Top 3 Logistics Stocks to Invest in India for 2024

Introduction

The logistics industry in India has a vital role in increasing the flow of investment and international trade, which ultimately inculcates economic growth. It facilitates the economical and timely movement of articles across the country and is a prerequisite for economic growth. In India, we are witnessing the growth of industrialization and urbanization, therefore, the increase in the requirement for proper logistics solutions is aided by evolving technologies and infrastructure. This makes logistics companies attractive investment targets for different parties. In the following article, I focus on revealing the three best Indian logistics stocks to invest in after analyzing their operational and financial results.

Understanding India's Logistics Industry

The logistics business in India involves the transport and delivery of goods, customer relationship management, storage and preservation, and other related services. Another advantage that has contributed to the growth of this industry over the past decade is technology development. This evolution has not only enhanced operational efficiency but also ensured that stocks in these companies become lucrative propositions for investors. The efficiency of Indian logistics transportation was evident in 2023 when India jumped six notches to the 38th position out of 139 in the World Bank’s Logistics Performance Index. According to forecasts, the growth will be approximately 8 percent per year. 8% annual growth, where the industry

should reach USD 484. 43 billion from the current USD 317 billion by 2029. 26 billion in 2024. This growth trajectory clearly explains why India is one of the most promising logistics markets in the world, with the help of constantly developing technology.

Top 3 Logistics Stocks in India for 2024

Explore India's Top Logistics Stocks Based on Market Capitalization:

