Battle of the Gaming Stocks: Comparative Analysis of Market Leaders

Gaming Industry in India

The Indian Gaming Industry is expanding exponentially from a traditional game to an online global market player with 9.5 billion gaming app downloads and 568 million gamers . Currently, the Indian gaming industry is just 1% of the global market with revenue generation of USD 1.5 billion. It is forecasted that the gaming industry revenue will reach USD 5 billion by 2025 and USD 7.24 billion by 2029 with a compounded annual growth rate of 38% in the next five years.

Government Initiatives and Investment Opportunities

The government of India has made amendments to IT Rules ,2021 and set up an AVGC (Animation, Visual Effects, Gaming and Comics) promotion task force to regulate, protect and support the gaming industry in India. In addition, the government of India has allowed 100% FDI in the gaming sector by both domestic and international investors.

Gaming Company Stocks in India

The niche gaming market in India, is a great opportunity for investors to invest in. But the challenge lies in identifying the top gaming stocks. Enrich Money, presents you the list of best gaming stocks in India in 2024. In this article, Enrich Money , analyses the three of the gaming stocks with strong fundamentals and offers investors with valuable insights to make a well-informed decision on investment in Gaming market in India.

Let’s analyze the three gaming stocks from the above list.

Experience the strength of Enrich Money's cutting-edge digital investment platform. Begin your path to financial success with a free demat trading account, backed by Enrich Money's expertise in wealth technology management

Intraday Price Comparative Analysis

|

Stock Name (as of 26th July, 2024) |

Nazara Technologies |

Zensar Technologies |

Delta Corp |

|

Open (INR) |

Rs.928.35 |

Rs.773.60 |

Rs.133.10 |

|

High (INR) |

Rs.928.35 |

Rs.826 |

Rs.137.28 |

|

Low (INR) |

Rs.900.95 |

Rs.773.60 |

Rs.132.75 |

|

Last Traded Price (INR) |

Rs.905.15 |

Rs.808.85 |

Rs.133.91 |

|

Volume |

171185 |

4148620 |

2366061 |

|

Previous Close (INR) |

Rs.911.75 |

Rs.773.60 |

Rs.132.26 |

As on 26th July, 2024, Nazara Technologies, Zensar Technologies, and Delta Corp exhibits mixed performance. Zensar technologies was traded on high trading volume and price fluctuations among the three.

