Top 3 Travel Stocks in India

Best 3 Travel Stocks in India

Introduction

India's travel and tourism industry is the largest within the service sector, encompassing a rich tapestry of heritage, cultural, medical, business, and sports tourism experiences. With a primary goal of promoting India as a premier destination for travelers, this dynamic sector plays a pivotal role in job creation and economic growth by continually expanding its array of diverse tourism offerings.

India's Travel Industry: A Comprehensive Overview

India, renowned for its rich cultural diversity, ranks among the world's top countries in international tourism spending. The IBEF report on the Growth of the Tourism and Hospitality Industry states that travel and tourism are among India's largest sectors, contributing around US$ 178 billion to the GDP.

India provides a diverse array of specialized tourism experiences, encompassing cruises, adventure travel, medical tourism, MICE (Meetings, Incentives, Conferences, and Exhibitions), film tourism, wellness retreats, sports tourism, rural escapes, eco-tourism, and religious pilgrimages.

The tourism sector plays a pivotal role in the Make in India initiative, driving economic growth and job creation. It catalyzes the development of multi-use infrastructure such as world-class hotels, resorts, fine dining, robust transportation networks (roads, shipping, aviation, and railways), and advanced healthcare facilities.

The Indian travel market is poised to reach US$ 125 billion by 2027, with international tourist arrivals projected to hit 30.5 million by 2028.

Top three Travel Stocks in India in 2025

The table below highlights the leading travel stocks for investment in India in 2025, ranked by market capitalization:

