Knowledge Center Fundamental Analysis

Types Of Orders

Market Order Limit Order

Market orders and limit orders are both orders to buy or sell stock — the main difference between the two is in the way the trades are completed. With a market order, you need to complete the trade as quickly as possible and place the order at a market price in order to buy or sell a contract/stock.

Market Order

The order placement must be made very quickly in order to place the order at Market Live Price to buy or sell a stock as the price of stock is not mentioned at time of order placement

Limit Order

The Limit order is about paying the price the trader wants. The trader can pre-plan his order in order to buy or sell at a desired price. This is where you want to buy a stock but the trader places a limit to how much he's willing to pay.

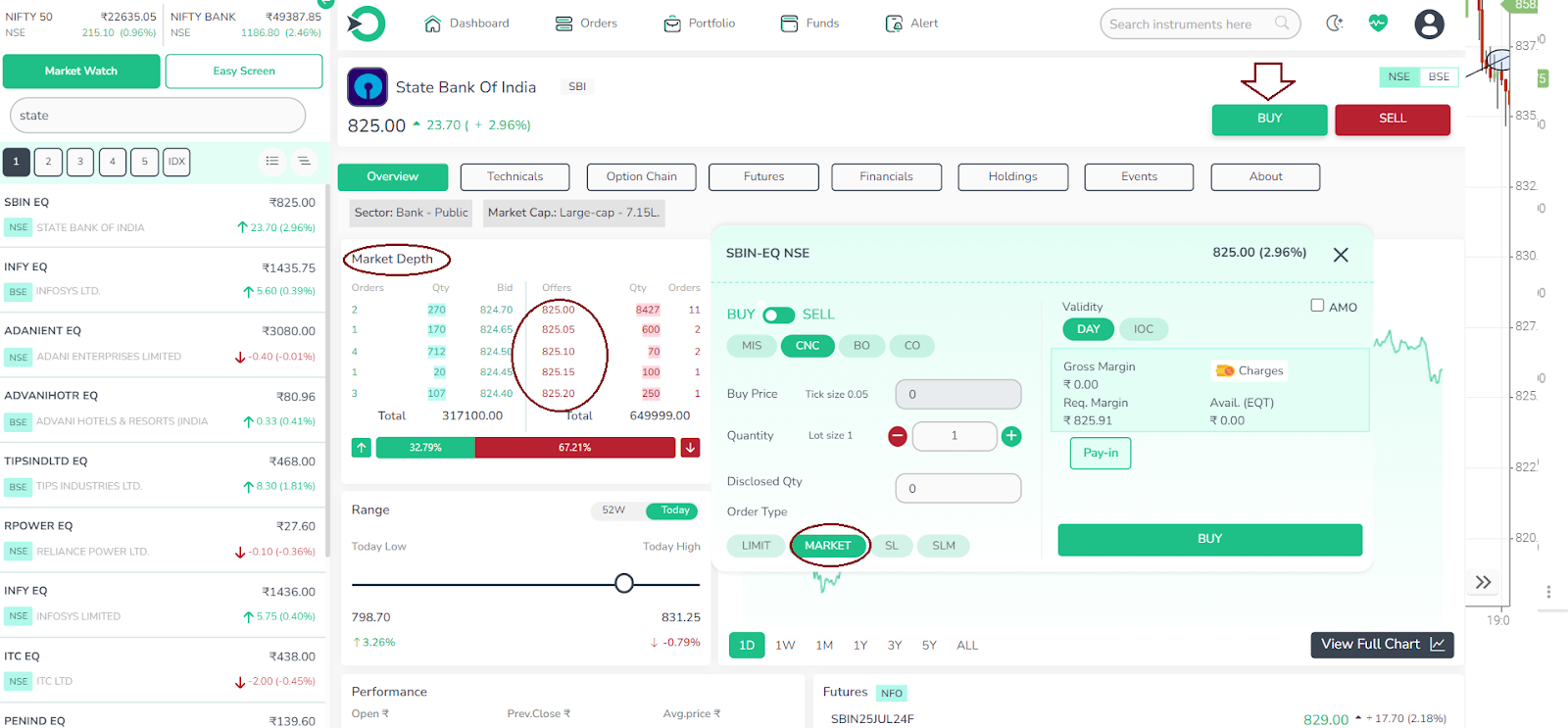

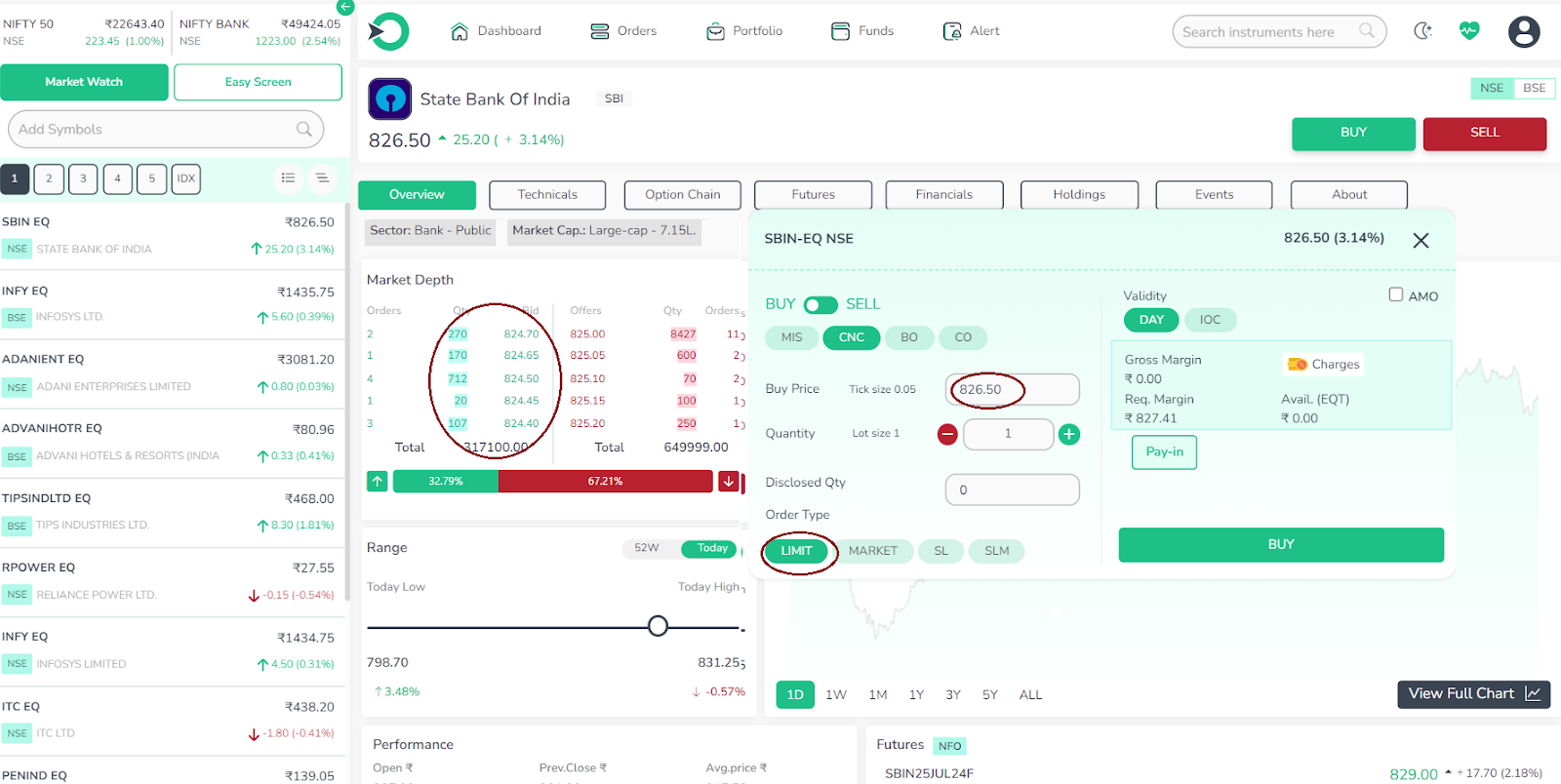

How To Buy Stock Limit or Market Orders

In market order trading , search for the stock to be bought or sold and select the order type as market order. Here, the trader will not be able to set the price or the trigger price. The trader can only select the Order quantity and continue with buy or sell order. When the buy or sell order is placed, the order will be executed with the stock price that is reported highest in the stock market.

