ETFs in Focus: Top 10 ETF funds in India to Invest in 2025

India’s ETF Landscape in 2025

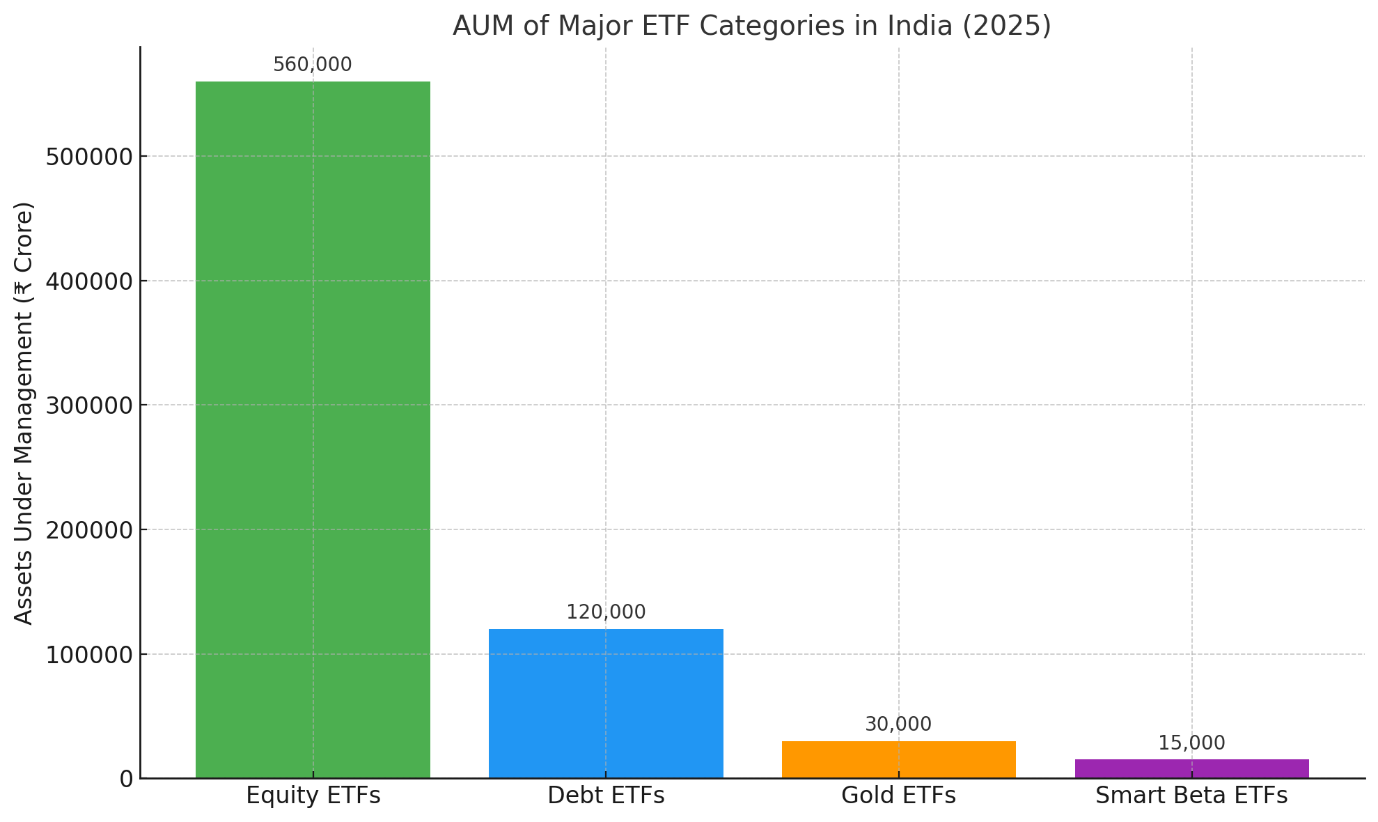

In 2025, Exchange Traded Funds (ETFs) in India will see rapid expansion, with total AUM crossing Rs.7.2 lakh crore, up from Rs.6.45 lakh crore in 2024, according to AMFI reports. ETFs now contribute to over 17% of the mutual fund preference.

Noteworthy Developments:

-

Equity-based ETFs have cornered the biggest share of the pie at about Rs.5.6 lakh crore with significant numbers concentrated in Nifty 50, Sensex, and PSU-themed funds.

-

Debt ETFs-comprising government-backed Bharat Bond ETFs-have grown to about Rs.1.2 lakh crore, especially conservatively oriented investors.

-

Gold ETFs regained their popularity when gold neared Rs.72,000 per 10 grams, making the total AUM of Gold ETFs past Rs.30,000 crore.

-

Participation by retail investors surged by 35 per cent year over year, driven by zero-brokerage apps and greater financial literacy.

-

Institutional interest is steady as the EPFO's exposure to ETFs has touched Rs.1.1 lakh crore by Q1 2025.

-

Smart Beta ETFs- offering access to various strategies like Value, Quality, Low Vol, among others-saw a surging growth of 60 per cent YoY, managing over Rs.15,000 crore.

-

Average daily turnover in ETF trades through NSE and BSE has touched Rs.3,500 crore as of early 2025.

-

As SEBI relaxes rules for active and international ETFs and fintech platforms simplify access, ETF adoption is expected to rise at a CAGR of 25–30% over the coming years.

