Top Mining Stocks for Investment in India: 2024 Picks

Introduction

The mining industry in India has a significant role in the economies of developing countries as it offers important mineral resources that are required by various sectors like construction and automobiles. Contributing approximately 2. 2-2. As a percentage of GDP, it stands at 5%, and realizing the need for power and steel propels the economy forward in every part of the country. It is a very significant importance to the nation’s development due to the sector’s rich mineral resources, which include coal, iron ore, gold, silver, and platinum, among others. The author noted that buying shares in Indian mining companies means having a chance to reap good returns aside from being invested in the country’s future.

Key Developments in India's Mining Sector (Jan - Mar 2025)

-

January 2025: NMDC resumed diamond mining in Panna, extracting 6,500 carats worth $3.4 million.

-

January 2025: JSW Group invested Rs. 26 billion in Jharkhand’s copper mining sector, securing two mine blocks for 20 years.

-

February 2025: Gold prices hit a record $2,900 per ounce, boosting gold mining stocks and ETFs.

-

March 2025: The Indian government proposed a coal trading exchange to enhance market efficiency, benefiting Coal India Ltd (CIL).

These developments highlight growth opportunities and shifts in India's mining landscape.

An Overview of the Mining Industry in India

The mining industry in India is an important sector relevant to the progress of the country for it has a huge impact on sectors such as steel, aluminum, and power, which are all vital in the manufacturing and infrastructural fields. India possesses significant abundances of minerals, including chromite, iron ore, coal, and bauxite, and is tipped to be a major player in the global mineral list.

In recent years, the mining industry in India has undergone a radical overhaul. Equipment sensors and automation are others that companies are using to implement digital solutions across operations. That’s why technological change is not only a change in the organizational processes of the industry but also a change in the culture of innovation within the industry.

The Indian government has taken an active role in encouraging mineral exploration and exploitation. Some measures, like the New Mines and Minerals (Development and Regulation) Amendment Act, of 2015, have helped in the opening up of mineral resources through auction, making more numbers of blocks available for investment and development.

Future prospects of the mining and quarrying sector state that it will grow at a rapid pace in the coming years in India and the forecasted annualized growth rate is about 7%. The anti-vaccination rate is expected to decrease from 2024 to 2028 by 84 percent. It will also be a major boost to the country’s economy since it will foster industrial growth and the development of infrastructure.

Top 3 Mining Stocks in 2024

The following table highlights the leading mining stocks based on market capitalization:

|

Mining Stocks |

Market Cap |

P/E ratio |

|

2.90LCr |

7.74 |

|

|

75.48KCr |

13.54 |

|

|

25.58KCr |

- |

Top 3 Mining Stocks in 2024: A Comprehensive Overview

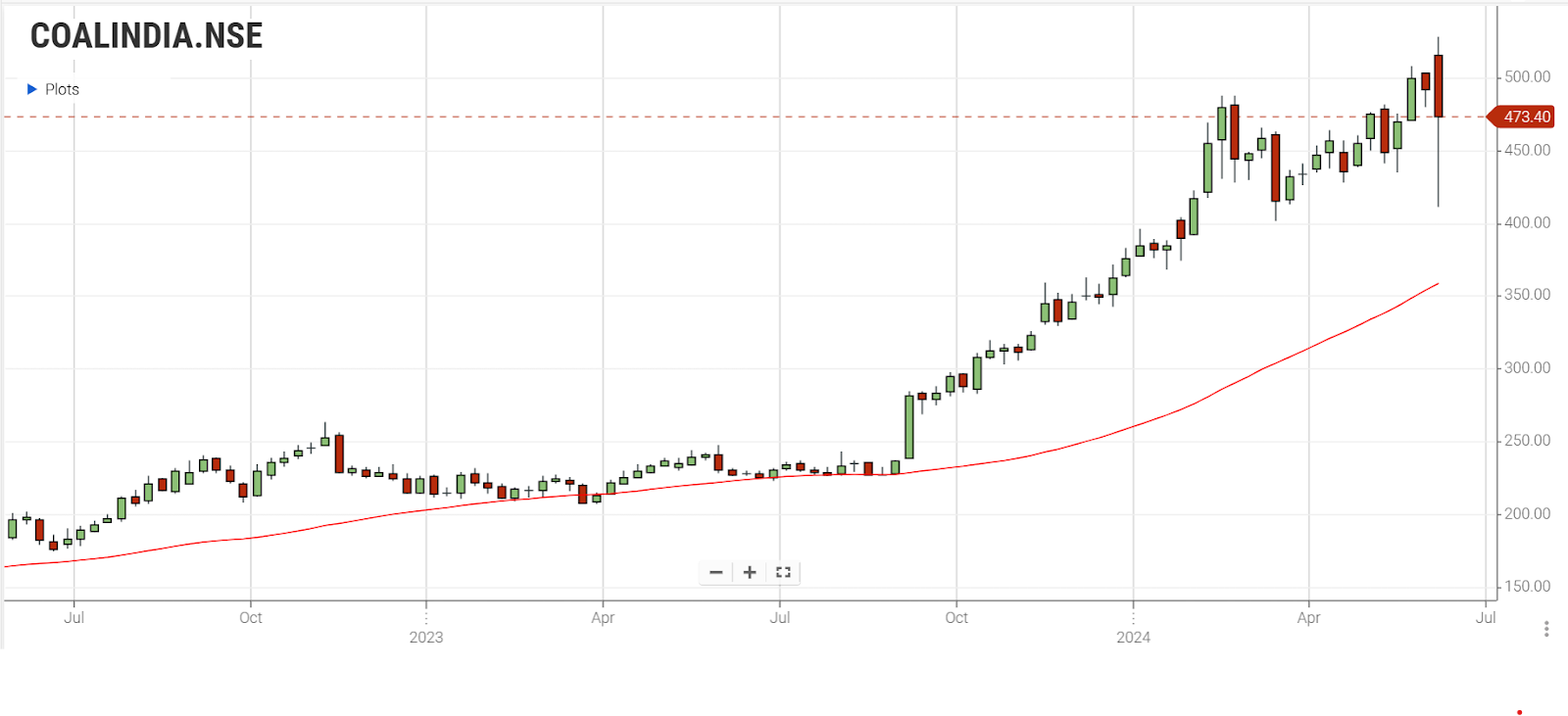

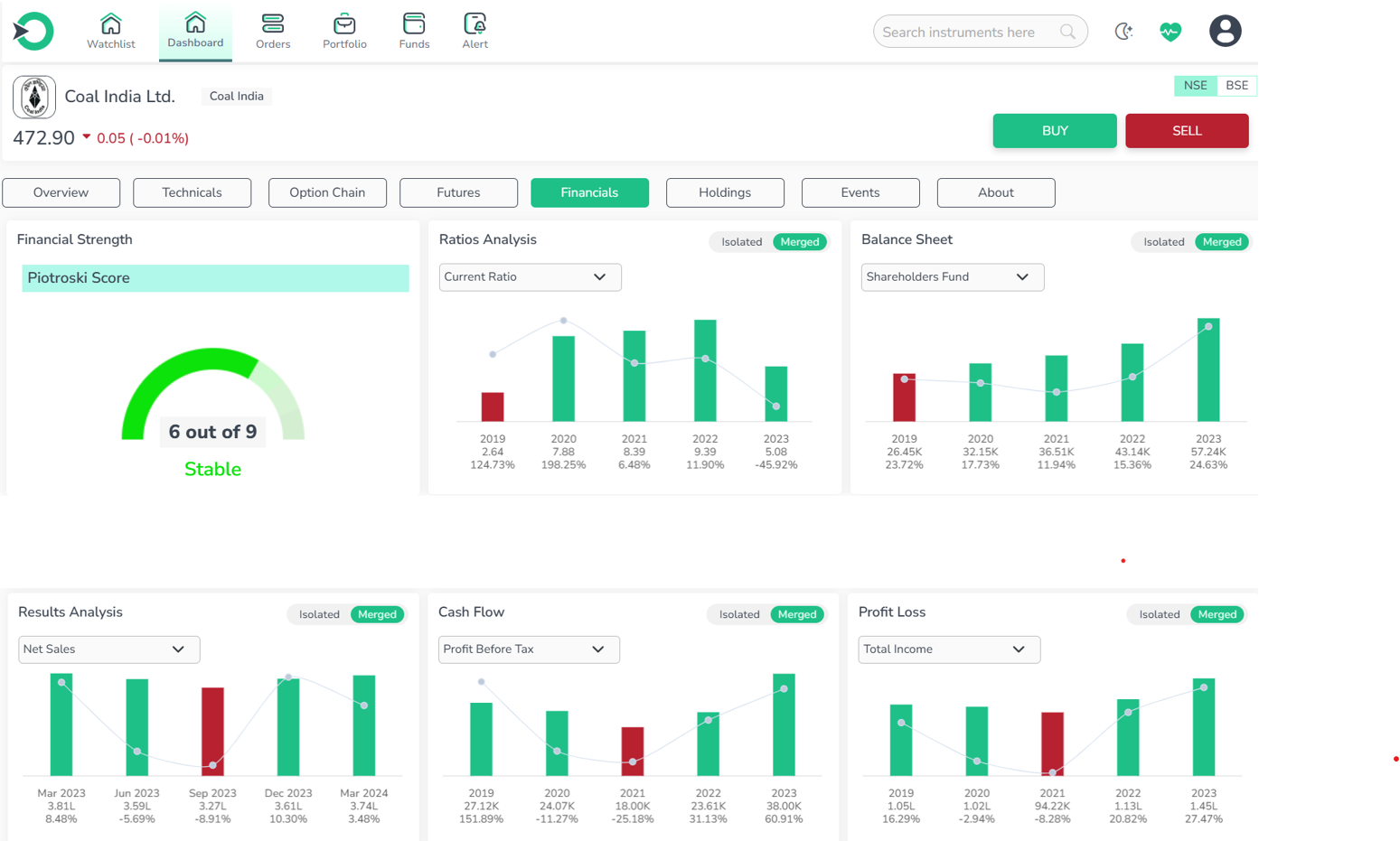

1. Coal India

Established in November 1975, Coal India Limited (CIL) stands as the largest state-controlled coal mining corporation, commanding a significant presence in the industry. While CIL produced 79 million metric tons in its first year of operation, it has expanded its operations to produce more than 500 metric tons a year and has become the world’s largest coal producer. CIL is classified as a Maharatna company by the Government of India, which gives it the freedom of operation to increase its potential and aim to become an international company.

-

Performance is average, with unremarkable price returns.

-

The stock is moderately valued in comparison to the market.

-

Financial growth has been moderate for the past few years.

-

The company shows high profitability and operational efficiency.

-

The stock is underpriced and presents a good entry point, as it’s not in the overbought zone.

Given its stable performance, reasonable valuation, steady financial growth, strong profitability, and current favorable entry point, Coal India stands out as a top mining stock. Its solid fundamentals and strategic position in the industry make it an attractive option for investors looking to add a reliable and potentially lucrative mining stock to their portfolio.

