Stocks Below Rs.2000 with High Piotroski and Promoter Holding

Investing in the stock market can be challenging , especially with the vast volume of options available. To make informed choices, experienced investors often rely on financial metrics and strategic criteria. One such approach involves identifying stocks priced under Rs.2000 with high Piotroski Scores and significant promoter holdings. This strategy not only targets value-driven opportunities but also focuses on stocks backed by strong fundamentals. Additionally, platforms like Enrich Money provide tools to help investors analyze and identify such promising stocks effectively.

Understanding Piotroski Score, Promoter Holding, and PE Ratio

Piotroski Score

The Piotroski Score evaluates a company’s financial health using nine criteria based on profitability, leverage, and efficiency. Developed by Professor Joseph Piotroski, it scores companies from 0 to 9, where 7 or higher indicates strong fundamentals and potential for investment.

Key factors:

-

Profitability: Assesses net income, cash flow, and return on assets.

-

Leverage and Liquidity: Examines debt reduction and liquidity improvement.

-

Efficiency: Tracks better gross margins and asset utilization.

Importance of High Promoter Holding

High promoter holding indicates promoters’ confidence, reduces unethical practices, and aligns with shareholder interests.

Role of Low PE Ratio

A low Price-to-Earnings (PE) ratio highlights undervalued stocks, especially when paired with strong fundamentals and a high Piotroski Score, offering potential for price gains.

Why Choose Stocks Below Rs.2000?

Stocks priced under Rs.2000 are affordable and accessible, especially for retail investors. These stocks are often in the small-cap or mid-cap category, offering significant growth potential

Advantages of This Strategy

Focusing on stocks with high Piotroski Scores, low PE ratios, and high promoter holding has multiple benefits:

-

Strong Fundamentals: High Piotroski scores reflect robust financial health.

-

Valuation Edge: Low PE ratios indicate undervaluation, offering room for growth.

-

Promoter Confidence: Significant promoter holding aligns management’s goals with shareholders’ interests.

-

Growth Potential: Affordable stocks in growing industries often deliver substantial long-term returns.

Promising Stocks Under Rs.2000 with High Piotroski and Promoter Holding

Explore promising stocks priced under Rs.2000 that feature substantial promoter holdings and a strong Piotroski Score. These stocks, highlighted by Enrich Money, offer a combination of stability and the potential for consistent returns.

Life Insurance Corporation of India

Sun Pharmaceutical Industries Limited

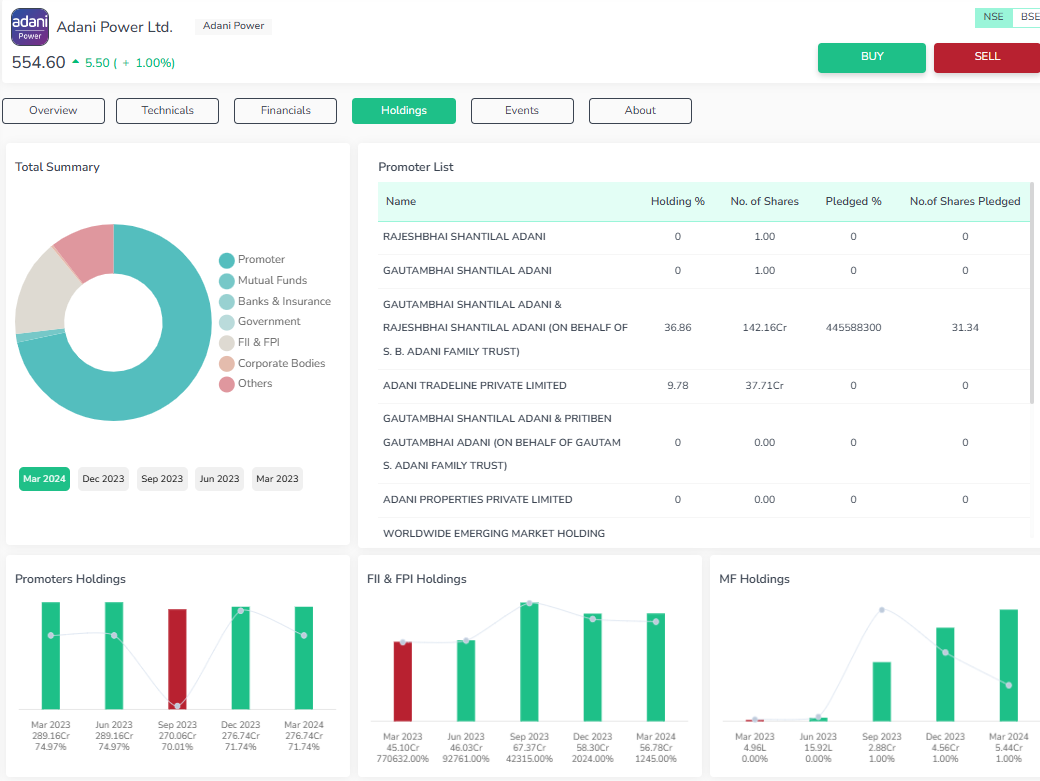

Adani Power Limited

Adani Power Limited is a leading player in the Indian power sector, known for its strong generation capacity and growth potential.

