Gold Price India 2025: Why Precious Metals Are Becoming Portfolio Essentials for Indian Investors

Introduction: Gold Goes Beyond Tradition

Gold has never been simply a metal in India — it’s a symbol of prosperity, trust, and family security. But in 2025, the relationship with gold has evolved. Gold is not just being worn, it’s being allocated into portfolios.

The phrase “Gold price India 2025” has become one of the most searched topics among Indian investors for a clear reason:

-

Gold prices have touched new highs

-

Silver is gaining equal popularity due to industrial demand

-

Market volatility is making investors seek safety nets

-

ETFs have made metals easier to invest in than ever before

Precious metals are back in the spotlight — and this time, every investor is paying attention.

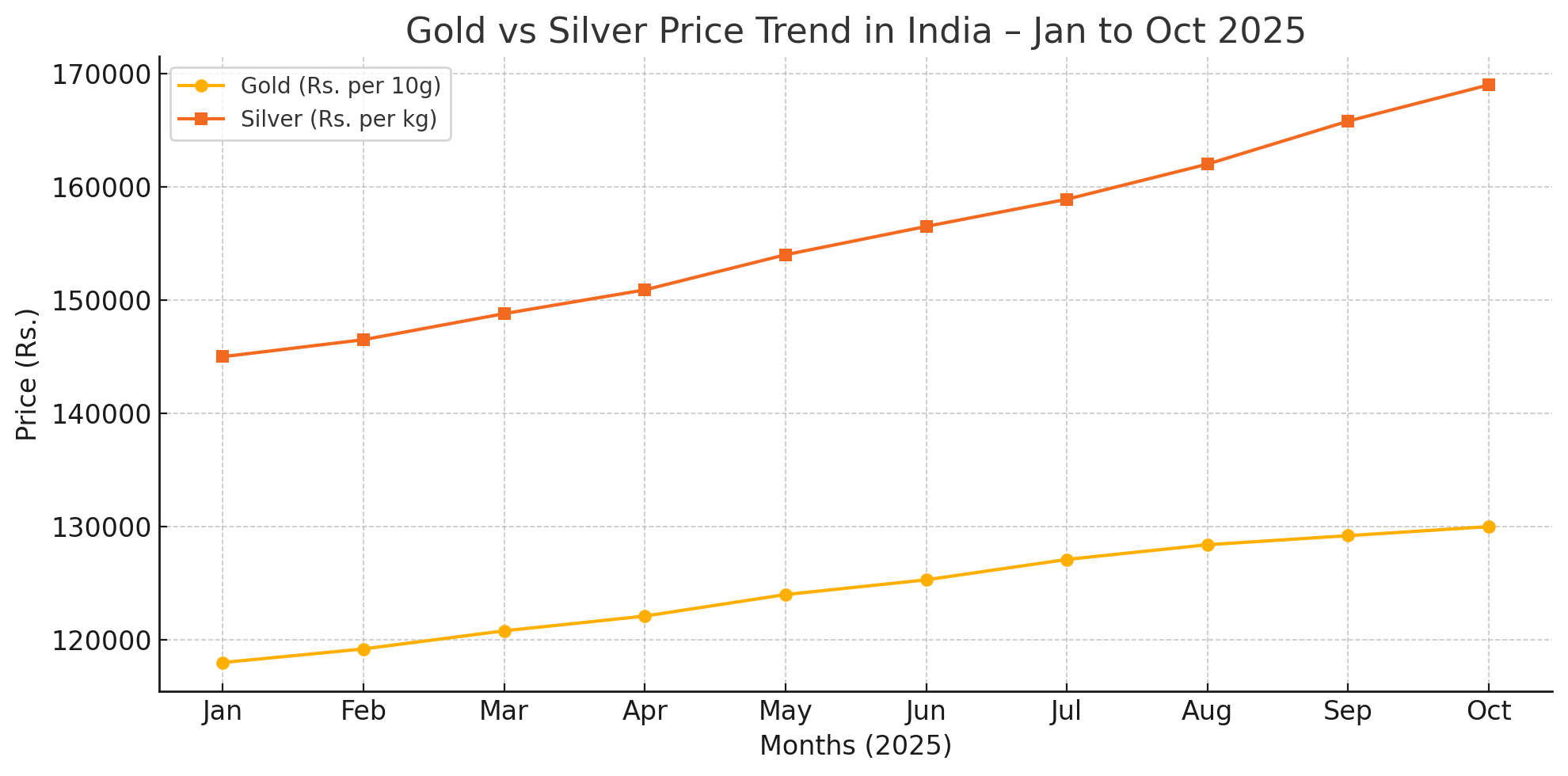

Price Performance: What’s Happening With Gold and Silver?

