Impact of Institutional Fund Flows & FII Outflows on Market Volatility

Overview of Market Volatility and Institutional Flows in November 2025

November 2025 has been a month of heightened volatility in Indian equity markets. At the heart of this turbulence is the complex interplay between institutional fund flows mainly FII and DII and changing global and domestic economic dynamics. FIIs, traditionally the major liquidity providers of the Indian market, have turned net sellers in the cash market against the backdrop of global uncertainty and geopolitical tensions. Meanwhile, DIIs played the role of a buoyant force, absorbing part of the selling pressure through steady buying, mainly supported by mutual funds and insurance companies on the back of strong retail SIPs.

This article aims to delve deep into the extent to which market volatility is being influenced by institutional fund flows, particularly the impact of FII outflows. From real-time data to advanced analytics and the powerful features of Enrich Money's ORCA trading app, investors can gain essential insights that will help them understand this volatile landscape more effectively.

Institutional Fund Flow Dynamics in November 2025

FII Outflows: Drivers and Market Impact

The net outflows by Foreign Institutional Investors in the first three weeks of November have surpassed Rs 12,000 crore. Some of the key reasons include:

Global economic uncertainties: Tighter monetary policies from major economies such as the US and Europe have increased risk aversion.

Sectoral reallocation: FIIs are moving toward markets that were beneficiaries of AI and technology re-rating, like the US and South Korea, and thus withdrawing capital from emerging markets temporarily.

Profit booking: After strong gains in the past few quarters, FIIs are booking profits, thereby putting a downward pressure on stock prices.

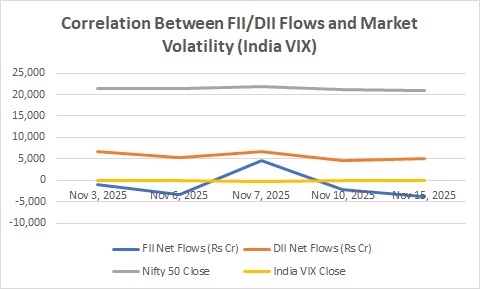

These outflows contributed significantly to intraday price swings, index fluctuations, and a high volatility index (India VIX). On days when FII selling is particularly intense, price action tends to see larger trading ranges and shaken market breadth.

DII Buying: A Stabilizing Force

In contrast, Domestic Institutional Investors, driven by strong retail inflows, have offset around 70% of FII selling through net buying amounting to approximately Rs 9,000 crore. SIPs, which are increasingly gaining traction with retail investors, provide regular capital to mutual funds that account for the majority of DII activity.

This dynamic tussle between selling by FIIs and buying by DIIs has set a backdrop for choppy but range-bound markets with frequent short-lived rallies and corrections.

Detailed Data and Charts

The above image depicts the Correlation Between FII/DII Flows and Market Volatility (India VIX). This image depicts the sharp inverse correlation: market dips aligned with FII outflows and the VIX spike

Market Sentiment and Sectoral Impact

The ongoing tussle between the institutional flows leads to sector-specific reallocations:

-

The financials and IT sectors remain firm due to domestic inflows and positive earnings.

-

Metal, commodity, and cyclical sectors are under pressure as FIIs reduce exposure amidst global uncertainty.

-

Defensive sectors, such as FMCG and pharmaceuticals, emerge resilient against all odds-on better demand and continued DII buying.

Traders following ORCA's AI Strategy Mode can take advantage of those sectoral shifts with automated, context-sensitive portfolio adjustments and options strategies.

Trading Strategy Considerations Using ORCA

Trade Mode: Ideal for discretionary traders who need to react quickly to volatile news and flow data.

Scalper Mode: Best for capitalizing on short-term price fluctuations caused by institutional moves.

AI Option Strategy Builder: Allows immediate access to 37 pre-built strategies to align trades with either a bullish, bearish, neutral, or sideways marketplace, triggered by fund flow-driven volatility.

Real-time data of FII/DII flow, integrated on ORCA, streamlines decision-making by alerting traders to institutional buying or sell momentum, thereby enhancing precision and risk management.

Institutional Fund Flows and How to Navigate Volatility

November 2025 has been a perfect example of how the game of FII outflows versus DII inflows impacts volatility in Indian markets. While the cautious stance of FIIs amid global uncertainty results in sharp market moves, the relentless buying by DIIs tempers a sell-off in expectations and largely stabilizes the market.

Investors who can use such advanced trading platforms as Enrich Money's ORCA, driven by AI-powered strategies and real-time tracking of institutional flow, will enjoy a competitive edge. The upside to all this is dynamic adaptability, harnessing volatility, and the reduction of risk through informed tactical positioning.

As India's capital markets mature, an understanding of the pulse of institutional fund flows becomes an important touchstone in building resilient investment portfolios for thriving amidst volatility.

Frequently Asked Questions

What triggered the major FII outflows in November 2025?

Global monetary tightening and portfolio realignments brought down exposure of FIIs in Indian equities.

How are domestic institutional investors influencing the market?

DIIs act as net buyers and stabilize markets by absorbing selling pressure from FIIs.

Why is the market volatility high despite DII buying support?

Large and sporadic FII sell-offs create spikes of volatility despite steady DII demand.

How can traders use Enrich Money's ORCA to navigate these trends?

ORCA provides AI-driven strategies and real flow alerts to align trades with institutional buying and selling.

Which sectors are most affected by institutional fund flow dynamics?

While DIIs support financials and IT sectors, FII selling weighs on metals and cyclicals.

The following research-based analysis furnishes investors and traders with critical insights related to institutional fund flows, shaping India's market volatility in November 2025. This will aid them in strategizing effectively toward better investments with platforms like ORCA.

Disclaimer: This blog is dedicated exclusively for educational purposes. Please note that the securities and investments mentioned here are provided for informative purposes only and should not be construed as recommendations. Kindly ensure thorough research prior to making any investment decisions. Participation in the securities market carries inherent risks, and it's important to carefully review all associated documents before committing to investments. Please be aware that the attainment of investment objectives is not guaranteed. It's important to note that the past performance of securities and instruments does not reliably predict future performance.