Insights for Investing in Telecommunications, Healthcare, and Energy in 2024

Introduction:

As we step into 2024, the Indian market presents promising opportunities for investors across various sectors. Among these, the telecommunications, energy, and pharmaceutical sectors stand out as key drivers of growth and innovation. With advancements in technology, evolving consumer preferences, and supportive government policies, these sectors are expected to thrive and offer significant returns on investment. Let's delve into the top three sectors and stocks poised for success in India in 2024.

Telecom Sector: Driving India's Digital Revolution

Current State of The Telecommounication Industry in India

The telecom industry in India is experiencing a significant transformation in 2024, with a focus on advanced technology and network expansion. The rollout of 5G technology is driving faster and more robust connectivity nationwide, prompting major telecom companies to invest heavily in infrastructure upgrades. Government initiatives, particularly spectrum auctions, are pivotal in shaping the telecom landscape, fostering both competition and collaboration among industry players. Despite challenges like regulatory constraints, the sector continues to fuel India's digital evolution.

The upcoming 5G spectrum auction has sparked intense competition among telecom giants, as they vie for high-speed network frequencies to enhance their service offerings. This auction reflects the industry's commitment to meeting the growing demand for data and driving economic development. It has the potential to bring about transformative changes across sectors, highlighting the crucial role of telecom operators in India's digital journey.

Key Players in Indian Telecom Stocks

The Indian telecom sector is characterized by a handful of key players who have significantly influenced its trajectory on the stock market. Amidst the evolving landscape of cutting-edge technologies and regulatory frameworks, these players continue to shape industry dynamics. Notable among them are:

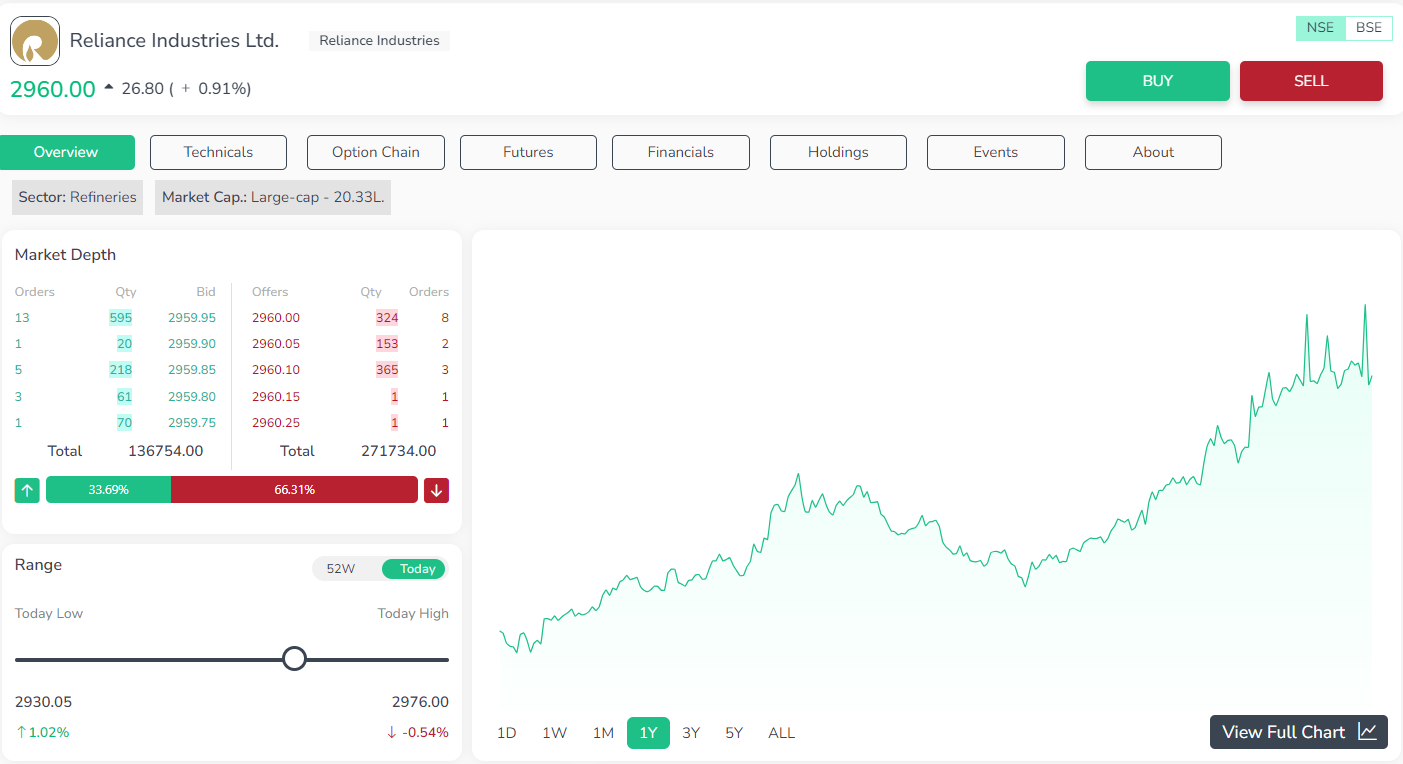

The parent company of Reliance Jio, RIL has been a game-changer in India's telecom sector since Jio's launch in 2016. Leveraging aggressive pricing strategies, Jio revolutionized the market with its free voice calls and affordable data plans. With a strong focus on technology, including widespread 4G adoption and plans for 5G rollout, Reliance remains a telecom industry leader, closely watched by investors for its market performance.

