Mastering Swing Trading Timeframes: A Complete Guide for Smart Traders

Overview

Swing trading is the most efficient trading strategy that fills the gap between day trading and long-term investment. Swing traders hold positions on a stock from a few days to few weeks, and take advantage of the short-term price fluctuations. The success of this strategy depends on the right choice of the best trading time frames.

This article provides a comprehensive guide to how to apply swing trading on different timeframes, for both novice and experienced traders.

Fundamentals In Swing Trading

Timeframe – Swing trades are usually applied from a few hours, days up to few weeks but less than a month.

Objective – Swing trading is used to take advantage of short-term price fluctuations.

Benefit – Traders can trade at less time than day trading.

Analysis - Swing trading depends on technical analysis, swing trading patterns in charts and indicators.

Swing Trading Timeframes

Timeframe refers to the specific duration on a chart where a trader makes use of the trade frequency, market news, volume to complete trade.

Categories Of Swing Trading Timeframes

Short Term Timeframe

-

Generally short timeframes like 5 – Minute timeframe, 15 – Minute timeframe up to 1 hour timeframe.

-

This short-term timeframe is best suited for scalpers and intraday traders who make use of small price fluctuations which are highly volatile.

-

Benefit – quick trading opportunities, active trades

-

Caution – highly sensitive to market noise, constant monitoring which may lead to emotional trading, increased costs.

CHART - 15 Minute Timeframe

Medium Term Timeframe

-

Generally medium timeframes like 4-hours timeframe and daily timeframe. 4-hour timeframe lasts up to a period of 1 to 2 weeks and the daily timeframe usually lasts up to 2 to 4 weeks.

-

The medium term timeframe is an ideal swing trading timeframe.

-

Benefit – It provides a clearer view of the price movements with less market noise interference. Does not require continuous monitoring. The 4 hours timeframe offers more frequent trading opportunities.

-

Caution – swing trades are less frequent in daily timeframes and higher chance of false breakouts occur in 4-hour timeframe.

CHART - Daily Timeframe with 50 Day Moving Average

Chart – 4 Hour Timeframe

Long Term Timeframe

-

Long term timeframes can extend for a period of week up to 3 months. A long term timeframe is used to identify macro level market conditions.

-

Benefits – it provides more frequent trading opportunities. Reduced market noise, reduced market volatility, less false breakouts.

-

Caution – since holding a position for a week which may lead to extending up to months which will be disadvantages at times of market downturn.

