Investing in Defence: Comparing Stocks in the Nifty India Defence Index in 2025

Strategic Significance and Industry Overview

India's defence production industry has huge strategic importance as a central part of the nation's national security establishment. With its position as the world's fourth-largest military power in terms of firepower, India is making its defence establishments stronger with intensifying security threats and border conflicts. The most visible segments of the industry are military aircraft, warships for the navy, and sophisticated missile systems.

Production Growth, Export Momentum, and Future Targets

India achieved its highest-ever annual defense production in FY24, with an increase of 16.7% year over year to around ?1.27 lakh crore (US$15.34 billion). Based on figures made public in March 2025, indigenous production currently provides 65% of the country's total defence equipment. Defence exports rose by 32.5% in FY24, reaching ?21,000 crore. Exports during Calendar Year 2024 crossed Rs.21,000 crore (US$2.43 billion), with Indian defence products finding homes in more than 75 foreign markets.

Some of the significant deals are a Rs.3,800 crore (US$440.3 million) order for BrahMos missiles to Indonesia (February 2025) and a subsequent consignment to the Philippines (April 2025). The government plans to increase defence exports to Rs.50,000 crore (US$5.8 billion) by 2029.

Policy Reforms and Push for Indigenous Production

To cut back on imports, the government keeps promoting the 'Make in India' drive through focused policy efforts. Defence was allocated Rs.6.81 lakh crore (US$78.7 billion) in the Union Budget 2025–26, with Rs.1.80 lakh crore (US$20.8 billion) allocated solely for capital expenditure.

Indigenization is facilitated by sites such as the SRIJAN portal and the Positive Indigenisation Lists, with a focus on locally produced components. The ADITI (Acing Development of Innovative Technologies with iDEX) program has also been initiated to boost defence tech innovation, with specific funds for Indian company and startup procurement. Foreign procurement reliance has declined gradually over the last four years.

Investments and Technological Milestones

The Indian defence industry has seen high-profile investments and collaborations. Rolls-Royce intends to develop its Indian supply chain network, while JSW Defence and TechEagle are poised to invest in the manufacture of drones. A major milestone was reached in October 2024 with the opening of India's first privately owned Final Assembly Line for military aircraft — the Tata C-295 facility.

At the cutting-edge is the successful induction of a Green Propulsion System under the Technology Development Fund (TDF). Furthermore, Defence Industrial Corridors in Tamil Nadu and Uttar Pradesh are increasingly attracting new investments.

Outlook and Emerging Opportunities

Forward-looking, the Indian defence industry presents strong opportunities in the key segments — aerospace (US$50 billion), ship-building (US$38 billion), and missile/artillery systems (US$21 billion). The roadmap of the government lists achieving US$34.7 billion of annual defence manufacturing by FY29 and 70% indigenous armament production by 2027.

Liberalized FDI guidelines and aggressive private sector participation are likely to spur sectoral development. From May 2025 onwards, India will launch 52 reconnaissance satellites within five years to augment space-based intelligence. In all, the country's domestic industry can gain from contracts of about Rs.4 lakh crore (US$57.2 billion) in the next 5–7 years.

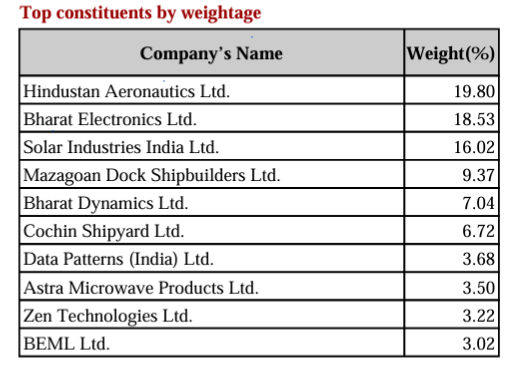

Nifty India Defence Stocks

Nifty India Defence index forms a constituent of Nifty's Equity Thematic index. This Nifty India Defence index assists in tracking the defence stock performance. The weightage for the Nifty India Defence stock index is on free float market capitalization method with defence stock weightage of 20% on its market capitalization. Nifty India Defence stock index was introduced on 19th January, 2022 with base date being 2nd April, 2018 with a base value of 1000. The index may comprise stocks of approximately 10 to 30. The index constituents are currently 18 in number. Semi-annual basis reconstitution of the index constituents is done side by side with Nifty Broad-based indices. Nifty India Defence index can be used for benchmarking, index fund launch, Equity Traded Funds and for structural products.

Eligibility of Nifty India Defence Index

• This Nifty India Defence index constitutes shares of companies which derive revenues of approximately 10% from the defence sector and on an average six-month free float market capitalization.

• The stocks that are part of Nifty Total Market are considered for Nifty India Defence index at review time.

