India's Paper Industry: Comparative Analysis of Major Stocks

Paper Industry

Paper industry plays an essential role in various other sectors like packaging, printing industry, FMCG products, pharmaceuticals packaging , healthcare etc. In India, paper consumption is forecasted to reach 30 million tonnes by 2027.

Paper Industry in India

India’s paper industry constitutes about 5% of the world’s capacity as it posted a turnover of over INR 80,000 crore and provided approximately INR 5000 crore to the government’s revenue. The Paper Industry provides direct employment and indirect employment to the Indian population. The primary material for the paper industry includes woods, bamboo and recycled fibres and the production and consumption rates are fairly divided among regions. Present per capita consumption of the paper is 15-16 kg in India. Also, India’s paper market is the fastest growing market in the world and in the future the growth will be multiplied with the growth of the economy.

Comparison of Paper Stocks in India

Let’s consider the three among the paper industry stocks which are classified based on market capitalization.

Discover the power of Enrich Money's advanced digital investment platform. Start your journey towards financial success with a free demat trading account, supported by Enrich Money's expertise in wealth technology management.

Let’s consider the following stocks for comparative analysis.

Intraday Price Comparative Analysis

|

Stock Name (as of 23rd July, 2024) |

JK Papers |

West Coast Paper Mills |

Seshasayee Paper & Boards |

|

Open (INR) |

Rs.570.50 |

Rs.655.45 |

Rs.339.90 |

|

High (INR) |

Rs.570.50 |

Rs.658.10 |

Rs.343.60 |

|

Low (INR) |

Rs.554.90 |

Rs.638.70 |

Rs.325.10 |

|

Last Traded Price (INR) |

Rs.556.70 |

Rs.638.00 |

Rs.333 |

|

Volume |

232181 |

53227 |

36602 |

|

Previous Close (INR) |

Rs.568.15 |

Rs.655.45 |

Rs.339.90 |

Chart Analysis

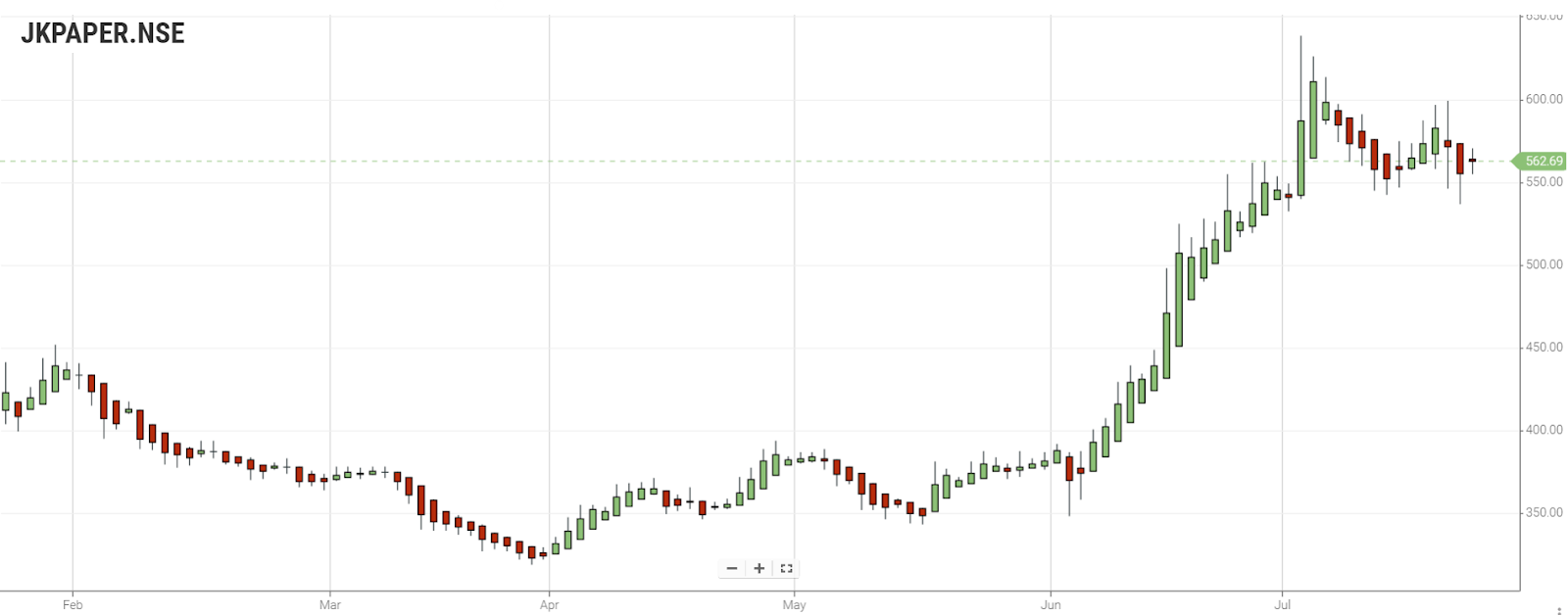

JK Paper Limited

JK Paper Limited, established in 1962, is a prominent producer of packaging boards and branded papers. It operates across four key segments: writing and printing papers, coated printing papers, office and copier papers, and high-end packaging boards. With mills in Gujarat, Odisha, and Telangana, JK Paper serves global markets, including the Middle East, USA, and Europe.

Bullish Initiation Heikin Ashi pattern is formed on JK Paper daily and monthly charts. Bullish Heikin Ashi pattern with a bullish tick from green to red is observed on weekly charts.