Chart Analysis

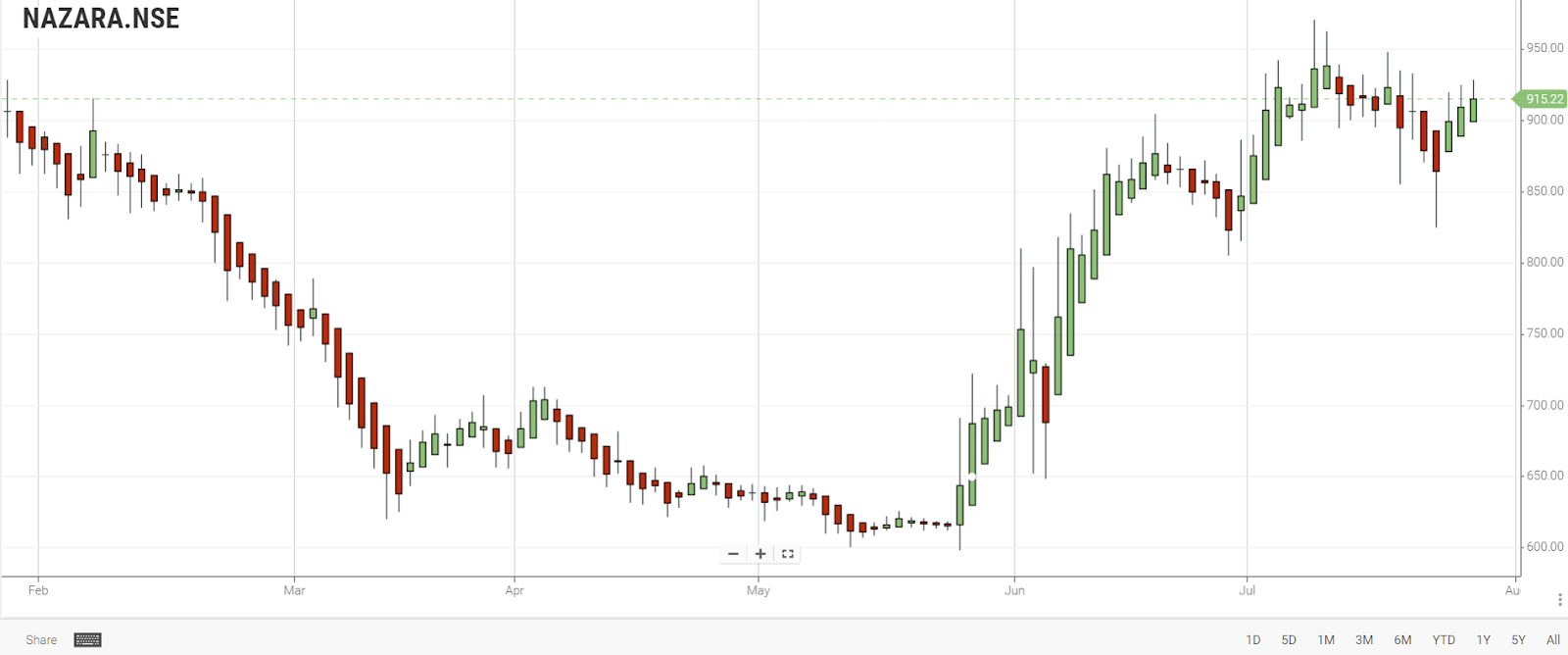

Nazara Technologies Limited

Nazara Technologies Limited, operates in the business of gaming and sports media in India. The company’s diverse business portfolio includes mobile games, eSports content and interactive entertainment. Nazara Technologies with its strong base in the digital entertainment sector provides its services to clients globally.

The Bullish Initiation Heikin Ashi Pattern is observed on monthly charts. The Bullish Continuation Heikin Ashi Pattern is observed on daily charts. Bearish tick from green to red is observed on weekly charts.