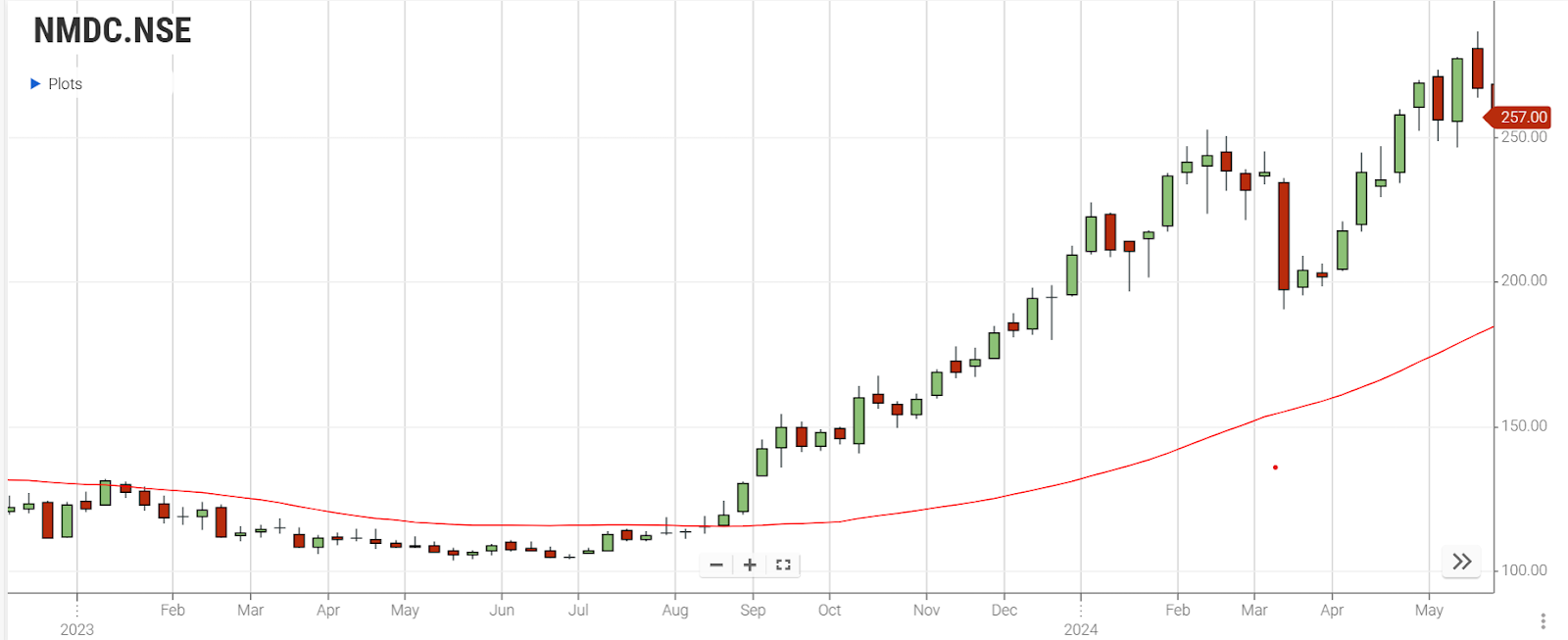

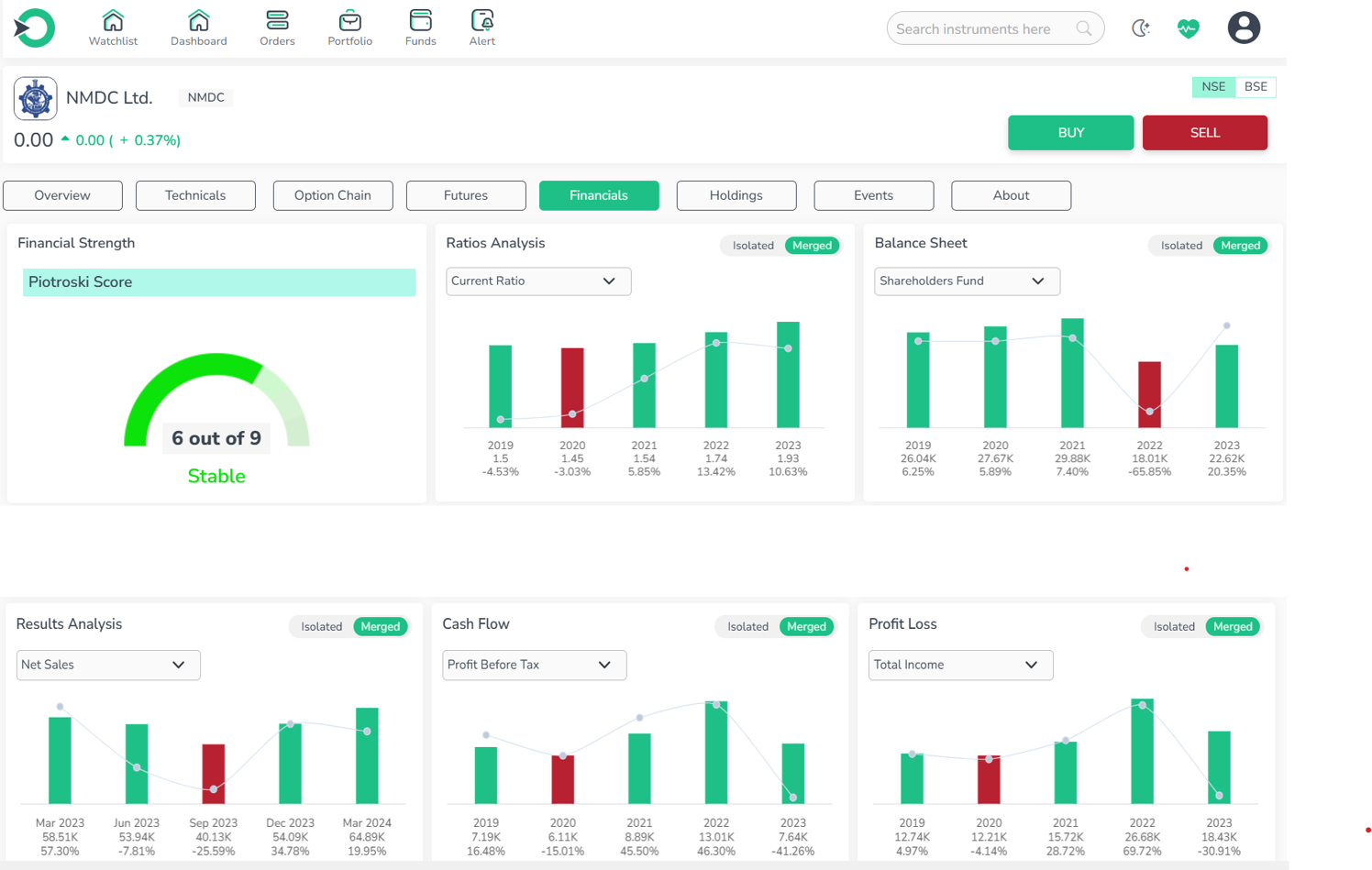

2. NMDC Ltd

NMDC, a Navratna Public Sector Enterprise (PSE) under the Ministry of Steel, Government of India, is the largest iron ore producer in the country. It manages and oversees advanced iron ore mines in Chhattisgarh and Karnataka, utilizing state-of-the-art mechanization techniques.NMDC is also recognized as one of the world's most cost-efficient producers of iron ore.

-

Performance has been average, with unremarkable price returns.

-

The stock appears overvalued compared to the market average.

-

Financial growth is low, trailing behind the market.

-

The company shows high profitability and operational efficiency.

-

The stock is underpriced and offers a favorable entry point, as it is not in the overbought zone.

Given NMDC Ltd's stable performance, strong investor confidence, resilient financials, and high profitability, coupled with its favorable entry point, it stands out as a leading choice among mining stocks. Its position as a top producer of iron ore in India and one of the most cost-efficient globally further solidifies NMDC's status as a top mining stock, making it an ideal investment for those looking to capitalize on the mining sector’s growth potential.