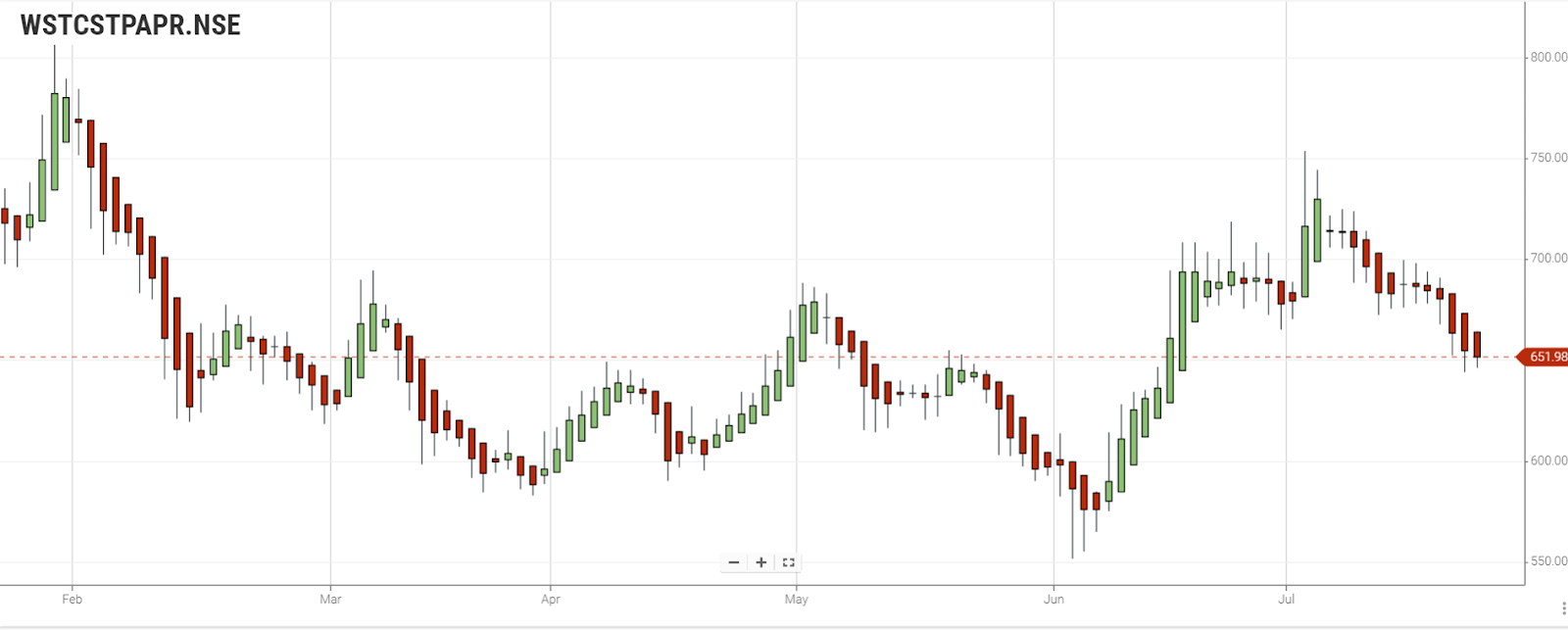

West Coast Paper Mills Limited

West Coast Paper Mills Limited, established in 1955, specializes in producing high-quality paper for printing, writing, and packaging. The company offers a diverse range of products, including premium and security-grade papers. Known for its expertise in customized solutions, West Coast Paper Mills caters to both commercial and niche market needs

.

Bullish Initiation Heikin Ashi Pattern is formed on monthly charts. Bearish Initiation Heikin Ashi pattern is formed on weekly charts. Bearish continuation Heikin ashi pattern is formed on daily charts.

