Top Picks: 2024's Top 5 Dividend Stocks in India

Overview

Dividend’s play an important role in the stock market; it serves as a way for companies to share their profits with shareholders and also to attract investors. Investors who seek regular income for their investments invest in good dividend paying stocks.

In times of market fluctuations, investors invest in good dividend paying stocks for the purpose of regular return for their investments. Usually, investors choose good dividend paying stocks as a valuable investment option because they possess the benefit of share price appreciation and consistent dividend payout.

Latest Moves on India's Top Dividend Stocks 2025

Vedanta Limited:

-

December 2024: Vedanta declared an interim dividend of Rs. 8.50 per share. The record date for this dividend was December 24, 2024, ensuring that shareholders holding the stock on this date were eligible for the payout. This announcement reinforced Vedanta's reputation for consistent shareholder returns.

Coal India Limited:

-

January 2025: Coal India announced its second interim dividend for the fiscal year 2024-25, amounting to Rs. 5.60 per share. The ex-dividend date was January 31, 2025, and shareholders holding the stock as of this date qualified for the dividend. This move highlighted Coal India's ongoing efforts to reward its investors.

Hindustan Aeronautics Limited (HAL):

-

February 2025: HAL reported a 14% increase in consolidated net profit for the third quarter, reaching Rs. 14.40 billion. This growth was driven by sustained demand for its aircraft from the defense ministry. The company declared a dividend of Rs. 25 per share for fiscal 2025, showcasing its financial strength.

Page Industries:

-

November 2024: Page Industries, the exclusive licensee of Jockey and Speedo brands in India, posted a 30% rise in second-quarter profit, reaching Rs. 1.95 billion. Announcing its financial stability, the company issued an interim dividend of Rs. 250 per share for the 2025 fiscal year.

March 2025: Several companies, including AccelerateBS India, Indian Railway Finance Corporation (IRFC), AGI Infra, Castrol India, and DIC India Limited, also declared dividends, further strengthening investor confidence in dividend-paying stocks.

Consideration for Investing in Dividend Paying Stocks

Before investing in dividend-paying stocks, several factors need consideration:

-

Limited growth potential: Dividend stocks may not offer significant growth potential. Companies that have experienced exponential growth often do not pay dividends.

-

Stable income for investors: These stocks are suitable for those seeking stable income over time. They are typically from stable companies that have reached a certain level of market saturation.

-

Goal setting: Setting annual return goals is crucial. It's important to invest in stocks that offer annual growth rates of 5% to 15%, along with dividends, for a steady investment approach.

Companies With Highest Dividend Yield in 2024

The below listed companies are stocks with good dividend yield. The stock has been analyzed by their consistent dividend payments for the last 5 years and with good share price performance

Vedanta Limited

Vedanta Limited, is India’s largest private metal mining industry, operates on the business of mining of natural resources . Vedanta Limited’s current market capitalisation is Rs 1,013,866 million.

Vedanta Limited has been one of the good dividend paying stocks that offer dividends since 23rd July, 2001.

Dividend History of Vedanta Limited

|

Vedanta Limited |

||||

|

Year Ended |

Face Value |

Dividend Per Share |

Dividend Yield % |

Dividend Yield % (End of Year) |

|

2019 |

1 |

Rs. 18.85 |

1885% |

10.30% |

|

2020 |

1 |

Rs. 3.9 |

390% |

6% |

|

2021 |

1 |

Rs. 9.5 |

950% |

4.20% |

|

2022 |

1 |

Rs. 45 |

4500% |

11.20% |

|

2023 |

1 |

Rs. 101.5 |

10150% |

36.90% |

For March ,2023, Vedanta Limited has announced a dividend yield of 10150% with dividend per share to Rs. 101.50. At the current share price of Rs. 273.40 (as on 21.03.2024) , the dividend yield is 36.90%. Vedanta Limited has made consistent dividends for the last 5 years. Vedanta Limited with its dividend yield of 10150%, stands out as top dividend yield stock in 2024.

Share Price Performance of Vedanta Limited for 1 year

Share price of Vedanta Limited dipped by 0.24% after its parent firm announced a deleverage of USD billion in debt for the next three years.