|

S.No. |

Top Logistics Shares in India |

Market Capitalisation (in Rs.) |

P/E ratio |

|

1 |

1.62LCr |

19.85 |

|

|

2 |

65.37KCr |

51.96 |

|

|

3 |

28.39KCr |

- |

Insights into India's Top 3 Logistics Stocks for 2024

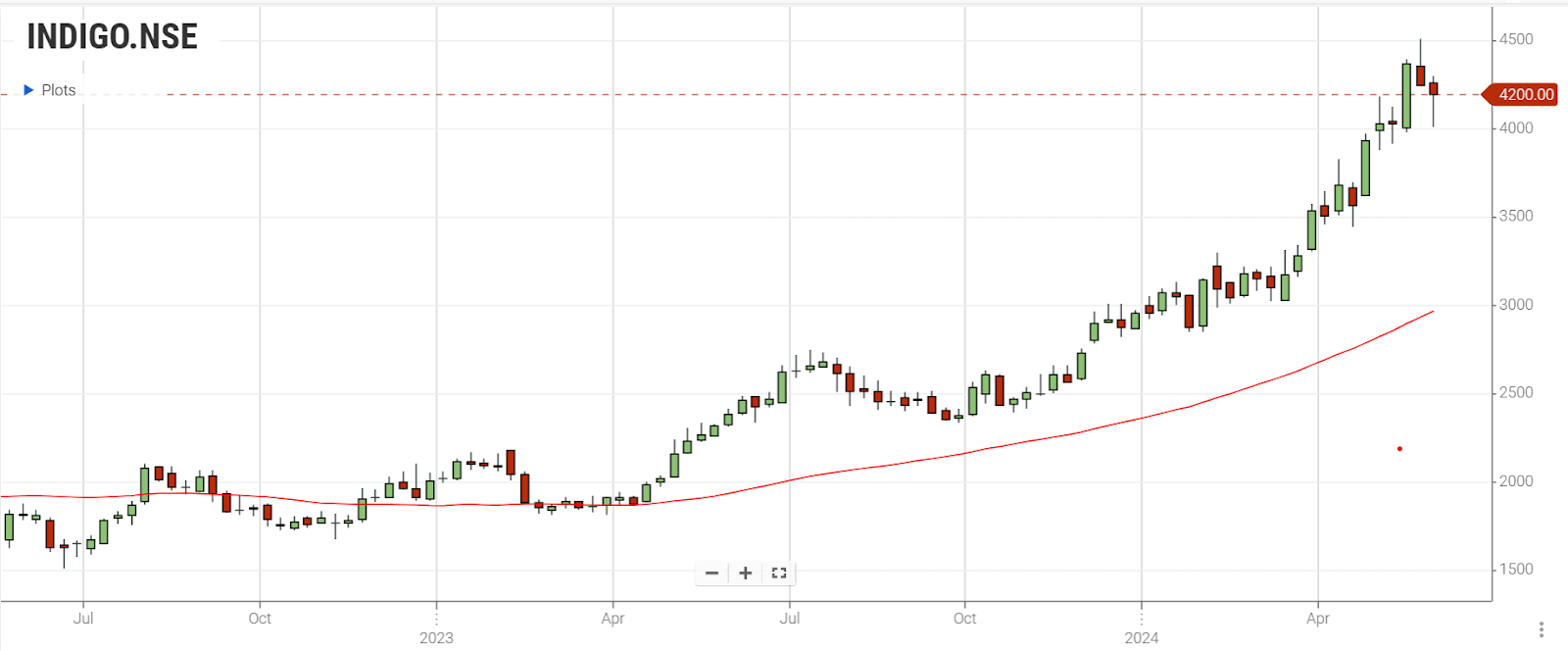

1.Interglobe Aviation

InterGlobe Aviation Limited, known as IndiGo, is a low-cost airline based in Gurgaon, Haryana, India. As of April 2024, it is the largest airline in India by passengers carried and fleet size, holding a 60.6% domestic market share.

-

The price return has been average, offering nothing exciting.

-

The stock seems to be overvalued compared to the market average.

-

Financial growth is lagging behind the market.

-

The company shows good signs of profitability and efficiency.

-

The stock is deemed overpriced but has not reached the overbought threshold.

Despite its average price return and high valuation, InterGlobe Aviation shows strong profitability and operational efficiency. Although it lags in financial growth, the stock is not in the overbought zone, making it a viable option. Based on these factors, InterGlobe Aviation stands out as one of the top three logistics stocks to invest in for 2024.