Understanding How Top 10 ETF funds in India Works

Basic Structure:

ETFs, or Exchange-Traded Funds, are pooled investment products representing an aggregation of assets like equities, bonds, or commodities. The performance is supposed to reflect the underlying index or asset class they are invested in, and ETFs are traded just like ordinary stock like ordinary shares on stock exchanges.

Creation & Redemption Mechanism:

Large institutional players, known as Authorized Participants (APs), play a key role by exchanging a set of underlying securities with the ETF provider to generate ETF units. This process ensures the ETF’s market price stays close to its actual asset value (NAV).

How Retail Investors Trade:

Individual investors can purchase or sell units of an ETF through a Demat and trading account on exchanges such as NSE and BSE during market hours—similar to the purchase of shares.

Price Dynamics:

ETF prices vary in real time as a function of their underlying assets' performance and investor flows. Arbitrage risk is reduced because of constant surveillance by APs.

Account Requirement:

A Demat account and trading platform access are essential for buying or selling top 10 ETF funds in India. Open your demat trading account with Enrich Money.

Top 10 ETF funds in India to Invest in 2025

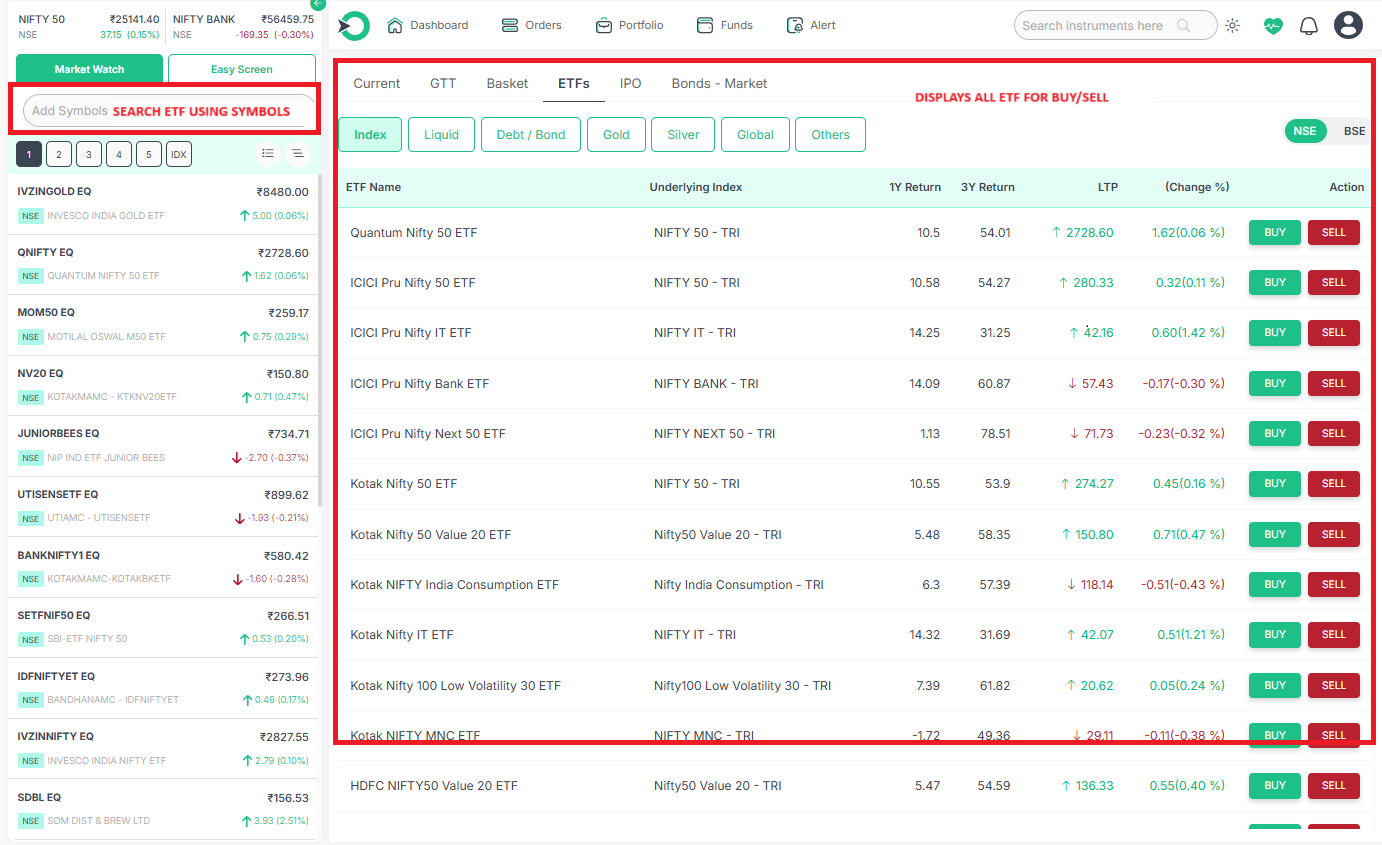

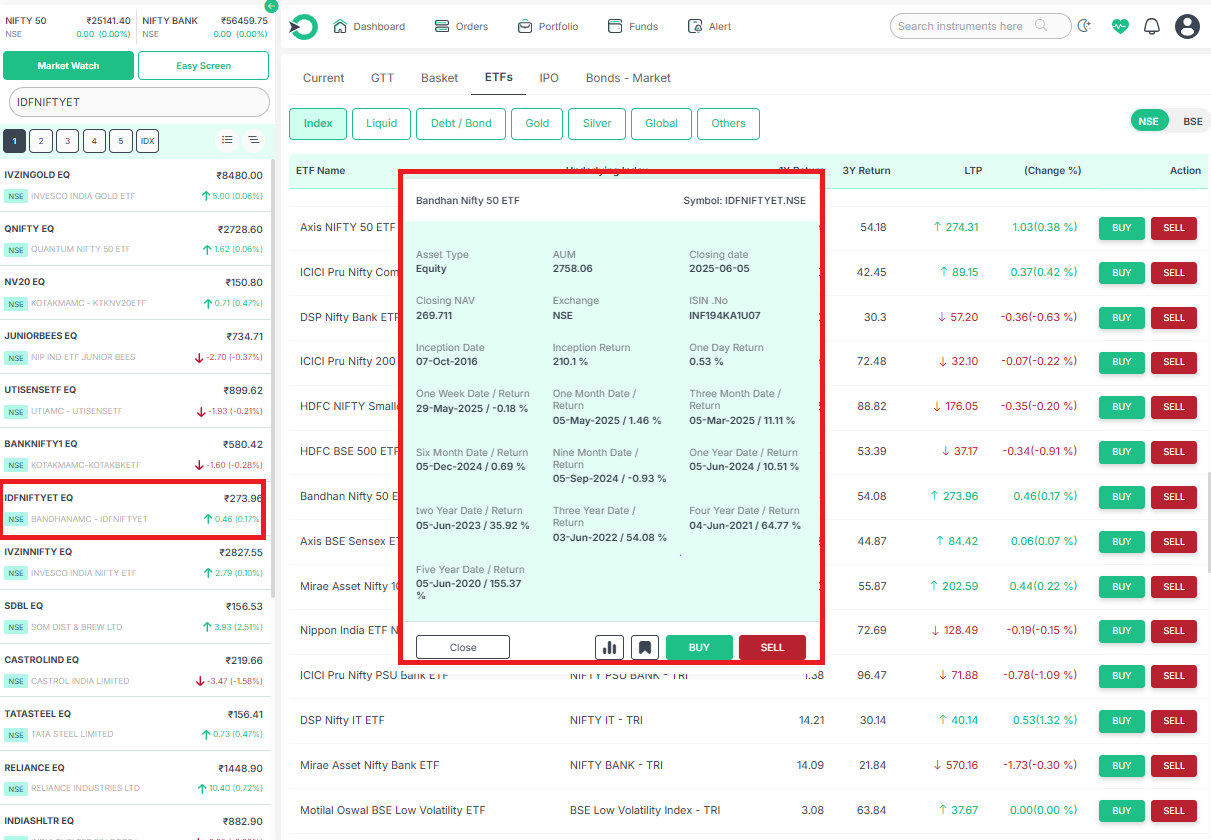

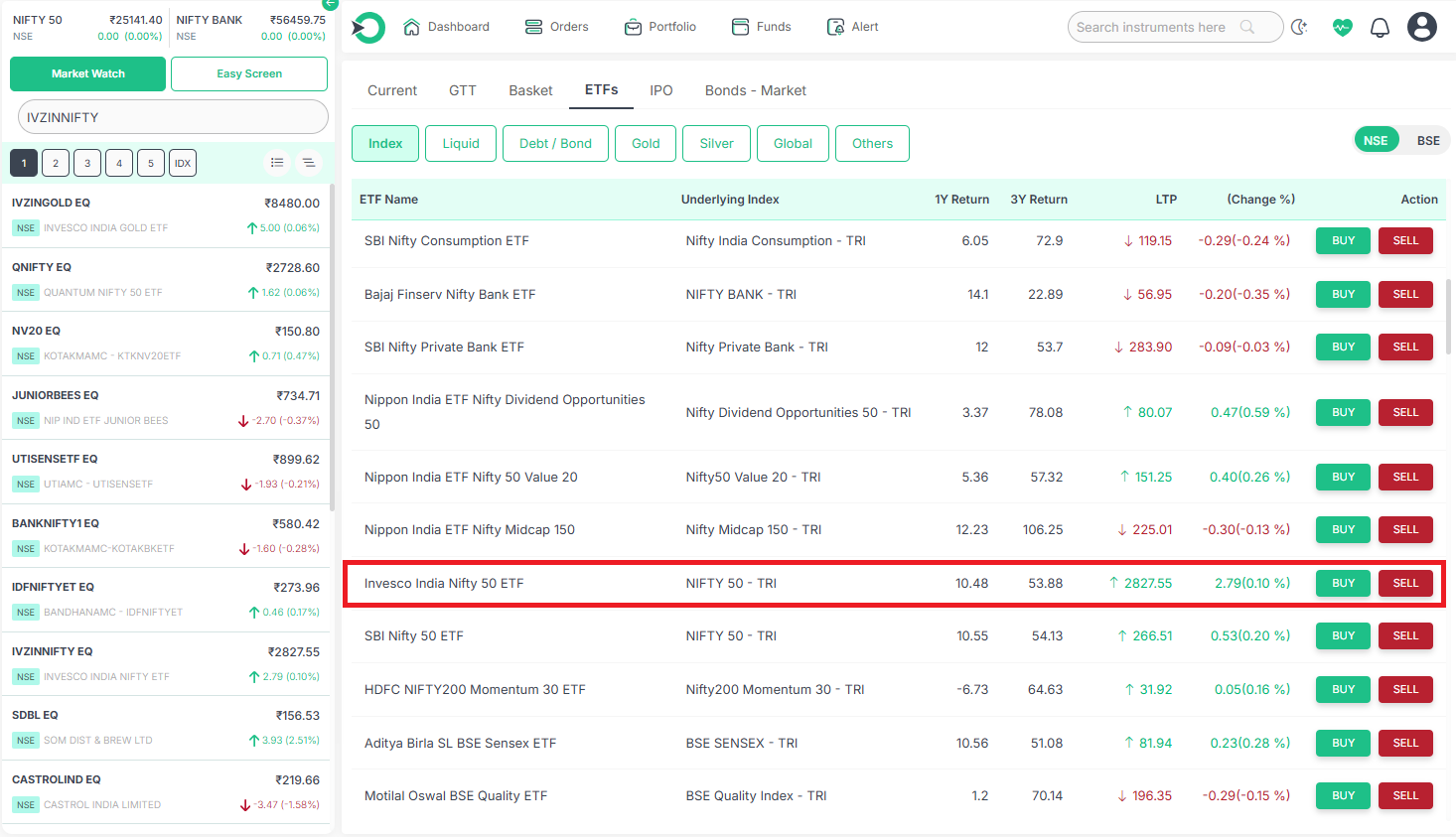

Investors can buy/sell top 10 ETF funds in India using ORCA. In the ORCA dashboard page, users can directly search for Top 10 ETF funds in India using the symbol. Investors can also find the Top 10 ETF funds in India under a dedicated ETF listing page.

