Discover the Top-Rated Stocks Under 500 Rupees Today

Embarking on the stock market investment journey, especially for beginners, can be quite complex. Navigating the vast array of listed companies poses a challenge, and investing a significant sum may appear impractical initially. In this article, our goal is to offer a detailed guide to discerning investors, presenting the best stocks under 500 Rs in 2025. We'll concentrate on fundamentally strong stocks under 500 rupees, ideal for long-term investments.

Best Stocks to Buy Under 500: An In-Depth Analysis

As individuals just stepping into the world of stock market investments, the prospect of acquiring shares from high-value companies seems daunting. The need to gain expertise and experience before delving into expensive stocks is paramount. To help both those just starting out and seasoned investors, we've handpicked a list of five fantastic stocks to consider under 500 for 2025. This offers a great chance for anyone aiming to create a strong and lasting investment portfolio.

|

S.No. |

Name |

CMP Rs. |

Mar Cap Rs.Cr. |

ROE % |

From 52w high |

|

1 |

408.55 |

5245.61 |

64.02 |

0.95 |

|

|

2 |

389.4 |

239882.6 |

55.99 |

0.96 |

|

|

3 |

142.65 |

656.46 |

50.58 |

0.99 |

|

|

4 |

286.3 |

926.59 |

50.25 |

0.83 |

|

|

5 |

175.1 |

17339.18 |

45.89 |

0.89 |

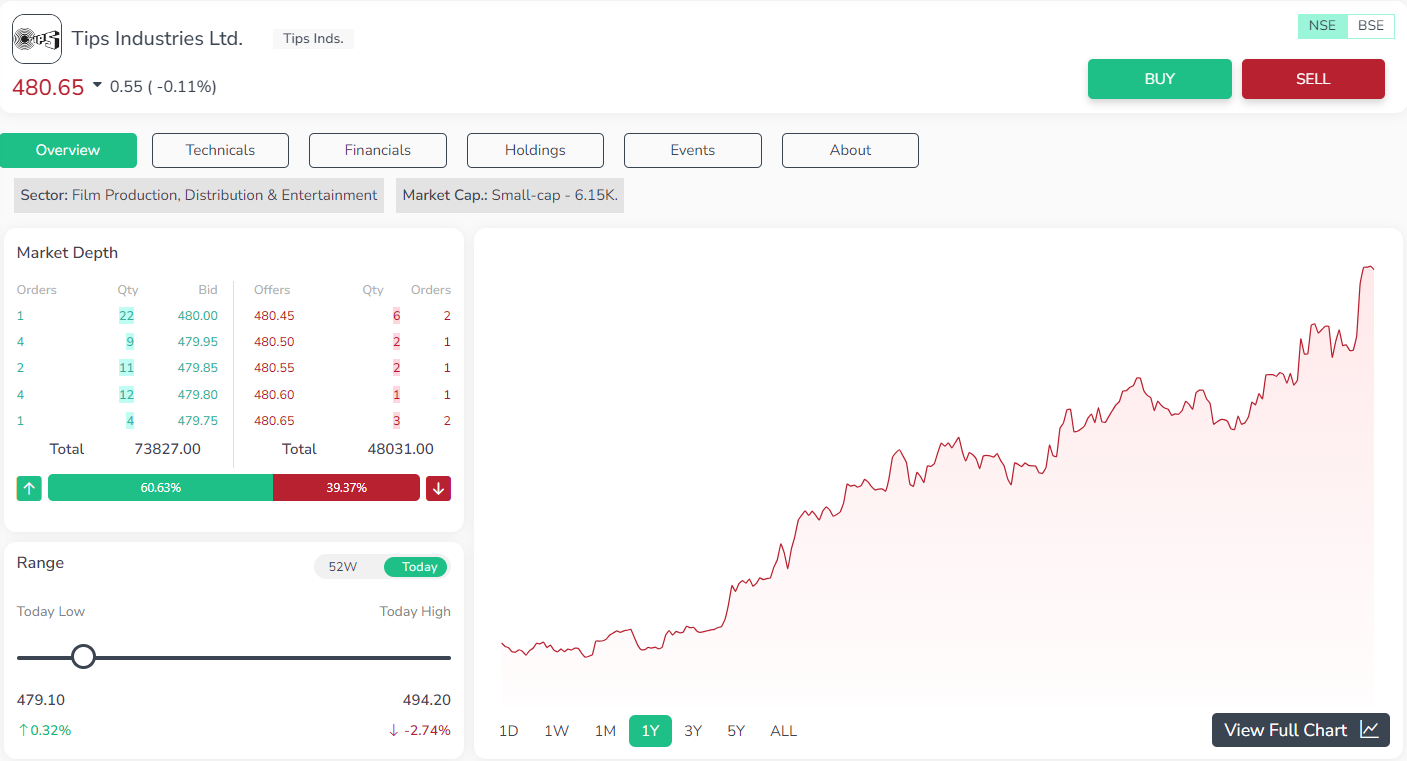

1. Tips Industries:

Established in 1996, Tips Industries Limited stands out as a prominent participant in the creation and distribution of motion pictures, along with the procurement and utilization of Music Rights. Recognized for its contributions, Tips Industries Limited is among the best stocks under 500 rupees, making it an appealing investment option in the market.

Pros:

-

Notably, the company is almost debt-free, showcasing a robust financial position.

-

Anticipation of a positive quarter, with a historical profit growth of 89.6% CAGR over the last five years.

-

A commendable return on equity (ROE) track record, boasting 58.8% over the past three years.

Cons:

-

The stock is currently trading at 28.6 times its book value.

-

A decrease in promoter holding by -6.08% over the last quarter.

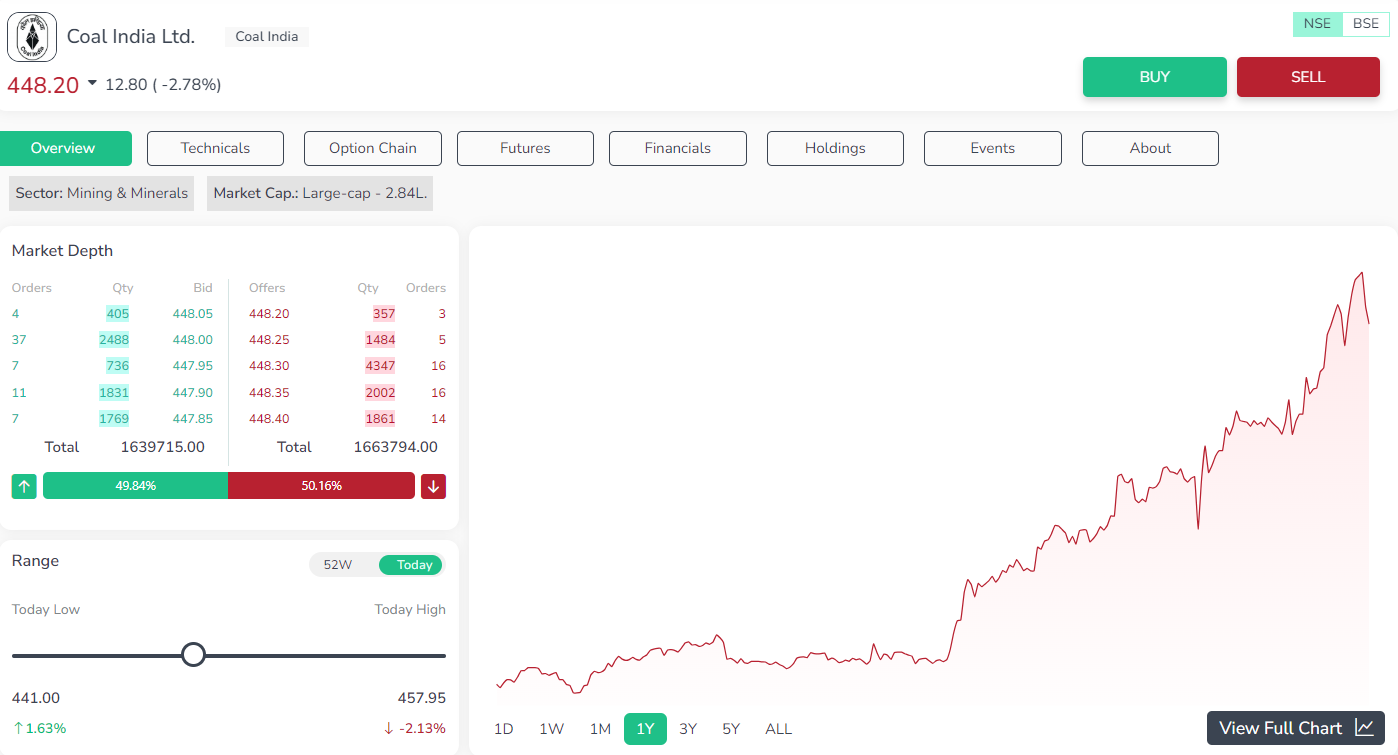

2. Coal India Ltd:

A significant participant in coal mining and production, catering to industries such as power and steel, qualifies as one of the best stocks under 500 rupees.

