PSU Bank Stocks Make a Comeback — Durable or Just a Blip?

Introduction

Public sector bank (PSU) stocks in India have staged a remarkable comeback in 2025, drawing investor attention after years of underperformance.

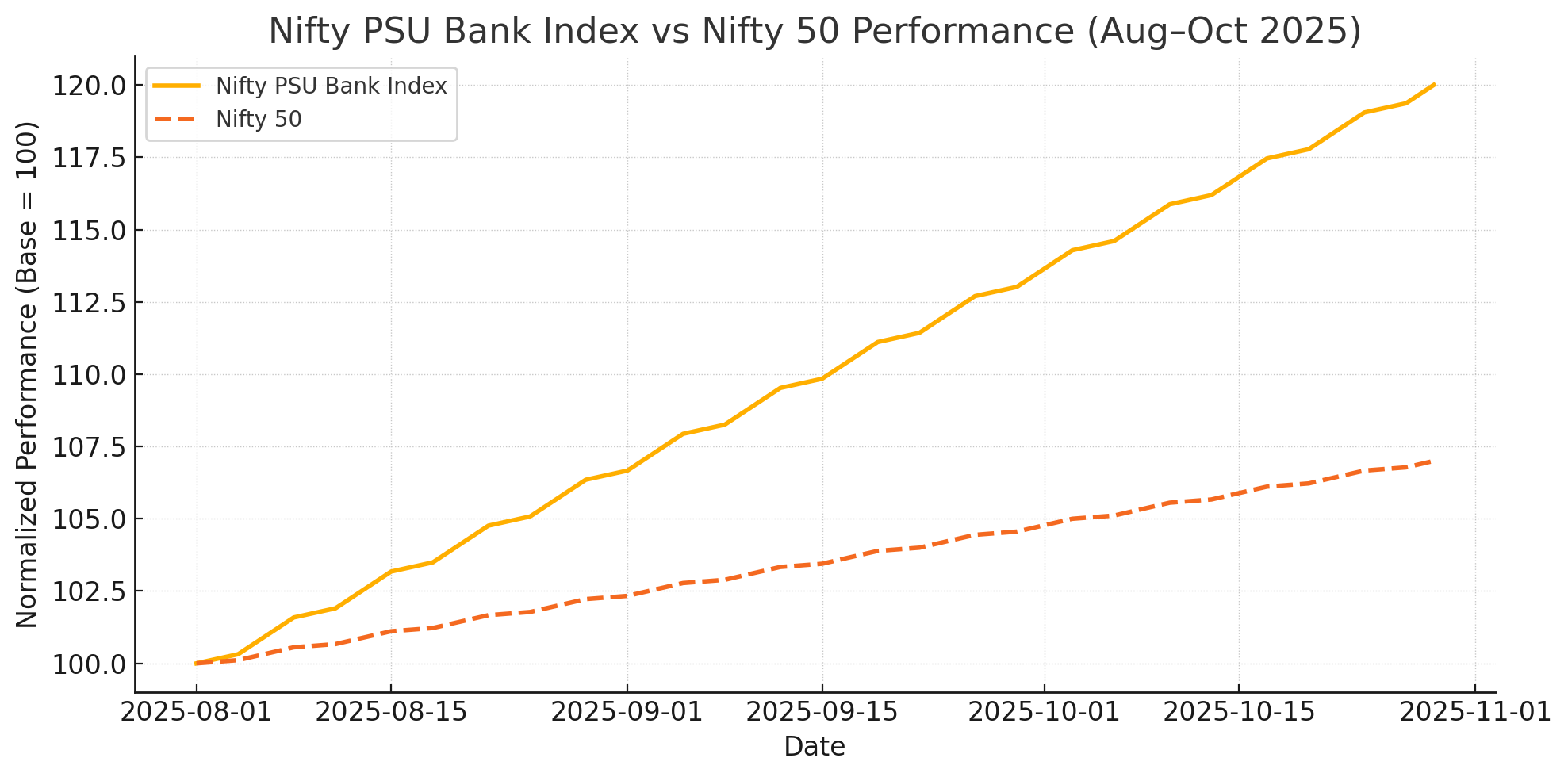

Over the past few months, PSU banks collectively added more than Rs. 2.3 lakh crore in market capitalisation. The Nifty PSU Bank Index surged around 20% in just two months, outpacing major indices.

State Bank of India (SBI), Bank of Baroda, Canara Bank, and Indian Bank have all hit new 52-week highs. Analysts credit this rally to improved earnings, policy reforms, stronger credit growth, and foreign investor interest amid expectations of government action to raise FDI limits in PSU banks.

But investors now ask the bigger question — is this rally sustainable, or just a short-lived surge?

How PSU Banks Became the Market’s Dark Horse

The rally in PSU banking stocks didn’t appear out of thin air. It’s the result of a combination of policy, performance, and perception.

Let’s decode each catalyst.

1. Earnings and Asset Quality Have Improved

The financial performance of PSU banks has improved dramatically over the last few quarters.