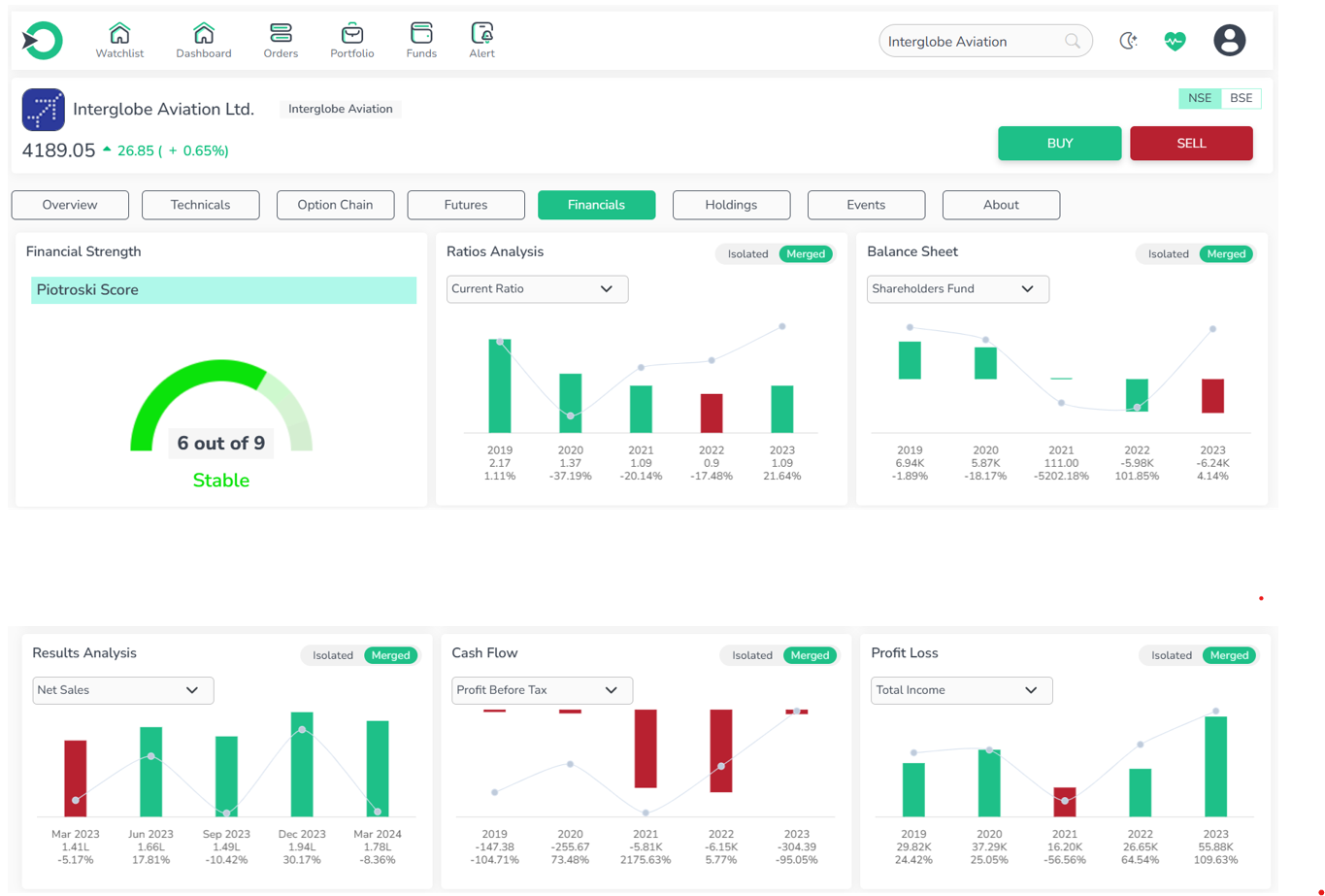

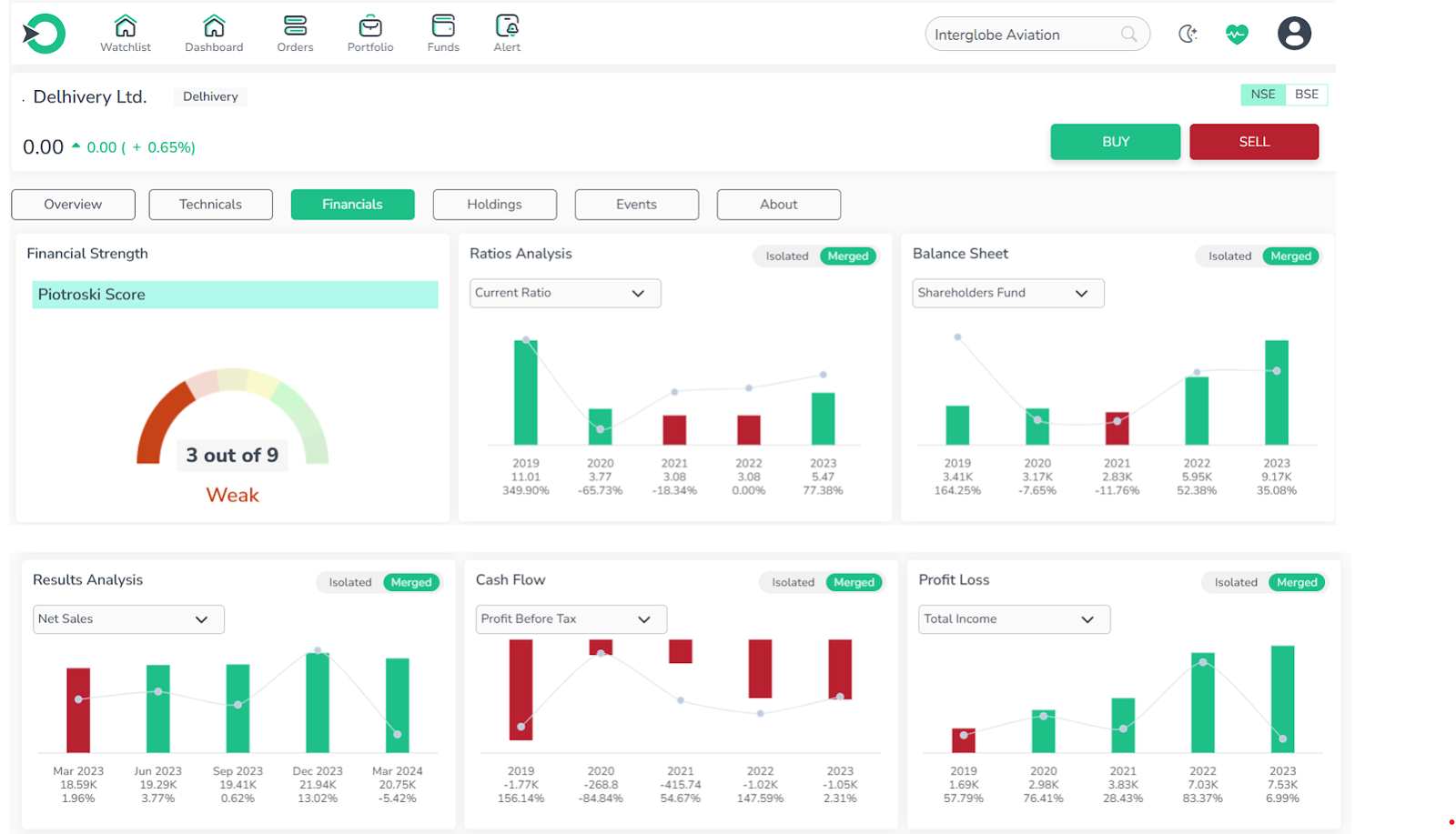

2. Container Corporation of India

Container Corporation of India Limited (CONCOR) is an Indian public sector undertaking specializing in the transportation and handling of containers. Established in March 1988 under the Companies Act, CONCOR began operations in November 1989 by taking over a network of seven inland container depots (ICDs) from Indian Railways.

-

Hasn't performed well, ranking among the lower performers.

-

The stock seems to be overvalued compared to the market average.

-

Financial growth is lagging behind the market.

-

Showing good signs of profitability and efficiency.

-

The stock is deemed overpriced but has not reached the overbought threshold.

Although Container Corporation of India has underperformed compared to its peers and appears overvalued, it shows strong profitability and operational efficiency. Despite lagging in financial growth, the stock remains reasonably priced and is not in the overbought zone. These factors position Container Corporation of India as one of the top three logistics stocks to consider for investment in 2024.

