Top 50 Shares for Long-Term Investment: Performance Review & Outlook

Introduction

India’s stock market is gaining strong traction in 2025, with the Nifty 50 crossing 25,100 and small- and mid-cap indices rebounding amid RBI rate cuts and improving global sentiment. The economy grew 7.4% in Q4 FY24, led by solid growth in construction and manufacturing, while retail leasing surged 169% YoY, showing strong domestic demand.

Key sectors like IT, renewables, and defence are booming. Notably, defence stocks rallied after a Rs. 30,000 crore procurement plan, and green energy is set for multi-billion-rupee expansion. With 2,670+ NSE-listed firms and over 110 million active investors, India’s equity market is ripe for long-term growth.

This 2025 edition of Top 50 Shares for Long-Term Investment in India highlights fundamentally strong companies with the potential to deliver sustained returns in a dynamic market landscape.

What Does Long-Term Investment in Shares Mean?

Long-term investment in shares refers to the practice of buying stocks with the intention to hold them for several years, typically five or more. This strategy is not driven by short-term price movements but by the belief that well-managed, fundamentally strong companies grow in value over time. Investors who follow this approach often benefit from consistent dividends, capital appreciation, and the power of compounding.

If you're exploring the top 50 shares to buy for long term, it's essential to look beyond daily market fluctuations and focus on the bigger picture — business sustainability, economic moats, and long-term industry trends. Even budget-conscious investors can find solid options under Rs. 100, provided those companies show clear growth potential and sound management.

50 Best Shares to Buy Today for the Long Term in India [2025 Edition]

Below is a curated list of the Top 50 Shares for Long-Term Investment in India [2025 Edition], selected based on their financial strength, consistent performance, and future growth potential. This table highlights key metrics to help investors make informed decisions.

