Pharma Penny Stocks Under Rs 100: A Comprehensive Guide

Introduction

The pharmaceutical sector has always been a focal point for investors seeking opportunities in India's stock market. Among the many investment options, pharma penny stocks under Rs 100 have garnered significant attention. These stocks represent small-cap pharmaceutical companies with the potential for exponential growth, albeit with higher risks. For investors with a high-risk tolerance and a speculative mindset, such stocks offer a chance to participate in the healthcare sector's growth story.

In this detailed guide, we will explore the dynamics of pharma penny stocks, their benefits, risks, performance metrics, and how investors can approach these stocks to maximize their potential.

What Are Pharma Penny Stocks?

Pharma penny stocks are shares of small pharmaceutical companies priced low, typically under Rs 10 or Rs 100, offering affordable investment opportunities. These stocks usually belong to companies with smaller market capitalizations and limited financial resources. Despite their affordability, these stocks can be highly speculative, exhibiting significant price fluctuations due to their sensitivity to market trends, news, and sector developments.

These stocks can be appealing because they provide investors with access to innovative ventures in pharmaceuticals and healthcare. Companies in this segment often work on pioneering drug discoveries, generic medicines, or novel therapeutic technologies. However, their low market capitalization and limited track records make them inherently risky.

Pharma Penny Stocks Under Rs 100 – Key Players

The table below lists some prominent pharma penny stocks under Rs 100 based on their market capitalization.

|

Name |

Market Cap (Rs. Cr) |

Close Price (Rs.) |

|

4,566.65 |

83.34 |

|

|

1,719.26 |

20.49 |

|

|

820.57 |

36.59 |

|

|

480.89 |

57.95 |

|

|

Gennex Laboratories Ltd |

474.23 |

20.85 |

-

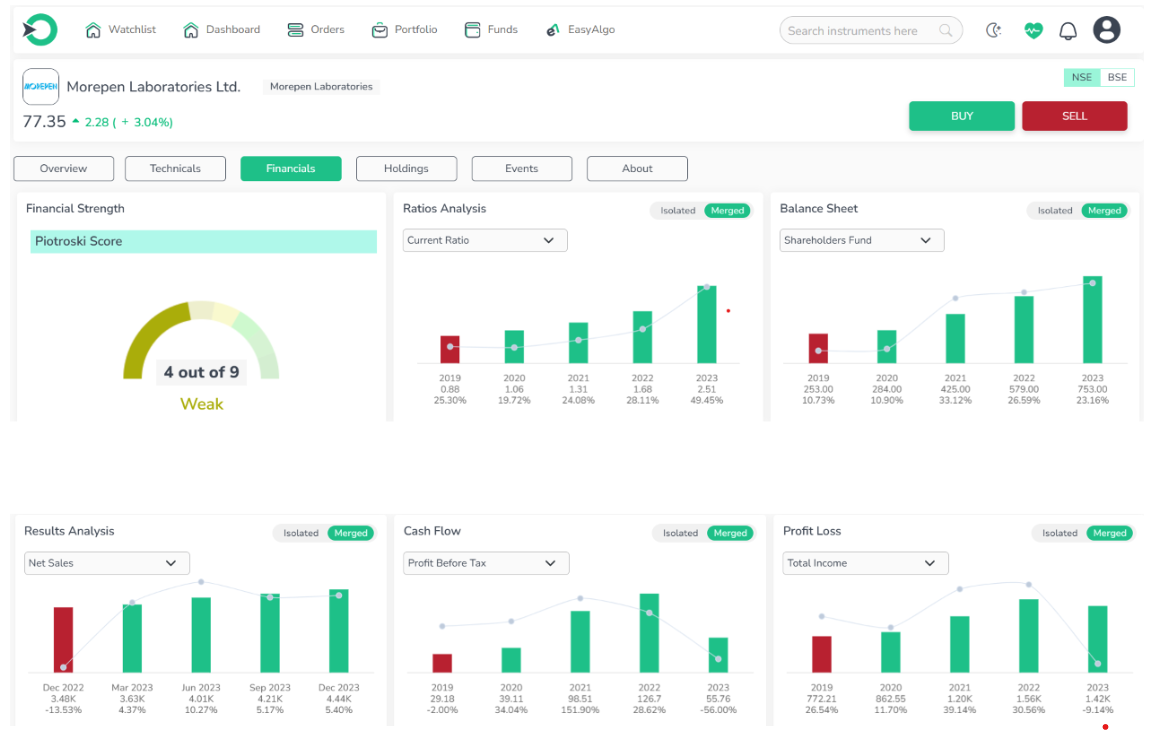

Morepen Laboratories Ltd

Morepen Laboratories Ltd is a well-established pharmaceutical company specializing in APIs, formulations, diagnostics, and over-the-counter products. Its flagship brand, Dr. Morepen, has earned consumer trust due to its quality and reliability. Morepen’s strong focus on innovation and global outreach ensures its position as a leading name in the industry.

