Stocks Under Rs. 1000 to Watch: Budget-Friendly Trading Choices for 2025

The Indian stock market is boozing with opportunities, especially for those looking to trade in affordable yet promising stocks. For traders who want to make strategic moves without stretching their budgets, stocks priced under Rs. 1000 offer a perfect blend of accessibility and growth potential. These budget-friendly options provide a gateway to participate in the stock market with manageable risk while still aiming for solid returns.

This article explores some of the top stocks under Rs. 1000 that are capturing attention this year, highlighting why they’re worth watching and how they align with trading strategies for maximizing profits. Whether you’re a beginner or a seasoned trader, these picks can be valuable additions to your watchlist.

Factors Considered to Trade in Stocks Under Rs.1000

When trading stocks priced under Rs. 1000, focusing on key factors can help identify promising opportunities with potential for solid returns. One critical metric to consider is a Low Price-to-Earnings (PE) Ratio. Comparing the PE ratio of a stock with its industry or sectoral average offers insights into its valuation—stocks with a lower PE than their sector may indicate an undervalued opportunity, potentially translating into profitable gains when the market recognizes its true value.

A High Piotroski Score, typically indicating scores from "strong" to "very strong," is another essential indicator of a company's financial health. Stocks with a higher Piotroski Score demonstrate good liquidity, profitability, and operational efficiency, which can enhance their stability and performance over time.

Strong fundamentals are crucial, especially for stocks within this price range. Look for companies with consistent earnings growth, healthy cash flow, and manageable debt levels. These factors signal resilience and potential for growth, even with market fluctuations.

For intraday trading, stocks under Rs. 1000 with good returns offer affordability and volatility, both critical for capturing price movements. Balancing these factors allows traders to tap into budget-friendly stocks while aiming for favourable returns in 2025.

Top Stocks to Trade Under Rs.1000

Let’s analyse the stocks under Rs.1000 which possess strong piotroski score, low PE ratio, good fundamentals.