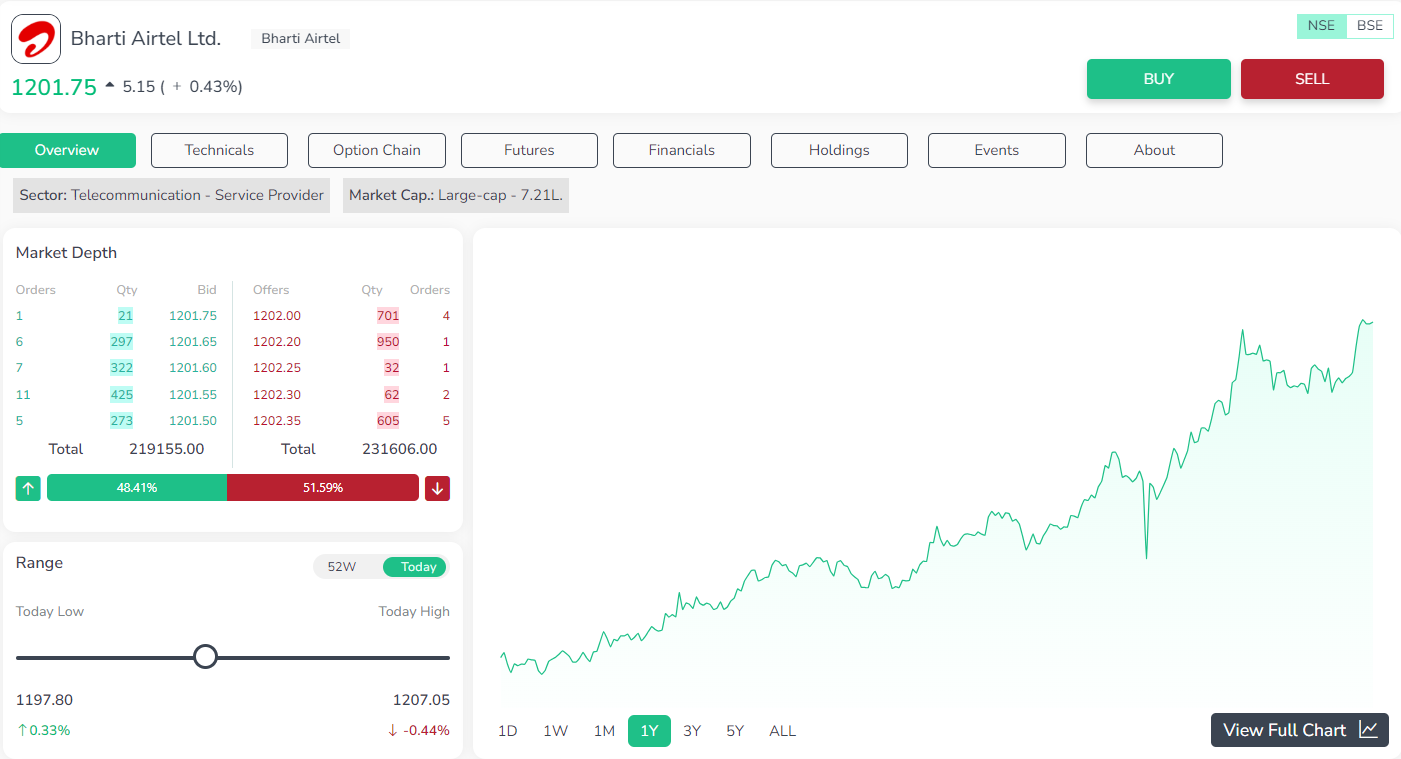

A stalwart in the Indian telecom industry, Bharti Airtel has maintained a robust market presence by continuously upgrading its network infrastructure and diversifying into digital services. Offering a diverse range of products and services, including broadband, mobile, and enterprise solutions, Bharti Airtel is perceived as a stable player in the telecom sector, attracting investors seeking reliability and stability.

