Knowledge Center Fundamental Analysis

Stock Market

The concept of 'delta' in the context of options trading

Let’s understand some basic concepts before we dive deep into the delta.

There are four major risk measures used by options traders.

Vega, Theta, Delta, and Gamma are the four risk measures.

As you understand, delta is one of four major risk measures used by options traders to analyze risk.

In simple words, delta is like a magical number that helps us understand how much an option's price will change when the price of the underlying stock moves.

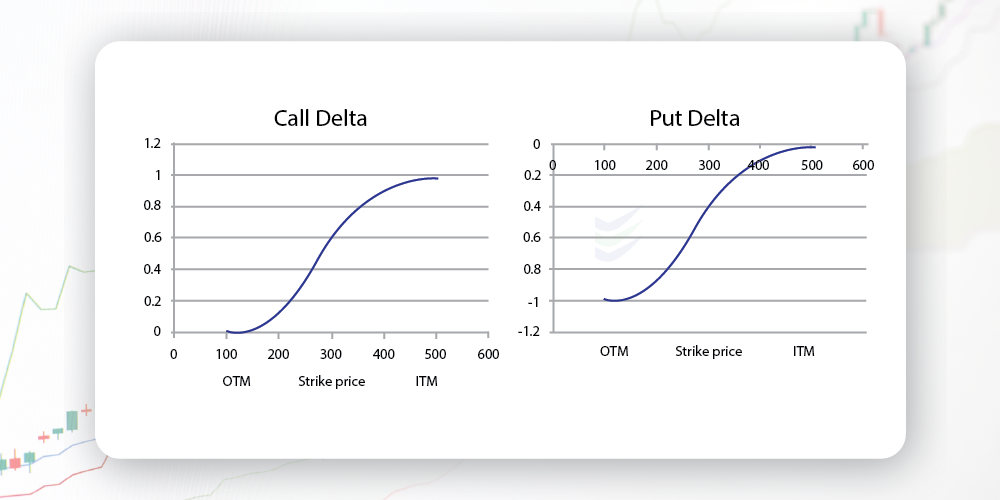

The option delta of a call option, i.e., the call option delta, will range from 0 to 1, while the option delta of a put option (the put option delta) will range from 0 to -1.

Examples and Interpretations of Delta Values-

Call option delta and put option delta

Delta formula for call options: δ=N(d1)

To find, d1=(ln(S/K)+(r+σ22))/σ√t

Where:

-

K is the option strike price.

-

N represents the standard normal cumulative distribution function.

-

r is the risk-free interest rate.

-

σ stands for the underlying asset volatility.

-

S is the underlying asset price.

-

t is the time until the option expires.

Delta Formula For, Put Options : δ=N(d1) −1

To find d1= (ln(S/K)+(r+σ22))/σ√ t

Where:

-

K - Option strike price

-

N - Standard normal cumulative distribution function

-

r - Risk-free interest rate

-

σ - Volatility of the underlying asset

-

S - Price of the underlying asset

-

t - Time to option's expiry

Imagine you have a call option, which gives you the right to buy a stock at a certain price.

If your call option has a delta of 0.50, it means that if the stock goes up by $1, the price of your call option will go up by 50 cents.

So, delta tells you how closely your option follows the moves of the stock.

On the other hand, if you have a put option (the right to sell a stock), and it has a delta of -0.30, it means that if the stock goes down by $1, the price of your put option will go up by 30 cents.

Delta formula:

The formula of delta= Change in the Price of Asset / Change in the Price of Underlying.

How Delta helps Options traders.

Delta helps traders make decisions. For instance, If you want to bet that a stock will go up, you might choose options with higher positive deltas.

If you think a stock will go down, you'd go for options with negative deltas. It's a tool that helps you understand and manage the risks of trading options.

Principle Use of Delta:

Delta is mainly used by online investors to predict how options might change in value with shifts in the underlying asset's price. It helps estimate the potential gains or losses from buying/exercising a specific option. Delta also guides traders in setting profit targets and limiting losses. It fluctuates with market changes and is usually higher for options close to expiration. Monitoring Delta helps traders plan their actions and maximize profits.

Long Option Delta

When you have a "long" position in an option, it means you've bought that option. The delta of a long option measures how much the option's price will change in response to changes in the price of the underlying asset.

If you have a long call option, a positive delta means your option's value will increase as the underlying asset's price rises. It's like riding the price wave up.

If you have a long put option, a negative delta means your option's value will increase as the underlying asset's price falls. It's like having insurance against a price drop.

Short Option Delta

When you have a "short" position in an option, it means you've sold that option. The delta of a short option measures how much the option's price will change in response to changes in the price of the underlying asset.

If you have a short call option, a negative delta means your option's value will decrease as the underlying asset's price rises. It's like taking on an obligation to potentially sell the asset at a lower price.

If you have a short put option, a positive delta means your option's value will decrease as the underlying asset's price falls. It's like taking on an obligation to potentially buy the asset at a higher price.

Have a look at the below tab for better understanding:

|

Long Call |

Short Call |

Long Put |

Short Put |

|

Delta Positive |

Delta Negative |

Delta Negative |

Delta Positive |

Position Delta

Position delta is a measure that tells you how much the total delta of your options positions, both long and short, will change in response to a one-point change in the price of the underlying asset. It's like a way to gauge the overall sensitivity of your option portfolio to movements in the market.

If your position delta is positive, it means your portfolio is generally sensitive to the price going up. If it's negative, your portfolio is more sensitive to the price going down. If it's near zero, your portfolio is relatively neutral, meaning it's less affected by price changes.

Traders use position delta to assess the risk and potential profitability of their options strategies and to make adjustments to their positions to achieve their desired market outlook and risk tolerance. It's a valuable tool for managing and balancing the overall risk in a portfolio of options.

Frequently Asked Questions

1. What is the delta in Options Trading?

Delta is a measurement that tells you how much the price of an option is likely to change in relation to a one-point change in the underlying asset's price.

2. How Does Delta Affect Call Options?

The delta for call options is positive and typically ranges from 0 to 1. A higher delta means the call option's price is more influenced by increases in the underlying stock's price.

3. What Does Delta Mean for Put Options?

The delta for put options is negative and typically ranges from -1 to 0. A lower delta means the put option's price is more influenced by decreases in the underlying stock's price.

4. How Can I Use Delta in My Options Trading Strategy?

You can use Delta to decide your options strategy for your market

For example, if you're bullish, you might choose options with higher positive deltas, and if you're bearish, you might go for options with negative deltas.

5. What is Position Delta?

Position delta measures the overall sensitivity of your entire options portfolio to market movements.

Key Takeaways:

Delta is crucial for option trading, helping traders anticipate how option prices will react to underlying asset price changes.

It enables informed strategy choices, aligning positions with market views and risk preferences.

Effective delta management aids in portfolio balance, risk control, and goal attainment.

Proficiency in delta is essential for adapting to market shifts and optimizing trading outcomes.