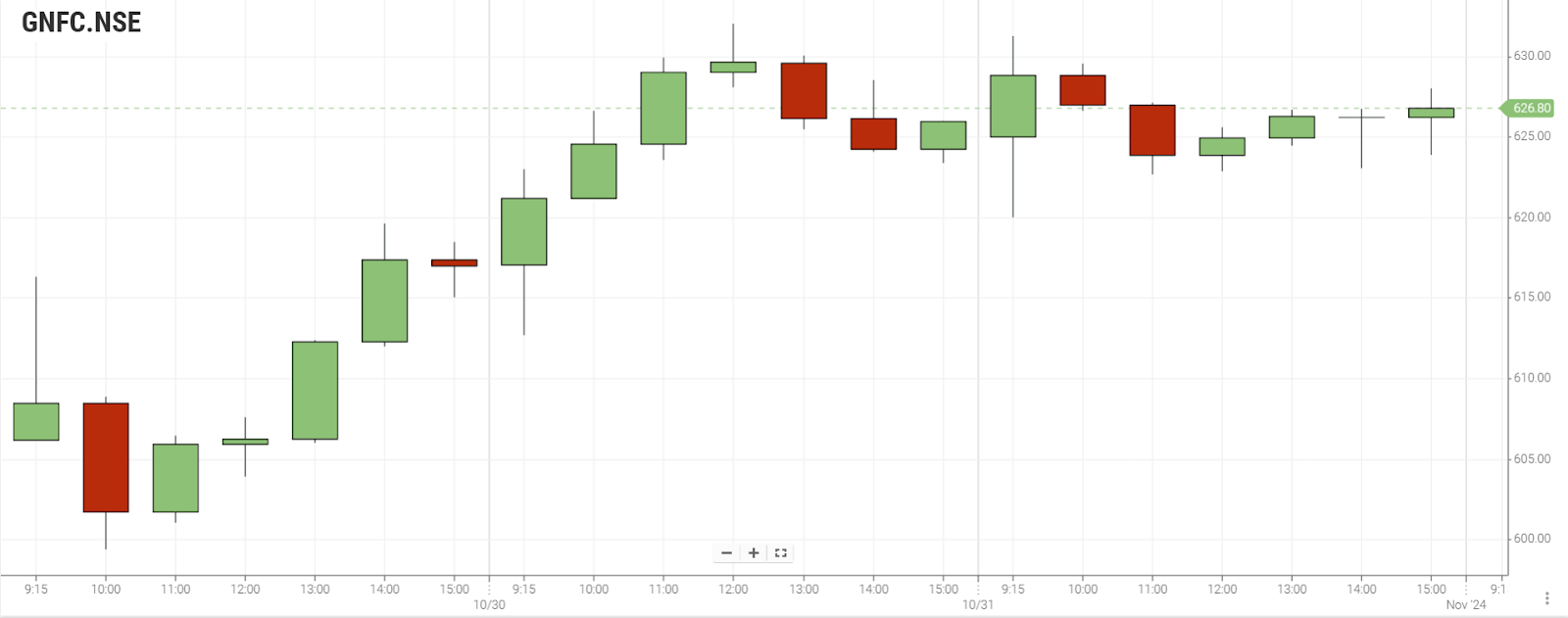

Gujarat Narmada Valley Fertilizers & Chemicals Limited

Gujarat Narmada Valley Fertilizers & Chemicals Ltd. (GNFC) is a leading Indian company specializing in fertilizers and chemicals, headquartered in Bharuch, Gujarat. Established in 1976, GNFC produces a range of industrial chemicals, fertilizers, and petrochemicals that support agriculture and various industries across India. The company is known for its eco-friendly practices and innovative product range, contributing significantly to India’s agricultural and industrial sectors.

GNFC has a piotroski score of 8 , indicating strong fundamentals. GNFC has a moderate risk with volatility 2.43 times of Nifty. GNFC's last trade has provided a return of 0.25%. The stock is underpriced and shows good signs of profitability and efficiency. GNFCs PE ratio is 17.43 , PB ratio is 1.11 and yields a dividend of 2.64% when compared to its industry TTM PE of 31.14, industry PB ratio of 3.51 and Industry dividend yield of 1.31%. GNFCs financial details indicate that GNFCs revenue has grown by 6.55% in the last 5 years. In the last 5 years, debt to equity ratio has reduced to 3.28% and the current ratio indicates that GNFC has high liquidity.