In 2025, gold prices in India have maintained a strong upward trend. Peaks and minor pullbacks are visible, but the direction remains upward.

Silver is also gaining ground — sometimes delivering faster percentage returns than gold.

What’s Causing This Rally?

Gold = Comfort During Uncertainty

Global markets have been uneasy — and when uncertainty rises, gold demand rises faster.

Gold works as:

-

An inflation hedge

-

A store of value

-

A protector during equity volatility

Investors trust gold when news flows turn unpredictable.

Silver’s Industrial Superpower

Silver isn’t just jewellery — it’s a critical ingredient in:

-

Solar panels

-

Electric vehicles

-

Smartphones and circuits

-

Battery technology

As these industries grow rapidly in India and globally, silver demand surges — and prices follow.

Rupee Trends Boost Domestic Prices

India is not a gold-producing nation.

Metals are imported → a weaker rupee = higher domestic prices (Rs.)

Even if world prices stay flat, the rupee can push gold prices higher in India.

Seasonal and Cultural Strength

India buys gold heavily during:

-

Wedding seasons

-

Dhanteras & Diwali

-

Spiritual ceremonies

Strong cultural demand continues to support price stability and liquidity.

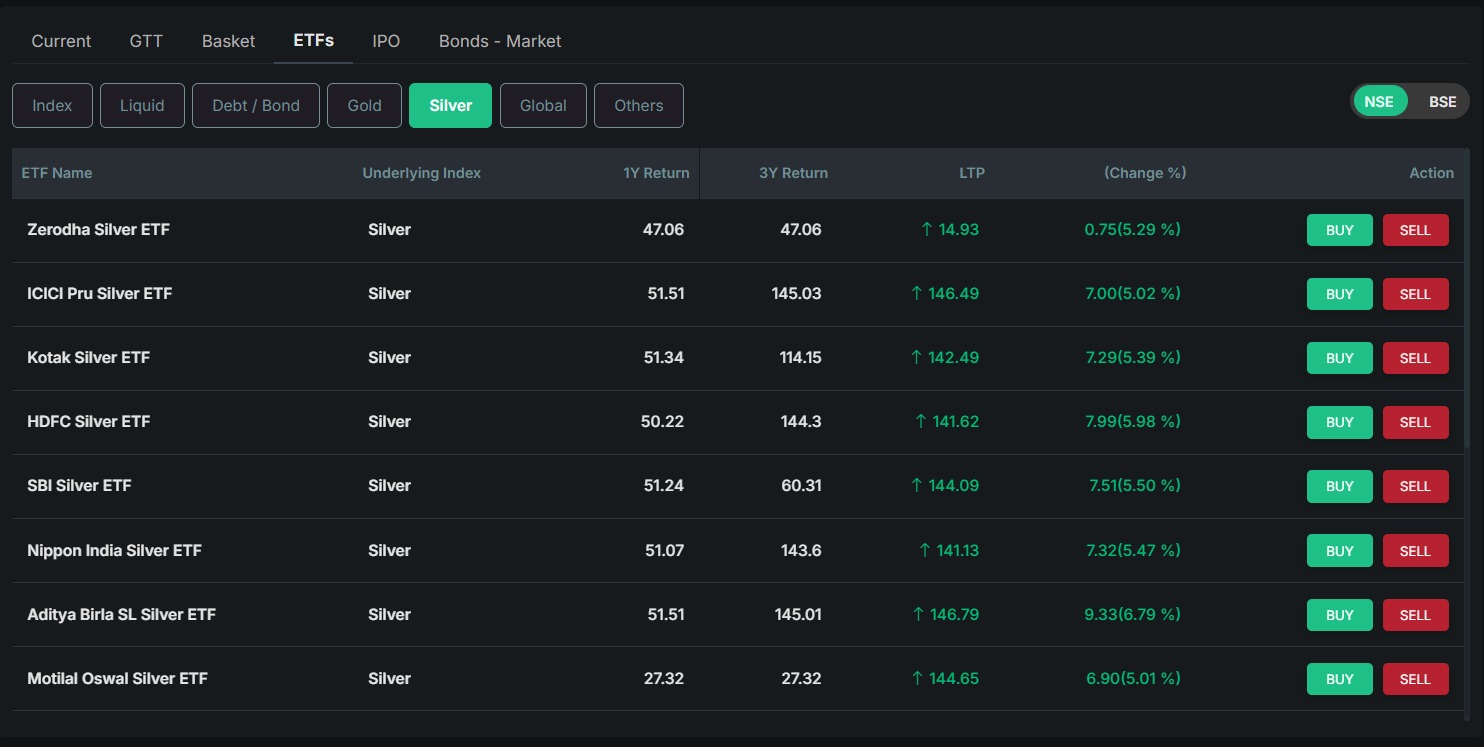

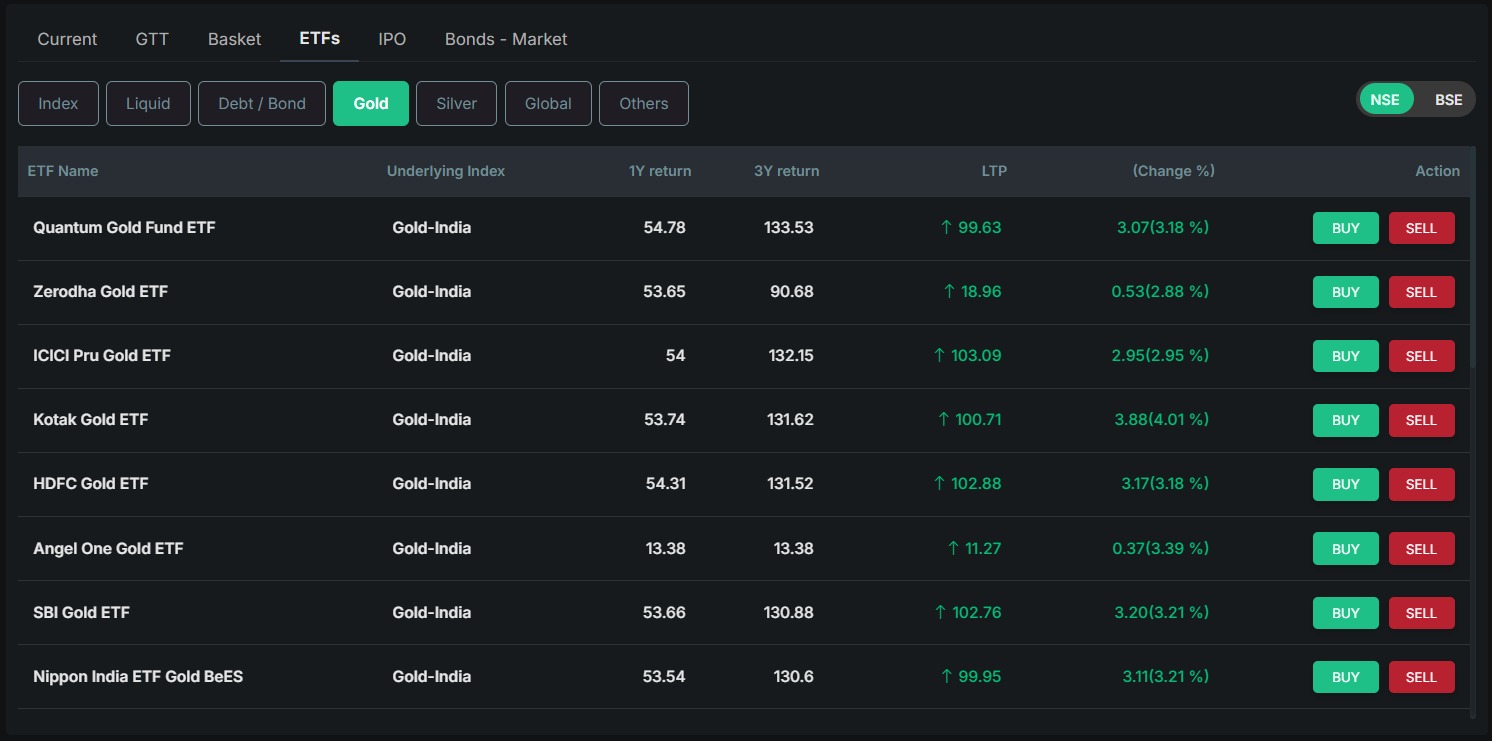

ETFs Making Metals Attractive & Accessible

Thanks to modern investment platforms like ORCA, ETFs allow:

-

Small ticket investing (starting with a few units)

-

Zero storage hassles

-

Transparent price tracking

-

Seamless trading from mobile/desktop

Many Indian investors are buying gold not from jewellers — but from trading apps.

