producers typically reach India within 5–10 days.

Once a tanker reaches an Indian port, the unloading process generally takes 24–36 hours. The crude oil is then transported to refineries through pipelines or coastal movement, where it is processed into petrol, diesel, aviation fuel, and other petroleum products.

The refining process typically takes 2–5 days, after which the fuel is distributed through pipelines, railways, and tanker trucks to depots and petrol pumps across the country. In total, the process from ship arrival to fuel availability at pumps usually takes around 5–10 days.

India also maintains a significant energy buffer. The country currently holds around 25 days of crude oil reserves and another 25 days of refined fuel stocks, along with strategic petroleum reserves, giving India a total supply cushion of approximately 50–60 days even without fresh imports.

Therefore, while the geopolitical situation is creating volatility in oil prices and financial markets, there is no immediate risk of fuel shortages in India. The key concern for markets at this stage is higher oil prices and their potential impact on inflation, the rupee, and corporate costs, rather than any disruption to fuel availability.

In simple terms, the market is reacting to price risk rather than supply risk. If shipping movement normalizes and tankers resume their regular flow through the Strait of Hormuz, oil supply to Indian refineries could stabilize within a couple of weeks, easing some of the pressure currently reflected in global financial markets.

Technical Outlook

NIFTY 50

Nifty 50 is expected to open sharply lower, with Gift Nifty indicating a gap-down opening near the 23,450–23,500 zone. The index is currently hovering near the 23,600 level, which is acting as an important near-term support. A decisive breakdown below this level could extend the decline toward the 23,300–23,000 region.

If selling pressure continues and the index forms fresh lower lows, the next major structural support emerges near the 22,500 zone, where a broader rising trendline support is positioned. This level could potentially slow the pace of the decline and lead to a period of consolidation while global markets assess the evolving geopolitical situation.

On the upside, the 23,800 zone now acts as the immediate resistance, and only a sustained recovery above this level could signal short-term stabilization. Momentum indicators continue to reflect weakness. The Relative Strength Index (RSI) is around 28, indicating oversold conditions, but there is still no clear confirmation of a reversal. Meanwhile, the MACD remains deep in negative territory, highlighting persistent bearish momentum in the broader trend. Nifty is likely to trade volatile with a downside bias unless key resistance levels are decisively reclaimed.

Bank Nifty

Bank Nifty is also expected to trade with a negative bias, continuing its recent underperformance amid sustained selling pressure in banking stocks. On the downside, 54,700 acts as the immediate support, and a break below this level could accelerate the decline toward the 54,000–53,500 zone. On the upside, the 55,600–55,700 range stands as the immediate resistance, while 56,000 remains a stronger hurdle that must be reclaimed to signal any meaningful recovery.

Momentum indicators remain weak in the banking space as well. The RSI is hovering near 27, indicating oversold territory, while the MACD continues to deepen in negative territory, reflecting persistent bearish pressure.

