Budget 2024 Breakdown: Spotlight on Growing Sectors

The unveiling of Budget 2024 brings forth a promising era for economic development, as the interim budget lays out pivotal proposals aimed at invigorating various sectors. The comprehensive plan encompasses significant boosts for housing, railways, microfinance, energy, tourism, and defense. These strategic initiatives are expected to foster growth, generate employment, and fortify the foundation of our nation's economy.

Sectoral Analysis of Budget 2024

A sector-wise split of the budgeted expenditure in FY25 provides a visual representation, where the size of the rectangle corresponds to the proposed spending. The color spectrum signifies changes in a sector's share compared to FY24, with deeper blues indicating an increase and deeper reds signaling a decrease. This graphical representation aids in comprehending the budget reallocations and their potential implications on different sectors.

As we delve into the intricacies of Budget 2024, it is imperative to scrutinize the sector-wise allocation, revealing which areas have emerged as victors and which have faced a downturn.

Housing Sector

One of the standout features of Budget 2024 is the dedicated housing scheme tailored for the middle class. Enabling easier access to home ownership and construction, this initiative is poised to have a cascading positive effect on the economy. The ripple effect will be felt across ancillary industries connected to housing, making it a catalyst for growth. Companies like HUDCO, LIC Housing Finance, PNB Housing, Aptus Value Housing, and NBCC are primed to thrive under the umbrella of this housing-centric boon.

Railways

The railway sector is poised for significant advancement under the provisions of the interim budget for 2024. This includes the introduction of three new corridors: the energy, mineral & cement corridor, port connectivity corridor, and high-traffic density corridor. To further bolster this momentum, the conversion of 40,000 normal rail bogies to the Vande Bharat standard is anticipated. Manufacturers such as Texmaco Rail, Jupiter Wagons, Titagarh Rail, Siemens, and Rail Vikas Nigam are well-positioned to capitalize on the opportunities generated by these strategic initiatives.

Microfinance

The budgeted expenditure in FY25 reveals an expansion of the Lakhpati Didi Scheme, with the target raised from 20 million to 30 million. This strategic move is anticipated to have a positive impact on the rural economy, leading to an increased demand for credit among microfinanciers. The empowerment initiative not only catalyzes economic growth in rural areas but also augments the credit demand for microfinance institutions. Stocks such as ESAF Small Fin Bank, CreditAccess Grameen, Ujjivan Financial Services, Equitas Small Finance Bank, and Fusion Micro are strategically positioned to reap medium-term benefits from these developments.

Energy

In the context of the Union Budget 2024-25, around 10 million households are scheduled to benefit from 300 units of complimentary electricity through the rooftop solar scheme, marking a significant stride towards sustainable energy practices. Collaborative efforts among state-run power entities, including NTPC, NHPC, Power Grid, and SJVN, are poised to propel the adoption of rooftop solar installations. Stocks such as Tata Power, Borosil Renewable, Waaree Renewables, Websol Energy System, IREDA, and Sterling & Wilson emerge as potential beneficiaries of this environmentally conscious initiative.

Tourism

Budget 2024 places a strong emphasis on promoting tourism by incentivizing states to develop tourism destinations. The provision of interest-free loans to states for tourism promotion is expected to create local opportunities and benefit companies in the travel, tourism, and hospitality sectors. Hotels, IRCTC, EaseMyTrip, Yatra Online, and Mahindra Holidays are poised to harness the potential created by these measures.

Defense

In a strategic move to bolster national security and promote local procurement, Budget 2024 allocates Rs 6.2 lakh crore to the defense sector. This marks a 4.4% increase from the FY24 budgeted allocation, showcasing the government's commitment to strengthening our defense capabilities. Companies like HAL, Bharat Dynamics, Bharat Forge, Bharat Electronics, Data Patterns, and Astra Microwave stand to gain from this heightened focus on defense expenditure.

Which sectors are experiencing significant uplift?

In the analysis of budgeted expenditure for FY25 across 26 sectors, 15 experienced a decline in allocation as a share of the total budget, while the remaining 11 sectors witnessed an increase when compared to FY24's revised estimates.

Interest Payments maintain an indisputable dominance, securing a substantial share of the total budget. With an allocation of Rs. 11,90,440 crore, interest payments constitute a formidable 24.98% of FY25's total budget, signaling a noteworthy 1.48 percentage point increase from FY24 (23.5%). This resounding commitment underscores the government's dedication to meeting its financial obligations.

Transport and Defence, while witnessing a slight dip in their share of the total budget, continue to command robust absolute allocations. The Defence sector's allocation, forming 9.54% of FY25's total budget, reflects a manageable 0.61 percentage point decrease from FY24 (10.15%). Similarly, the Transport sector's allocation constitutes a substantial 11.42% of FY25's total budget, showcasing a modest 0.27 percentage point decrease from FY24 (11.69%). Despite these fractional declines, these sectors remain pivotal recipients of governmental funds.

Strategic sectors encompassing Rural Development, IT and Telecom, Health, Energy, Education, Social Welfare, Scientific Departments, Health, Urban Development and Planning, and Statistics witness incremental increases in their share of the total budget. This strategic reinforcement emphasizes the government's forward-looking stance, positioning these sectors for sustained growth and development.

Sectors facing setbacks:

The Fertilizer Subsidy sector faces a notable reduction, recording the most significant drop among its counterparts. Constituting 3.44% of FY25's total budget, it experiences a noteworthy 0.77 percentage point decrease from FY24 (4.21%). This reduction prompts a closer examination of potential challenges for the agriculture sector, warranting scrutiny of its implications for both farmers and fertilizer manufacturers.

