Top Waste Management and Recycling Stocks to Watch in 2025: Based on 1-Year Returns

Introduction

The rising emphasis on sustainability has made effective waste management and recycling practices essential in India. With growing environmental concerns, stricter regulations, and heightened public awareness, the demand for innovative solutions in this sector is at an all-time high. Consequently, waste management companies are not only contributing significantly to environmental preservation but are also emerging as compelling investment opportunities. For those looking to align their portfolio with green initiatives, here’s a closer look at some leading waste management and recycling companies in India worth considering.

Understanding Waste Management Stocks

Waste management stocks represent shares in companies specializing in providing waste disposal, recycling, and environmental services to residential and commercial customers. These firms play a pivotal role in the efficient collection, transportation, treatment, recycling, and disposal of waste materials. Their primary objective is to deliver environmentally responsible waste handling solutions that minimize ecological impact while generating revenue.

Investing in waste management companies is an attractive prospect for several reasons. The industry is experiencing significant growth fueled by urbanization, population expansion, and rising environmental consciousness. Additionally, stringent waste management regulations worldwide have created a consistent demand for responsible waste disposal and recycling services. Many of these companies leverage cutting-edge technology and sustainable practices, aligning with global initiatives to reduce carbon footprints. This makes waste management stocks a unique investment opportunity, offering both financial returns and the satisfaction of contributing to a more sustainable future.

Overview of the Waste Management Industry

The waste management industry plays a vital role in safeguarding public health and ensuring environmental sustainability. This sector encompasses the collection, transportation, recycling, treatment, and disposal of various waste types, including household waste and hazardous materials. With the rapid pace of urbanization and increasing environmental challenges, the industry has evolved to prioritize sustainable practices, innovative technologies, and strict regulatory compliance. Initiatives like waste-to-energy systems and advanced recycling methods are gaining traction, significantly reducing ecological impact and preserving natural resources. As governments worldwide enforce stricter waste management policies, the industry has become a cornerstone for sustainable development, offering substantial long-term growth potential.

Top Waste Management Stocks to Invest in India

Company Name |

Sector |

Market Cap (? Cr) |

Stock Price (?) |

PE Ratio (x) |

ROCE (%) |

Net Profit Margin (%) |

1-Year Return (%) |

|

Water Management |

10,585.74 |

1,702.15 |

43.1 |

16.58 |

8.47 |

262.01 |

|

|

Environmental Services |

8,215.44 |

668.3 |

41.92 |

24.06 |

8.19 |

23.19 |

|

|

Construction & Engineering |

4,388.60 |

790.3 |

28.8 |

24.18 |

18.83 |

166.14 |

|

|

Environmental Services |

2,241.95 |

790.45 |

26.01 |

13.02 |

9.62 |

94.52 |

|

|

Eco Recycling Ltd |

Business Support Services |

1,789.58 |

927.4 |

100.37 |

30.67 |

50.55 |

258.21 |

The data provided above reflects information as of November 2024.

