Anticipated Short-Term Surges: Mahanagar Gas, Ujjivan Small Finance Bank, and Reliance Industries on the Rise with Over 10% Gains

Introduction

In the dynamic finance realm, short-term investments are sought for quick gains amid market fluctuations. They promise agility and sizable rewards, but pose higher risks than long-term options. Market volatility, economic uncertainties, and risk management are key. This article explores high-return strategies on stocks, options emphasizing analysis. With liquidity and flexibility as priorities, short-term investments require active management and vigilance. Investors must assess risk tolerance, set objectives, allocate capital, and cultivate research skills. Tenures range from weeks to a few years, adapting to market conditions and investment types.

News Updates-2025: Reliance Industries Up Over 10%

Mahanagar Gas News (Jan-Mar 2025)

In January, Mahanagar Gas saw a 30% dip in Q3 profit at Rs.221 crore caused by decreased allocation of gas. The board ratified an interim dividend of Rs.12 per equity share.

In February, it hiked stake in IBC India to 44%, envisaged an 8% expansion of gas sales volume for FY2025-26, and demarcated its expansion plans.

In March, the company scheduled an investor meeting to discuss its strategic goals and expansion.

Ujjivan Small Finance Bank News (Jan-Mar 2025)

Ujjivan Small Finance Bank sought a universal banking license in January with the goal of increasing its services. Its shares increased 16% on the announcement.

The bank received a Rs.6.70 lakh fine from the RBI in February for defaulting on loan agreement terms.

In March, it sanctioned the sale of worth Rs.270 crore of NPAs, enhancing its balance sheet. The share of the bank exhibited marginal growth, trading at Rs.36.10.

Reliance Industries News (Jan-Mar 2025)

In January, Reliance reported robust Q3 numbers. Consolidated Revenue: Rs.2.1 lakh crore, which is an increase of 8% year-on-year and Net Profit: Rs.15,700 crore, an increase of 12% from Q3 FY2024.

In February, analysts were optimistic about its retail and digital expansion.

In March, Reliance tied up with SpaceX for Starlink services and finished a JV with Disney. The company also wound-up Reliance Eagleford Upstream. Reliance shares gained 1.68%, although they were still 22.45% short of their 52-week high.

Nifty 50 Index

On November 3, 2023, the Nifty 50 traded near its 52-week high at Rs. 19,230.60, with a 52-week low of Rs. 16,828.35. The market maintained a beta value of 1, indicating alignment with market volatility. Key metrics included a Price to Book ratio of 3.4, Price to Earnings Ratio of 20.9, Dividend Yield of 1.4, and an Earnings Per Share (EPS) of 921.

Technical indicators revealed a neutral stance with a Momentum Score of 43.1, an RSI of 44.5, and a strong bearish signal from the MACD at -155.4. The moving averages were at Rs. 18,641.9 for the 200-day Simple Moving Average and Rs. 18,846.1 for the 200-day Exponential Moving Average.

The day saw Nifty open with a 130-point gap-up, experience fluctuations, and ultimately close positively with a 0.76% gain. Support levels were identified at 19,100, 19,050, and 19,000, with resistance at 19,175, 19,200, and 19,250.

Research report calls included a buy call above 19,158.05 and a sell call below 19,112.65, each with specific targets and stop loss levels. Overall, the market opened positively, with gains across various sectors, driven by optimism that U.S. interest rates may have peaked.

Reliance Industries Limited

Overview

|

Close |

Rs.2319.70 |

|

52 weeks low |

Rs. 2180 |

|

52 weeks high |

Rs. 2817.35 |

|

Volume |

4425.08 K |

|

Market Capitalization |

Rs. 1569094.50 crore |

|

Industry |

Crude Oil/ Natural Gas |

|

Sector |

Energy |

Company Profile

Reliance Industries, India's largest private company, joined the Fortune Global 500 in 2004. Established in 1966 as a textile manufacturer, it officially incorporated in 1973 and later became a petrochemical giant, opening the world's largest grassroots refinery in Jamnagar in 2000. The company operates in various sectors, including hydrocarbon exploration, petroleum refining, petrochemicals, retail, and telecommunications. It encountered challenges from the COVID-19 pandemic while managing its diverse business segments and expanding into new areas.