Adani Power demonstrates solid financial health with a Piotroski score of 7, indicating strong profitability and efficiency. The company’s PE ratio of 16.60 is significantly lower than the sector average of 34.47, suggesting potential undervaluation. With an impressive ROE of 48.28% and ROCE of 31.59%, Adani Power excels in generating returns. Its revenue and net income growth over the past five years outperform the sector. However, the company carries a high debt-to-equity ratio of 343.24%, raising concerns about leverage risk. Promoter holding is strong at 74.96%, with minimal pledged shares, reflecting confidence in future growth.

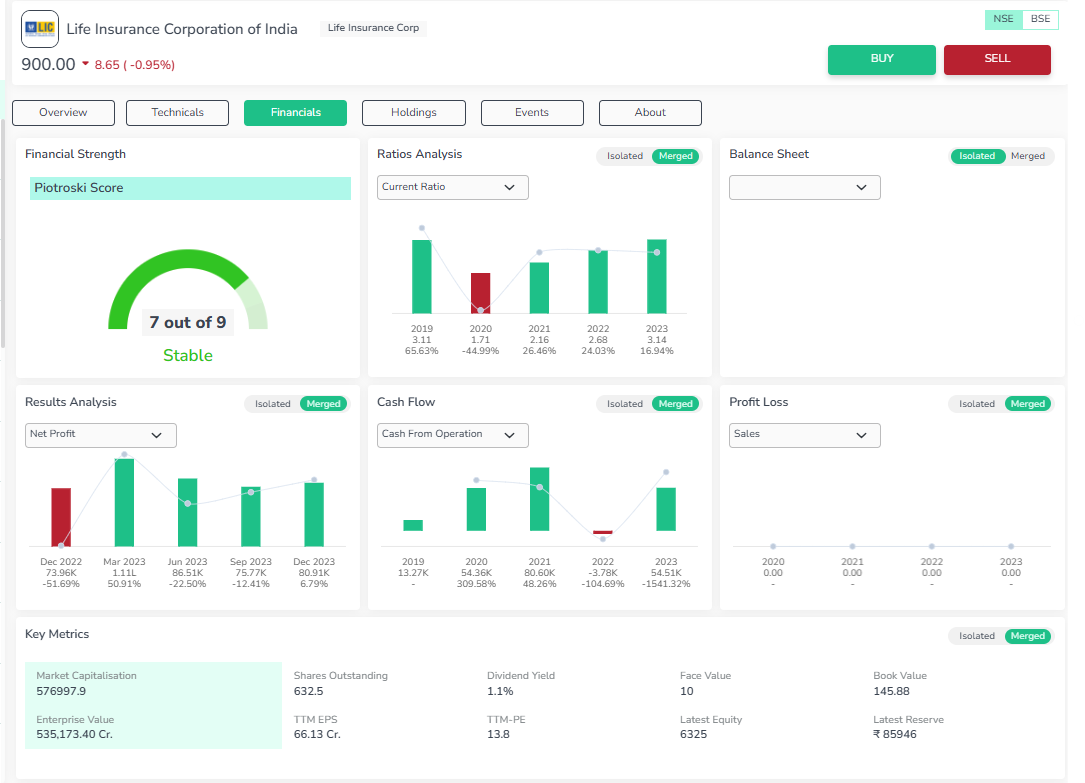

Life Insurance Corporation of India

Life Insurance Corporation of India (LIC) stock represents a key player in the Indian insurance sector, offering stability with strong market presence and growth potential.

LIC has a Piotroski score of 7, indicating solid financial health. Its PE ratio of 13.68 is significantly lower than the sector’s average of 34.81, suggesting it may be undervalued. The company boasts a strong ROE of 49.36%, although its ROCE of 0.79% is notably low. Over the past five years, LIC's revenue and net income have underperformed the sector. Despite low profitability margins (EBITDA: 3.29%, net profit: 2.14%), LIC maintains impressive liquidity at 288.41%. However, its high debt-to-equity ratio (4615.46%) raises concerns. The company has a robust promoter holding of 96.50%, with minimal pledged shares.