The company is virtually debt-free and boasts a strong interest coverage ratio of 43.45, with an efficient cash conversion cycle of 22.22 days. Its current ratio of 2.39 reflects a healthy liquidity position, while its operating leverage stands at a strong average of 5.54. However, the company has faced poor growth, with a profit increase of just 5.58% and revenue growth of 11.39% over the past three years.

-

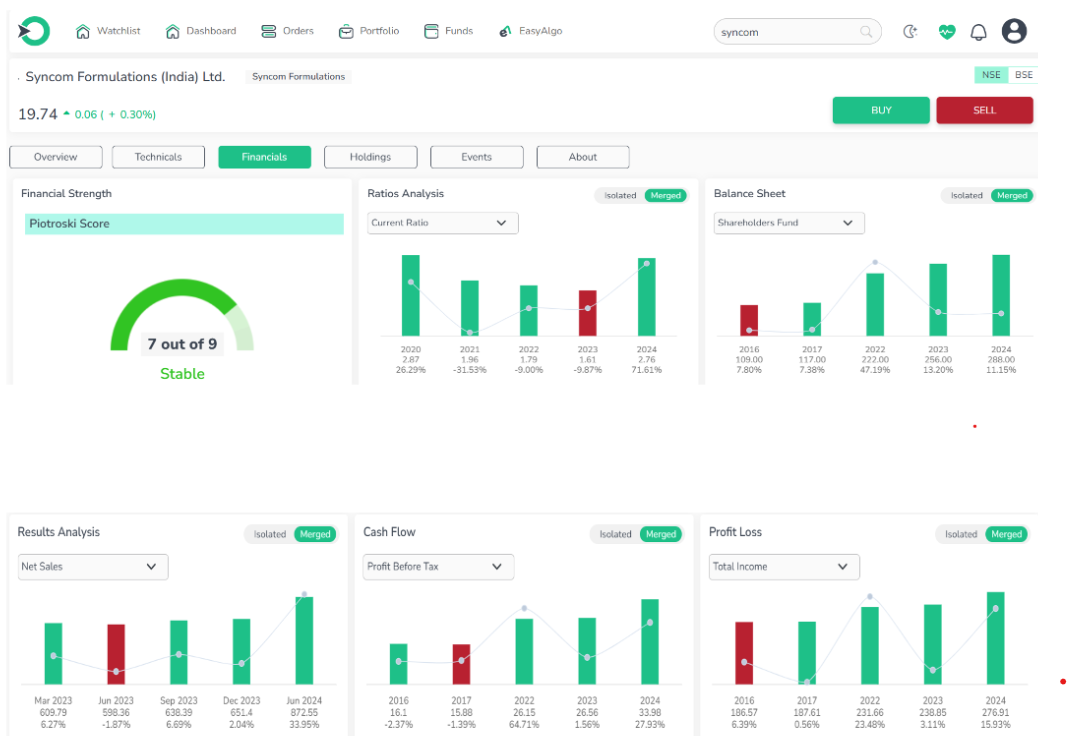

Syncom Formulations (India) Ltd

Syncom Formulations (India) Ltd focuses on manufacturing pharmaceutical products such as tablets, capsules, and syrups. Known for affordable healthcare solutions, it caters to both domestic and international markets. The company’s adherence to quality standards and commitment to innovation make it a notable player in this segment.

Syncom Formulations (India) Ltd. has a healthy liquidity position with a current ratio of 2.76 and a strong promoter holding of 50.57%. However, the company faces challenges with a poor profit growth of -6.79% and minimal revenue growth of 1.81% over the past three years. Additionally, it has negative cash flow from operations of -5.94 and is trading at a high price-to-earnings (PE) ratio of 58.45.