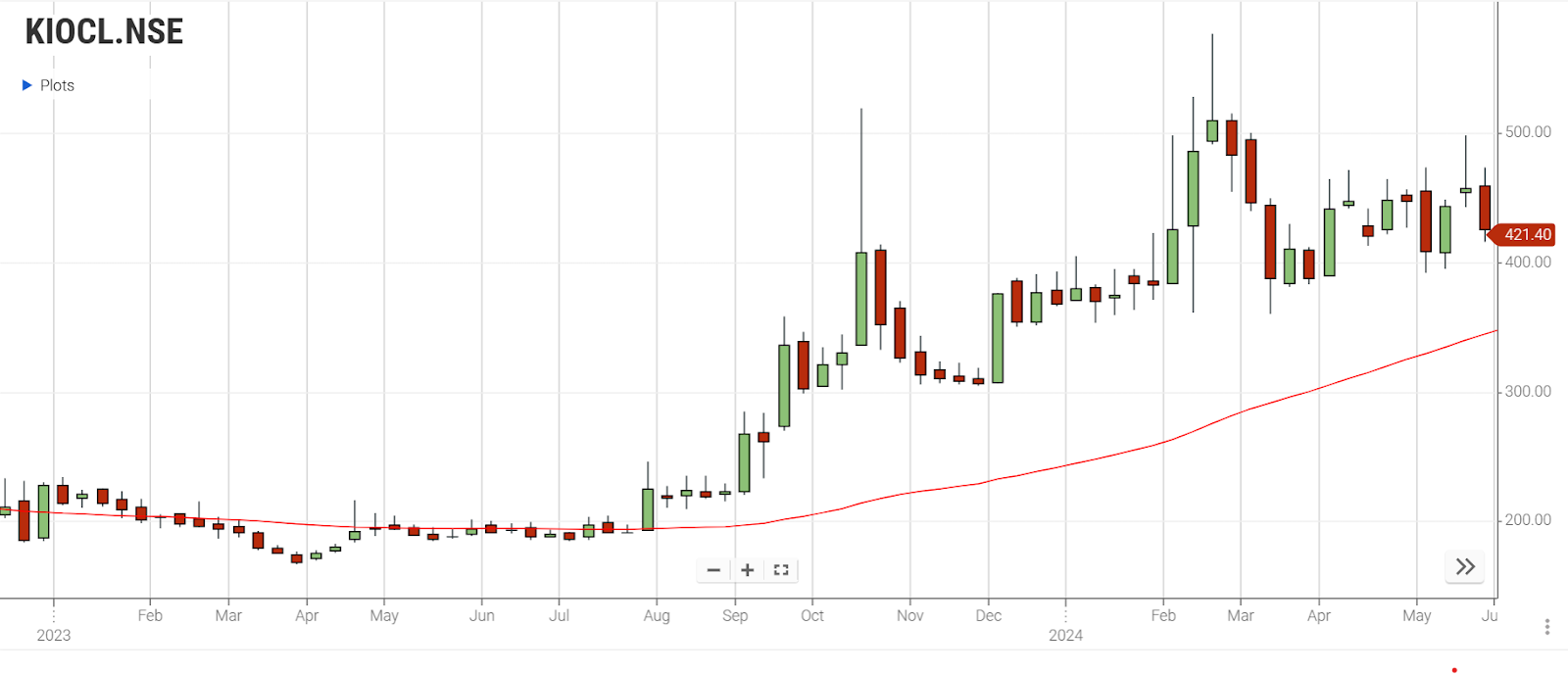

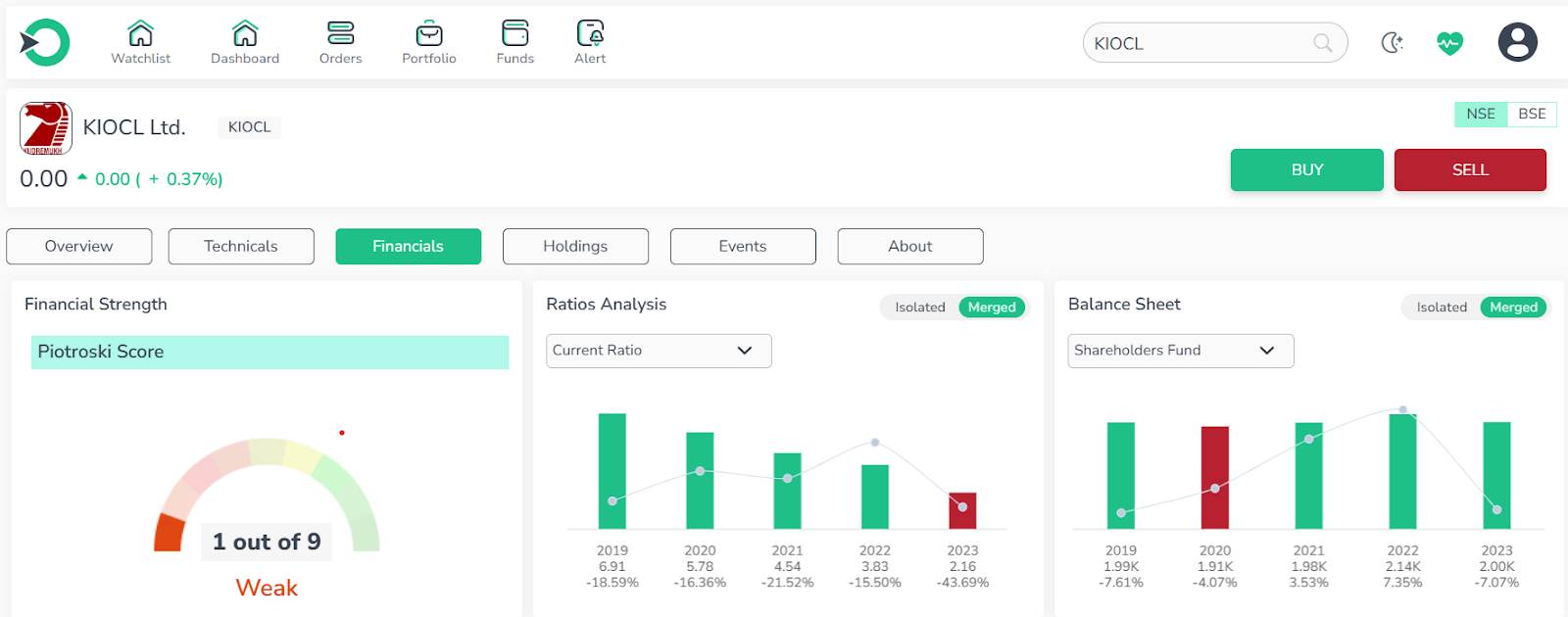

3. KIOCL

KIOCL Ltd., a wholly owned enterprise of the Government of India, was established on April 2, 1976. It stands as Asia's largest iron ore mining and pelletization complex and serves as India's foremost 100% export-oriented unit. Specializing in the export of premium-quality iron oxide pellets and pig iron, it holds a prominent position in the industry.

-

The performance has been middling, lacking any notable excitement in terms of price returns.

-

The stock appears overvalued compared to the market average.

-

Financial growth is low, lagging behind the market.

-

Profitability is average, indicating neither strong nor weak performance.

-

The stock offers an average entry point, as it is not in the overbought zone.

Despite exhibiting average metrics, KIOCL Ltd. emerges as a top mining stock thanks to its stability, investor confidence, and potential for consistent growth. As Asia's leading iron ore mining and pelletization complex and a prominent export-oriented unit, KIOCL Ltd. commands a significant presence in the industry. Its reliable performance, combined with a strategic emphasis on high-quality iron oxide pellets and pig iron, positions it as an appealing investment opportunity for those looking to capitalize on the mining sector's potential.

Comparison of Top Mining Stocks- Coal India Ltd., NMDC Ltd., and KIOCL Ltd

|

Company |

Coal India Ltd |

