Top Small-Cap Stocks in India 2024

Introduction

As investors, it's imperative to prioritize high-quality stocks and incorporate various investment vehicles to construct a robust, diversified investment portfolio. Amidst diversification efforts, integrating Best Small Cap Stocks into your portfolio holds significance. This article aims to furnish comprehensive insights necessary for investing in small-cap stocks, including an exploration of the best small-cap investment stocks available.

Understanding Small Cap Stocks

In the stock market, companies with a market capitalization below 2 billion are categorized as small-cap companies. The defining characteristic of small-cap companies is their market capitalization, which typically falls below Rs. 5000 Cr.

This classification is dynamic, subject to fluctuations based on the company's market valuation, which refers to the remaining shares available in the market.

As defined by the Securities and Exchange Board of India (SEBI), companies ranked 251 and beyond based on market capitalization fall into the category of small-cap.Both the The National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE) oversee specialized small-cap benchmark indices, which track the collective performance of small-cap stocks in India.The BSE Small Cap Index and the Nifty Small Cap Index are the designated names for these indices.

Top Small Cap Stocks Worth Investing in Now in India

It's crucial to recognize that every large or mid-cap company was once a small-cap entity, and only those that effectively expand their business and sustain profitability can ascend the ladder to become mid-cap or large-cap companies. Small-cap companies typically exhibit lower revenues and a smaller workforce compared to their larger counterparts.

Nevertheless, these companies boast significant growth potential alongside heightened risk. Aggressive investors with a higher tolerance for risk are often drawn to small-cap companies in pursuit of potentially substantial returns.

Below are the curated Top small cap companies list:

|

Company Name |

Market Cap (in Cr) |

PE Ratio |

Share Price |

|

Rs. 12,831.46 |

37.36 |

146.15 |

|

|

Rs. 19608.38 |

55.36 |

1,877.00 |

|

|

Rs. 16,868.62 |

28.28 |

331.3 |

|

|

Rs. 21701.2 |

28.5 |

743.65 |

|

|

Rs. 23,259.05 |

16.34 |

717.25 |

Let's delve into the top small cap stocks to buy. Here's a brief overview of all the five top small cap stocks included in the list of small cap company:

-

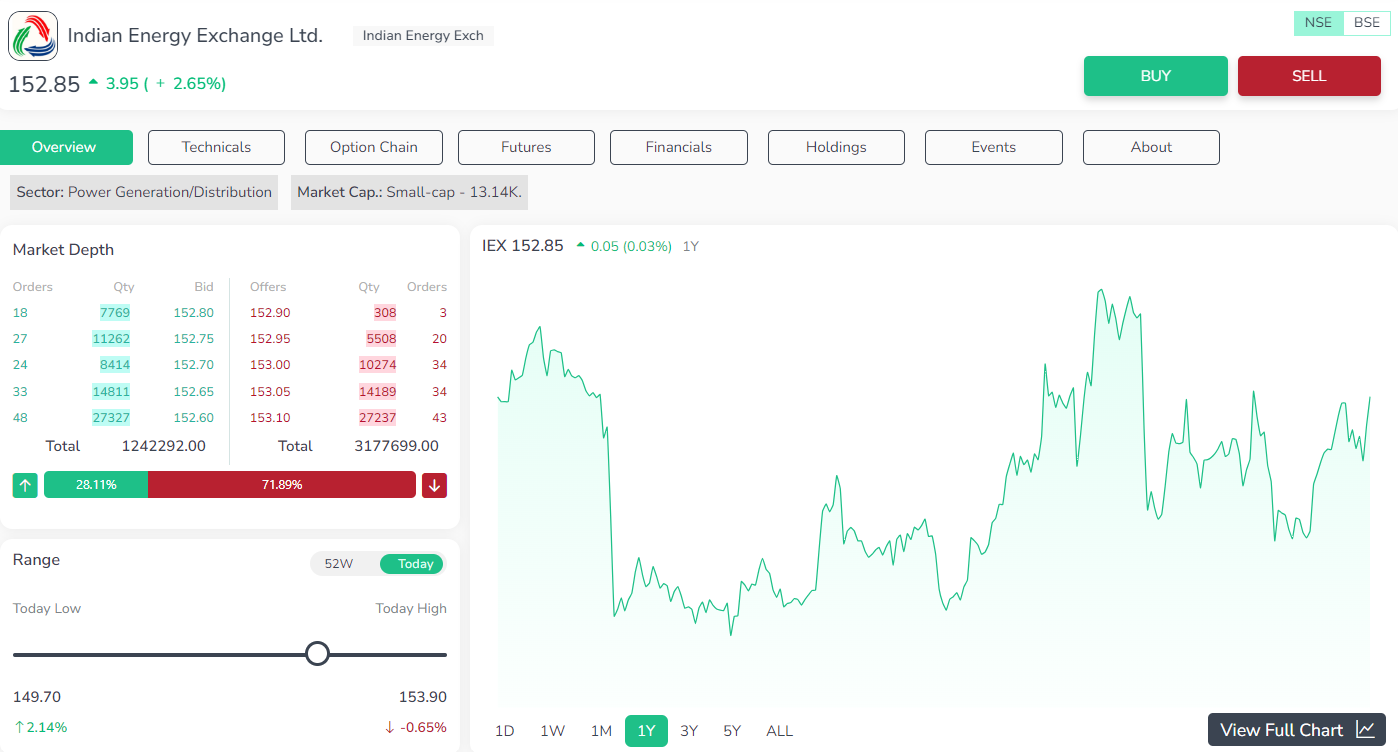

Indian Energy Exchange Ltd

Indian Energy Exchange Ltd has shown impressive revenue growth of 13.74% annually over the last five years, surpassing the industry average of 9.39%. Its portion of the market has also risen from 1.94% to 2.36%. Moreover, it maintains a low debt to equity ratio of 1.78%, compared to the industry average of 182.23%. Additionally, its current ratio stands at a healthy 149.39%, higher than the industry average of 125.08%. Overall, the company demonstrates strong financial performance, with potential for further market expansion and stability.