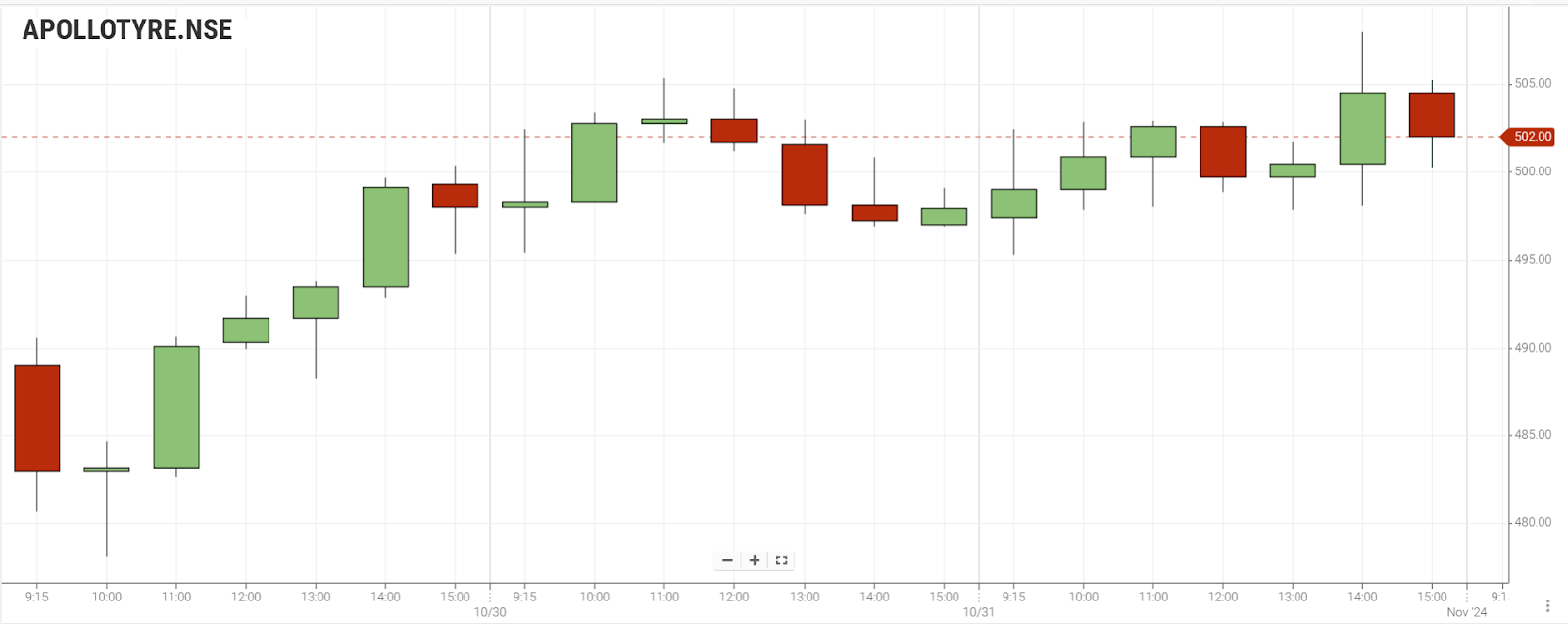

Apollo Tyres Limited

Apollo Tyres Limited is a prominent Indian tire manufacturer known for its wide range of products, including tires for passenger cars, commercial vehicles, and off-road applications. With a strong global presence, it operates in multiple countries and has built a reputation for innovation and durability. The company consistently focuses on expanding its product portfolio and advancing technology to meet diverse customer needs.

Apollo has a piotroski score of 8 , indicating strong fundamentals. Apollo has a moderate risk with volatility 2.24 times of Nifty. Apollo's last week trade has provided a return of 4.59%. The stock is not in the overbought zone and shows good signs of profitability and efficiency. Apollo's PE ratio is 19.71 , PB ratio is 2.31 and yields a dividend of 1.19% when compared to its industry TTM PE of 38.75, industry PB ratio of 6.75 and Industry dividend yield of 0.49%. Apollo's financial details indicate that Apollo's net income has grown by 20.43% in the last 5 years. In the last 5 years, the current ratio indicates that Apollo has high liquidity.

Ramkrishna Forgings Limited

Ramkrishna Forgings Ltd (RK Forge) is a leading Indian manufacturer specializing in forged components for sectors like automotive, railways, and mining. Known for its strong focus on quality, the company serves both domestic and international markets. Its consistent growth and innovative product offerings make it a key player in the forging industry.

RK Forge has a piotroski score of 8 , indicating strong fundamentals. RK Forge has a moderate risk with volatility 2.96 times of Nifty. RK Forge 's last trade has provided a return of 1.49%. The stock is not in the overbought zone and shows good signs of profitability and efficiency. RK Forge 's PE ratio is 36.87 , PB ratio is 6.20 and yields a dividend of 0.22% when compared to its industry TTM PE of 49.42, industry PB ratio of 6.92 and Industry dividend yield of 0.55%. RK Forge 's financial details indicate that RK Forge 's revenue has grown by 15.55% in the last 5 years.

Thyrocare Technologies Limited

Thyrocare Technologies Ltd is a leading Indian diagnostics company known for its affordable and extensive range of health tests and preventive care services. Leveraging advanced automation, Thyrocare operates a centralized processing laboratory that efficiently handles high test volumes. The company is especially recognized for its cost-effective wellness packages, catering to customers across the country.

Thyrocare has a piotroski score of 8 , indicating strong fundamentals. Thyrocare has a moderate risk with volatility 2.65 times of Nifty. Thyrocare 's last week trade has provided a return of 4.67%. The stock is not in the overbought zone and shows good signs of profitability and efficiency. Thyrocare 's PE ratio is 58.98 , PB ratio is 9.39. Thyrocare 's financial details indicate that Thyrocare 's debt to equity has reduced to 4.34% and current ratio of 132.57% in the last five years.

