Webinar On - {{item.WebinarName}} {{item.Date}} Book Now

ORCAPRO

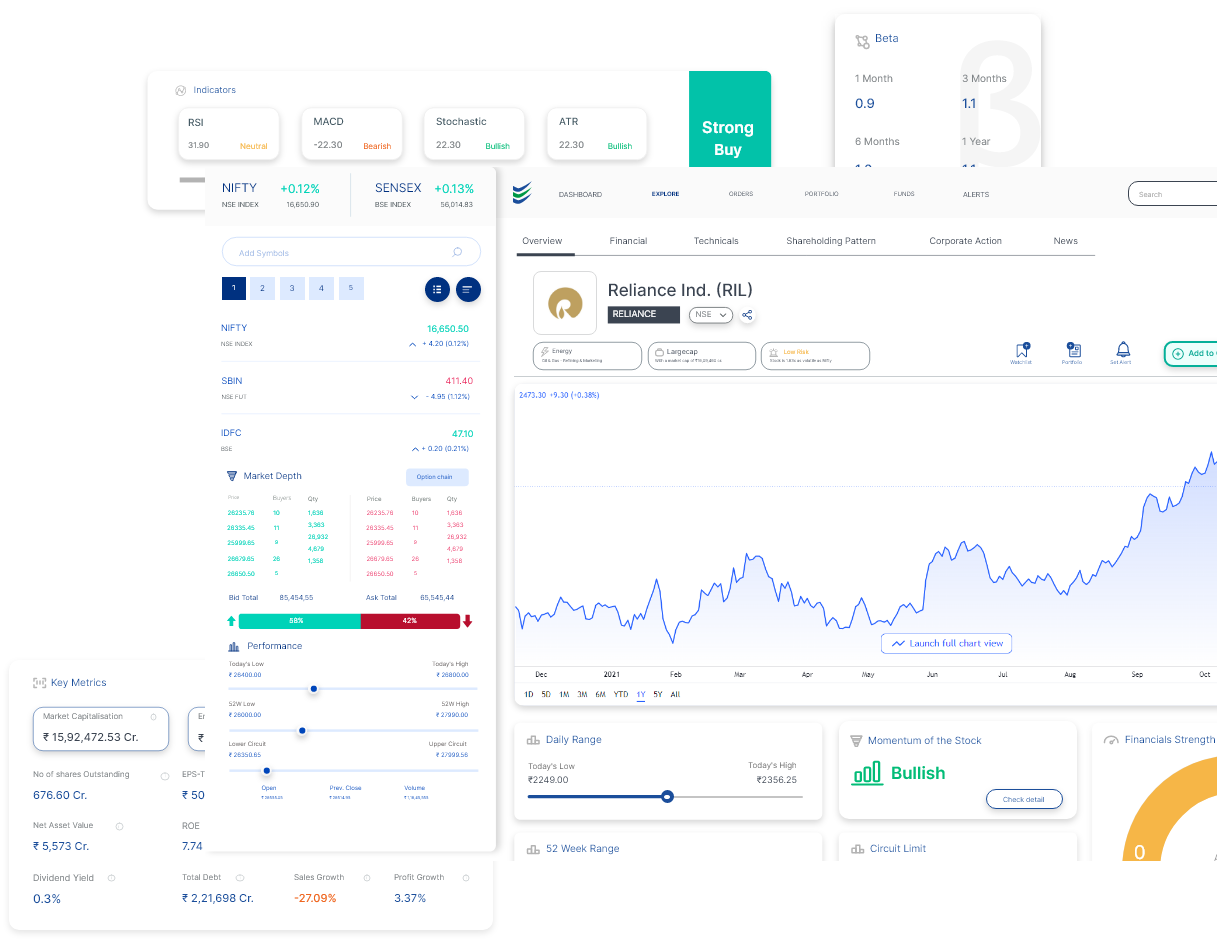

Offers in-depth technical and fundamental analysis that helps investors to analyse any stocks within minutes.

Get Started

Why ORCA Pro?

Daily Range

Daily Range

Today's Low

₹ 2249.00

Today's Low

₹ 2249.00

52 Week Range

52 Week Range

Today's Low

₹ 2249.00

Today's Low

₹ 2249.00

Stock Momentum

To predict the overall market trend (Bullish/Bearish) based on 25+ Variables.

Momentum of the Stock

Momentum of the Stock

Bullish

Bullish

Circuit Limit

Circuit Limit

Upper

₹ 2249.00

Lower

₹ 2249.00

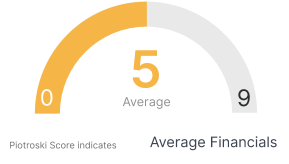

Piotroski score

To identify the strength of the stocks

Financials Strength Score

Financials Strength Score

Open a Demat Account with Enrich Money in Just a Few Minutes.

Open a Demat AccountFAQs

To Analyse a stock fundamentally

- we have to look at the company's financial strength, which is already available for all companies in ORCA pro using the Piotroski Score method.

- Sales Growth

- PAT Growth

- EPS

- PE

- ROCE

And many more financial ratios are also available to clearly understand how the company is doing; hence, if all the indicators consistently give a positive outlook, we can decide to take a position as per the risk appetite.

To analyze a stock price, you have to look at the technical indicators to understand if it is in the overbought zone or otherwise, for which you have to look at

- Stoch RSI

- ROC

- UltimateOscillator

- Williams Indicator

- CCI Indicator

- MACD

- EMA & SMA Levels

- Beta

- RSI

- ATR

We can go for a position if all the above indicators give a positive outlook and a buy signal.

For analysing the MF, we have first to look at the holdings of the scheme and its heavyweights; once we take the heavyweights, we have to start analysing those both fundamentally and technically; doing so, we will able to understand that if MF is risky or not, although every MF has a riskometere to convey the risk. There is another method of analysing the MF, which is with its benchmark, to see if MF is outperforming or underperforming when compared with it.

It is crucial to analyse before investing in market-related products to understand the risk better.

Post-analysis, as per the outcome of the analysis, we can decide to either go ahead with the investment or not.

There are various indicators used to analyse a stock both fundamentally and technically; some of the indicators are:

- Piotroski Score

- Sales Growth

- PAT Growth

- EPS

- PE

- ROCE

- Stoch RSI

- ROC

- UltimateOscillator

- Williams Indicator

- CCI Indicator

- MACD

- EMA & SMA Levels

- Beta

- RSI

- ATR