Knowledge Center Technical Analysis

Candlestick Patterns

Bearish Engulfing and Bullish Engulfing Patterns

An engulfing pattern serves as a robust signal for market reversal, displaying both bullish and bearish variations, each composed of two distinct candlesticks—a bullish one followed by a bearish one. For an engulfing pattern to be valid, three key criteria must be met:

-

Confirm a short-term uptrend or downtrend for a valid engulfing pattern, avoiding sideways markets.

-

Ensure the first candlestick's body is smaller than the second.

-

The second candlestick must fully engulf the preceding one, with its body opposite in direction to the first candlestick.

It's important to note that a more powerful engulfing pattern emerges when the entire body of the second candle engulfs the complete range of the preceding day, from its highest to lowest points. While engulfing only the body still signals a potential reversal, encompassing the full range provides a more compelling indication.

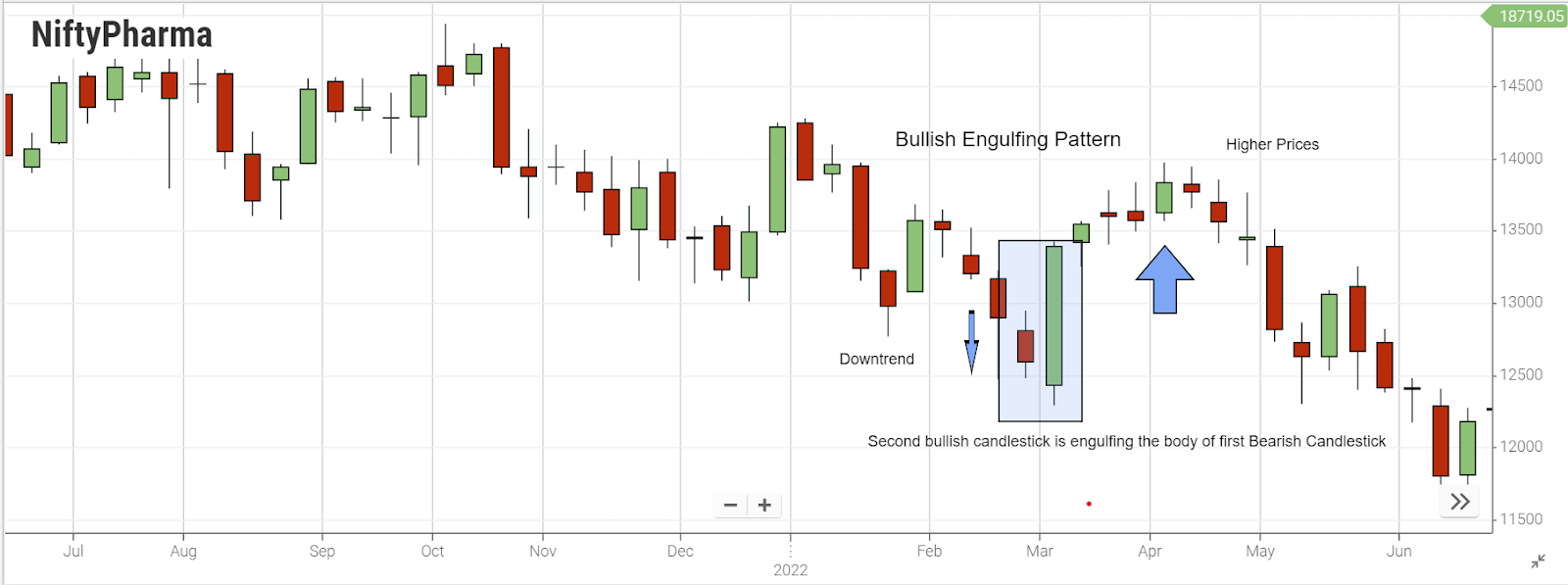

Bullish Engulfing Pattern

The bullish engulfing candle serves as a signal for reversing a downtrend, signifying an increase in buying pressure when observed at the downtrend's bottom.

This pattern prompts a reversal in the prevailing trend as more buyers enter the market, driving prices upward.

Comprising two candles, the pattern features a second green candle that entirely engulfs the body of the preceding red candle.