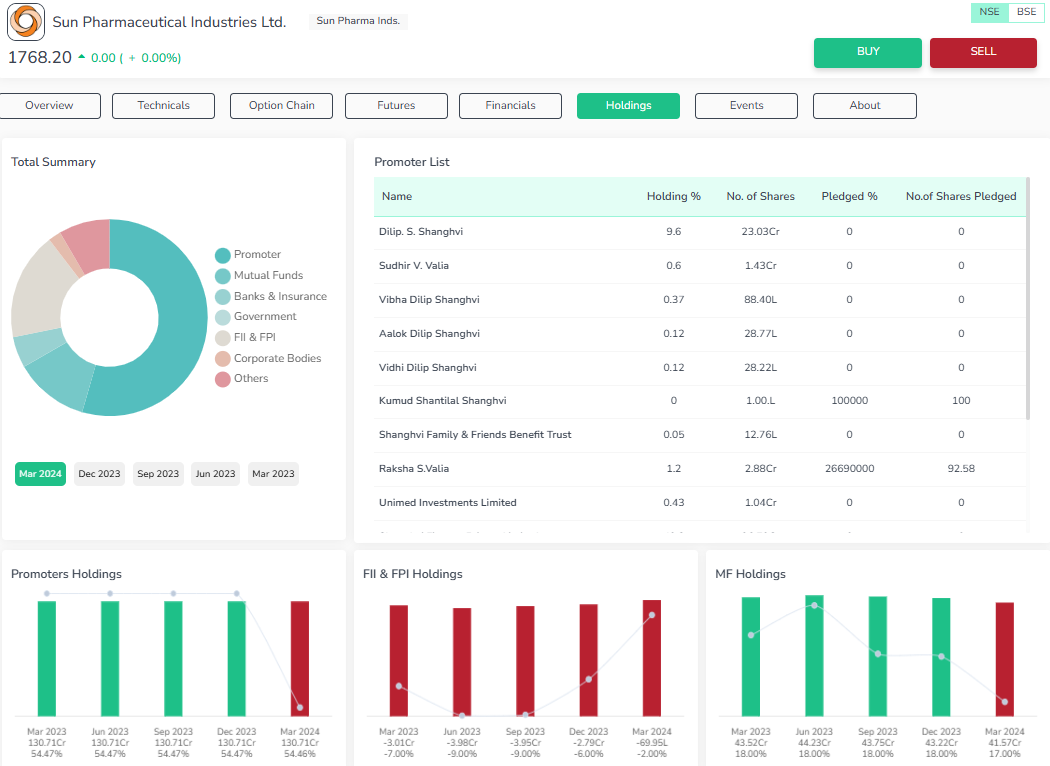

Sun Pharmaceutical Industries Limited

Sun Pharmaceutical Industries Limited is a leading pharmaceutical company known for its strong market presence and consistent growth in both domestic and international markets.

Sun Pharma demonstrates strong financial health with a Piotroski score of 8/9, indicating solid fundamentals. Its PE ratio of 38.08 is slightly below the sector average of 39.84, suggesting reasonable valuation. The company boasts a healthy ROE of 14.38% and ROCE of 16.54%, reflecting efficient utilization of capital. Revenue and net income growth surpass sector averages over the past five years, with impressive margins—EBITDA at 21.73% and net profit at 13.23%. Sun Pharma maintains strong liquidity (209.73%) and a low debt-to-equity ratio (8.75%). The promoter holding of 54.48% is substantial, with minimal pledged shares, ensuring confidence in management.