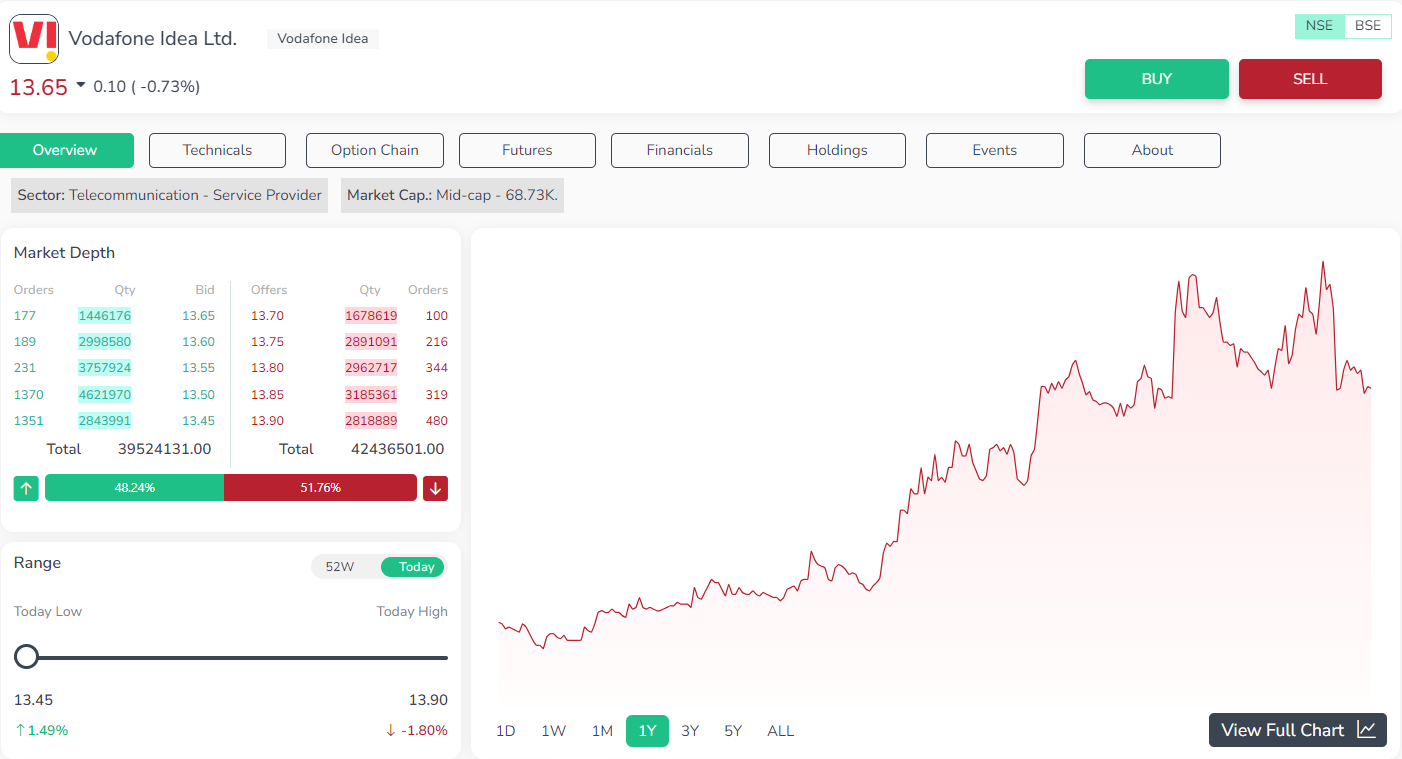

Formed through the merger of Vodafone India and Idea Cellular, Vodafone Idea emerged as a significant player in the Indian telecom market. However, the company faces challenges such as intense competition, financial pressures, and regulatory burdens. Investors closely monitor Vodafone Idea's strategies and efforts to address these challenges, which significantly influence its performance in the stock market.

Future of Indian Telecom Stocks

The future of Indian telecom stocks looks promising, driven by advancing technology, increasing data demand, and the upcoming 5G rollout. Government initiatives for enhanced mobile access further bolster the demand for telecom stocks. However, regulatory changes, competition, and long-term capital requirements may impact stock performance.

In conclusion, investing in Indian telecom stocks offers a promising chance to be part of the country's digital transformation. Despite challenges, investors should stay vigilant, conduct thorough research, and diversify their investments. Telecom stocks remain essential sectors for investors, aligning with India's digital trajectory and offering exposure to the telecommunications sector.

Let's bridge the gap to a digitally connected India. Invest in the future of telecommunications with Enrich Money today!

Energy Stocks in India (2024): Powering Your Portfolio with Power Sector Shares

The current state of the Energy sector in India

In India, the energy sector has undergone significant changes, with a shift towards renewables and an increased focus on energy efficiency.

Coal still dominates, supplying around 70% of electricity, but renewables like wind, solar, and hydropower now contribute over 23% of installed capacity. Plans to boost nuclear energy from 6.7 GW to 22.5 GW by 2031 are underway.

India aims for 450 GW of renewable capacity by 2030, including 280 GW of solar and 140 GW of wind. Government schemes like PAT and Ujala promote energy efficiency.

By 2040, renewables are expected to generate over half of India's electricity. The government also targets 30% electric vehicle adoption by 2030, aligning with a net zero emissions goal by 2070.