|

S.No. |

Travel Stocks in India |

Market Cap |

P/E ratio |

|

1 |

80.36KCr |

72.58 |

|

|

2 |

7.41KCr |

88.07 |

|

|

3 |

11.53KCr |

45.49 |

Overview of Top Three Travel Stocks to invest in India in 2025

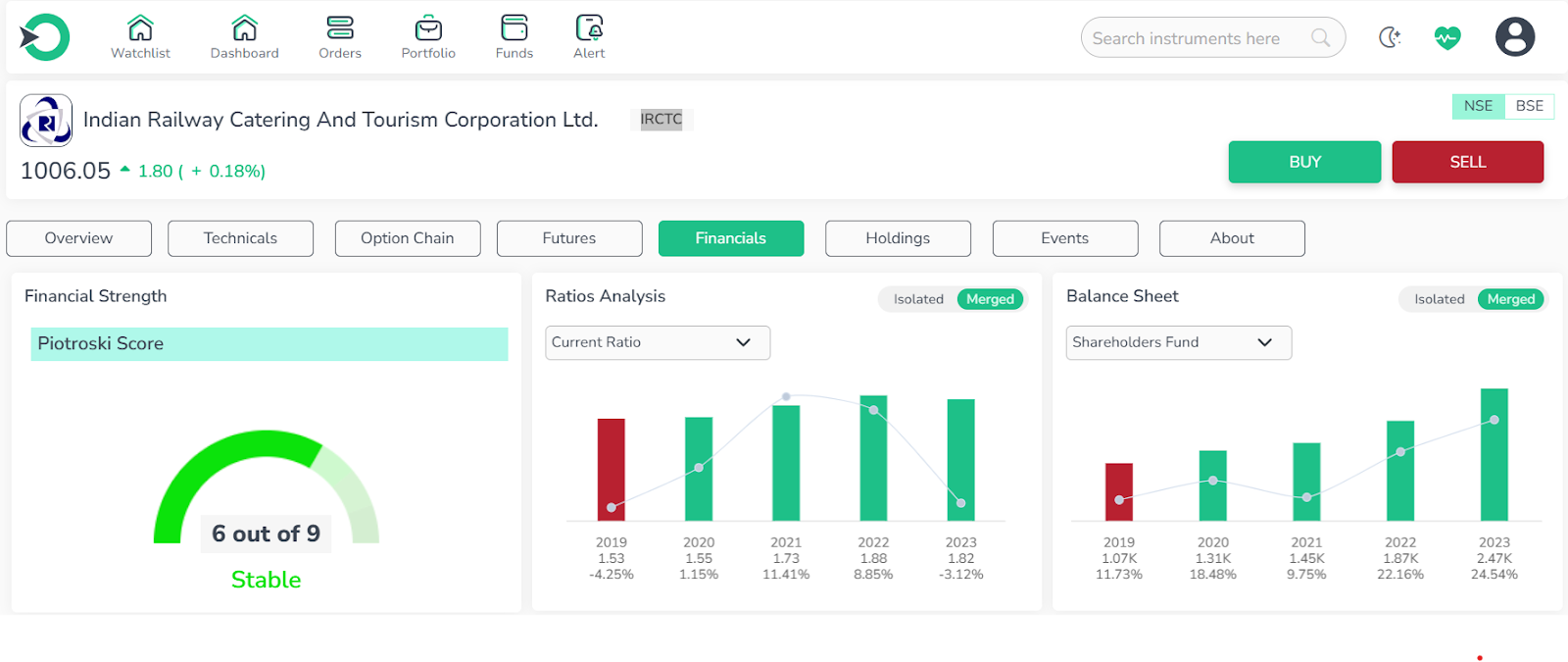

1. IRCTC

Indian Railway Catering and Tourism Corporation (IRCTC) is a public sector entity in India, responsible for ticketing, catering, and tourism services for Indian Railways. Founded in 1999, IRCTC operates under the Ministry of Railways, Government of India.

IRCTC's performance has been poor, placing it among the low performers.

-

The company's valuation is high, suggesting that IRCTC may be overvalued compared to the market average.

-

Financial growth at IRCTC has been moderate, showing steady but unspectacular improvement over the past few years.

-

IRCTC exhibits strong profitability, indicating good signs of efficiency and profit generation.

-

The stock's entry point for IRCTC is average; it is somewhat overpriced but not excessively so.

In conclusion, despite some challenges in performance and valuation, IRCTC remains a leading travel stock in India. Its strong profitability, solid growth potential, and pivotal role in the country's tourism infrastructure make it a valuable asset for investors looking to capitalize on the expanding travel and tourism sector. With its comprehensive services and strategic importance to Indian Railways, IRCTC stands out as a top choice for those seeking to invest in the future of travel in India.

