Global Engineering, Global Markets: Tata Technologies Limited's IPO Saga

Tata Technologies Limited, an Indian multinational specializing in product engineering, offers a spectrum of services encompassing engineering, research and development (ER&D), digital enterprise solutions, education offerings, products and value-added reselling, managing the life cycle of products, manufacturing, developing products, and IT service management. Catering to automotive, aerospace, and industrial machinery OEMs, the company, a subsidiary of Tata Motors, operates globally. With its headquarters in Pune and regional offices in the United States (Detroit, Michigan), Tata Technologies boasts a robust global workforce exceeding 11,000 employees distributed across 18 delivery centers in India, North America, Europe, and the Asia-Pacific region, as of 2023.

Tata Technologies Limited - The Journey

Established in 1989, Tata Technologies originated as the automotive design unit within Tata Motors. However, it evolved into an independent entity in 1994, with Tata Motors maintaining a majority stake and remaining its primary client.

A notable development occurred in August 2005 when Tata Technologies Inc acquired INCAT International, a UK- and US-based engineering company in the automotive and aerospace sectors, for £53.4 million.

In 2011, Tata Technologies secured Rs. 141 crore (US$30 million) by divesting a 13% stake to Tata Capital and Alpha TC Holdings.

April 2013 marked another milestone as Tata Technologies acquired Cambric Corporation, an American engineering services company, for $32.5 million.

In a strategic move to alleviate Tata Motors' debt burden in 2017, the Tata Group intended to sell a 43% stake in Tata Technologies to private equity firm Warburg Pincus for $360 million, relinquishing its controlling share. However, this deal was ultimately called off in 2018.

Engineering R&D Services Industry Overview

Tata Technologies business revenue is from North America (30%), Asia Pacific (including India) (36%) and UK and Europe (34%). Indicating almost, 65% of their business revenue is achieved from Global market and only about 30% of their business revenue is generated within India.

According to the report by Zinnov Management Consulting Private Limited titled "ER&D Market Deep Dive with A Focus on Automotive, Aerospace, Industrial and Transportation, Construction & Heavy Machinery"

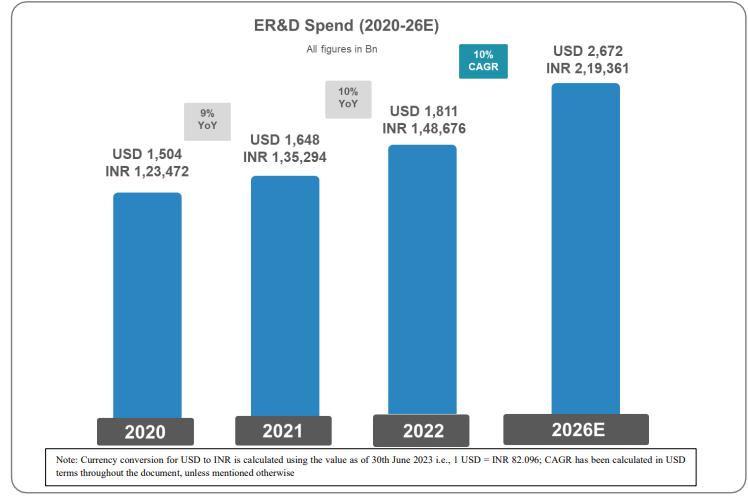

In 2022, the Engineering Research and Development (ER&D) sector experienced robust growth, reflecting a commitment to sustained innovation fuelled by cost optimization and productivity enhancements. Enterprises focused on future-proofing and digital engineering, navigating a landscape marked by technological shifts, changing industry standards, and evolving client preferences. Despite global challenges like inflation and recessionary pressures, the ER&D spending, estimated at $1,811 billion, remains resilient, with a particular emphasis on digital engineering, constituting $810 billion. The digital engineering sector is poised to grow at a compound annual growth rate (CAGR) of approximately 16% from 2022 to 2026.Hence, a moderate industry growth rate is expected