• Those companies that come under the industry category of basic industries or as part of SIFM with 10% defence revenue are part of Nifty India Defence index.

Performance Comparison of Nifty India Defence Sector Index

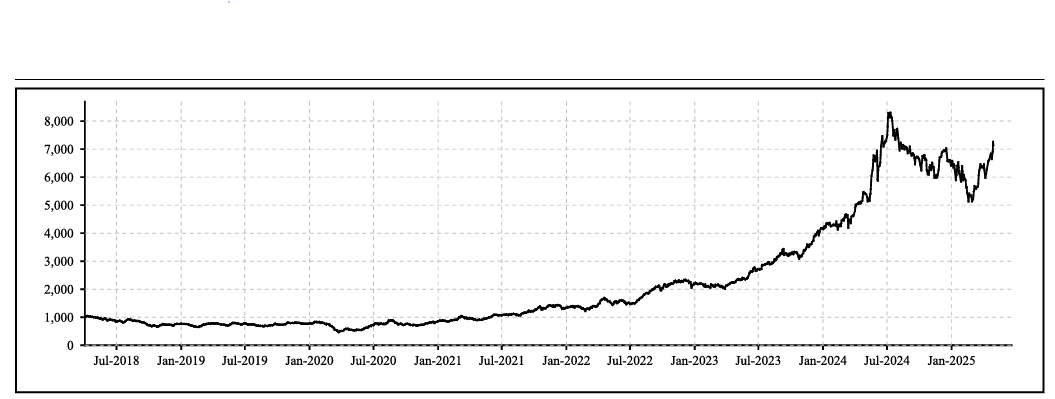

Nifty India Defence index shares have given a total return of 32.80% over a period of 1 year. The 1-year price return stands at 32.03%. The total price return quarter to date was 11.49 % and year to date was 9.78%

Historical Price Analysis of Nifty India Defence Index

Price to equity ratio is 52.35 and price to book ratio is 12.54. Nifty India Defence index has provided a dividend yield of 0.5%.

The price to equity ratio is 52.35 and price to book ratio is 12.54. The Nifty India Defence index has delivered a dividend yield of 0.5%.

Defense Sector Stocks Analysis – as on May 22, 2025

To analyze the Nifty India Defence index stocks, let’s consider five of the performing Nifty India Defence Index stocks for comparative analysis.

Discover Enrich Money's digital investing platform and take your financial future into your own hands. Sign up for a free demat trading account today with Enrich Money, your trusted partner in wealth tech management.