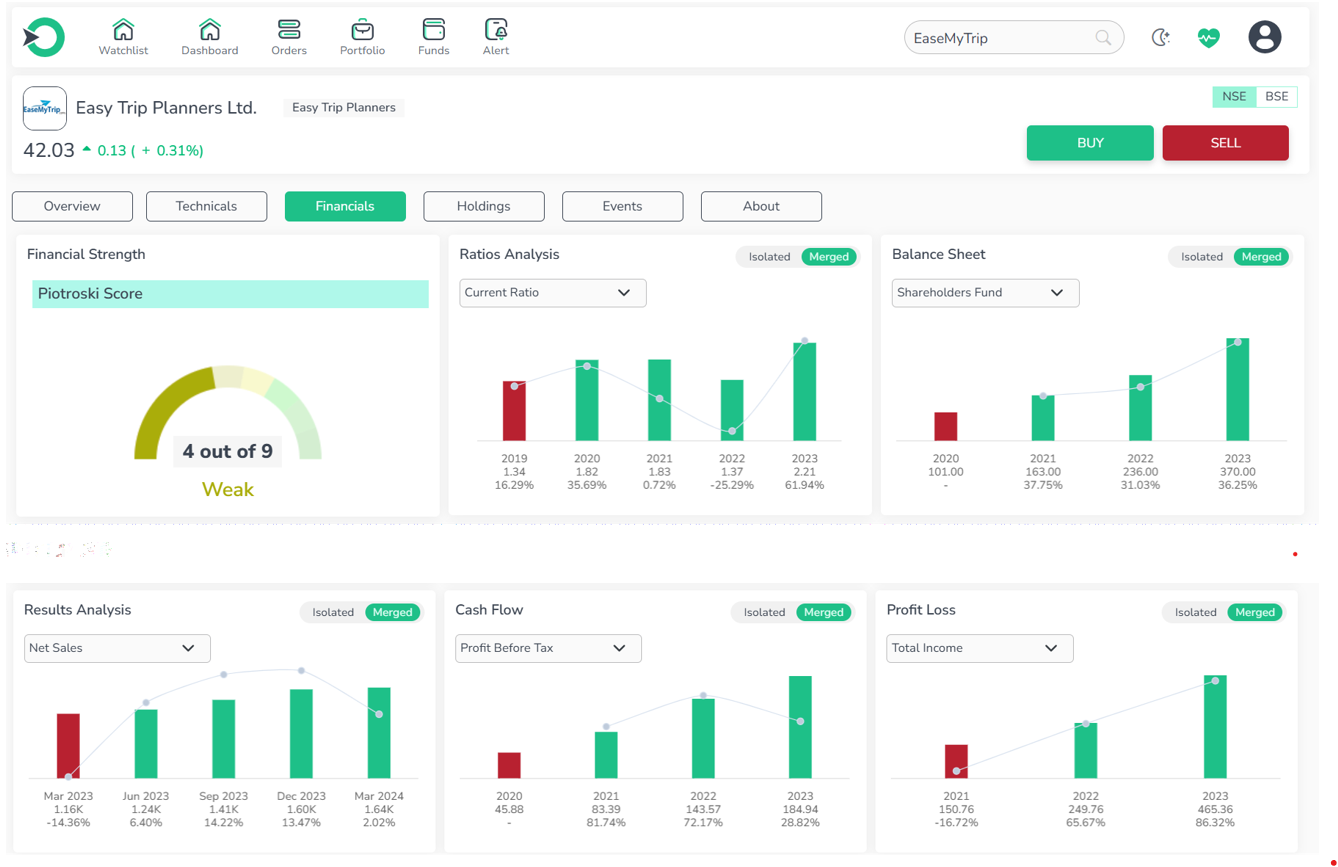

2. EaseMyTrip

Easy Trip Planners Limited provides a wide range of travel products and services, including flights, hotels, holiday packages, rail and bus tickets, and taxis, along with add-ons like travel insurance and visa processing. Notably, the company offers a no-convenience fee option, ensuring transparency and avoiding hidden costs for customers.

-

The company's elevated valuation suggests it might be priced higher than the market average.

-

Easy Trip Planners has demonstrated strong financial growth over the years.

-

Profitability is robust, showcasing good efficiency and profit generation.

-

The stock's entry point is average, and it is not currently in the overbought zone.

In conclusion, despite some performance challenges, Easy Trip Planners stands out as a leading travel stock due to its strong financial growth and robust profitability.

