Top 3 Agriculture Stocks in India for 2025: Best Investment Options

Introduction

India's agriculture sector is a cornerstone of the nation's development. Investing in agriculture stocks within India presents numerous long-term benefits and growth opportunities. As India's population continues to surge, the demand for food and agricultural products is set to increase, driving industry expansion.

Furthermore, the Government of India is actively supporting the agricultural sector through various initiatives and policies, including subsidies, enhanced infrastructure, and farmer welfare schemes.

In this blog, we will delve into the top agriculture stocks in India that offer promising investment prospects.

A Brief Overview of the Agriculture Industry in India

The agriculture sector in India is a global powerhouse, serving as the primary source of income for about 55% of the population. India holds the distinction of having the largest cattle herd (buffaloes) and the most extensive areas for cultivating rice, wheat, and cotton. It also leads the world in milk, pulses, and spice production.

India is also the second-largest producer of fruits, vegetables, sugarcane, tea, farmed fish, and sugar.

Although the sector's contribution to India's GDP has significantly declined from 1990-91 to 2022-23 due to industrialization, agriculture has still achieved an average compound annual growth rate (CAGR) of 4% over the past 5 years.

To counteract this decline, the Government of India allocated approximately 1.9% of the total Union Budget for the fiscal year 2023-24 to the Agriculture and Allied sectors. About 1.3% of this is dedicated to supporting small and marginal farmers through the PM KISAN Yojana, while a significant portion, around 8.3%, is allocated for major subsidies, including those for food, fertilizer, and petroleum.

Leading Agriculture Stocks for 2024: Top 3 Picks

Below is a table showcasing the leading agriculture stocks in India for 2024 based on market capitalization:

Comparison of Agriculture Stocks in India

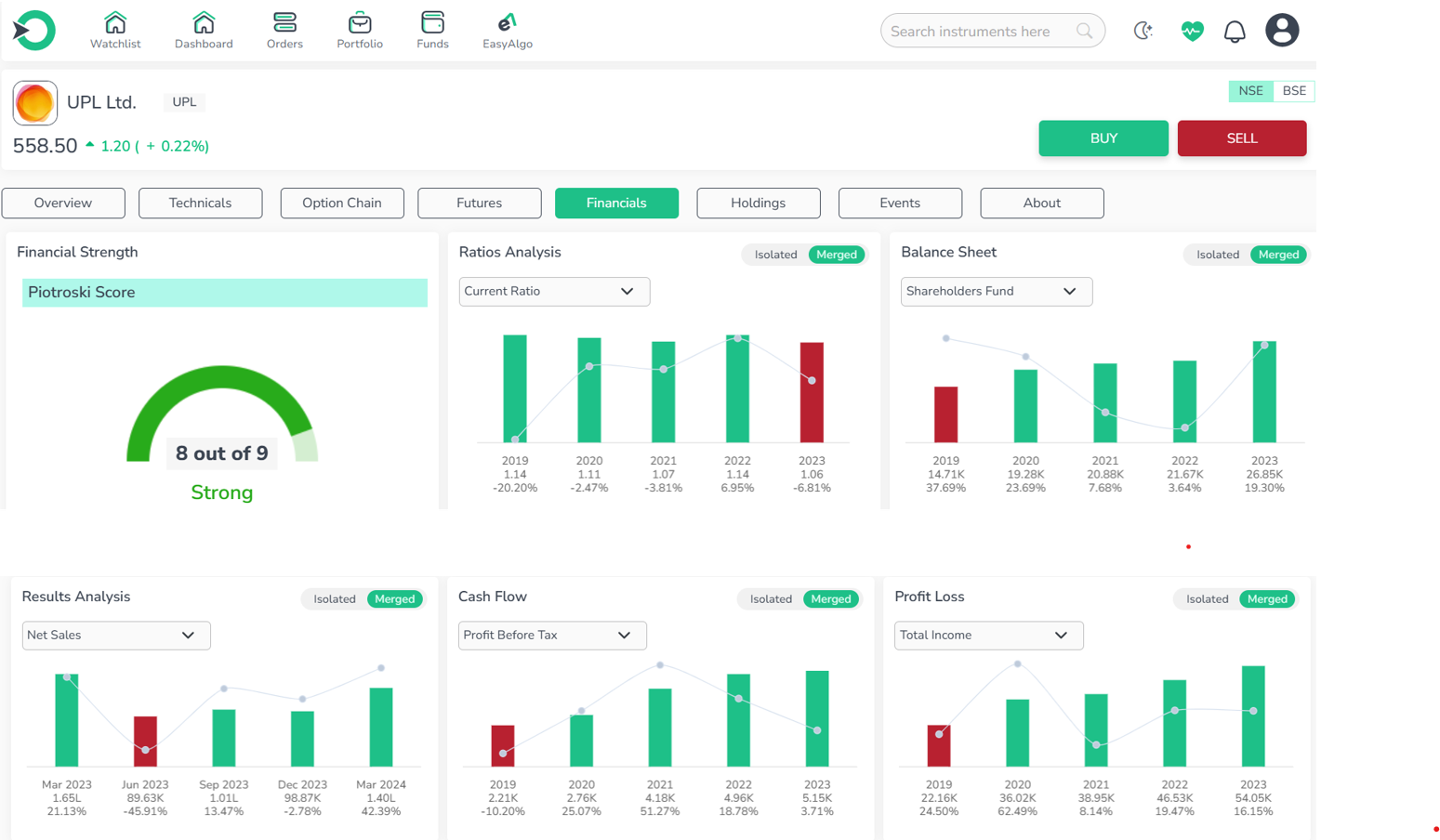

1. UPL Limited

UPL stands out as a global leader in food systems and ranks among the top five agricultural solutions companies worldwide. Following its acquisition of Arysta LifeScience, UPL became the fifth-largest agrochemical company globally.

-

UPL Limited seems to be overvalued compared to the market average.

-

The company's financial growth is lagging behind the market.

-

UPL Limited demonstrates strong profitability and efficiency.

-

The stock is at an average entry point and is not currently in the overbought zone.

In conclusion, UPL Limited stands out as a leading agriculture stock with strong indicators of profitability and efficiency. Despite being overvalued compared to the market average and lagging in financial growth, the company has demonstrated robust revenue growth of 24.90% over the past three years. UPL has significantly reduced its debt by Rs. 1,099 Cr and is now virtually debt-free. Additionally, it boasts an efficient cash conversion cycle of -70.36 days and effective cash flow management, with a CFO/PAT ratio of 2.56. The stock is currently at an average entry point, not in the overbought zone, making it a compelling consideration for investors.

