Refining the Future: Gandhar Oil Refinery India IPO Overview

Gandhar Oil Refinery Limited stands as a leading white oils manufacturer by revenue, with a significant emphasis on the consumer and healthcare industries. With a diverse product suite of over 440 items under the "Divyol" brand, spanning personal care, healthcare, lubricants, and more, the company is a key ingredient supplier for global and Indian firms across sectors like automotive, industrial, and power. As of June 30, 2023, the company's products reached over 100 countries, serving a broad customer base of 3,500, including renowned names like Procter & Gamble, Unilever, and Marico. According to the CRISIL Report, Gandhar Oil Refinery achieved exceptional revenue growth, with a CAGR of 40.59% between Financial Years 2021 and 2023, positioning itself as a dominant player in the global white oils market. The company's commitment to stringent quality standards, demonstrated through long-standing relationships and certifications, underscores its prowess in the specialty oils sector.

Gandhar Oil Refinery Limited -The Journey

The company's journey unfolds as follows:

-

1992: Incorporated as 'Gandhar Oil Refinery (India) Private Limited.'

-

1994: Initiated business operations at the Taloja plant.

-

2000: Expanded into specialty oils manufacturing at the Silvassa plant.

-

2004: Commenced the export of specialty oils.

-

2010: Secured the first order from the Ministry of Railways, Government of India.

-

2013: Achieved a turnover exceeding Rs. 10,000 million; established an in-house R&D center recognized by DSIR.

-

2015: Attained the status of a 'Three Star Export House' by the Directorate General of Foreign Trade.

-

2018: Crossed a consolidated turnover of Rs. 25,000 million.

-

2019: Surpassed a consolidated turnover of Rs. 30,000 million.

-

2022: Texol Lubritech FZC became a subsidiary.

-

2022: Celebrated the 30th anniversary since incorporation.

Indian Specialty Oil Industry Overview

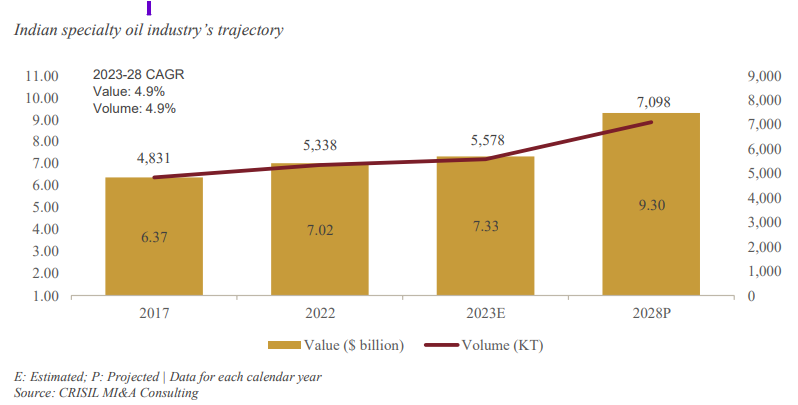

The Indian specialty oil market is projected to be valued at $7.33 billion in 2023, with an anticipated growth to $9.30 billion by 2028, reflecting a Compound Annual Growth Rate (CAGR) of 4.9%. In parallel, the market volume is estimated to be 5,578 kilo tonnes (KT) in 2023, projected to increase to 7,098 KT by 2028, maintaining a CAGR of 4.9%.

Gandhar Oil Refinery Limited IPO Details

Gandhar Oil Refinery Limited - IPO Goals & Objectives

The Selling Shareholders will receive their proportionate share of the Offer for Sale proceeds, with the deduction of their respective share of Offer-related expenses and applicable taxes. The company will not receive any proceeds from the Offer for Sale, and the funds obtained from the Offer for Sale will not be included in the Net Proceeds.

The Net Proceeds from the Fresh Issue are intended to be utilized by the Company for the following purposes:

-

Providing a loan to Texol for financing the repayment/pre-payment of a loan facility obtained from the Bank of Baroda is Rs.227.13 million.