|

ETF |

SYMBOL |

ETF NAME |

|

Invesco India Gold ETF |

IVZINGOLD |

Invesco India Gold ETF |

|

Kotak Nifty Bank ETF |

BANKNIFTY1 |

Kotak Nifty Bank ETF |

|

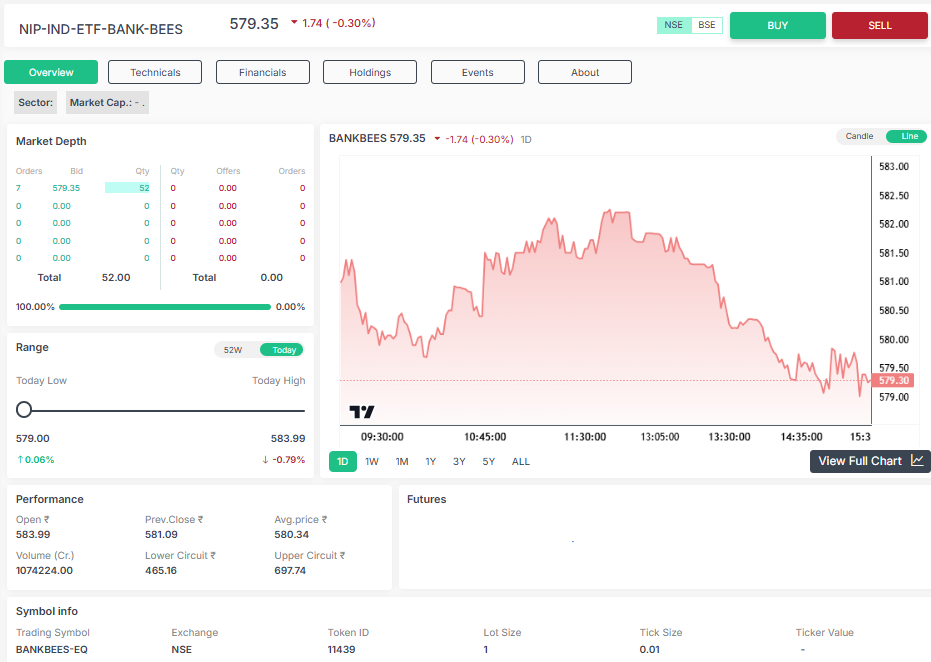

NIP-IND-ETF-BANK-BEES |

BANKBEES |

Nippon India ETF Nifty Bank BeES |

|

SBI Nifty 10 yr Benchmark G-Sec ETF |

SETF10GILT |

SBI Nifty 10 yr Benchmark G-Sec ETF |

|

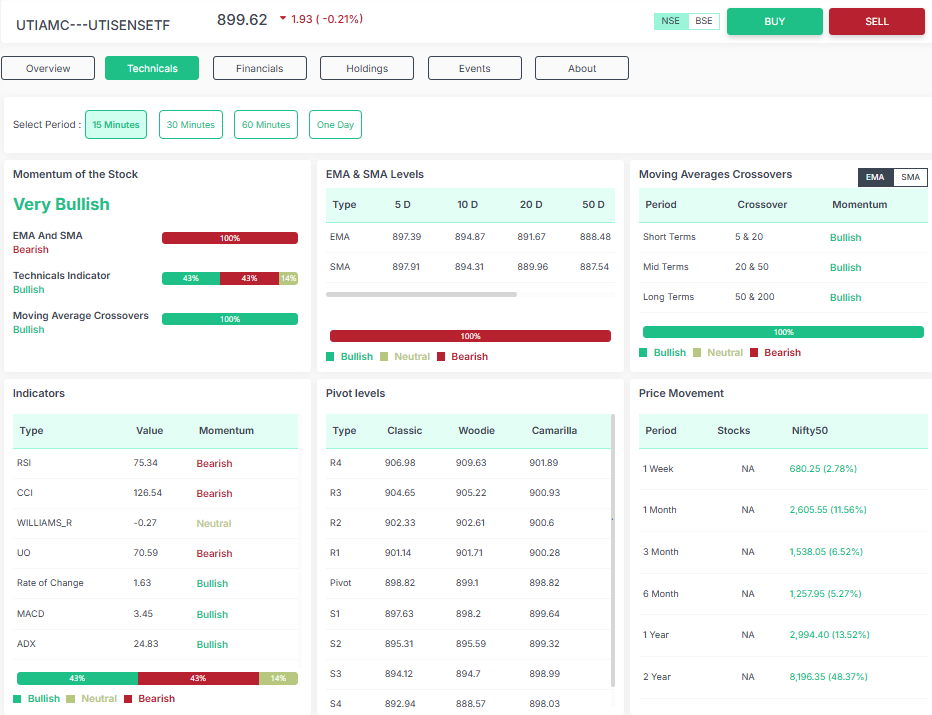

UTI BSE Sensex ETF |

UTISENSETF |

UTI BSE Sensex ETF |

|