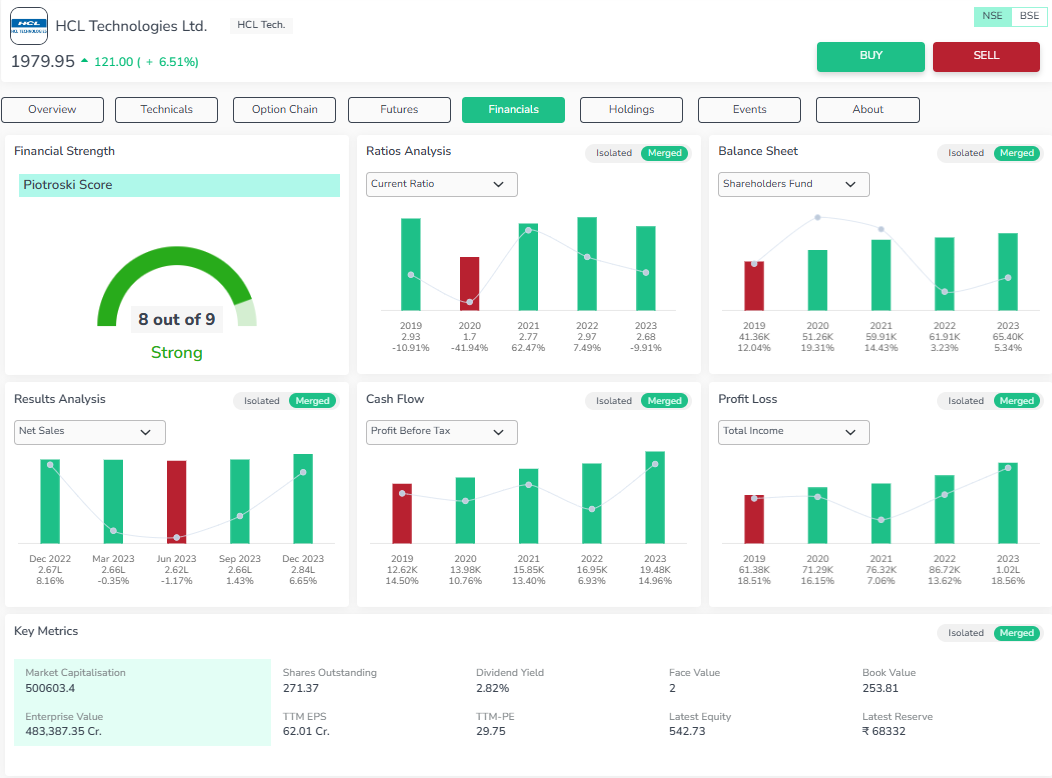

HCL Technologies Limited

HCL Technologies Limited is a leading global IT services company, known for its strong digital transformation solutions and consistent financial performance.

HCL Technologies boasts a strong Piotroski score of 8/9, indicating solid financial health. Its PE ratio of 30.07 is lower than the sector’s average of 38.03, suggesting it is relatively undervalued. The company shows impressive profitability with a Return on Equity (ROE) of 23.01% and Return on Capital Employed (ROCE) of 27.93%. Despite having a solid EBITDA margin of 28.78%, the net profit margin at 14.85% is comparatively lower. With high liquidity at 253.3% and a low debt-to-equity ratio of 10.59%, HCL remains financially stable. Promoter holdings are robust at 60.81%, with minimal pledged shares, reflecting confidence in the company.