Also, Vedanta Limited has bought SBI Electoral Bonds for Rs.400.65 crores.

Vedanta Limited has planned to transfer its Sterlite Power Transmission projects in a joint venture with GIC Lte.

Coal India Limited

Coal India Limited, India’s world largest coal producer, operates on the business of metal mining. A Maharatna company with market capitalization of Rs. 266260 crores.

Coal India Limited has been one of the good dividend paying stocks that offer dividends since 18th February, 2011.

Dividend History of Coal India Limited

|

Coal India Limited |

||||

|

Year Ended |

Face Value |

Dividend Per Share |

Dividend Yield % |

Dividend Yield % (End of Year) |

|

2019 |

10 |

Rs. 13.10 |

131% |

5.5% |

|

2020 |

10 |

Rs. 12 |

120% |

8.6% |

|

2021 |

10 |

Rs. 16 |

160% |

12.3% |

|

2022 |

10 |

Rs. 17 |

170% |

9.3% |

|

2023 |

10 |

Rs. 24.25 |

243% |

11.4% |

For March, 2023, Coal India Limited has announced a dividend yield of 243% with dividend per share to Rs. 24.25. At the current share price of Rs. 432.05 (as on 21.03.2024) , the dividend yield is 11.40%. Coal India Limited has made consistent dividends for the last 5 years.