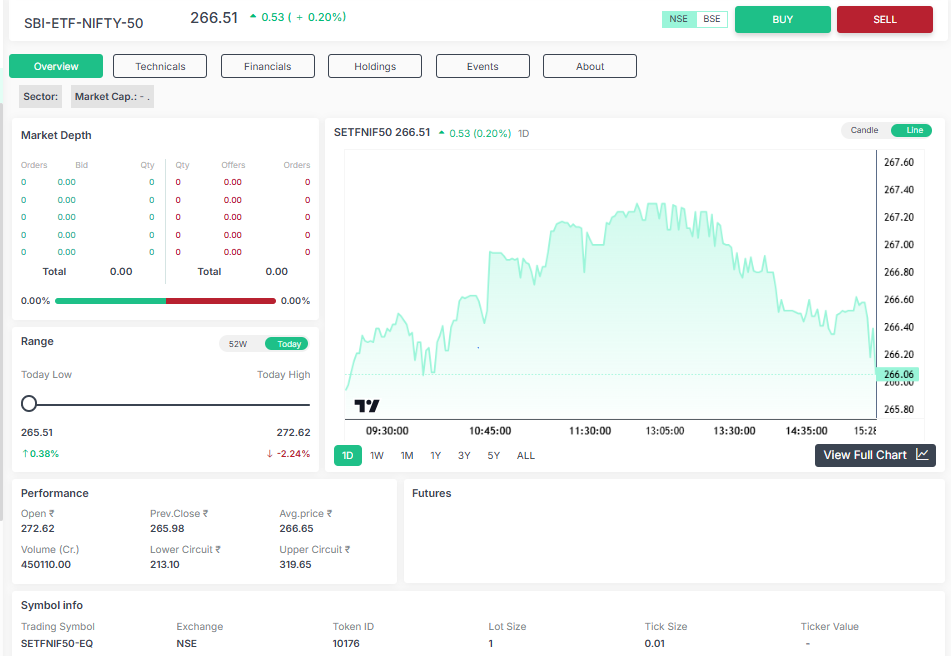

SBI-ETF-NIFTY-50 |

SETFNIF50 |

SBI Nifty 50 ETF |

|

MOTILAL-OSWAL-M50-ETF |

MOM50 |

Motilal Oswal Nifty 50 ETF |

|

Bandhan Nifty 50 ETF |

IDFNIFTYET |

Bandhan Nifty 50 ETF |

|

INVESCO-INDIA-NIFTY-ETF |

IVZINNIFTY |

Invesco India Nifty 50 ETF |

|

CPSE ETF |

CPSEETF |

CPSE ETF |

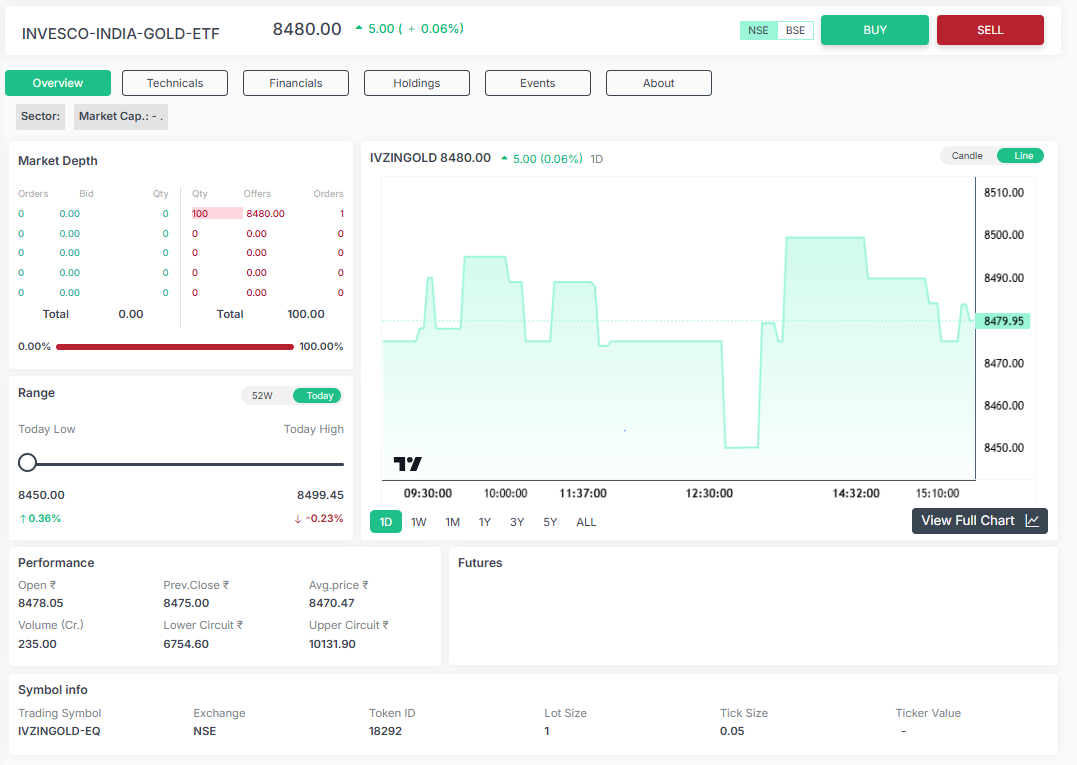

Invesco India Gold ETF - IVZINGOLD

Invesco India Gold ETF is an index scheme that replicates the price performance of physical gold.