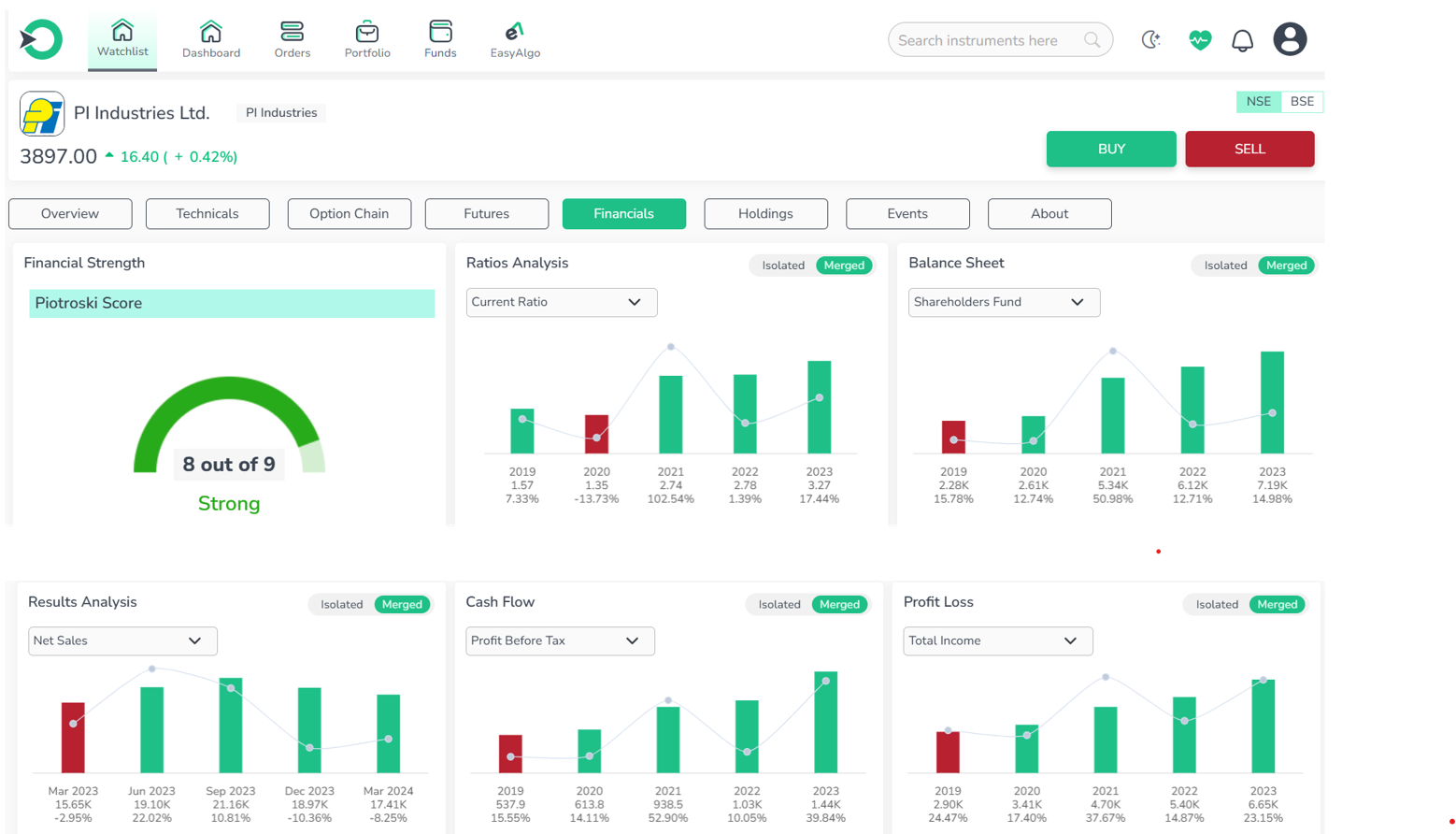

2. PI Industries Limited

PI Industries is a leading agrochemical company in India, known for providing integrated and innovative products and solutions to its customers. The company has earned significant brand recognition and established a strong global presence over the years, founded on principles of trust, integrity, and respect for intellectual property.

-

PI Industries Ltd seems to be overvalued compared to the market average.

-

The company's financial growth is lagging behind the market.

-

PI Industries Ltd demonstrates strong profitability and efficiency.

-

The stock is trading at a premium compared to its intrinsic value but is not experiencing excessive buying pressure.

In conclusion, PI Industries Ltd stands as a prominent player among agriculture stocks, demonstrating strong indicators of profitability and efficiency. Despite being overvalued compared to the market average and showing slower financial growth, the company has achieved impressive profit and revenue growth rates of 39.91% and 23.77%, respectively, over the past three years. PI Industries has also successfully reduced its debt by Rs. 267.80 Cr, maintaining a healthy Return on Capital Employed (ROCE) of 20.09% consistently over the same period. These factors underscore PI Industries Ltd's position as a compelling choice for investors looking at the agriculture sector.

