Mastering Wealth Creation: The Ultimate Guide to SIP 500 per Month for 5 and 20 Years

Mutual Fund Industry in India

Mutual Fund Industry in India has undergone a remarkable transformation making a robust growth in retail investments. The Asset Under Management (AUM) has made a uptrend of 20% year on year change from 40.5 trillion rupees in 2022 to Rs.48.75 Trillion rupees in 2023.Despite global uncertainties, the remarkable performance of mutual fund industry was driven by robust macroeconomic growth, GDP, optimistic economic outlook, strong domestic inflows of funds, etc...People's preference has shifted from debt oriented funds to equity oriented fund with the growth of Exchange Traded Fund (ETF) market share from 16.1% in 2022 to 16.8% in 2023.

The Systematic Investment Plan (SIP), a monthly investment in mutual funds, reached an uptrend of 17073 crores in rupees in 2023. The retail inflows of funds in SIP accounts increased to Rs.7.44 crores in 2023. This uptrend brought by SIP is shaping the mutual fund industry in a systematic and disciplined way.

Mutual fund minimum investment 500 Rupees

Investors can invest in mutual Fund Scheme of SIP 500 per month, will be an investment strategy where the investor can invest in mutual fund 500 per month at every stipulated time period. This aids investors to participate in the stock market investments passively and get benefitted by buying more units of 500 Rs investment in mutual funds. The advantage of mutual fund minimum investment 500 rupees is Rupee Cost Averaging.

Factors To Consider in SIP 500 per month

Before investing in SIP 500 per month, investors should consider the following factors.

1. Risk Tolerance - Investor should analyze his risk tolerance before making any investment in SIP 500 per month. Consider analyzing the average mutual fund return with your investment goals.

2. Investment Goals - Investor should analyze the investment period and the expected risk return when investing in SIP 500 per month. Short term products like treasury bills, equities offer returns in short term whereas long term products like bonds and debentures offers returns over long period.

3.Past Performance of the SIP Plans - Investors should analyze the past performance of SIP 500 per month scheme to ensure good return.

4.Expense ratio - It indicates how much the SIP 500 per month would charge annually to manage your investment portfolio.

Top 5 Mutual Fund SIP 500 Per Month

Investors can invest in some of the best mutual fund SIP 500 per month for 5 years.

|

Scheme Name |

NAV in Rs. As on 31/01/2024 |

Fund Size in INR Crores |

Lock In Period |

Asset Allocation |

Average Annual Return |

|

35.78 |

5819.07 |

Nil |

Equity -98.52% & Others - 1.48% |

27.70% |

|

|

159.03 |

43815.61 |

Nil |

Equity - 96.42% & Others - 3.56% |

27.20% |

|

|

101.29 |

18615.72 |

Nil |

Equity - 92.87% & Debt -8.93% |

25.53% |

|

|

136.91 |

26836.99 |

Nil |

Equity - 90.81% & Others - 9.19% |

21.42% |

|

|

252.39 |

13002 |

Nil |

Equity -97.85% & Others - 0.69% |

19.81% |

SIP Scheme Analysis of Top 5 SIP 500 Per Month in 2024

Invest 500 per month for 5 years with detailed research and individual risk tolerance.

