Financial Horizons Unveiled: Fedbank's IPO Beyond Banking

Fedbank Financial Services Limited (Fedfina) offers a comprehensive suite of financial solutions, including Gold Loans, Home Loans, Loan Against Property (LAP), and Business Loan Services. Positioned as a retail-focused NBFC, Fedbank boasts the second-lowest cost of borrowing among MSMEs, gold loans, and the MSME & gold loan peer set in India for Fiscal 2023. Serving primarily the MSME and emerging self-employed individuals (ESEI) sectors, their product range spans mortgage loans, small and medium ticket LAP, unsecured business loans, and gold loans. Embracing a Phygital doorstep model, seamlessly merging digital and physical initiatives, they provide personalized services to customers.

As of March 31, 2023, Fedbank operates through 575 branches across 191 districts in 16 states and union territories, with a robust presence in the Southern and Western regions, including key states like Andhra Pradesh (including Telangana) and Rajasthan.

Their competitive strengths lie in their strategic presence in underpenetrated markets, a collateralized lending model targeting individuals and the emerging MSME sector, strong underwriting capability, and a well-diversified funding profile with a lower cost of funds. With a technology-driven scalable operating model, Fedbank Financial Services is poised for sustained growth and innovation.

Fedbank Financial Services Limited -The Journey

Fedbank Financial Services Limited, an NBFC backed by Federal Bank, embarked on a transformative journey marked by strategic achievements. Positioned as a cost-efficient player, they secured the second and third lowest cost of borrowing among MSMEs and gold loan peer sets. With a robust three-year CAGR of 33% in AUM between Fiscals 2020 and 2023, they emerged as the third-fastest growing NBFC. Focused on unaddressed segments like ESEIs and MSMEs, their tailored product suite, including mortgage loans and gold loans, mirrored their commitment to customer-centric solutions. Trust was reinforced with "AA" and "AA-" ratings by CARE and India Ratings. Geographically expanding to 17 states, their "Phygital" doorstep model and technology integration showcased efficiency. Recognized as a "Great Place to Work," their people-centric approach reflects dedication.

Mortgage Industry Overview

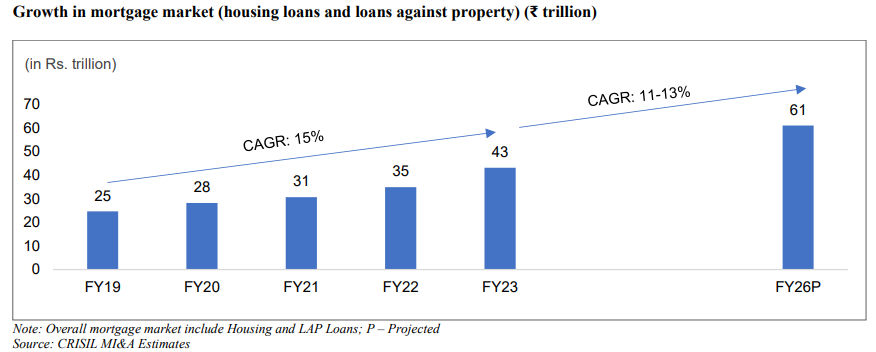

The Indian mortgage sector, encompassing housing loans and loans against property, demonstrated consistent growth at approximately 15% from Fiscal 2019 to Fiscal 2023. This upward trajectory is attributed to factors such as enhanced affordability due to rising disposable income, the trend towards urbanization and nuclearization of families, government initiatives like "Housing for all," pandemic-related impetus packages, the NHB Refinance scheme, the emergence of tier-2 and tier-3 cities, simplified financing options, and increased accessibility to financial institutions.

Looking ahead, CRISIL MI&A predicts a robust 11-13% Compound Annual Growth Rate (CAGR) for the mortgage market between Fiscal 2023 and 2026. This growth is expected to be fuelled by ongoing urbanization, heightened demand from tier-2 and tier-3 cities, incentives such as tax benefits and favourable interest rates, along with continued government initiatives in the sector.