Overview of the Top Waste Management Stocks

-

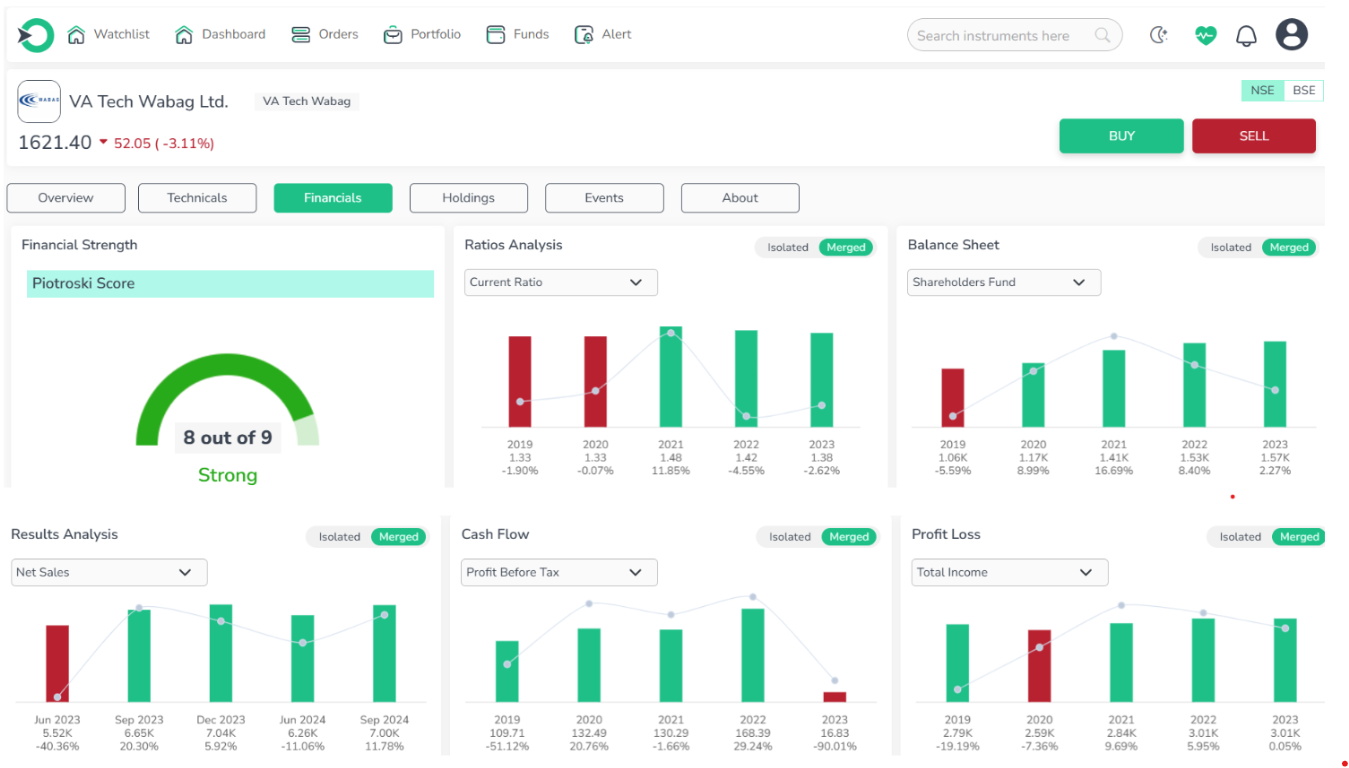

Va Tech Wabag Ltd

VA Tech Wabag Limited is a holding company specializing in the design, supply, installation, construction, and management of operations for drinking water systems, wastewater treatment facilities, industrial water solutions, and desalination plants.

Over the past three years, the company has achieved impressive profit growth of 47.80% and maintains an efficient cash conversion cycle of -98.48 days, reflecting strong cash flow management with a CFO/PAT ratio of 1.48. Its average operating leverage of 18.81 highlights robust operational efficiency. However, revenue growth has been modest at 10.84%, and high debtor days of 233.10 indicate challenges in managing receivables.

In conclusion, VA Tech Wabag emerges as a leading waste management and recycling stock, showcasing strong profit growth and operational efficiency. However, challenges like modest revenue growth and high debtor days persist, making it essential to weigh its robust cash flow management against these factors for a balanced investment decision.

