Knowledge Center Fundamental Analysis

Fundamentals Of Trading

Intraday Trading Strategies

Overview

Intraday trading strategy involves leveraging technical analysis, implementing risk management with stop-loss orders, and focusing on liquid stocks for quick buy-and-sell opportunities within the same trading day.

Technical Analysis: Intraday traders often use technical indicators and chart patterns to predict short-term price movements.

Risk Management: Setting stop-loss orders and adhering to a risk-reward ratio is crucial to limit potential losses.

Liquidity Focus: Intraday traders prefer liquid stocks to ensure ease of buying and selling within the same trading day, capitalizing on small price movements for profits.

Best Intraday Trading Strategy

Intraday trading demands precise timing and market insight. A successful strategy relies on technical analysis, practical execution, indicator utilization, and effective risk management. Here, we present intraday trading strategies suitable for beginners, offering a pathway to start trading. Consistent practice can lead to expertise, but it's crucial to back intraday trades with stop-loss limits for risk mitigation. Discovering a trading style aligned with personal requirements and temperament is essential. Explore the list of successful trading strategies tailored for the Indian market.

Momentum Trading Strategy

Momentum trading is one of the best intraday strategy, as it capitalizes on market momentum by identifying stocks before significant trend changes. Traders make buying or selling decisions based on factors like news, takeovers, and quarterly earnings, adjusting their portfolios accordingly. Quick decision-making is crucial due to share price fluctuations driven by external factors, and the duration of holding shares depends on the market's momentum.

Momentum trading involves opening positions based on the strength of price movements, focusing on stocks with daily fluctuations of around 25-35%. Stock scanners are used to identify these moving stocks, and the strategy relies on the premise that a strong price move is likely to continue in the same direction. Momentum can be influenced by catalysts like earnings or occur as a technical breakout without fundamental support. Traders aim for a profit-to-loss ratio of 2:1 and may hold stocks for minutes, days, or hours, depending on the rate of movement. This strategy is most effective during early trading hours or when the trading volume is high, offering opportunities for substantial gains.

Breakout Trading Strategy

The breakout market strategy is also a best trading strategy for intraday which entails entering the market when prices exceed their resistance and support levels, identified using technical indicators like volume patterns. Breakouts require swift entries and exits, with traders relying on strong signals preceding impulsive market movements. Breakouts occur when prices impulsively break out of established ranges, providing quick trading opportunities. Despite its effectiveness, this strategy is risky as opportunities for buying diminish once the breakout concludes.

Reversal Trading Strategy

This strategy for intraday trading carries a high level of risk as it involves making investment decisions counter to the prevailing market trend through analysis and calculations. Reversal Trading, also known as Pull Back Trading, revolves around betting against the current price trends of stocks in anticipation of a reversal. In this intraday strategy, traders seek stocks at extreme highs and lows, anticipating a potential reversal. Once a security's movement reverses, a stop is set, and traders await maximum fluctuation before executing a trade based on the estimated reversal value.

A reversal in trading signifies a shift in the direction of an asset's price, and the trend reversal strategy is employed by both day traders and long-term investors to time market entries or exits. Traders executing reversal trades analyze price actions using tools like trend lines and trading channels, incorporating technical indicators such as moving averages (MA) and moving average convergence divergence (MACD) to identify and isolate potential reversals.

Compared to other strategies, reversal trading is more intricate, demanding extensive market knowledge from intraday traders. Accurately identifying pullbacks and strengths adds an additional layer of complexity to this approach.

Scalping Trading Strategy

The scalping trading strategy involves capitalizing on small price changes to achieve financial gains, particularly favoured by intraday traders dealing with commodities and frequently employed in high-frequency trading. In this technique, the significance lies more in price action than in fundamental or technical setups. Individuals adopting this intraday trading strategy should select liquid and volatile stocks, emphasizing the implementation of stop-loss orders for risk management.

Scalping is the best strategy for intraday in the Forex market, emphasizing minor price changes with a focus on precise timings due to the strategy's brief trade durations. While it carries inherent risks, the scalping strategy seeks small gains from incremental price fluctuations, aiming to accumulate profits over time rather than pursuing high-risk ventures. The effectiveness of this strategy relies on the gradual accumulation of gains, illustrating its reliance on the snowball effect rather than a one-time significant win.