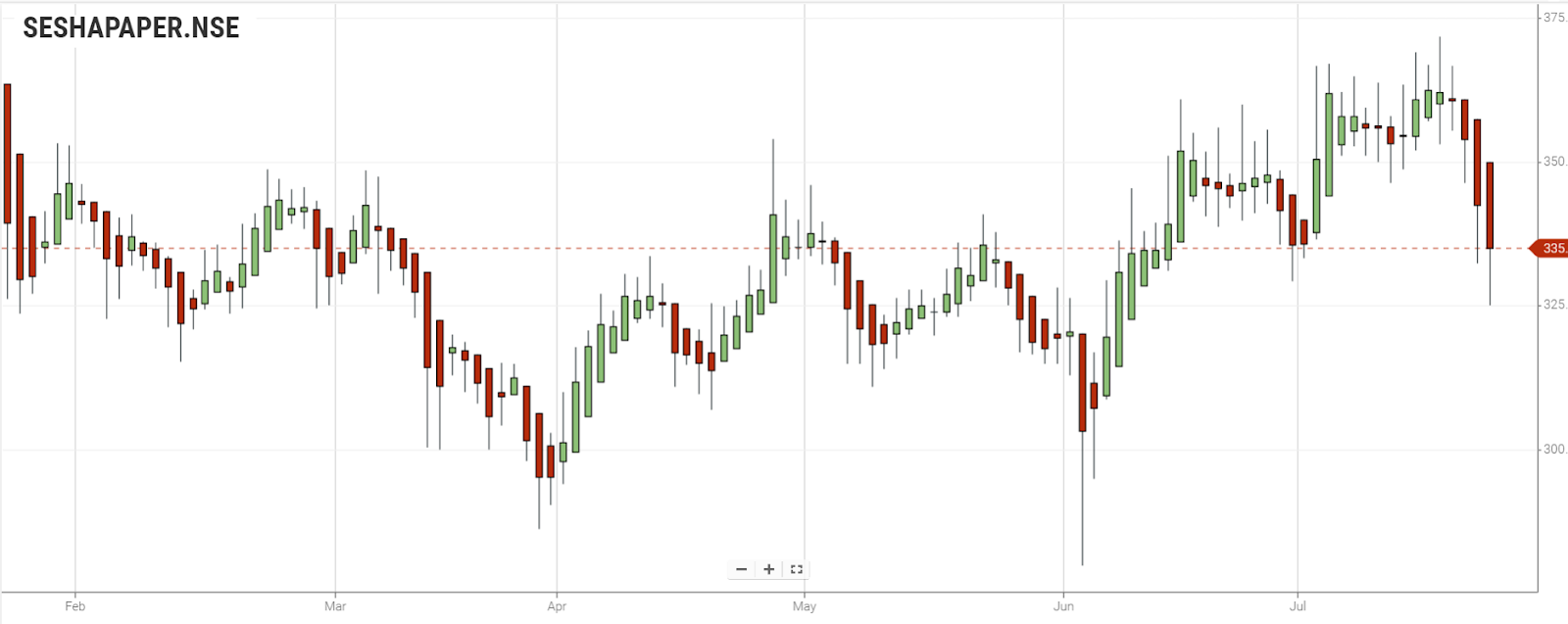

Seshasayee Paper & Boards Limited

Seshasayee Paper & Boards Limited focuses on producing a diverse range of paper and paperboards, primarily for printing and writing applications. With manufacturing facilities in Tirunelveli and Erode, the company has a robust annual production capacity of around 255,000 tons. The firm's product portfolio includes various grades such as Azurelaid, Color Sprint, and MG Poster, catering to specialized

The Bearish Initiation Heikin Ashi Pattern is formed on weekly and monthly charts. Bearish continuation Heikin ashi pattern is formed on daily charts.

