Knowledge Center Fundamental Analysis

Stock Trading Basics

Risk Reward Ratio In Trading

Introduction

The risk reward ratio is a tool that helps traders understand how much profit they could potentially earn in comparison to the amount of money they might lose in a trade. It offers an objective way to assess and compare different trades, enabling traders to refine their overall trading strategy.

Uses of the Risk-Reward Ratio:

Investors utilize risk-reward ratios as a tool to assist them in making investment decisions. Specifically, investors employ the risk-reward ratio to evaluate the feasibility of a particular investment opportunity. This ratio also enables investors to compare one potential investment against another by assessing the level of risk associated with each investment in relation to their expected returns.

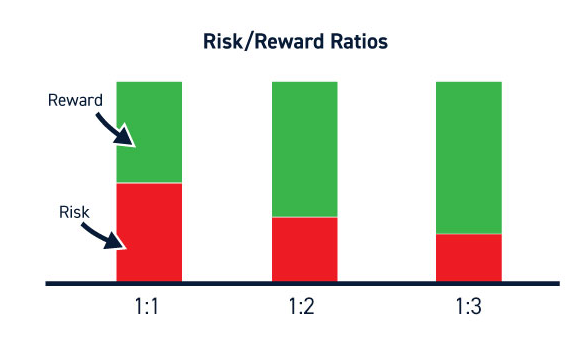

While the acceptable ratio can vary, financial advisors and other experts frequently recommend a ratio ranging from 1:2 to 1:3 as a guideline for identifying worthwhile investments. It's worth noting that some individuals use the ratio in reverse, known as the reward-risk ratio. In this case, it calculates the potential reward (net profit) in comparison to the potential risk (the amount that could be lost) and presents them in the opposite order to the risk-reward ratio.

For instance, a reward-risk ratio of 3-to-1 indicates the possibility of a Rs. 3 potential reward for every Rs.1 at risk.

How to Calculate Risk-Reward Ratio

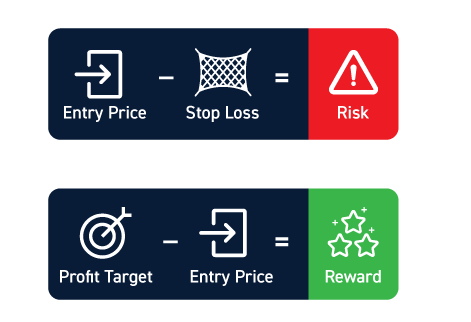

To calculate the risk/reward ratio for a trade, you need to have three key pieces of information: your entry price, your price target, and your stop loss. Your risk is the amount you stand to lose if your trade doesn't go as planned, which is determined by the difference between your entry price and stop loss. On the other hand, your reward is the potential gain if your trade unfolds as expected, and it's determined by the difference between your price target and entry price.

See the below picture, which represents the risk-reward ratio formula.

For example, let's say you're considering trading shares of XYZ. You intend to enter the trade at Rs. 165 per share with the expectation that the price will increase to Rs. 180. Therefore, your potential reward amounts to Rs. 15 per share (Rs. 180–Rs. 165). In order to mitigate potential losses, you establish a stop loss of Rs. 160 per share. Consequently, your potential risk is Rs. 5 per share (Rs. 165–Rs. 160). In this trade, your risk/reward ratio is 1:3 (Rs. 5/Rs. 15).

Considerations for Trading with Risk-Reward Ratio

1. Realistic Risk and Reward:

-

Determine your price target and stop loss based on market conditions.

-

Calculate the risk/reward ratio after setting these levels.

-

Use past trade data to guide your decisions.

2. Commit to Your Plan:

-

Stick to your trading plan and exit at the stop-loss price.

-

Avoid unlimited potential risk by following your plan.

3. Realistic Trade Expectations:

-

Be realistic about a trade's potential success.

-

High risk/reward ratios may not be achievable due to volatility.

4. Position Size:

-

Consider how much money you're okay with potentially losing.

-

Choose a position size that aligns with your risk/reward ratio.

Benefits and Limitations of Using Risk-Reward Ratios:

Benefits:

-

Risk Management: It helps investors and project leaders manage their risks by providing a tool to assess and express potential risks.

-

Objective Evaluation: It facilitates objective evaluation of risks and rewards since it relies on mathematical calculations, reducing subjective bias.

-

Adaptability: Allows for quick reassessment of risks and rewards when market dynamics or values change.

Limitations:

-

Excludes Probability: doesn't consider the likelihood of outcomes, which is crucial for a comprehensive risk assessment.

-

Dependent on Research: The quality of an investor's research and their ability to gauge risk significantly impact the accuracy of the ratio.

-

Limited Scope: Fails to account for other factors and calculations, such as the possibility of minimal price fluctuations in certain trades.

Conclusion

In conclusion, calculating the risk-to-reward ratio provides traders with an approximate understanding of the potential trading outcomes, allowing them to consider contingency plans in case of losses. This concept applies to various trading scenarios, including the share market, Indian stock market, national stock exchange, equity market, and stock trading. Employing strategies and combinations and seeking expert advice can lead to favorable investment returns.

Frequently Asked Questions

-

What is a Risk-Reward Calculator in Trading?

A Risk-Reward calculator is a tool that helps traders determine the potential profit compared to the potential loss in a trade, aiding in making informed trading decisions.

-

What Does Risk vs. Reward Mean in Trading?

Risk vs. reward in trading refers to the balance between the amount of money you could lose (risk) and the potential profit you could make (reward) in a trade.

-

What is the risk-reward ratio in Trading?

The Risk-Reward ratio in trading is a numerical measure that assesses the potential gain (reward) compared to the potential loss (risk) in a trade, helping traders evaluate the trade's viability.

-

How Do I Calculate the Risk-Reward Ratio in Forex Trading?

To calculate the Risk-Reward ratio in forex, subtract your entry price from your stop loss to find the risk, and subtract your entry price from your target price to find the reward. Next, you should divide the potential loss by the potential gain.

-

What is the Risk ratio formula in Trading?

The risk ratio formula is calculated by dividing the potential risk (the difference between entry price and stop loss) by the potential reward (the difference between entry price and target price).

-

How Does the Risk-Reward Ratio Apply to Options Trading?

In options trading, the Risk-Reward ratio assesses the potential profit and loss in options strategies, helping traders make choices based on the balance between risk and potential rewards.