Key Players in the Energy Sector

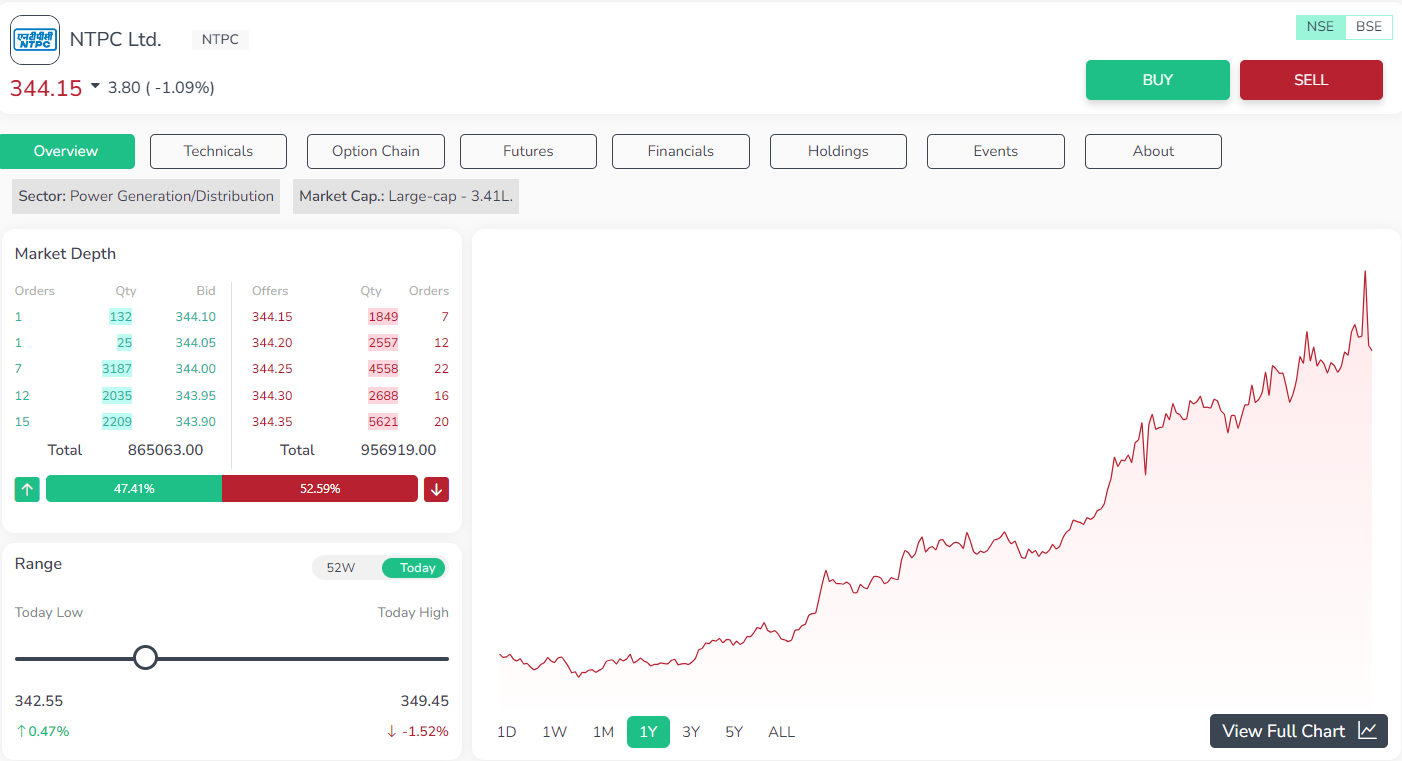

Established in 1975, NTPC Ltd is India’s largest power utility company, specializing in electricity and power generation. Listed under energy stocks in India, it's considered one of the best power stocks to buy due to its extensive operations and strong track record.

