Knowledge Center Fundamental Analysis

Fundamentals Of Trading

Best Intraday Gap Trading Strategies

Gap Trading Strategy

Gap trading focuses on stocks that experience a price gap between the previous day's closing price and the opening price of the next day. This type of trading is easily carried out online. A price rising above a specific range indicates a buying opportunity , while falling below signals a short-selling opportunity.

Four gap patterns are identified when analyzing chart patterns.

1. Common Gap:

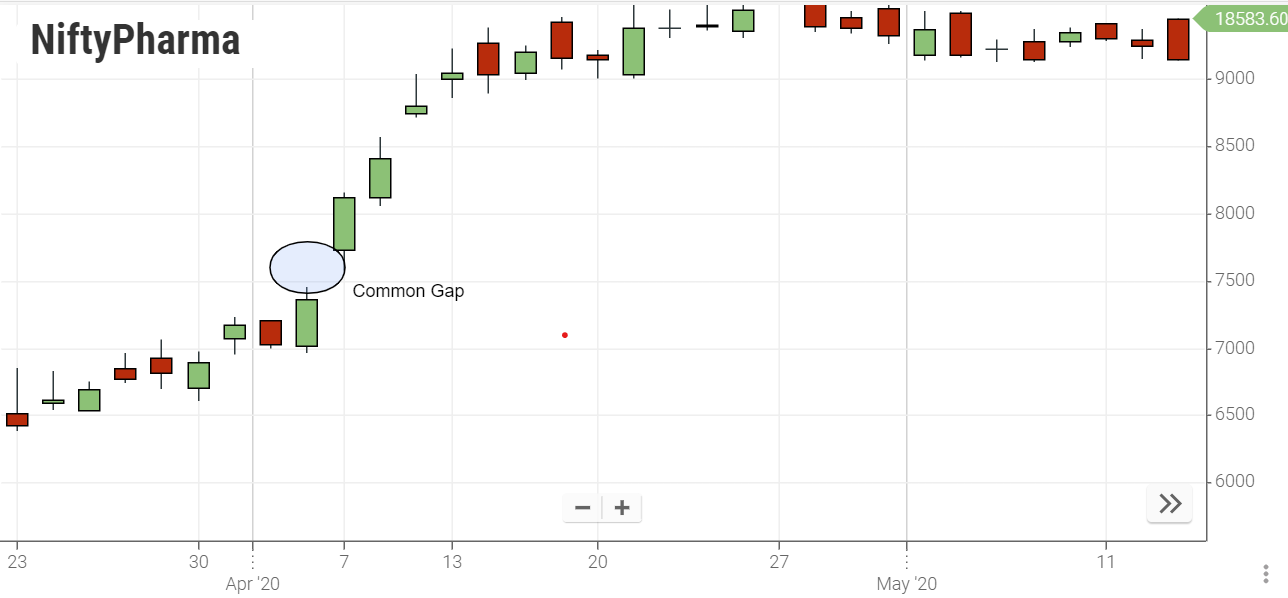

As the name suggests, a common gap is a regular occurrence and tends to happen frequently without significant implications for future price movements.

Common gaps are typical during price ranges. They are relatively small in size and tend to be filled promptly. In the screenshot below, the price chart for Nifty Pharma illustrates frequent common gaps within a range, but they do not indicate any significant signals.

Therefore, it is advisable to steer clear of trading gaps within a range unless there are additional confirming factors. The other three types of gaps typically offer more favorable and higher probability trading opportunities.