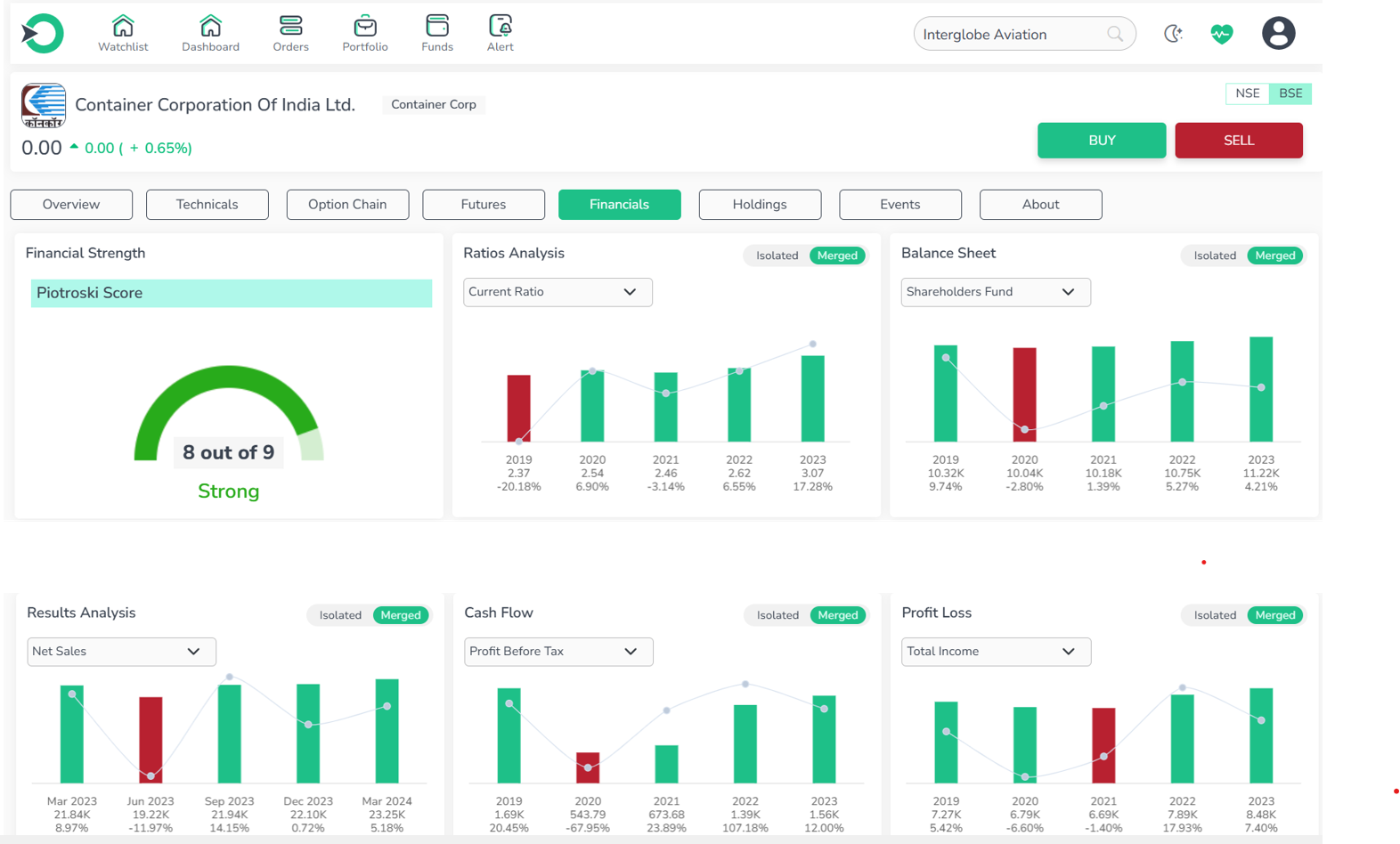

3. Delhivery

Delhivery is an Indian logistics and supply chain company headquartered in Gurgaon. Founded in 2011 by Sahil Barua, Mohit Tandon, Bhavesh Manglani, Suraj Saharan, and Kapil Bharati, it boasts over 85 fulfillment centers, 29 automated sort centers, 160 hubs, 7,500 plus partner centers, and 3,500 plus direct delivery centers as of 2021. Roughly two-thirds of its earnings originate from offering third-party logistics and delivery services to e-commerce enterprises.

-

Hasn't fared well, ranking among the low performers.

-

The stock seems to be overvalued compared to the market average.

-

Financial growth is lagging behind the market.

-

Average profitability, neither particularly good nor bad.

-

The stock has not entered the overbought zone.

Despite Delhivery's lower performance and overvaluation compared to the market average, it maintains average profitability and is not in the overbought zone. While its financial growth lags behind the market, these factors combined position Delhivery as one of the top logistics stocks to consider for investment in 2024.