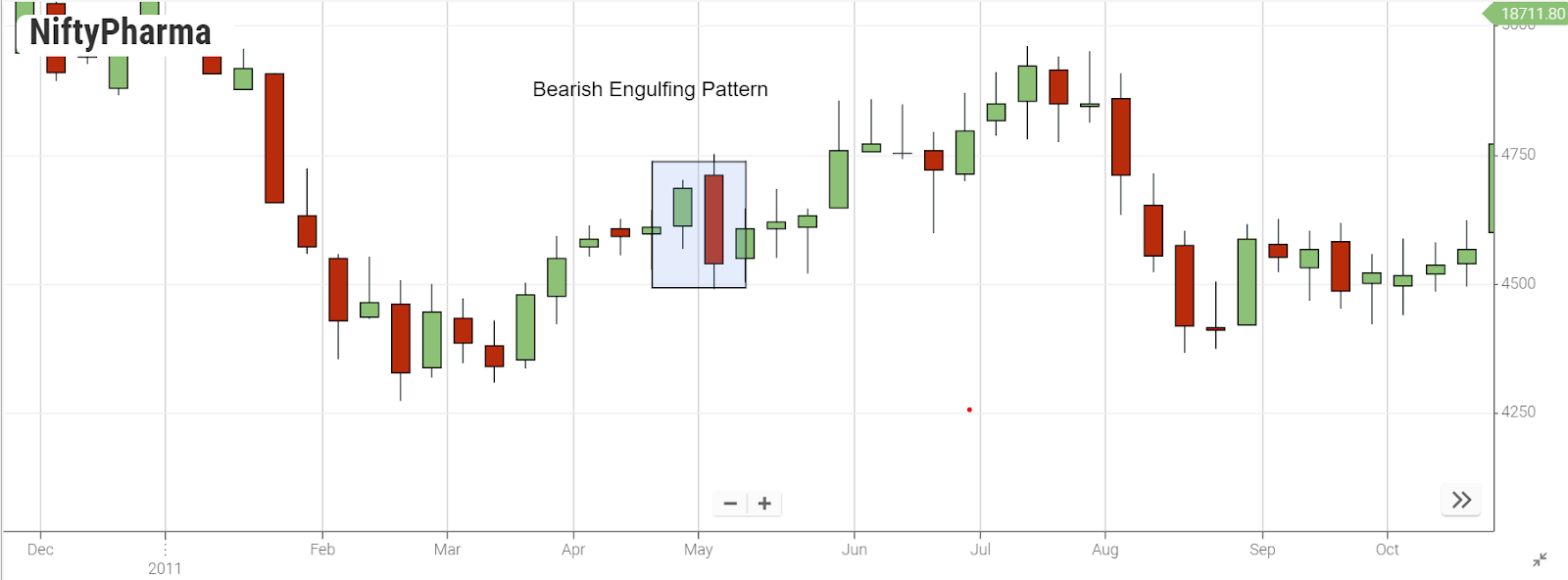

Bearish Engulfing Pattern

The bearish engulfing pattern contrasts with its bullish counterpart, indicating a reversal of the uptrend and a descent in prices driven by selling pressure when situated at the uptrend's peak.

This pattern initiates a shift in the existing trend as additional sellers enter the market, causing prices to decline. It involves two candles, with the second bearish candle fully engulfing the body of the preceding green candle.

Insights on Bullish and Bearish Engulfing Patterns for Traders:

-

Trend Continuation: Engulfing patterns indicate the continuation of the current trend. For instance, a bullish engulfing pattern in an uptrend suggests the trend will persist.

-

Reversals: These patterns signal trend reversals. A bullish engulfing at the downtrend's bottom signals an uptrend reversal, while a bearish engulfing at the uptrend's top signals a downtrend reversal.

-

Exit Strategy: Engulfing patterns can serve as signals to exit positions when a trader holds a buying or selling position in a trend that is concluding.

Trading Example for Bullish Engulfing Pattern and Bearish Engulfing Pattern

Illustrated below is a practical application of executing a bullish engulfing pattern trade in the daily chart of Reliance Industries.

It's crucial to keep in mind the following considerations when engaging in trading with the bullish engulfing pattern:

-

Prior Trend: Recognize that the preceding trend is a downtrend.

-

Pattern: Confirm that the second candlestick is bullish and entirely engulfs the body of the first candlestick.

-

Stop Loss: Position the stop loss below the low where the bullish engulfing pattern occurs.

-

Confirmation of the Pattern: Ensure the signals from this pattern are validated by other technical indicators; for instance, in this example, we incorporate the Relative Strength Index (RSI).

Similarly, when trading with the Bearish Engulfing pattern, consider the following points:

-

Prior Trend: Observe that the preceding trend is an uptrend.

-

Pattern: Ensure the second candlestick is bearish and fully engulfs the body of the first candlestick.

-

Stop Loss: Position the stop loss below the high where the bearish engulfing pattern occurs.

-

Confirmation of the Pattern: Remember to validate signals from this pattern with other technical indicators for enhanced confirmation.

Nutshell

-

Both patterns serve for trend identification.

-

The bearish engulfing pattern is utilized as an entry point.

-

The bullish engulfing pattern functions as an exit point.

-

A well-rounded trading strategy involves combining different patterns and indicators.

Frequently Asked Questions

-

What is the difference between a bearish engulfing pattern and a bullish engulfing pattern?

A bearish engulfing pattern signals a potential reversal of an uptrend, while a bullish engulfing pattern suggests a reversal of a downtrend.

-

How is a bearish engulfing pattern identified in candlestick analysis?

It is recognized by the second candlestick being bearish and fully engulfing the body of the preceding bullish candlestick.

-

Can you explain the characteristics of a bearish, engulfing candlestick?

A bearish engulfing candlestick is marked by its larger size, fully covering the prior bullish candlestick and indicating increased selling pressure.

-

What is the significance of a bullish, engulfing candlestick pattern?

A bullish engulfing candlestick pattern signifies a potential reversal of a downtrend, indicating a rise in buying pressure at the bottom of the trend.

-

How do I recognize a bullish, engulfing candlestick pattern?

Look for the second candlestick to be bullish and fully engulf the body of the preceding bearish candlestick.