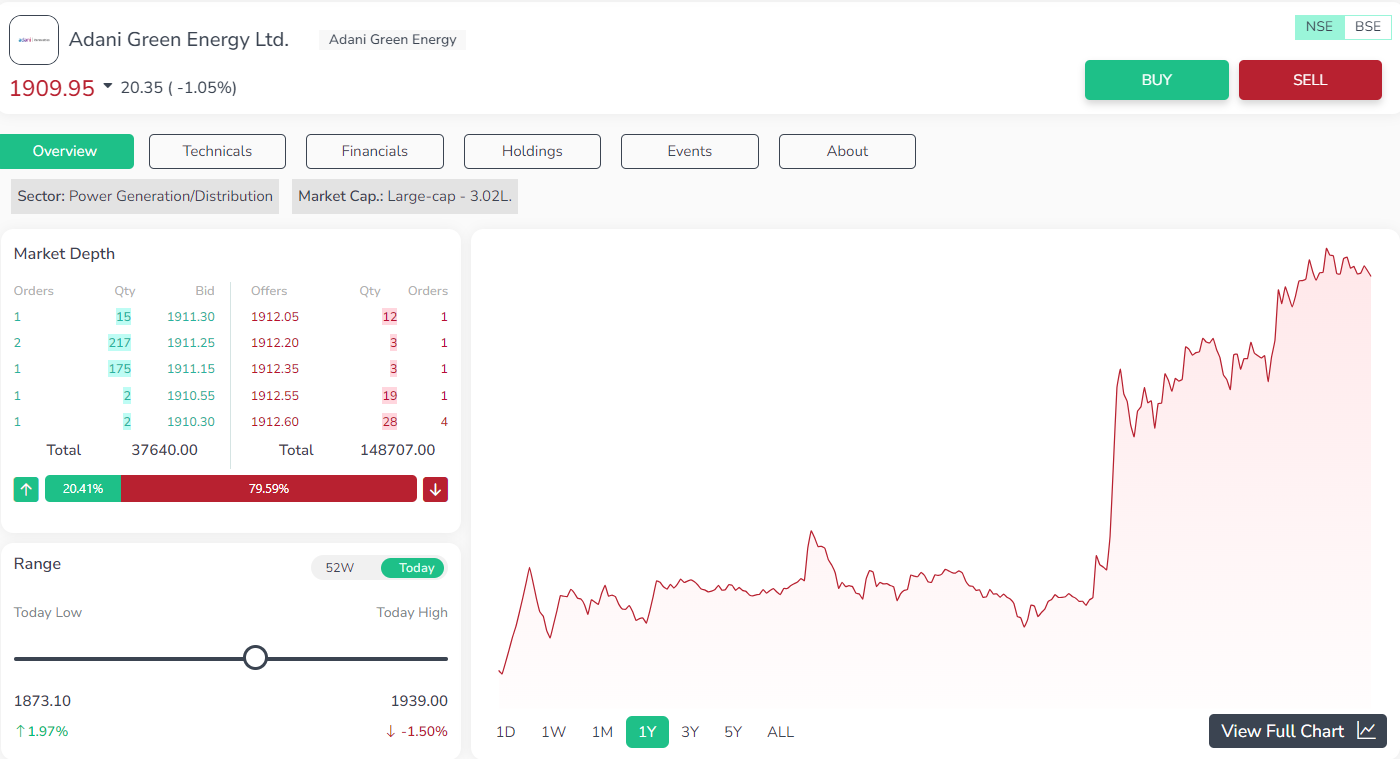

Founded in 2015 by Gautam Adani, Adani Green Energy Ltd is a leading player in India's renewable energy sector. Focused on wind and solar power generation, it operates across multiple states and offers investors exposure to cheap green energy stocks with significant growth potential.

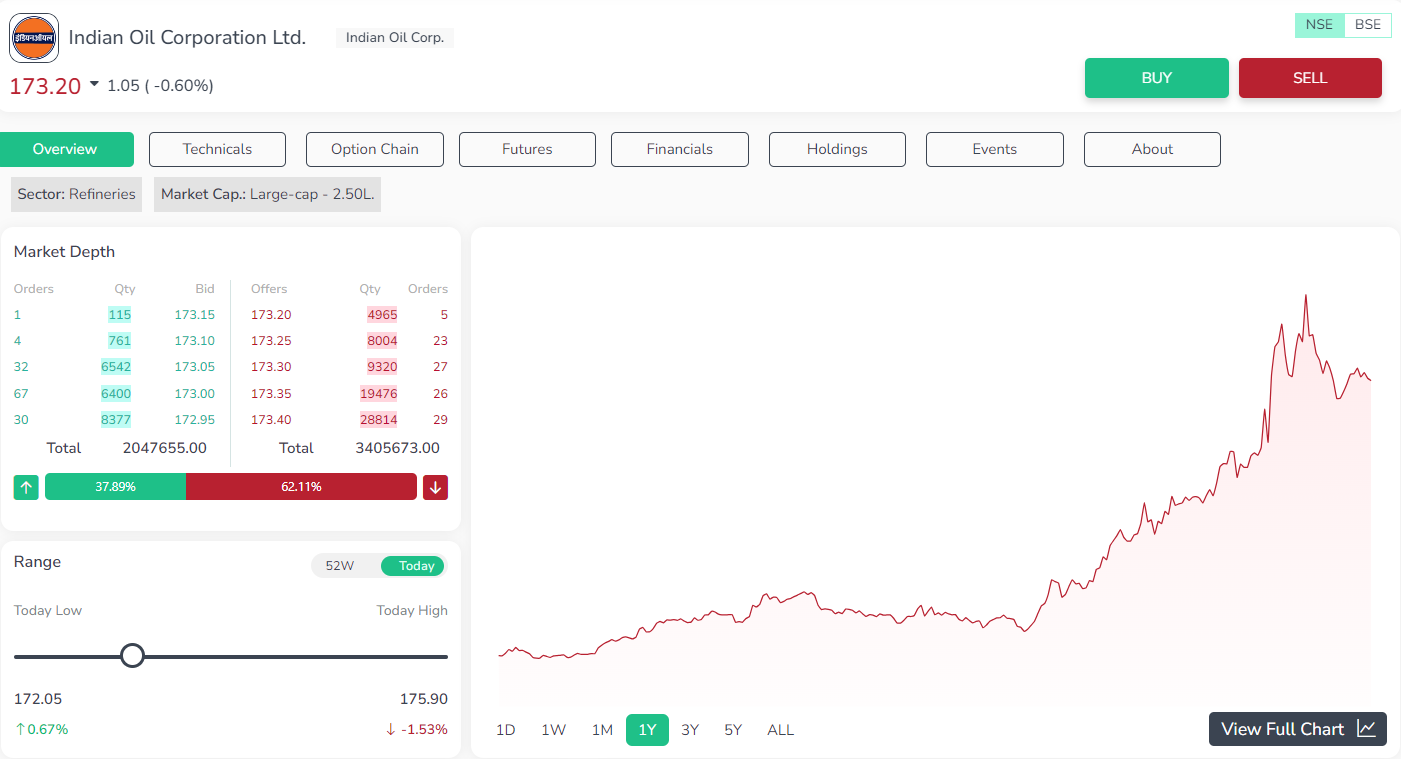

Indian Oil Corporation Limited specializes in refining and selling petroleum products and petrochemicals. With operations spanning various segments, including petroleum products and petrochemical sales, it holds a prominent position in India's energy market, providing investors with opportunities in the energy sector.

