Top Performing Stocks Under 100 Rupees in 2025

First, what is meant by stocks under 100 Rupees? Generally, publicly traded companies which trade their stock under 100 rupees. are considered as stocks under 100 Rupees.

An investor can invest any amount in the stock market. If you are a beginner investor, you can invest in stock below 100 Rs. Which does not require a huge amount to be invested as capital and also it's affordable.

Many investors seek stocks under 100 Rupees as a part of diversification of asset classes in their portfolio. Investors can start investing in fundamentally strong stocks under 100 rupees which would help them to build their assets at less risks.

How To Identify the Stocks Under 100 Rupees?

Identifying stocks under 100 Rupees requires a detailed analysis of the companies’ fundamentals and its market conditions. The key parameters to consider are stock price, Earnings Per Share, Price to Earnings Ratio, Dividend Per Share, Net Profit Margin, Debt to Equity Ratio, Current Ratio etc.

Latest Moves Regarding Stocks Under Rs. 100 (December 2024 – February 2025)

?Over the past three months (December 2024 to February 2025), several notable developments have occurred concerning stocks priced under ?100. Here's a chronological summary of key updates:?

-

December 12, 2024: NHPC Limited announced the commissioning of a new 500 MW hydroelectric project in Himachal Pradesh, enhancing its renewable energy capacity and contributing to the nation's green energy goals.

-

December 20, 2024: SJVN secured a contract for a 700 MW solar power project in Rajasthan, marking a significant expansion into solar energy and aligning with its diversification strategy.

-

January 15, 2025: Equitas reported a 25% year-on-year increase in its loan portfolio, driven by growth in the microfinance and small business segments, indicating robust demand and effective outreach.

-

January 22, 2025: Ujjivan launched a digital banking platform aimed at enhancing customer experience and expanding its reach in the retail banking sector, reflecting its commitment to technological advancement.

-

February 5, 2025: JM Financial announced a strategic partnership with a leading fintech company to offer digital lending solutions, aiming to streamline loan processing and expand its customer base.

-

February 18, 2025: IDFC First Bank reported a 30% increase in net profit for Q3 FY2024-25, attributed to higher net interest income and improved asset quality, signaling strong financial performance.?

These developments highlight the dynamic nature of stocks priced under Rs. 100, reflecting both opportunities and challenges. Investors are advised to stay informed and conduct thorough research when considering investments in this segment.

How To Invest in Stocks Under 100 Rupees?

Investing in stocks Under 100 Rupees. would help the investors to diversify their portfolio. The easiest method to invest in stocks under 100 Rupees is through opening a free demat account with no annual charges at Enrich Money.

Best Stocks to Buy Today Under 100 Rs

The best stocks under 100 Rs for long term are gathered based on the stock’s market capitalization between Rs. 4000 crores to Rs.1000000 crores with PE ratio of 0-50. These stocks are ranked based on market capitalization from highest to lowest.

|

Stock Name |

Sub Sector |

Market Capitalization in Crores |

Close Price in Rs. |

PE Ratio |

1 Year Return |

5Y Avg Net Profit Margin % |

Net Profit Margin % |

|

Renewable Energy |

80,762.08 |

83.3 |

20.76 |

90.62 |

29.84 |

34.16 |

|

|

Renewable Energy |

44,465.63 |

116.45 |

32.71 |

227.97 |

44.15 |

41.27 |

|

|

Private Banks |

12,024.84 |

106.3 |

20.96 |

93.98 |

9.33 |

11.87 |

|

|

Private Banks |

10,831.49 |

54.65 |

9.85 |

98.39 |

6.3 |

23.14 |

|

|

Investment Banking & Brokerage |

10,525.15 |

113.4 |

17.62 |

65.91 |

17.77 |

17.87 |

Top 20 Stocks Under 100 Rupees

We have listed 20 good stocks to buy under 100 rupees which is good for investment. These stocks are listed based on highest to lowest market capitalization.