-

Undertaking capital expenditure, including the purchase of equipment and civil work necessary for expanding the capacity of automotive oil at their Silvassa Plant is Rs. 277.29 million

-

Meeting the working capital requirements of the Company is Rs.1,850.08 million; and

-

Catering to general corporate purposes.

|

Particulars |

Numbers |

|

Fresh Issue of 17,869,822 shares @ Rs.169 per share |

Rs. 3,01,99,99,918 |

|

Secondary Issue: Offer for Sale of 11,756,910 shares by the Selling Shareholders @ Rs.169 per share |

Rs. 1,98,69,17,790 |

|

Total Issue Size of 2,96,26,732 shares |

Rs. 5,00,69,17,708 |

Gandhar Oil Refinery Limited IPO Dates

|

Event |

Indicative Date |

|

IPO Open Date: |

22nd November,2023 (Wednesday) |

|

IPO closing Date: |

24th November,2023 (Friday) @5.00 pm |

|

Finalisation of Allotment |

30th November,2023 (Thursday) |

|

Initiation of refunds / releasing of funds from ASBA |

1st December,2023 (Friday) |

|

Credit of the Equity Shares to allottees’ depository accounts |

4th December,2023 (Monday) |

|

Commencement of trading in stock exchanges |

5th December,2023 (Tuesday) |

Gandhar Oil Refinery Limited IPO Price details

|

IPO |

Details |

|

Face value of share |

Rs.2 per share |

|

IPO band price |

Rs.160-169 per share |

|

Lot size |

88 |

|

Lot amount |

Rs.14080– 14872 |

|

Fresh Issue |

17,869,822 equity shares |

|

Offer for sale |

11,756,910 equity shares |

|

Total issue size |

2,96,26,732 equity shares |

|

Listing Stock Exchanges |

BSE, NSE |

|

Book Running Lead Managers |

ICICI Securities Limited Nuvama Wealth Management Limited |

|

Registrar |

Link Intime India Private Ltd |

Gandhar Oil Refinery Limited IPO Lot Details

Investors can choose to bid for a minimum of 88 shares and in multiples thereof. The table below illustrates the minimum and maximum investments for both retail investors and High Net Worth Individuals (HNIs) in terms of shares and their corresponding amounts.

|

Application Type |

Lots |

Shares |

Amount (Rs.) |

|

Retail (Min) |

1 |

88 |

Rs.14872 |

|

Retail (Max) |

13 |

1144 |

Rs.19336 |

|

S-HNI (Min) |

14 |

1232 |

Rs.208208 |

|

S-HNI (Max) |

67 |

5896 |

Rs.996424 |

|

B-HNI (Min) |

68 |

5984 |

Rs.1011296 |

Gandhar Oil Refinery Limited IPO Reservation Details

|

Investor Category |

Shares Offered |

|

QIB Shares Offered |

maximum of 50% of Net offer. |

|

Retail Shares Offered |

minimum of 35% of Net offer. |

|

NII (HNI) Shares Offered |

minimum of 15% of Net offer. |

Gandhar Oil Refinery Limited IPO - Investment Potential

Qualitative Factors

-

Dominant market share in the Indian white oils market with substantial international sales, concentrating on the consumer and healthcare sectors

-

Broad and varied customer and supplier base, including major oil companies with competitive pricing terms

-

Strategically positioned manufacturing facilities coupled with in-house research and development capabilities

-

Adaptable, resilient, and scalable business model supported by a judicious risk management framework

-

Demonstrated history of steady financial performance

-

Proficient and experienced management team.