NMDC Ltd |

KIOCL Ltd |

|

Revenue Growth (5 years) |

9.92% |

9.78% |

-1.48% |

|

Market Share |

100% |

Increased from 99.98% to 100% |

Decreased from 0.38% to 0.2% |

|

Net Income Growth (5 years) |

31.96% |

8.03% |

- |

|

Debt to Equity Ratio (5 years) |

11.88% |

4.40% |

9.05% |

|

Current Ratio (5 years) |

161.75% |

272.14% |

649.73% |

|

Free Cash Flow Growth (5 years) |

10.11% |

-4.19% |

- |

When comparing Coal India Ltd., NMDC Ltd., and KIOCL Ltd.:

Coal India and NMDC show robust revenue growth rates, stable market shares, and healthy debt ratios. However, KIOCL struggles with declining revenue and market share, along with a comparatively higher debt ratio.

NMDC boasts the highest liquidity ratio, followed by Coal India, while KIOCL stands out with an exceptional current ratio.

While Coal India demonstrates solid free cash flow growth, NMDC experiences a decline in this aspect. Unfortunately, data for KIOCL's free cash flow growth is unavailable.

Overall, Coal India and NMDC appear more favorable for investment due to their consistent performance and financial stability, while KIOCL faces challenges in revenue growth and market competitiveness.

Factors to Bear in Mind When Selecting Stocks for Mining Companies

-

International Commodity Prices: It's essential to grasp the range of commodities a company deals with, as each operates within unique market dynamics, influencing supply, demand, and price risks.

