ASK Automotive Limited IPO: Braking into the Stock Market

ASK Automotive focuses on automotive safety through innovation. They manufacture Advanced Braking Systems for various vehicle segments, including motorcycles, scooters, passenger vehicles, and commercial vehicles in both internal combustion and electric segments. Additionally, they produce Aluminum Lightweighting Precision Solutions for a range of automotive components. ASK Automotive also manufactures Safety Control Cables, serving OEMs like HMSI, HMCL, Suzuki, TVS, Yamaha, Bajaj, Royal Enfield, Denso, Magneti Marelli, and more, as well as the independent aftermarket and export market through 15 manufacturing facilities across the nation. ASK Automotive proudly contributes to the 'Make in India' campaign, exporting to 12 countries. Their manufacturing facilities hold prestigious certifications, including IATF 16949:2016, ISO 9001:2015, ISO 14001:2015, and ISO 45001:2018, attesting to their commitment to quality and safety."

ASK Automotive Limited - The Journey

In 1989, ASK initiated manufacturing at ASK-1 in Gurugram, Haryana, India, venturing into the OEM market for AB systems with brake shoes. By 2001, they expanded with ASK-2. In 2004, ASK-3 in IMT, Haryana, and ASK-4 in Haryana followed in 2009. ASK-5 began in 2010, ASK-7 in 2012, and ASK-8 in 2013. ASK-9 & ASK-10 started production in 2014, with ASK-9 sold in 2018. ASK-11 launched in 2015, targeting the aftermarket for safety control cables. In 2018, a joint venture with Fras-Le, Brazil, was formed as ASK Fras-Le Friction Private Limited. ASK-12 began operations in Haryana in 2019. In 2021, ASK established a wholly-owned subsidiary, ASK Automobile Private Limited, as a private limited company under the Companies Act, 2013.

Auto Component Industry Overview

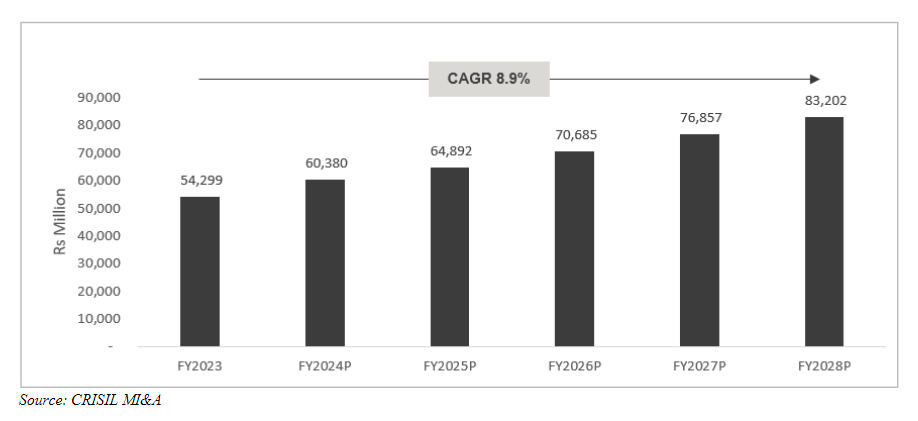

According to the report by CRISIL, MI&A was created for ASK Automotive Limited, estimated from FY2023 and projected till FY2028.

The advanced braking systems market in Fiscal 2023 is valued at Rs 54,299 million, with an expected 8.9% CAGR to reach Rs 83,202 million by Fiscal 2028. Growth is driven by passenger vehicles, 2-wheelers, and commercial vehicles. All vehicle segments are projected to experience significant production growth over this period, with 2-wheelers, 3-wheelers, passenger vehicles, and commercial vehicles expected to grow at CAGRs of 8-10%, 8-10%, 6-8%, and 2-4%, respectively, boosting the OEM braking solutions market. Urbanization is set to rise from 35% in Fiscal 2020 to 37-38% by Fiscal 2027, promoting 2-wheeler adoption for urban commuting. The Production-Linked Incentive (PLI) scheme for the auto industry is likely to enhance exports and stimulate demand for auto components in India.