2. Breakaway Gap:

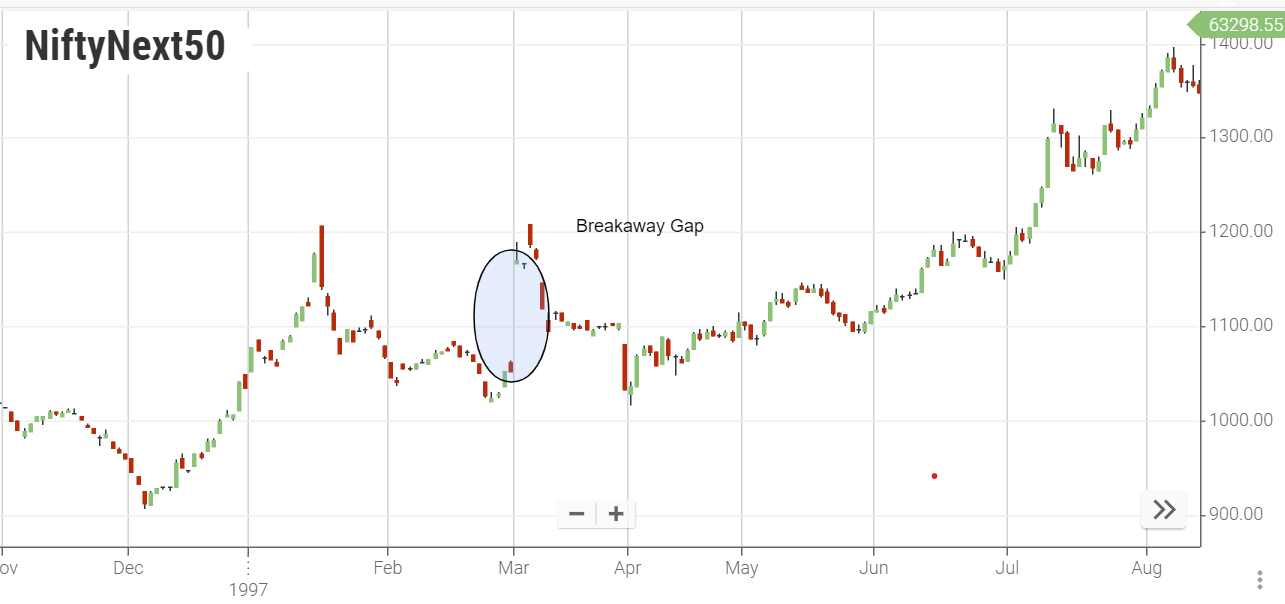

The breakaway gap refers to a price gap that occurs over a support or resistance level.

In the chart below, you can observe the price chart of Nifty Pharma with a notable resistance level. Following the formation of the gap, the trend gained momentum.

Therefore, the breakaway gap typically serves as a signal for the continuation of the existing trend.

3. Runaway Gap:

Continuation/ and runaway gaps manifest within ongoing trends. In an upward trend, an upward gap indicates a continuation and reflects the entry of more buyers into the market, propelling prices higher.

Ideally, continuation or runaway gaps are moderate in size to affirm their sustainability. Excessive price or gap movements could potentially indicate an imminent change in the dynamics between buyers and sellers.

4. Exhaustion Gap:

The exhaustion gap typically occurs within a trend, signaling a potential reversal. The price experiences one last gap in the direction of the prevailing trend before reversing.

What is gap filling?

A filled gap indicates that the price has retraced to the level preceding the gap formation.

Gap filling can occur due to:

-

a) Price patterns

-

b) Technical resistance

-

c) Irrational exuberance

Executing this trading strategy requires careful consideration. Technical or fundamental factors influencing the BSE and NSE may contribute to gap occurrences. It is essential to implement these strategies with thorough research to ensure profitable trading.

Key Takeaways:

-

Gap trading focuses on stocks with price gaps between the previous day's close and the next day's open.

-

Common gaps are small and regular occurrences within price ranges.

-

Breakaway gaps signal trend continuation when prices gap over support or resistance.

-

Continuation and runaway gaps indicate ongoing trends, with moderation in gap size preferred.

-

Exhaustion gaps suggest potential reversals within trends.

-

Gap filling involves retracing prices to the pre-gap level, influenced by factors like patterns and resistance.

-

Caution is needed when trading common gaps, and thorough research ensures profitable gap strategies.

Frequently Asked Questions

-

What does "gaping" mean in trading?

Gaping in forex trading refers to a price difference on a chart's opening, where the price reappears considerably higher or lower than the previous closing. There are four types of gaps: common, breakaway, runaway, and exhaustion gaps.

-

What happens when a stock gaps up?

Gaps in a stock chart occur when its price moves suddenly, usually due to news outside of market hours. These gaps may be filled as trading action brings the price back towards the previous close, presenting trading opportunities.

-

What is the gap trading strategy?

Gap trading exploits price differences between the closing price of one day and the opening of the next. These gaps can result from news or financial events. Traders anticipate whether the gap will be filled or if prices will continue in the direction of the gap.

-

What are morning gap trading strategies?

Morning gap trading strategies involve navigating price gaps in the morning session, often driven by overnight news or events. Traders analyze these gaps for potential trading opportunities.

-

What is the overnight trading strategy?

The overnight trading strategy involves placing orders just before the market closes and holding the position until the market opens the next day. Some traders use overnight trading to capitalize on market changes after the markets close.