Knowledge Center Fundamental Analysis

Fundamentals Of Trading

What is Bull Market Trading?

A bull market signifies a state in the financial market where prices are increasing or anticipated to increase. While commonly associated with the stock market, the term "bull trading" is applicable to any traded asset, including bonds, real estate, currencies, and commodities.

The designation "bull market" is typically employed during prolonged durations when a significant portion of security prices is on an upward trend. These optimistic market conditions can endure for months or even years, reflecting a sustained period of rising asset values.

Bull Market Example

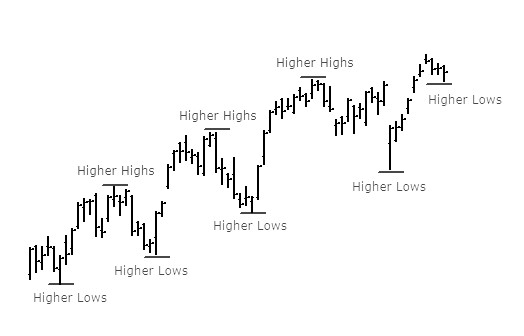

In a bull market or bull trading, a clear example is observed through market prices exhibiting higher highs and higher lows over an extended period. This trend is often accompanied by characteristics like shallow pullbacks and a robust upward momentum.

An illustrative example of a bull in share market is as follows:

The surge in this bull run was sparked by the Covid-19 pandemic, marked by a substantial increase in online shopping due to lockdowns and health concerns. Bull market trends can be monitored using indicators such as a trend line, which traces rising lows, and the moving average.

How to trade in a bull market

To navigate a bull market successfully, investors aiming to capitalize on rising prices should consider buying early and selling at the peak. While predicting market bottoms and tops is challenging, losses during bull markets are often minimal and temporary. Here, we'll explore various strategies, including IPO trading strategies and bull stock trading, that investors employ in bull markets, acknowledging the inherent risk due to the difficulty of accurately assessing the current market state.

1. Buy and Hold:

-

This fundamental strategy involves purchasing security and holding onto it with the expectation of selling it at a later date.

-

The optimism inherent in bull markets supports the buy-and-hold approach, as investors anticipate upward price movement.

2. Increased Buy and Hold:

-

A variation of the buy and hold strategy, increased buy and hold involves additional risk.

-

Investors employing this approach continue to add to their holdings as long as the security's price keeps rising.

-

One method suggests buying a fixed quantity of shares for every pre-set increase in the stock price.

3. Retracement Additions:

-

Acknowledging that even in bull markets, prices may experience brief reversals, investors using retracement additions buy the dip during these periods.

-

The strategy relies on the assumption that, if the bull market persists, the security's price will quickly recover, offering the investor a discounted purchase price.

4. Full Swing Trading and IPO Trading Strategies:

-

A more aggressive approach to capitalizing on a bull market, full-swing trading involves active roles and techniques like short-selling.

-

Investors using this strategy aim to maximize gains by actively responding to shifts within the broader bull market context, including employing Indian intraday trading strategies and utilizing bull market support bands.

Every strategy comes with its unique set of considerations and risks. Given the dynamic nature of markets, investors should carefully evaluate their risk tolerance and market conditions before implementing these approaches.

Nutshell

-

The bull trading signifies rising prices and positive investor sentiment.

-

Applies to stocks, bonds, real estate, currencies, and commodities.

-

Characterized by increased demand, rising profits, GDP, and declining unemployment.

-

Contrast: Bear market involves falling prices and pessimism.

-

Bull trading involves seizing opportunities early and strategic selling.

-

The bull market strategy includes IPO and Indian intraday trading strategies.

-

The bull trading app aids investors with tools and insights.

-

The bull market support band sets a range for expected price movements.

-

Bull in the stock market represents a positive, upward market trend.

Frequently Asked Questions

-

How to trade in a bull market?

In a bull market or bull trading, the strategy involves going long or 'buying,' anticipating a prolonged upward price trend.

-

what is bull in stock market?

A bull market is commonly defined as a period during which major stock market indexes generally experience a sustained rise, eventually reaching new highs.

-

How is an investor categorized as a bull in trading?

In trading, investors are often classified as bulls and bears. A "bull" refers to an investor who engages in bull stock trading, buying shares with the belief that the market will experience a rise.

-

What does the Bull Market Support Band Moving Average consist of?

The Bull Market Support Band Moving Average is composed of the 20-week Simple Moving Average (20we SMA) and the 21-week Exponential Moving Average (21we EMA).

-

What is bull market strategy

The Bull Trade Strategy involves a trader buying a call option at a specific strike price and simultaneously selling another call option with the same expiration date but a lower strike price.