Comparison of Top 3 Logistics Stocks - Interglobe Aviation, Container Corporation of India and Delhivery

|

Criteria |

Interglobe Aviation |

Container Corporation of India Ltd |

Delhivery |

|

Revenue Growth (5-year CAGR) |

18.45% |

4.17% |

- |

|

Market Share Change (5-year) |

Increased (42.63% to 84.31%) |

Decreased (15.82% to 9.74%) |

- |

|

Debt to Equity Ratio (5-year average) |

Negative (5204.42%) |

5.72% |

20.59% |

|

Current Ratio (5-year average) |

134.53% |

257.26% |

466.49% |

|

Industry Average (where available) |

3.35% (Revenue Growth), 75.97% (Current Ratio) |

66.11% (Debt to Equity Ratio), 106.09% (Current Ratio) |

66.11% (Debt to Equity Ratio), 106.09% (Current Ratio) |

In comparing Interglobe Aviation and Container Corporation of India Ltd., notable differences emerge. Interglobe Aviation has exhibited robust revenue growth and market share expansion over the past five years, coupled with a negative debt-to-equity ratio suggesting a healthy financial position. On the other hand, Container Corporation of India Ltd., while experiencing more moderate revenue growth and a decline in market share, maintains a lower debt-to-equity ratio compared to the industry average. Each company presents unique strengths and weaknesses, reflecting diverse strategies and market dynamics within the logistics sector.

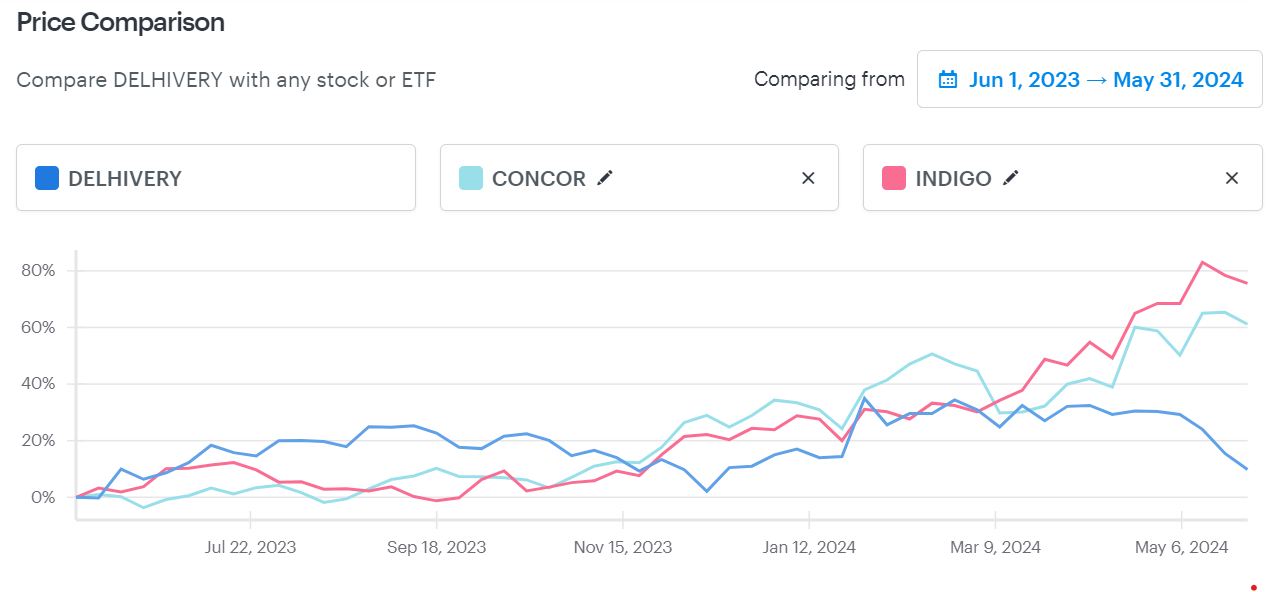

Please refer to the below snapshot for a comparison of stock prices.