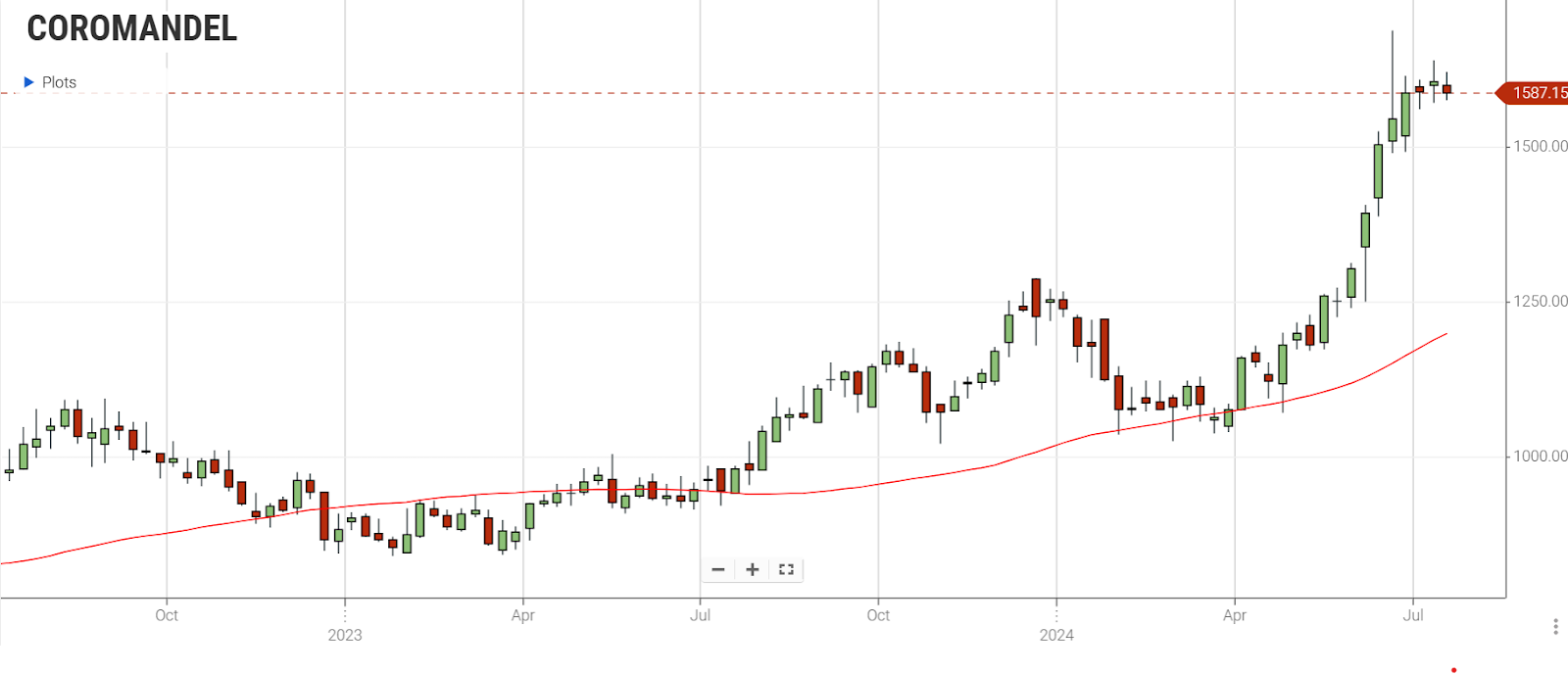

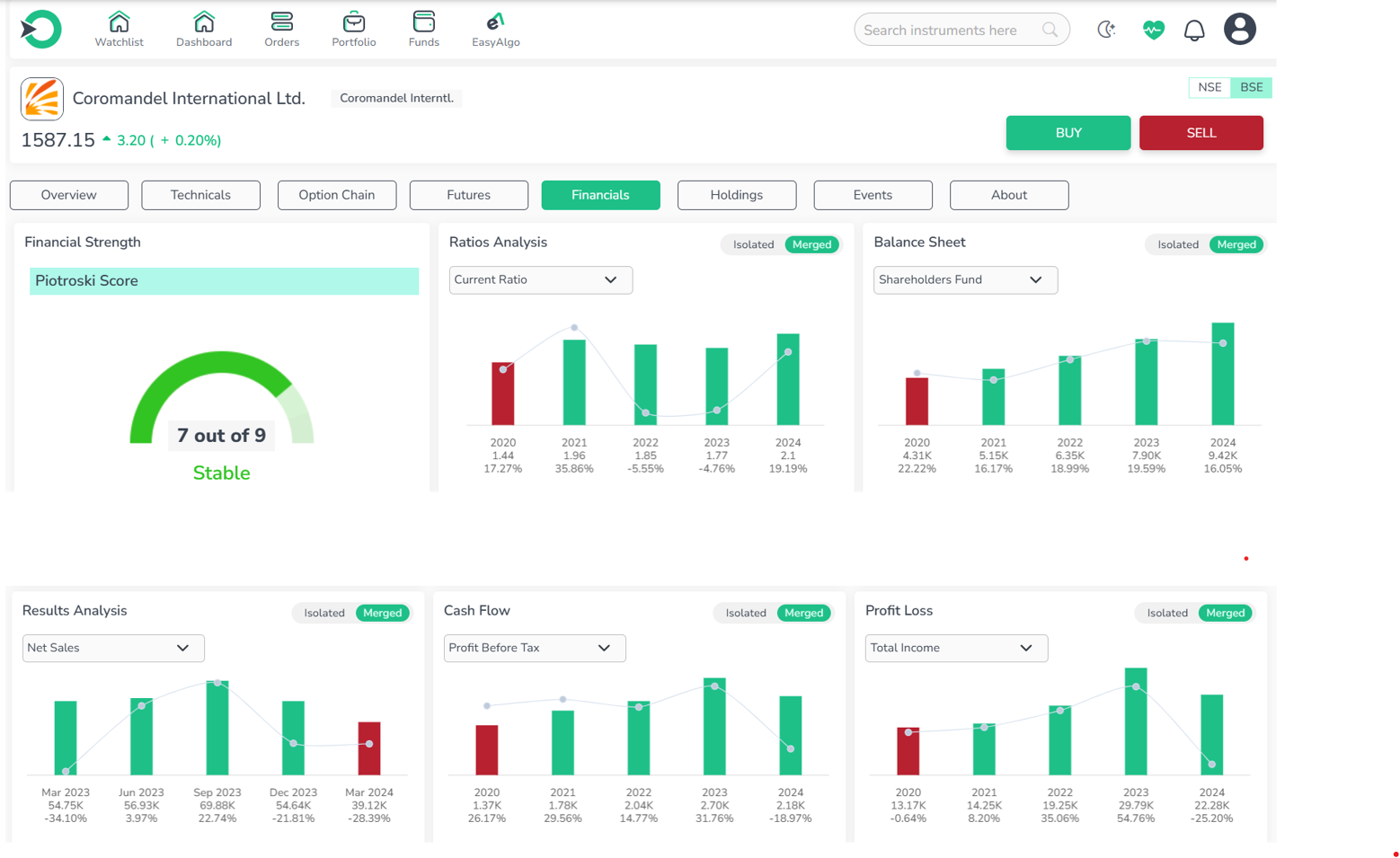

3. Coromandel International Limited

Coromandel International Limited, originally known as Coromandel Fertilisers, is an Indian agrochemicals company specializing in crop protection products. The company produces fertilizers, pesticides, and specialty nutrients. It is a part of the Murugappa Group and operates as a subsidiary of EID Parry.

-

Coromandel International Limited seems to be trading at a higher valuation relative to the market average.

-

The company's financial growth is lagging behind the market.

-

Coromandel International Limiteddemonstrates strong profitability and efficiency.

-

The stock is overpriced but is not currently in the overbought zone.

Coromandel International Ltd emerges as a leading agricultural stock with strong indicators of profitability and efficiency. Despite being overvalued compared to the market average and experiencing slower financial growth, the company has achieved a commendable revenue growth of 15.88% over the past three years. Coromandel International has also successfully reduced its debt by Rs. 4.21 Cr, while maintaining a healthy Return on Equity (ROE) of 24.44% and Return on Capital Employed (ROCE) of 34.80% consistently over the same period. These factors highlight Coromandel International Ltd's robust position in the agricultural sector.

Key Factors to Consider Before Investing in Agriculture Stocks in India

-

Assess the resilience of agriculture firms in managing complex supply chains for production, distribution, and transportation. The ability to handle disruptions from logistical challenges, transportation issues, or labor shortages is crucial for stable operations and financial performance.