|

Name |

Market Cap (Cr.) |

PE Ratio |

52W High |

52W Low |

1 Yr Returns |

5 Yr Returns |

ROE |

ROCE |

EPS |

|

8,439.80 |

14.28 |

274.7 |

158.3 |

-5.50% |

301.41% |

0.1051 |

5.20% |

13.52 |

|

|

8,041.20 |

9.87 |

539.5 |

240 |

-39.56% |

144.57% |

0.1537 |

14.29% |

50.83 |

|

|

7,961.40 |

6.11 |

30.58 |

22.27 |

11.58% |

381.82% |

0.1213 |

5.80% |

4.44 |

|

|

7,839.30 |

19.22 |

588 |

363.15 |

16.86% |

90.72% |

-0.0003 |

15.27% |

11.27 |

|

|

7,685.00 |

6.04 |

245 |

162.2 |

-7.16% |

403.00% |

0.1437 |

5.65% |

35.39 |

|

|

7,425.70 |

21.41 |

371.98 |

212.55 |

16.97% |

1263.53% |

0.1519 |

20.67% |

33.31 |

|

|

7,022.00 |

9.9 |

236.6 |

86.25 |

-28.89% |

948.41% |

0.1447 |

18.62% |

14.98 |

|

|

7,005.70 |

- |

246 |

105.3 |

-7.92% |

250.51% |

0.0985 |

9.84% |

- |

|

|

6,571.60 |

- |

57.5 |

21.97 |

-8.57% |

595.79% |

0.0372 |

50.39% |

- |

|

|

6,415.30 |

15.65 |

638.75 |

275.75 |

-10.43% |

292.73% |

0.2174 |

19.52% |

56.25 |

|

|

6,259.00 |

3.69 |

319 |

159.34 |

0.48% |

315.19% |

0.1888 |

16.90% |

19.35 |

|

|

5,326.70 |

20.35 |

459.9 |

287.9 |

-13.84% |

0.17% |

0.0787 |

14.07% |

11.43 |

|

|

5,201.80 |

9.57 |

246.85 |

127.69 |

-13.26% |

371.83% |

0.0863 |

12.14% |

17.36 |

|

|

4,686.10 |

23.24 |

875 |

264.56 |

12.34% |

154.99% |

- |

11.37% |

- |

|

|

4,602.10 |

7.48 |

148.5 |

101.41 |

12.31% |

103.64% |

0.1057 |

6.59% |

17.25 |

|

|

3,924.60 |

20.09 |

252.5 |

167.41 |

19.21% |

596.29% |

0.1708 |

42.77% |

14.49 |

|

|

3,664.60 |

10.48 |

74.4 |

35.68 |

-27.20% |

242.71% |

0.0601 |

15.41% |

2.69 |

|

|

3,397.60 |

10.91 |

753.5 |

385.1 |

-16.69% |

235.17% |

0.2063 |

25.30% |

84.84 |

|

|

3,214.10 |

19.79 |

1330 |

567.75 |

12.12% |

2505.47% |

0.1416 |

20.05% |

42.47 |

|

|

3,187.40 |

22.81 |

697.5 |

315 |

-4.66% |

200.11% |

0.0795 |

13.82% |

19.51 |

|

|

3,157.60 |

- |

1360 |

653 |

48.40% |

432.58% |

0.0442 |

10.43% |

- |

|

|

2,711.20 |

15.7 |

281.79 |

167.55 |

-14.23% |

402.24% |

0.1552 |

16.10% |

14.92 |

|

|

2,657.40 |

15.47 |

1150 |

505.55 |

16.83% |

72.90% |

0.0758 |

3.08% |

16.33 |

|

|

2,590.60 |

21.81 |

236.7 |

135.49 |

17.31% |

122.89% |

0.0659 |

13.62% |

8.08 |

|

|

2,541.50 |

16.58 |

513.7 |

201.55 |

3.34% |

912.30% |

0.0677 |

14.64% |

17.43 |

|

|

2,426.30 |

51.13 |

954.75 |

437 |

-34.57% |

78.69% |

0.0331 |

3.51% |

28.63 |

|

|

2,378.10 |

59.86 |

455.17 |

177.42 |

-21.99% |

238.43% |

0.0606 |

12.61% |

5.13 |

|

|

2,299.10 |

19.71 |

2559.95 |

1521.95 |

-10.00% |

32.53% |

0.0543 |

8.94% |

95.72 |

|

|

2,236.70 |

12.71 |

494.35 |

290.5 |

18.80% |

1055.81% |

0.1602 |

12.57% |

25.74 |

|

|

2,197.40 |

11.79 |

452.5 |

305 |

-3.76% |

757.28% |

0.177 |

23.18% |

32.97 |

|

|

2,109.40 |

10.24 |

474.9 |

245.15 |

-7.06% |

-1.06% |

0.1766 |

19.13% |

20.88 |

|

|

2,102.00 |

17.65 |

438.6 |

255.6 |

5.97% |

9.05% |

0.0783 |

10.69% |

12.24 |

|

|

2,012.90 |

25.54 |

803 |

193 |

-63.11% |

-46.44% |

0.1374 |

12.39% |

61.28 |

|

|

1,996.80 |

9.84 |

3230 |

1160.3 |

-25.13% |

168.84% |

0.0711 |

9.09% |

213.76 |

|

|

1,993.40 |

23.17 |