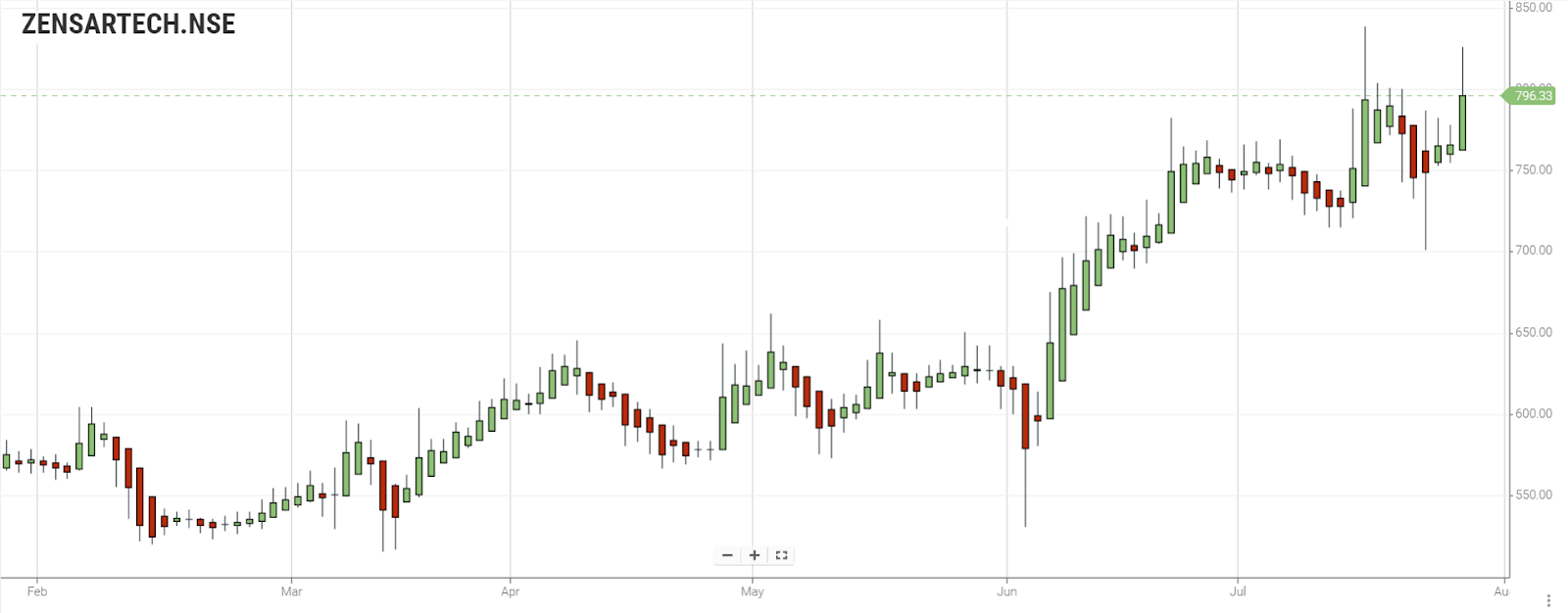

Zensar Technologies Limited

Zensar Technologies Limited, operates in the business of IT consulting, software development, BPM and digital solutions with its headquarters at Pune, India. It offers digital transformation services to banking, retail, manufacturing and healthcare sectors globally.

The Bullish Initiation Heikin Ashi Pattern is observed on monthly and daily charts. Bullish pattern with high volume is observed on weekly charts.

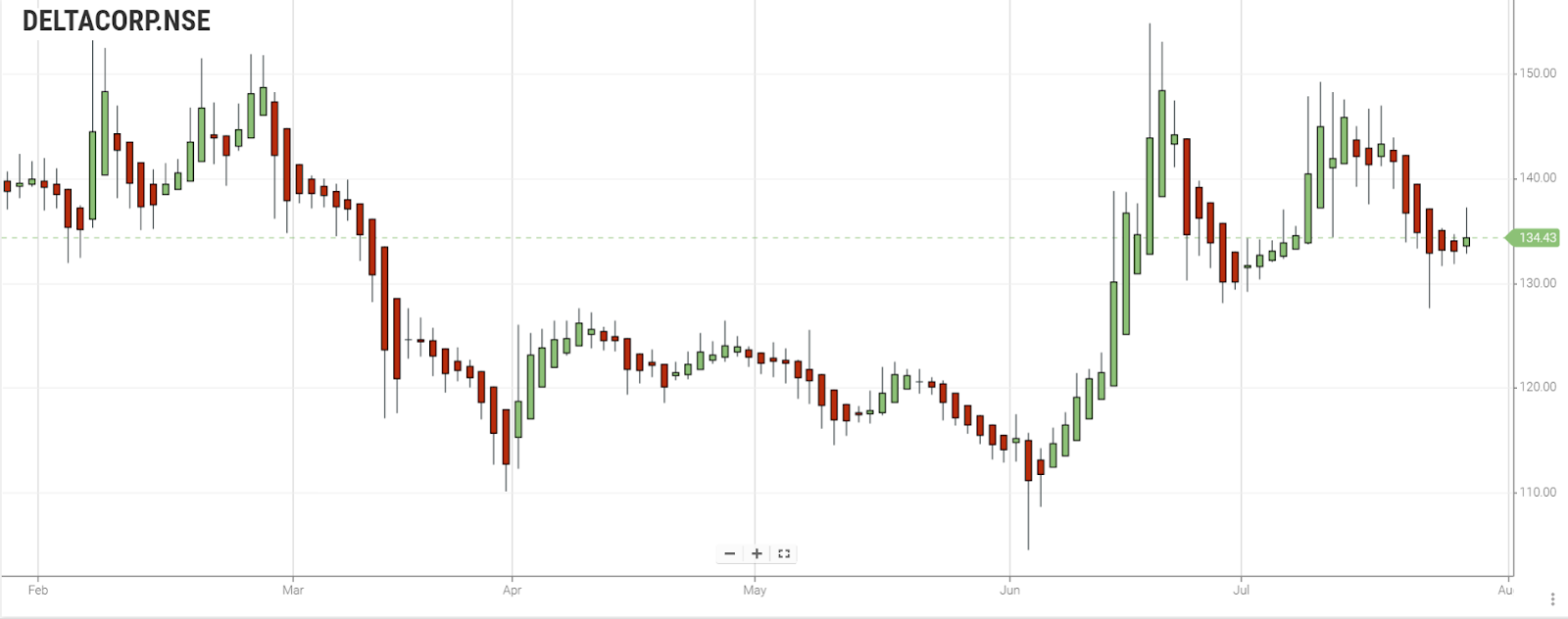

Delta Corp Limited

Delta Corp Limited has operated in the business casinos (Goa and Sikkim), online gaming (through its subsidiary Adda52) and hospitality services since 1990.