A few key highlights:

-

Net Interest Margins (NIMs) have expanded for most PSU banks due to strong credit demand and a fall in provisioning requirements.

-

Gross NPA ratios have dropped to multi-year lows — most PSU banks now report GNPA below 4%, compared with over 10% in 2018.

-

Credit growth remains strong, led by retail and MSME segments.

For instance, SBI’s Q2FY26 net profit (reported in Oct 2025) grew by 12% YoY, while Bank of Baroda’s profit jumped 15%. These results reflect improved asset quality and lower credit costs — a critical shift from the NPA crisis era.

2. Policy and Reform Momentum Boosted Sentiment

One of the strongest tailwinds for PSU banks is the renewed policy focus from the government.

-

FDI/FII Limit Hike Talks: Reports indicate that the government may raise foreign investment limits in PSU banks from 20% to 49%. This could unlock approximately USD 4 billion (Rs. 33,000 crore) in potential foreign inflows into the banking sector.

-

Privatisation and Governance Reforms: While large-scale privatisation is still being debated, the government’s consistent message on better governance, risk management, and digital transformation within PSBs has reassured investors.

-

Capital Infusion and Consolidation: Past mergers (e.g., Canara – Syndicate, PNB – Oriental Bank – United Bank) have now started showing synergy benefits, strengthening the balance sheets.

In short, investors are pricing in a policy-driven re-rating rather than just cyclical momentum.

3. Renewed FII and Institutional Interest

Foreign institutional investors (FIIs), who had long ignored PSU banks, are gradually coming back.

Data from NSDL shows that between August and October 2025, FIIs increased their holdings in key PSU names — particularly SBI, Bank of Baroda, and Canara Bank.

Domestic institutional investors (DIIs), including mutual funds, are also overweight PSU banks. For example, PSU bank exposure in mutual fund portfolios rose from 2.1% in March 2024 to 4.8% by October 2025.

This twin domestic-foreign participation gives the rally stronger footing.

4. Valuations Remain Attractive

Despite the rally, PSU banks are still valued at modest multiples compared to private sector peers.

The Nifty PSU Bank Index trades at approximately 1.2× P/BV, versus around 2.8× for private banks.

That valuation gap, while narrowing, still leaves room for re-rating if earnings remain strong.

Recent Market Performance: Numbers Speak for Themselves

|

Metric |

Value (as of Oct 29, 2025) |

|

Total market-cap added by PSU banks |

Rs. 2.3 lakh crore |

|

Nifty PSU Bank Index gain (2 months) |

~20% |

|

SBI share price |

Rs. 939.8 |

|

Indian Bank – new high |

Rs. 644.95 |

|

Estimated FII inflows if limit raised |

~USD 4 billion |

Observation: The PSU Bank Index gained nearly 20% while the Nifty 50 rose only around 7%, showing significant sectoral outperformance.

Is the PSU Bank Rally Durable or Just a Blip?

Let’s examine both sides of the argument.

The Bull Case: Why the Rally Could Sustain

-

Policy Tailwinds Are Real: If the government goes ahead with raising FDI limits or introduces selective privatisation, PSU banks could see a sustained structural re-rating.

-

Improving Profitability: Lower NPAs, better credit demand, and cost efficiencies are driving profitability. FY26 EPS for major PSBs is expected to grow 10–12%.

-

Lower Dependence on FIIs: Domestic inflows (via SIPs and DIIs) now cushion volatility. With over Rs. 23,000 crore SIP inflows monthly (AMFI data – Sept 2025), PSU exposure within mutual fund portfolios is at record highs.

-

Economic Upswing: India’s GDP growth remains robust at 6.8%, creating a conducive environment for loan growth and banking credit expansion.

-

Digital Transformation: PSU banks have rapidly digitised post-COVID – from SBI YONO to BOB World – narrowing the tech gap with private peers.

The Bear Case: Why Investors Should Remain Cautious

-

Valuation Euphoria: After a 20% rally in two months, short-term valuations look stretched. Any earnings miss could trigger profit-taking.

-

Policy Uncertainty: FDI-limit hikes are still in discussion; delays or dilution could dampen sentiment.

-

Interest Rate Volatility: If global or domestic rates rise unexpectedly, bond-portfolio losses and funding-cost pressure could weigh on profits.

-

Competition from Private Banks: Despite improvements, PSU banks still trail in ROE (12–14%) vs private peers (16–18%).

-

Global Market Risks: Geopolitical tensions or global risk-off sentiment could hurt capital flows and banking stocks globally.

Comparing PSU and Private Bank Metrics (as of Oct 2025)

|

Parameter |

PSU Banks (Average) |

Private Banks (Average) |

|

Price to Book Value (P/BV) |

1.2× |

2.8× |

|

Return on Equity (ROE) |

13% |

17% |

|

Gross NPA |

3.8% |

2.1% |

|

Credit Growth (YoY) |

13% |

15% |

|

CASA Ratio |

43% |

45% |

Observation: PSU banks have narrowed the performance gap, yet valuations remain modest — suggesting possible long-term opportunity.