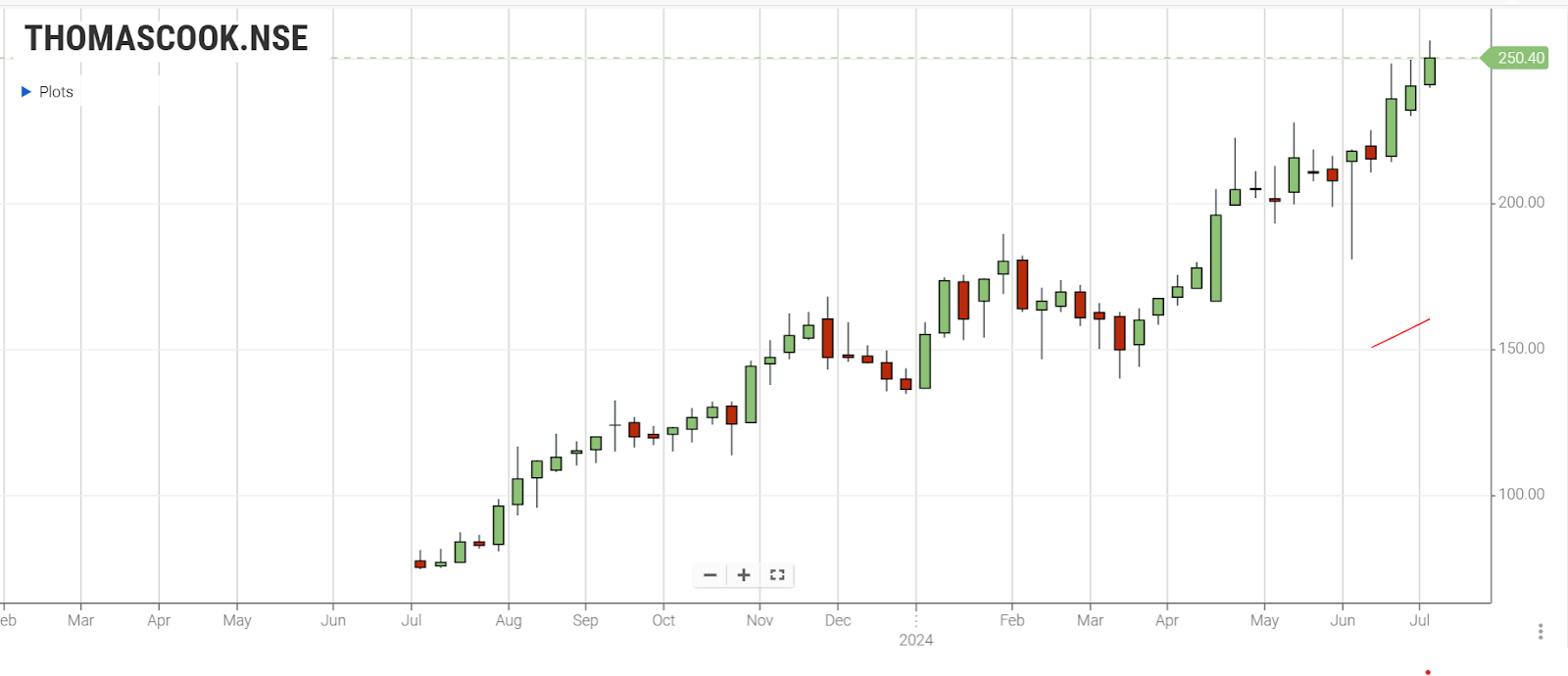

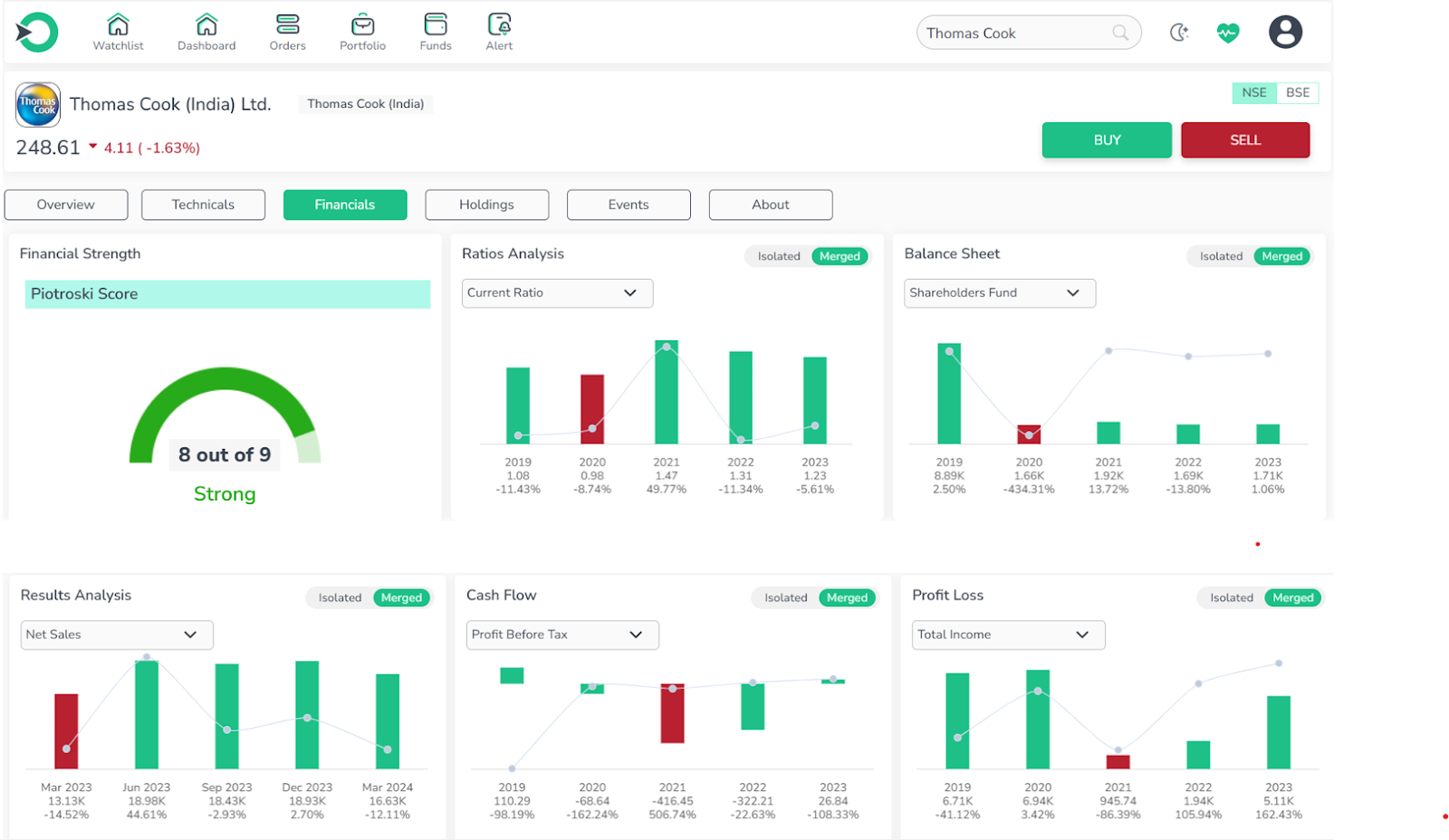

3. Thomas Cook India

Thomas Cook (India) Ltd., headquartered in Mumbai, is a premier Indian travel agency offering a wide range of services including foreign exchange, international and domestic holidays, visas, passports, travel insurance, and MICE (Meetings, Incentives, Conferences, and Exhibitions).

-

Performance has been average, with price returns showing no significant excitement.

-

The valuation is high, indicating the company may be overvalued compared to the market average.

-

Financial growth has been moderate, showing steady progress over the past few years.

-

Robust profitability highlights excellent efficiency and solid profit margins.

-

The stock's entry point is average, being somewhat overpriced but not excessively overbought.

In conclusion, Thomas Cook (India) Ltd. remains a leading travel stock due to its robust profitability and comprehensive range of travel services, making it a solid choice for investors in the travel sector.

Comparison of Three Travel Stocks to invest in India: IRCTC, EaseMyTrip, and Thomas Cook (India) Ltd

|

Company |

Revenue Growth Rate |

Net Income Growth Rate |

Market Share Change |

|

Indian Railway Catering and Tourism Corporation Ltd |

17.31% (vs industry avg 20.89%) |

Not specified |

Decreased from 14.7% to 12.67% |

|

EaseMyTrip |

32.15% (vs industry avg 2.84%) |

33.86% (vs industry avg 24.38%) |

Increased from 1.34% to 6.57% |

|

Thomas Cook (India) Ltd |

1.89% (vs industry avg 2.84%) |

25.02% (vs industry avg 24.38%) |

Increased from 60.2% to 80.21% |

Comparison Summary:

Over the past five years, Indian Railway Catering and Tourism Corporation Ltd (IRCTC) has shown a revenue growth rate of 17.31%, slightly below the industry average of 20.89%. However, its market share has declined from 14.7% to 12.67%, indicating some competitive challenges.

In contrast, EaseMyTrip has exhibited remarkable growth with a revenue growth rate of 32.15%, significantly outperforming the industry average of 2.84%. Its net income growth has also been robust at 33.86%, compared to the industry average of 24.38%. EaseMyTrip has effectively increased its market share from 1.34% to 6.57%, reflecting strong market penetration and competitive strategy.