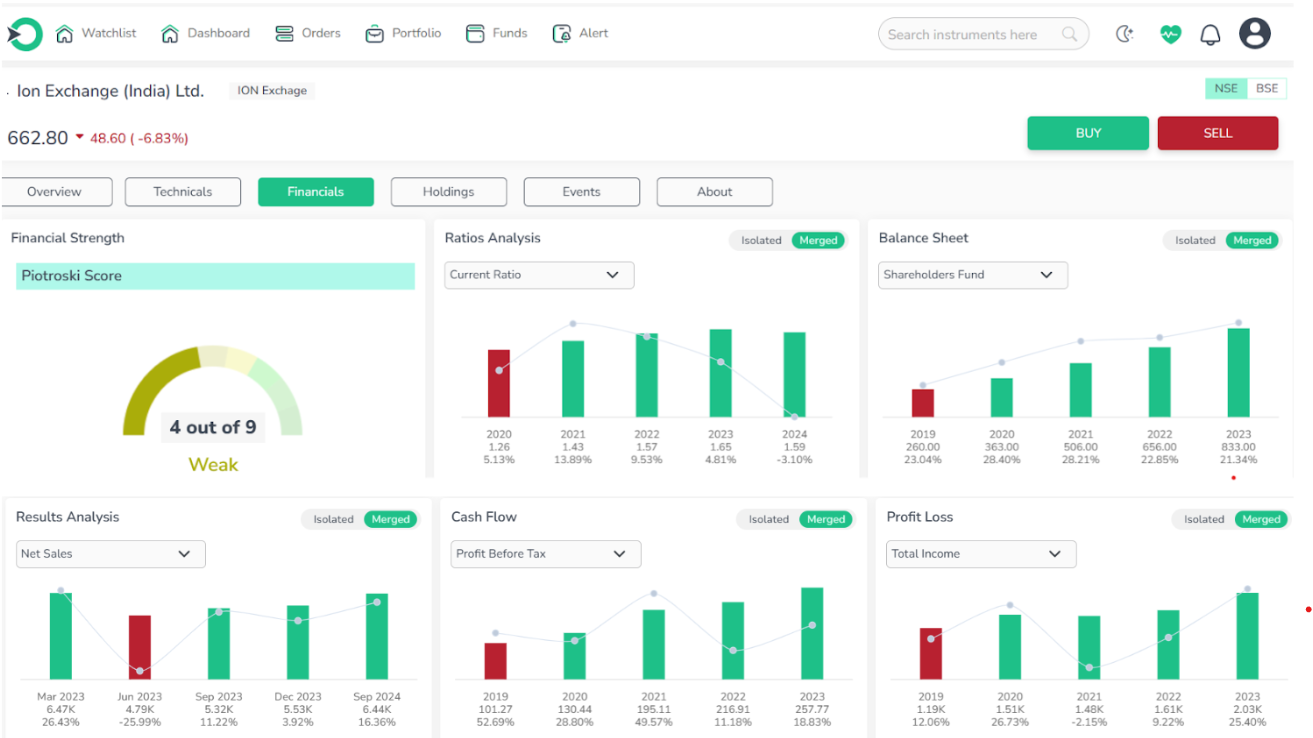

Ion Exchange (India) Limited operates in the water and environmental management sector, providing solutions such as ion exchange resins, water treatment systems, and chemical additives.

Over the past three years, the company has achieved steady revenue growth of 15.86%, maintained a robust Return on Equity (ROE) of 21.77%, and an impressive Return on Capital Employed (ROCE) of 29.16%. Additionally, its virtually debt-free status highlights strong financial health and prudent management.

In conclusion, the company's consistent performance and solid financial metrics position it as a leading waste management stock, offering stability and growth potential in the sector.