Food Allocation, another sector grappling with a considerable decrease, forms 4.31% of FY25's total budget. This marks a noticeable 0.42 percentage point drop from FY24 (4.73%). The declining allocation for food raises pertinent questions about its potential impact on food security and welfare programs, necessitating a thorough evaluation of strategies in place to address ensuing challenges.

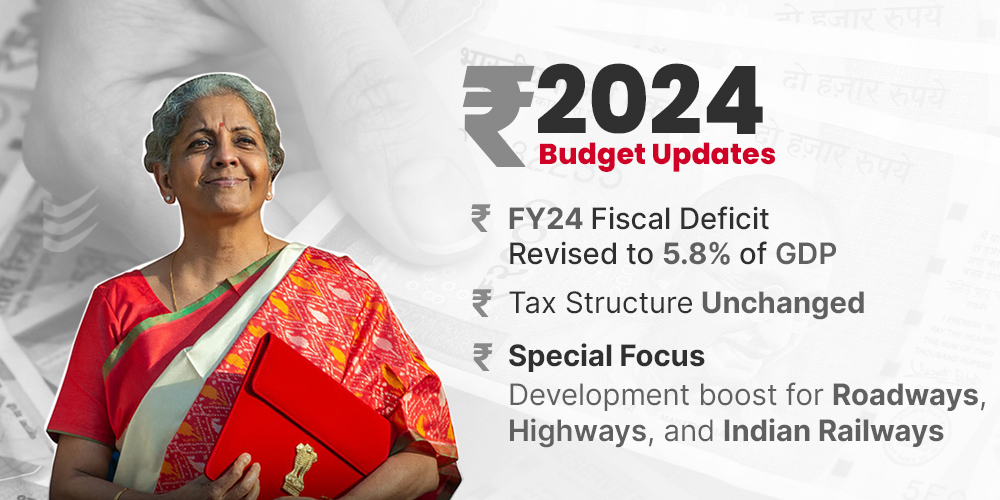

Key Fiscal Highlights and Targets of Budget 2024

1. Capex Increase:

-

-

The government raises the capital expenditure target by 11.1% to Rs. 11.11 lakh crore for FY25, constituting 3.4% of the GDP.

-

Planned capex for FY24 initially set at Rs. 10 lakh crore; however, the revised estimate (RE) now stands at Rs. 9.5 lakh crore.

-

2. Fiscal Deficit Dynamics:

-

-

Budgeted fiscal deficit for FY24 reduced to 5.8% from the estimated 5.9%.

-

Target for 2024-25 fixed at 5.1%, aiming for a deficit below 4.5% by 2025-26.

-

3. Divestment Goals:

-

-

Government sets a divestment target of Rs. 50,000 crore for FY25.

-

Revised disinvestment target for the current fiscal year is Rs. 30,000 crore, down from the initial Rs. 51,000 crore.

-

4. Tax Regime Stability:

-

-

The corporate tax rates persist at 22% for existing domestic companies and 15% for specific new manufacturing companies.

-

Individuals with an income of up to Rs. 7 lakh bear no tax liability under the new tax regime.

-

Revised tax receipts for FY24 at Rs. 23.24 lakh crore; budget estimate for FY25 is Rs. 26.02 lakh crore.

-

Government announces withdrawal of outstanding direct tax demands, benefiting individuals up to Rs. 25,000 for FY10 and up to Rs. 10,000 for FY11-FY15.

-

5. Expenditure Overview:

-

-

Revised Estimate of total expenditure for FY24 is Rs. 44.90 lakh crore.

-

Budget estimate for total expenditure for FY25 projected at Rs. 47.66 lakh crore, reflecting government expenditure estimates.

-

Conclusion

In summary, Budget 2024 charts a course for comprehensive economic growth, addressing various pivotal sectors essential for the nation's advancement. The anticipated ripple effect of these initiatives is poised to cultivate an environment of prosperity and development across diverse industries.

This in-depth sectoral analysis unveils the complex tapestry of budgetary choices, highlighting the government's astute strategy in fiscal management and economic priorities. The trajectory of each sector, whether on an upward trajectory or encountering challenges, adds to the overarching narrative of Budget 2024 and its impact on the nation's economic panorama.

Frequently Asked Questions

-

What sectors receive significant focus in Budget 2024?

Budget 2024 places substantial emphasis on key sectors such as housing, railways, microfinance, energy, tourism, and defense, outlining strategic initiatives for their growth and development.

-

Are there sectors facing challenges in Budget 2024?

Yes, sectors like the fertilizer subsidy and food allocation encounter reductions in their budget share, prompting a closer examination of potential challenges for agriculture and food security.

-

How does Budget 2024 support middle-class housing?

It introduces a dedicated scheme for the middle class, easing access to home ownership and construction, stimulating economic growth.

-

What's the focus on sustainable energy in Budget 2024?

The budget targets 10 million households for free electricity under the rooftop solar scheme, promoting sustainable practices.

-

How does Budget 2024 empower rural areas?

The Lakhpati Didi Scheme expansion aims to boost the rural economy, increasing credit demand among microfinanciers for sustained growth.

Disclaimer: This blog is dedicated exclusively for educational purposes. Please note that the securities and investments mentioned here are provided for informative purposes only and should not be construed as recommendations. Kindly ensure thorough research prior to making any investment decisions. Participation in the securities market carries inherent risks, and it's important to carefully review all associated documents before committing to investments. Please be aware that the attainment of investment objectives is not guaranteed. It's important to note that the past performance of securities and instruments does not reliably predict future performance.