98.54 |

46.05 |

-25.72% |

192.68% |

0.0987 |

12.88% |

2.66 |

|

|

1,989.10 |

24.28 |

938 |

407.25 |

-10.93% |

470.31% |

0.061 |

10.14% |

25.87 |

|

|

1,938.90 |

13.87 |

231.3 |

107.68 |

16.62% |

152.09% |

-0.0442 |

12.79% |

10.59 |

|

|

1,860.50 |

16.79 |

914.95 |

543.6 |

5.19% |

53.78% |

0.0694 |

16.37% |

31.34 |

|

|

1,841.90 |

5.13 |

490.25 |

123.96 |

-58.55% |

-40.65% |

0.1667 |

12.68% |

34.7 |

|

|

1,832.30 |

21.17 |

59.3 |

27.75 |

-41.45% |

-42.17% |

0.2497 |

19.04% |

2.01 |

|

|

1,794.90 |

9.62 |

248 |

131.8 |

-28.46% |

143.27% |

0.1816 |

15.35% |

41.04 |

|

|

1,767.40 |

11.35 |

96.7 |

66.22 |

8.52% |

420.36% |

0.3051 |

18.23% |

8.47 |

|

|

1,745.00 |

19.65 |

57 |

24.31 |

-36.46% |

-51.24% |

0.1708 |

7.74% |

6.96 |

|

|

1,734.60 |

65.3 |

2428.3 |

1800 |

24.48% |

24.48% |

0.0278 |

3.77% |

- |

|

|

1,725.40 |

21.5 |

253.2 |

128.48 |

-14.71% |

-42.19% |

0.2804 |

20.28% |

12.94 |

|

|

1,588.40 |

12.13 |

111.4 |

65.01 |

-21.11% |

79.25% |

0.1019 |

10.73% |

8.28 |

|

|

1,557.80 |

13.57 |

212.75 |

97.97 |

-26.29% |

-46.60% |

0.049 |

7.38% |

22.44 |

|

|

1,555.40 |

17.46 |

128 |

65.1 |

-24.42% |

75.84% |

0.1795 |

22.64% |

62.58 |

|

|

1,550.90 |

84.09 |

64.52 |

21.6 |

11.24% |

357.85% |

- |

10.21% |

- |

Top 10 Picks from the 50 Best Shares to Buy Today for the Long Term in India

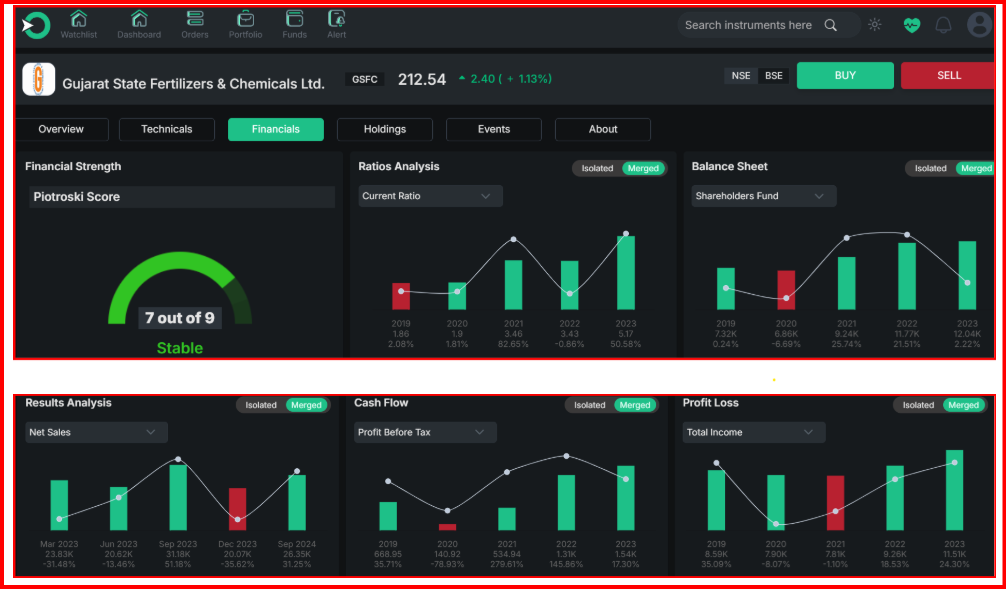

1 . Gujarat State Fertilizers & Chemicals

Gujarat State Fertilizers & Chemicals Ltd. (GSFC) secures its position among the top 50 shares to buy for long term due to its solid financial foundation and operational efficiency. The company carries almost no debt and maintains an impressive interest coverage ratio of 60.35, indicating its solid capacity to meet financial obligations with ease.Its efficient cash conversion cycle of 25.87 days and a robust current ratio of 4.47 indicate sound liquidity management. Additionally, with an average operating leverage of 3.45, GSFC is well-placed to benefit from any uptick in revenues through improved margins.

However, GSFC has faced challenges in recent years, with a modest profit growth of 7.88% and revenue growth of 6% over the past three years. Its return on equity (ROE) has also remained subdued at 7.92%, and it reported negative cash flow from operations of -271.97, reflecting current business pressures. While challenges exist, GSFC’s zero-debt profile, solid liquidity position, and robust operations position it as a reliable pick among the top 50 long-term investment stocks—particularly suited for cautious investors interested in the fertilizer and chemicals space.

2 . PNC Infratech

PNC Infratech Ltd. emerges as a strong contender among the top 50 shares to buy for long term, thanks to its impressive financial performance and robust operational metrics. Over the past three years, the company has delivered a healthy profit growth of 32.91% and revenue growth of 16.06%, reflecting consistent business expansion. A solid ROCE of 22.70% highlights the company’s effective use of capital to drive growth and generate healthy returns. Being virtually debt-free with an interest coverage ratio of 18.26, the company demonstrates excellent financial discipline.

