Honasa Consumer Limited Unveils IPO Plans:

Digital Beauty And Personal Care Platform Takes Center Stage

Honasa Consumer Limited holds the distinction of being India's foremost digital-first company in the beauty and personal care (BPC) sector in terms of revenue generated during the Financial Year 2023. Their primary focus has been on creating products that tackle the beauty and personal care challenges experienced by consumers. Their flagship brand, Mamaearth has surged to become the fastest-growing BPC brand in India, by the Financial Year 2023, achieving an annual revenue of Rs. 10 billion within the preceding 12 months, all within six years of its inception.

Honasa Consumer Limited - The Journey

The journey commenced in 2016 when Ghazal and Varun Alagh embarked on their mission to introduce baby care products through Mamaearth. By 2017, Mamaearth had expanded its offerings to include beauty and personal care products. In 2020, The Derma Co was launched to make dermatologist-designed skincare products more accessible.

In 2021, Honasa marked significant milestones by introducing two new brands, 'Aqualogica' and 'Ayuga,' while also completing the acquisition of Momspresso. The following year, in 2022, Honasa pursued strategic acquisitions of 'BBlunt' and 'Dr. Sheth's.' Notably, Honasa achieved an annual revenue of 1000 crore, becoming the fastest company to attain this milestone, and was honored as India's first Unicorn of 2022.