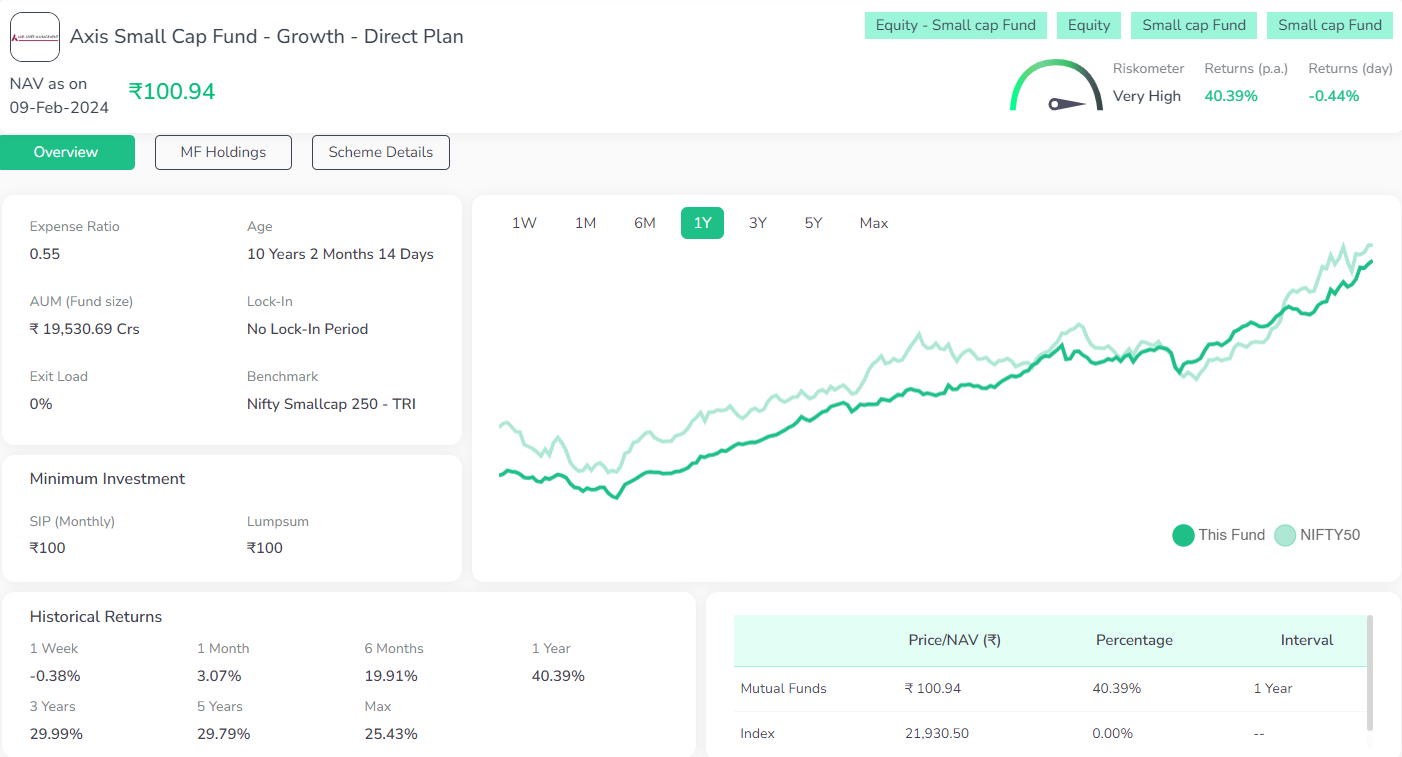

Axis Small Cap Fund Growth Direct Plan

Axis Small Cap Fund Growth Direct Plan is a Nifty SmallCap 250 - TRI mutual fund scheme introduced by Axis Mutual Fund on 11/11/2013.

The fund has an expense ratio of 0.55%. This SIP 500 per month for 5 years, would yield 116.76% of total return. Since its inception, the SIP has given a total return of 25.53% average annual returns for the last 10 years.

Pros - Good protection against market volatility, Highest return generator amongst small funds in last 10 years, Highest SUM growth in past 12 months, 20% more return for every unit of risk.

Cons - Ranks lowest in terms of return consistency, exit load of 1% if investment beyond 10% redeemed within 12 months.