-

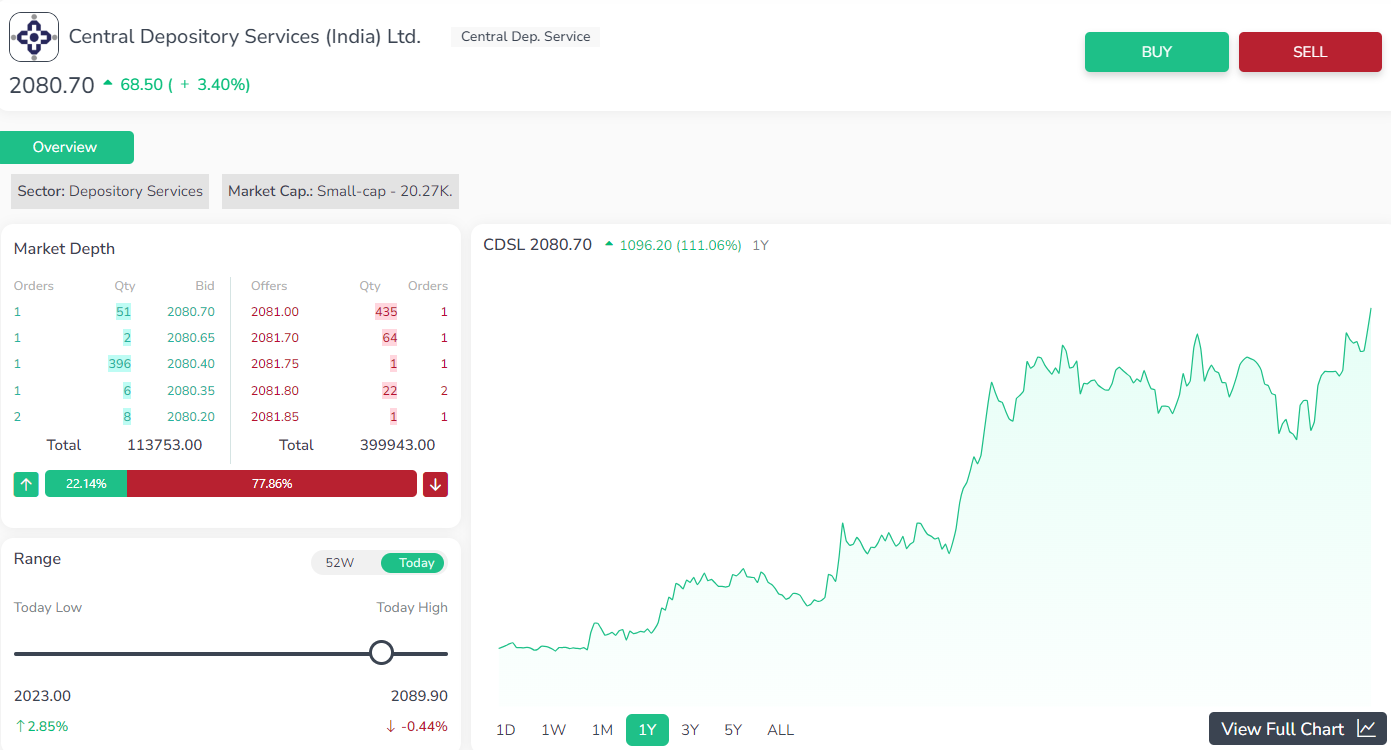

Central Depository Services (India) Ltd

Over the last five years, the Central Depository Services (India) Ltd has excelled in various aspects: annual revenue growth at 22.44% (industry avg. 7.53%), market share increased from 5.22% to 9.99%, and net income grew annually at 21.74% (industry avg. -0.01%). Its conservative debt to equity ratio of 0.05% (industry avg. 0.93%) and a robust current ratio of 425.41% (industry avg. 221.6%) highlight its solid financial health and potential for sustained growth.