Essential Factors for Investing in Logistics Stocks in India

-

Evaluate a logistics company's infrastructure for operational efficiency.

-

Assess technological integration to improve processes and reduce costs.

-

Consider supply chain resilience in handling unexpected disruptions.

-

Analyze financial performance indicators like revenue growth and profitability.

-

Understand competitive positioning, including market share and differentiation strategies.

-

Assess the effectiveness and track record of the management team.

-

Gauge resilience to fluctuations in crude oil prices and its impact on operational costs.

Should one invest in stocks involved in logistics?

Logistics firms are crucial participants in the effective movement of goods and serve various sectors, which makes their equities seem promising. Nonetheless, their performance depends on changes in regulations, shifts in technologies, the global economic situation, and industry risks.

Logistics stocks are also risky investments. Natural disasters, political instabilities, or market fluctuations can harm financial performance through disruptions in the supply chain. Nevertheless, there are more challenges inherent to the organization, such as increased competition, fluctuating fuel prices, and labor scarcity.

For this reason, investors should conduct extensive research before investing in logistics stocks. Pay particular attention to market trends and sectors that are involved, and make investment decisions based on financial objectives and the capacity to absorb risks.

Conclusion

Logistics is one of the most important sectors for further economic development, provided that investors can make good profits during its formation. The idea of examining individual shares with a view to the company buying them is relevant when directing attention to the context of specific logistics shares in India. Depending on what information is available, it is possible to discuss the firms’ financial situation and their potential for evolution as factors that may influence investment choices.

Container Corporation of India, Interglobe Aviation, and Delhivery are perceived to be highly attractive propositions to investors interested in logistics in India in 2024. Nevertheless, they all have their respective advantages and opportunities, ranging from increased revenue growth and market share gains to sound financial market share standing and opportunities for new innovations. Given these prospects for the logistics industry, these stocks may be ideal for any investor with an eye on long-term gains.

Frequently Asked Questions

-

What are the trends that currently support growth in the logistics industry?

The problems faced by the logistics sector comprise an increase in e-commerce, the need for express delivery, the common domestic sales tax (GST), freight corridors, logistics parks, and the use of modern technological services for tracking consignments and finding the shortest routes.

-

What is the distinction between stocks classified as transportation and those classified as logistics?

Transportation stocks are more related to the actual movement of commodities and people, for example, companies that transport goods through trucks and ships. Logistic companies are necessarily more diverse than courier services in that they provide complete solutions for the actual flow of goods from origin to destination, including shipping, warehousing, and transportation; supply chain solutions; and value-added services.

-

Is there a distinction that could be made between various categories of logistics companies?

Indeed, the logistics sector includes players such as; freight forwarders, shipping firms, warehousing companies, third-party logistics service providers (3PLs), and specialists in cold chain logistics who each play different roles in the supply chain.

-

What should one do to investigate a vehicle logistics stock before putting in an investment?

Explore company websites, annual reports, and financial news articles for insights into financial health, growth strategies, and future prospects. For personalized advice, consult with a financial advisor. Check out the features of the 'enrich money' trading platform for comprehensive insights and tools.

-

What is the attraction of buying stocks in logistics companies?

Logistics stocks are perfect to invest in because they present your portfolio with exposure to an important market segment. It is therefore believed that an increase in city logistics services as a result of rapid developments in e-commerce and international business will support stock price growth.

Related Stocks :

Agarwal Industrial Corporation Ltd.

Disclaimer: This blog is dedicated exclusively for educational purposes. Please note that the securities and investments mentioned here are provided for informative purposes only and should not be construed as recommendations. Kindly ensure thorough research prior to making any investment decisions. Participation in the securities market carries inherent risks, and it's important to carefully review all associated documents before committing to investments. Please be aware that the attainment of investment objectives is not guaranteed. It's important to note that the past performance of securities and instruments does not reliably predict future performance.