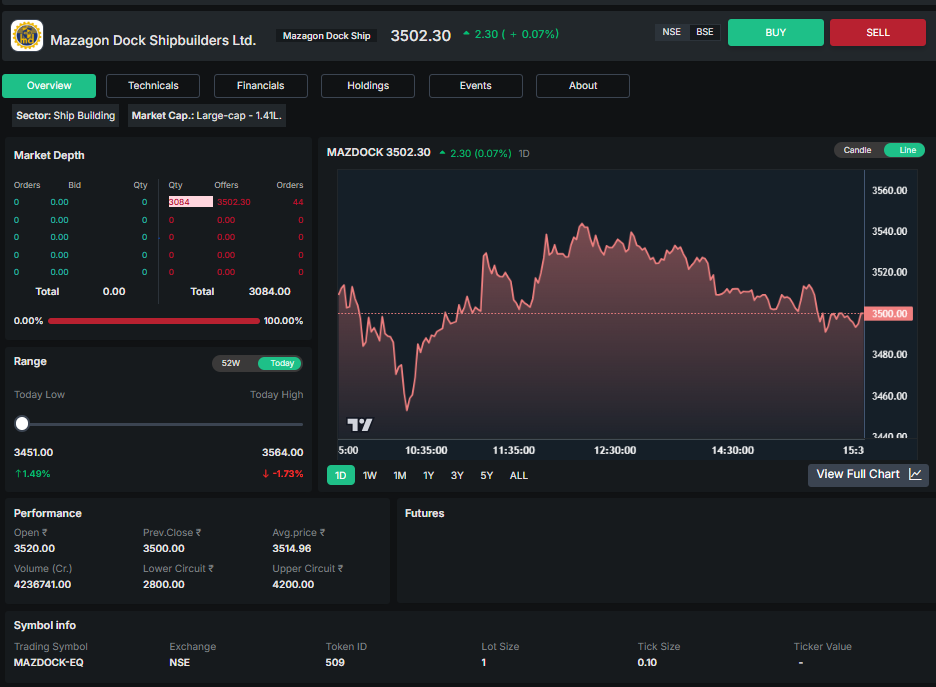

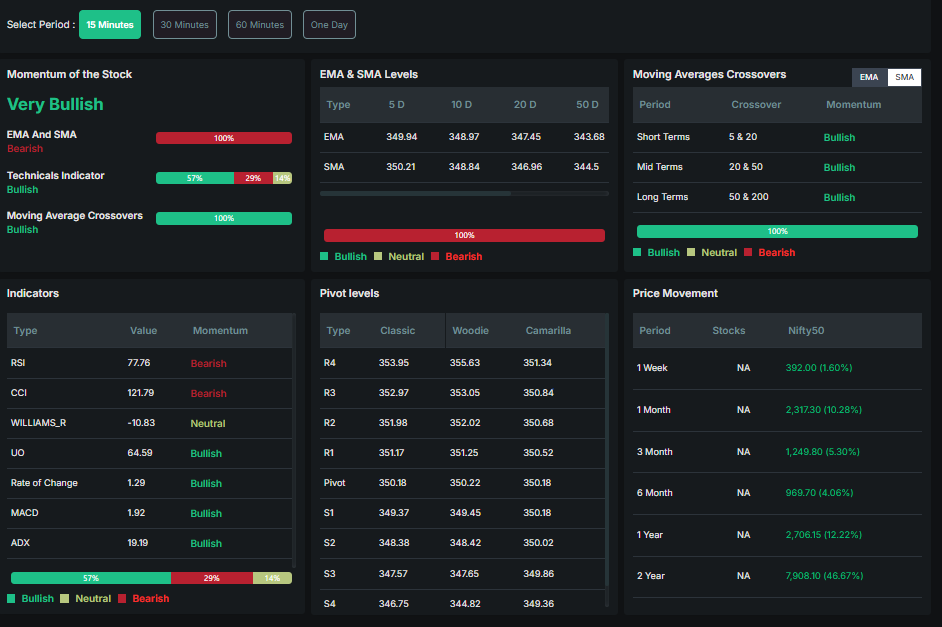

Mazagon Dock Shipbuilders Ltd

Mazagon Dock is India's leading naval shipbuilder with specialization in submarines and warships for the Indian Navy. The state-run business is based out of Mumbai and has forged alliances with global defense contractors. The firm is at the forefront of India's naval modernization program, producing sophisticated submarines such as Scorpene-class ships and indigenous destroyers.

Garden Reach Shipbuilders & Engineers Ltd

Garden Reach Shipbuilders is an Indian shipyard with expertise in naval ships and commercial vessels. It is headquartered in Kolkata and produces frigates, corvettes, and patrol vessels for the Indian Navy and Coast Guard. GRSE has diversified into engineering consultancy services and ship repair, banking on years of shipbuilding experience for local and export markets.

Zen Technologies Ltd

Zen Technologies is a defense tech firm that specializes in simulators and training systems for the military. The Hyderabad company manufactures combat simulation trainers, electronic warfare systems, and drone counters. With increased emphasis on locally manufacturing defense equipment, Zen has been awarded contracts for simulator systems and venturing into counter-UAV technologies for the military space.

Bharat Electronics Ltd

Bharat Electronics is the country's biggest defense electronics producer, manufacturing radars, communication systems, and electronic warfare gear. The Navratna PSU has various plants throughout India for defense, aerospace, and civilian customers. BEL sells surveillance systems, sonar systems, and satellite communications devices, and it is central to India's defense electronics industry.

Cochin Shipyard Ltd

Cochin Shipyard is India's biggest shipbuilding and repair center, making commercial and naval ships. Based in Kerala, the firm manufactures aircraft carriers, destroyers, and merchant ships and provides repair services. CSL has executed landmark projects such as India's first indigenous aircraft carrier and has substantial orderbook from Indian Navy and global customers.

Market Data

|

Company Name |

Current Price (Rs) as on 22nd May 2025 |

% Change |

Price Change |

Market Cap (Rs Cr) |

52 Week High (Rs) |

52 Week Low (Rs) |

PE TTM |

|

3,500 |

2.60% |

88.5 |

1,41,183 |

3,733 |

1,200 |

50.02 |

|

|

2,756 |

10.20% |

256 |

31,573 |

2,834 |

1,093 |

54.31 |

|

|

1,889 |

0.38% |

7.1 |

17,054 |

2,627 |

893.95 |

60.63 |

|

|

383.4 |

0.11% |

0.4 |

2,80,257 |

386.75 |

230 |

52.61 |

|

|

1,904 |

3.54% |

65 |

50,085 |

2,979 |

1,180 |

58.47 |

Market Data Analysis

The defense industry exhibits divergent performance on May 22, 2025, with Garden Reach Shipbuilders at the lead with 10.20% gains (+Rs.256), possibly due to contract releases or good performances. Cochin Shipyard and Mazagon Dock trail with 3.54% and 2.60% gains respectively, while Bharat Electronics is flat and Zen Technologies exhibits low 0.38% growth.