-

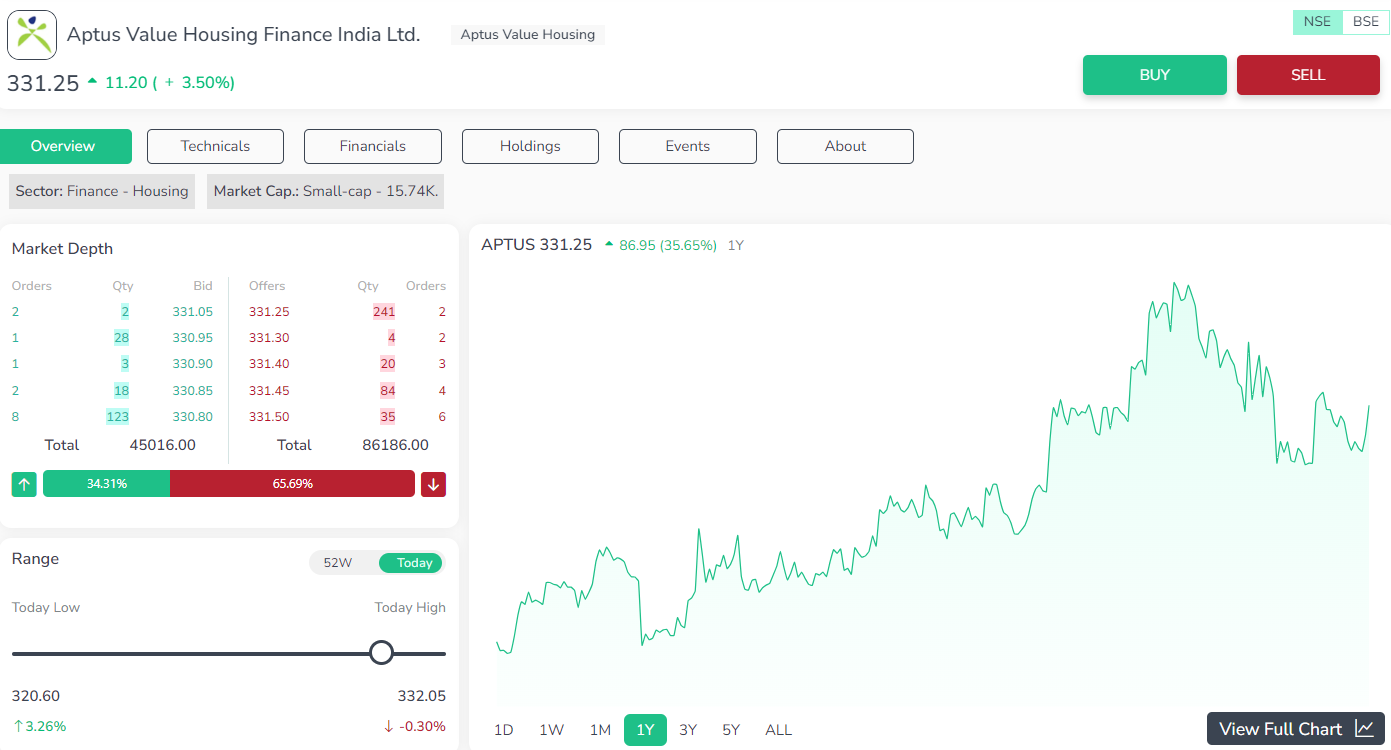

Aptus Value Housing Finance India Ltd

Over the last five years, the Aptus Value Housing Finance India Ltd. has shown remarkable growth across multiple fronts. Revenue surged annually by 40.85%, significantly outpacing the industry average of 10.71%. This growth was mirrored in the company's market share, which expanded from 0.15% to 0.54%. Additionally, net income experienced exceptional growth, rising by 49.78% annually, compared to the industry's 14.57%. Despite maintaining a debt to equity ratio of 136.4%, below the industry average of 419.9%, and boasting a current ratio of 916.32%, far above the industry's 20.53%, the company exhibits robust financial health. Overall, these impressive metrics indicate the company's potential for sustained growth and profitability.