Pros:

-

Almost debt-free and offering an attractive dividend yield of 6.23%.

-

Strong profit growth of 31.9% CAGR over the last five years.

-

Consistent debtor day improvement from 50.6 to 34.5 days.

Cons:

-

Faces a challenge with a poor sales growth of 10.2% over the past five years.

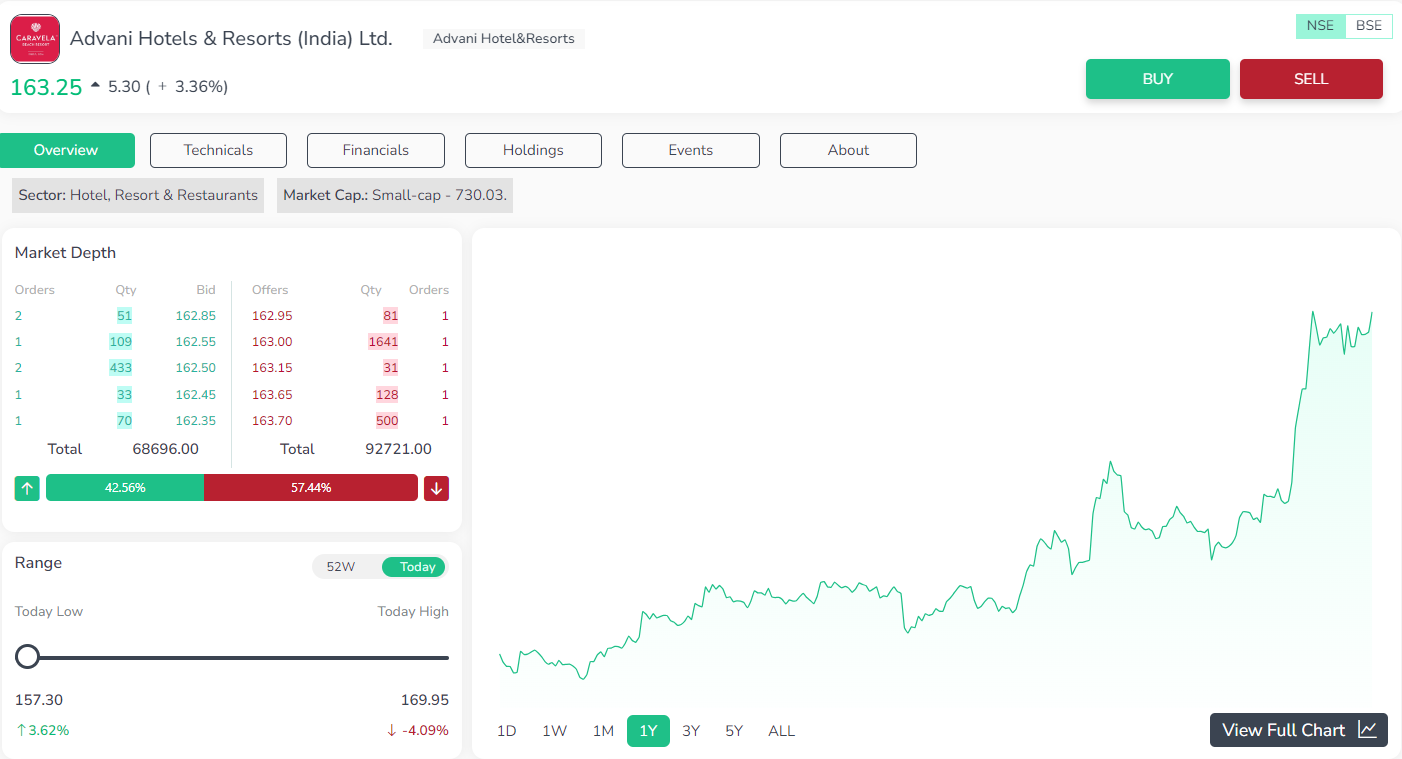

3. Advani Hotels & Resorts (India) Ltd:

Specializing in the hotel business, the company thrives through its ownership and operation of the "Caravela Beach Resort" in South Goa. This venture positions it among the best stocks under 500, making it an attractive choice for potential investors.