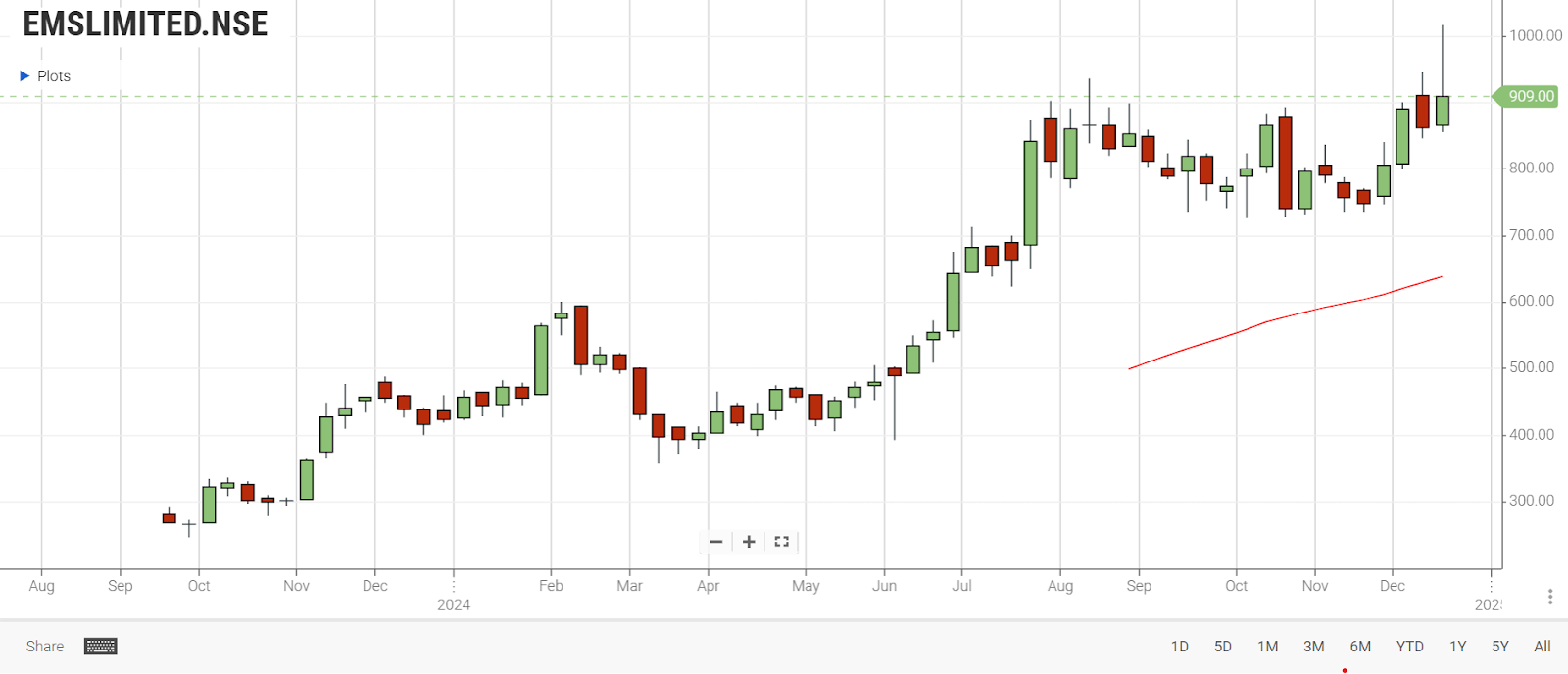

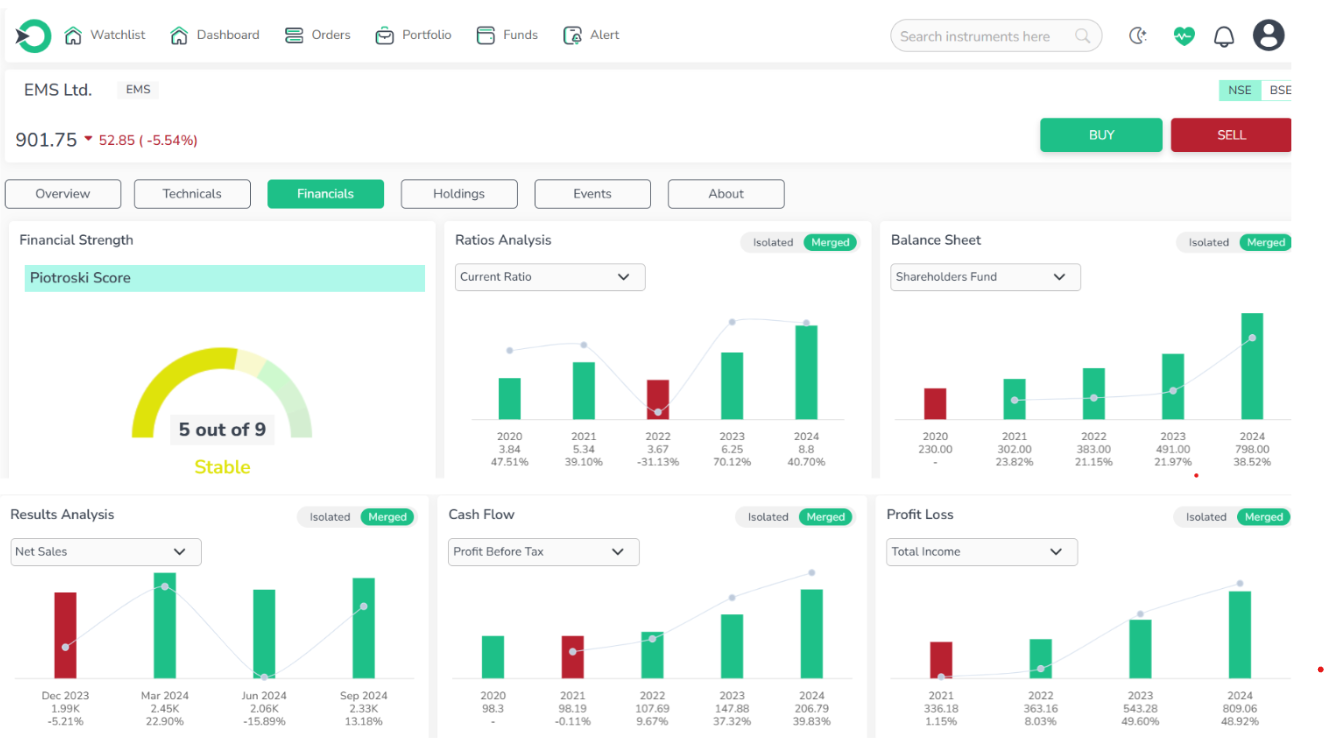

EMS Limited offers a wide range of services, including sewage systems, water supply infrastructure, electrical transmission, road construction, and facility maintenance for government projects.

EMS Ltd has demonstrated remarkable financial performance, achieving profit growth of 29.02% and revenue growth of 32.83% over the past three years. The company boasts a healthy ROE of 23.33% and ROCE of 31.38%, with virtually no debt and a robust interest coverage ratio of 93.65. Its effective average operating margins of 29.60% over five years, strong liquidity with a current ratio of 8.80, and high promoter holding of 69.70% further highlight its solid position in the market.

In conclusion, despite challenges like contingent liabilities of ?288.45 crore and negative cash flow from operations, EMS Ltd's impressive financial metrics and operational efficiency establish it as a leading waste management stock with promising growth potential.

Performance Comparison of Va Tech Wabag Ltd, Ion Exchange (India) Ltd, and EMS Ltd Across Key Metrics

Metric |

Va Tech Wabag Ltd |

