Knowledge Center Technical Analysis

Moving Averages

Time Series Forecast

The Time Series Forecast indicator, monitors the fluctuations of selected data points, such as a security's price, across a defined time span, capturing data at consistent intervals and predicts future stock prices. There's no strict requirement for a minimum or maximum duration, enabling the collection of data tailored to the specific information sought by investors or analysts studying the activity.

The time forecast indicator stands out as a widely employed tool in technical analysis, employed by both seasoned professionals and novice investors in their trading endeavours. While it doesn't guarantee infallibility, when utilized appropriately, the Time Series indicator proves to be a valuable asset. It can assist in forecasting price changes, identifying buy or sell signals, and discerning potential market trends. Time Series Forecasting represents a set of discrete-time data, proficiently anticipating forthcoming values by relying on observations from earlier data points.

Understanding Time Series

A time series can be applied to any variable undergoing changes over time. In the realm of investing, it is customary to employ a time series to monitor the evolution of a security's price. This tracking can span short-term intervals, like the hourly fluctuations in a security's price throughout a business day, or extend to the long term, such as observing the closing price of a security at the end of each month over a five-year duration.

The utility of time series analysis forecasting lies in its ability to reveal the dynamics of changes in assets, securities, or economic variables across time. It serves as a valuable tool not only to understand the evolution of a chosen data point but also to scrutinize how these changes correspond to shifts in other variables over the same timeframe.

An example of time series forecasting is predicting the future stock prices of a company based on historical stock price data. Let's say you have daily closing prices of a particular stock for the past several months. Using time series forecasting methods, such as time series moving averages, exponential smoothing, or more advanced techniques like ARIMA trading strategy (Auto Regressive Integrated Moving Average), you can analyze the historical data to create a model that forecasts the future closing prices.

For instance, if the stock prices have shown a consistent upward trend during certain periods and a cyclic pattern corresponding to certain market conditions, a time series forecasting model could potentially predict the future stock prices by taking into account these historical patterns. This forecasting can aid investors and traders in making informed decisions about buying or selling stocks based on the anticipated price movements.

How Does It Work?

Time Series Forecasting is a very common technique in Finance and it can stand for ‘TSF’.

The TSF indicator, also known as moving linear regression, shares similarities with a moving average. It involves a linear regression calculation that utilizes the least square fit method to plot the current regression value for each bar.

For instance, a TSF value covering a 15-day period mirrors the value of a 15-day Time Series Forecast. The key distinction from the Linear Regression indicator lies in the fact that the Linear Regression Forecast indicator doesn't incorporate the slope into the final value of the regression line.

Time series forecasting can be applied in various ways:

-

Predicting a future value of a variable based on its past values.

-

Predicting past values given their future values.

-

Assessing the impact of a set of variables on another variable (impulse response functions).

-

Evaluating how another variable influences a set of variables (forecast error variance decomposition).

Interpretation of Time Series

The interpretation of a Time Series Forecast closely resembles that of a moving average. However, the Time Series Forecast indicator holds two distinct advantages over traditional moving averages.

In contrast to a moving average, the Time Series Forecast demonstrates less delay when adapting to price fluctuations. Due to its nature of "fitting" itself to the data rather than averaging them, the Time Series Forecast proves to be more responsive to changes in price.

As the name implies, the Time Series Forecast can be employed to predict the price in the upcoming period. This prediction is grounded in the trend of the security's prices over the specified period (e.g., 20 days). If the current trend persists, the Time Series Forecast value serves as an estimate for the price in the next period.

Consider an instance, when prices deviate from the Time Series Prediction line, investors may anticipate reverting to it. A possible purchase signal might be formed when the price is close to the bar, and a potential sell signal could be generated when the price is far away. However, how much the price must deviate from the line is highly variable.

Consider the Time Series Forecasting stock prices for Nickel 15 minutes chart. First, you need to obtain a list of all closing prices for the stock with a 15 minutes interval and list them in chronological order. By this you can obtain a closing price time series for the Nickel stock. The yellow line is drawn representing the long linear regression trendlines.

Formula

The form of the best-fit line corresponding to the n points (x1, y1), (x2, y2), . . ., (xn, yn) is as follows:

y = mx + b

Here,

m – slope

b – y-intercept, here it is the stock price.

Time Series Forecasting Model

There are many models for Time Series Forecasting:

• Moving Average Model

• Exponential Smoothing Model

• ARIMA Model (Auto Regression Integrated Moving Average)

Moving Average Model

-

The Moving Average Model is a widely used time series analysis tool in the Indian stock market.

-

It calculates the average of a specified number of past data points to identify trends and smooth out fluctuations.

-

Traders often use moving average time series forecasting to generate buy or sell signals based on crossovers with the stock's current price.

-

Common types include Simple Moving Average (SMA) and Exponential Moving Average (EMA).

-

Understanding moving averages in time series assists investors in making informed decisions by highlighting potential shifts in stock price trends.

Time Series Moving Average formula is:

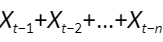

![]()

Where:

-

SMAt is the simple moving average at time t.

-

are the data points for the previous n periods.

are the data points for the previous n periods.