JK Paper shows strong bullish signals on daily and monthly charts, indicating potential upward movement. West Coast Paper presents mixed signals with bullish monthly and bearish weekly/daily patterns. Seshasayee Paper demonstrates bearish trends across daily, weekly, and monthly charts, suggesting a downward trajectory.

Fundamental Analysis

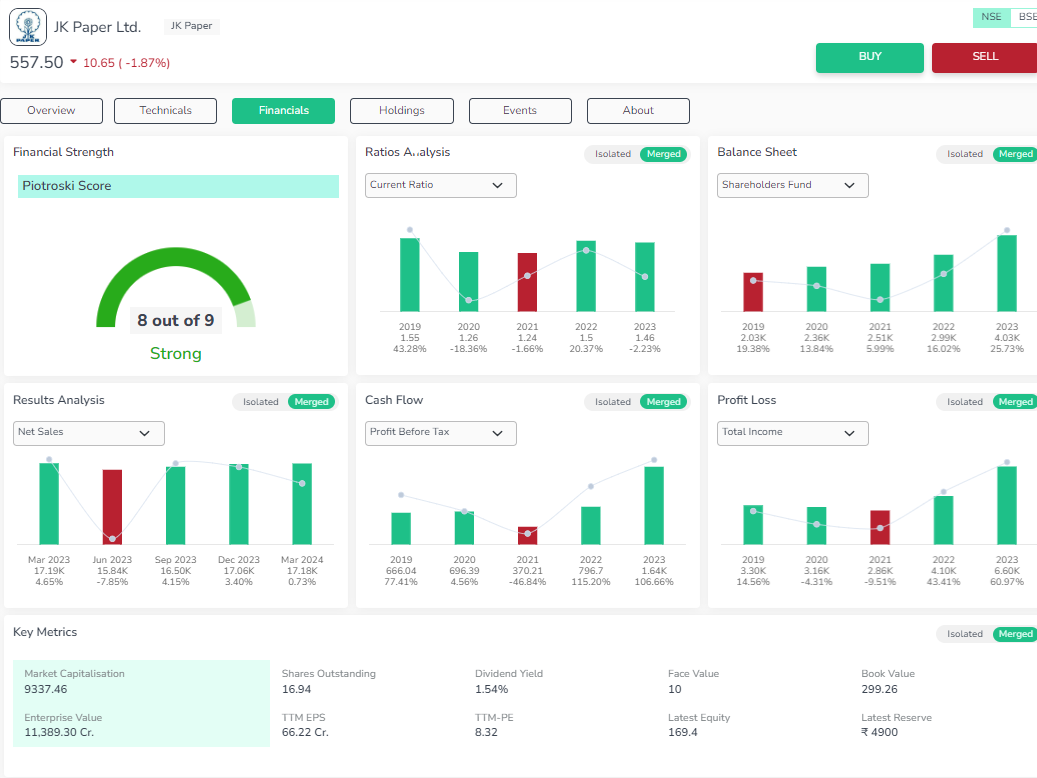

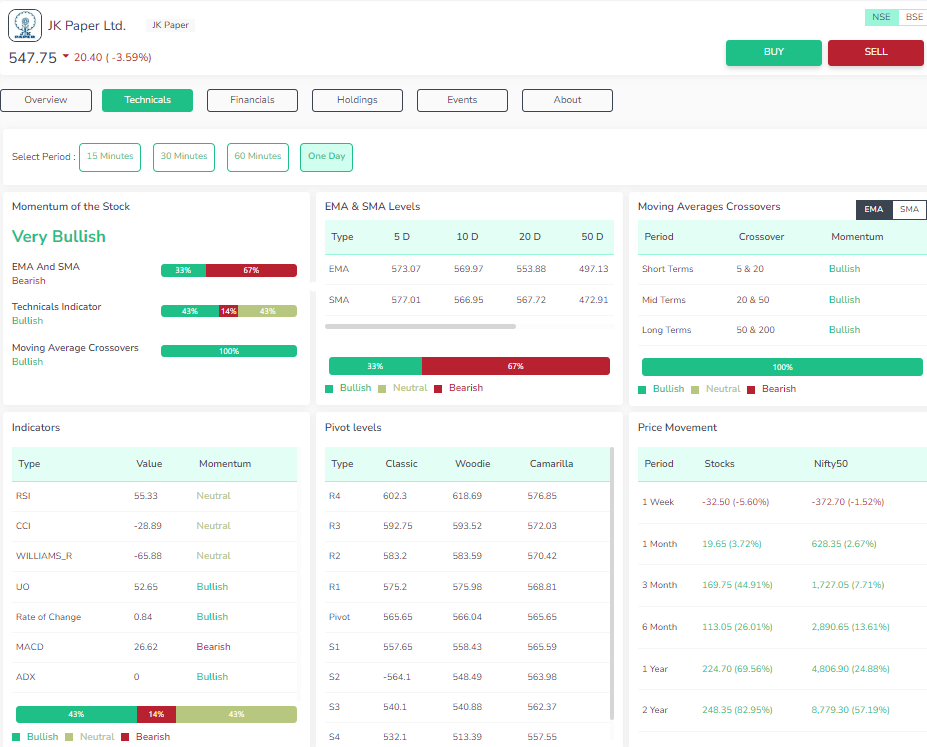

JK Paper Limited

Valuation – On valuation, the book price of the stock is underpriced indicating a strong buy signal for the investors.

Profitability – On analysis, the company has made excess earnings , and positive return on equity , net margin and RoCE

Growth – On analysis, the company has made a positive impact on its net and total annual sales.