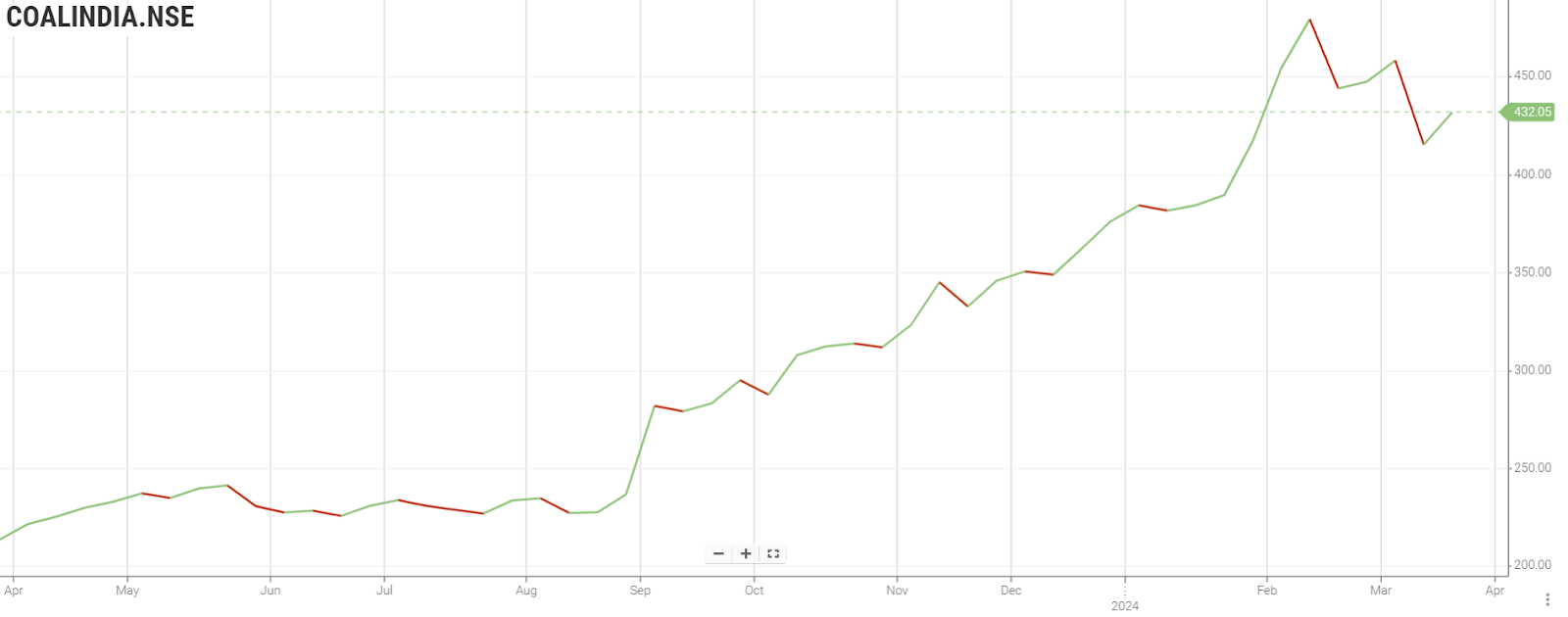

Share Price Performance of Coal India Limited for 1 year

Market capitalization of Coal India Limited dropped to Rs. 186 billion with GoI holding 63% , which led to the dip in share prices. Coal India Limited has planned a coal gasification project in Engineering, Procurement and Construction model in order to make the project more feasible. In the month of February, 2024, the e-auction premium of Coal India fell to 45% compared to past premium of 117%.

Hindustan Zinc Limited

Hindustan Zinc Limited, a metal mining industry, operates in the Zinc, Lead, Silver, Wind energy segments. Hindustan Zinc Limited is also a subsidiary of Vedanta Limited, with a market capitalization of Rs. 124182 crores.

Hindustan Zinc Limited Vedanta Limited has been one of the good dividend paying stocks that offer dividends since 28th June,2001.

Dividend History of Hindustan Zinc Limited

|

Hindustan Zinc Limited |

||||

|

Year Ended |

Face Value |

Dividend Per Share |

Dividend Yield % |

Dividend Yield % (End of Year) |

|

2019 |

2 |

Rs. 20 |

1000% |

6.7% |

|

2020 |

2 |

Rs. 16.50 |

825% |

5% |

|

2021 |

2 |

Rs. 21.30 |

1065% |

7.8% |

|

2022 |

2 |

Rs. 18 |

900% |

5.8% |

|

2023 |

2 |

Rs. 75.50 |

3775% |

25.7% |

For March ,2023, Hindustan Zinc Limited has announced a dividend yield of 3775% with dividend per share to Rs. 75.50. At the current share price of Rs. 293.90 (as on 21.03.2024) , the dividend yield is 25.7%. Hindustan Zinc Limited has made consistent dividends for the last 5 years.