Its PEG ratio of 0.30 suggests the stock may be undervalued relative to its growth, making it even more attractive for long-term investors. Operationally, PNC Infratech maintains an efficient cash conversion cycle of 40.27 days and a current ratio of 2.21, highlighting solid liquidity. The substantial promoter stake of 56.07% reflects strong faith in the company’s long-term prospects and stability.With no significant limitations, PNC Infratech justifiably earns its place among the top 50 shares to buy for long term, offering a solid mix of growth, efficiency, and financial stability.

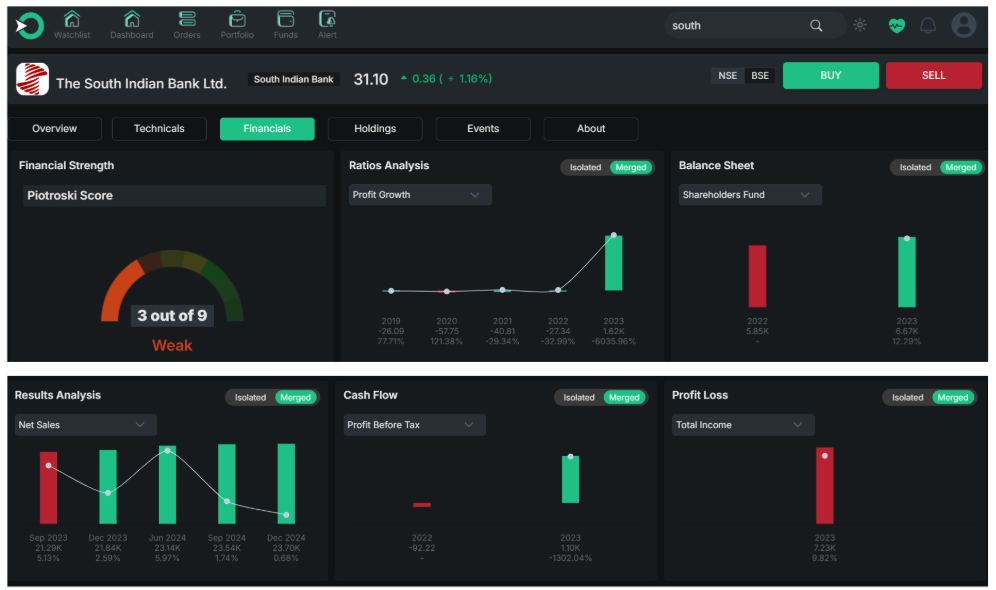

3 . South Indian Bank

The South Indian Bank Ltd. finds its place in the top 50 shares to buy for long term driven by its strong capital position and a remarkable turnaround in profitability. With a Capital Adequacy Ratio of 19.91%, the bank is well-buffered against potential credit risks, and its profit growth of 158.55% over the past three years signals an encouraging phase of recovery and operational improvement.

However, some structural challenges remain. The bank has a weak return on assets (ROA) with a 3-year average of just 0.58%, indicating underutilization of its asset base. CASA growth has declined by -0.90% YoY, and a high cost-to-income ratio of 61.47% continues to weigh on efficiency. Income growth has also been sluggish at 5.64%, while provisions and contingencies rose by 29.92% YoY, suggesting ongoing asset quality concerns. Despite these hurdles, the strong capital base and significant profit turnaround make South Indian Bank a calculated inclusion in the top 50 shares to buy for long term, especially for investors looking at potential value in the evolving private banking space.