Moving Average Crossover Trading Strategy

The moving average crossover strategy is a successful intraday trading strategy in India, signifying changes in momentum when stock prices move above or below the moving average. An uptrend occurs when share prices surpass the moving average, prompting recommendations for entering long positions or buying stocks. Conversely, a downtrend is observed when stock prices fall below the moving average, prompting traders to enter short positions or sell shares.

This strategy involves the occurrence of a moving average crossover, where two distinct moving average lines intersect. While this technique may not precisely capture tops and bottoms due to the lagging nature of moving averages, it serves as a valuable tool for identifying major trends. The crossover system provides specific triggers for potential entry and exit points, offering opportunities to enter the market or exit positions. Although effective in volatile or trending environments, the crossover strategy may not perform as well during ranging price scenarios. In summary, moving average crossovers assist in recognizing emerging trends or signalling the potential conclusion of existing trends.

Gap and Go Trading Strategy

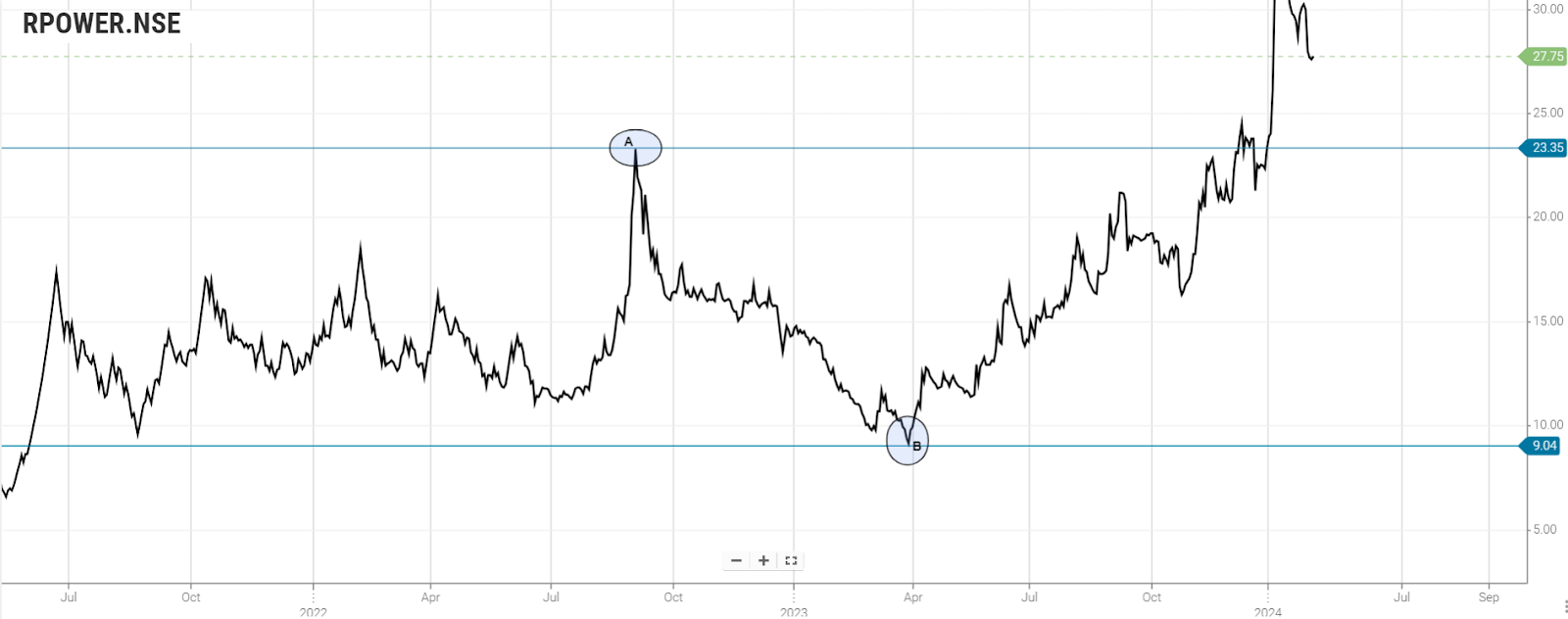

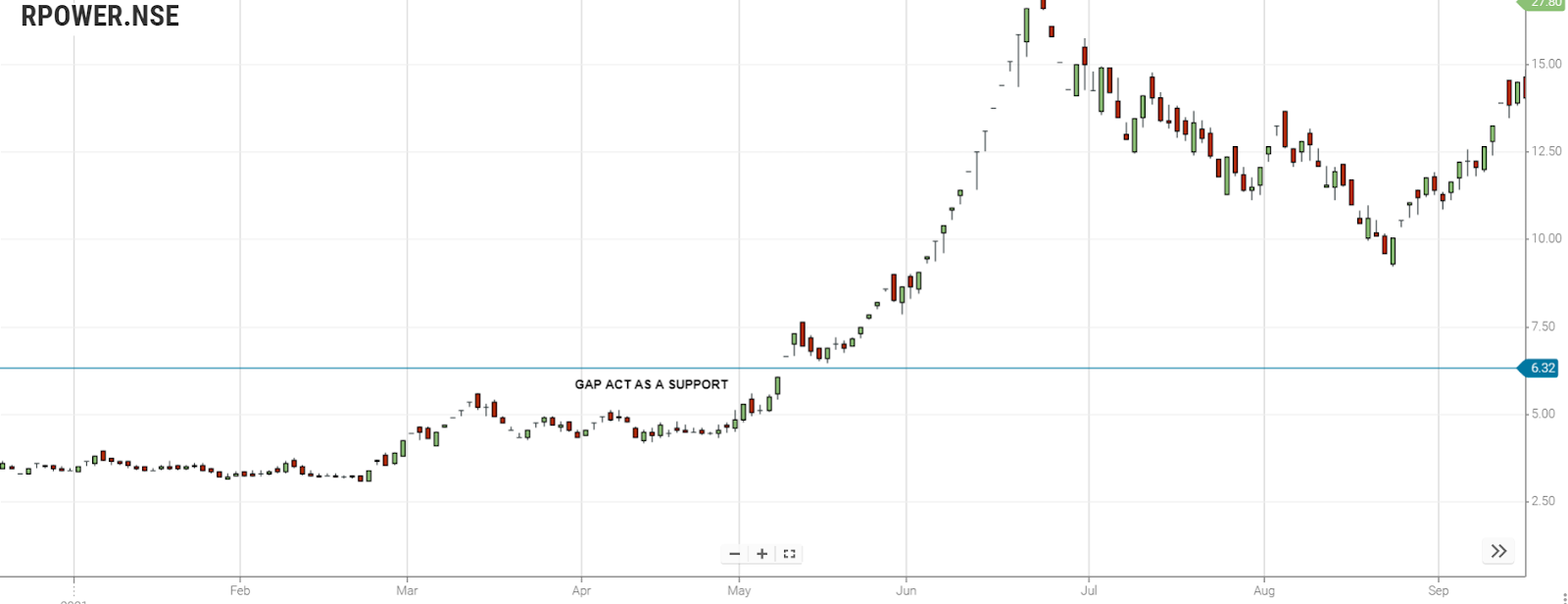

The Gap-and-Go strategy, often regarded as the best strategy for intraday trading, involves identifying stocks with no pre-market volume, creating a gap between the opening price and the previous day's closing price.

When a stock opens higher than the previous day's close, it's a gap up, while a lower opening is a gap down. Intraday traders employing this strategy purchase stocks anticipating the gap to close before the market closes.