Ion Exchange (India) Ltd |

EMS Ltd |

|

Revenue Growth (5 years) |

0.78% p.a. |

14.88% p.a. |

- |

|

Market Share (5 years) |

62.73% → 56.69% |

80.03% → 60.8% |

- |

|

Net Income Growth (5 years) |

18.52% p.a. |

24.6% p.a. |

- |

|

Debt to Equity Ratio (5 years) |

25.66% |

15.25% |

5.41% |

|

Current Ratio (5 years) |

141.38% |

141.05% |

467.94% |

Key Observations:

-

Revenue Growth: Ion Exchange (India) Ltd shows a strong annual revenue growth rate of 14.88%, outpacing Va Tech Wabag Ltd at 0.78%. This highlights Ion Exchange’s more substantial expansion in the last 5 years.

-

Market Share: Va Tech Wabag Ltd and Ion Exchange (India) Ltd have both seen a decrease in market share, with Ion Exchange experiencing a larger drop from 80.03% to 60.8%.

-

Net Income Growth: Both companies showed solid net income growth, but Ion Exchange (India) Ltd has a slightly higher annual growth rate at 24.6%, compared to Va Tech Wabag’s 18.52%.

-

Debt to Equity Ratio: EMS Ltd has the most favorable debt-to-equity ratio (5.41%), indicating a strong financial position with minimal debt compared to Va Tech Wabag Ltd (25.66%) and Ion Exchange (India) Ltd (15.25%).