-

Identify companies leveraging technology to enhance productivity and efficiency. Firms adopting innovative agricultural practices, precision farming, and digital solutions are likely to show long-term growth potential.

-

Stay informed about government policies, subsidies, and regulations impacting agriculture. Policies affecting crop pricing, fertilizers, and subsidies can significantly influence a company's profitability.

-

Keep abreast of global and domestic trends in agriculture. Changes in policy, market dynamics, and international trade can have significant effects on agriculture stocks.

-

Seek agricultural stocks that uphold diversified portfolios spanning multiple segments of the agriculture value chain. This strategy effectively mitigates risks linked to particular agriculture sectors.

-

Analyze the financial health of agriculture companies by examining factors such as revenue growth, profitability, debt levels, and cash flow. These metrics offer valuable insights into the stability and growth prospects of stocks within the agricultural sector.

Is Investing in Agriculture Stocks Right for You?

Before investing in agriculture sector stocks in India, it is essential to understand the potential risks involved. Changes in government regulations regarding essential materials and chemicals can directly affect the product offerings of these businesses. This may lead to a sudden halt in sales revenue, necessitating significant investments in research and development for new products.

Poor marketing strategies can lead to reduced market share, affecting overall company performance as competitors gain ground.

India's unpredictable weather patterns and uneven rainfall can disrupt farming activities and crop yields, affecting the demand for fertilizers and influencing the company’s sales. Financial risks, including cash flow shortages, diminished profitability, and potential market share erosion, are critical factors that necessitate careful consideration.

Therefore, a comprehensive understanding of these factors is crucial before considering investment in agriculture stocks.

Conclusion

In conclusion, investing in agriculture stocks in India offers substantial growth prospects for investors. However, it is essential to thoroughly evaluate factors such as financial health, technology adoption, and the regulatory environment before making investment decisions. Understanding these aspects can help mitigate risks and enhance the potential for returns in your investment portfolio.

Top agriculture stocks in India, including UPL Limited, PI Industries Limited, and Coromandel International Limited, exhibit strong indicators of profitability, efficiency, and market positioning. These companies have shown resilience in their financial performances and strategic initiatives within the agriculture sector.

For those looking to invest seamlessly, platforms like Enrich Money ORCA offer convenient avenues to access and invest in these promising agriculture stocks.

Frequently Asked Questions

-

Is it wise to invest in top agriculture stocks?

Investing in leading agriculture stocks can be beneficial for those with a long-term investment perspective and a moderate to high-risk tolerance. It is essential to conduct thorough research, understand the associated risks, and diversify your portfolio to mitigate potential risks.

-

How can I invest in agriculture sector stocks?

You can invest in agriculture sector stocks through various channels, including stock brokers, online trading platforms, or mutual funds that focus on agriculture-related companies.

-

What is agriculture's role in trade?

Agriculture plays a crucial role in India's trade, with the country exporting a variety of agricultural products such as rice, spices, tea, coffee, and processed foods. Leading stocks in the agriculture sector can positively influence India's trade balance and foreign exchange reserves.

-

How do global factors affect agriculture stock investments?

Global economic conditions, trade policies, and climate trends impact agriculture stocks. Understanding these factors helps navigate market volatility and optimize investment decisions.

-

Why choose Enrich Money for investing in agriculture stocks?

Enrich Money offers a seamless and user-friendly platform to invest in top agriculture stocks like UPL Limited, PI Industries Limited, and Coromandel International Limited. With easy access to market insights, real-time updates, and diverse investment options, Enrich Money ensures you stay informed and make well-informed investment decisions in India's thriving agriculture sector.

Disclaimer: This blog is dedicated exclusively for educational purposes. Please note that the securities and investments mentioned here are provided for informative purposes only and should not be construed as recommendations. Kindly ensure thorough research prior to making any investment decisions. Participation in the securities market carries inherent risks, and it's important to carefully review all associated documents before committing to investments. Please be aware that the attainment of investment objectives is not guaranteed. It's important to note that the past performance of securities and instruments does not reliably predict future performance.