This formula calculates the average of the last n data points at each time point t in a time series.

Exponential Smoothing Model

-

The Exponential Smoothing Model is a forecasting technique widely applied in the Indian stock market for its adaptability to changing trends.

-

It assigns exponentially decreasing weights to past observations, giving more importance to recent data.

-

This model is particularly useful for capturing short-term fluctuations and responding quickly to market changes.

-

Alpha, the smoothing parameter, controls the influence of recent observations, with higher values placing more emphasis on recent data.

-

Investors employ Exponential Smoothing to make more responsive predictions, enhancing their ability to navigate the dynamic Indian stock market.

ARIMA Model

-

The ARIMA (AutoRegressive Integrated Moving Average) model is a powerful time series forecasting tool widely used in the Indian stock market.

-

ARIMA combines autoregressive (AR), differencing (I), and moving average (MA) components to capture and predict complex patterns in stock prices.

-

Investors often apply ARIMA to identify trends, seasonality’s, and cyclic patterns in historical stock data.

-

The model requires tuning parameters such as p (autoregressive order), d (differencing order), and q (moving average order) for optimal performance.

-

ARIMA modelling enhances predictive capabilities, aiding investors in making more informed decisions in the dynamic environment of the Indian stock market.

Pros and Cons of Time Series Forecasting Models

Moving Average Models:

Pros:

-

Simple Implementation: Moving average models are straightforward to implement and understand, making them accessible for beginners.

-

Smoothing Effect: They provide a smoothing effect that can help highlight underlying trends by reducing noise in the data.

Cons:

-

Lagging Indicators: Moving averages are lagging indicators, meaning they might not quickly reflect sudden changes or shocks in the data.

-

Limited Predictive Power: They may not capture complex patterns or seasonality in the data.

Exponential Smoothing Models:

Pros:

-

Adaptability to Trends: Exponential smoothing models adapt to changing trends, making them suitable for datasets with evolving patterns.

-

Weighted Recent Data: They assign higher weights to recent observations, making them responsive to recent changes in the data.

Cons:

-

Sensitivity to Initial Conditions: These models can be sensitive to the initial conditions, and small changes in initial values may affect forecasts.

-

Limited Handling of Non-Linear Patterns: They may not perform well when the time series exhibits non-linear patterns.

ARIMA (AutoRegressive Integrated Moving Average) Models:

Pros:

-

Versatility: ARIMA models are versatile and can handle a wide range of time series data, including those with trend and seasonality.

-

Statistical Framework: They have a solid statistical framework, and their parameters can be interpreted.

Cons:

-

Parameter Selection: ARIMA models require careful selection of parameters (p, d, q), which can be challenging and might need expertise.

-

Assumption of Stationarity: They assume that the time series data is stationary, and pre-processing steps like differencing may be necessary.

Choosing the appropriate model depends on the specific characteristics of the time series data and the forecasting goals. Combining these models or using more advanced techniques, such as machine learning algorithms, is also common to enhance forecasting accuracy.

Considerations for Time Series Forecast

• Check if your data has seasonality. Some stocks tend to perform better during certain months or seasons of the year.

• Check if your data has a trend in it. The direction means a constant increase or decrease in the value over some time.

• Check if there is any noise in your data. Noise means random fluctuations in data that cannot be attributed to anything specific.

Summary

A time series is essentially a dataset that systematically records the evolution of a sample over successive intervals. It serves as a valuable tool for understanding the factors that impact specific variables across different periods. Time series analysis proves beneficial in examining the dynamic changes in assets, securities, or economic variables over time. Forecasting techniques employing time series find application in both fundamental and technical analysis, enhancing predictive insights. It's worth noting that while cross-sectional data is typically considered the counterpart to time series, in practice, these two forms of data analysis are frequently employed in conjunction to provide a comprehensive understanding of trends and patterns.

Frequently Asked Questions

How to do stock market forecasting using time series analysis?

-

Collect historical stock price data.

-

Apply time series analysis techniques like moving averages or ARIMA models to identify patterns.

-

Use the insights gained to forecast future stock prices and make informed investment decisions.

What is the moving average in time series?

A moving average in time series is a statistical calculation that smoothens fluctuations by averaging data points over a specified window, highlighting trends. It is commonly used to identify patterns, reduce noise, and generate insights into the overall direction of the data. Common types include Simple Moving Average (SMA) and Exponential Moving Average (EMA).

How does the Time Series Forecast (TSF) indicator differ from traditional moving averages?

While similar to moving averages, the TSF indicator incorporates a linear regression calculation, making it more responsive to changes in stock prices. It predicts the future value based on the trend over a specified period, demonstrating less delay compared to traditional moving averages.

What is the Time Series Forecast indicator in stock market analysis?

The Time Series Forecast indicator is a tool used in technical analysis to predict future stock prices based on historical data patterns. It captures fluctuations in data, such as a security's price, over a defined time span, assisting investors and analysts in forecasting price changes and identifying trends.

What distinguishes Time Series Forecasting from other forecasting techniques?

Time Series Forecasting focuses on predicting future values by analyzing past data points at consistent intervals. It stands out in the stock market for its versatility, accommodating various time spans and providing valuable insights into potential market trends.