Analysis & Forecast

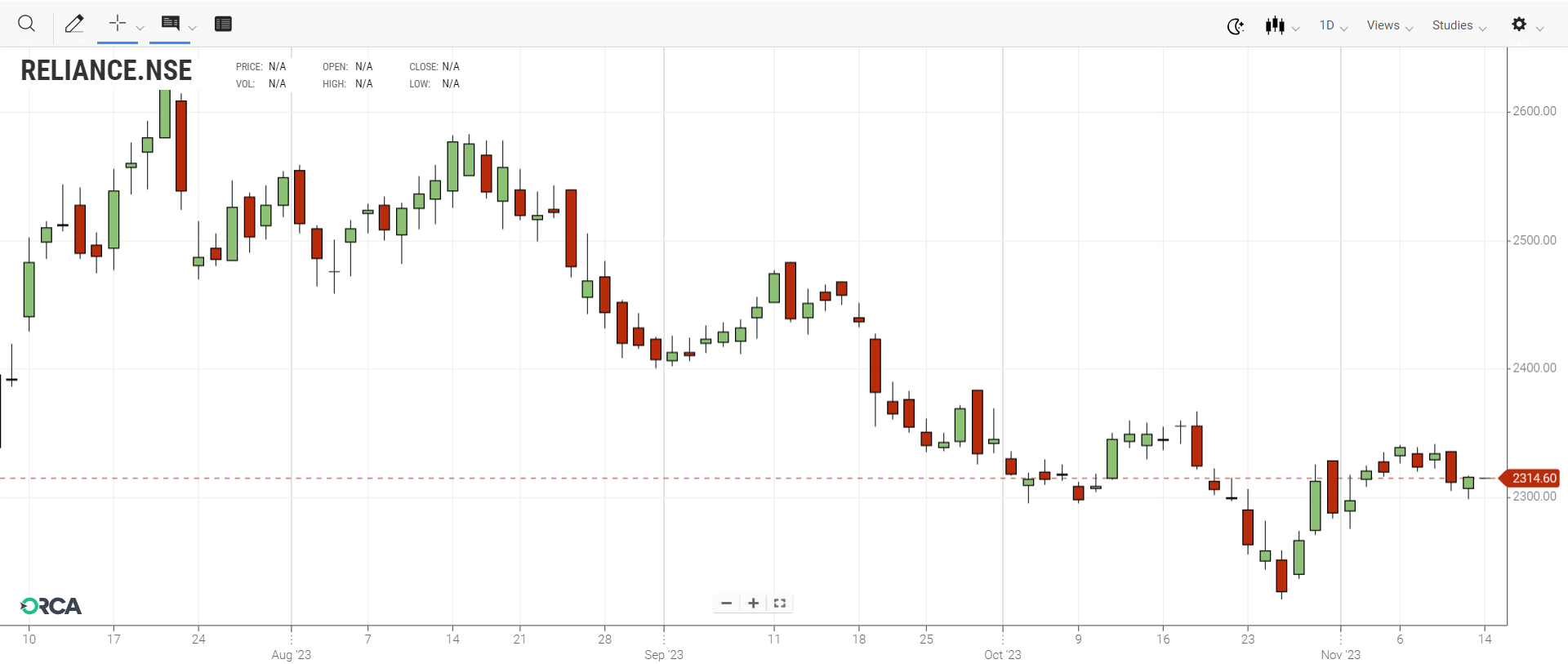

Stock Performance: Reliance Industries Limited's shares are currently priced at Rs. 2,319.70, with a 52-week range of Rs. 2,180 to Rs. 2,817.35.

Key Fundamentals: With a market capitalization of Rs. 1,569,094.50 crore, the company has shown a 12% QoQ growth in consolidated revenue, reaching Rs. 2,319 billion. EBITDA increased by 8% QoQ to Rs. 409.7 billion, and PAT grew by 9% QoQ to Rs. 173.9 billion.

Return on Equity (ROE) and Return on Capital Employed (ROCE): ROE and ROCE have risen to 9.86% and 10.95%, respectively, with sales growth surging to 26.13%. The current ratio remains strong at 0.65.

Moving Averages & Piotroski Score: Historically, RIL stocks performed well, with a 1-year return of 6.52% in the Nifty and 5.80% in the Sensex. The Piotroski score is 6, and the 200-day simple moving average is Rs. 2,430.83, while the 200-day exponential moving average is Rs. 2,441.6.

Technical Analysis: The Relative Strength Index (RSI) stands at 49.13, indicating an uptrend.

Pivot Levels: Buying target above Rs. 2,326.54 with a stop loss at Rs. 2,321.55, and selling target below Rs. 2,320.39, down to Rs. 2,311.75, with the pivot level at Rs. 2,323.47.

Candlestick Pattern: RIL presents a short-term trading opportunity, possibly with upward movements despite a bearish candlestick pattern, given its proximity to the 52-week low.