Thomas Cook (India) Ltd has shown a more modest revenue growth rate of 1.89%, slightly below the industry average of 2.84%. However, its net income growth rate has been strong at 25.02%, surpassing the industry average of 24.38%. Thomas Cook has notably increased its market share from 60.2% to 80.21%, indicating a dominant position in the market despite slower revenue growth.

In conclusion, while each company has its strengths and growth trajectories, EaseMyTrip stands out for its exceptional revenue and net income growth rates, along with significant market share expansion. Thomas Cook (India) Ltd demonstrates strong profitability and market dominance, while IRCTC faces challenges in revenue growth and market share retention.

Price Comparision Snapshot:

Key Considerations for Investing in Indian Travel Stocks

Before investing in travel stocks in India for 2025, consider these essential factors:

-

Government Regulations: Governments are increasingly focusing on reducing CO2 emissions, which could lead to stricter regulations and taxes for the travel industry. Look for companies prepared to adapt to these changes to safeguard long-term stock performance.

-

Pent-up Demand: Post-Covid-19 restrictions, there's a surge in travel enthusiasm, particularly in leisure travel. Consider investing in companies poised to capitalize on this rising demand.

-

Budgetary Incentives: Government initiatives like interest-free loans for tourism development can significantly impact travel-related companies. Monitor firms leveraging these incentives.

-

Industry Outlook: Stay informed about industry trends, technological advancements, consumer behavior shifts, competitive landscape, regulatory updates, and environmental considerations to make well-informed investment decisions.

-

Company Performance and Financials: Analyze financial metrics including revenue, earnings, debt levels, cash flow, profit margins, return on equity, and price-to-earnings ratio before making investment choices.

Is Investing in Travel Stocks Right for You?

When considering investing in tourism stocks in India, it's crucial to evaluate the inherent risks within the industry. The travel sector is susceptible to various factors that can impact investment returns.

Economic downturns, such as recessions or global crises, can lead to a significant drop in travel demand as people reduce discretionary spending, including on vacations and leisure activities. Natural disasters and pandemics also pose a threat by disrupting travel plans and reducing revenue for travel-related companies.

Moreover, the travel industry is highly competitive, with many companies vying for market share. This intense competition can lead to price wars and narrow profit margins, which may adversely affect the financial performance of travel stocks. Additionally, failure to comply with regulatory requirements can result in fines, legal issues, and damage to a company’s reputation.

Considering these risks, it is essential to conduct a thorough analysis of travel stocks before making any investment decisions.

Conclusion

Investing in top tourism sector stocks provides a valuable opportunity for diversification, especially as the global tourism industry continues to grow, driving higher demand for hotels and accommodations.

By diversifying your portfolio across various segments of the travel industry, including hospitality, you can reduce investment risks and potentially enhance returns. However, it is crucial to consider the previously mentioned factors and assess your risk tolerance before making investment decisions.

Frequently Asked Questions

-

How can I invest in top travel stocks in India through Enrich Money?

Enrich Money provides a user-friendly platform where you can easily search for and invest in leading travel stocks such as IRCTC, EaseMyTrip, and Thomas Cook India. Simply create a demat account, add funds, and start trading through our intuitive interface.

-

Why should I consider investing in India's tourism sector?

Investing in India's tourism sector offers diversification and potential growth as the industry expands and demand for travel increases.

-

What are the benefits of investing in travel stocks?

Travel stocks provide exposure to a growing industry, the potential for high returns, and benefits from increased travel demand and government incentives.

-

What are the key factors to consider before investing in travel stocks?

Consider factors like government regulations, pent-up demand, budgetary incentives, industry trends, and company financial performance before investing.

-

What are the risks of investing in travel stocks in India?

The risks include economic downturns, natural disasters, pandemics, intense competition, and regulatory compliance issues that can impact returns.

Disclaimer: This blog is dedicated exclusively for educational purposes. Please note that the securities and investments mentioned here are provided for informative purposes only and should not be construed as recommendations. Kindly ensure thorough research prior to making any investment decisions. Participation in the securities market carries inherent risks, and it's important to carefully review all associated documents before committing to investments. Please be aware that the attainment of investment objectives is not guaranteed. It's important to note that the past performance of securities and instruments does not reliably predict future performance.