Beauty & Personal Care in India

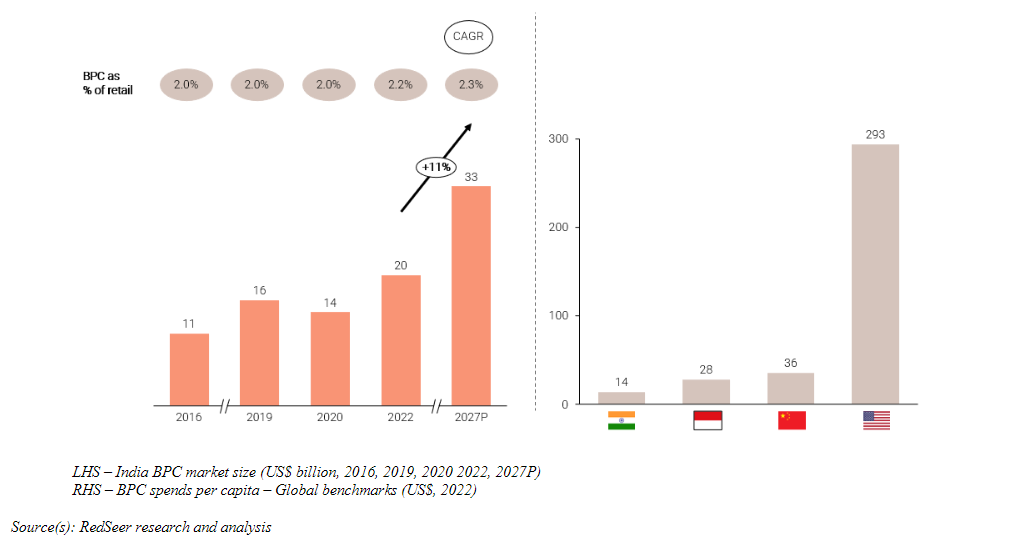

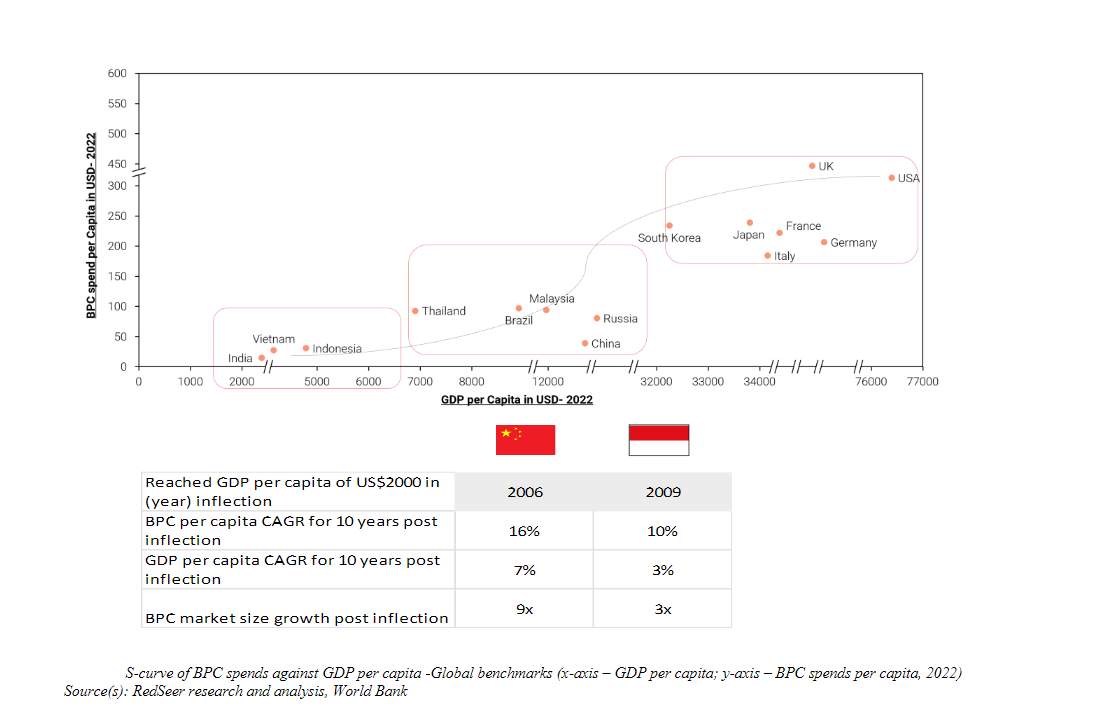

With a market size of US$20 billion, India's Beauty and Personal Care (BPC) sector is the 6th largest worldwide. However, it remains underpenetrated. Traditionally, Indian households allocate less to BPC compared to other countries. For instance, in 2022, per capita BPC spending in China was three times that of India. Even compared to smaller economies like Indonesia, India's per capita BPC spending is lower, indicating substantial growth potential. The BPC market in India is undergoing significant reindustrialization due to technology, demographics, and consumer aspirations. It's expected to outpace other categories like food and consumer electronics, making it an attractive retail segment. India's per capita spend on BPC is currently among the lowest in developing countries and is poised for growth as GDP per capita crosses $2,000, as seen in other developing economies.

Honasa Consumer Limited IPO (Initial Public Offering) Details

Honasa Consumer Ltd IPO – Goals & Objectives

Honasa Consumer Limited proposes to utilise the Net Proceeds towards funding the following objects:

|

Particulars |

Amount (In Rs. Million) |

|

Expenditures allocated to increase the recognition and prominence of the brands through advertising |

1820.00 |

|

Investment to be made by the company for the establishment of new exclusive brand outlets (EBOs) |

206 |

|

Investment in the subsidiary, Blunt, to establish new salons. |

260 |

|

Net Proceeds |

2286 |

|

General Purpose |

Not yet finalized |

Honasa Consumer Limited IPO Dates

|

Event |

Indicative Date |

|

IPO Open Date |

31st October, 2023 (Tuesday) |

|

IPO closing Date |

2nd November, 2023 (Thursday) |

|

Finalisation of Allotment |

7th November, 2023 (Tuesday) |

|

Initiation of refunds / releasing of funds from ASBA |

8th November, 2023 (Wednesday) |

|

Credit of the Equity Shares to allottees’ depository accounts |

9th November, 2023 (Thursday) |

|

Commencement of trading in stock exchanges |

10th November, 2023 (Friday) |

Honasa Consumer Limited IPO Price details

|

IPO |

Details |

|

Face value of equity share |

Rs.10 each |

|

IPO price band |

Rs.308-324 per share |

|

Lot size |

46 shares |

|

Lot amount |

Rs.14168 – 14904 per lot |

|

Fresh Issue |

Rs.3650 million |

|

Offer for sale |

41,248,162 Equity Shares of Rs.10 |

|

Total issue size |

53,098,811 shares (Aggregating up to Rs. 17010 million) |

|

Listing Stock Exchanges |

Bombay Stock Exchange National Stock Exchange |

|

Book Running Lead Managers |

Kotak Mahindra Capital Company Limited Citigroup Global Markets India Private Limited JM Financial Limited J.P. Morgan India Private Limited |

|

Registrar |

KFin Technologies Limited |

Honasa Consumer Limited - Investment Potential

Qualitative Factors

Some of the qualitative factors that forms the basis of offer price computation are

• Expertise in brand development and reusable strategies

• Customer-focused product innovation

• Digital-oriented, comprehensive distribution

• Data-driven, personalized marketing

• Proficiency in achieving growth and profitability with efficiency in capital usage

• Leadership by the founder with a robust professional management team.

