Knowledge Center Fundamental Analysis

Stock Market

What Is The Relation Between The Bank Nifty And The Nifty Charts?

Nifty and Bank Nifty are widely followed indices in the Indian stock market, offering investors a means to assess the overall market performance and specifically the banking sector. Nifty represents the top 50 stocks across various sectors, while Bank Nifty focuses on the top 12 banking and financial stocks. These indices serve as benchmarks, providing valuable insights into the market's health and the performance of the banking industry.

Bank Nifty

The Nifty Bank Index comprises the most liquid and prominent banking stocks in India, providing a reliable benchmark for market intermediaries and investors to assess the performance of the country's banking sector. This index includes a maximum of 12 banking companies listed on the National Stock Exchange of India (NSE), accurately reflecting the capital market performance of Indian banks. The calculation of the Nifty Bank Index is based on the free float market capitalization methodology.

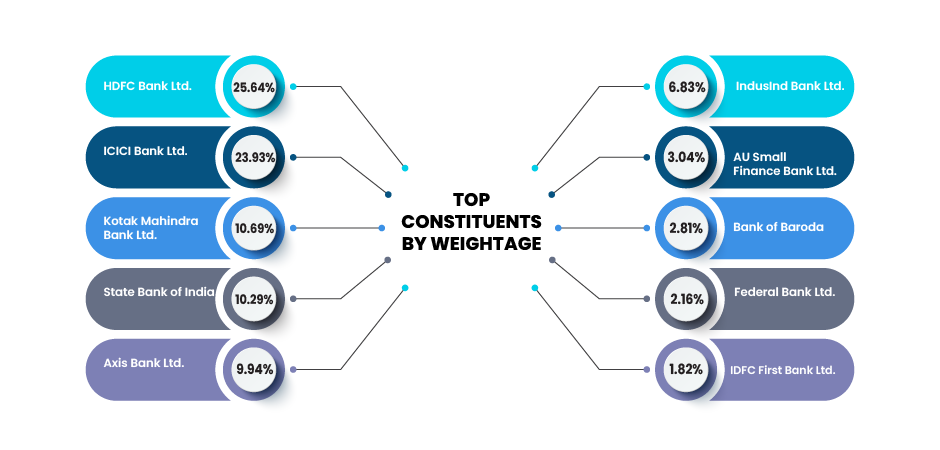

The top 5 listed sector on NSE are as follows:

-

HDFC Bank Ltd. holds the leading position with a value of 25.64. Known for its robust banking services,

-

ICICI Bank Ltd. secures the second spot with a value of 23.93. ICICI Bank is renowned for its wide range of financial products and services.

-

Kotak Mahindra Bank Ltd. stands at number three with a value of 10.69. The bank has made significant strides in the market with its innovative solutions and customer-centric approach.

-

State Bank of India (SBI) holds the fourth position with a value of 10.29. As the largest bank in India, SBI has a vast network and offers a comprehensive suite of banking services to millions of customers across the country.

-

Axis Bank Ltd. rounds up the top 5 with a value of 9.94. Axis Bank has gained prominence in recent years by consistently delivering efficient and reliable banking solutions to its customers.

Nifty50

The Nifty 50 index serves as a comprehensive market indicator by encompassing a diversified portfolio of 50 prominent companies. It provides valuable insights into the overall market performance. The calculation of the Nifty 50 Index utilizes the free float market capitalization methodology, ensuring an accurate representation of the market's dynamics and trends. Nifty 50 may be used for many different things, including benchmarking fund portfolios and establishing index funds, exchange-traded funds, and structured products.

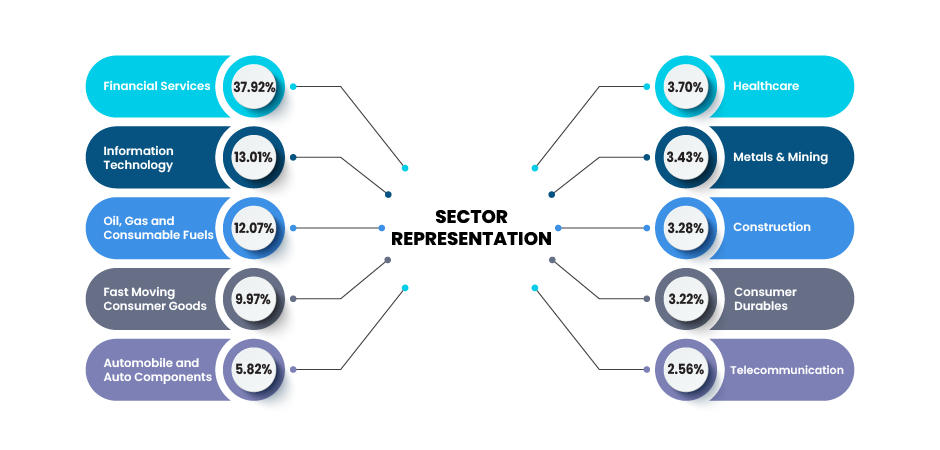

The top 5 Nifty sector are as follows:

-

Financial Services (37.92%): The financial services sector holds the highest weightage in the Nifty index, indicating its significant contribution to the Indian economy.Within this sector, one can find a wide range of entities including banks, non-banking financial companies (NBFCs), insurance firms, and various other financial institutions. These components collectively contribute to the dynamic landscape of the sector, each playing a distinct role in shaping the overall financial ecosystem.. It plays a crucial role in mobilizing and allocating funds, facilitating economic growth, and providing various financial services to individuals and businesses.

-

Information Technology (13.01%): The Information Technology (IT) sector holds the second-highest weightage in the Nifty index. It encompasses companies involved in software development, IT services, IT consulting, and technology hardware manufacturing. The IT sector has been a key driver of India's economic growth, with Indian IT companies providing services globally and contributing to innovation, digital transformation, and job creation.

-

Oil, Gas & Consumable Fuels (12.07%): This sector comprises companies engaged in oil and gas exploration, production, refining, and distribution. It also includes companies involved in the production and distribution of consumable fuels such as liquefied petroleum gas (LPG) and compressed natural gas (CNG). Given India's substantial energy requirements, the oil, gas, and consumable fuels sector plays a crucial role in meeting the nation's energy demands and supporting various industries.

-

Fast Moving Consumer Goods (FMCG) (9.97%): The FMCG sector consists of companies that produce and market non-durable consumer goods such as packaged food, beverages, personal care products, and household items. With a considerable weightage in the Nifty index, this sector reflects the consistent demand for essential consumer products in India. FMCG companies often enjoy stable revenues and have a widespread consumer base, making them attractive investments.

-

Automobile and Auto Components (5.82%): The Automobile and Auto Components sector includes companies involved in the manufacturing of automobiles, motorcycles, commercial vehicles, and auto parts. This sector contributes significantly to India's manufacturing output, exports, and employment generation. The weightage in the Nifty index highlights the importance of the automotive industry in the Indian economy, although it is relatively lower compared to the aforementioned sectors.

Correlation between Nifty and Bank Nifty

-

The charts for Bank Nifty and Nifty are related. The bank nifty and the nifty have a 0.88 correlation. This strong correlation indicates that the bank nifty and the nifty trend will be the same.

-

This information is used by traders to jointly analyze the charts. They can switch to the other chart to view the market trend and movement of the index at that moment if one of the charts is not clear.

-

The bank nifty beta value is 1.2. Any stock or index's volatility is measured by beta. The niftyness is contrasted with this value.

-

When the bank nifty beta value is 1.2, the nifty will always move ahead of it.

-

If the succeeding bank nifty index gives you what appears to be a signal, you can utilize it to trade the nifty.

-

The majority of traders trade the bank nifty even though its beta is larger than the nifty's because it moves considerably more quickly. As a result, you should always make it a habit to assess both the bank nifty and the nifty charts to start your trading day.

Contrary between Nifty and Bank nifty

-

Though Nifty and Bank Nifty have a correlation in terms of market movement, it varies some times. Let's examine.

-

Major bank stocks like ICICI Bank, Kotak Bank, HDFC Bank, and SBI collectively contribute to a 39% weightage in the broader Nifty index.

-

The Bank Nifty index is heavily influenced by HDFC Bank and ICICI Bank, which together hold a significant 60% weightage in the index. If these influential stocks have witnessed declines.Then the Bank Nifty index will underperform.

-

Though the Banking heavyweights underperform, if the remaining sectors in the NIFTY performs well then there is a possibility of NIFTY to surge in market. Vice versa happens if the scenario changes.

-

The synchronization of the Nifty and Bank Nifty indices is not always guaranteed, as their movements are contingent upon the individual performances of the key stocks within each index. The dynamics of these indices rely on the specific factors influencing the respective stocks, highlighting the importance of monitoring and analyzing the performance of individual components within each index.