Nifty Financial Services Index in 2025: Trends, Challenges & Opportunities Ahead

Overview

Nifty Financial Services Index indicates the efficiency of the Indian Financial Services Market like financial institutions. These financial institutions are banks, housing finance, insurance companies etc…Nifty Financial Services Index is calculated based on float adjusted market capitalization methodology.

Application

Nifty Financial Services Index is used in portfolio performance evaluation, initiating passive funds, stock market traded funds and for hybrid investment products.

Nifty Financial Services Index Stocks List

|

5.43% |

NBFC |

Financial Services |

|

|

2.43% |

Holding Company |

Financial Services |

|

|

1.47% |

NBFC |

Financial Services |

|

|

1.14% |

AMC |

Financial Services |

|

|

32.77% |

Private Sector Bank |

Financial Services |

|

|

1.89% |

Life Insurance Company |

Financial Services |

|

|

21.80% |

Private Sector Bank |

Financial Services |

|

|

1.08% |

General Insurance |

Financial Services |

|

|

0.56% |

Life Insurance Company |

Financial Services |

|

|

2.36% |

Investment Company |

Financial Services |

|

|

6.93% |

Private Sector Bank |

Financial Services |

|

|

0.40% |

Housing Finance Company |

Financial Services |

|

|

0.62% |

NBFC |

Financial Services |

|

|

1.35% |

Financial Institution |

Financial Services |

|

|

1.09% |

Financial Institution |

Financial Services |

|

|

0.61% |

NBFC |

Financial Services |

|

|

1.82% |

Life Insurance Company |

Financial Services |

|

|

2.13% |

NBFC |

Financial Services |

|

|

6.87% |

Public Sector Bank |

Financial Services |

Based on the Nifty Financial Service Index Constituents of 20 stocks, the stocks HDFC Bank and ICICI Bank dominate the index, creating a combined weightage of over 40% ,these two private-sector stocks largely influence the index’s direction. State Bank of India stock and Kotak Mahindra Bank stock offer additional banking strength, indicating a broad exposure of the index on large public and private banks. Bajaj Finance stock and Bajaj Finserv stock lead the NBFC segment. The sectors Insurance, AMC, housing finance, and other NBFCs each contribute approximately 1–3%, providing diversification beyond pure banking exposure . Overall, the Nifty Financial Services Index is heavily influenced by banks (60–70%), and a reasonable influence from NBFCs and insurance. This ensures both depth in core banking and breadth across the financial ecosystem.

NIFTY Financial Services Index Performance Analysis

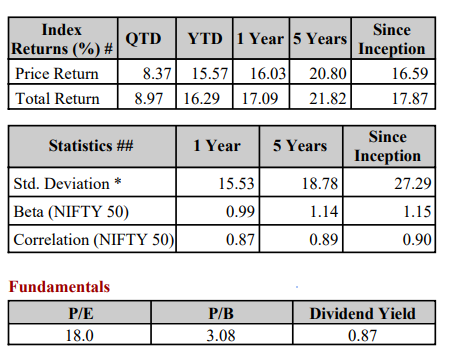

Based on the Nifty Indices , the index performance is given below.

Based on the index returns, the index has provided consistent returns over the years. The compounded 5-year return is strong which indicates strong long-term performance. But the total return with dividend included has slightly outperformed price return.

The risk metrics indicate that volatility of the index is moderately high and increasing over a long term period. Beta values are moderately high since inception in comparison with Nifty 50 which reflects that the index is highly sensitive to market fluctuations and the index is closely related to Nifty 50 trends.

The index is neither under or over valued and also contains growth-oriented companies. The dividend yield of the index suggests that it should focus on capital appreciation.

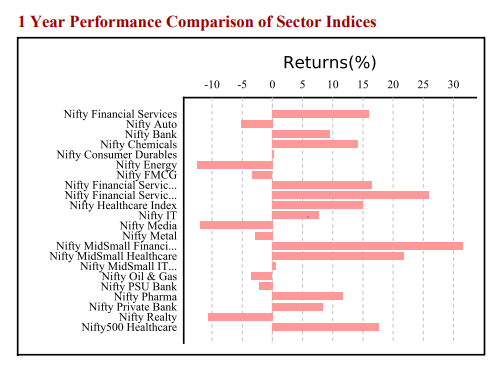

Nifty Financial Services – 1-Year Performance Comparative Analysis:

Based on the above image from Nifty Indices, in comparison of one year sector indices efficiency , Nifty Financial Services Index has delivered a return of approximately 18 -20%. Nifty Financial Services Index has been one of the performing sectors next to Metals, health care and auto indices.