Investor Takeaways: How to Approach PSU Bank Stocks

-

Prefer Quality over Quantity: Focus on stronger names such as SBI, Bank of Baroda, and Canara Bank, which have better risk controls and earnings consistency.

-

Consider PSU Bank ETFs or Thematic Funds: Investors who want exposure without stock-specific risk can opt for PSU Bank ETFs or sectoral mutual funds that mirror the Nifty PSU Bank Index.

-

Track Policy Announcements: The rally’s sustainability depends largely on FDI/privatisation progress and budget announcements.

-

Stay Alert on Credit Cycle: Monitor credit growth, NPA trends, and provisioning levels every quarter.

-

Limit Portfolio Allocation: For diversified investors, allocate 10–15% of the equity portfolio to PSU banks or ETFs — not more — given cyclical nature and volatility.

Risks to Watch

-

Earnings Volatility: PSU banks’ earnings are more sensitive to macro changes like rate hikes and inflation.

-

Asset Quality Pressure: Any spike in retail or MSME defaults can quickly reverse gains.

-

Profit Booking by Institutions: After large inflows, short-term outflows can exaggerate corrections.

-

Delayed Policy Action: If the government postpones FII reforms or capital-raising plans, valuations could compress.

Outlook for 2026: Structural Revival or Short-Cycle Trade?

Scenario 1 – Structural Bullish:

If the government delivers on FDI reforms and PSU banks sustain profitability, the rally can evolve into a multi-year re-rating cycle. Earnings growth plus valuation expansion can lift the Nifty PSU Bank Index another 15–20%.

Scenario 2 – Short-Cycle Correction:

If policy execution slows or markets price in excessive optimism, a 10–15% pull-back is possible before the next up-move.

In both cases, PSU banks are no longer the “ignored stepchild” of Dalal Street — they are back in institutional conversations.

Broader Market Context

The PSU rally isn’t isolated. It’s part of a broader theme:

-

Domestic liquidity is abundant — monthly SIP inflows above Rs. 23,000 crore (AMFI data).

-

FII inflows into India turned positive since August 2025 after the US Fed rate cut.

-

Bank Nifty also gained around 9% since September, with PSU banks leading the move.

Hence, PSU banking strength aligns with both macro and micro fundamentals.

Summary Table: Key PSU Bank Data (Oct 2025)

|

Bank |

Market Cap (Rs. Cr) |

YTD Return (%) |

Gross NPA (%) |

ROE (%) |

|

SBI |

8,32,000 |

+26 |

3.0 |

14 |

|

Bank of Baroda |

1,52,000 |

+29 |

3.3 |

13 |

|

Canara Bank |

1,42,500 |

+32 |

3.7 |

12 |

|

Indian Bank |

84,000 |

+35 |

3.8 |

13 |

FAQ

1. Why are PSU bank stocks suddenly in demand?

Investors are noticing improved earnings, lower NPAs, and renewed government focus on reforms. The market believes PSU banks are finally entering a more stable and profitable phase.

2. Are PSU bank shares suitable for long-term investment?

Yes, selectively. Large PSU banks like SBI or Bank of Baroda can be held long-term, provided earnings growth and asset quality remain consistent. Avoid smaller names that are still volatile.

3. What risks should investors keep in mind?

PSU stocks are sensitive to policy delays, interest rate changes, and profit-booking by institutions. Short-term corrections are common even during broader rallies.

4. How can investors get exposure to PSU banks easily?

The simplest way is through PSU Bank ETFs or banking sector mutual funds, which offer diversified exposure without the need to track each stock individually.

5. Is it a good time to enter now?

The sector looks promising, but prices have run up sharply. Enter gradually — through SIPs in banking funds or staggered stock purchases — instead of investing a lump sum.

Conclusion

The comeback of PSU bank stocks in 2025 is more than just a momentary spurt.

This rally reflects structural progress — healthier balance sheets, government reform intent, and investor confidence returning after years of neglect.

However, sustainability will depend on consistent earnings, policy delivery, and disciplined valuation. Investors would do well to participate selectively — favouring large, fundamentally strong PSU banks or diversified PSU ETFs — while avoiding short-term exuberance.

If the expected FDI limit reforms and digital transformation continue, PSU banks could evolve from cyclical bets into long-term compounding opportunities within India’s growth story.

In short, the rally has legs — but only if the fundamentals keep walking.

Disclaimer: This blog is dedicated exclusively for educational purposes. Please note that the securities and investments mentioned here are provided for informative purposes only and should not be construed as recommendations. Kindly ensure thorough research prior to making any investment decisions. Participation in the securities market carries inherent risks, and it's important to carefully review all associated documents before committing to investments. Please be aware that the attainment of investment objectives is not guaranteed. It's important to note that the past performance of securities and instruments does not reliably predict future performance.