Ponmudi R, CEO of Enrich Money

Today Nifty Outlook

NIFTY50

Today Bank Nifty Outlook

BANK NIFTY

Upcoming Webinars

View All

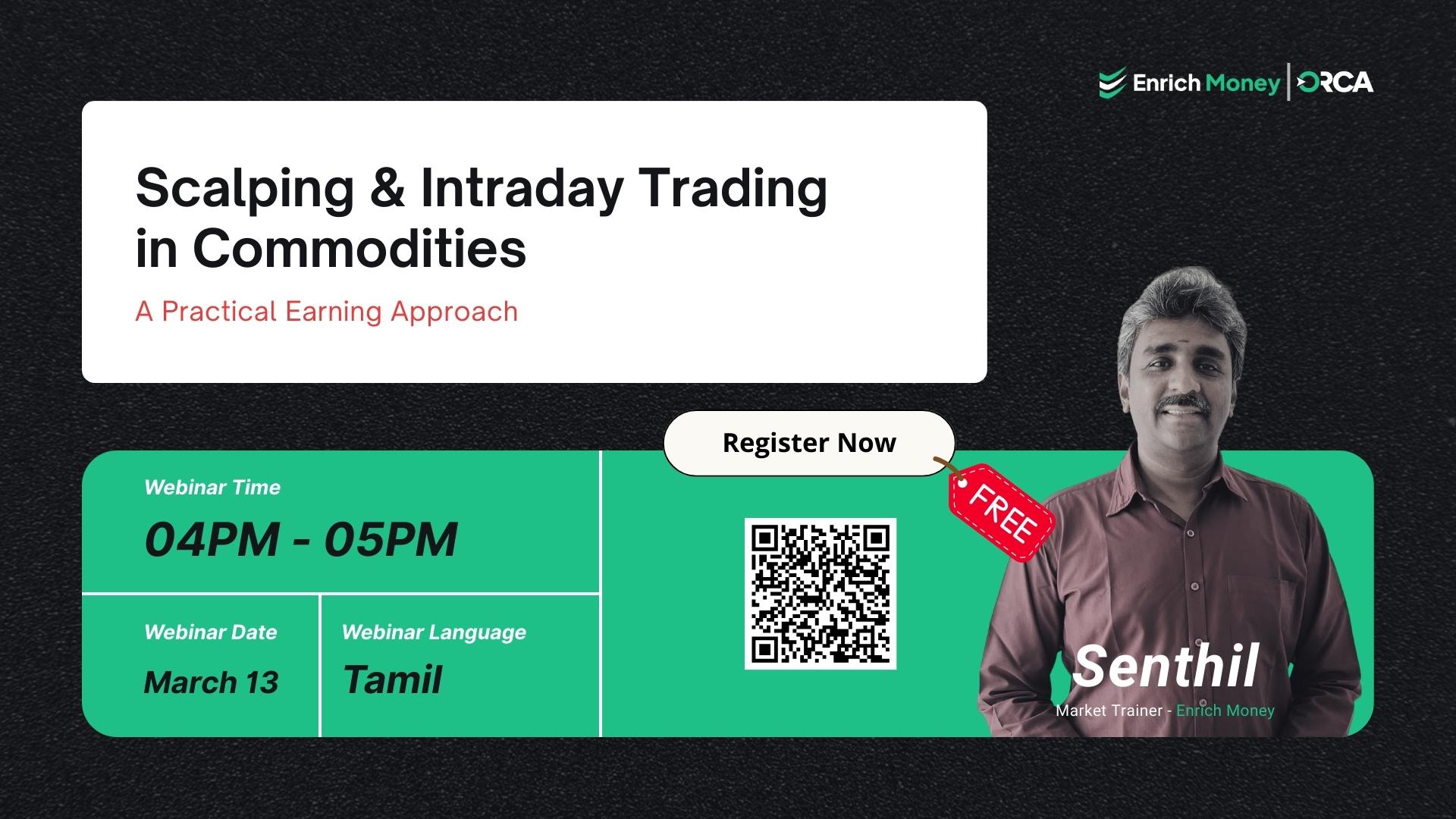

Scalping & Intraday Trading in Commodities – A Practical Earning Approach

Free

Tamil

13 Mar 20264:00PM

All-in-One Investing with ORCA: Stocks, ETFs, Gold & More

Free

Malayalam

13 Mar 20265:00PM

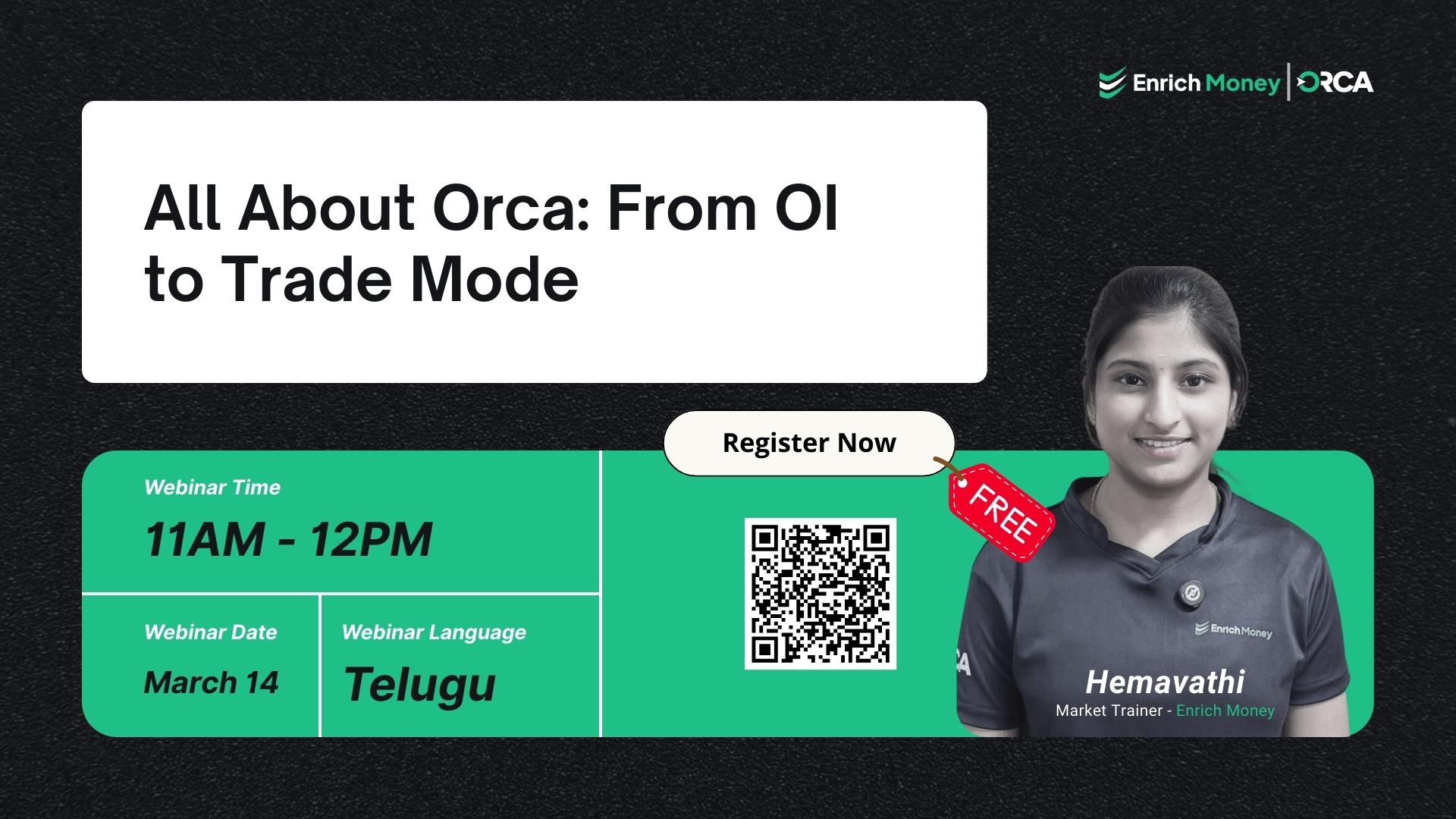

All About Orca: From OI to Trade Mode

Free

Telugu

14 Mar 202611:00AM

How to draw levels in chart

Free

Tamil

14 Mar 202611:00AM

Send all media enquiries to

digitalmarketing@enrichmoney.in