Art meets Finance: Evaluating the DOMS Industries Limited IPO

Doms Industries Limited, a leading creative products company in India's 'stationery and art' market. Operating under their flagship brand 'DOMS,' they design, manufacture, and distribute a diverse range of products domestically and in over 40 countries by March 31, 2023. Their strong brand recall is a result of a focus on R&D, product engineering, and integrated manufacturing, coupled with a robust pan-India distribution network. Core products like 'pencils' and 'mathematical instrument boxes' command significant market shares, 29% and 30%, respectively, in Fiscal 2023.

Their offerings span seven categories, and their extensive product breadth sets them apart globally. In Fiscal 2020 to Fiscal 2022, they emerged as India's fastest-growing 'stationery and art material' company by revenue, attributed to their presence in multiple categories and price points.

Doms Industries Limited - The Journey

Launched in 2005, our flagship brand "DOMS" revolutionized India's 'stationery and art material' industry. A strategic 2012 partnership with F.I.L.A., an Italian multinational, expanded our global reach and technological capabilities. The acquisition of Pioneer Stationery in subsequent years strengthened our market presence. In 2023, we took a minority stake in ClapJoy Innovations, entering the 'toys' sector for kids and young adults. Simultaneously, a majority stake in Micro Wood enhanced our backward integration strategy, focusing on manufacturing tin and paper-based packing materials. Our journey reflects continuous growth and diversification, shaping the future of the creative products landscape.

Stationery And Art Materials Market Overview

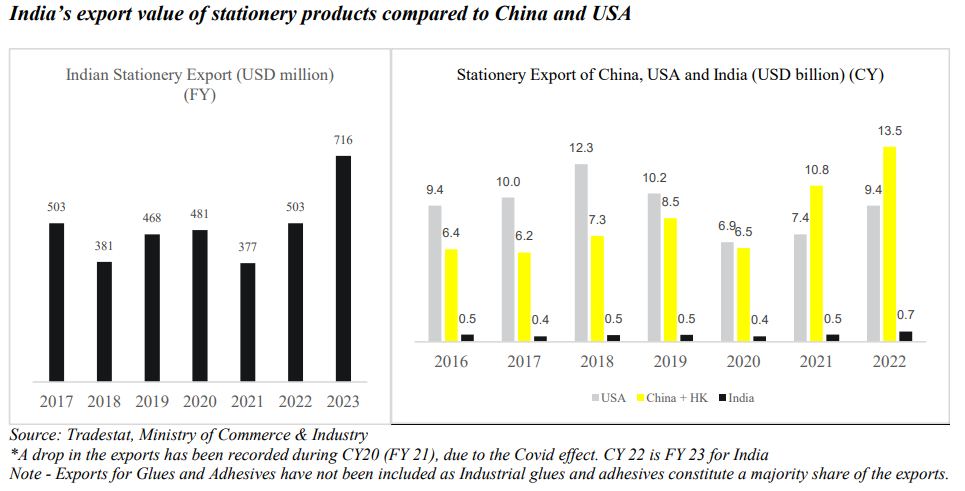

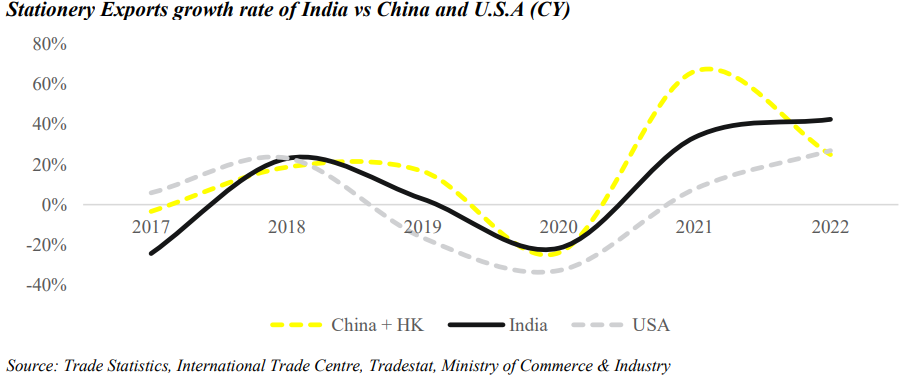

In recent decades, India has emerged as a major exporting nation, propelling its economy to new heights. The thriving stationery and art materials industry presents numerous opportunities for India to establish itself as a global export hub. The demand for stationery products is surging worldwide, driven by increasing literacy rates and education levels. India, with its abundance of raw materials and cost-effective manufacturing due to lower labour costs, can produce a diverse range of stationery products competitively.