Pros:

-

Almost debt-free with a good dividend yield of 3.36%.

-

Consistent profit growth of 26.7% CAGR over the last five years.

-

Maintains a healthy dividend payout of 51.4%.

Cons:

-

The stock is currently valued at 10.8 times its book value.

-

Historical poor sales growth of 9.56% over the past five years.

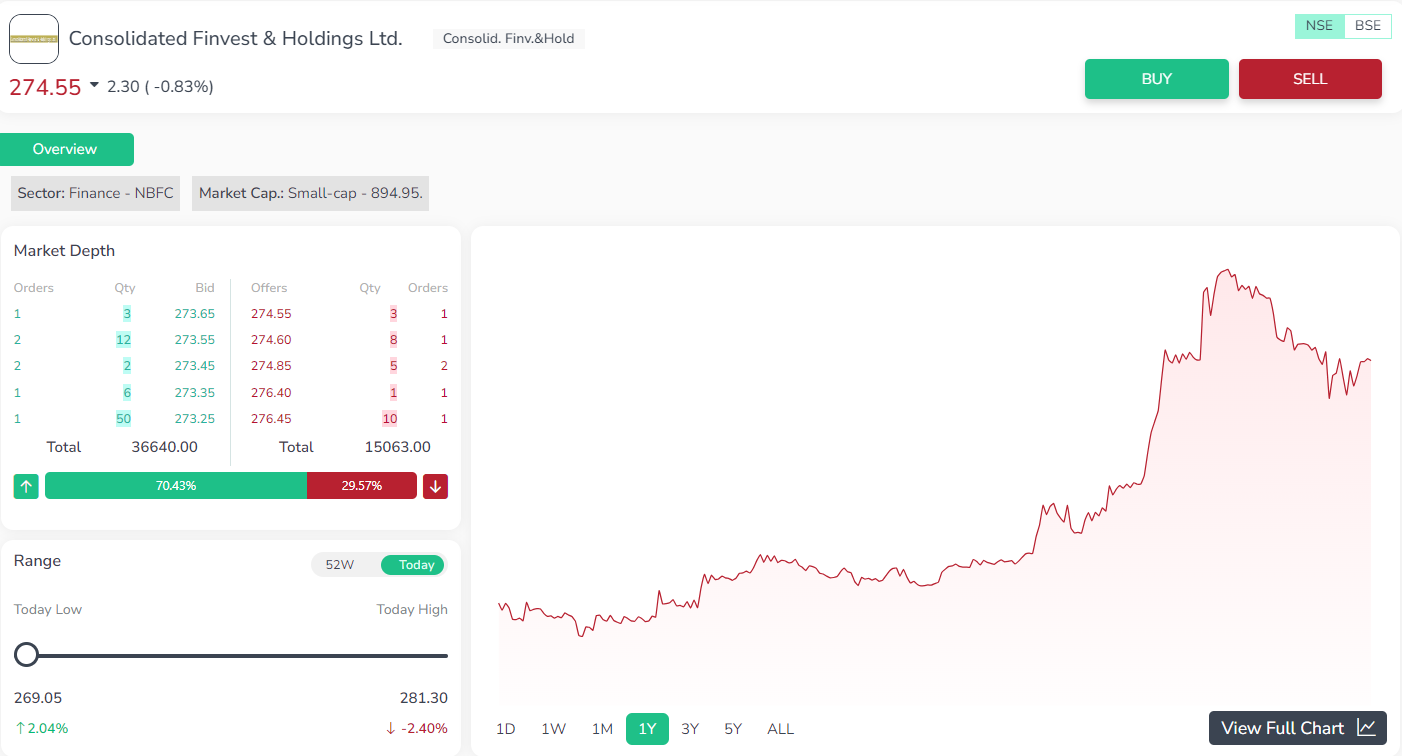

4. Consolidated Finvest & Holdings Ltd:

Registered with the Reserve Bank of India as a Non-Banking Financial Company (NBFC), this entity concentrates on investments and loans, earning its place among the best stocks under 500 and making it an appealing prospect for investors.

Pros:

-

Almost debt-free and trading at 1.18 times its book value.

-

Impressive profit growth of 208% CAGR over the last five years.