FedBank Financial Services Limited IPO Details

FedBank Financial Services Limited - IPO Goals & Objectives

The offering consists of a Fresh Issue by the company and an Offer for Sale by the Selling Shareholders.

|

Particulars |

Numbers |

|

Fresh Issue of 42,912,087 shares @ Rs.140 per share |

Rs. 6,00,76,92,180 |

|

Secondary Issue: Offer for Sale of 35,161,723 shares by the Selling Shareholders @ Rs.140 per share |

Rs. 4,92,26,41,220 |

|

Total Issue Size of 78,073,810 shares |

Rs. 10,93,03,33,400 |

|

The Federal Bank Limited (promoter) |

5,474,670 Shares |

|

True North Fund VI LLP (investor) |

29,687,053 Share |

FedBank Financial Services Limited IPO Dates

|

Event |

Indicative Date |

|

IPO Open Date: |

22nd November,2023 (Wednesday) |

|

IPO closing Date: |

24th November,2023 (Friday) @5.00 pm |

|

Finalisation of Allotment |

30th November,2023 (Thursday) |

|

Initiation of refunds / releasing of funds from ASBA |

1st December,2023 (Friday) |

|

Credit of the Equity Shares to allottees’ depository accounts |

4th December,2023 (Monday) |

|

Commencement of trading in stock exchanges |

5th December,2023 (Tuesday) |

FedBank Financial Services Limited IPO Price details

|

IPO |

Details |

|

Face value of share |

Rs.10 per share |

|

IPO band price |

Rs.133 - 140 per share |

|

Lot size |

107 |

|

Lot amount |

Rs.14231– 14980 |

|

Fresh Issue |

42,912,087 equity shares |

|

Offer for sale |

35,161,723 equity Shares |

|

Total issue size |

78,073,810 equity Shares |

|

Listing Stock Exchanges |

BSE, NSE |

|

Book Running Lead Managers |

ICICI Securities Limited Bnp Paribas Equirus Capital Private Limited Jm Financial Limited |

|

Registrar |

Link Intime India Private Ltd |

FedBank Financial Services Limited IPO Lot Details

Investors have the option to bid for a minimum of 107 shares and in multiples of that quantity. The table below outlines the minimum and maximum investments for retail investors and High Net Worth Individuals (HNIs) in both shares and the corresponding amounts.

|

Application Type |

Lots |

Shares |

Amount (Rs.) |

|

Retail (Min) |

1 |

107 |

Rs.14980 |

|

Retail (Max) |

13 |

1391 |

Rs.194740 |

|

S-HNI (Min) |

14 |

1498 |

Rs.209720 |

|

S-HNI (Max) |

66 |

7062 |

Rs.988680 |

|

B-HNI (Min) |

67 |

7169 |

Rs.1003660 |

Fedbank Financial Services Limited IPO Reservation Details

|

Investor Category |

Shares Offered |

|

QIB Shares Offered |

A maximum of 50% of the Net offer. |

|

Retail Shares Offered |

A minimum of 35% of the Net offer. |

|

NII (HNI) Shares Offered |

A minimum of 15% of the Net offer. |

Fedbank Financial Services Limited IPO - Investment Potential

Qualitative Factors

The offer price is determined based on the following qualitative factors:

-

Their footprint in expansive, untapped markets with significant growth prospects

-

Concentration on retail loan products employing a collateralized lending model tailored for individuals and the burgeoning MSME sector

-

Robust underwriting capabilities and a presence in specific customer segments, complemented by strong risk management focused on efficient underwriting and collections

-

A seasoned management team with a proven track record through various business cycles