-

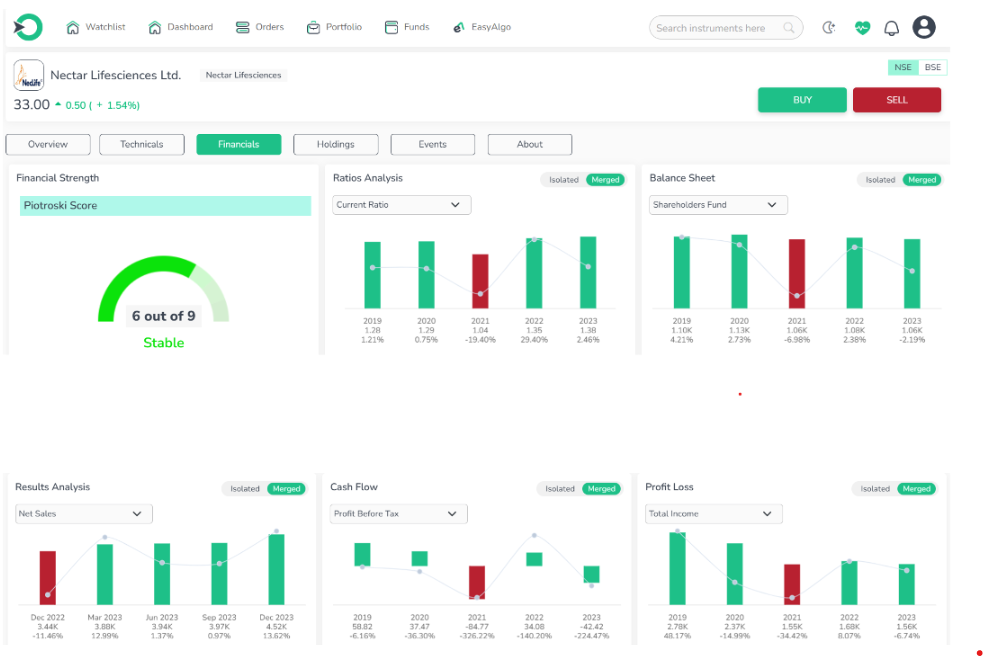

Nectar Lifesciences Ltd

Nectar Lifesciences Ltd is a vertically integrated pharmaceutical company engaged in the production of APIs and finished dosages. Operating in over 70 countries, the company leverages advanced facilities and a robust pipeline to cater to critical therapeutic areas like antibiotics and cardiovascular medications.

Nectar Lifesciences Ltd. has demonstrated strong profit growth of 27.41% over the past three years and maintains a favorable PEG ratio of 0.57. The company also exhibits an efficient cash conversion cycle of 81.28 days and a high degree of operating leverage, with an average operating leverage of 19.26. However, the company faces challenges with poor revenue growth of 2.99%, a low return on equity (ROE) of 0.25%, and a modest return on capital employed (ROCE) of 4.97%. Additionally, it is trading at a high PE ratio of 69.49, and promoter pledging stands at 100%.