The Bullish Initiation Heikin Ashi Pattern is observed on monthly charts.

Bullish tick from red to green is observed on daily charts.

The Bullish Initiation Heikin Ashi Pattern is observed on weekly charts.

To summarize,

Bullish pattern is observed on Nazara Technologies monthly and daily charts but the weekly trend is bearish. Whereas bullish pattern is observed on Zensar Technologies and Delta Corp across all time frames.

Fundamental Analysis

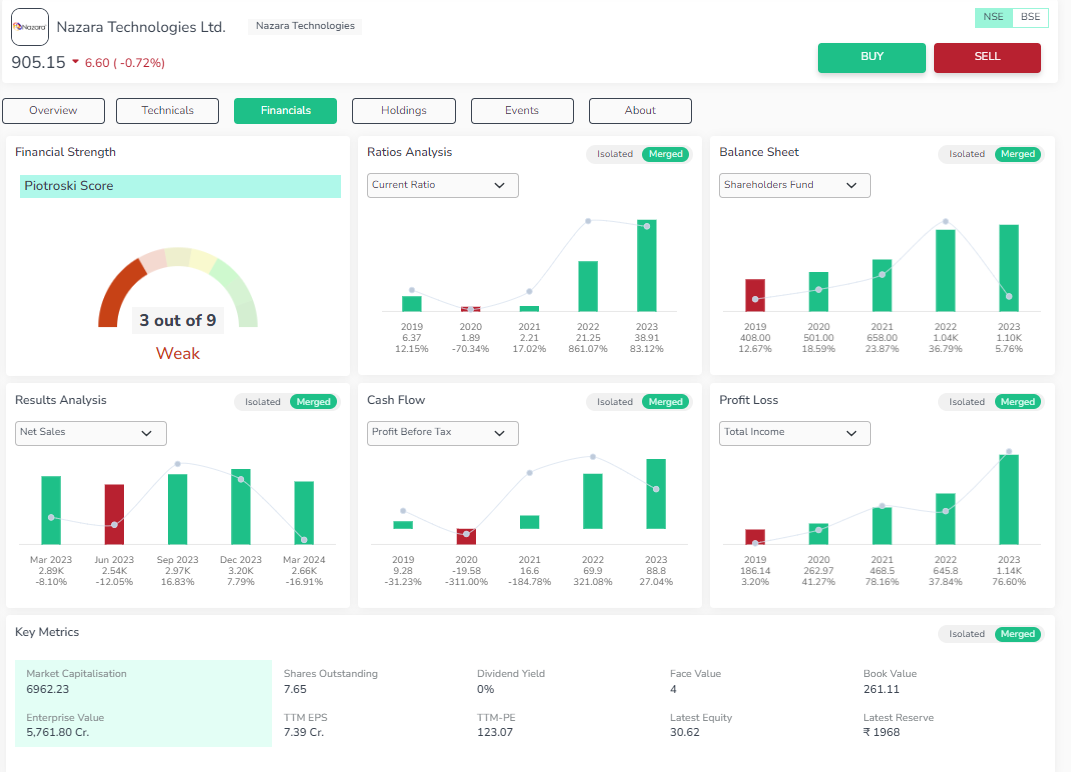

Nazara Technologies Limited

Valuation – On analysis, the book value of the share indicates that it's overpriced.

Profitability – On analysis, the company has made good returns in net profit and EBITDA continuously in the last three years , But the yield on dividend is less, along with weak RoE and RoA.

Growth – On analysis, the company has made a positive impact on its annual sales and total assets continuously in the last three years.

Stability – On analysis, the company has maintained excellent liquidity and is working towards getting debt free.