Gap up signifies the stock opening higher than the previous close, and gap down indicates the opposite. This strategy targets gapers—points on the stock chart where no trading has occurred due to factors like news, earnings announcements, or a trader's altered strategy. Successful gap trading involves using a pre-market scanner to find stocks with volume in the premarket, making this approach popular among day traders who seek gapping stocks each morning.

Bull Flag Trading Strategy

The bull flag pattern, serving as a continuation chart pattern, supports the extension of an uptrend. Price action consolidates between two parallel trend lines, counter to the uptrend, before breaking out and resuming the upward trajectory.

Unlike the bear flag that occurs in a downtrend, the bull flag is inherently bullish. A flagpole forms during a robust price movement in a specific direction. Once the resistance line is breached, a new movement begins, propelling stocks forward. Bull flags exhibit initial intensity due to the breakout, catching bears off guard.

Characterized by a robust initial price movement followed by a pullback forming parallel high and low patterns, the bull flag formation is a time-consuming process. The development of both upper and lower lines contributes to the gradual emergence of the bull flag pattern.

Pull Back Trading Strategy

A pullback is one among the intraday trading methods which occurs when there is a movement in the opposite direction of a long-term trend, and the pullback strategy serves to protect traders from losses while aligning with the trend. This trading approach is specifically designed for stocks exhibiting significant strength and trading with high relative volume.

