The Road Ahead: Indian Stock Market Predictions for 2024 and Beyond

The Indian stock market in 2024 presents a mix of opportunities and challenges influenced by domestic and global trends. Factors like global geopolitical tensions, shifts in monetary policies, and sector-specific challenges impact market dynamics. Understanding broader economic contexts and key indicators like the 20-day moving average can guide investment decisions. The technology sector faces challenges, while sectors like Realty, Telecom, Healthcare, Power, and Oil & Gas show strength. Observing FIIs' behaviour, monitoring sector performances during earnings season, and staying informed about macro trends and general elections are crucial. Diversifying portfolios and adapting to market changes are key strategies for investors navigating the market landscape.

India in 2024

The year 2024, is marked by elections in 40 countries, starting with Taiwan in January , India in May to the US presidential election at the end of year in November,2024.

These elections would have a major influence on the global GDP with its significant impact in shaping the geopolitical and economic landscape for the decade.

Post elections, there is a possibility of profit making in the Indian Stock Market especially in mid and small cap segments. Whereas large cap segments would be profitable for risk craving investors. Moderate investors can make returns in diversified portfolios.

Over the last three years, small cap segments have thrived in the Indian Stock Market through IPOs and good returns which has put them on par with large cap segments.

Nifty, currently at a fair zone in the Indian Stock Market, is expected to grow at a potential of 8% upside. The Indian stock market sectors like BFSI and IT are major considerations in 2024. It is expected that BFSI would perform well similar to 2023. But the IT sector which has faced a 2-year downtrend , would be largely benefitted by global stability and low interest rates.

Indian stock market performance 2024

The Indian Stock Market is expected to gain by 9% in mid-2024. Amidst general election, the BSE Sensex would undergo corrections, reaching new heights of gain of 19% . Recently , the BSE Sensex has crossed the 73000 mark and has gained by 1% in the year beginning. It is expected that the Indian stock market would perform better and this would add up another 4% in gain of Sensex to 76000 marks by mid-2024.

The Indian Stock Market benchmark index Nifty is also expected to hit 24000 marks in 2024 with the belief that the current government would have a stable, positive global environment, increased FIIs.

Indian stock market performance 2024 chart for Nifty 50 is given below.

Indian Stock Market Crash In 2024

Will Indian stock market crash in 2024? Maybe.

On March 1st,2024, Sensex gained its momentum by 1245.05 points reaching a new high of 73745.35 mark and Nifty remained above 22000 marks at 22338.75 with an increase of 355.95 points. The Indian stock market performance is backed by positive GDP (8.4% in Q3FY2024)and strong performance of Bank Nifty, Steel sector and BFSI sector.

But on 28th February 2024, the Indian Stock Market faced a dip of more than 1% in its indices Nifty & Sensex. Indian Stock Market movements were influenced by easing of US Federal Reserves. Also, the global market was influenced by US decisions, European Stocks fell by 0.1% and MSCI world equity index fell by 0.2%, S&P futures fell by 0.3%, including Wall Street's.

It is advised that this ongoing boom of 2023 may be unsustainable. A 10% fall in Indian stock market conditions would be expected, which might lead to the next Indian stock market crash prediction for 2024.

Future of Indian Stock Market in 2030

Over the past decade, India has undergone fundamental structural reforms which has set the stage for the country and the Indian Stock Market to realize its full potential. Currently, the Indian Stock Market capitalization is of $4.3 trillion ranking fifth in the world, behind US, China, Japan and Hong Kong. It was predicted earlier that India’s GDP will reach $5 trillion by 2027, which would make India the third largest economy in the world , before Japan and Germany.