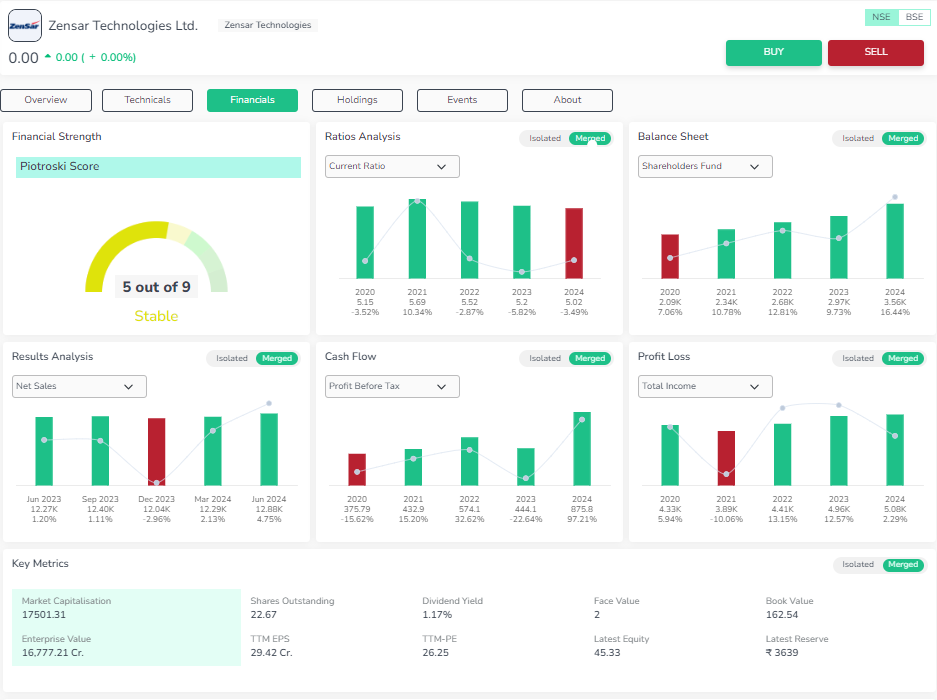

Zensar Technologies Limited

Valuation – On analysis, though the book value of the share is increasing, still the price to book ratio indicates that the stock is overpriced.

Profitability – On analysis, the company has made good returns in net profit , EBITDA , annual net profit, RoCE, net margin and RoE . But the dividend and earnings yield are low.

Growth – On analysis, the company has made a positive impact on its annual and quarterly sales and total assets continuously in the last three years.

Stability – On analysis, the company has maintained excellent liquidity and has high revenue with debt getting decreased.

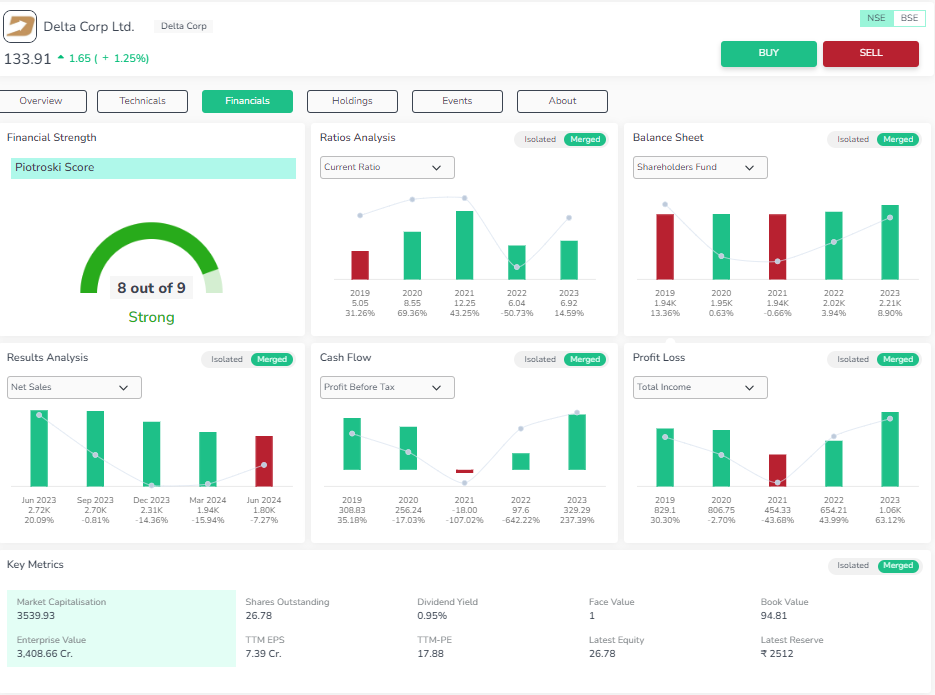

Delta Corp Limited

Valuation – On analysis, though the book value of the share is increasing and the price to book ratio indicates that the stock is underpriced.