ASK Automotive Limited IPO Details

ASK Automotive Limited - IPO Goals & Objectives

The Offer Proceeds will go to the Promoter Selling Shareholders, proportionate to their sold Offered Shares after expenses and taxes. ASK foresees benefits in listing Equity Shares, boosting visibility, brand, and liquidity for existing shareholders while creating a public market in India.

|

Particulars |

Numbers |

|

Fresh Issue |

Nil |

|

Secondary Issue: Offer for Sale of a 2,95,71,390 shares by the Selling Shareholders @ Rs.282 per share |

Rs. 8,33,91,31,980 |

|

Promoter selling shareholder - Kuldip Singh Rathee |

20,699,973 Equity Shares |

|

Promoter selling shareholder - Vijay Rathee |

8,871,417 Equity Shares |

ASK Automotive Limited IPO Dates

|

Event |

Indicative Date |

|

IPO Open Date: |

7th November,2023 |

|

IPO closing Date: |

9th November, 2023 @5.00pm (Thursday) |

|

Finalisation of Allotment |

15th November, 2023 (Wednesday) |

|

Initiation of refunds / releasing of funds from ASBA |

16th November, 2023 (Thursday) |

|

Credit of the Equity Shares to allottees’ depository accounts |

17th November, 2023 (Friday) |

|

Commencement of trading in stock exchanges |

20th November, 2023 (Monday) |

ASK Automotive Limited IPO Price details

|

IPO |

Details |

|

Face value of equity share |

Rs.2 each |

|

IPO price band |

Rs.268-282 per share |

|

Lot size |

53 shares |

|

Lot amount |

Rs. 14204 – 14946 per lot |

|

Fresh Issue |

0 |

|

Offer for sale |

2,95,71,390 Shares of Rs.2 |

|

Total issue size |

2,95,71,390 Shares (Aggregating up to Rs.833.91 crore) |

|

Listing Stock Exchanges |

Bombay Stock Exchange National Stock Exchange |

|

Book Running Lead Managers |

Jm Financial Limited, Axis Capital Limited, ICICI Securities Limited and IIFL Securities Ltd |

|

Registrar |

Link Intime India Private Ltd |

ASK Automotive Limited IPO Lot Details

Investors have the option to bid for at least 53 shares and in multiples of that quantity. The table below illustrates the minimum and maximum investment allowed for both retail investors and high-net-worth individuals (HNIs) in terms of shares and their corresponding monetary values.

|

Application Type |

Lots |

Shares |

Amount (Rs.) |

|

Retail (Min) |

1 |

53 |

Rs. 14946 |

|

Retail (Max) |

13 |

689 |

Rs. 194298 |

|

S-HNI (Min) |

14 |

742 |

Rs. 209244 |

|

S-HNI (Max) |

66 |

3498 |

Rs. 986436 |

|

B-HNI (Min) |

67 |

3551 |

Rs. 1001382 |

ASK Automotive Limited IPO Reservation Details

|

Investor Category |

Shares Offered |

|

QIB Shares Offered |

Up to 50% of the Net Issue |

|

Retail Shares Offered |

At least 35% of the Net Issue |

|

NII (HNI) Shares Offered |

At least 15% of the Net Issue |

ASK Automotive Limited IPO - Investment Potential

Qualitative Factors

The foundation for calculating the offer price includes the following qualitative factors:

1. A well-established manufacturer of safety systems and critical engineering solutions for major Indian original equipment manufacturers ("OEMs").

2. A robust production model centered on research, development, and design, emphasizing advanced material knowledge for customizing products to customer specifications and engineering lighter precision products.

3. A technology and innovation-driven manufacturing process, offering a wide range of systems and solutions for both electric vehicle (EV) and internal combustion engine (ICE) sectors.