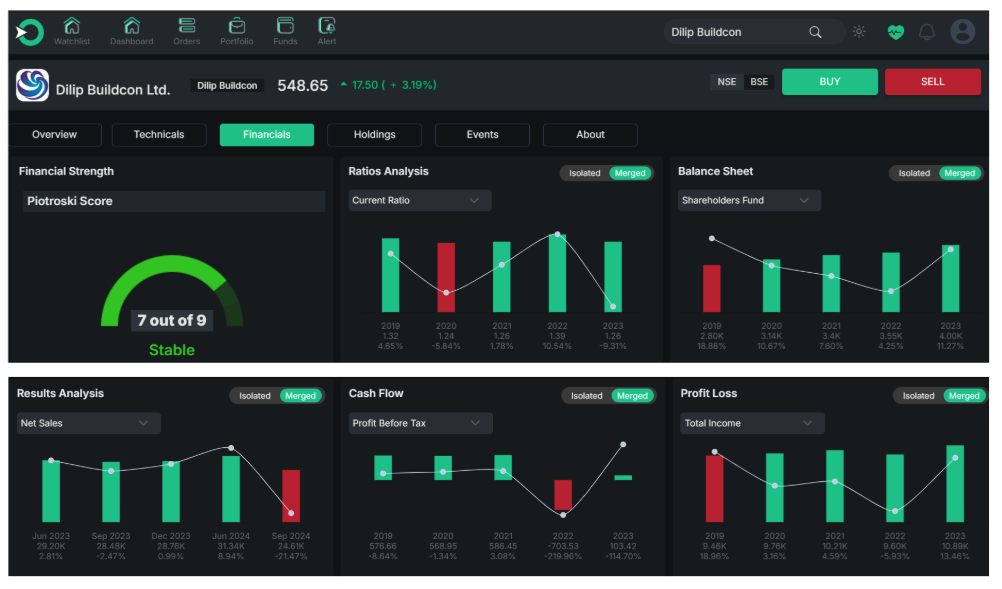

4 . Dilip Buildcon

Dilip Buildcon Ltd. earns a spot among the top 50 shares to buy for long term due to its focused financial restructuring and operational efficiency, despite modest growth metrics. A significant reduction in debt by Rs. 819.18 crore signals a strong move towards financial stability. A PEG ratio of 0.29 suggests the stock is undervalued when compared to its projected earnings growth, making it appealing for long-term investors. The company operates with an exceptionally efficient cash conversion cycle of -64.14 days, reflecting strong receivables and payables management. Additionally, its CFO/PAT ratio of 3.89 shows prudent cash flow utilization, while an average operating leverage of 14.31 reveals strong potential for earnings expansion when revenue improves.

On the downside, Dilip Buildcon’s profit and revenue growth over the past three years have been subdued at 9.75% and 4.59% respectively. A low ROE of 3.87% also highlights challenges in generating returns on shareholder equity. The presence of contingent liabilities amounting to Rs. 3,710.16 crore is a notable risk. Still, the company’s strategic debt reduction and operational strengths justify its inclusion in the top 50 shares to buy for long term, especially for investors who believe in infrastructure-led growth with a long-term horizon.

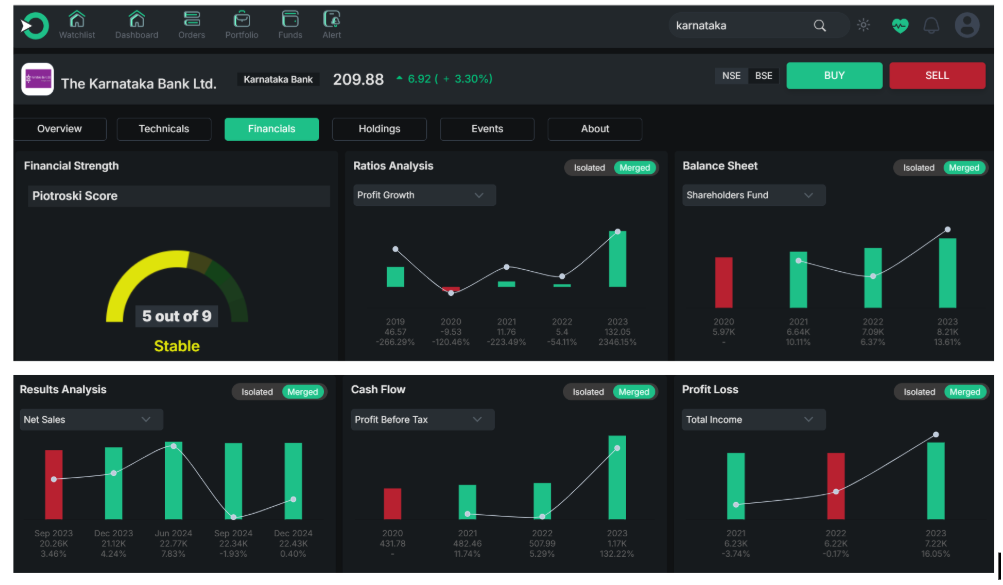

5 . Karnataka Bank

The Karnataka Bank Ltd. features among the top 50 shares to buy for long term owing to its consistent profitability and strong capital position. The bank has maintained a solid return on equity (ROE) of 12.96% over the past three years, indicating efficient use of shareholder capital. A consistent net interest margin of 3.24% along with a healthy capital adequacy ratio of 18% highlights the bank’s financial strength and operational stability. Its profit growth of 39.37% over three years adds further credibility to its long-term investment appeal.