India and China are key players in the Asian stationery export market, with India's exports growing steadily. Despite China's dominance, India possesses opportunities to supply high-quality, customized products to the global market. Indian manufacturers emphasize attention to detail, craftsmanship, and quality control, catering to customers valuing superior stationery products. Additionally, India has made strides in eco-friendly and sustainable stationery, aligning with global demand for environmentally conscious products.

The strategy opens avenues for Indian manufacturers to diversify and tap into new markets. Government initiatives, including "Make in India" and the Production-Linked Incentive scheme, aim to boost exports, providing a conducive environment for Indian stationery manufacturers to expand globally. With the right policies and incentives, India can significantly enhance its share in the global stationery and art materials industry.

Doms Industries Limited IPO Details

Doms Industries Limited - IPO Goals & Objectives

|

Particulars |

Numbers (Rs. in million) |

|

Gross Proceeds from Fresh Issue 4,430,380 shares |

Rs.3500 |

|

Secondary Issue: Offer for Sale of a 10,759,493 shares Equity Shares by the Selling Shareholders @ Rs.10 per share |

Rs. 8500 |

|

F.I.L.A.- Fabbrica Italiana Lapis ed Affini S.p.A |

Rs. 8000 |

|

Sanjay Mansukhlal Rajani |

Rs. 250 |

|

Ketan Mansukhlal Rajani |

Rs. 250 |

Doms Industries Limited IPO Dates

|

Event |

Indicative Date |

|

IPO Open Date: |

13th December, 2023 (Wednesday) |

|

IPO closing Date: |

15th December, 2023 (Friday) before 5.00 pm |

|

Finalisation of Allotment |

18th December,2023 (Monday) |

|

Initiation of refunds / releasing of funds from ASBA |

19th December, 2023 (Tuesday) |

|

Credit of the Equity Shares to allottees’ depository accounts |

19th December, 2023 (Tuesday) |

|

Commencement of trading in stock exchanges |

20th December,2023 (Wednesday) |

Doms Industries Limited IPO Price details

|

IPO |

Details |

|

Face value of equity share |

Rs.10 |

|

IPO band price |

Rs.750 – Rs.790 per share |

|

Lot size |

18 shares |

|

Lot amount |

Rs. 13500 – Rs. 14220 |

|

Fresh Issue |

Rs. 3500 million |

|

Offer for sale |

Rs. 8500 million |

|

Total issue size |

Rs. 12000 million |

|

Listing Stock Exchanges |

National Stock Exchange Bombay Stock Exchange |

|

Book Running Lead Managers |

Jm Financial Limited, Bnp Paribas, ICICI Securities Limited Iifl Securities Ltd |

|

Registrar |

Link Intime India Private Ltd |

Doms Industries Limited IPO Lot Details

|

Application Type |

Lots |

Shares |

Amount (Rs.) |

|

Retail (Min) |

1 |

18 |

Rs. 14220 |

|

Retail (Max) |

14 |

252 |

Rs. 199080 |

|

S-HNI (Min) |

15 |

270 |

Rs. 213300 |

|

S-HNI (Max) |

70 |

1260 |

Rs. 995400 |

|

B-HNI (Min) |

71 |

1278 |

Rs. 1009620 |

Doms Industries Limited IPO Reservation Details

|

Investor Category |

Shares Offered |

|

QIB Shares Offered |

Minimum 75% of Net Issue |

|

Retail Shares Offered |

Maximum 10% of Net Issue |

|

NII (HNI) Shares Offered |

Maximum 15% of Net Issue |

Doms Industries Limited IPO - Investment Potential

Qualitative Factors

The basis for determining the offer price is based on the following qualitative factors:

-

Dominant role in the Indian 'stationery and art material' sector, boasting an extensive product lineup that fuels swift business expansion.

-

Notable brand recognition propelled by top-notch, innovative, and distinct products.

-

State-of-the-art manufacturing facilities emphasizing backward integration for enhanced efficiency.

-

A resilient multi-channel distribution system spanning across India and internationally.

-

Strategic collaboration with FILA, providing entry into global markets and expertise in product development.