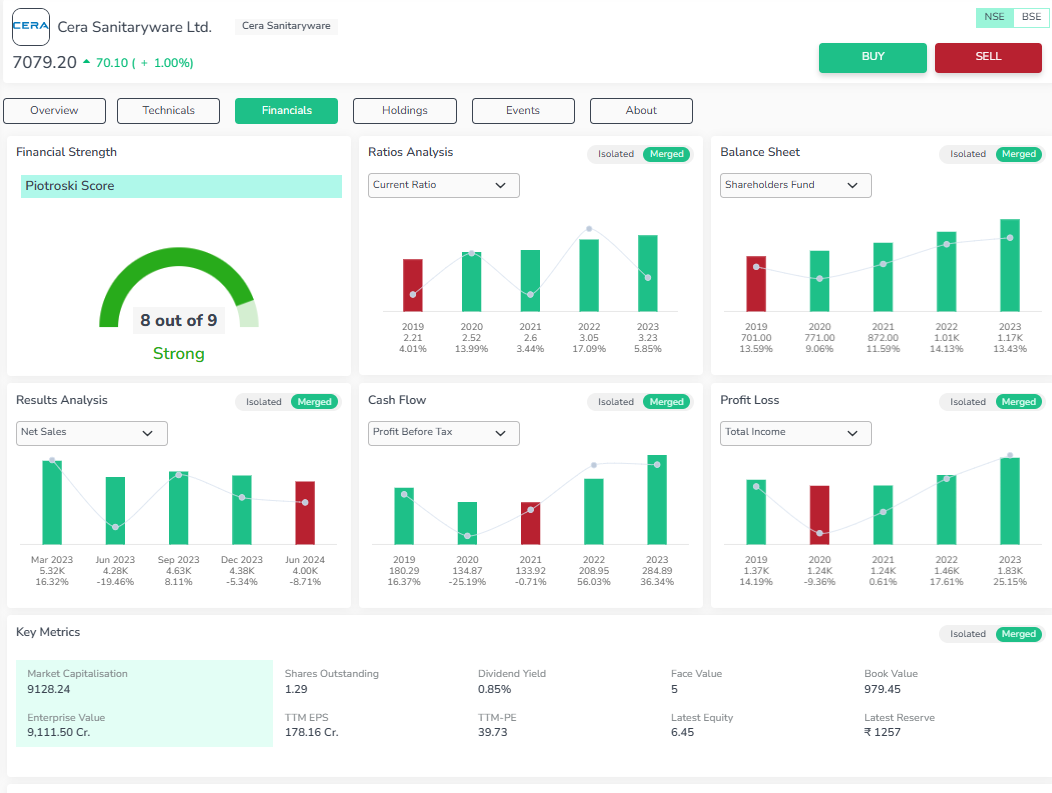

Cera Sanitaryware Limited

Cera Sanitaryware Limited is a leading manufacturer in the sanitaryware industry, known for its strong market presence and consistent growth in both domestic and international markets.

Cera Sanitaryware has an impressive Piotroski score of 8/9, indicating strong financial health. Its PE ratio of 38 is lower than the sector average of 47.29, suggesting it is undervalued relative to peers. With an ROE of 17.59% and a ROCE of 22.28%, the company demonstrates efficient utilization of equity and capital. Over the past five years, Cera has outperformed the sector in revenue and net profit margin, with EBITDA and net profit margins of 16.49% and 10.24%, respectively. Its liquidity ratio of 287.53% and low debt-to-equity ratio of 6.46% reflect strong financial stability, while promoter holding stands at 54.41%, with minimal pledging.

Risks to Consider

While this strategy is effective, investors should remain mindful of potential risks:

-

Over-Reliance on Metrics: While helpful, Piotroski Scores and PE ratios alone cannot guarantee success.

-

Market Volatility: External factors such as economic or political events may affect stock prices.

-

Liquidity Issues: Mid-cap or small-cap stocks may face liquidity challenges during downturns.

-

Corporate Governance Risks: Even with high promoter holding, governance issues could arise.

Using platforms like Enrich Money can help mitigate these risks by providing real-time updates and tools to assess stocks comprehensively.

Pro Tips for Smart Investing

Adopt a Long-Term Perspective: Stocks with high Piotroski Scores often deliver superior returns over time.

Stay Updated: Follow market news, sector updates, and company announcements.

Leverage Analytical Tools: Platforms like Enrich Money can enhance decision-making with comprehensive data.

Focus on Risk Management: Always use stop-loss orders to minimize potential losses during volatile phases.

Conclusion

Investing in stocks priced below Rs.2000 with high Piotroski Scores and significant promoter holdings offers an effective strategy for building a value-driven portfolio. Such stocks combine affordability with strong fundamentals and growth potential, making them ideal for both novice and experienced investors.

With apps from Enrich Money like ORCA app , identifying these stocks becomes even simpler. By using smart filters, financial analysis, and market insights, you can make informed decisions and achieve your investment goals. Remember, while these metrics are helpful, thorough research and a diversified portfolio remain essential to minimize risks and maximize returns.

Take the first step today—start screening and analyzing stocks to secure your financial future!

Frequently Asked Questions

What are Piotroski Scores and why are they important for stock investment?

Piotroski Scores evaluate a company's financial health, with a score of 7 or higher indicating strong fundamentals.

How do high promoter holdings impact a stock's performance?

High promoter holdings suggest strong confidence and alignment between management and shareholders, reducing risks.

Why focus on stocks below Rs.2000?

Stocks under Rs.2000 are more affordable and often present growth opportunities, particularly in the mid-cap and small-cap sectors.

What is the significance of a low PE ratio in stock selection?

A low PE ratio indicates undervaluation, offering the potential for price appreciation when supported by strong financials.

How can platforms like Enrich Money assist in finding these stocks?

Enrich Money provides tools to screen stocks based on Piotroski Scores, promoter holdings, and PE ratios, helping investors make informed choices.

Related Blogs:

Top Performing Stocks Under 100 Rupees in 2025

Discover the Top-Rated Stocks Under 500 Rupees Today

Pharma Penny Stocks Under Rs 100

Stocks Under Rs. 1000 to Watch: Budget-Friendly Trading Choices for 2025

Disclaimer: This blog is dedicated exclusively for educational purposes. Please note that the securities and investments mentioned here are provided for informative purposes only and should not be construed as recommendations. Kindly ensure thorough research prior to making any investment decisions. Participation in the securities market carries inherent risks, and it's important to carefully review all associated documents before committing to investments. Please be aware that the attainment of investment objectives is not guaranteed. It's important to note that the past performance of securities and instruments does not reliably predict future performance.