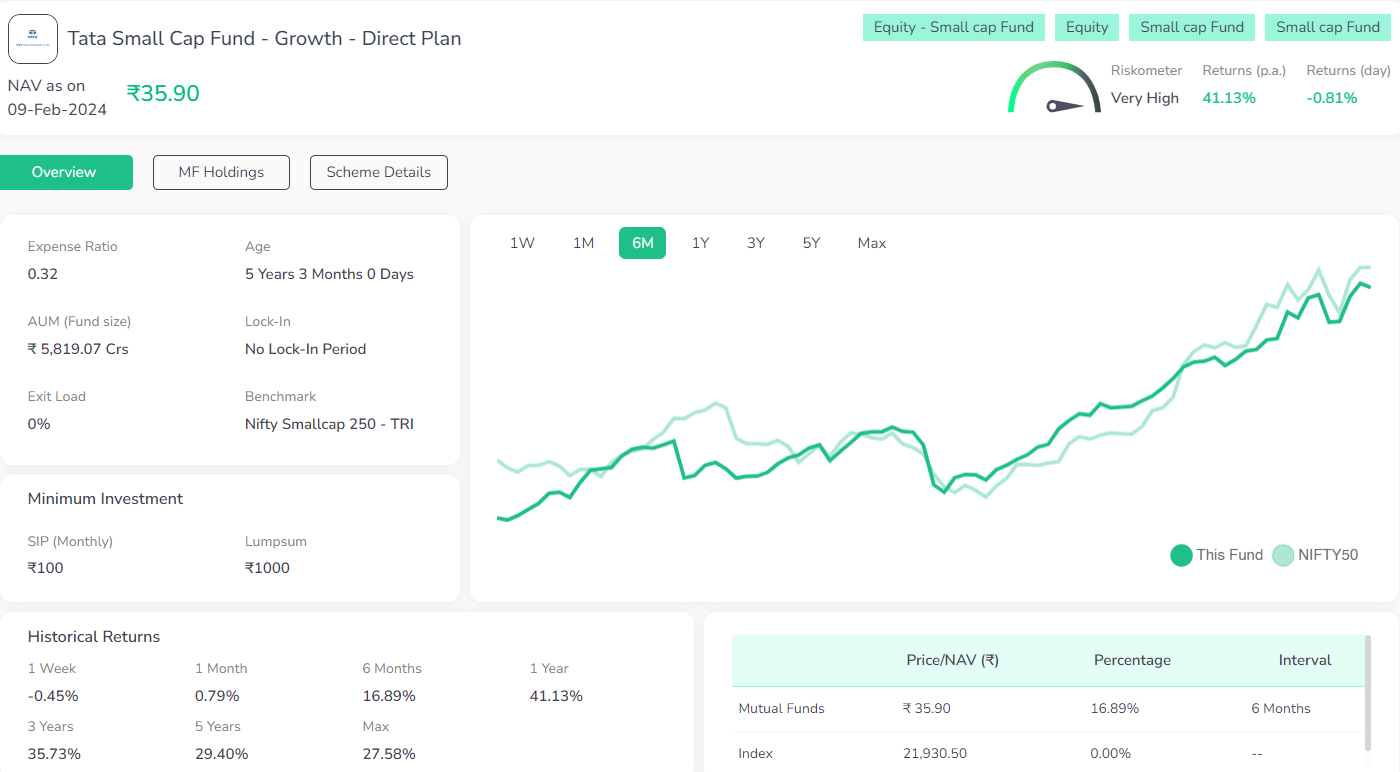

Tata Small Cap Fund Growth Direct Plan

Tata Small Cap Fund Growth Direct Plan is a Nifty Small Cap -TRI mutual fund scheme introduced by Tata Mutual Fund on 19/10/2018. This SIP 500 per month has a less expense ratio of 0.32%. In every 3 years, the scheme has provided double the return.

Pros - Since its inception, the fund has highest return of 27.7% annually and highest AUM growth in past 12 months. The scheme produces 20% more return for every unit of risk taken.

Cons - If withdrawn within 12 months, for units above 12% investment, exit load of 1% is levied.