Future of the Energy Sector Stocks

The Indian energy sector presents diverse investment opportunities, ranging from traditional oil and gas firms to emerging players in green energy.

Investing in green energy stocks not only fosters sustainable development but also holds the promise of attractive returns as the global shift toward sustainability gains momentum. With governmental backing and escalating demand for renewable energy sources, green energy stocks in India are poised for substantial growth in the foreseeable future.

Let's collectively work towards making India a net zero-emission country by 2070. How can we contribute? By initiating investments in Enrich Money today!

Pharmaceutical Sector

Current State of the pharmaceutical sector in India

India's pharmaceutical industry is experiencing significant growth, with projections indicating a rise to $65 billion by 2024 and $130 billion by 2030 from its current valuation of $50 billion. This sector attracts substantial foreign investment, given its global reach, with Indian pharmaceutical exports serving over 200 countries. India is a major player in the global pharmaceutical market, supplying 50% of Africa's generics, 40% of the US generic market, and 25% of the UK's medicine demand. Additionally, India dominates the global vaccine market, meeting 60% of global demand and supplying essential vaccines like DPT, BCG, and Measles vaccines, with 70% of WHO's vaccines sourced from India. Supported by favorable policies, the pharmaceutical sector benefits from initiatives promoting research, international collaboration, and quality standards, further driving its growth and competitiveness.

Key Players in the pharmaceutical sector

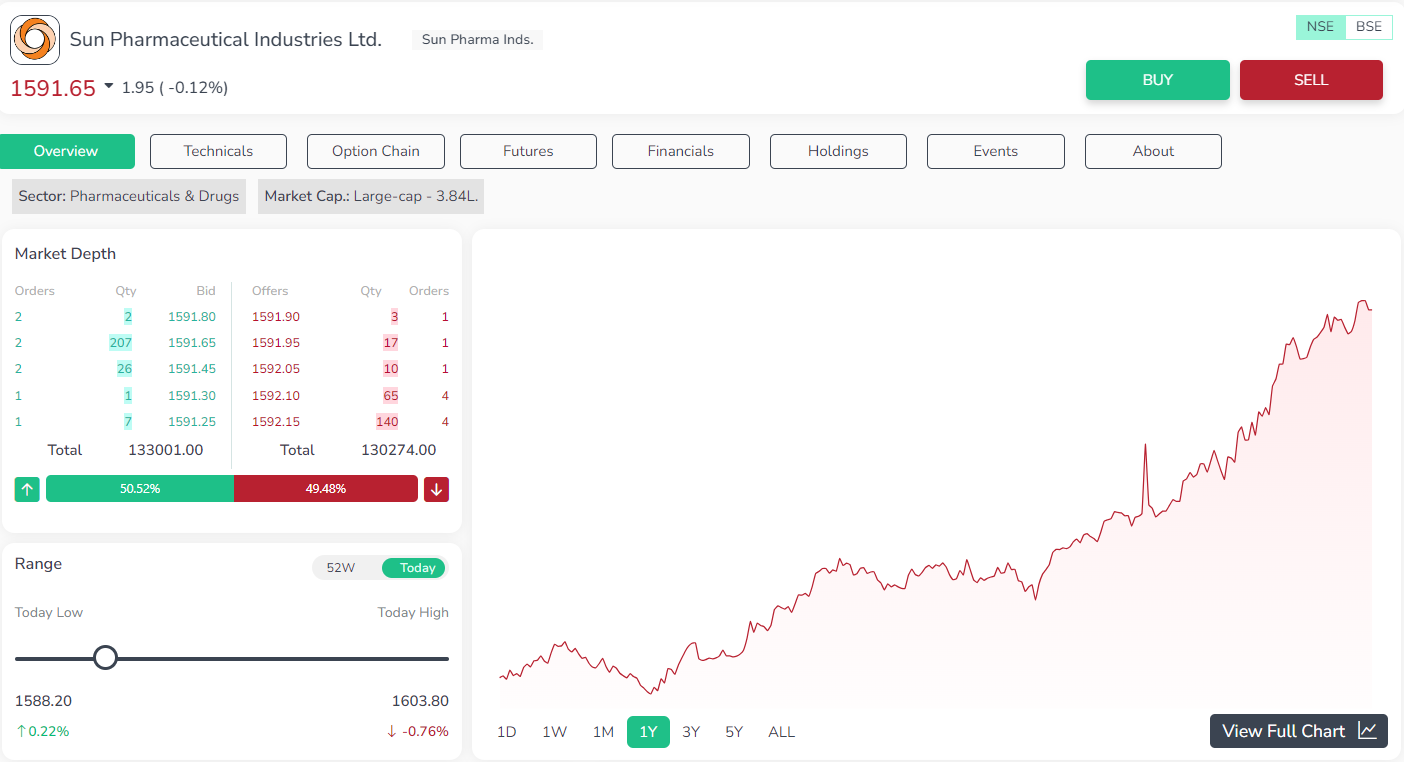

A Mumbai-based multinational pharmaceutical giant, Sun Pharma ranks fourth in India's generic pharmaceutical sector by revenue. Its diverse product portfolio spans tablets, capsules, injectables, and topicals, solidifying its position in the global market.