|

Stock Name |

Sub Sector |

Market Capitalization in Crores |

Close Price in Rs. |

PE Ratio |

1 Year Return |

|

Public Banks |

1,12,532.58 |

104.5 |

33.61 |

94.6 |

|

|

Private Bank |

90,535.23 |

83.5 |

24.43 |

58.59 |

|

|

Renewable Energy |

80,762.08 |

83.3 |

20.76 |

90.62 |

|

|

Auto Parts |

74,540.64 |

115.4 |

49.84 |

58.84 |

|

|

Private Banks |

56,261.99 |

80.05 |

22.64 |

40.69 |

|

|

Public Banks |

47,614.95 |

54.35 |

28.36 |

82.69 |

|

|

Iron & Steel |

47,521.69 |

119.1 |

21.83 |

32.48 |

|

|

Renewable Energy |

44,465.63 |

116.45 |

32.71 |

227.97 |

|

|

Public Banks |

38,062.38 |

53.4 |

14.61 |

81.32 |

|

|

Construction & Engineering |

29,681.69 |

50.7 |

41.22 |

75.86 |

|

|

Cables |

27,278.24 |

60.95 |

56.01 |

19.86 |

|

|

Diversified Financials |

18,447.82 |

116 |

4.35 |

39.76 |

|

|

Telecom Equipment |

15,083.62 |

105.75 |

50.12 |

50 |

|

|

Private Banks |

12,024.84 |

106.3 |

20.96 |

93.98 |

|

|

Commodities Trading |

11,347.50 |

75.3 |

7.26 |

121.8 |

|

|

TV Channels & Broadcasters |

10,869.04 |

64.25 |

93.55 |

90.09 |

|

|

Private Banks |

10,831.49 |

54.65 |

9.85 |

98.39 |

|

|

Investment Banking & Brokerage |

10,525.15 |

113.4 |

17.62 |

65.91 |

|

|

Logistics |

7,818.03 |

79.85 |

12.42 |

2.97 |

Overview of Stocks Under 100 Rupees

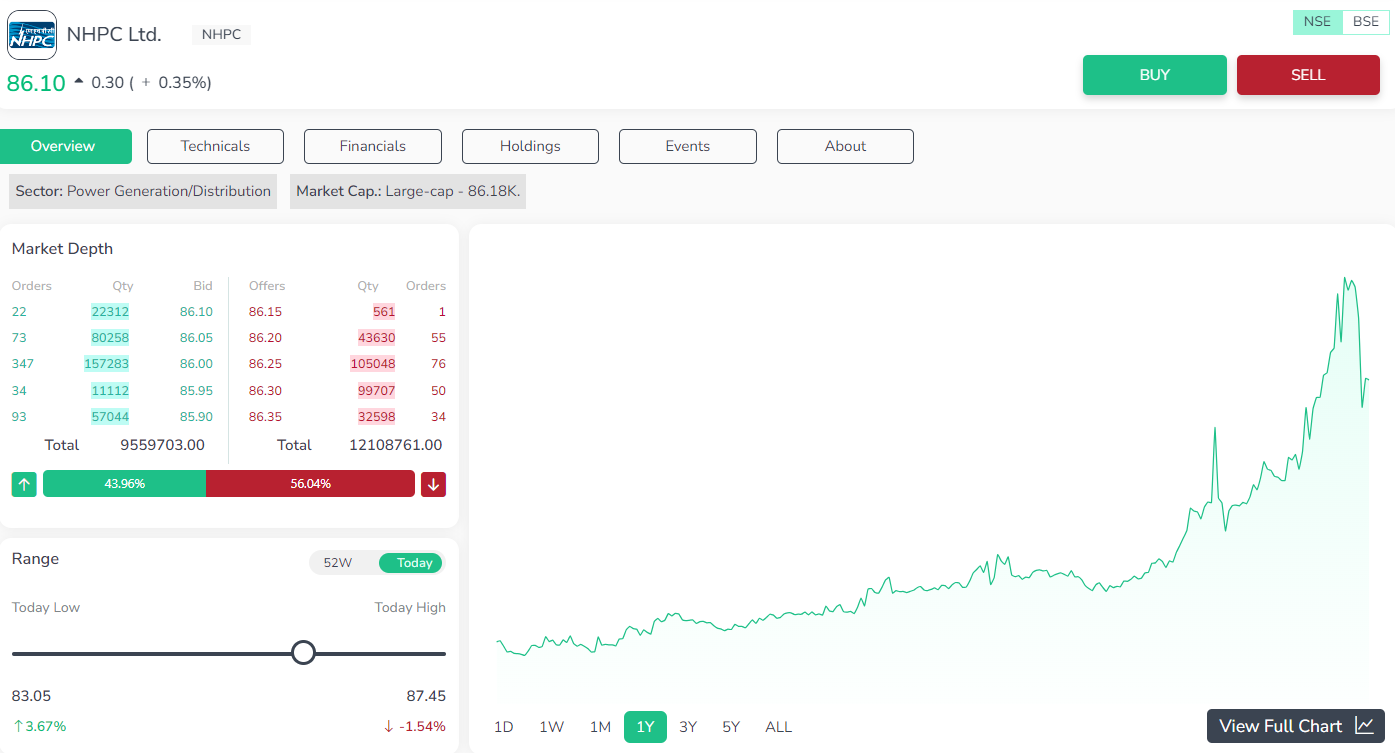

NHPC Ltd

NHPC Limited is a Mini Ratna Company, a GOI’s flagship Power and Renewable Electricity Producer engaged in electricity generation through hydroelectric power plants. It is also involved in the business of project management, construction contracts, consultancy assignment services and trading of power.

The stock is undervalued with its price to intrinsic value of 0.966.

The stock has good profitability of Total stockholder’s return (TSR) profitability index to be 68.12, in the last 3 years its net profit margin is increasing remarkably year on year by 4.24%. Over the past 12 months, the company has shown strong uptrend in net profit margin by 37.84% and all the TTM net profit margin in uptrend by 15%. Its Return on Equity has increased by 10.43% with steady EPS growth in the last four quarters. But the company has given poor Return on Assets in the past 3 years. But there is a steady growth in Total Assets in the past 3 years. When the liquidity of the stock is analyzed, the company has been unable to generate enough liquid cash to support business.