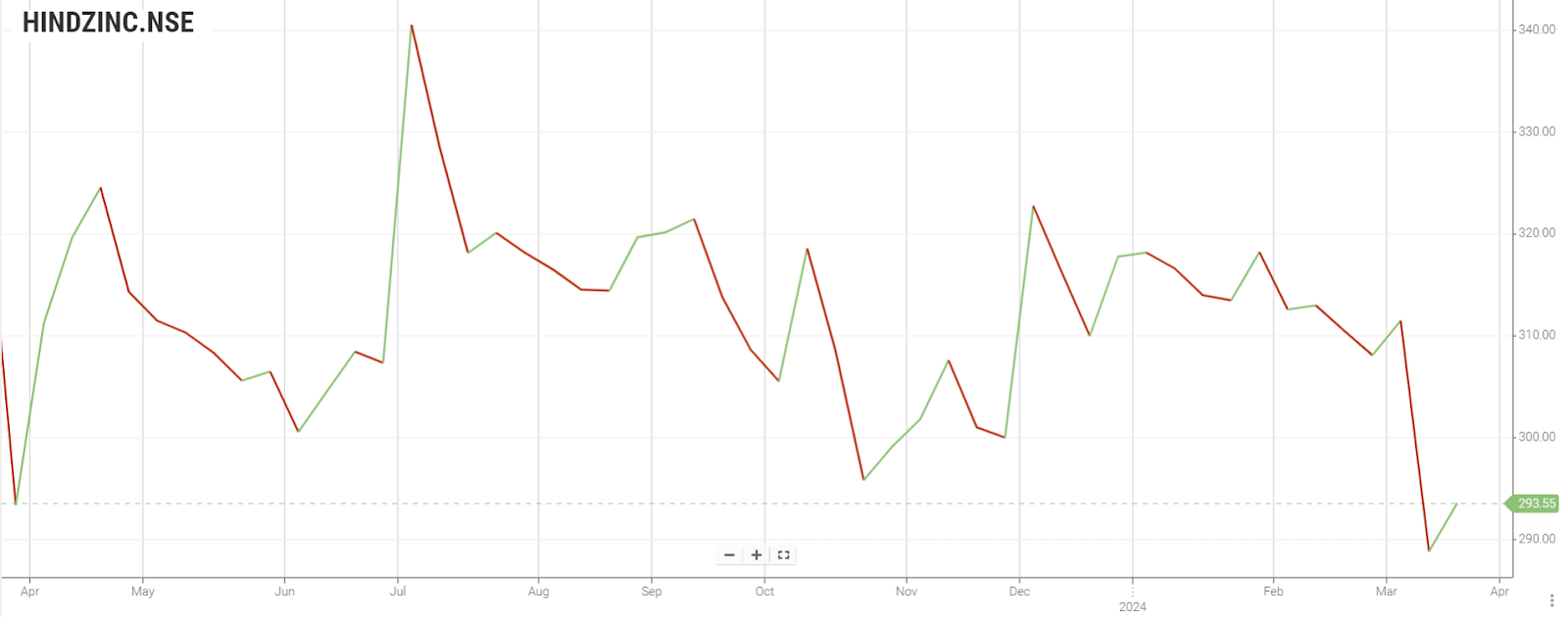

Share Price Performance of Hindustan Zinc Limited for 1 year

The spike in Silver imports has created huge demand for silver production within India. Hindustan Zinc Limited , in which Vedanta Limited holds majority stakes , have made strategic restructuring plans to divide their verticals as separate entities. Also , the company has reduced its operational cost in production of silver. With the Q3 results by Vedanta having booked profit, the share price of Hindustan Zinc Limited has also risen.

Power Finance Corporation Limited

Power Finance Corporation Limited, a non-banking term lending finance company, operates in the business of financing to power sectors throughout India. Incorporated in the year 1986, the company has a market capitalization of Rs. 127631 crores.

Power Finance Corporation Limited Vedanta Limited has been one of the good dividends paying stocks that offer dividends since 7th September,2007

Dividend History of Power Finance Corporation Limited

|

Power Finance Corporation Limited |

||||

|

Year Ended |

Face Value |

Dividend Per Share |

Dividend Yield % |

Dividend Yield % (End of Year) |

|

2019 |

10 |

Rs. 0 |

0% |

0% |

|

2020 |

10 |

Rs.9.50 |

95% |

10.3% |

|

2021 |

10 |

Rs.10 |

100% |

8.8% |

|

2022 |

10 |

Rs.12 |

120% |

10.7% |

|

2023 |

10 |

Rs.13.25 |

132.5% |

8.7% |

For March ,2023, Power Finance Corporation Limited has announced a dividend yield of 132.5% with dividend per share to Rs. 13.25. At the current share price of Rs. 386.75 (as on 21.03.2024) , the dividend yield is 8.7.

Share Price Performance of Power Finance Corporation Limited for 1 year

The company’s share price rose to four days high after the company sold its Solapur Transmission Unit to Torrent Power. The share price hiked after the company reported its Q3 results with a net profit increase in 20%.

NTPC Limited

NTPC Limited, a power generator/ distributor , operates in the business of Integrated power generation as a value chain. They also provide services like consulting , trading and mining in power through solar, coal, gas, nuclear, thermal and renewable energy. NTPC Limited has a current market capitalization of Rs.315141 crores.

NTPC Limited Vedanta Limited has been one of the good dividends paying stocks that offer dividends since 25th February,2005

Dividend History of NTPC Limited

|

NTPC Limited |

||||

|

Year Ended |

Face Value |

Dividend Per Share |

Dividend Yield % |

Dividend Yield % (End of Year) |

|

2019 |

10 |

Rs. 6.08 |

60.8% |

4.5% |

|

2020 |

10 |

Rs.3.15 |

31.5% |

3.7% |

|

2021 |

10 |

Rs.6.15 |

61.5% |

5.8% |

|

2022 |

10 |

Rs.7 |

70% |

5.2% |

|

2023 |

10 |

Rs.7.25 |

72.5% |

4.1% |

For March ,2023, NTPC Limited has announced a dividend yield of 72.5% with dividend per share to Rs. 7.25. At the current share price of Rs. 325(as on 21.03.2024) , the dividend yield is 4.1%