Cons:

-

Although the company consistently generates profits, it has chosen not to distribute dividends

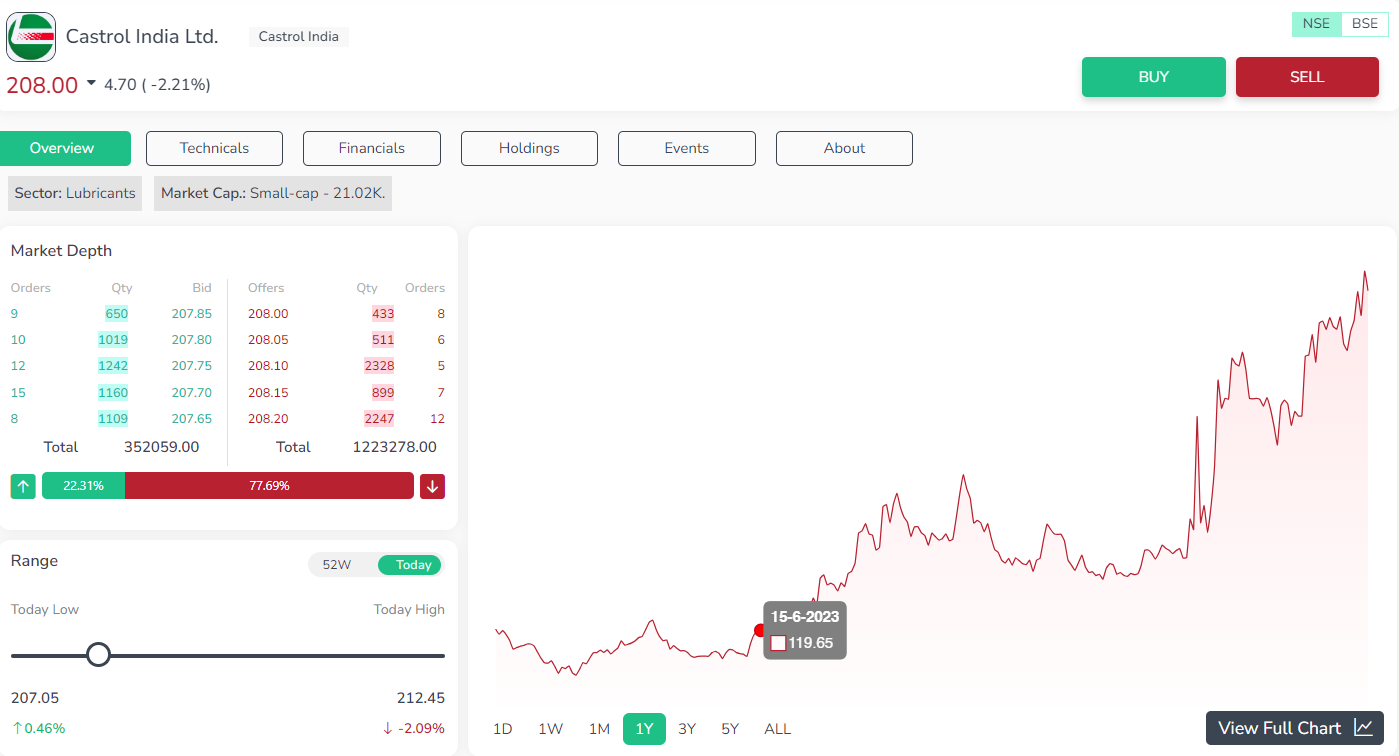

5. Castrol India Ltd:

Primarily involved in the production and promotion of automotive and industrial lubricants, this company stands out as one of the best stocks under 500, presenting a compelling opportunity for investors.

Pros:

-

Almost debt-free with a substantial dividend yield of 3.71%.

-

A good return on equity (ROE) track record, boasting 45.9% over the past three years.

-

Maintains a healthy dividend payout of 81.3%.

Cons:

-

The stock is trading at 8.77 times its book value.

-

Faces a challenge with a poor sales growth of 5.90% over the past five years.