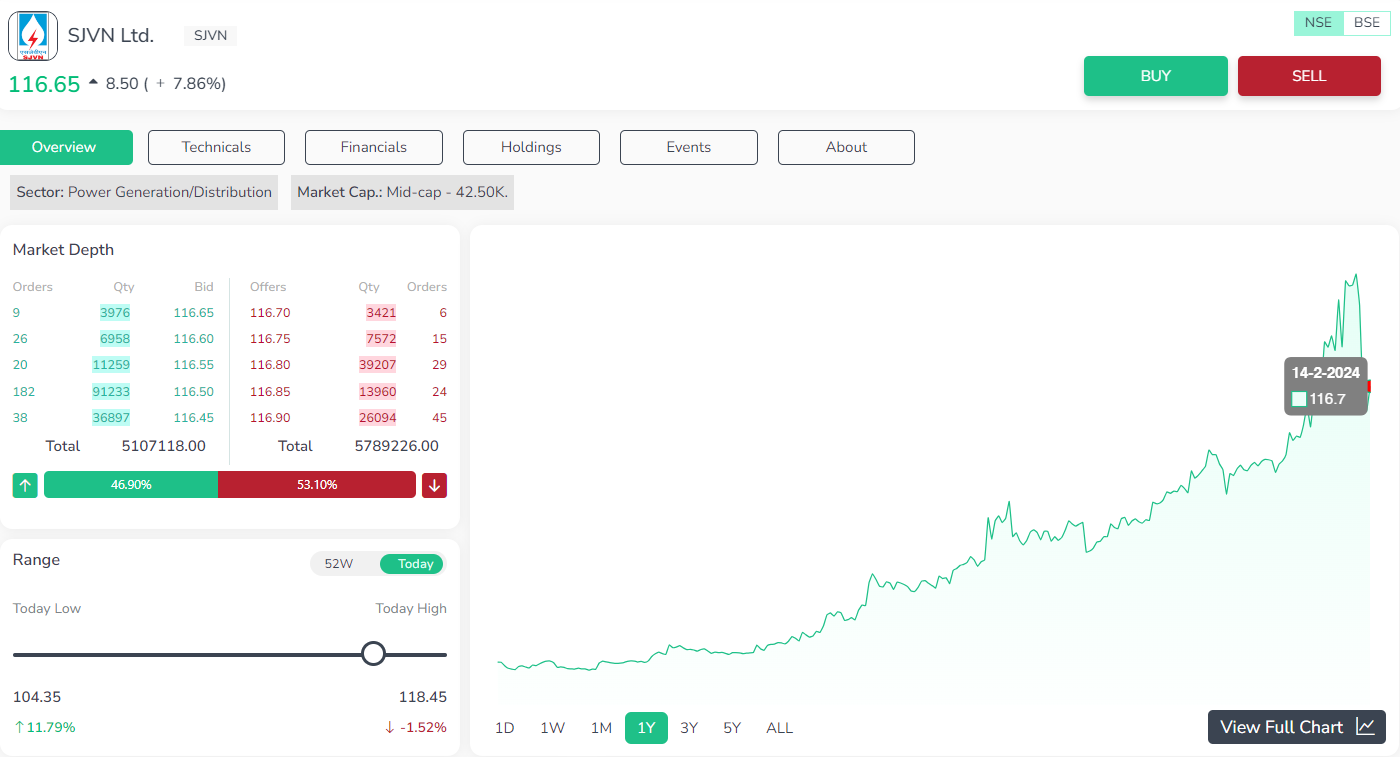

SJVN Ltd

SJVN is also engaged in the business of electricity generation through hydroelectric power.

The book value of the stock has increased in the last 3 years. The stocks TSR profitability index is at a good score of 71.88. Its net profit margin is increasing on a yearly basis by 12.61%. and the company has shown a positive net profit margin in the last 12 months at 38.94%. The company has shown steady EPS growth for the last 4 quarters. But the earning yield% is low at 2.18%. On