-

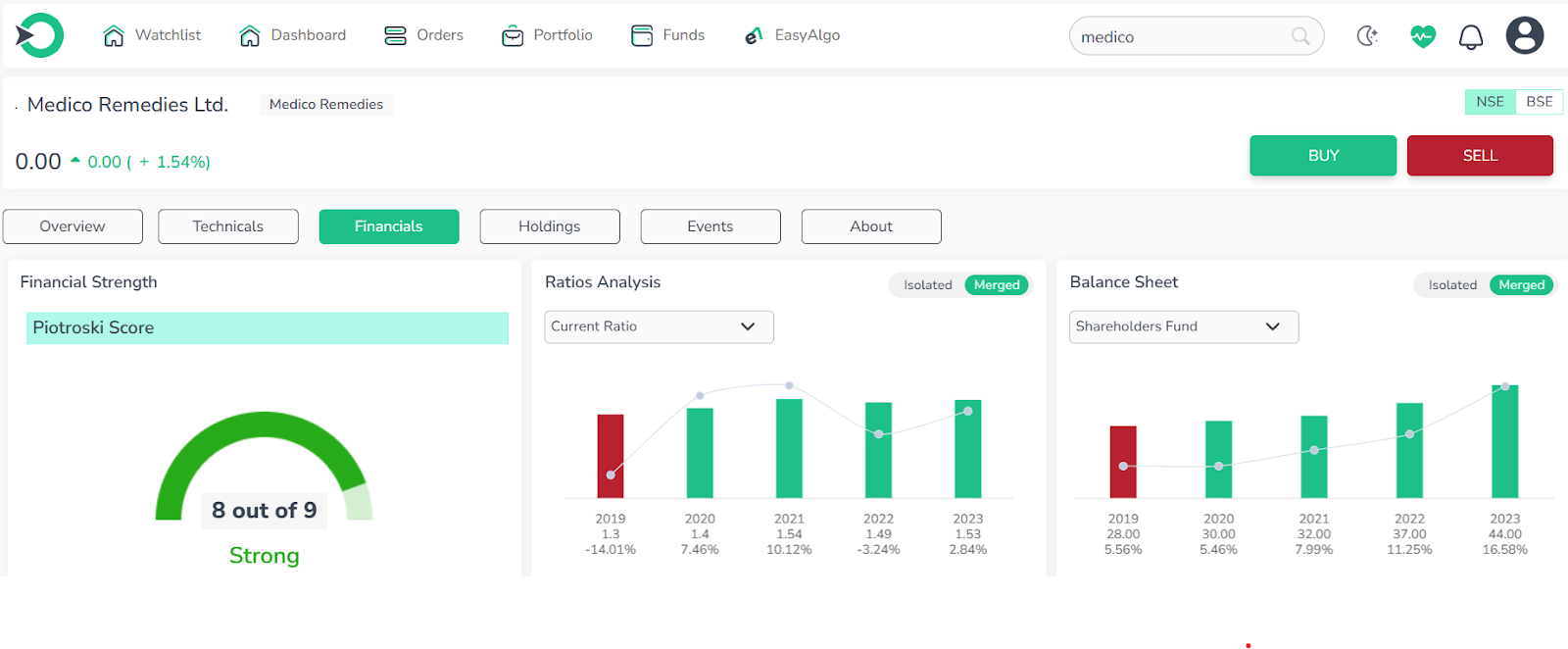

Medico Remedies Ltd

Medico Remedies Ltd focuses on manufacturing and exporting high-quality pharmaceutical products, emphasizing formulations tailored for global healthcare needs. Its strategic partnerships and strong distribution network enable it to expand its footprint globally. The company’s attention to quality and compliance positions it as a reliable name in the industry.

Medico Remedies Ltd. has shown strong profit growth of 47.38% over the past three years and maintains a healthy interest coverage ratio of 14.76. The company benefits from an efficient cash conversion cycle of 34.15 days and boasts a high promoter holding of 73.34%. However, it has struggled with modest revenue growth of 5.79% and is trading at a high PE ratio of 49.61.