Valuations look stretched in the industry, with PE multiples varying between 50-61x. Mazagon Dock is priced at the lowest of 50.02x, while Zen Technologies has the highest premium tag of 60.63x, which is characteristic of defence-tech firms. Garden Reach (54.31x) and Cochin Shipyard (58.47x) demonstrate high growth expectations.

Price performance analysis reveals that most stocks at or near 52-week highs, reflecting continued interest by investors. Mazagon Dock and Garden Reach are near recent highs, while Zen Technologies has more upside potential with a 28% discount to its Rs.2,627 high.

The industry derives advantage from India's higher defense outlays, "Make in India" programs, and global trends in defense modernization. Nevertheless, high valuations demand caution with due monitoring of order book realization and margin resilience in the face of inflationary pressure. Players with good execution skills and diversified top lines should be the investors' focus.

Financial Data Analysis

|

Stock Name |

1M Returns |

1Y Returns |

YTD Returns |

Divid end Yield % |

ROE % |

ROCE % |

|

27.02% |

143.18% |

0.72% |

0.42% |

35.20% |

44.20% |

|

|

58.94% |

131.11% |

2.08% |

0.34% |

28.10% |

37.30% |

|

|

29.37% |

87.05% |

1.41% |

0.05% |

26.10% |

36.70% |

|

|

26.39% |

35.19% |

0.26% |

0.57% |

29.30% |

39.00% |

|

|

27.87% |

16.56% |

1.84% |

0.51% |

15.80% |

20.10% |

Mazagon Dock: Outstanding 143.18% annual returns with high ROE (35.20%) and ROCE (44.20%). Steep profit growth acceleration from 29% to 72% indicating operational leverage. Debt-free with low dividend yield (0.42%).

Garden Reach: Excellent momentum with 58.94% monthly returns and 131.11% annual returns. Healthy ROE (28.10%) and stable profit growth (26% to 54%). High liquidity with 1.56 crore shares volume.

Zen Technologies: Explosive growth pattern with 411% profit growth in 3 years. Solid ROE (26.10%) even with low dividend (0.05%). Symbolizes emerging defense-tech sector opportunity with high volatility.

Bharat Electronics: Consistent performer with 35.19% return per year and highest dividend yield (0.57%). Solid ROE (29.30%) with huge liquidity (4.35 crore volume). Suitable for conservative investors.

Cochin Shipyard: With regard to deceleration with profit growth falling from 28% to 4%. Subpar ROE (15.80%) shows operational issues. Value opportunity potential needing turnaround.

Final Analysis

Garden Reach is in the lead among momentum plays, Mazagon provides balanced growth, Zen gives tech exposure, Bharat provides stability, and Cochin is a value opportunity. All are debt-free, which aids India's growing defense industry.

Conclusion

India's defence industry offers attractive investment prospects due to strong policy backing, rising domestic production goals, and significant export expansion potential. The components of the Nifty India Defence Index exhibit a range of risk-return profiles, from the defensive stability of Bharat Electronics to the momentum leadership of Garden Reach. The sector's foundations are still solid, with defence production expected to reach Rs.1.27 lakh crore in FY24 and export goals of Rs.50,000 crore by 2029. High valuations, however, necessitate careful stock selection based on operational effectiveness, order book quality, and execution skills. While taking advantage of India's strategic shift toward defence self-reliance and international market expansion, investors should match their decisions with their risk tolerance.

Frequently Asked Questions

How many stocks are included in the Nifty India Defence Index and what is it?

Currently comprising 18 constituent companies with market cap-based weightings, the Nifty India Defence Index is a thematic equity index that tracks the performance of defence stocks.

What are India's goals for defence exports and production in the upcoming years?

By 2029, India wants to export defence goods worth ?50,000 crore. By 2027, it wants to produce 70% of its own weapons, with yearly manufacturing reaching US$34.7 billion by FY29.

At the moment, which defensive stock has the best momentum performance?

With outstanding 58.94% monthly returns and 131.11% annual gains, Garden Reach Shipbuilders is the industry's top momentum play.

Based on PE ratios, what is the current range of defence stock values?

With Mazagon Dock at the lowest (50.02x) and Zen Technologies at the highest (60.63x), defence stocks trade at elevated PE ratios between 50 and 61x.

For conservative investors looking for stability, which defence stock is best?

With steady yearly returns of 35.19%, the highest dividend yield of 0.57%, and enormous liquidity of 4.35 crore shares, Bharat Electronics provides the best stability.

Disclaimer: This blog is dedicated exclusively for educational purposes. Please note that the securities and investments mentioned here are provided for informative purposes only and should not be construed as recommendations. Kindly ensure thorough research prior to making any investment decisions. Participation in the securities market carries inherent risks, and it's important to carefully review all associated documents before committing to investments. Please be aware that the attainment of investment objectives is not guaranteed. It's important to note that the past performance of securities and instruments does not reliably predict future performance.