analyzing the company’s growth, the total assets of the company are in uptrend in the last 3 years. But the company in unable to generate enough liquid cash to meet its business operations which is identified from its quick ratio to decrease in yearly basis to -29.85%

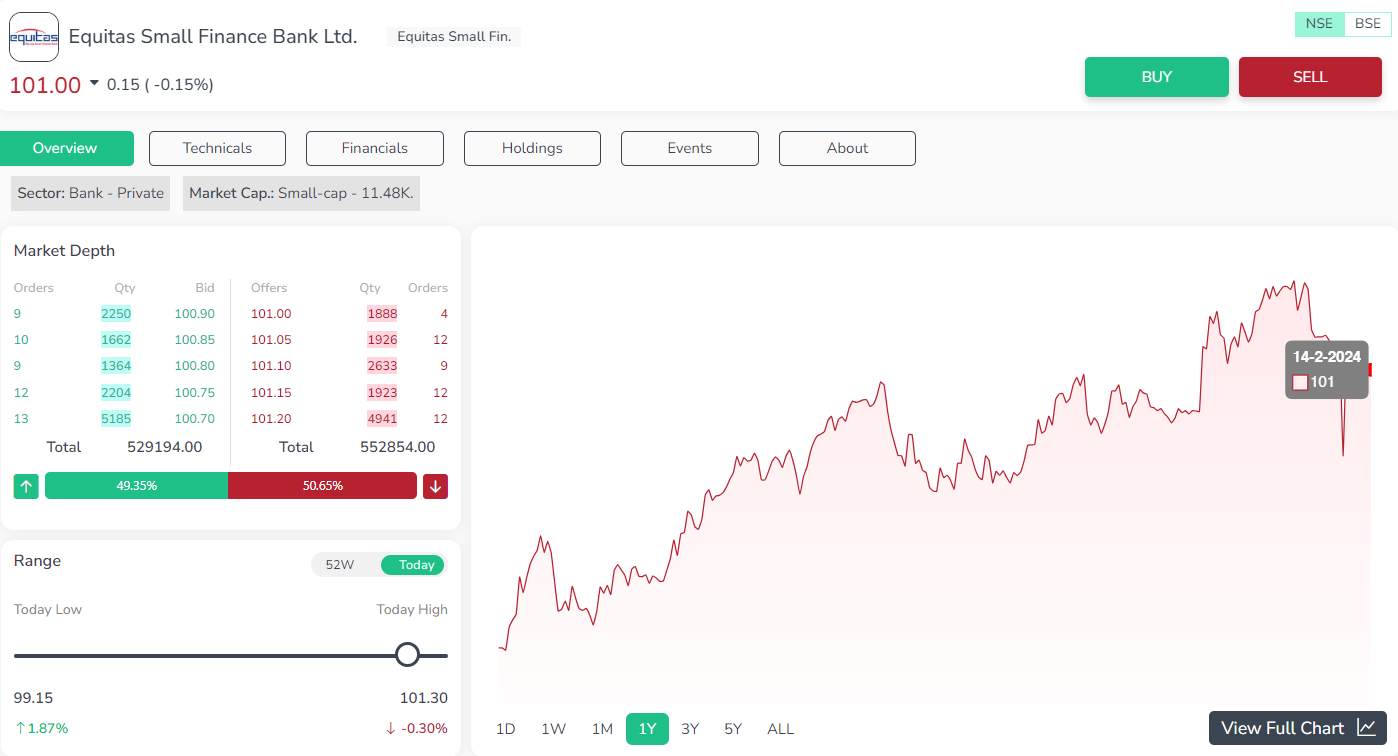

Equitas Small Finance Bank Ltd

This company operates as a wholly owned subsidiary of Equitas Holding Limited. This company provides finance to small businesses, vehicles, microfinance, housing, MSME and others etc.