Stability – On analysis, the company has maintained good liquidity.

West Coast Paper Mills Limited

Valuation – On valuation, the book price of the stock is underpriced indicating a strong buy signal for the investors.

Profitability – On analysis, the company has made excess earnings , and positive return on equity , net margin and RoCE. But the company’s earnings per share has reduced in the past four quarters.

Growth – On analysis, the company has made positive impact on its total assets

Stability – On analysis, the company has maintained good liquidity.

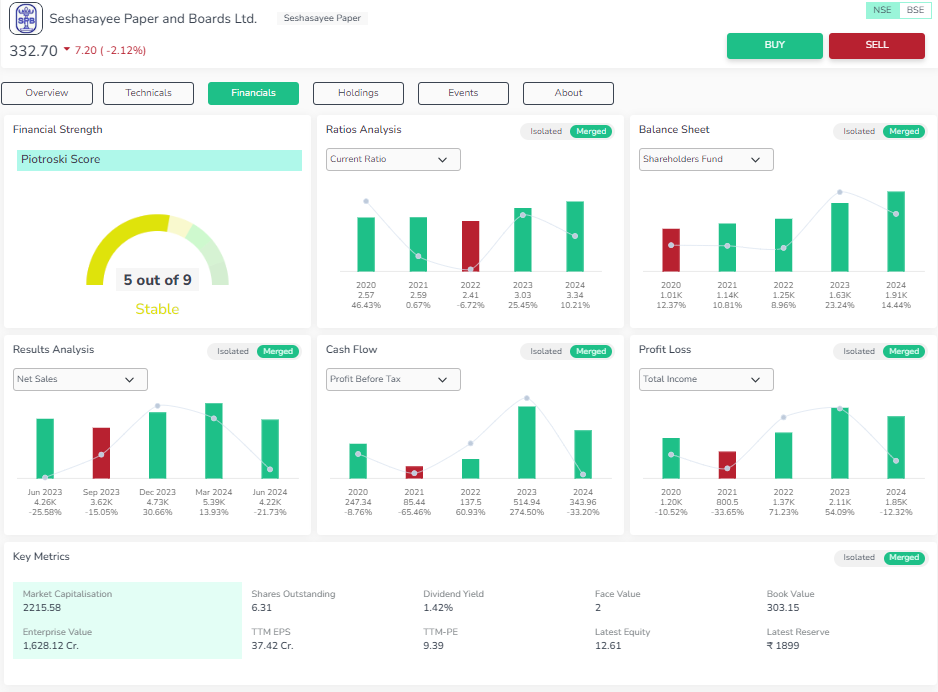

Seshasayee Paper & Board Limited

Valuation – On valuation, the book price of the stock is underpriced indicating a strong buy signal for the investors.