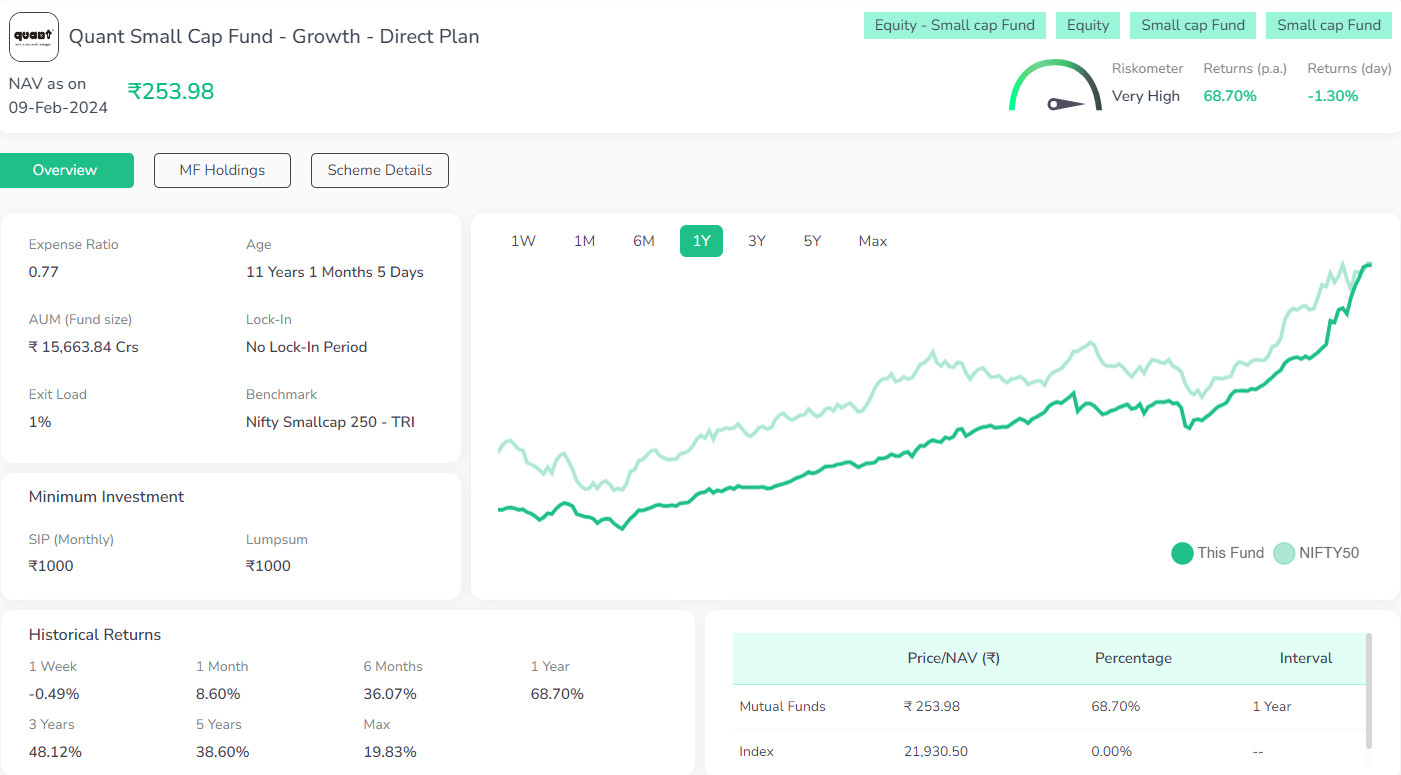

Quant Small Cap Fund Growth Direct Plan

Quant Small Cap Fund Growth Direct Plan is a Nifty SmallCap 250 - TRI mutual fund scheme introduced by Quant Mutual Fund on 1/1/2013.

This SIP 500 per month has an expense ratio of 0.77%. Since its inception, the SIP has given a total return of 19.81%% average annual returns for the last 10 years. In every 2 years, the scheme has provided double the return.

Pros - The scheme has generated highest consistent return of 7.12% annually. Also, highest AUM growth in past 12 months.

Cons - The scheme is highly sensitive to volatility and so possess highest risk. If withdrawn within 12 months, exit load of 1% is levied.