The total shareholder’s return value has a good score of 68.06. Its Price to book ratio for TTM is 0.657, indicating that the stock is undervalued. Also, the Book value of the stock has also increased multifidly in the last 3 years. But the price to intrinsic value indicates that the stock is too expensive to buy. On analyzing the company’s profitability, the earning yield % is 6.59%. Over the last 3 years and the last 5 quarters, the company’s annual net profit is increasing. EBITDA for the last 3 years is also trending up. Steady EPS growth for the last 4 quarters. Return on Equity is positive at 15.08&. But the dividend yield is found to be very low at 0.94% and the company ROA is also not good in the last 3 years. On analyzing the company's growth, the total sales and net profit for the short term is positive. The net sales have trended up on a year-on-year basis. Also, the quarterly sales in the last 5 years and total sales in the last 3 years has increased tremendously. But the Operating cash flow decreased in the last 3 years. The Debt-to-Equity ratio has decreased and found to be lowest in the past 5 years, indicating the company’s stability. As usual, the company’s ability to generate liquid cash to meet its business operations is low.

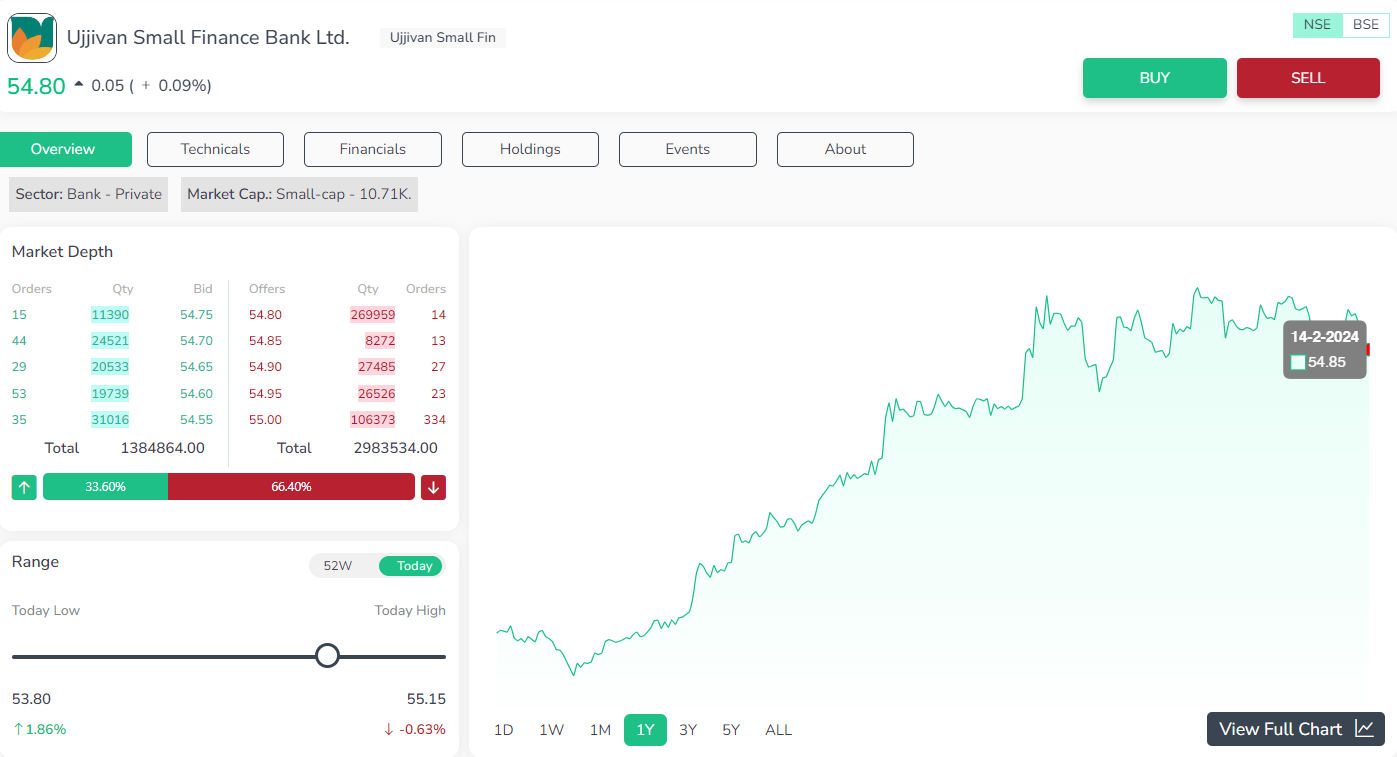

Ujjivan Small Finance Bank Ltd

The NBFC company serves mainly to financially unserved and underserved segments of the country i.e. economically active poor. Its main objective is to achieve financial inclusion in the country. Its main business segments are retail and wholesale banking and treasury.

On analyzing the company, it is observed that the stock is undervalued with its price to earnings ratio at 8.47 and Enterprise value to EBITDA is 2.86. But the stock is too expensive to buy with its price to intrinsic value of 2.70. But there has been a decrease in book value in the last 3 years. On analyzing the company’s profitability, earning yield good at 11.81%, net profit has returned to be positive. RoE in the last 12 months is strong at 28.64%. The RoCE is good at 16.06%. But the net Margin and RoA in the last 3 years has been poor. The quarterly sales growth is increasing in the last 5 years and total assets are in uptrend in the last 3 years. The company is liquid enough to meet its business operations.