Gold vs Silver: Which One Makes Sense Today?

Both metals play important but different roles.

|

Feature |

Gold |

Silver |

|

Risk |

Low to Moderate |

Moderate to High |

|

Role |

Wealth safety + inflation hedge |

Return booster + industrial demand |

|

Best For |

Long-term wealth protection |

Tactical gains |

|

Returns |

Steady, stable |

Can outperform gold in bull cycles |

|

Ideal Tool |

Gold ETFs, Sovereign Bonds |

Silver ETFs |

Smart Rule for 2025:

Gold protects your wealth.

Silver accelerates your wealth.

A balanced mix unlocks both benefits.

Gold & Silver ETFs — Why They Matter More Now

Gold & Silver ETFs solve investor pain points:

|

Benefit |

What It Means for Investors |

|

No making charges |

More cost-efficient than jewellery |

|

No purity concerns |

Fund directly tracks bullion |

|

Easy liquidity |

Buy/sell anytime through trading app |

|

No storage issue |

Held in DEMAT securely |

|

Transparent pricing |

Matches live market rates |

|

Small unit investing |

Accessible for all investor types |

Explore Gold ETFs & Silver ETFs

This encourages investors to shift from emotion-based gold buying to goal-based gold investing.

How Much Allocation Is Right?

Different investors, different goals.

|

Profile Type |

Allocation Suggestion |

|

New/Conservative Investors |

5% — mostly Gold ETF |

|

Balanced Investors |

7–10% mix of both metals |

|

Aggressive Investors |

10–12% with silver overweight |

Important: Metals are hedge assets, not core growth drivers.

The idea is to reduce risk, not replace equity investing.

Best Investment Strategy: Timing Matters

Gold and silver prices are high right now.

So the strategy should be:

-

Buy in phases (SIP-style)

-

Accumulate on dips

-

Track global events

-

Use alerts on your broking platform

Suggested approach:

-

Gold ETF: 3–5 year holding horizon

-

Silver ETF: 1–2 year tactical horizon, monitor industrial demand

This ensures both wealth security and growth capture.

Risks Every Investor Must Know

Price Correction Risk

After strong runs, short-term pullbacks are common.

Don’t be scared — stay invested with discipline.

Industrial Slowdown Risk

Silver depends heavily on industry cycles.

Slowdowns can create quicker volatility.

Policy & Import Duty Change

Government decisions can alter metal pricing overnight.

Over-Allocation Risk

Too much gold can mean missed stock market returns.

Balance is key.

FAQ

Q1: Is this the right time to buy gold in India?

Yes — but invest gradually. Prices are high. Use systematic buying strategies.

Q2: Should I buy jewellery for investment?

Jewellery is for personal use. If the goal is return — Gold ETF is smarter.

Q3: Is silver worth adding?

Yes, but only as a smaller, higher-growth portion.

Q4: Why choose ETFs over physical gold?

Lower costs, purity guaranteed, liquidity, and seamless tracking.

Q5: How long should I hold gold?

Ideally above 3 years — gold shines brightest over longer cycles.

Conclusion:

Gold and silver remain timeless assets — but the way Indians invest in them has changed.

We’ve moved from buying impulsively during festivals to strategically allocating through investment products.

The core message for Indian investors in 2025:

-

Gold = Preserve wealth

-

Silver = Enhance returns

-

ETFs = Smart access method

As market volatility continues, a thoughtful allocation to precious metals can protect your profits, stabilize your portfolio, and strengthen your financial confidence.

Disclaimer: This blog is dedicated exclusively for educational purposes. Please note that the securities and investments mentioned here are provided for informative purposes only and should not be construed as recommendations. Kindly ensure thorough research prior to making any investment decisions. Participation in the securities market carries inherent risks, and it's important to carefully review all associated documents before committing to investments. Please be aware that the attainment of investment objectives is not guaranteed. It's important to note that the past performance of securities and instruments does not reliably predict future performance.