Restated Financial Statements (all amounts in Rs. million)

|

Period |

30th June, 2023 |

31st March, 2023 |

31st March, 2022 |

31st March, 2021 |

|

Total Assets |

10480.27 |

9664.15 |

10350.12 |

3026.39 |

|

Equity |

6382.63 |

6059.01 |

7056.24 |

(17651.43) |

|

Total Liabilities |

4097.64 |

3605.14 |

3293.88 |

20677.82 |

|

Total expenses |

4431.44 |

15016.11 |

9419.06 |

17967.10 |

|

RoNW % |

4.07% |

(23.57%) |

2.23% |

- |

|

EBITDA |

293.10 |

227.64 |

114.59 |

(13340.33) |

|

PAT |

247.15 |

(1509.66) |

144.43 |

(13322.15) |

|

Net Worth |

6382.63 |

6059.01 |

7056.24 |

(17561.43) |

|

Total Borrowings |

67.90 |

36.09 |

35.86 |

19539.99 |

|

Weighted Average Basic EPS |

0.85 |

(4.66) |

0.53 |

(18.54) |

|

Weighted Average Diluted EPS |

0.83 |

(4.66) |

0.52 |

(98.35) |

|

No. of Brands |

6 |

6 |

5 |

2 |

|

Net Cash Flow – Operating Activities |

486.62 |

(515.54) |

445.88 |

297.26 |

|

Net Cash Flow – Investing Activities |

(427.10) |

428.63 |

(4997.57) |

(206.06) |

|

Net Cash Flow – Financing Activities |

(63.80) |

(140.56) |

4807.97 |

(12.77) |

Risk Factors

Before deciding to invest in Equity Shares, it is crucial for investors to thoroughly evaluate all the information provided in this Red Herring Prospectus, particularly the risks and uncertainties outlined, as it signifies a substantial level of risk associated with such investments.

Risks that Honasa Consumer Limited could face are highlighted.

-

The company has incurred negative cash flows in its operating, investing, and financing activities in previous periods.

-

The subsidiaries acquired in the past, such as Just4Kids, BBlunt, B: Blunt Spratt, and Fusion, have recorded losses during specific historical periods. However, there is no guarantee that these entities will achieve profitability in the future.

-

The funding needs and the intended allocation of Net Proceeds have not been evaluated by any bank, financial institution, or independent agency. The management will have significant discretion in determining how to utilize the Net Proceeds.

-

In this Red Herring Prospectus, they have presented a comparison of consolidated financial data for the years ending March 31, 2022 and March 31, 2023, along with their standalone financial information for the year ended March 31, 2021, and consolidated financial data for the three-month period ending June 30, 2023.

-

It's important to note that these timeframes are not directly comparable to one another.

-

This Red Herring Prospectus includes data from external sources, including an industry report prepared by an independent third-party research agency, RedSeer Management Consulting Private Limited (RedSeer). The company has engaged and funded RedSeer's services to validate the company's comprehension of the industry, specifically in relation to the offering.

It is advised to the investors to read the Red Herring Prospectus diligently before investing.

Frequently Asked Questions

What is the Offer Open and Close date for IPO?

The Bid opens on 31st October,2023 (Tuesday) and closes on 2nd November, 2023 (Thursday by 5.00pm).

What is Honasa Consumer Limited IPO Price offer?

Honasa Consumer Limited IPO price band is Rs308- Rs.324 per share

How to apply for the IPO?

The investor can apply for the IPO through an ORCA trading app. IPO applications should follow ASBA process.

Who all can apply?

Anchor Investors, Qualified Institutional Buyers like Foreign Institutional Investors, Indian Financial Institutions, Mutual Funds etc. Non institutional investors like corporates, NRI, HUFs, and Retail Investors.

What is the Lot size?

The lot size is 46 shares

Related Blogs

Disclaimer: This blog is dedicated exclusively for educational purposes. Please note that the securities and investments mentioned here are provided for informative purposes only and should not be construed as recommendations. Kindly ensure thorough research prior to making any investment decisions. Participation in the securities market carries inherent risks, and it's important to carefully review all associated documents before committing to investments. Please be aware that the attainment of investment objectives is not guaranteed. It's important to note that the past performance of securities and instruments does not reliably predict future performance.