Profitability – On analysis, the company has made good returns in net margin and EBITDA. Whereas the company has low EPS, low dividend and earning yield.

Growth – On analysis, the company has made a positive impact on total assets but the sales are decreasing .

Stability – On analysis, the company has poor liquidity and debt.

To summarize,

Nazara Technologies: Overpriced with weak RoE and RoA, but strong sales growth and liquidity.

Zensar Technologies: Overpriced, yet strong profitability and growth, with decreasing debt.

Delta Corp: Underpriced, good profitability, but declining sales and poor liquidity.

Technical Analysis

Gain comprehensive insights into stock performance with the Orca app. Instantly access detailed technical and fundamental analysis. Download Now!

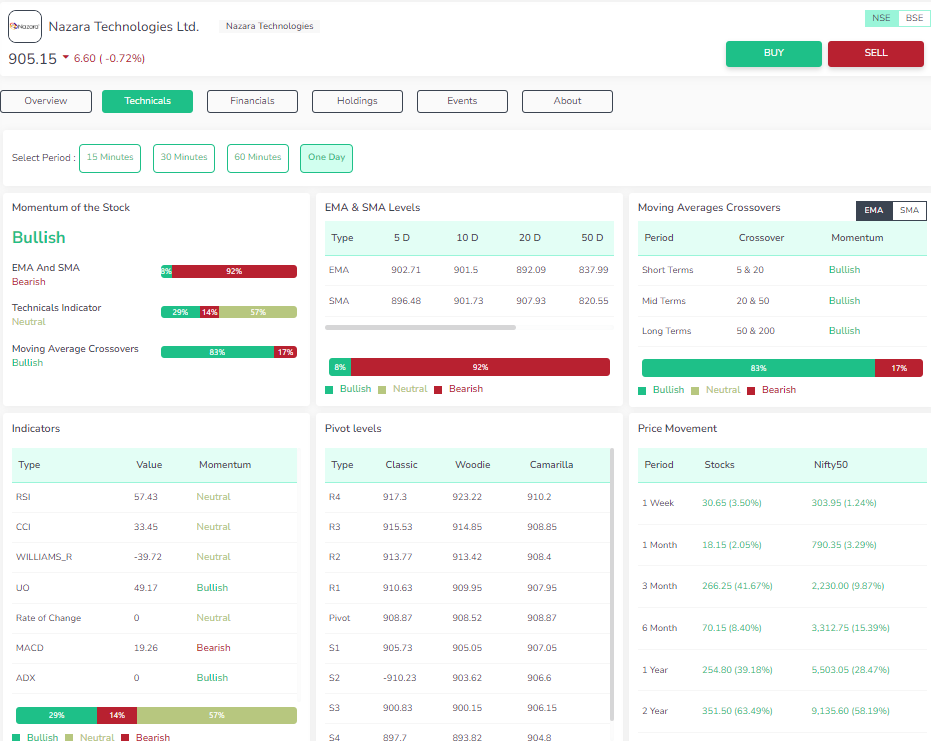

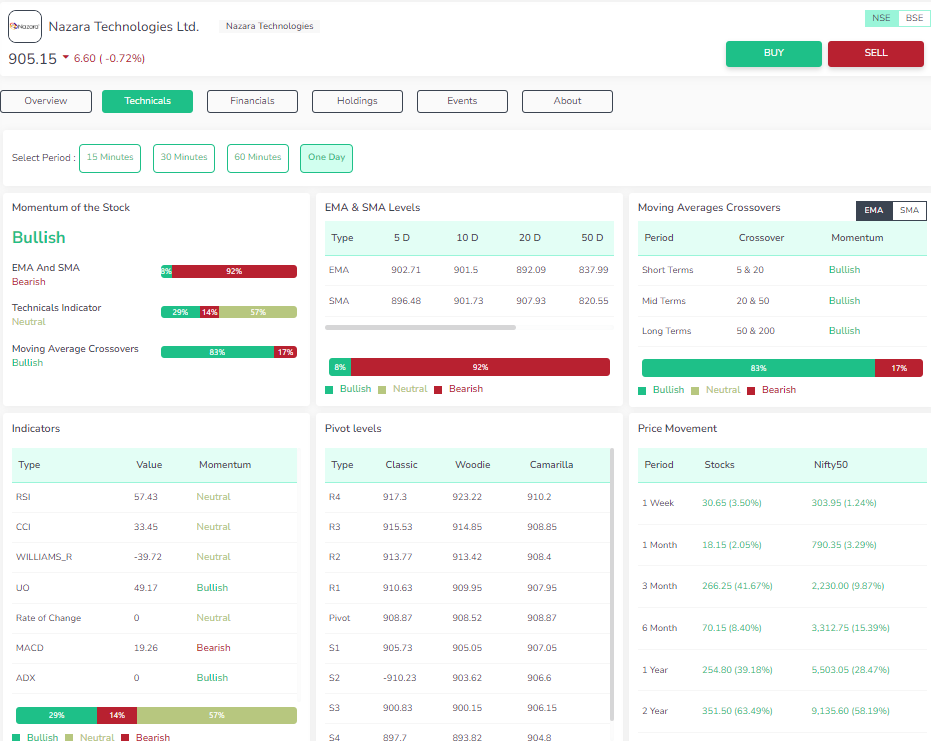

Nazara Technologies Limited

Based on the moving averages, the Nazara Technologies stock exhibits bearish signals. Technical indicators are neutral indicating continuity in the pattern. Moving average crossovers exhibit bullish signals.

Zensar Technologies Limited

Based on the moving averages, the Zensar Technologies stock exhibits bearish signals. Technical indicators and Moving average crossovers exhibit bullish signals.

Delta Corp Limited

Based on the moving averages and crossovers , the Delta Corp stock exhibits bearish signals. Technical indicators are neutral indicating no changes.

To summarize, Nazara Technologies shows bearish trends with neutral technical indicators and bullish crossovers. Zensar Technologies has similar bearish signals with bullish moving average crossovers. Delta Corp also shows bearish signals with neutral indicators.

The above chart exhibits the comparative technical study of three gaming stocks based on Moving average crossover signals and Relative strength index for a period of 6 months.

Conclusion