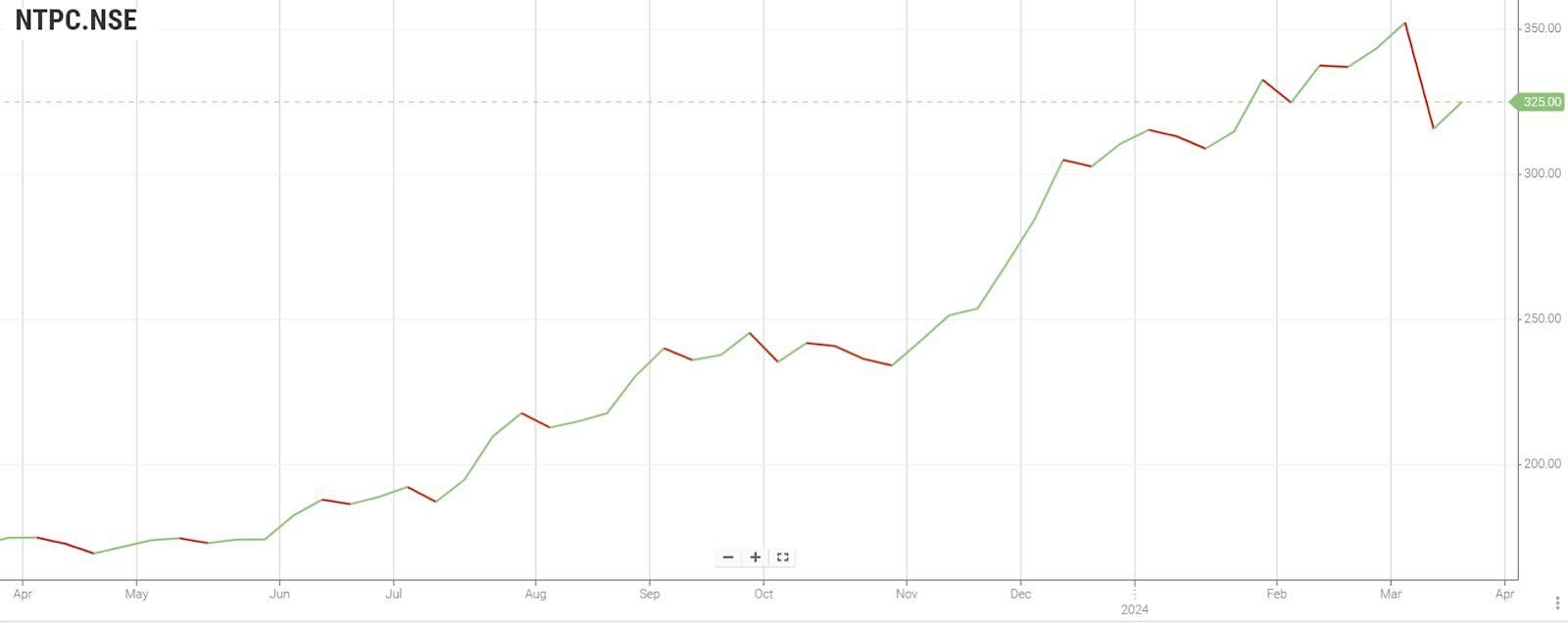

Share Price Performance of NTPC Limited for 1 year

The Non-convertible debenture issue by NTPC worth Rs. 1500 crore has led to the share price hike by 4%. NTPC Limited has launched 1 Giga Watt solar wind hybrid power project.