-

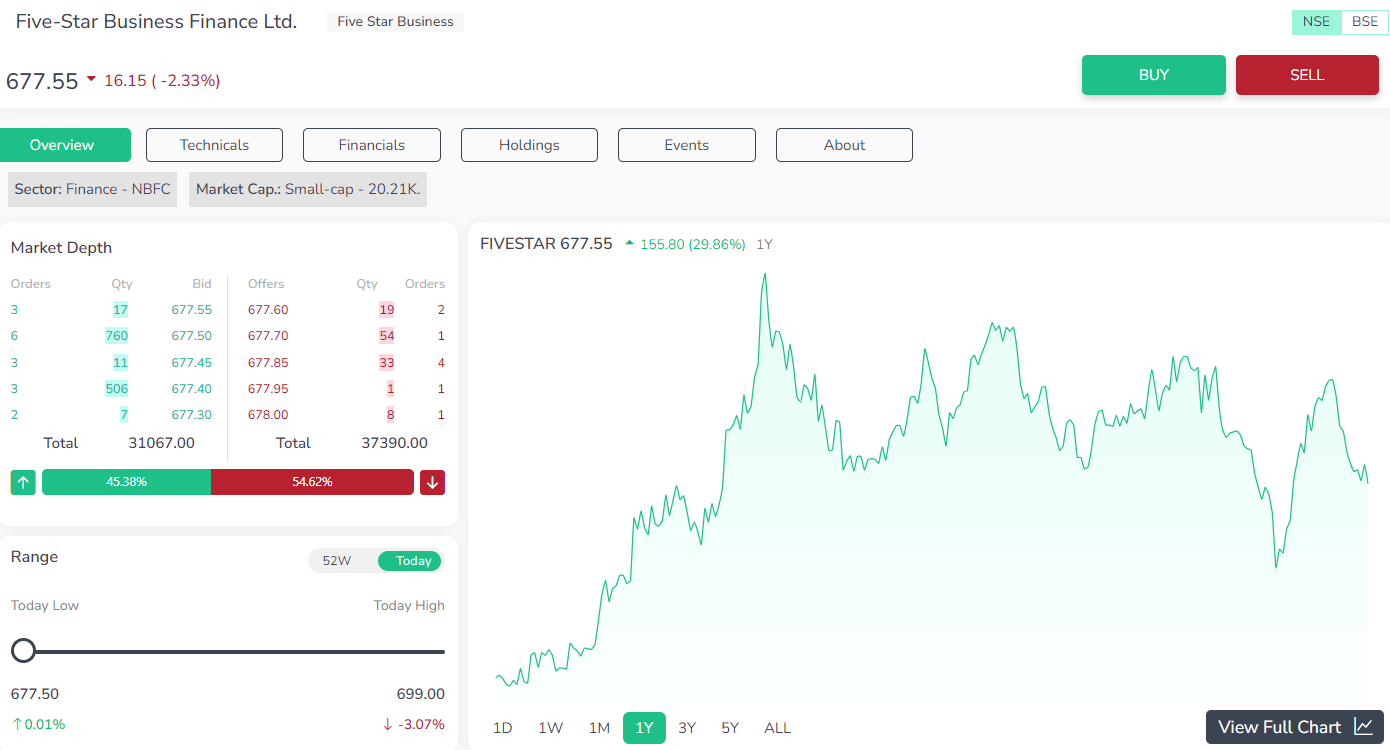

Five-Star Business Finance Ltd

Over the past 5 years, the Five-Star Business Finance Ltd. has shown exceptional growth compared to industry averages. Revenue surged annually by 50.65%, surpassing the industry average of 14.81%, while its market share expanded from 0.22% to 0.93%. Net income grew at a remarkable yearly rate of 62.73%, outpacing the industry's 22.78%. Despite a debt to equity ratio of 100.73%, lower than the industry average of 369.63%, and a current ratio of 1133.39%, far above the industry's 58.7%, the company exhibits robust financial health. This suggests significant potential for sustained growth and profitability.