It's essential to distinguish a pullback from a trend reversal. In the pullback strategy, weaknesses are leveraged for buying opportunities, and strengths are capitalized upon for selling. An opportune moment to buy a pullback is typically right after a breakout. Pullbacks tend to be relatively short-lived, lasting only a few trading sessions, whereas a reversal indicates a more profound shift in market sentiment.

Pivot Point Trading Strategy

A pivot point strategy proves advantageous in situations involving critical support and resistance levels, especially in the forex market. This intraday trading technique is particularly valuable for range-bound traders as an entry approach and offers insights for breakout traders to identify breakout levels.

A pivot point represents a level where market sentiment transitions from bullish to bearish, and vice versa. When the price surpasses the initial support or resistance, market expectations often lean towards a movement to the second level.

In essence, pivot points serve as crucial tools employed by seasoned professionals to anticipate price movements, determine take-profit and stop-loss levels, and pinpoint potential areas of support and resistance. They constitute integral instruments in the toolkit of many professional day traders.

CFD (Contracts for Difference) Trading Strategy

Intraday trading demands considerable expertise for profit generation, but trader-friendly instruments like CFDs offer simplicity and ease of use. CFD, or contracts for difference, represents the difference between the entry and exit points in a trade.

CFDs serve as derivative products allowing speculation on various global markets such as forex, commodities, indices, and shares without the need to own the underlying asset. Leveraged in nature, CFDs enable access to positions with a small deposit, known as margin.

However, it's crucial to recognize that profit and loss are calculated based on the full position size, making leverage a factor that can amplify both gains and losses, potentially exceeding deposits for individual positions. Despite associated risks, dedicating time to enhancing your knowledge can provide a significant advantage and mitigate risks.

Tips for Intraday Trading

Intraday trading, more volatile than regular stock market investing, often leads to losses, especially for beginners. Here are some intraday trading tips for the Indian share market to assist investors in making informed decisions:

-

Opt for Liquid Shares: Choose highly liquid shares for intraday trading, ensuring they are sold before the day ends.

-

Implement Stop Loss: Utilize stop loss to automatically sell shares if prices fall below a set limit, limiting potential losses.

-

Avoid Volatile Stocks: While volatile stocks offer profit potential, intraday trading in such stocks is risky.

-

Consider Correlated Stocks: Invest in companies closely tied to an index or sector for clear market trend indications.

-

Prioritize Transparency: Invest in stocks of companies providing sufficient information about their activities.

-

Focus on News-Sensitive Stocks: Select stocks responsive to news for intraday trading.

Ensure a good understanding of the specific stock or sector and set stop losses to mitigate risk.

Choose companies with straightforward business processes and stable management.

Conclusion

Intraday trading is a dynamic and demanding venture that requires a deep understanding of various strategies. Traders engage in swift decision-making, leveraging technical analysis and risk management to capitalize on short-term market fluctuations. The discussed strategies, such as Momentum Trading, Breakout Trading, Reversal Trading, Scalping, Moving Average Crossover, Gap and Go, Bull Flag, Pull Back, Pivot Point, and CFD Trading, provide a diverse toolkit for intraday traders. Each strategy demands precision, market insight, and effective risk mitigation. Success in intraday trading hinges on continuous learning, adaptability, and a thorough understanding of market dynamics to navigate the intricacies of this fast-paced financial landscape.

Frequently Asked Questions

Why is intraday trading popular?

Intraday trading is popular due to its potential for quick profits, as traders do not hold positions overnight, avoiding overnight market risks.

What are Intraday Trading Strategies?

Intraday trading strategies involve leveraging technical analysis, risk management, and focusing on liquid stocks for quick buy-and-sell opportunities within the same trading day.

What's the Importance of Continuous Learning in Intraday Trading?

Continuous learning is crucial in intraday trading to adapt to market dynamics, understand new strategies, and enhance decision-making skills for navigating the fast-paced financial landscape. Traders can utilize the Orca trading app and Enrich Money platform to do demo trading and can also gain knowledge about the Stock Market through its Resources.

Is Intraday Trading Risky?

Yes, intraday trading involves risks due to market volatility. Traders should implement effective risk management strategies, such as setting stop-loss orders, to mitigate potential losses.

What are the Best Intraday Trading Strategies?

Effective intraday trading strategies include Momentum Trading, Breakout Trading, Reversal Trading, Scalping, Moving Average Crossover, Gap and Go, Bull Flag, Pull Back, Pivot Point, and CFD Trading.