-

Current Ratio: EMS Ltd stands out with an exceptionally high current ratio of 467.94%, suggesting an outstanding liquidity position compared to both Va Tech Wabag Ltd (141.38%) and Ion Exchange (India) Ltd (141.05%).

Why Consider Investing in Waste Management Stocks in India?

Investing in waste management stocks in India presents a promising opportunity due to several key factors. As the country experiences rapid urbanization and population growth, the need for efficient waste management solutions has become increasingly vital. The government's push for cleaner, sustainable practices and the implementation of stricter environmental regulations signal significant growth potential for the sector. Additionally, rising awareness about environmental issues is driving demand for eco-friendly waste management services. By investing in this sector, you not only tap into a thriving industry with strong financial prospects but also support India's journey toward sustainable development, making it a prudent and forward-thinking investment choice.

Key Considerations Before Investing in Waste Management Stocks in India

Before investing in waste management stocks in India, it’s important to evaluate several factors. Understanding the regulatory framework is crucial, as policy changes can impact the sector. Assessing market growth prospects, driven by urbanization and environmental awareness, is also key. Analyze the competitive landscape, financial health, and sustainability efforts of companies, as those with strong recycling infrastructure and innovative technologies are likely to perform better. Additionally, consider the geographic reach of companies and the broader economic environment, as these factors can influence demand. Finally, reviewing dividend policies is important for investors seeking steady returns.

Conclusion

Investing in waste management and recycling stocks in India presents a unique opportunity to support environmental sustainability while seeking strong financial returns. Industry leaders like Va Tech Wabag and Eco Recycling are at the forefront of this growing sector, offering promising investment potential. As the demand for sustainable solutions increases, these companies are well-positioned for long-term growth, making them appealing choices for investors looking to align their portfolios with both profitability and responsible, eco-friendly practices.

Frequently Asked Questions

-

What are waste management stocks?

Waste management stocks refer to shares in companies that handle the collection, processing, recycling, and disposal of waste materials. These waste management companies focus on providing sustainable and efficient solutions to handle various types of waste, contributing to environmental protection.

-

Why invest in waste management stocks?

Investing in waste management stocks offers exposure to a resilient industry that benefits from growing urbanization and stricter regulations. As the demand for eco-friendly solutions increases, companies focusing on waste management recycling are well-positioned to grow. These companies often provide stable cash flows, which can positively influence the stock market waste management sector, and strategic acquisitions may lead to significant increases in the share price of waste management companies.

-

What potential risks come with investing in waste management stocks?

One risk associated with waste management stocks is the potential impact of regulatory changes, which can affect a company's operations and profitability. Additionally, companies that fail to keep up with technological advancements in waste management recycling might face challenges, and economic downturns can reduce waste generation, influencing stock performance. Fluctuations in commodity prices and growing competition can also affect the stock price waste management companies.

-

How do I value waste management stocks?

To value waste management stocks, investors often use metrics such as the P/E ratio, which compares the stock price waste management to the company’s earnings. The EV/EBITDA ratio helps evaluate a company's overall value compared to its cash flow. Growth rates, including historical and projected revenue and earnings, are key to determining the company’s future potential. Companies with strong waste management recycling initiatives and low customer concentration tend to offer more stability in the long term.

-

What ESG factors should be considered when investing in waste management stocks?

When investing in waste management stocks, it is essential to assess the company’s commitment to environmentally sustainable practices, particularly in waste management recycling. Social factors, such as safety records and community impact, are also important, as is governance, which includes ethical practices and transparency within the waste management company. These ESG considerations can significantly influence the long-term viability and growth of waste management stocks.

Related Stocks

Disclaimer: This blog is dedicated exclusively for educational purposes. Please note that the securities and investments mentioned here are provided for informative purposes only and should not be construed as recommendations. Kindly ensure thorough research prior to making any investment decisions. Participation in the securities market carries inherent risks, and it's important to carefully review all associated documents before committing to investments. Please be aware that the attainment of investment objectives is not guaranteed. It's important to note that the past performance of securities and instruments does not reliably predict future performance.