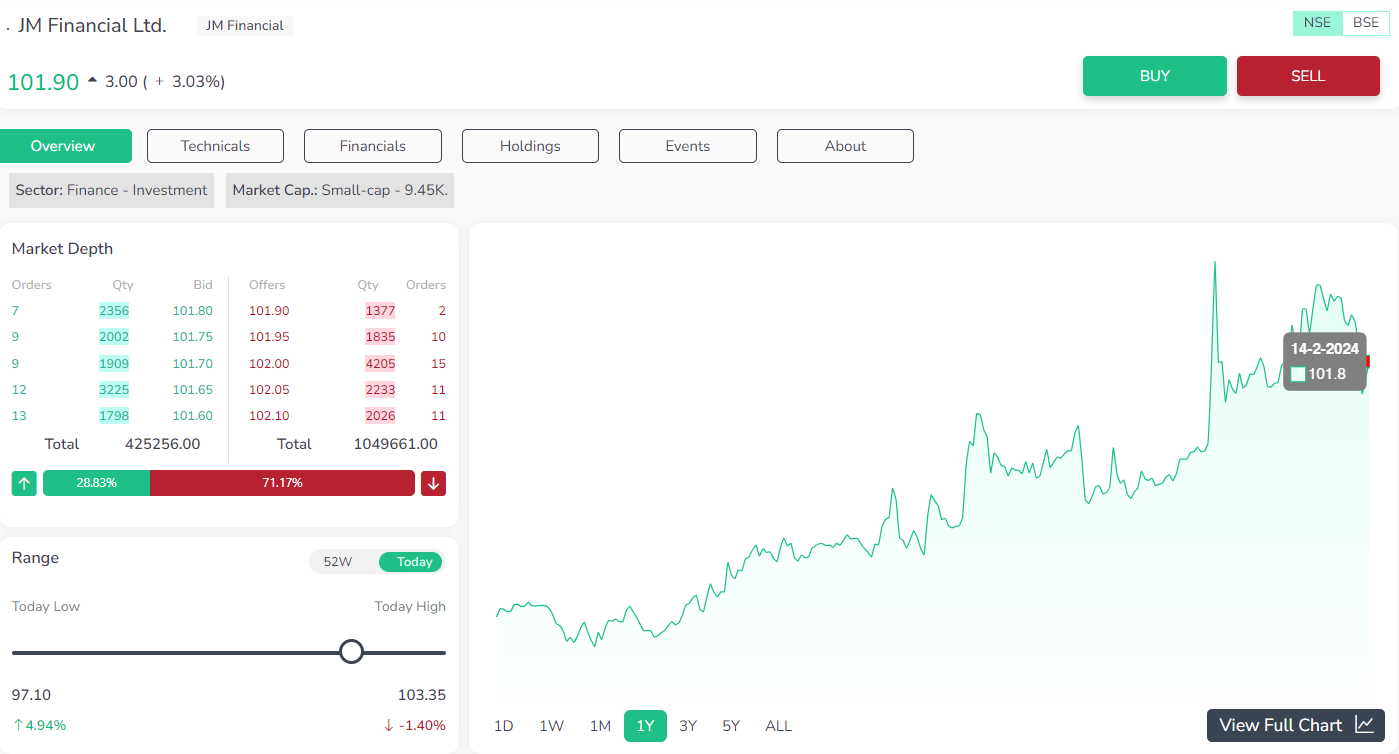

JM Financial Ltd

This financial service company services mortgage lending, distressed credit, asset management. It also services investment banking and private equity funds management.

Book value in the last 3 years is trending up. But the stock seems to be very expensive with its price to intrinsic value at 9.34. Company’s net profit has increased in the last 5 quarters. Net Margin is positive at 14.91%. But the earning yield is low at 5.21 and the RoA is decreasing in the last 3 years. On analyzing its growth, the quarterly sales in the last 5 years are trending up with steady uptrend in total assets in the past 3 years. Company is unable to generate enough liquid cash to meet its business operations.

Conclusion

It is very crucial for the investors and traders to conduct in depth research before investing in these stocks under 100 Rupees

Visit Enrich Money for more information and stock analysis, to invest in stocks under 100 Rupees, utilize their free demat account with no annual charges.

Frequently Asked Questions

What is the Benefit of Investing in Stocks Under 100 Rupees?

Below is the list of benefits in investing in stocks under 100 Rupees

-

Accessible to all: Anyone can engage in value investing without financial constraints or specific qualifications.

-

Patience pays off: The strategy focuses on long-term returns, emphasizing the significance of patience amid market fluctuations.

-

Compounding advantages: Reinvest returns from value stocks to witness substantial profit growth over time through compounding.

-

Low-risk approach: Value investing, especially in stocks under Rs. 100, is praised for its stability, minimizing exposure to market volatility.

-

Maximize profits strategically: Choose financially robust stocks under Rs. 100 for a tried-and-tested method to maximize long-term stock market gains.

Key Considerations to Keep in Mind When Investing in Stocks Under 100 rupees?

Key considerations to keep in mind while investing in stocks under 100 rupees

-

Avoid Blindly Following Tips: Never blindly follow stock market tips, irrespective of the source. Thorough personal research is essential to make informed decisions.

-

Remove Losing Stocks: Acknowledge poor-performing stocks in your portfolio and sell them promptly to prevent further losses, as there's no guaranteed recovery after a significant fall.