However, the bank has seen a marginal decline in its CASA ratio, registering a YoY fall of -1.00%, and its cost-to-income ratio remains on the higher side at 53.15%, suggesting room for operational improvements. Even so, Karnataka Bank’s strong core metrics and consistent financial performance make it a sound candidate among the top 50 shares to buy for long term, particularly for investors seeking stable growth within the private banking space.

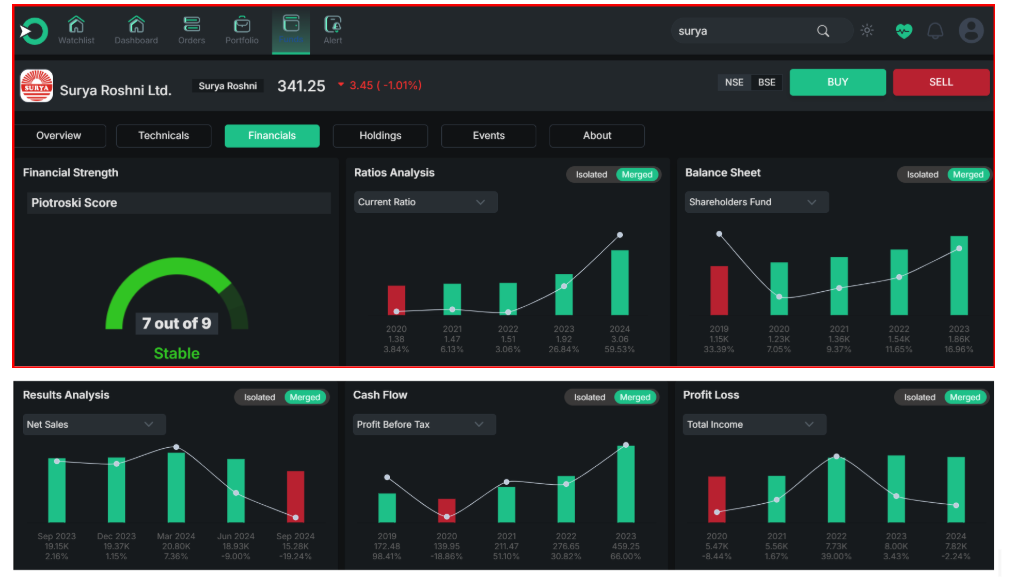

6 . Surya Roshni

Surya Roshni Ltd. earns its spot among the top 50 shares to buy for long term due to its solid financials and operational efficiency. The company has delivered 28.09% profit growth over three years while reducing debt by Rs. 400.21 crore, making it virtually debt-free. With a healthy ROCE of 20.08%, interest coverage of 19.49, and strong liquidity, it reflects sound financial management. A current ratio of 3.06, efficient cash conversion cycle, and high promoter holding further strengthen its position.

Though revenue growth was moderate at 12.02% and contingent liabilities stand at Rs. 555.15 crore, its strong fundamentals justify its inclusion in the top 50 shares to buy for long term.