-

Diversified funding profile providing the advantage of lower funding costs

-

A technology-driven company with a scalable operational model

Quantitaive Factors

|

Financial Information |

30th June, 2023 |

31st March, 2023 |

31st March, 2022 |

31st March, 2021 |

|||||

|

Key Accounting Ratios |

|||||||||

|

Basic EPS |

1.67 |

5.60 |

3.32 |

2.19 |

|||||

|

Diluted EPS (In Rs.) |

1.67 |

5.59 |

3.31 |

2.18 |

|||||

|

Weighted Average (Basic EPS in Rs.) |

4.27 |

||||||||

|

Weighted Average (Diluted EPS in Rs.) |

4.26 |

||||||||

|

RoNW (%) |

3.81 |

13.29 |

8.97 |

7.39 |

|||||

|

Weighted Average |

10.87 |

||||||||

|

NAV per equity share |

43.95 |

42.11 |

|||||||

|

RoAE% |

3.89% |

14.36% |

10.41% |

8.08% |

|||||

|

Total Equity |

14149.03 |

13556.82 |

11535.18 |

8347.34 |

|||||

|

Revenue From Operations |

3613.92 |

11788 |

8693.15 |

6918.25 |

|||||

|

EBITDA Margin (Rs. in million) |

2443.08 |

7570.40 |

5235.58 |

4173.88 |

|||||

|

PAT |

538.83 |

1801.33 |

1034.59 |

616.84 |

|||||

|

Total Assets |

94125.05 |

90709.91 |

65557.07 |

54663.05 |

|||||

|

Net Worth |

14149.03 |

13556.82 |

11535.18 |

8347.34 |

|||||

|

Reserves & Surplus |

10768.27 |

10189.60 |

8217.76 |

5392.85 |

|||||

|

Net Cash Flow from Investing Activities |

1359.99 |

(1295.28) |

(4169.20) |

(705.24) |

|||||

|

Net Cash Flow from Operating Activities |

(2922.62) |

(14740.01) |

(5778.93) |

(3712.30) |

|||||

|

Net Cash Flow from Financing Activities |

3100.77 |

16315.23 |

5347.44 |

8255 |

|||||

|

Total Borrowings |

76195.16 |

71358.23 |

50168.35 |

43280.92 |

|||||

|

Market Capitalization (Rs. in million) |

51651 |

||||||||

|

P/E (x) |

25.04 |

||||||||

Risk Factors

Before considering an investment in Equity Shares, investors should thoroughly review the contents of the Red Herring Prospectus. It is essential to pay close attention to the prominently highlighted risks and uncertainties, as they signal substantial investment hazards.

Risks that Fedbank Financial Services Limited could face are highlighted.

-

The company has experienced negative cash flows in previous periods and may encounter continued negative cash flows in the future.

-

The company encounters potential liquidity risks due to the mismatch in the maturity periods of their assets and liabilities.

-

The company and their promoter are currently involved in pending litigations. Any unfavourable decisions in these proceedings could result in liabilities or penalties, potentially impacting their business, cash flows, and reputation.

-

As of June 30, 2023, their Gross Non-Performing Assets (NPA) and Net NPA amounted to Rs. 1,897.71 million and Rs. 1,473.85 million, respectively. There is a risk that they may struggle to sustain the quality of their loan portfolio or effectively manage its growth, potentially leading to a substantial increase in non-performing assets and provisions.

Investors are strongly advised to meticulously examine the Red Herring Prospectus before making any investment decisions.

Frequently Asked Questions

What services does Fedbank provide?

Fedbank offers a range of financial services, including Gold Loans, Hoe Loans, Loan Against Property (LAP), and Business Loan Services.

What is the offer bid open and close date for Fedbank Limited IPO?

The bid offer opens on 22nd November,2023 and bid closes on 24th November,2023.

How to apply for the IPO?

The investor can apply for the IPO through an ORCA trading app. IPO applications should follow ASBA process.

What is the minimum and maximum bid for Fedbank IPO?

The minimum and the maximum bid are

|

Application Type |

Bid Size |

|

Retail (Min) |

1 |

|

Retail (Max) |

13 |

|

S-HNI (Min) |

14 |

|

S-HNI (Max) |

66 |

|

B-HNI (Min) |

67 |

What is the issue price of Fedbank shares?

The price range for the shares is between Rs.133 and Rs.140 per share, with a minimum order quantity of 107 shares.

Related Blogs

Related Stock

HDFC Asset Management Company Ltd

Disclaimer: This blog is dedicated exclusively for educational purposes. Please note that the securities and investments mentioned here are provided for informative purposes only and should not be construed as recommendations. Kindly ensure thorough research prior to making any investment decisions. Participation in the securities market carries inherent risks, and it's important to carefully review all associated documents before committing to investments. Please be aware that the attainment of investment objectives is not guaranteed. It's important to note that the past performance of securities and instruments does not reliably predict future performance.