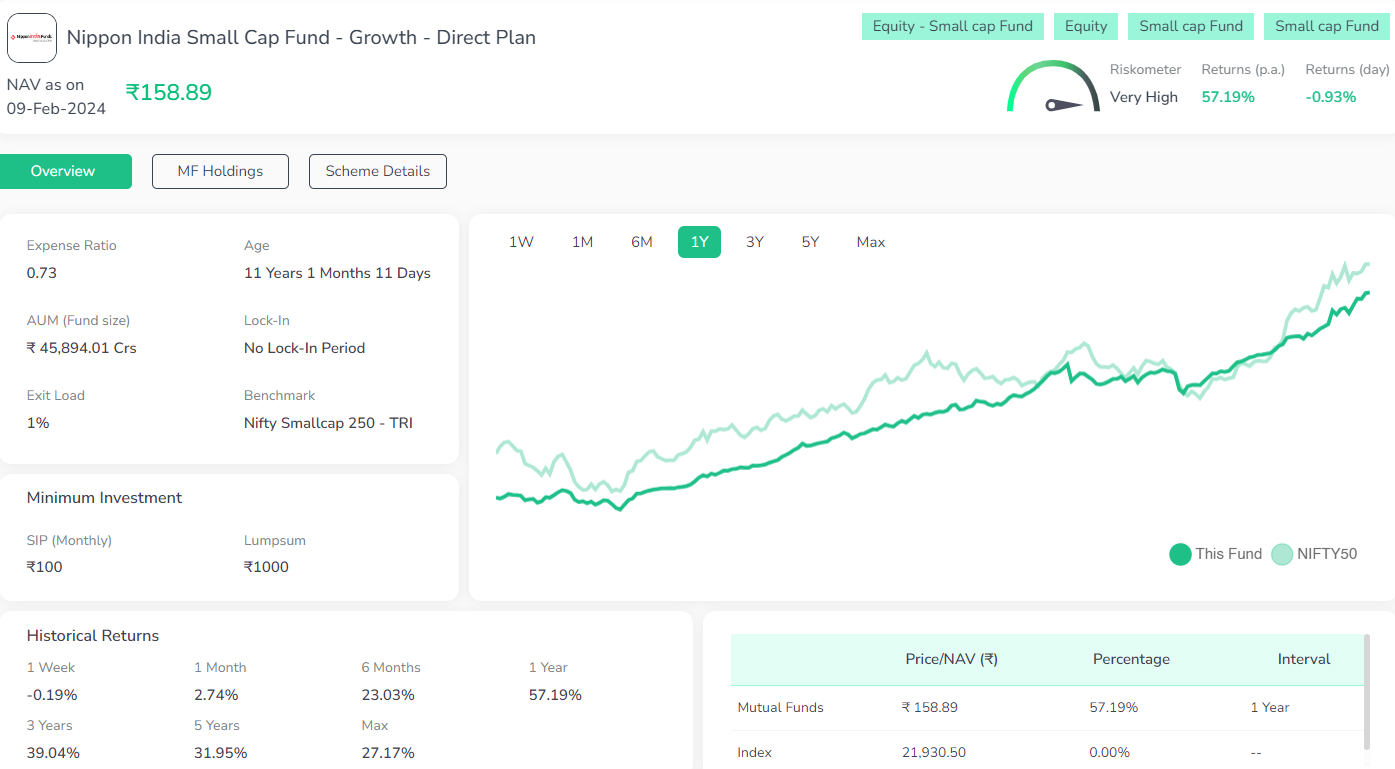

Nippon India Small Cap Fund Growth Direct

Nippon India Small Cap Fund Growth Direct Plan is Nifty Small Cap 250-TRI mutual fund scheme from Nippon India Mutual Fund on 1/1/2013. This scheme of SIP 500 per month has an expense ratio of 0.67%. Since its inception, the SIP has given a total return of 27.20% average annual returns for the last 10 years. In every 3 years, the scheme has provided double the return.

Pros - The scheme has generated highest consistent return in past 10 years. Also, highest AUM growth in past 12 months. The scheme has generated 20% more return for every unit of risk

Cons - The scheme is highly sensitive to volatility. If withdrawn within 1 month, exit load of 1% is levied.