Top Stocks Under 500: Expanding Investment Horizons

Broadening our focus beyond the initial five, the article introduces 15 more fundamentally strong stocks under Rs 500. Each of these stocks offers distinct opportunities and challenges across various sectors. It is imperative for investors to engage in comprehensive fundamental research for each company before making well-informed investment decisions.

|

S.No. |

Name |

CMP Rs. |

P/E |

Mar Cap Rs.Cr. |

Div Yld % |

ROE % |

|

1 |

408.55 |

43.81 |

5245.61 |

1.47 |

64.02 |

|

|

2 |

389.4 |

8.57 |

239882.6 |

6.23 |

55.99 |

|

|

3 |

142.65 |

26.53 |

656.46 |

3.36 |

50.58 |

|

|

4 |

286.3 |

2.77 |

926.59 |

0 |

50.25 |

|

|

5 |

175.1 |

21.26 |

17339.18 |

3.71 |

45.89 |

|

|

6 |

386.9 |

8.46 |

1019.64 |

0.65 |

48.23 |

|

|

7 |

321.75 |

33.94 |

3563.31 |

0.25 |

28.92 |

|

|

8 |

169.5 |

14.8 |

1540.6 |

1.77 |

24.63 |

|

|

9 |

467.1 |

20.25 |

13459.45 |

2.19 |

25.3 |

|

|

10 |

225.75 |

26.62 |

8356.66 |

0.48 |

26.43 |

|

|

11 |

389.4 |

60.07 |

16049.5 |

0.19 |

29.53 |

|

|

12 |

457.75 |

14.37 |

14550.1 |

2.5 |

22.89 |

|

|

13 |

217.15 |

12.71 |

63638.1 |

3.04 |

23 |

|

|

14 |

189.7 |

41.73 |

138666.5 |

0.95 |

22.79 |

|

|

15 |

Kilburn Engg. |

273.6 |

27.81 |

1027.93 |

0.37 |

33.73 |

|

16 |

155.85 |

15.07 |

917.12 |

0.8 |

21.86 |

|

|

17 |

204.9 |

14.4 |

657.53 |

0.49 |

21.05 |

|

|

18 |

315.05 |

35.15 |

3349.38 |

0.22 |

22.67 |

|

|

19 |

402.5 |

12.27 |

574.08 |

0.31 |

20.71 |

|

|

20 |

377.6 |

42.9 |

4329.61 |

0.2 |

20.43 |

Best Stocks under 500 for Long Term: Conclusion

In concluding our exploration of the best stocks under 500 rs in 2025, it is vital to note that the stock prices and market capitalizations are as of January 24, 2024, and are subject to market fluctuations. Before diving into any investment, conducting fundamental research on each company is a prudent step. We invite readers to share their thoughts, suggest any stocks not included in the list, and consider the diverse investment opportunities presented.

Explore the potential of the best trading platform in India for beginners. Elevate your portfolio with the Best Stocks Under 500 Rupees, uncovering lucrative opportunities for long-term gains in 2025. Discover the power of the “Enrich Money” trading platform in making your investment journey seamless and rewarding.

Frequently Asked Questions

-

Why focus on stocks under 500 Rupees?

Investing in the best stocks under 500 provides an affordable entry point, making it accessible for beginners and those seeking a diversified portfolio without a substantial initial investment.

-

What defines fundamentally strong stocks under 500?

Fundamentally strong stocks under 500 have robust financials, sustainable growth potential, and are selected based on criteria like strong balance sheets, positive earnings history, and promising long-term outlook.

-

How do I identify the best stocks to buy under 500?

Identifying the best stocks under 500 involves comprehensive research into factors such as historical performance, growth prospects, and financial health. Look for companies with a strong track record and potential for long-term gains.

-

What is the best trading platform in India for beginners?

Enrich Money is tailored to cater to beginners with its intuitive design, making the platform accessible and easy to navigate. The inclusion of educational resources ensures that beginners can learn and grow their trading skills with confidence.

-

How can I assess if a Rs 500 stock is a worthwhile investment?

Many investors use the Price-to-Earnings (P/E) ratio to gauge the value of a stock. The P/E ratio is calculated by dividing a company's stock price by its most recent earnings per share. This ratio provides insights into whether a stock is reasonably priced in relation to its earnings, helping investors make informed decisions about its potential worthiness as an investment.

Disclaimer: This blog is dedicated exclusively for educational purposes. Please note that the securities and investments mentioned here are provided for informative purposes only and should not be construed as recommendations. Kindly ensure thorough research prior to making any investment decisions. Participation in the securities market carries inherent risks, and it's important to carefully review all associated documents before committing to investments. Please be aware that the attainment of investment objectives is not guaranteed. It's important to note that the past performance of securities and instruments does not reliably predict future performance.