Factors Supporting Growth of Nifty Financial Services Index

Increase in credit – the rise in retail and corporate lending over the past 1 year.

Steady recovery of NBFC and Insurance Sector – Insurance, asset management and NBFCs are facing uptrend growth.

Improved Asset Quality – NPAs have been reduced considerably across all financial institutions.

RBI’s stability in interest rates – this has supported banking and financial stocks in performing well during the last 1 year.

Risks Associated with Nifty Financial Services Index

-

Highly influenced by RBI rate changes and global financial trends

-

Changes in credit management and regulatory tightening actions affect Nifty Financial Services Index performance.

-

Nifty Financial Services Index Stocks are overvalued after an uptrend; investors are advised to review the stocks fundamentals and valuation before investment.

Historical Nifty Financial Services Index performance Analysis

Before the global financial crisis, the Nifty Financial Services Index had followed an uptrend, which was followed by a recovery phase in the next decade. In early 2020s , due to pandemic, the Nifty Financial Services Index took a dip, followed by an uptrend post pandemic. Nifty Financial Services Index has increased approximately five times from its launch in 2004 till date standing at 26000 points. Nifty Financial Services Index has displayed steady growth despite its downtrend during market downturns.

Key Milestones

-

2007: crossed 5,000 points

-

2017: crossed 10,000 points

-

2021: Crossed 15,000 points, post-COVID liquidity rally

-

2023–24: Crossed 20,000 points and then 25,000 points.

Strategies to trade / invest in Nifty Financial Services Index

Endure Perseverance – Though the Nifty Financial Services Index has met with sharp downtrends, the recoveries of the index were strong and accelerated. Long term investments in the Nifty Financial Services Index are beneficial at multifold.

Be prepared for Volatility – since Nifty Financial Services Index are highly volatile to market fluctuations, investors must be well prepared to face the large swings.

Adopt SIPs – regular investments in the Nifty Financial Services Index helps investors to average out the large swings during market fluctuations.

Focussed Allocation – investors must opt for quality stocks with good fundamentals for investment at times of market rally.

Nifty Financial Services Index in 2025

The year 2025 started with a decline in Nifty Financial Services Index return by 1.7%.The RBI lending norms ease for NBFCs and for smaller borrowers in February, led to the recovery of the index by 0.6%,assisting in market turnaround. By the end of February, due to fresh rate cuts and easing inflation led to the rebound of the index by rising to 4%. In March, the index rose by 1%, taking the index above 22,500 points with a strong rebound. April , driven by strong bank earnings, weaker USD and higher FPI inflows, rose the index by 0.8%. The NSE had an increase in investors by 1 million which led the Nifty increase by 5%. The uptrend continued in May, leading the Nifty Financial Services Index to rise by 1.3%. The stock Bajaj Finance performance led to the rise in index by 0.25%. While the stocks ICICI Bank, LIC Housing Finance, and Muthoot Finance faced minor downtrend in May. In June, the index recorded as a top performing sector with a return of 15.5% and recorded an intraday record of around 27,305 points. The new uptrend was mainly influenced by RBI provisioning on reliefs and global rate cuts cues, alleviated geopolitical tensions, lower crude oil and USD prices and RBI project finance guidelines.

Conclusion

Nifty Financial Services Index has been a market leader, benefiting from India’s strong economic & consumption story. The index is favourable for long-term investors, but it is advisable to take new positions after corrections or sector consolidation. The Nifty Financial Services Index is a mirror that reflects the health of the Indian and Global Economy,

Frequently Asked Questions

What is the Nifty Financial Services Index?

It's a free-float market-cap weighted index of leading 20 banks, insurance, NBFCs, and housing finance companies in India

When was nifty financial services launched and what's its base value?

Launched by NSE in January 2021 with a base value of 1,000

How often is the index rebalanced?

Constituents are revised and rearranged semi-annually on the basis of free-float market cap

How do users of Enrich?Money track Fin Nifty share price?

Enrich?Money offers charts, technical and fundamental analyzing tools for its users.

Why invest in Nifty Fin Service stocks?

It provides focused exposure to the financial sector while serving as a solid benchmark for portfolios of a related nature

Disclaimer: This blog is dedicated exclusively for educational purposes. Please note that the securities and investments mentioned here are provided for informative purposes only and should not be construed as recommendations. Kindly ensure thorough research prior to making any investment decisions. Participation in the securities market carries inherent risks, and it's important to carefully review all associated documents before committing to investments. Please be aware that the attainment of investment objectives is not guaranteed. It's important to note that the past performance of securities and instruments does not reliably predict future performance.