Debt Situation: RIL is debt-free, with a debt-to-equity ratio of zero, which is generally viewed positively by investors.

Corporate News & Announcements

Reliance Industries declared a Rs 9.00 per share (90%) dividend, yielding 0.39% at the current share price of Rs 2319.70. A recent board meeting on October 27, 2023, discussed quarterly results. The company's market valuation surged by Rs 36,399.36 crore, making it the most valuable firm at Rs 15,68,995.24 crore, surpassing peers like TCS and HDFC Bank. Investors welcomed the management's efforts to reduce debt, boost cash flow, and cut capital spending in 2024. Factors like retail warehouse sales and refining constraints in China are expected to boost the stock's value. Key financial highlights include a 2.11% net sales increase to Rs 140,450.00 crore in September 2023. Quarterly net profit for September 2023 jumped by 62.08% to Rs. 11,208.00 crore, and EBITDA increased by 44.4% to Rs. 22,125.00 crore. Reliance's earnings per share (EPS) grew to Rs. 16.56 in September 2023, up from Rs. 10.22 in September 2022.

Mahanagar Gas Limited

Overview

|

Close |

Rs.1038.95 |

|

52 weeks low |

Rs.820.10 |

|

52 weeks high |

Rs. 1152 |

|

Volume |

278304 |

|

Market Capitalization |

Rs.10262 crore |

|

Industry |

Natural Gas |

|

Sector |

Gas & Petroleum Sector |

Company Profile

Mahanagar Gas Limited (MGL) is a prominent city gas distribution (CGD) company in India. It exclusively distributed compressed natural gas (CNG) and piped natural gas (PNG) in Mumbai, Thane, adjacent areas, and Raigad district, Maharashtra. MGL serves CNG for vehicles and PNG for residential, commercial, and industrial use via an extensive pipeline network. Established in 1995 as a joint venture among Gas Authority of India (GAIL), BG Group UK (formerly British Gas), and the Government of Maharashtra, MGL has grown its operations substantially. It was listed on the stock exchange in 2016 and has expanded its network and services, including CNG stations and pipeline installations in recent years.

Analysis & Forecast

-

Moving Averages: Both the 200-day simple and exponential moving averages (SMA and EMA) are higher than the current stock price, a positive technical signal.

-

Revenue Growth: MGL's revenue is Rs. 6299.3, reflecting a substantial 75.84% increase from the previous year.

-

Profitability: Annual net profit rose by 32.35% in the last year, reaching Rs. 790.05 crores, a positive profitability indicator.

-

Debt: MGL is debt-free with a debt-to-equity ratio of zero, favorable for investors.

-

P/E Ratio: A P/E ratio of 8.94, lower than the sector's average of 43.45, suggests relative undervaluation.

-

ROE and ROCE: Both ROE (20.44%) and ROCE (27.55%) increased, indicating efficiency and profitability.

-

Candlestick Pattern: A bullish broadening wedge pattern suggests potential upward movement.

-

Piotroski Score: A strong Piotroski score of 8 indicates robust financial health.

-

Industry Comparisons: MGL outperforms industry averages in debt-to-equity and current ratios, a positive sign.

-

Pivot Levels: Provide buying/selling targets and stoploss levels, valuable for traders.

-

Relative Strength Index (RSI): An RSI of 41.24 suggests an uptrend but should be considered alongside other factors.

Corporate News & Announcements

In Mahanagar Gas's latest quarterly report, significant financial growth was evident. September 2023 net sales reached Rs 1,728.94 crore, a 10.64% increase from September 2022. The quarterly net profit surged to Rs. 338.50 crore, a 106.44% rise from September 2022. EBITDA in September 2023 stood at Rs. 522.59 crore, an 87.43% increase from September 2022, leading to an EPS of Rs. 34.27. MGL shares closed at Rs. 1,017.15 on October 30, 2023, with returns of 1.33% over 6 months and 18.05% over 12 months. In addition, MGL declared a 160% final dividend and a 100% interim dividend last year.

Ujjivan Small Finance Bank Limited

Overview

|

Close |

Rs. 53.85 |

|

52 weeks low |

Rs.22.8 |

|

52 weeks high |

Rs. 61.4 |

|

Volume |

1,02,29,924 |

|

Market Capitalization |

Rs. 10,527.95 crore |

|

Industry |

Small Finance Bank |

|

Sector |

Banks |

Company Profile

Ujjivan Small Finance Bank Limited offers diverse banking and financial services in India through its Treasury, Retail Banking, and Corporate/Wholesale Banking segments. Its services range from various types of accounts to loans, insurance products, and more. With numerous banking outlets and ATMs, the company was established in 2016 and is based in Bengaluru, India, operating as a subsidiary of Ujjivan Financial Services Limited.