The Enrich Money Orca app offers investors in-depth insights into stock momentum trends. For informed decisions, it is recommended to utilize both technical and fundamental analysis tools for comprehensive evaluations.

Frequently Asked Questions

What factors should I consider when comparing gaming stocks?

When comparing gaming stocks, evaluate financial performance, growth potential, market share, and competitive advantage. Additionally, consider their revenue streams, such as mobile vs. console gaming.

How do I assess the growth potential of gaming stocks?

Analyze historical performance, industry trends, and future projections. Gain deeper insights through Enrich Money.

What role does market share play in gaming stock comparisons?

Market share reflects a company’s competitive position and potential for revenue growth. A larger market share often indicates stronger market presence and profitability.

How important is the revenue model in comparing gaming stocks?

Revenue models are crucial as they reveal how companies generate income, whether through in-game purchases, subscriptions, or ads. Diversified revenue streams can mitigate risks and drive growth.

Should I consider a company's investment in technology when comparing gaming stocks?

Yes, investment in cutting-edge technology, such as AR/VR or game development tools, can significantly impact a company's competitive edge and future growth potential in the gaming industry.

Disclaimer: This blog is dedicated exclusively for educational purposes. Please note that the securities and investments mentioned here are provided for informative purposes only and should not be construed as recommendations. Kindly ensure thorough research prior to making any investment decisions. Participation in the securities market carries inherent risks, and it's important to carefully review all associated documents before committing to investments. Please be aware that the attainment of investment objectives is not guaranteed. It's important to note that the past performance of securities and instruments does not reliably predict future performance.