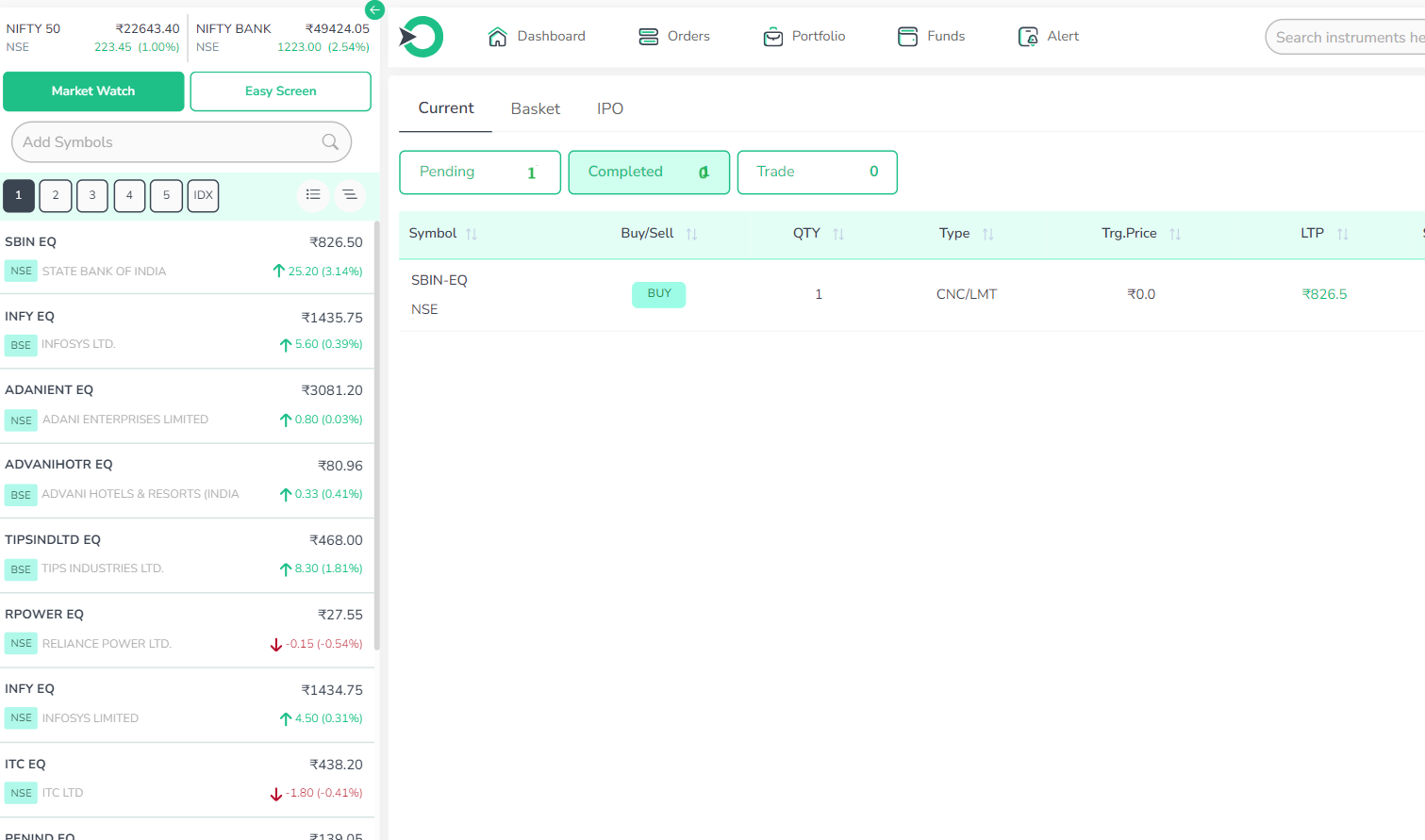

In Limit order trading, search for the stock to buy or sell and select the order type as Limit Order. Here, the trader can set his desired price at which he wants to buy the stock and then select the order quantity. When the trader makes the buy order, his order remains pending and will be executed only when any seller of the stock executes an order at the same trader quoted price.

Buy above and Sell Below Limit Order in Future Market Segment

When a trader places limit orders for Buy Above or Sell Below , he must place these orders as new orders. Such limit orders must be placed as Stop Loss Buy Order or Stop Loss Sell Order. For example, consider selling a stock at 'Sell Below Limit Order' . These orders cannot be placed as CNC (Cash N Carry)orders. These types of limit orders can be placed only as MIS (Margin Intraday Square Off) order. After selecting the selling stock , order type as MIS , the trader has to enter the desired selling price and trigger price. When the stock reaches trigger price in the market, the traders sell orders will be pushed into the market. Buy Above Limit Order is just the opposite process for Sell Below order.

Hence, stop loss buy and stop loss sell orders are both important in the market.

Market Order Vs Limit Order_ Pros and Cons

Market Order Type is not always advisable. The trader can make a market order only when the market is down and the trader wants to quickly sell and book a profit. Sometimes, when the traders sell a stock, the market price may go down by 50 to 100 points and the trader will be able to male use of this type of opportunity and book a good profit.

Likewise, when there is high volatility in the market and if the trader is about to incur losses in the position, the trader can take a quick exit from the position by choosing the square off option in the market. Hence, Market order can be used as an emergency tool in stock market trading.

Whereas Limit order is not advisable to be used as an emergency tool. The limit order will be executed only when the stock price reaches the desired exact stock price. If the stock price goes above or below the desired price , the limit order will not be executed. So, in limit order it is not advisable to place limits at any short difference. If the trader wants to place any limit order, then there must be a minimum difference between the market price and desired price. Otherwise, it’s best to buy any order at market price by executing market order.

Frequently Asked Questions

Which order type provides certainty of execution?

A market order provides certainty of execution as it prioritizes speed over price.

Which order type allows investors to control the price?

A limit order allows investors to control the price at which they buy or sell a security.

When should I use a market order?

Market orders are suitable for highly liquid securities when immediate execution is desired.

When should I use a limit order?

Limit orders are used when investors want to specify the maximum price to buy or the minimum price to sell a security.

Can a market order be filled at a different price than expected?

Yes, a market order can be filled at a different price due to market fluctuations.

Are there any risks associated with using market and limit orders?

Both market and limit orders carry risks, including price volatility and execution at unfavourable prices.