Key Highlights:

Long-Term Growth: Throughout the years, this one of the Top 10 ETF funds in India has provided steady returns.

Assets Under Management (AUM): The fund has a high AUM of Rs.6,765 crore, which reflects strong investor confidence.

These Top 10 ETF funds in India are a great choice for Indian investors seeking to diversify their portfolio and protect themselves against inflation — all through the security and ease of gold-backed assets.

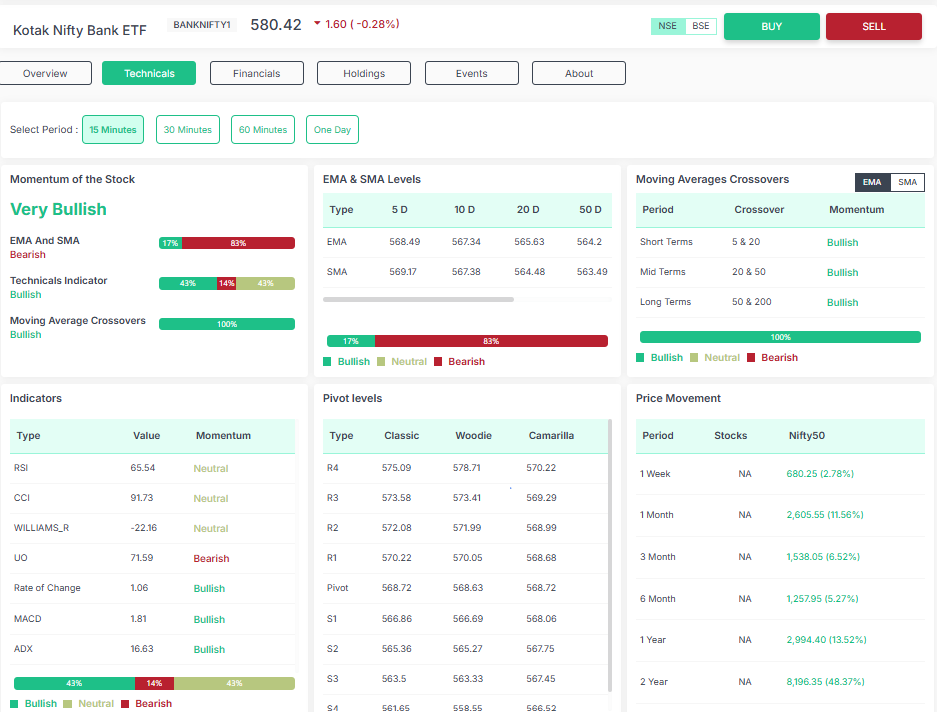

Kotak Nifty Bank ETF - BANKNIFTY1

The Kotak Nifty Bank ETF is designed to replicate the NIFTY BANK Total Return Index

Key Takeaways:

Impressive Returns: One of the best-performing Top 10 ETF funds in India, in the industry and a strong indicator of excellent long-term prospects.

Competitive Advantage:

The Top 10 ETF funds in India tracks the performance of Nippon Bank BeES (14.03% vs. 14.00%) well, showcasing excellent index tracking ability. Investors can pick and choose depending on aspects such as trading volume or cost.

Sector Outperformance:

Banking-themed ETFs have surpassed overall market alternatives like Nifty 50 ETFs (14.03% vs ~10.5%), highlighting the banking space's strong recovery and favorable outlook in the current macroeconomic backdrop.

Kotak Nifty Bank ETF is notable for its stable performance, sectoral outperformance, and efficient index replication—making it an attractive pick for investors optimistic about India's banking space.

Nippon India ETF Nifty Bank BeES - BANKBEES

It tracks the performance of the NIFTY BANK Total Returns Index (TRI), providing direct exposure to India's leading banking stocks. With a price of Rs.584.42, it enables investors to tap into the potential of the sector without needing to select individual banking stocks.

Key Highlights:

Strong Returns: Indicates strong momentum and grit in the banking sector.

Performance Parity:

Closely tracks Kotak Nifty Bank ETF returns, reflecting its consistency in matching the benchmark index and providing investors with freedom to choose between two effective alternatives.

Focused Exposure:

Provides pure-play exposure to the banking space—ideal for investors who are wagering on India's growth story in finance.

High Liquidity:

Having a strong trading volume as well-established Top 10 ETF funds in India, it is hassle-free to buy or sell

BANKBEES is an intelligent low-cost means of surfing India's banking sector boom. With good returns, effective tracking, and decent liquidity, it continues to be a choice favorite among banking-themed ETF investors.

SBI Nifty 10 yr Benchmark G-Sec ETF - SETF10GILT

It provides investors with an easy means of exposure to Indian government bonds with a maturity of 10 years

Key Insights:

Performance Snapshot: Returns shows the stable nature of bond market returns which is fueled by a favorable interest rate environment.