-

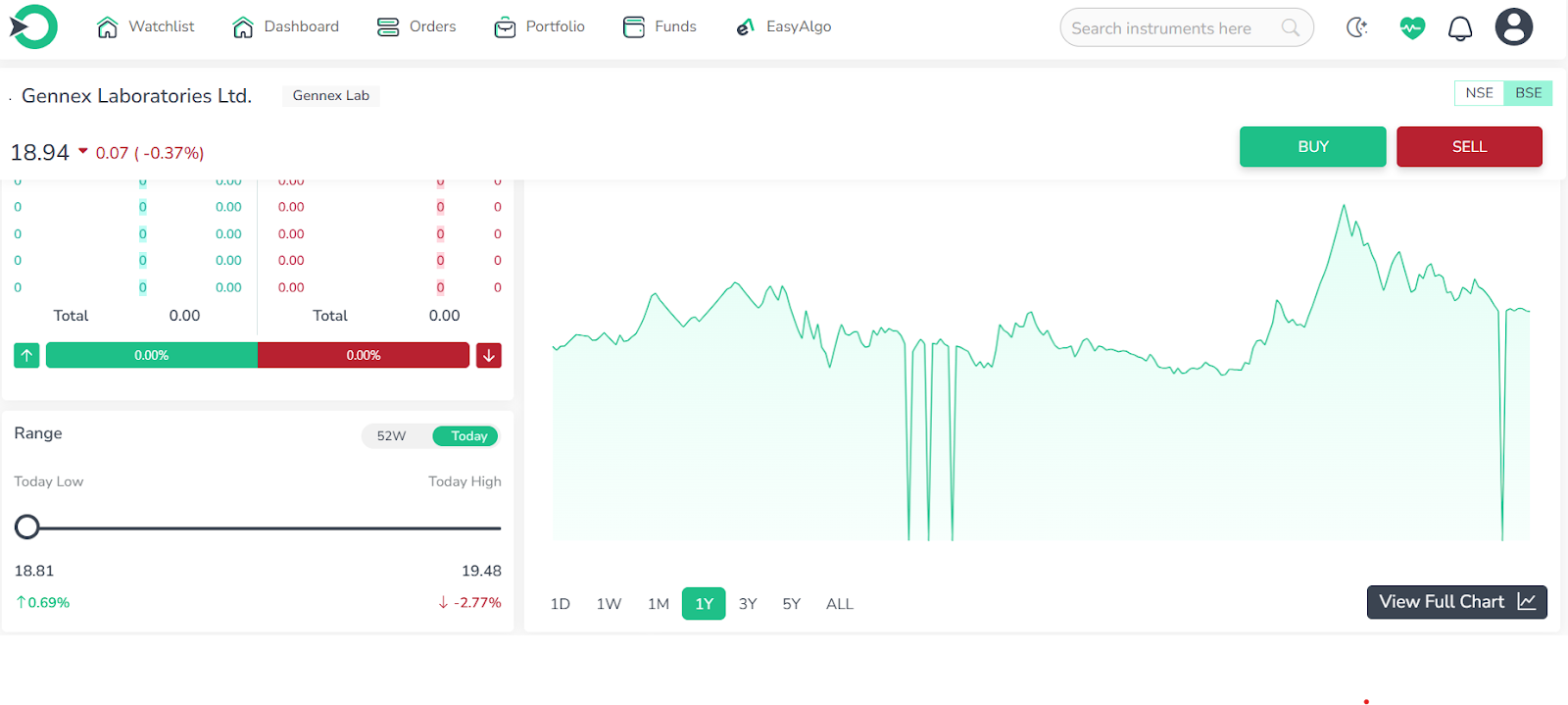

Gennex Laboratories Ltd

Gennex Laboratories Ltd develops APIs and intermediates, serving both domestic and international markets. With its emphasis on cost-effective production and adherence to global standards, the company continues to build its reputation in the pharmaceutical sector.

Gennex Laboratories Ltd. has achieved strong profit growth of 42.96% over the past three years and remains virtually debt-free. The company boasts a healthy interest coverage ratio of 13.77, a PEG ratio of 0.29, and an efficient cash conversion cycle of 32.75 days. It also enjoys a solid liquidity position with a current ratio of 5.45 and a strong degree of operating leverage with an average of 16.75. However, the company has faced poor revenue growth of just 3.85% and negative cash flow from operations of -33.43.

Comparison of Pharmaceutical Companies: Key Financial and Operational Metrics

|

Parameter |

Gennex Laboratories |

||||

|

Revenue Growth (5 Years) |

17.16% (Industry Avg: 9.03%) |

Not Mentioned |

-9.44% (Industry Avg: 9.03%) |

8.11% (Industry Avg: 9.03%) |

10.12% (Industry Avg: 9.03%) |

|

Market Share Change |

0.35% → 0.45% |

Not Mentioned |

1.27% → 0.45% |

0.05% → 0.04% |

0.03% → 0.02% |

|

Net Income Growth (5 Years) |

27.23% (Industry Avg: 15.28%) |

Not Mentioned |

-36.31% (Industry Avg: 15.28%) |

39.66% (Industry Avg: 15.28%) |

42.64% (Industry Avg: 15.28%) |

|

Debt-to-Equity Ratio (5 Years) |

12.19% (Industry Avg: 24.16%) |

Not Mentioned |

72.58% (Industry Avg: 24.16%) |

32.98% (Industry Avg: 24.16%) |

12.01% (Industry Avg: 24.16%) |

|

Current Ratio (5 Years) |

170.76% (Industry Avg: 186.71%) |

2.76 (Healthy Liquidity) |

127.78% (Industry Avg: 186.71%) |

154.36% (Industry Avg: 186.71%) |

225.42% (Industry Avg: 186.71%) |

|

Free Cash Flow Growth |

Not Mentioned |

Not Mentioned |

-0.59% (Industry Avg: 34.98%) |

4.51% (Industry Avg: 34.98%) |

Not Mentioned |

|

Promoter Holding |

Not Mentioned |

50.57% |

Not Mentioned |

73.34% |

Not Mentioned |

|

Pledged Promoter Holding |

Not Mentioned |

Insignificant |

100% |

Not Mentioned |

Not Mentioned |

|

PE Ratio |

Not Mentioned |

58.45 |

69.49 |

49.61 |

Not Mentioned |

|

Institutional Holding |

Not Mentioned |

Foreign institutional holding constant |

Not Mentioned |

Not Mentioned |

Not Mentioned |

|

Cash Conversion Cycle |

Not Mentioned |

34.15 Days |

Not Mentioned |

81.28 Days |

32.75 Days |

|

Operating Leverage |

Not Mentioned |

Average: 5.54 |

Average: 19.26 |

Average: Not Mentioned |

Average: 16.75 |

Who Should Consider Investing in Pharma Penny Stocks Under Rs 100?