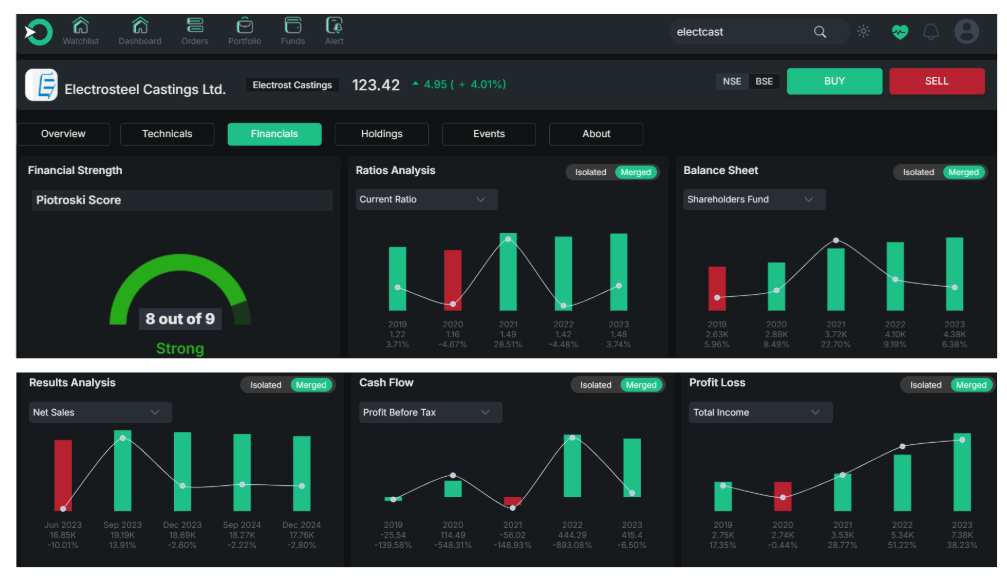

7. Electrosteel Castings

Electrosteel Castings Ltd. stands out as a strong candidate among the top 50 shares to buy for long term owing to its impressive growth and valuation metrics. The company has delivered a robust profit growth of 77.80% and revenue growth of 31.15% over the past three years, reflecting strong business momentum.

With an exceptionally high operating leverage of 63.85, even modest revenue increases can significantly boost profits. With no notable limitations, Electrosteel Castings justifies its inclusion in the top 50 shares to buy for long term for investors seeking high-growth industrial plays.

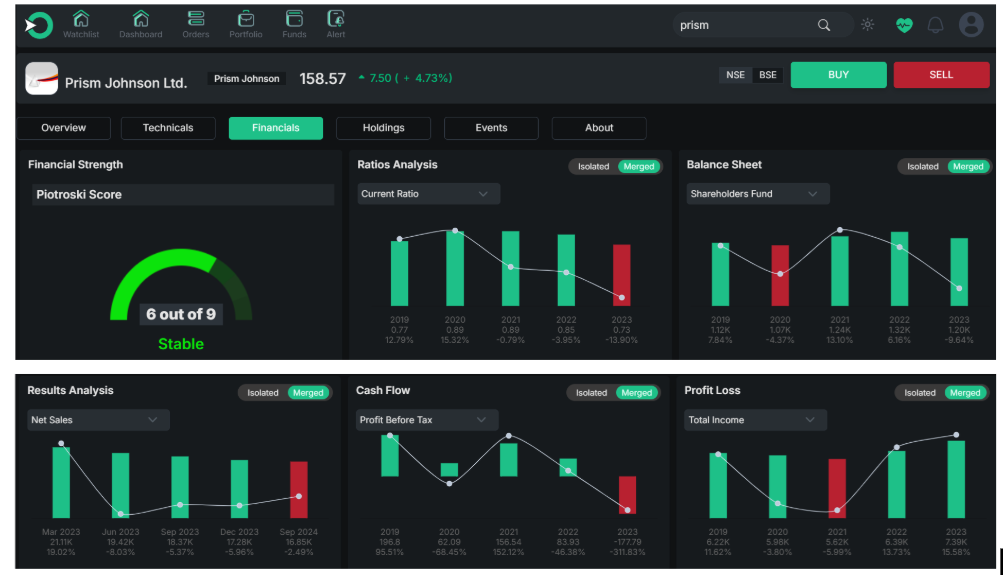

8 . Prism Johnson

Prism Johnson Ltd. makes it to the top 50 shares to buy for long term owing to its strong operational metrics and attractive valuation. A 0.19 PEG hints at strong growth potential at a fair price.The company operates with an efficient cash conversion cycle of -63.02 days and maintains excellent cash flow management, reflected in its CFO/PAT ratio of 6.82. A high promoter holding of 74.87% and strong operating leverage of 17.85 further add to investor confidence.

However, its performance has been muted with a profit decline of -1.64%, revenue growth of just 11.97%, and a low ROE of 6.99% over the past three years. Despite these concerns, its strong cash position and operational leverage support its inclusion in the top 50 shares to buy for long term.

9 . Hindustan Construction Company

Hindustan Construction Company Ltd. secures a position in the top 50 shares to buy for long term based on its strong financial performance and capital efficiency. The company has delivered a solid profit growth of 32.29% and revenue growth of 24.87% over the past three years, along with an impressive ROCE of 33.16%, reflecting effective capital utilization. Its high operating leverage of 26.13 indicates strong potential for profit expansion with revenue growth.

However, promoter pledging at 78.89% raises red flags and may impact investor confidence.Still, the company’s consistent performance and growth prospects make it a compelling choice among the top 50 shares to buy for long term.