Performance Comparison of Good Dividend Paying Stocks

|

Performance Comparison |

||||

|

Company |

5-year CAGR |

Debt to Asset Ratio |

Net Profit |

Annual Revenue |

|

Vedanta Limited |

10.78% |

0.7 |

Rs. 14506 crores |

Rs. 147308 crores |

|

Hindustan Zinc Limited |

1.25% |

0.75 |

Rs. 10511 crores |

Rs. 34098 crores |

|

Coal India Limited |

15.36% |

0.63 |

Rs. 28124 crores |

Rs. 138251 crores |

|

Power Finance Corporation Limited |

59.37% |

0.92 |

Rs. 21178 crores |

Rs. 77568 crores |

|

NTPC Limited |

28.50% |

0.79 |

Rs. 17121 crores |

Rs. 176206 crores |

Stocks That Give Monthly Dividends in 2024

Good dividend paying stocks which give monthly dividends are listed below.

|

Name |

Close Price |

Dividend Yield % |

1Y Return % |

EPS (Q) |

|

123.9 |

0.52 |

142.94 |

2.21 |

|

|

148.85 |

1.85 |

105.17 |

4.89 |

|

|

4054.2 |

0.63 |

52.67 |

20.17 |

|

|

4307.35 |

0.46 |

43.78 |

27.5 |

|

|

4971.5 |

1.48 |

7.21 |

23.11 |

Upcoming Dividend Stocks in India in March 2024

Upcoming good dividend paying stocks that are expected to announce its dividend in March, 2024.

On 22nd March 2024, Power Finance Corporation Ltd is expected to announce its interim dividend of Rs. 3 per share.

On 21st March 2024, Ksolves India Ltd , Patanjali Foods Ltd and Castrol India Ltd are expected to announce their dividends.

Ksolves India Limited's dividend per share is Rs.5, Patanjali Food Limited's dividend per share is Rs. 6 and Castrol India Limited's dividend per share is Rs. 4.5.

On 20th March 2024, AGI Infra Limited is expected to announce its dividend per share of Rs.1 and Axtel Industries Limited's dividend per share is Rs. 6.

Conclusion

The article lists out some of the good dividend paying stocks that stand out as some of India's premier options for dividend investors. However, it's vital to understand that regular good dividend paying stocks alone do not guarantee suitability for investment. Conducting thorough research into a company's background, financial performance, and key metrics is essential for making informed long-term investment decisions.

Effectively navigating the world of good dividend paying stocks requires a deep understanding and careful analysis that goes beyond immediate advantages. While the good dividend paying stocks may seem enticing, they also come with significant risks. Therefore, it's wise to delve deeply into the financial health and sustainability of dividends before making any investment choices. Seeking advice from financial advisors can help align investment strategies with evolving market conditions and individual goals.

Furthermore, Avail the free demat trading account from Enrich Money, which provides essential tools to analyze good dividend paying stocks and best resources for embarking on investment journeys with confidence.

Frequently Asked Questions

Why invest in good dividend paying stocks?

Investing in good dividend paying stocks can provide a reliable income stream, offer a hedge against market volatility, and potentially provide long-term capital appreciation.

What are the risks in investing in good dividend paying stocks?

The risks of investing in good dividend-paying stocks include the possibility of dividend cuts or suspensions, limited growth potential compared to growth stocks, and vulnerability to economic downturns affecting company profitability.

What are the sectors known to provide good dividend paying stocks?

Certain sectors offer good dividend paying stocks due to stable revenue streams. Utilities and REITs, with regulated operations and consistent demand, lead in this regard. Consumer staples and healthcare also provide resilience and reliable dividends, emphasizing the importance of sectoral performance in dividend investing.

How often dividends are paid out in good dividend paying stocks?

In good dividend paying stocks, dividends are typically paid out quarterly, although some companies may pay them annually or semi-annually. The frequency of dividend payments can vary based on the company's dividend policy and financial performance.

How do I identify good dividend paying stocks?

To identify good dividend paying stocks, look for companies with a history of consistent dividend payments and growth. Check the dividend yield compared to industry averages and assess the company's financial health and stability. Additionally, consider factors like payout ratio, dividend history, and future growth prospects.

Related Stocks

Aditya Birla Sun Life Dividend Yield

ICICI Prudential Dividend Yield

Disclaimer: This blog is dedicated exclusively for educational purposes. Please note that the securities and investments mentioned here are provided for informative purposes only and should not be construed as recommendations. Kindly ensure thorough research prior to making any investment decisions. Participation in the securities market carries inherent risks, and it's important to carefully review all associated documents before committing to investments. Please be aware that the attainment of investment objectives is not guaranteed. It's important to note that the past performance of securities and instruments does not reliably predict future performance.