Pharma penny stocks under Rs 100 are ideal for investors willing to embrace high risks for potentially high rewards. These stocks attract individuals with a speculative approach who have a deep understanding of market trends and pharmaceutical industry dynamics. For risk-averse investors, however, such stocks may not align with their financial goals due to their inherent volatility and unpredictability.

A Guide to Investing in Pharma Penny Stocks Priced Below Rs 100

Investing in pharma penny stocks demands thorough research and a disciplined strategy. Start by analyzing the company’s financial health, drug pipeline, and market potential. Use reliable brokerage platforms that offer robust tools for monitoring penny stocks. Diversification is key to mitigating risks, so allocate only a small portion of your portfolio to these investments. Staying informed about industry trends and news can help you make timely decisions, while a long-term perspective often proves beneficial in realizing the potential of these stocks.

Performance Metrics of Pharma Penny Stocks

The performance of pharma penny stocks depends on multiple factors, including their financial stability, trading volume, and industry-specific developments. Successful clinical trials or FDA approvals can trigger substantial price hikes, while adverse regulatory outcomes can lead to sharp declines. Investors should also monitor trading volumes to assess market interest and liquidity, ensuring they can exit positions if needed.

Benefits of Investing in Pharma Penny Stocks

Pharma penny stocks present a distinctive combination of low cost and the possibility for significant growth. These stocks are often priced below Rs 100, making them accessible to a wide range of investors while offering the potential for substantial returns if the companies experience success or breakthroughs in their respective fields. Their low prices allow investors to acquire significant quantities of shares without substantial capital. If these companies achieve major breakthroughs, the returns can be exponentially higher. Additionally, such investments provide exposure to cutting-edge pharmaceutical research and innovation, allowing investors to be part of transformative developments in healthcare.

Challenges of Investing in Pharma Penny Stocks

Despite their appeal, pharma penny stocks come with several challenges. Their high volatility can lead to significant losses in a short time. Limited trading volumes may result in liquidity issues, making it harder to sell shares during unfavorable market conditions. Furthermore, the lack of transparency in financial reporting by smaller companies increases the difficulty of conducting accurate due diligence. Regulatory setbacks or operational inefficiencies can also have a disproportionately large impact on their stock prices.

Tips for Successful Investment

Success in investing in pharma penny stocks lies in staying informed and strategic. Focus on companies with sound fundamentals and promising growth trajectories. Diversify your portfolio to balance risks and rewards, and regularly monitor the performance of your investments. Patience and a keen eye for market signals can often make the difference between success and failure in this high-risk segment.

Conclusion

Pharma penny stocks under Rs 100 offer an exciting opportunity for investors willing to explore the pharmaceutical sector’s growth potential. While their speculative nature makes them risky, disciplined research and strategic investment can yield substantial rewards. By staying informed and diversifying investments, you can mitigate the challenges and make the most of this dynamic market segment.

Frequently Asked Questions

-

Which pharmaceutical penny stocks are the best options under Rs 100?

Some top pharma penny stocks include Morepen Laboratories Ltd, Syncom Formulations (India) Ltd, and Nectar Lifesciences Ltd.

-

Is it possible to invest in pharma penny stocks priced below Rs 100?

Yes, but it is essential to understand the high risks involved. Conduct thorough research and diversify your portfolio to mitigate potential losses.

-

Is investing in pharma penny stocks under Rs 100 a good idea?

These stocks can be lucrative for high-risk investors, but they require careful analysis and an understanding of market dynamics.

-

How can you invest in pharma penny stocks priced under Rs 100?

Choose stocks with solid fundamentals, use a reliable brokerage platform, and stay informed about industry developments to make informed decisions.

Related Stocks

- Astrazeneca Pharma India Ltd.

- Tatva Chintan Pharma Chem Ltd.

- Strides Pharma Science Ltd.

- Balaxi Pharmaceuticals Ltd.

Disclaimer: This blog is dedicated exclusively for educational purposes. Please note that the securities and investments mentioned here are provided for informative purposes only and should not be construed as recommendations. Kindly ensure thorough research prior to making any investment decisions. Participation in the securities market carries inherent risks, and it's important to carefully review all associated documents before committing to investments. Please be aware that the attainment of investment objectives is not guaranteed. It's important to note that the past performance of securities and instruments does not reliably predict future performance.