Diversification Benefit:

Serves as a defensive asset, which serves to offset portfolio volatility when equities move.

Lower Risk Profile:

As opposed to equity ETFs, this bond-heavy Top 10 ETF funds in India provides more stability, constituting a better bet for conservative or income-conscious investors.

SBI’s G-Sec ETF is a solid choice for those looking to add fixed-income exposure, reduce overall risk, and diversify away from equities—all while enjoying the transparency and liquidity among the Top 10 ETF funds in India.

UTI BSE Sensex ETF - UTISENSETF

The UTI BSE Sensex ETF is constructed to mirror the performance of the legendary BSE Sensex index, providing investors with direct access to India's 30 most reputable large-cap corporations.

Key Highlights:

Performance Overview: Returns are with wider market averages, but slightly lower than gold and banking ETFs and indicate a strong sustained long-term value creation for investors.

Diversification Advantage:

Supplements Nifty 50 ETFs, enabling investors to diversify risk across a different portfolio of blue-chip stocks.

UTI Sensex ETF is one of the Top 10 ETF funds in India which is perfect for investors who want stability, long-term appreciation, and exposure to India's best-known firms—all in one easy, inexpensive investment vehicle.

SBI Nifty 50 ETF - SETFNIF50

SBI Nifty 50 ETF provides investors with direct, low-cost entry into India's leading 50 companies by following the NIFTY 50 Total Returns Index (TRI).

Key Insights:

Strong Returns: The returns align with other Nifty 50 ETFs, which confirms its dependability.

Market Positioning:

Surpasses more risk-averse alternatives such as the G-Sec ETF (12.29% 1Y), providing more robust growth for those who invest in equity.

Effective Benchmark Replication:

Emulates closely the performance of comparable Nifty 50 ETFs, demonstrating its ability in replicating the benchmark index.

SBI Nifty 50 ETF is a compelling pick for those looking for broad exposure to equities, stable returns, and a convenient means of participating in the long-term story of India through its best-performing businesses.

Motilal Oswal Nifty 50 ETF - MOM50

Motilal Oswal Nifty 50 ETF (MOM50) replicates the Nifty 50 index, providing investors exposure to India's largest and most prominent companies by market cap.

Key Highlights:

Trustworthy Returns: accurate index replicator and reflects solid performance from India's large-cap segment.

Competitive Match:

Provides comparable returns to fellow peers SBI and Bandhan Nifty 50 ETFs, reiterating its effective management and benchmark faithfulness.

Motilal Oswal's Nifty 50 ETF is a reliable choice for investors looking for stable growth, cost-effectiveness, and hassle-free entry into India's best-performing large-cap firms—all via a convenient ETF form.

Bandhan Nifty 50 ETF - IDFNIFTYET

The Bandhan Nifty 50 ETF replicates the Nifty 50 index performance, providing investors with a simple and inexpensive method of investing in India's 50 largest blue-chip stocks.

Key Highlights:

Consistent Returns: Very much in line with other top Nifty 50 ETFs and also shows good and consistent long-term performance.

Cost Efficiency:

With an expense ratio of only 0.09%, Bandhan Nifty 50 ETF is low-cost, offering investors greater value for their investment.

Bandhan Nifty 50 ETF is a shrewd choice for those seeking low-cost, passive exposure to India's large-cap universe with the support of sturdy returns and effective tracking of the index benchmark.

Invesco India Nifty 50 ETF - IVZINNIFTY

Invesco India Nifty 50 ETF follows the NIFTY 50 Total Returns Index (TRI), providing exposure to India's largest 50 large-cap companies from primary sectors.

Key Insights:

Competitive Returns: Closely in line with peer Nifty 50 ETFs and also demonstrates consistent performance in India's large-cap space.

NAV Difference

Higher NAV of Rs.2,827.20 reflects a different unit size, not necessarily premium—investors keep in mind unit size and price per unit.

Investor Consideration:

Though performance is quite in sync with the peers, one should also consider expense ratio and liquidity while selecting among several Nifty 50 ETF choices.

Invesco's Nifty 50 ETF provides solid benchmark exposure with solid returns and positive momentum. Suitable for investors wanting large-cap equity exposure with passive ease, but savvy investors must also consider costs and ease of trading.

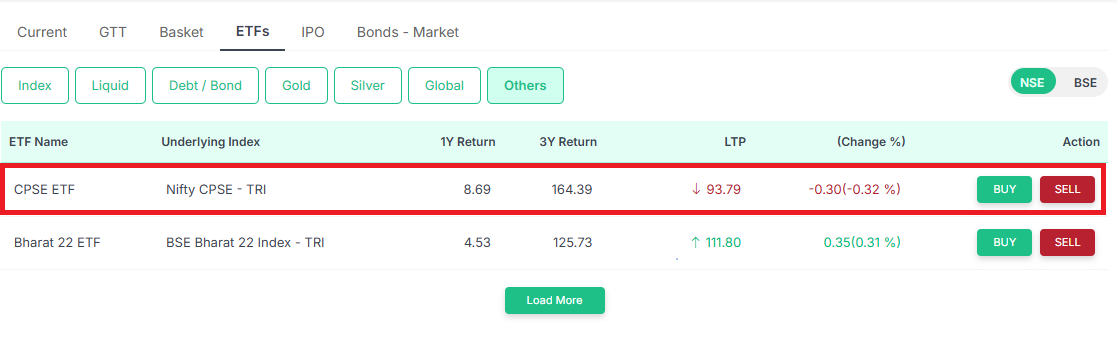

CPSE ETF - CPSEETF

The CPSE ETF or Central Public Sector Enterprises ETF aims to replicate the Nifty CPSE index, providing investors with exposure to India's leading government-owned businesses.