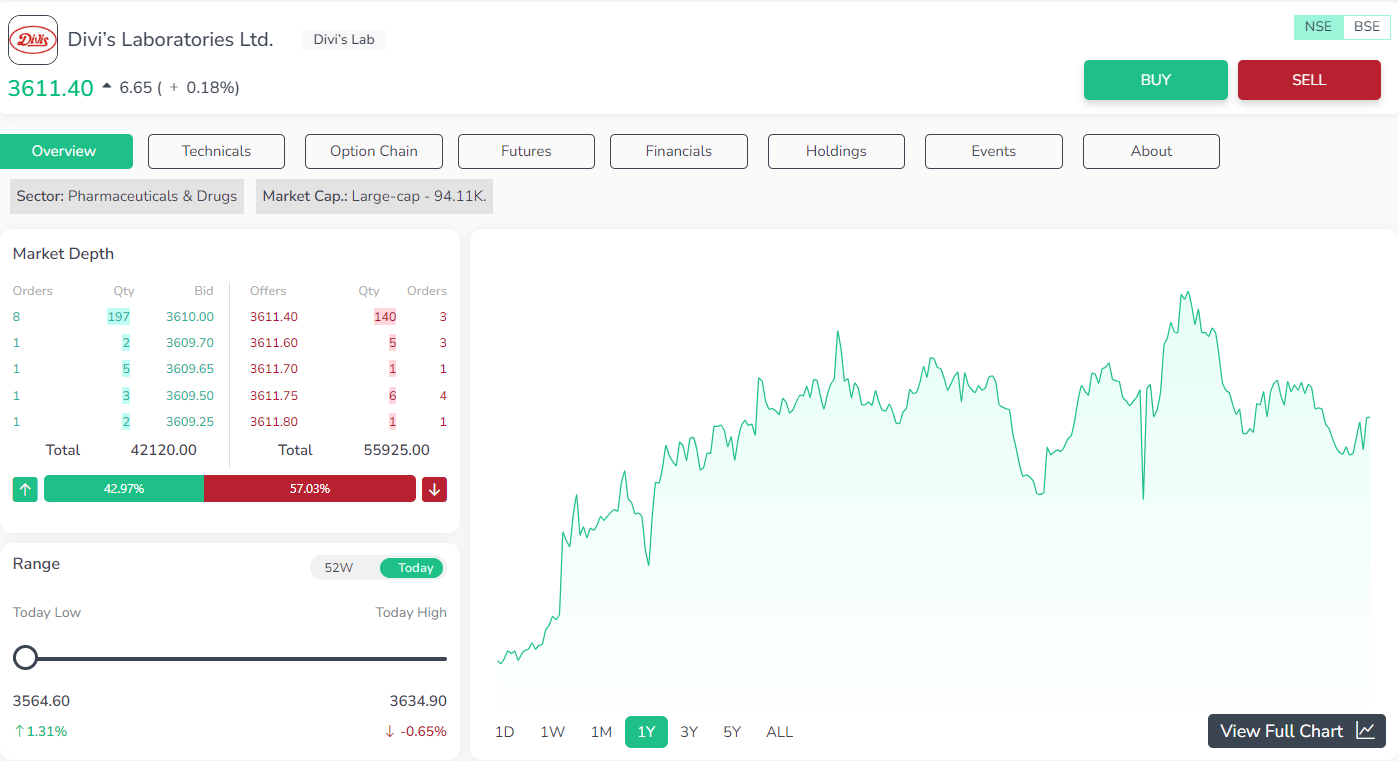

Headquartered in Hyderabad, Telangana, Divi’s Laboratories is renowned for its expertise in producing active pharmaceutical ingredients (APIs) and finished dosages. With a strong export footprint in over 100 countries, it remains a prominent player in the pharmaceutical domain.