Analysis & Forecast

Ujjivan Small Finance Bank's performance and outlook are positive:

Stock Performance: Priced at Rs. 53.85, it reached a 52-week low of Rs. 22.75 and a high of Rs. 61.40.

Earnings and Growth: TTM EPS is 6.41, up 112.39% YoY, with a PEG ratio of 0.1. It outperforms with both 200-day simple and exponential moving averages.

Market Momentum: RSI at 49.6 suggests potential price increase, and a one-year Beta value of 0.96 indicates moderate volatility.

Financial Health: Strong revenue growth of 52.08% to Rs. 4,754.19 Crores, net profit surged by 365% to Rs. 1,099.92 Crores. Debt-to-equity is 0.66, and Interest Coverage Ratio is 2.01.

Quarterly Performance: Quarterly revenue rose by 40.07% YoY, reaching Rs. 1,579.78 Crores, and quarterly net profit increased by 11.37% to Rs. 327.74 Crores.

Dividend and Yield: It offered Rs. 1.25 in dividends, resulting in a yield of 2.32%.

Bank Performance: Achieved an all-time high PAT with improved GNPA.

Comparative Analysis: Annual revenue growth outperforms the 3-year CAGR.

Industry Comparison: Favorable financial indicators compared to the industry average.

Pivot Levels: Pivot level at Rs. 53.58, with specific buy and sell thresholds.

Future Outlook: Asset quality improvement, strong advance growth, lower credit costs, and a reverse merger with the parent company in 2024.

Chart Pattern: A positive breakout from a rounding bottom pattern, indicating improved sentiment and support around the 20-SMA.

Corporate News & Announcements

Ujjivan Small Finance Bank's Q2FY24 results are highlighted as follows:

-

NII increased by 24% YoY to Rs 823 crore.

-

NIM stood at 8.8% for Q2FY24.

-

PAT grew by 11% YoY, reaching Rs 328 crore.

-

The gross loan book increased by 27% YoY to Rs 26,574 crore.

-

Q2FY24 PPoP reached Rs 483 crore, up 26% YoY.

-

Asset quality improved with GNPA at 2.2%, NNPA at 0.09%, and a PAR of 3.7%.

-

Rs 56 crore was written off in Q2FY24.

-

The provision coverage ratio as of September 2023 is 96%.

-

Deposits increased by 43% YoY to Rs 29,139 crore, with a 56% growth in retail term deposits.

-

The bank expanded with 39 new branches, totaling 700, and launched a nationwide brand campaign and value-added liability products.

Frequently Asked Questions

How can I purchase Reliance Industries Limited shares online?

You can acquire RIL shares online by opening a free Demat and trading account with Enrich Money, enabling you to initiate trading using their mobile app.

What metrics are significant for evaluating Mahanagar Gas Share Price?

Mahanagar Gas share can be swiftly assessed based on the following metrics: PE ratio of 8.94, Price to Book Ratio of 2.52, Dividend Yield of 2.50, and trailing 12-month EPS of 116.20.

What is Ujjivan SFB's market capitalization?

Ujjivan SFB shares boast a market capitalization of Rs 10,527.95 Cr, securing the 29th position within the Banks sector in terms of market cap rank.

How can I enhance my understanding of short-term stock analysis?

To deepen your grasp of short-term stock analysis, consider avenues such as delving into technical analysis, enrolling in online courses, or seeking guidance from financial experts like Enrich Money.

What are the primary objectives of short-term stock analysis?

The fundamental objectives of short-term stock analysis revolve around exploiting transient price fluctuations, realizing swift profits, and executing timely decisions for buying or selling.

Check our ORCA app to analyze Mahanagar Gas stocks' performance:

Mahanagar Gas Ltd Share Price Today

Mahanagar Gas Technical Analysis

Mahanagar Gas Financial Statements

Mahanagar Gas Shareholding Pattern

Mahanagar Gas Latest Corporate News

Mahanagar Gas Stock/Company Overview

Related Stocks

Disclaimer: This blog is dedicated exclusively for educational purposes. Please note that the securities and investments mentioned here are provided for informative purposes only and should not be construed as recommendations. Kindly ensure thorough research prior to making any investment decisions. Participation in the securities market carries inherent risks, and it's important to carefully review all associated documents before committing to investments. Please be aware that the attainment of investment objectives is not guaranteed. It's important to note that the past performance of securities and instruments does not reliably predict future performance.