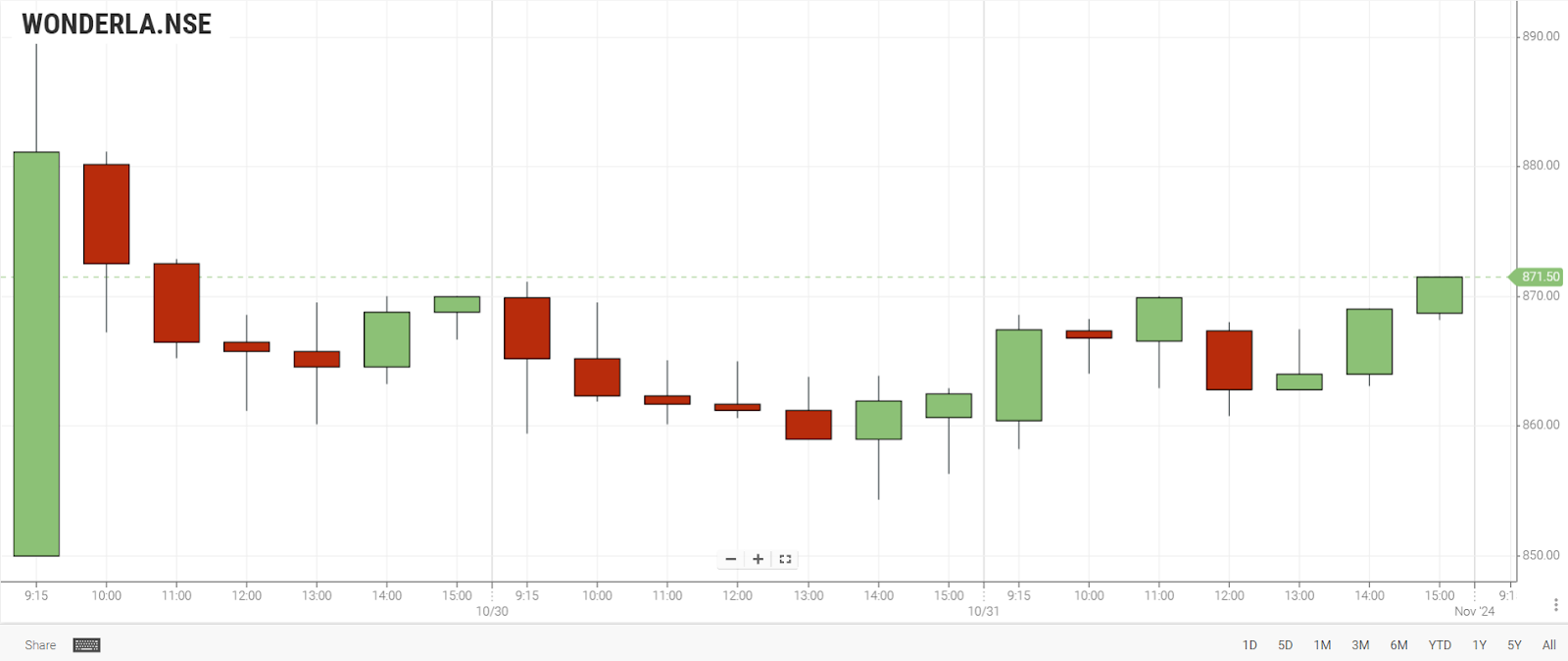

Wonderla Holidays Limited

Wonderland Holidays Ltd is a leading amusement park operator in India, known for its parks in Bangalore, Kochi, and Hyderabad. It offers a variety of thrill rides, water attractions, and family-friendly experiences, attracting visitors of all ages. The company is recognized for maintaining high safety standards and creating memorable entertainment experiences across its locations.

Wonderla has a piotroski score of 8 , indicating strong fundamentals. Wonderla has a moderate risk with volatility 2.78 times of Nifty. Wonderla 's last trade has provided a return of 0.13%. The stock is not in the overbought zone and shows good signs of profitability and efficiency. Wonderla 's PE ratio is 36.02 , PB ratio is 4.50 and dividend yield of 0.29% in comparison with its sectoral PE ratio of 38.75, PB ratio of 6.75 and dividend yield of 0.49%. Wonderla 's financial details indicate that Wonderla 's debt to equity has reduced to 0.55% and current ratio of 472.97% in the last five years.