Tata Technologies Limited IPO Details

Tata Technologies Limited - IPO Goals & Objectives

The objectives of the offer are twofold: (i) to realize the advantages associated with listing the Equity Shares on the Stock Exchanges, and (ii) to conduct the Offer for Sale, involving up to 60,850,278 Equity Shares by the Selling Shareholders. Additionally, the company anticipates that the planned listing of its Equity Shares will amplify visibility and brand image while establishing a public market for the Equity Shares in India.

|

Particulars |

Numbers |

|

Fresh Issue |

Nil |

|

Secondary Issue: Offer for Sale of a 60,850,278 Equity Shares by the Selling Shareholders @ Rs.500 per share |

Rs. 30,42,51,39,000 |

|

Tata Motors Limited |

46,275,000 Equity Shares |

|

Alpha TC Holdings Pte. Ltd. |

9,716,853 Equity Share |

|

Tata Capital Growth Fund I |

4,858,425 Equity Shares |

Tata Technologies Limited IPO Dates

|

Event |

Indicative Date |

|

IPO Open Date: |

22nd November,2023 (Wednesday) |

|

IPO closing Date: |

24th November,2023 (Friday) |

|

Finalisation of Allotment |

30th November,2023 (Thursday) |

|

Initiation of refunds / releasing of funds from ASBA |

1st December,2023 (Friday) |

|

Credit of the Equity Shares to allottees’ depository accounts |

4th December,2023 (Monday) |

|

Commencement of trading in stock exchanges |

5th December,2023 (Tuesday) |

Tata Technologies Limited IPO Price details

|

IPO |

Details |

|

Face value of equity share |

Rs.2 per share |

|

IPO band price |

Rs.475 – 500 per share |

|

Lot size |

30 |

|

Lot amount |

Rs.14250 – 15000 |

|

Fresh Issue |

Nil |

|

Offer for sale |

60,850,278 Equity Shares |

|

Total issue size |

60,850,278 Equity Shares |

|

Listing Stock Exchanges |

BSE, NSE |

|

Book Running Lead Managers |

Jm Financial Limited Citigroup Global Markets India Private Limited Bofa Securities India Limited |

|

Registrar |

Link Intime India Private Ltd |

Tata Technologies Limited IPO Lot Details

Investors have the option to bid for a minimum of 30 shares and in multiples thereof. The table below illustrates the minimum and maximum investments for retail investors and High Net Worth Individuals (HNIs) in both shares and corresponding amounts.

|

Application Type |

Lots |

Shares |

Amount (Rs.) |

|

Retail (Min) |

1 |

30 |

Rs.15000 |

|

Retail (Max) |

13 |

390 |

Rs.195000 |

|

S-HNI (Min) |

14 |

420 |

Rs.210000 |

|

S-HNI (Max) |

66 |

1980 |

Rs.990000 |

|

B-HNI (Min) |

67 |

2010 |

Rs.1005000 |

Tata Technologies Limited IPO Reservation Details

|

Investor Category |

Shares Offered |

|

QIB Shares Offered |

A maximum of 50% of the Net Issue. |

|

Retail Shares Offered |

A minimum of 35% of the Net Issue. |

|

NII (HNI) Shares Offered |

A minimum of 15% of the Net Issue. |

Tata Technologies Limited IPO - Investment Potential

Qualitative Factors

The basis for determining the offer price encompasses the following qualitative factors:

-

Profound proficiency in the automotive sector;

-

Distinguished capabilities in emerging automotive trends, including electric vehicles, connected, and autonomous technologies;

-

Robust digital capabilities supported by exclusive accelerators;

-

Impressive portfolio of clients spanning anchor accounts, traditional OEMs, and companies focused on new energy vehicles;

-

A global delivery model that facilitates close client engagement and scalability;

-

Utilization of a proprietary e-learning platform leveraging extensive manufacturing domain knowledge to tap into the vast upskilling and reskilling market; and

-

A well-established brand with an experienced Promoter, board of directors, and management team.