-

Be Budget-Conscious: Avoid hastily exceeding your investment budget. Opt for a fixed amount and distribute it across diverse, well-performing stocks instead of concentrating it on a single stock.

-

Prioritize Practicality: Understand the importance of being realistic about possibilities and impossibilities in the stock market to make prudent investment decisions.

-

Focus on Diversification: Allocate your budget evenly across multiple stocks to mitigate risks and enhance the potential for long-term returns in comparison to concentrating on a single stock.

What are the advantages of investing in stocks priced under 100 Rupees?

Investing in stocks below Rs 100 provides an opportunity for strategic investments in quality stocks, offering the potential for substantial returns. Additionally, lower-priced stocks enable investors to achieve diversification with a relatively modest investment, maximizing the benefits of a well-rounded portfolio.

Why Opt for Fundamental Analysis Before Choosing Stocks?

To wisely choose undervalued stocks under 100 rupees, value investors should prioritize fundamental analysis. It is advised that any investment lacking thorough research is speculative, underscoring the significance of studying an organization's fundamentals for assured outcomes.

Is it possible for investors to profit from stocks priced below 100?

Indeed, stocks below 100 can yield profits for investors. Profitability hinges on factors beyond stock price, such as company fundamentals, growth potential, and market trends. Investors should understand both the growth prospects and challenges associated with the best shares under 100.

Disclaimer: This blog is dedicated exclusively for educational purposes. Please note that the securities and investments mentioned here are provided for informative purposes only and should not be construed as recommendations. Kindly ensure thorough research prior to making any investment decisions. Participation in the securities market carries inherent risks, and it's important to carefully review all associated documents before committing to investments. Please be aware that the attainment of investment objectives is not guaranteed. It's important to note that the past performance of securities and instruments does not reliably predict future performance.