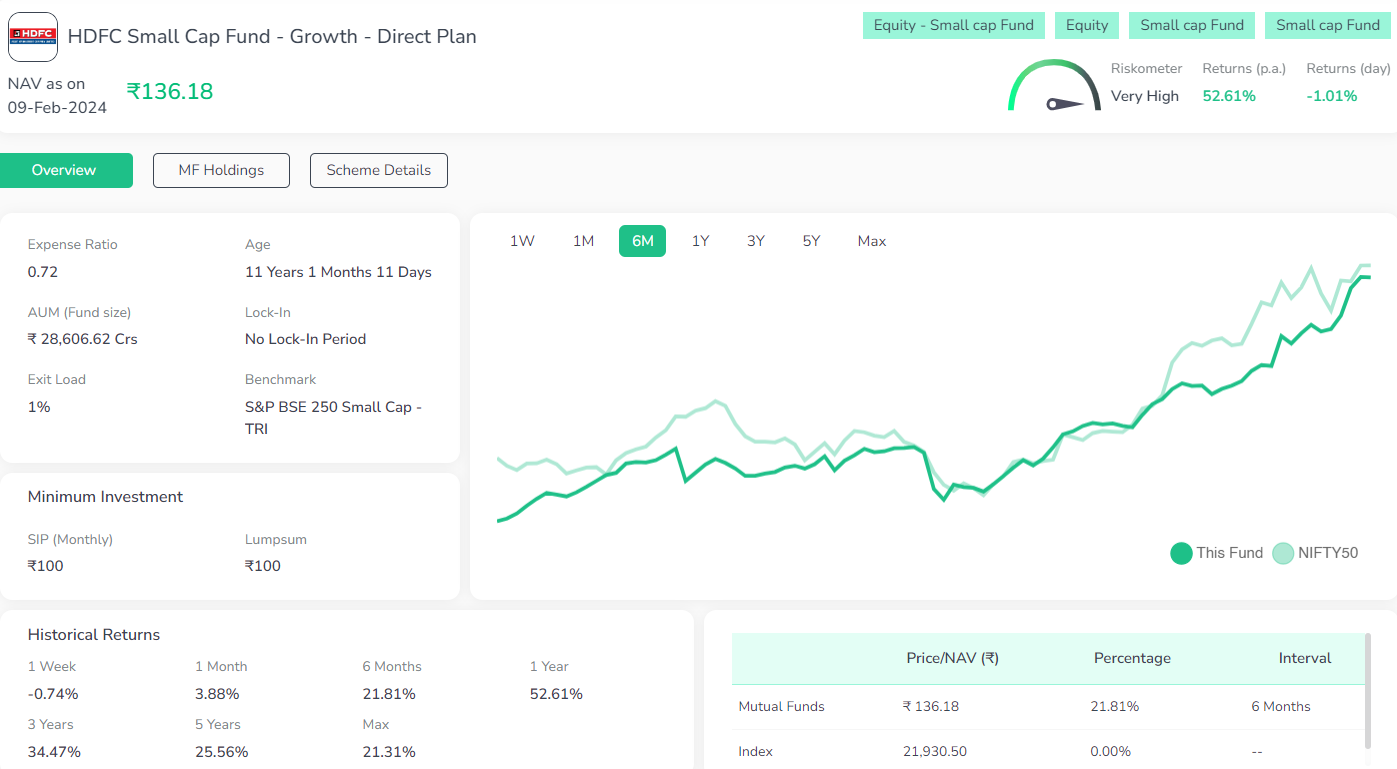

HDFC Small Cap Fund Growth Direct Plan

HDFC Small Cap Fund Growth Direct Plan is Nifty Small Cap 250-TRI mutual fund scheme from HDFC Mutual Fund on 1/1/2013. This Scheme of SIP 500 per month has an expense ratio of 0.72%. Since its inception, the SIP has given a total return of 21.42% average annual returns. In every 2 years, the scheme has provided double the return.

Pros - The scheme has generated highest consistent return in last 3 years. Also, highest AUM growth in past 12 months. The scheme has generated 20% more return for every unit of risk

Cons - The scheme is highly sensitive to volatility. If withdrawn within 1 year, exit load of 1% is levied.