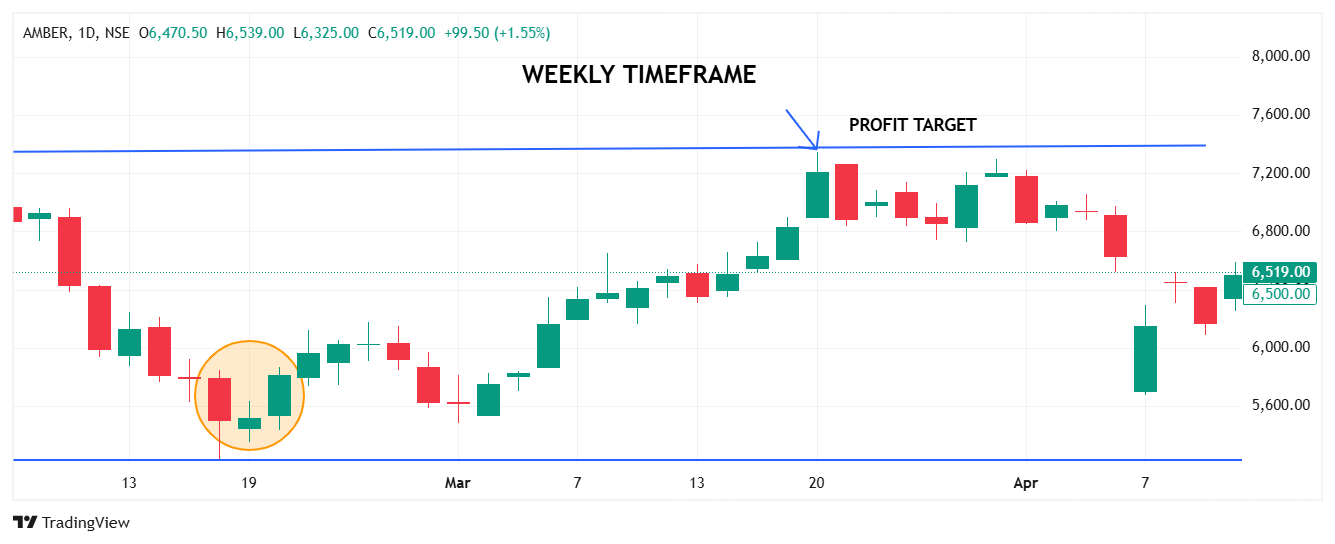

Chart- Weekly Timeframe

Best Timeframe for Swing Trading

The best timeframe for swing trading stocks depends on the trader's trading style, risk tolerance level and the amount of screen time he could spend on swing trading.

The commonly used timeframes for swing trading are

Daily

In the below daily chart, traders can make clear trade with less market noise interference. But the traders have chances of missing short frequent intraday moves.

4 Hours Timeframe

In the below 4-hour timeframe chart, traders can utilize more frequent trading chances in a day but the noise interference will be more.

1 Hour Timeframe

In the below 1-hour swing trading timeframe chart, traders can make frequent trades but the market interference will be too high.

Weekly Timeframe

In the below weekly swing trading timeframe, traders have a clear trend view with less market noise but the frequency of trading chances is too low.

Multi-Timeframe Analysis (MTFA)

In multi timeframe analysis, swing traders analyze trades by utilizing a combination of timeframes to reduce noise, remove false breakouts and confirm trading opportunities. It increases the chances of positive trading.

Benefits – confirmed trend direction, removes false breakouts, optimization of entry and exit.

Conclusion: Trade Smart with the Right Timeframe

Swing trading mastery is not all about identifying swing trading chart patterns—it's about selecting the appropriate timeframe to maximize your strategy and minimize risk. From the frenetic 15-minute charts to the consistent signals from weekly timeframes, every swing trading approach has its own beat. The secret is to match your objectives, monitor time, and risk tolerance with the most fitting timeframe. Furthermore, multi-timeframe analysis can greatly enhance your precision through confluence verification and noise reduction.

Whether a novice or expert trader, having the capability to trade through Enrich Money puts you in touch with advanced charting technology, lag-free execution, and the freedom to study all timeframes with confidence. Get equipped with the proper information, pick your timeframe smartly, and let Enrich Money guide you swing into intelligent, profitable trading.

Frequently Asked Questions

Which time frame is best for swing trading for beginners?

The daily chart is ideal for starters because it offers a good balance between the clarity of trends and less market noise.

Can I use multiple timeframes for swing trading?

Yes, the use of multi-timeframe analysis confirms trends and makes trade more accurate.

Is swing trading ideal for individuals with full-time work?

Yes, since it needs less screen time than intraday trading.

Which timeframe provides more frequent trading opportunities?

The 4-hour and 1-hour time frames give more setups but with higher volatility.

How do I begin swing trading simply?

Create a free Demat account and trade with Enrich Money to get necessary tools and time frames.

Disclaimer: This blog is dedicated exclusively for educational purposes. Please note that the securities and investments mentioned here are provided for informative purposes only and should not be construed as recommendations. Kindly ensure thorough research prior to making any investment decisions. Participation in the securities market carries inherent risks, and it's important to carefully review all associated documents before committing to investments. Please be aware that the attainment of investment objectives is not guaranteed. It's important to note that the past performance of securities and instruments does not reliably predict future performance.