-

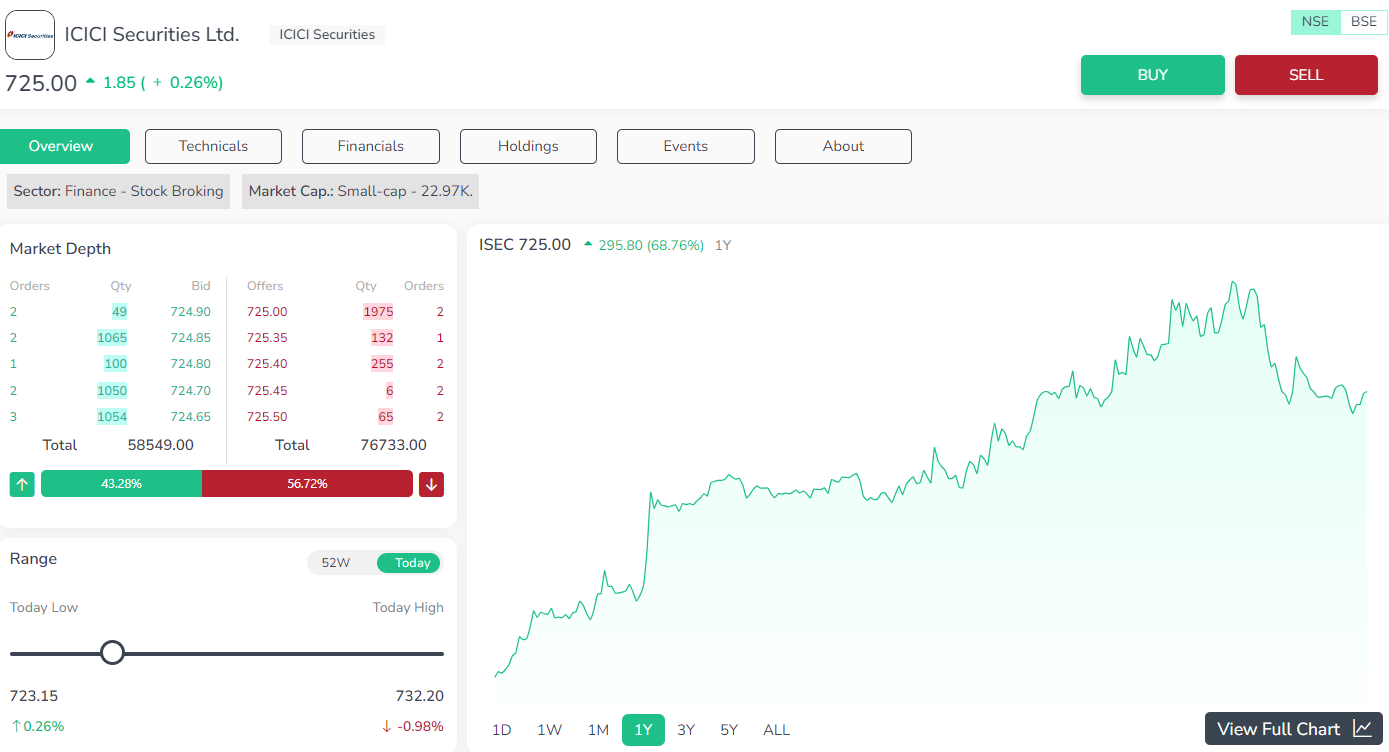

ICICI Securities Ltd

Over the past five years, the ICICI Securities Ltd. has maintained a debt to equity ratio of 206.4%, compared to the industry average of 156.69%. Its current ratio stood at 88.72%, lower than the industry average of 131.3%. Revenue growth over this period has been steady at a yearly rate of 12.98%, slightly above the industry average of 10.36%. Although market share increased marginally from 6.56% to 6.76%, the company's net income grew at a slower yearly rate of 15.09%, compared to the industry average of 30.87%. These metrics suggest a mixed performance, indicating areas for potential improvement in profitability and liquidity management.

Key Considerations for Selecting Stocks in the Small Cap Category

-

Financial Strength:

Assessing the financial health of a company is paramount for investors, regardless of its size. While small cap companies may not boast the same level of sales as their larger counterparts, a stable balance sheet with healthy cash flows and minimal debt signifies resilience and potential for outperformance within their peer group. Hence, investing in financially robust companies with significant growth potential is crucial, irrespective of their scale.

-

Top-Line & Bottom-Line Growth:

Evaluating the historical performance of small-cap companies is essential. A track record spanning at least five years provides valuable insights. Analyzing metrics such as Sales and Profit Compound Annual Growth Rate (CAGR) over the past five years, and comparing them with industry peers, offers a glimpse into a company's relative performance. Consistent growth in sales and profits often translates into superior returns for investors.

-

Market Size & Positioning:

Small capital companies typically operate within niche markets, often focusing on a single product or service line. Understanding the overall market size and the company's positioning within its market segment is crucial. A niche market presence or the presence of entry barriers can significantly impact a company's valuation.

-

Management Quality & Commentary:

The quality of a company's management team is instrumental in shaping its future prospects. Prior to investing in a small capital company, thorough scrutiny of its management history is advisable, including any past lapses. Instances of poor corporate governance or financial misreporting can severely impact investor confidence. Additionally, avoiding companies embroiled in legal or regulatory battles is prudent, as small cap companies are particularly vulnerable to such challenges.

Is Investing in Small Cap Stocks a Wise Choice?

Investing in small cap stocks can indeed be lucrative if approached wisely. When purchased at favorable prices and exhibiting robust growth potential surpassing that of large-cap or blue-chip companies, they can yield substantial returns for investors.