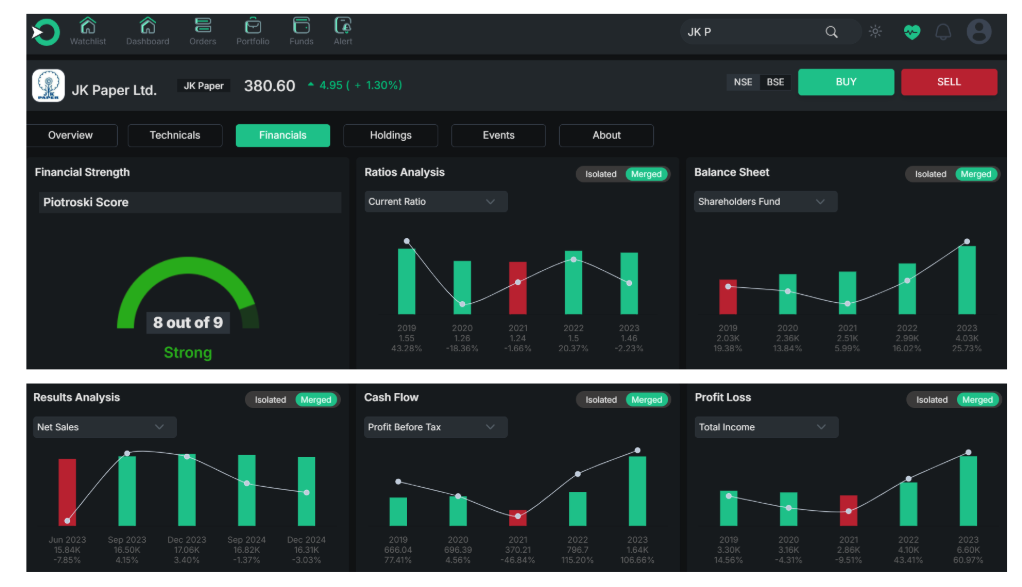

10 . JK Paper

JK Paper Ltd. holds a strong position in the top 50 shares to buy for long term due to its consistent profitability and efficient operations. Over the past three years, the company has delivered a solid profit growth of 40.96% and revenue growth of 28.81%, supported by a healthy ROE of 21.92% and ROCE of 20.21%. It has maintained impressive operating margins of 23.38% over the last five years and operates with an efficient cash conversion cycle of -22.92 days. Its CFO/PAT ratio of 1.33 reflects sound cash flow management.

Although the tax rate remains low at 9.42%, JK Paper’s strong fundamentals and sustained performance make it a reliable pick among the top 50 shares to buy for long term.

Conclusion

The journey to building wealth begins with making smart, well-informed investment decisions. The top 50 shares for long-term investment presented in this article are backed by strong fundamentals, industry relevance, and future growth potential. New or seasoned, investors can rely on these picks for steady, long-term growth.

Start investing with confidence on Enrich Money – a trusted platform offering research-backed insights and powerful tools to grow your investments.

Enrich Money makes it easier to plan, invest, and stay ahead in your journey toward financial freedom.

Frequently Asked Questions

-

How do I pick the best stocks to buy today long term?

Start by identifying companies with steady earnings, low debt, and leadership in growing industries. These traits often define the best stocks to buy today long term for sustainable returns.

-

How do top long-term stocks distinguish themselves?

They consistently deliver value through solid financials, business durability, and future-ready strategies. Investing in the best stocks to buy for long term can provide both stability and growth.

-

Who benefits most from the top 10 long-term stocks?

Investors looking for wealth creation over time should consider the top 10 stocks to buy for long term, especially those who prefer a low-maintenance portfolio with solid growth prospects.

-

How do I find the best fundamental stocks for long term gains?

Look for high ROE, consistent revenue growth, and debt control. These factors usually indicate the best fundamental stocks for long term value accumulation.

-

How can I create the best portfolio stocks for long term success?

Blend high-growth, stable, and dividend-paying companies across different sectors to build the best portfolio stocks for long term resilience and performance.

Disclaimer: This blog is dedicated exclusively for educational purposes. Please note that the securities and investments mentioned here are provided for informative purposes only and should not be construed as recommendations. Kindly ensure thorough research prior to making any investment decisions. Participation in the securities market carries inherent risks, and it's important to carefully review all associated documents before committing to investments. Please be aware that the attainment of investment objectives is not guaranteed. It's important to note that the past performance of securities and instruments does not reliably predict future performance.