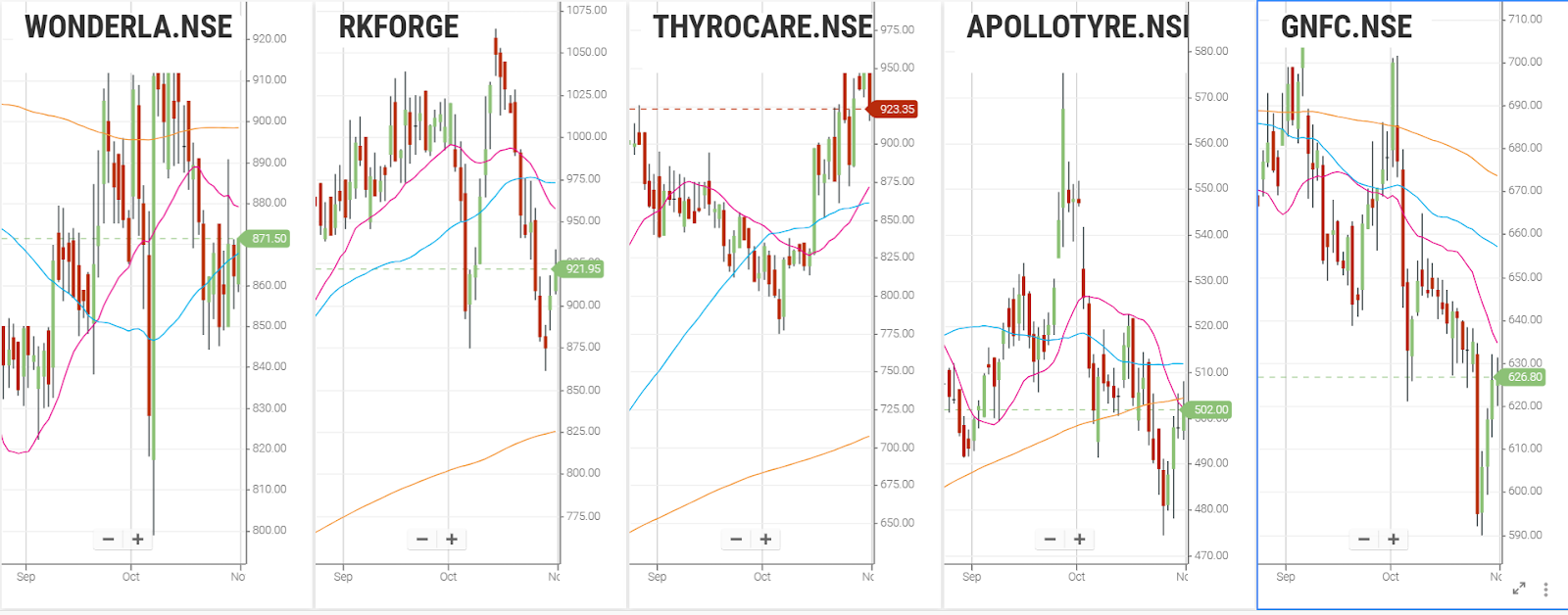

Moving Average Crossover for a period of one month for all the five stocks under Rs.1000.

Conclusion

Stocks under Rs. 1000 offer a valuable opportunity for investors looking to optimize returns within a budget. With a strategic approach that includes assessing factors like low PE ratios, high Piotroski scores, and robust fundamentals, traders can identify stocks with strong growth potential. Companies like GNFC, Apollo Tyres, Ramkrishna Forgings, and Thyrocare demonstrate these characteristics, showing resilience, profitability, and growth. These affordable options provide a diversified entry into the market, ideal for both beginners and seasoned traders aiming for steady gains in 2025. As with any investment, a balanced approach with careful analysis can lead to successful outcomes in this price range.

Frequently Asked Questions

Can stocks priced below Rs. 1000 be good for long-term investment?

Yes, several affordable stocks have promising growth potential, making them viable for long-term portfolios.

Is there a risk in buying stocks under Rs. 1000?

While these stocks can be more volatile, studying their fundamentals and market trends can help mitigate risks.

Are budget-friendly stocks under Rs. 1000 a good choice for beginners?

Yes, these stocks offer a low-cost way for beginners to start investing and diversify with limited capital.

What’s the best way to evaluate stocks priced below Rs. 1000?

Focus on factors like earnings growth, industry outlook, and company fundamentals when assessing these options.

Are low-cost stocks under Rs. 1000 appropriate for long-term growth?

With the right selection, many budget stocks with strong business models can deliver good long-term returns.

Disclaimer: This blog is dedicated exclusively for educational purposes. Please note that the securities and investments mentioned here are provided for informative purposes only and should not be construed as recommendations. Kindly ensure thorough research prior to making any investment decisions. Participation in the securities market carries inherent risks, and it's important to carefully review all associated documents before committing to investments. Please be aware that the attainment of investment objectives is not guaranteed. It's important to note that the past performance of securities and instruments does not reliably predict future performance.