Quantitaive Factors

|

Financial Information |

30th September, 2023 |

31st March, 2023 |

31st March, 2022 |

31st March, 2021 |

|

Key Accounting Ratios |

||||

|

Basic EPS |

8.67 |

15.38 |

10.77 |

5.89 |

|

Diluted EPS (In Rs.) |

8.67 |

15.37 |

10.77 |

5.89 |

|

Weighted Average (Basic & Diluted EPS in Rs.) |

12.26 |

|||

|

RoNW (%) |

12.33 |

20.87 |

19.16 |

11.17 |

|

Weighted Average |

18.68 |

|||

|

Total Equity |

28531.27 |

|||

|

Key Performance Indicators |

||||

|

Revenue From Operations |

25267.02 |

44141.77 |

35295.80 |

23809.11 |

|

EBITDA Margin (%) |

18.39% |

18.60% |

18.29% |

16.20% |

|

PAT |

3519.01 |

6240.37 |

4369.91 |

2391.73 |

|

Total Assets |

51424.17 |

52014.87 |

42179.99 |

35727.35 |

|

Total Income |

25874.24 |

45019.29 |

35783.82 |

24257.38 |

|

Net Worth |

28531.27 |

29894.71 |

22801.61 |

21421.54 |

|

Reserves & Surplus |

24552.9 |

26056 |

20289.3 |

18974.6 |

|

Net Cash Flow from Investing Activities |

5803.21 |

(4874.20) |

7)42.05 |

(6735.74) |

|

Net Cash Flow from Operating Activities; |

(78.21) |

4013.79 |

386.79) |

11128.90 |

|

Net Cash Flow from Financing Activities |

(5265.12) |

(3468.68) |

(444.11) |

(440.71) |

|

Total Borrowings |

Nil |

|||

|

Market Capitalization (Rs. in million) |

202834 |

|||

|

P/E (x) |

32.53 |

|||

Risk Factors

Prior to contemplating an investment in Equity Shares, investors must diligently assess the contents of the Red Herring Prospectus. It is crucial to focus on the prominently emphasized risks and uncertainties, as they indicate significant investment hazards.

Risks that Tata Technologies Limited could face are highlighted.

Investors are highly recommended to carefully review the Red Herring Prospectus before making any investment decisions.

-

The company's revenue heavily relies on clients concentrated in the automotive sector. Economic slowdowns or factors impacting this segment could adversely affect their business, financial condition, and operational results.

-

Historically, they experienced negative cash flows, and this trend may persist in the future, posing potential challenges to their liquidity and operations.

-

The Offer Price of the Equity Shares, the company's price-to-earnings ratio, and their enterprise value to EBIDTA ratio might not accurately predict the trading price of the Equity Shares after listing on the Stock Exchanges following the Offer. Consequently, investors could incur significant losses, potentially losing a substantial portion or the entirety of their investment.

Frequently Asked Questions

What is the offer bid open and close date for Tata Technologies Limited IPO?

The bid offer opens on 22nd November,2023 and bid closes on 24th November,2023.

How to apply for the IPO?

The investor can apply for the IPO through an ORCA trading app. IPO applications should follow ASBA process.

What risks should investors consider before investing in Tata Technologies IPO?

Investors should carefully assess risks, including dependency on the automotive sector, economic slowdown effects, historical negative cash flows, and potential discrepancies in the Offer Price, price-to-earnings ratio, and enterprise value to EBIDTA ratio.

What are the key qualitative factors influencing Tata Technologies' IPO?

Factors include deep expertise in the automotive industry, differentiated capabilities in new-age automotive trends, strong digital capabilities, a notable client portfolio, a global delivery model, a proprietary e-learning platform, and a well-recognized brand.

What is the minimum and maximum bid for Tata Technologies IPO?

The minimum and the maximum bid are

|

Application Type |

Bid Size |

|

Retail (Min) |

1 |

|

Retail (Max) |

13 |

|

S-HNI (Min) |

14 |

|

S-HNI (Max) |

66 |

|

B-HNI (Min) |

67 |

Related Blogs

Disclaimer: This blog is dedicated exclusively for educational purposes. Please note that the securities and investments mentioned here are provided for informative purposes only and should not be construed as recommendations. Kindly ensure thorough research prior to making any investment decisions. Participation in the securities market carries inherent risks, and it's important to carefully review all associated documents before committing to investments. Please be aware that the attainment of investment objectives is not guaranteed. It's important to note that the past performance of securities and instruments does not reliably predict future performance.