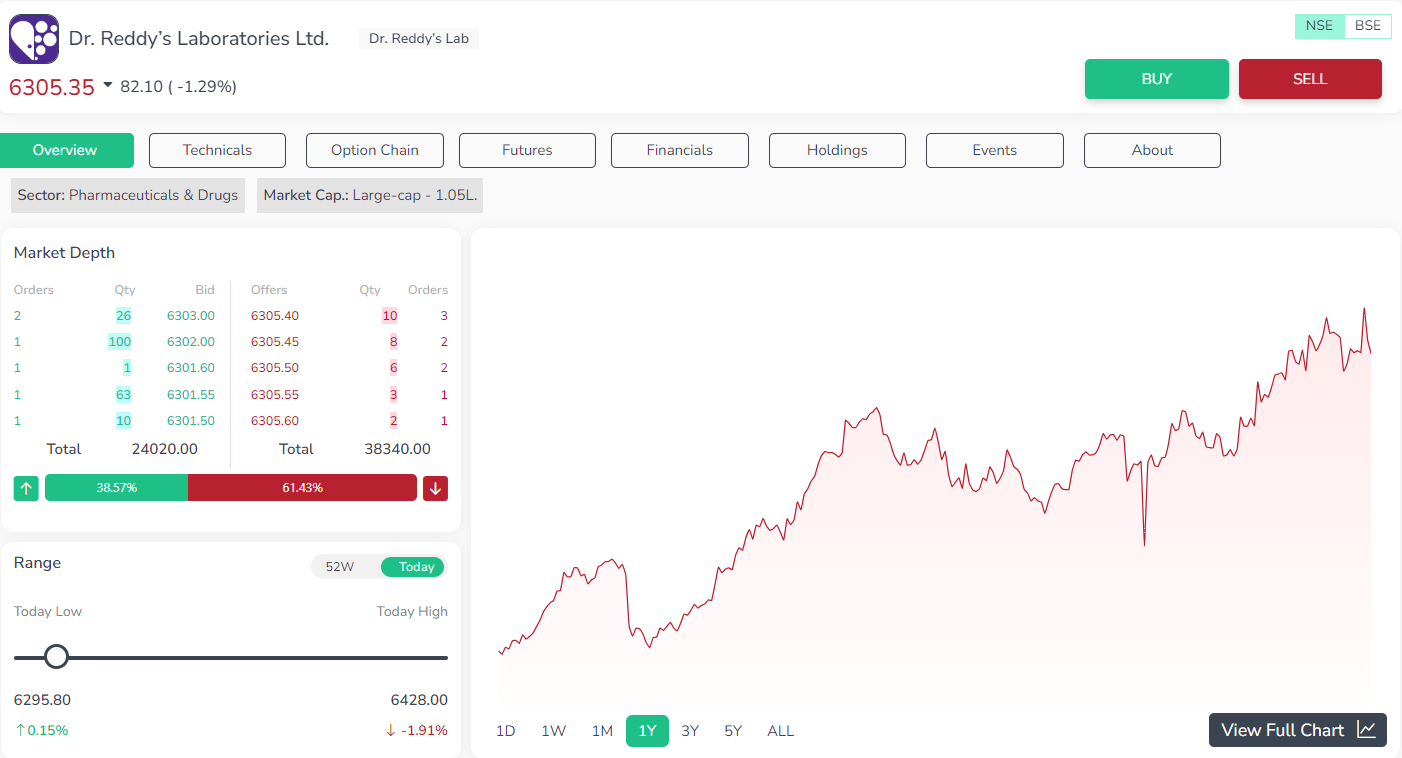

Another Hyderabad-based multinational pharmaceutical company, Dr. Reddy’s stands out for its contributions to both generic and branded pharmaceuticals. With a focus on research and development, particularly in novel drug formulations, it continues to make significant strides in the pharmaceutical sector.

Future of the Pharmaceutical Sector Stocks

In summary, the Indian stock market has shown resilience and promising growth potential throughout 2023. As we progress further into the year, numerous pharmaceutical companies have attracted investor interest and demonstrated promising performance.

Investing in popular stocks through Enrich Money could be an effective way for investors to capitalize on growth opportunities.

Conclusion

In conclusion, the telecommunications, energy, and pharmaceutical sectors emerge as the top contenders for investment in India in 2024. With the telecom industry driving digital transformation, the energy sector transitioning towards sustainability, and the pharmaceutical sector experiencing significant growth, investors have ample opportunities to capitalize on these trends. By carefully selecting stocks in these sectors, investors can position themselves to benefit from India's economic growth and technological advancements in the coming year.

Frequently Asked Questions

-

How can I invest in Energy stocks?

You can invest in energy stocks by exploring options in Enrich Money or investing in ETFs and mutual funds focused on the energy sector.

-

Are Energy stocks profitable for investors?

Yes, Energy stocks, including power stocks, often offer high returns, but investors should assess growth potential and challenges before investing.

-

What is the future of the pharmaceutical industry in 2024?

In 2024, small-molecule drugs are expected to maintain dominance in the pharmaceutical market, comprising over 54.9% of global sales.This is because they are easier to manufacture, formulate, administer, and cost less compared to biologics.

-

What is the trend in the telecom industry in 2024?

One of the leading trends in the telecom industry in 2024 is the expansion of 5G networks, as service providers focus on enhancing their 5G infrastructure and manufacturers introduce a wider range of 5G-capable devices to the market.

-

What are the sectors with promising investment opportunities in India for 2024?

Key sectors offering potential investment opportunities in India for 2024 include telecommunications, renewable energy, healthcare, and technology.

Related Stocks

Tata Teleservices (Maharashtra) Ltd.

Healthcare Global Enterprises Ltd.

Disclaimer: This blog is dedicated exclusively for educational purposes. Please note that the securities and investments mentioned here are provided for informative purposes only and should not be construed as recommendations. Kindly ensure thorough research prior to making any investment decisions. Participation in the securities market carries inherent risks, and it's important to carefully review all associated documents before committing to investments. Please be aware that the attainment of investment objectives is not guaranteed. It's important to note that the past performance of securities and instruments does not reliably predict future performance.