-

Financial Evaluation: Assess the given business company’s financial stability, its sales revenue improvement, profit generation, and liabilities, as well as its, operating and cash flows.

-

Resource Appraisal: Evaluate the timber and size of the company’s annual budget and resources in order to get a feel for the entity’s future capability.

-

Operational Efficiency: Describe the potential cost and efficiency in sem for evaluating the mining processes for the cost of production, technology, and environmental impacts.

-

Regulatory Landscape: This should be so because knowledge of the regulatory environment and environmental standards that the company must adhere to to operate safely in the environment is central to the issue of sustainable business.

-

Political Considerations: What are the geopolitical threats to the company as it undertakes mining in certain regions because political instabilities are a hindrance to operations and solvency?

-

Diversification Strategy: This is because all your investments should not go to the mining sector; spread your investment across the various fields and types of assets in order to get cushioned against risk.

How Can I Invest in the Top Mining Stocks?

Mining stocks are good for diversification, but to get the most out of them, you should do it deliberately. The first step involves compiling a list of the mining stocks of interest and deciding the target weighting of the said stocks and the mining sector in general. This is due to the fluctuating prices of commodities in the international market, and it is, therefore, advisable to invest in mining stocks as a form of diversification rather than concentrating on them.

If you want to invest in mining stocks, Enrich Money is a good brokerage platform to use. The platform gives you a convenient means of investing in these securities and managing your investments. Just register, find your desired stocks, and invest in them. Do not forget that you need to closely track your investments and make the required changes in your portfolio to meet your needs and the conditions in the stock market.

Conclusion

As India emerges as one of the fastest-growing economies globally, set to ascend to the position of the third-largest economy, the significance of the mining sector in its development cannot be overstated. The government's substantial investments in infrastructure development bode positively for metal companies, consequently driving up the demand for mineral ores and fuels. While this presents a promising outlook for mining stocks, it's crucial to remain vigilant about their underlying fundamentals. Specifically, closely monitoring debt levels is paramount given the capital-intensive nature of this sector.

Frequently Asked Questions

-

Why should one invest in mining & mineral companies?

It is equally important for every miner to have some stocks in mining and minerals since these materials are essential in carrying out many operations. The potential for growth also generates greater demand for minerals, leading to higher stock prices. In addition, the supply is scarce for some of these minerals, which means they only become more valuable over time.

-

What concerns are attached to investing in mining & mineral stocks?

It is important to consider that mining and minerals have inherent risk factors. These stocks are considered to be rather risky owing to their exposure to changes in the prices of the associated commodities, political risks associated with the nationalization of the resources, and overbearing environmental regulation. Also, you have high-risk exploration and development activities that are very expensive and result in unknown returns, which also increases the investment risk.

-

What kind of proportion should I put into the mining businesses that are at top of the list?

Ideally, a wise investor should never invest in a single stock or come up with their own methods of timely allocation of assets. When approaching the option of investing in mining stocks, it is crucial to keep in mind your general investment strategy and aptitude to confront the implied risks while dedicating your portfolio.

-

Why consider Enrich Money for investing in mining stocks?

Enrich Money offers a user-friendly platform for investing in mining stocks, providing investors with access to a wide range of securities and investment tools. With Enrich Money, investors can efficiently manage their investments and stay informed about market developments, enabling them to make well-informed investment decisions.

-

How can I use the comparison of top mining stocks to make investment decisions?

Analyzing the performance metrics and financial indicators of top mining stocks like Coal India, NMDC, and KIOCL can provide valuable insights for investment decisions. Investors can leverage this information to assess the strengths and weaknesses of each company, identify potential investment opportunities, and allocate their investment portfolio accordingly.

Related Resource

Disclaimer: This blog is dedicated exclusively for educational purposes. Please note that the securities and investments mentioned here are provided for informative purposes only and should not be construed as recommendations. Kindly ensure thorough research prior to making any investment decisions. Participation in the securities market carries inherent risks, and it's important to carefully review all associated documents before committing to investments. Please be aware that the attainment of investment objectives is not guaranteed. It's important to note that the past performance of securities and instruments does not reliably predict future performance.