-

Seasoned promoters and a proficient management team steering the company.

Quantitative Factors

|

Financial Information |

31st March 2021 |

31st March 2022 |

31st March 2023 |

|||||

|

Key Accounting Ratios |

||||||||

|

Basic EPS |

(1.07) |

3.05 |

18.29 |

|||||

|

Diluted EPS (In Rs.) |

(1.07) |

3.05 |

18.29 |

|||||

|

Weighted Average (Basic & Diluted EPS in Rs.) |

9.98 |

|||||||

|

RoNW (%) |

(3.86) % |

5.81% |

28.39% |

|||||

|

Weighted Average |

15.49% |

|||||||

|

Total Equity |

2416.79 |

2580.94 |

3553.45 |

|||||

|

Key Performance Indicators |

||||||||

|

Revenue From Operations |

4028.17 |

6836.01 |

12118.90 |

|||||

|

EBITDA Margin (%) |

7.45 |

10.20 |

15.40 |

|||||

|

PAT |

(60.26) |

171.40 |

1028.71 |

|||||

|

Total Assets |

4575.24 |

4974.61 |

6397.83 |

|||||

|

Total Income |

4087.88 |

6862.25 |

12165.23 |

|||||

|

Net Worth |

2336.11 |

2472.47 |

3374.32 |

|||||

|

Reserves & Surplus |

2332.38 |

2468.74 |

3370.59 |

|||||

|

Net Cash Flow from Investing Activities |

(187.49) |

(337.26) |

(1359.34) |

|||||

|

Net Cash Flow from Operating Activities; |

152.13 |

509.39 |

1732.63 |

|||||

|

Net Cash Flow from Financing Activities |

249.27 |

(305.85) |

(123.74) |

|||||

|

Total Borrowings |

972.74 |

849.04 |

1000.65 |

|||||

|

Market Capitalization (Rs. in million) |

47938 |

|||||||

|

P/E (x) |

43.19 |

|||||||

Risk Factors

Before considering an investment in Equity Shares, investors should thoroughly examine the details outlined in the Red Herring Prospectus. It is essential to pay close attention to the prominently highlighted risks and uncertainties, as they signify substantial investment challenges.

Risks that Doms Industries Limited could face are highlighted.

-

Relying on FILA for over 60% of their export sales in the last three Fiscals poses a significant risk. Any harm to FILA's reputation could negatively impact Doms business, financial condition, and operational results.

-

Utilizing Net Proceeds for capital expenditure, including the Proposed Project, entails risks such as potential delays, cost overruns, and uncertainties. Pending placement of orders for essential plant and machinery further contributes to project-related uncertainties.

-

As of July 31,2023, their total borrowings stood at Rs.1,687.90 million which would impact their business, operational results and financial condition if the company fails to meet its obligations

Frequently Asked Questions

What is Doms Industries Limited?

Doms Industries Limited is a company operating in the 'stationery and art material' industry.

When is Doms Industries Limited IPO scheduled to open and close?

The IPO open date is on December 13, 2023 (Wednesday) and close date is on December 15, 2023 (Friday) before 5:00 pm.

How to apply for the IPO?

The investor has the option to submit their application for the IPO using the ORCA trading app. IPO applications should follow ASBA process.

What are the major risk factors associated with Doms Industries Limited IPO?

Risks include dependence on FILA for export sales, potential delays and cost overruns in the Proposed Project, and the risk associated with meeting debt obligations.

How has DOMS Industries Limited's revenue changed recently?

DOMS Industries Limited experienced a significant increase in revenue, marking a growth of 77.28% between the financial years ending March 31, 2023, and March 31, 2022.

What is the percentage growth in DOMS Industries Limited's profit after tax (PAT)?

The profit after tax (PAT) of DOMS Industries Limited recorded a remarkable growth of 500.18% between the financial years ending March 31, 2023, and March 31, 2022.

Related Blogs

Disclaimer: This blog is dedicated exclusively for educational purposes. Please note that the securities and investments mentioned here are provided for informative purposes only and should not be construed as recommendations. Kindly ensure thorough research prior to making any investment decisions. Participation in the securities market carries inherent risks, and it's important to carefully review all associated documents before committing to investments. Please be aware that the attainment of investment objectives is not guaranteed. It's important to note that the past performance of securities and instruments does not reliably predict future performance.