Profitability – On analysis, the company has made excess earnings , and positive return on equity , net margin and RoCE. But the company’s earnings per share have reduced in the past four quarters.

Growth – On analysis, the company increased its total assets in the past three years.

Stability – On analysis, the company has maintained good liquidity.

The fundamental analysis of JK Paper Limited, West Coast Paper Mills Limited, and Seshasayee Paper & Board Limited reveals that all three stocks are currently undervalued, making them strong buy signals. While JK Paper shows robust profitability and growth, West Coast and Seshasayee have seen a reduction in earnings per share but maintain positive liquidity and asset growth.

Technical Analysis

Unlock deep insights into stock performance with the Orca app. Access detailed technical and fundamental analysis instantly. Download now!

JK Paper Limited

While observing EMA and SMA signals, JK Paper exhibits bearish signals . Technical indicators and moving average crossovers indicate a bullish pattern.

West Coast Paper Mills Limited

While observing EMA and SMA signals, Technical indicators and moving average crossovers indicate bullish patterns in West Coast Paper Mills.

Seshasayee Paper & Boards Limited

While observing EMA , SMA and moving average crossovers, Seshasayee indicates a bullish pattern. While the Technical indicators remain neutral.

The technical analysis reveals that JK Paper Limited shows mixed signals with bearish EMA and SMA but bullish crossovers, West Coast Paper Mills Limited displays a strong bullish pattern across all indicators, and Seshasayee Paper & Boards Limited indicates a bullish pattern despite neutral technical indicators.

The above chart exhibits the comparative technical study of three Paper stocks based on Moving average crossover signals and Relative strength index for a period of 6 months.

Conclusion

JK Paper Limited shows a mix of bearish and bullish signals, indicating potential but cautious optimism. West Coast Paper Mills Limited presents strong bullish indicators, suggesting a promising outlook. Seshasayee Paper & Boards Limited shows bullish patterns despite neutral technical indicators.

The Enrich Money Orca app provides investors with detailed insights into stock momentum trends. Investors are advised to perform thorough evaluations using both technical and fundamental analysis tools before making any investment decisions.

Frequently Asked Questions

How can I analyze and invest in Paper Industry stocks through Enrich Money?

Enrich Money provides a user-friendly investment platform for investors to invest in Paper Industry stocks. This tool provides a detailed analysis and forecast of each stock. Open a free demat account, fund it, and start trading using our user-friendly interface.

What factors should I consider when comparing paper industry stocks?

Consider market capitalization, production capacity, profitability, growth prospects, and financial stability. Also, analyze technical indicators like EMA, SMA, and moving average crossovers.

Which paper stocks are covered in this comparison?

This comparison includes JK Paper Limited, West Coast Paper Mills Limited, and Seshasayee Paper & Boards Limited. Each stock is analyzed based on fundamental and technical aspects.

What are the current technical indicators for JK Paper Limited?

JK Paper shows mixed signals with bearish EMA and SMA but bullish moving average crossovers. This suggests a cautious yet optimistic outlook.

Why is it important to use both fundamental and technical analysis?

Combining fundamental and technical analysis offers a holistic view of a stock's performance. It helps investors understand both the financial health and market trends, leading to more informed investment decisions.

Related Stocks

Orient Paper & Industries Ltd.

Seshasayee Paper and Boards Ltd.

Disclaimer: This blog is dedicated exclusively for educational purposes. Please note that the securities and investments mentioned here are provided for informative purposes only and should not be construed as recommendations. Kindly ensure thorough research prior to making any investment decisions. Participation in the securities market carries inherent risks, and it's important to carefully review all associated documents before committing to investments. Please be aware that the attainment of investment objectives is not guaranteed. It's important to note that the past performance of securities and instruments does not reliably predict future performance.