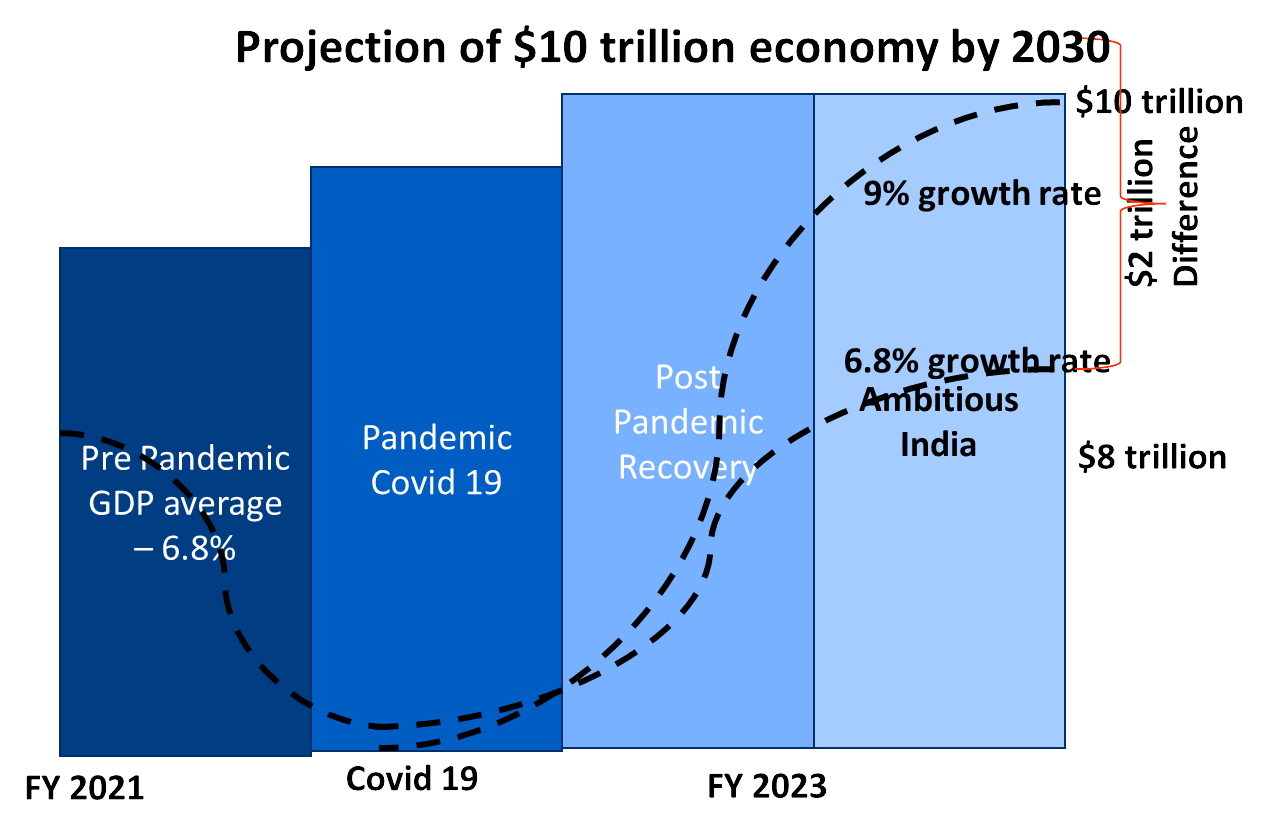

India is still maintaining its status as the fastest growing nation in terms of economy. India’s outlook globally is very optimistic and it’s projected that Indian Stock Market value would be doubled to $10 trillion by 2030, influenced by better capital expenditure cycle, strong earning potential, double digit growth history, increased FDI and FII, increased global rankings etc…

Conclusion

To achieve the $10 trillion value in the Indian Stock Market by 2030, India must maintain an average growth rate of 9% assuming positive geopolitical factors and a stable global and Indian stock market. However, the fact of maintaining a growth rate of 9% seems to be unrealistic. Government post-election, should bring out major reforms like reinvention of demand landscape, accumulation of essential resources, governance that would boost the Indian economy in all sectors.

When faced with challenges, stay steadfast. Begin your investment journey with Enrich Money, our trusted wealth tech partner, offering your free demat account with no annual charges.

Frequently Asked Questions

Where Can I get stock market live updates?

Enrich Money offers real-time updates and insights on the Indian stock market, keeping you informed about the latest developments. Their platform provides comprehensive fundamental analysis, which includes evaluating a company's financial statements, management team, industry position, and other key factors affecting its stock price. Additionally, they offer detailed technical analysis, which involves studying past market data, primarily price and volume, to forecast future price movements. By combining these analytical approaches, Enrich Money helps you make informed decisions about your investments in the Indian stock market.

Where can I find stock market today live chart?

Enrich Money offers a user-friendly platform where you can access live charts for the stock market today. These charts provide real-time data on stock prices, indices, and other market indicators. Additionally, Enrich Money provides detailed analysis and insights to help you understand market trends and make informed investment decisions.

List the factors influencing the Indian stock market in 2024?

The Indian stock market in 2024 is influenced by global geopolitical tensions, shifts in monetary policies, and sector-specific challenges. Understanding broader economic contexts and key indicators like the 20-day moving average can guide investment decisions. While the technology sector faces challenges, sectors like Realty, Telecom, Healthcare, Power, and Oil & Gas show strength.

What are the predictions for the Indian stock market performance in 2024?

The Indian Stock Market is expected to gain by 9% in mid-2024. The BSE Sensex would undergo corrections amidst the general election, reaching new heights of gain at 19%. Nifty is also expected to hit the 24000 marks in 2024. Sectors like BFSI and IT are on major considerations, with BFSI expected to perform well similar to 2023.

What is the outlook for the Indian stock market in 2030?

India's outlook is optimistic, with projections that the Indian Stock Market value would double to $10 trillion by 2030. This growth is influenced by factors like better capital expenditure cycle, strong earning potential, double-digit growth history, increased FDI and FII, and increased global rankings. Achieving this value would require maintaining an average growth rate of 9%.

Disclaimer: This blog is dedicated exclusively for educational purposes. Please note that the securities and investments mentioned here are provided for informative purposes only and should not be construed as recommendations. Kindly ensure thorough research prior to making any investment decisions. Participation in the securities market carries inherent risks, and it's important to carefully review all associated documents before committing to investments. Please be aware that the attainment of investment objectives is not guaranteed. It's important to note that the past performance of securities and instruments does not reliably predict future performance.