Return Analysis of Top 5 SIP 500 Per Month in 2024

|

Mutual Fund SIP Name |

Investment Amount Monthly in Rs. |

Term - 1 year |

Term -2 years |

Term -3 years |

Term - 5 years |

Term - 10 years |

|

Axis Small Cap Fund Growth Direct Plan |

500 |

|

|

|

|

|

|

Total Investment |

|

6000 |

12000 |

18000 |

30000 |

60000 |

|

Profit |

|

1509 |

4366.8 |

9093.6 |

35028 |

151506 |

|

Total Amont |

|

7509 |

16366.8 |

27093.6 |

65028 |

211506 |

|

Absolute Return |

|

25.15% |

36.39% |

50.52% |

116.76% |

252.51% |

|

|

|

|

|

|

|

|

|

Tata Small Cap Fund Growth Direct Plan |

500 |

|

|

|

|

|

|

Total Investment |

|

6000 |

12000 |

18000 |

30000 |

- |

|

Profit |

|

1375.8 |

4689.6 |

10018.8 |

39540 |

- |

|

Total Amont |

|

7375.8 |

16689.6 |

28018.8 |

69540 |

- |

|

Absolute Return |

|

22.93% |

39.08% |

55.66% |

131.80% |

- |

|

|

|

|

|

|

|

|

|

Quant Small Cap Fund Growth Direct Plan |

500 |

|

|

|

|

|

|

Total Investment |

|

6000 |

12000 |

18000 |

30000 |

60000 |

|

Profit |

|

2610 |

7522.8 |

15175.8 |

69486 |

205290 |

|

Total Amont |

|

8610 |

19522.8 |

33175.8 |

99486 |

265290 |

|

Absolute Return |

|

43.50% |

62.69% |

84.31% |

231.62% |

342.15% |

|

|

|

|

|

|

|

|

|

Nippon India Small Cap Fund Growth Direct Plan |

500 |

|

|

|

|

|

|

Total Investment |

|

6000 |

12000 |

18000 |

30000 |

60000 |

|

Profit |

|

1903.2 |

5883.6 |

12364.2 |

47448 |

188400 |

|

Total Amont |

|

7903.2 |

17883.6 |

30364.2 |

77448 |

248400 |

|

Absolute Return |

|

31.72% |

49.03% |

68.69% |

158.16% |

314.00% |

|

|

|

|

|

|

|

|

|

HDFC Small Cap Fund Growth Direct Plan |

500 |

|

|

|

|

|

|

Total Investment |

|

6000 |

12000 |

18000 |

30000 |

60000 |

|

Profit |

|

1819.2 |

5896.8 |

11728.8 |

40383 |

148146 |

|

Total Amont |

|

7819.2 |

17896.8 |

29728.8 |

70383 |

208146 |

|

Absolute Return |

|

30.32% |

49.14% |

65.16% |

134.61% |

246.91% |

Best SIP 500 per month for 20 years

|

MF Scheme Name |

Fund Size in INR Crores |

Expense Ratio in % |

20-Year Average SIP Return in % |

|

ICICI Prudential Technology Fund |

8,993.09 |

2.11 |

18.52 |

|

ICICI Prudential FMCG Fund |

1,156.49 |

2.57 |

17.76 |

|

Sundaram Midcap Fund |

7,048.79 |

1.87 |

17.29 |

|

Nippon India Growth Fund |

13,409.61 |

1.83 |

17.04 |

|

Quant Active Fund |

3,531.89 |

2.63 |

16.41 |

|

Nippon India Banking & Financial Services Fund |

3,826.52 |

2.05 |

16.21 |

|

HDFC Flexi Cap Fund |

31,672.65 |

1.77 |

16.08 |

|

ABSL Digital India Fund |

3,338.13 |

2.11 |

16.01 |

|

Franklin India Prima Fund |

7,359.95 |

1.90 |

15.89 |

|

Franklin India Flexi Cap Fund |

9,989.33 |

1.86 |

15.50 |

Conclusion

The inflow of domestic funds, increased financial awareness among public, increased interest in investments have driven the mutual fund industry growth in India.

As investors navigate through the complexities of the mutual fund industry, Enrich Money serves as a compass, helping investors to make informed decisions. Invest in mutual funds through the best trading platform in India for beginners.

Frequently Asked Questions

How Does Mutual Fund SIP operate?

Mutual Fund SIPs allow investments starting from INR 500 at fixed intervals. Similar to a piggy bank, these periodic investments accumulate over time, earning compounded returns. Unlike a static piggy bank, SIPs invest in various asset classes through mutual funds. Lump sum investors can opt for Systematic Transfer Plans (STP) to move funds from a liquid or short-term fund to an equity fund. SIPs instil investment discipline, helping investors save for specific goals, and can be redeemed either as lump sums or through Systematic Withdrawal Plans (SWP) for regular payouts.

How to Invest in SIP?

To invest in SIP (Systematic Investment Plan), choose a best trading platform in India for beginners, set a fixed amount to invest regularly, and benefit from rupee cost averaging for long-term wealth creation in the Indian Stock Market. Ensure to conduct thorough research before selecting a fund.

Does investing in SIP for 20 years is best?

Investing in SIP for 20 years can be a prudent strategy, leveraging the power of compounding for long-term wealth growth in the Indian Stock Market. It helps mitigate market volatility and allows you to benefit from rupee cost averaging over an extended period, potentially yielding substantial returns. Regularly review and adjust your SIP contributions based on financial goals and market conditions.

What are the tax implications of SIP investments in India?

SIP investments in equity mutual funds held for over one year qualify for long-term capital gains tax with indexation benefits. The tax rate is 10%, exceeding a threshold. For debt mutual funds, the tax on gains is applicable based on your individual tax slab, with indexation benefits for holding over three years. Stay updated on tax regulations as they may change.

Which mutual fund investment qualifies for tax exemptions in India?

Equity-linked mutual funds (ELSS) allow a deduction of up to Rs 1.5 lakh on mutual fund investments, and the capital gains up to Rs 1 lakh are exempt from taxes

Disclaimer: This blog is dedicated exclusively for educational purposes. Please note that the securities and investments mentioned here are provided for informative purposes only and should not be construed as recommendations. Kindly ensure thorough research prior to making any investment decisions. Participation in the securities market carries inherent risks, and it's important to carefully review all associated documents before committing to investments. Please be aware that the attainment of investment objectives is not guaranteed. It's important to note that the past performance of securities and instruments does not reliably predict future performance.