4. Strong, enduring customer relationships with domestic and global OEM players.

5. Strong financial and return metrics, showcasing growth and efficient capital utilization.

6. A professional management team and board of directors.

Quantitaive Factors

|

Financial Information |

30th June, 2023 |

31st March, 2023 |

31st March, 2022 |

31st March, 2021 |

|

Key Accounting Ratios |

||||

|

Basic & Diluted EPS |

1.77 |

6.18 |

4.09 |

5.22 |

|

Weighted Average (Basic & Diluted EPS in Rs.) |

5.32 |

|||

|

RoNW (%) |

5.13% |

19.10% |

13.08% |

17.07% |

|

Weighted Average |

16.75% |

|||

|

Face Value per equity share |

Rs.2 |

|||

|

Total Equity |

6437.71 |

|||

|

Key Performance Indicators |

||||

|

Revenue From Operations |

6565.08 |

25551.67 |

20130.83 |

15439.92 |

|

EBITDA Margin (%) |

9.85% |

9.65% |

9% |

13.40% |

|

PAT |

348.29 |

122953 |

826.59 |

1062.01 |

|

RoAE (%) |

5.25% |

19.27% |

13.33% |

17% |

|

RoACE (%) |

5.31% |

22.06% |

16.76% |

21.98% |

|

Debt to Equity Ratio |

0.57 |

0.49 |

0.25 |

0.13 |

|

Total Assets |

14433.36 |

12812.08 |

11055.63 |

9482.5365 |

|

Total Income |

6575.46 |

25662.79 |

20242.60 |

15677.67 |

|

Net Worth |

- |

6467.71 |

6319.08 |

6222.25 |

|

Reserves & Surplus |

6390.32 |

6043.40 |

5917.30 |

5815.40 |

|

Net Cash Flow from Investing Activities |

(798.18) |

(1608.62) |

(799.63) |

(60.20)605.05 |

|

Net Cash Flow from Operating Activities |

205.09 |

1385.80 |

1442.17 |

1279.55 |

|

Net Cash Flow from Financing Activities |

605.05 |

232.07 |

(814.79) |

(1067.64) |

|

Borrowings/ Debt as at the end of the period/ year |

3180.11 |

1597.93 |

798.94 |

- |

Risk Factors

Before considering an investment in Equity Shares, it is imperative for investors to conduct a thorough evaluation of the contents of the Red Herring Prospectus, paying particular attention to the prominently highlighted risks and uncertainties, which signify substantial investment hazards.

Risks that ASK Automotive Limited could face are highlighted.

Investors are strongly encouraged to conduct a thorough examination of the Red Herring Prospectus before making an investment decision.

-

ASK is unable to retrieve certain historical records, including documents filed with the Registrar of Companies in Haryana.

-

Their Promoters, who also serve as their Directors (Kuldip Singh Rathe and Vijay Rathee), previously held roles in a company whose equity shares were suspended and later voluntarily delisted from the Calcutta Stock Exchange Limited during their tenure from March 21, 2014, to August 18, 2021.

-

ASK does not own their Registered Office and the land where some of their manufacturing facilities are situated. Failing to renew their existing lease agreements on favorable terms or at all could significantly impact their business, financial health, and operational results.

-

ASK has been providing financial support to their Joint Venture, ASK Fras-Le Friction Private Limited, which has incurred losses in the last three fiscal years.

-

The ASK subsidiary has a negative net worth and may not achieve profitability in the future.

-

Red Herring Prospectus includes information from an industry report prepared by an independent third-party research agency, CRISIL, commissioned and paid for solely to enhance our understanding of the industry in connection with the Offer. Relying on this information for investment decisions carries inherent risks.

-

ASK has conducted two buybacks of Equity Shares in the past three years at a price that may be lower than the Offer Price.

Frequently Asked Questions

What does the ASK Automotive IPO entail?

The ASK Automotive IPO involves a main-board offering of 29,571,390 equity shares with a face value of Rs. 2, totaling Rs. 833.91 Crores. The price range for the shares is set at Rs.268 to Rs.282 per share, and the minimum order quantity is 53 shares. The IPO subscription period commences on November 7, 2023, and concludes on November 9, 2023. The registrar for this IPO is Link Intime India Private Ltd, and the shares are intended to be listed on both the BSE and NSE stock exchanges.

What technological and innovative strengths does ASK Automotive possess?

Their well-established and tested customer base and manufacturing processes position them effectively for both traditional IC models and the emerging EV models, providing them with a competitive edge in technology and innovation

What is the Lot size for ASK Automotive Limited IPO?

The Lot size of ASK Automotive Limited IPO is 53 shares.

What is the offer bid open and close date for ASK Automotive IPO?

The IPO bid offer commences on November 7, 2023, and concludes on November 9, 2023 @5.00pm.

How to apply for the IPO?

The investor can apply for the IPO through an ORCA trading app. IPO applications should follow ASBA process.

Related Blogs

Related Stock

Disclaimer: This blog is dedicated exclusively for educational purposes. Please note that the securities and investments mentioned here are provided for informative purposes only and should not be construed as recommendations. Kindly ensure thorough research prior to making any investment decisions. Participation in the securities market carries inherent risks, and it's important to carefully review all associated documents before committing to investments. Please be aware that the attainment of investment objectives is not guaranteed. It's important to note that the past performance of securities and instruments does not reliably predict future performance.