Benefits of Investing in Top Small Cap Stocks for the Long Term:

-

Higher Returns: Small cap stocks in India for 2024 hold the promise of delivering superior returns compared to large-cap stocks.

-

Growth Potential: Indian small cap companies have the capacity to expand at a swifter pace than their larger counterparts.

-

Diversification: Integrating the best small cap stocks into a portfolio can enhance diversification, spreading risk across different asset classes.

Risks Associated with small cap Stocks

It's imperative to acknowledge the risks associated with small cap investments. These include:

-

Higher Risk: Small cap Indian companies are inherently riskier due to their susceptibility to financial hardships and limited access to capital.

-

Limited Liquidity: The best small cap stocks may suffer from restricted trading volume, potentially impeding the swift sale of shares.

-

Greater Volatility: Despite their growth potential, small cap stocks often experience heightened price fluctuations compared to large cap stocks, reflecting their volatile nature.

Given these risks, investors must conduct thorough research and exercise caution before making investment decisions in the small cap segment.

Who Should Consider Investing in Small Cap Stocks?

Small cap stocks appeal primarily to investors with a high-risk tolerance seeking opportunities in undervalued and often overlooked businesses, aiming for potentially lucrative returns that are not influenced by larger financial institutions. Investing in small cap stocks can provide access to quality stocks at reasonable valuations.

However, it's essential for investors to conduct comprehensive research and/or seek guidance from their financial advisor before making any investment decisions.

Conclusion

Investing in small cap stocks offers a means to diversify one's portfolio and potentially attain higher returns. Nevertheless, it's crucial to undertake thorough research and analysis before committing to any investment, including small cap stocks.

In conclusion, small cap stocks represent a segment of the Indian stock market comprising small cap companies with significant growth prospects. While investing in small cap stocks can diversify a portfolio and potentially yield higher returns, it's essential to acknowledge the associated risks and exercise caution. Conducting thorough research and analysis beforehand is imperative, whether through personal efforts or with the assistance of financial advisors. For those interested, exploring opportunities through an AMC free demat account can provide an avenue for investment while managing risks effectively.

Frequently Asked Questions

-

What is a Small Cap Market Index?

A Small Cap Market Index, exemplified by the NIFTY Smallcap 100 Index, mirrors the performance of the nifty small cap companies in the financial market. It consists of 100 publicly listed and tradable companies on the exchange. This index serves as a benchmark for investors, offering valuable insights into the trends and dynamics of the small cap sector.

-

What are the Best Small Cap Stocks to Buy in 2024?

In 2024, notable small cap stocks include Indian Energy Exchange Ltd and Central Depository Services (India) Ltd. However, please note that this list is for educational purposes only and not recommendatory.

-

How can I invest in the top small-cap stocks in India?

With Enrich Money, investing in the top small cap stocks in India is convenient and accessible. Simply sign up for our trading platform, where you'll gain access to a wide range of small cap stocks.

-

Why Invest in Small Cap Stock Index?

Investing in a small cap stock index offers substantial growth potential unmatched by larger companies. Small cap stock index funds also enable passive investors to enhance returns. Furthermore, opportunities arising from merger and acquisition activity provide additional potential for gains.

-

How do mid-cap and small cap stocks differ?

Mid-cap stocks are slightly riskier than large-cap stocks but less risky than small cap stocks. Conversely, small cap stocks entail elevated risk levels. Despite their risk, small cap stocks offer significant growth potential. Large-cap funds tend to be less volatile unless influenced by significant news.

Disclaimer: This blog is dedicated exclusively for educational purposes. Please note that the securities and investments mentioned here are provided for informative purposes only and should not be construed as recommendations. Kindly ensure thorough research prior to making any investment decisions. Participation in the securities market carries inherent risks, and it's important to carefully review all associated documents before committing to investments. Please be aware that the attainment of investment objectives is not guaranteed. It's important to note that the past performance of securities and instruments does not reliably predict future performance.