Key Highlights:

Stellar Long-Term Performance: A leader among sectoral ETFs and Top 10 ETF funds in India, owing to the steep re-rating of PSU stocks. It also indicates recent consolidation, perhaps due to cyclical corrections.

Value Opportunity:

The recent underperformance may be an opportunity for value investors to enter on lower levels, particularly as the PSU revival theme picks pace.

Placed to gain from sustained government attention to infrastructure outlay and energy reforms—primary drivers of PSU outperformance.

The CPSE ETF is well-suited for investors with a high to medium risk appetite who want to take advantage of India's changing public sector revival. It balances long-term potential with tactical opportunities based on government policy and sectoral tailwinds.

Performance Snapshot of Top 10 ETF funds in India in 2025

Top 10 ETF funds in India provide a well-diversified basket in equity, commodity, bond, and thematic categories. A summary of Top 10 ETF funds in India is as follows:

|

ETF NAME |

UNDERLYING INDEX |

1 Y Return % |

3 Y Return % |

LTP |

|

Invesco India Gold ETF |

Gold-India |

35.2 |

89.05 |

8407.40 |

|

Kotak Nifty Bank ETF |

NIFTY BANK - TRI |

14 |

60.49 |

584.64 |

|

Nippon India ETF Nifty Bank BeES |

NIFTY BANK - TRI |

14 |

60.64 |

584.42 |

|

SBI Nifty 10 yr Benchmark G-Sec ETF |

Nifty 10 yr Benchmark G-Sec |

12.3 |

31.46 |

257.76 |

|

UTI BSE Sensex ETF |

BSE SENSEX - TRI |

10.6 |

51.15 |

899.69 |

|

SBI Nifty 50 ETF |

NIFTY 50 – TRI |

10.6 |

54.13 |

265.99 |

|

Motilal Oswal Nifty 50 ETF |

NIFTY 50 – TRI |

10.5 |

54.13 |

258.85 |

|

Bandhan Nifty 50 ETF |

NIFTY 50 – TRI |

10.5 |

54.08 |

272.67 |

|

Invesco India Nifty 50 ETF |

NIFTY 50 – TRI |

10.5 |

53.88 |

2827.20 |

|

CPSE ETF |

Nifty CPSE - TRI |

8.69 |

164.39 |

93.80 |

Invesco India Gold ETF (IVZINGOLD) has provided a fantastic 35.18% 1 -Year return, thanks to gold's global upswing and inflation hedging demand. Also, 89.05% 3 -Year return supports gold's position as a long-term hedge.

Kotak Nifty Bank ETF (BANKNIFTY1) has provided a strong 1 -Year return of 14.03%, echoing banking space strength.

Nippon India ETF Nifty Bank BeES (BANKBEES) has excellent index tracking.

CPSE ETF (CPSEETF) has a stunning 164.39%, driven by PSU sector re-rating and govt capex.

CPSE ETF excels as a PSU-focused high-growth bet.

Landscape of Top 10 ETF funds in India by Category

Banking ETFs have a Solidly strong, with returns at ~60%, indicating strong sector fundamentals.

Several Nifty 50 ETFs like SBI, Bandhan, Motilal Oswal, Invesco, with comparable 1Y returns (10.48–10.59%) are perfect for passive, large-cap exposure.

Gold ETF has provided robust diversification, particularly in times of economic uncertainty.

Debt ETF is suitable for risk-averse investors wanting bond exposure.

Final Thoughts

From defensives such as bonds and gold to high-growth sectors such as banking and public sector companies Top 10 ETF funds in India has something for all types of investors. The CPSE ETF is the leader in long-term performance, while gold shines brightest in short-term returns. Broad market ETFs provide stability with choice between expense ratios and liquidity.

Frequently Asked Questions

What is the minimum investment to invest in the top 10 ETF funds in India?

Most Indian top 10 ETF funds in India permit you to invest with a minimum of the cost of one unit, usually ranging from Rs.100 to Rs.500, based on the ETF.

Are the top 10 ETF funds in India safe for long-term investments?

Yes, top 10 ETF funds in India particularly those from widely tracked indices such as Nifty 50 or Sensex are low-cost, diversified exposure and are best for long-term wealth accumulation.

How do I invest in the top 10 ETF funds in India using Enrich Money?

You can invest in top 10 ETF funds in India via the Enrich Money ORCA trading app. Simply open a free Demat & trading account, look for your desired top 10 ETF funds in India and place a buy order.

What is the tax on gains from the top 10 ETF funds in India?

Gains from equity ETFs are taxed at capital gains: 15% short-term (held <1 year) and 10% long-term (>1 year, over Rs.1 lakh per annum). Gold and debt ETFs have separate tax provisions.

Do top 10 ETF funds in India give dividends?

Some ETFs do pay dividends, but others stick to a growth pattern, where returns are reinvested into the fund.

All ETFs

Disclaimer: This blog is dedicated exclusively for educational purposes. Please note that the securities and investments mentioned here are provided for informative purposes only and should not be construed as recommendations. Kindly ensure thorough research prior to making any investment decisions. Participation in the securities market carries inherent risks, and it's important to carefully review all associated documents before committing to investments. Please be aware that the attainment of investment objectives is not guaranteed. It's important to note that the past performance of securities and instruments does not reliably predict future performance.