Quantitaive Factors

|

Financial Information |

30th June, 2023 |

31st March, 2023 |

31st March, 2022 |

31st March, 2021 |

|||||

|

Key Accounting Ratios |

|||||||||

|

Weighted Average (Basic EPS in Rs.) |

20.11 |

||||||||

|

Weighted Average |

31.11% |

||||||||

|

NAV per equity share |

101.35 |

95.03 |

- |

- |

|||||

|

RoE% |

6.91% |

32.28% |

32.54% |

24.77% |

|||||

|

RoCE% |

9.30% |

41.19% |

42.10% |

29.37% |

|||||

|

Debt to Equity Ratio |

0.41 |

0.22 |

0.28 |

0.18 |

|||||

|

Total Equity |

8107.93 |

7602.05 |

5607.05 |

4448.25 |

|||||

|

Revenue From Operations |

3725.44 |

11831.93 |

6167.82 |

- |

|||||

|

EBITDA Margin (Rs. in million) |

840.58 |

3166.19 |

2459.66 |

1387.66 |

|||||

|

PAT |

542.84 |

2131.75 |

1635.84 |

1003.22 |

|||||

|

Total Assets |

17955.74 |

16134.35 |

13182.09 |

11009.32 |

|||||

|

Total Income |

10715.15 |

41017.91 |

33979.76 |

20695.82 |

|||||

|

Net Worth |

8107.93 |

7602.05 |

5607.05 |

4448.25 |

|||||

|

Reserves & Surplus |

7640 |

7192 |

- |

3557 |

|||||

|

Net Cash Flow from Investing Activities |

(66.23) |

(734.29) |

(1159.58) |

(223.56) |

|||||

|

Net Cash Flow from Operating Activities |

(1326.95) |

1032.96 |

1666.53 |

1180.55 |

|||||

|

Net Cash Flow from Financing Activities |

1515.20 |

(437.92) |

(41.28) |

(910.86) |

|||||

|

Total Borrowings |

3356.17 |

1695.25 |

1581.59 |

787.43 |

|||||

|

Market Capitalization (Rs. in million) |

16540 |

||||||||

|

P/E (x) |

6.16 |

||||||||

Risk Factors

-

The company is heavily reliant on its personal care, health care, and performance oil business divisions. Downturns in the industries associated with these divisions could have a substantial impact on the company's business, financial health, and operational outcomes.

-

The company is obligated to adhere to stringent quality requirements, standards, and inspections. The success and acceptance of its products by customers hinge significantly on its capability to meet these requirements and standards.

-

Potential delays, interruptions, or reductions in the supply of raw materials necessary for manufacturing the company's products, coupled with abrupt fluctuations in raw material prices, have the potential to affect the company's business operations.

Frequently Asked Questions

What is the Gandhar Oil Refinery India IPO?

The Gandhar Oil Refinery India IPO is a book-built issue of Rs 500.69 crores, consisting of a fresh issue of 1.79 crore shares amounting to Rs 302.00 crores and an offer for sale of 1.18 crore shares aggregating to Rs 198.69 crores.

When is the opening and closing date for the Gandhar Oil Refinery India IPO?

The subscription for the IPO commences on November 22, 2023, and concludes on November 24, 2023.

When is the expected finalization of allotment for the Gandhar Oil Refinery India IPO?

The allotment for the Gandhar Oil Refinery India IPO is anticipated to be concluded on Thursday, November 30, 2023.

Where will Gandhar Oil Refinery India IPO be listed, and what is the listing date?

The IPO will list on BSE and NSE, with a tentative listing date fixed as Tuesday, December 5, 2023.

What is the price band for the Gandhar Oil Refinery India IPO?

The Gandhar Oil Refinery India IPO Share price band is set at Rs.160 to Rs.169 per share.

Related Blogs

Disclaimer: This blog is dedicated exclusively for educational purposes. Please note that the securities and investments mentioned here are provided for informative purposes only and should not be construed as recommendations. Kindly ensure thorough research prior to making any investment decisions. Participation in the securities market carries inherent risks, and it's important to carefully review all associated documents before committing to investments. Please be aware that the attainment of investment objectives is not guaranteed. It's important to note that the past performance of securities and instruments does not reliably predict future performance.