Insights for Investing in Automobiles, IT and Banking Sector in 2024

Indian Stock Market in 2024

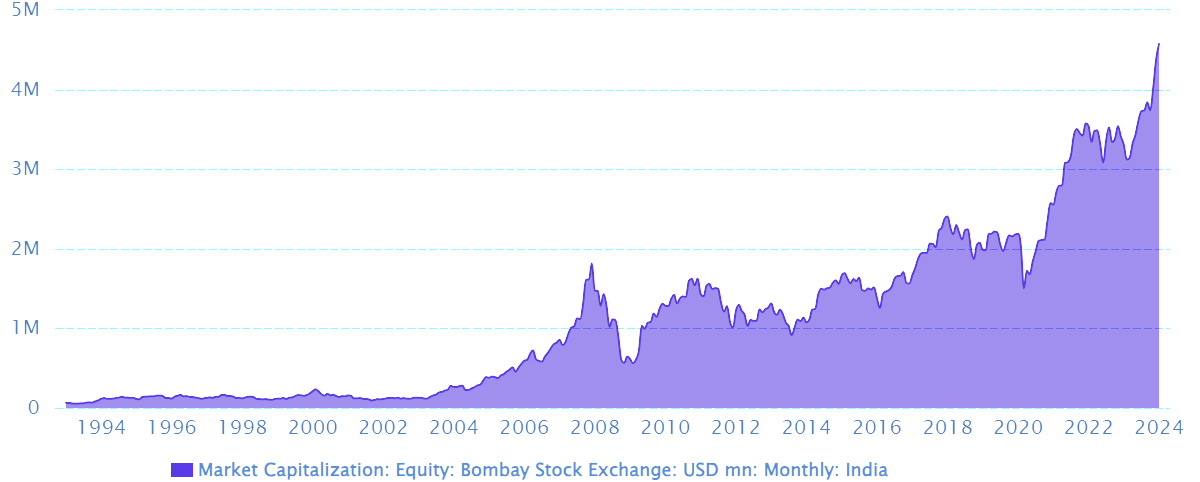

As of January 2024, Indian stock market capitalization was $4574606 billion which is the highest since 1993. Also, the Indian Stock Market is expected to gain momentum and reach the ambitious growth rate of 9% in 2024. Both the BSE and NSE have reached their fresh all time high by March, 2024. While BSE Sensex has recorded 74119.39 mark as on 9th March , 2024 and NSE Nifty 50 has recorded 22493.55 mark as on 9th March, 2024. With all confidence on continuation of stable government , optimistic global environment and increase in FIIs , The Indian Stock Market would certainly cross 76000 mark and Nifty to hit 24000 marks by mid-2024.

Indian stock market capitalization from the year 1993 to 2023 are given as a graph.

For more detailed analysis on Nifty 50 and Bank Nifty, visit Enrich Money.

India in 2027

India's captivating future forecast of achieving a $5 trillion economy by 2027 , with the strong belief of an ambitious growth rate of 9% and thriving economy to become the third largest economy in the world by 2027, has posed various questions on the role of different Indian sectors in this new global paradigm. Will this trajectory for India's progression be just in numbers or it would create a path for the Indian sectors to undergo a transformation ?

India’s Top 3 Sectors to Thrive in 2024

India's automobile, IT and banking sectors are expected to provide top returns in the Indian Stock Market in 2024.

Automobile Sector

Automobile sector comprises companies that manufacture vehicle making components and vehicles. They range from manufacture of 2-wheelers, 3- wheelers and 4 wheelers.

India's automobile industry regained its growth momentum back in 223 after a strong hit due to covid-19 pandemic in 2021. Automobile industry is expected to provide higher returns in 2024. Automobile industries are expected to launch new vehicle models this year. The fuel prices are expected to be stable in 2024 due to the upcoming general election. while the interest rates are expected to come down and the consumers' sentiment on the automobile industry are optimistic for the likeliness of higher returns in the automobile industry.

|

Automobile Sales Growth (%) on YoY basis in 2023 |

|

|

Total Vehicle Sales |

11% |

|

2-wheeler sales |

9.5% |

|

3-wheeler sales |

58.5% |

|

Cars & SUVs |

11% |

|

Tractors |

7% |

|

Buses & Trucks |

8% |

List of Top 5 Auto Sector stocks in India in 2024

Maruti Suzuki India Limited

Maruti Suzuki India Limited , an Indian subsidiary of Suzuki Motors Corporation, is the largest passenger car maker in India . The company is engaged in the business of manufacturing and sales of passenger vehicles. Their products range from small cars like Alto 800 to luxury cars like Sedan Ciaz. Currently, the Suzuki Motor Corporation owns an equity stake of 56.2% .

Technical Indicators for Maruti Suzuki India Limited.

|

Technical |

||

|

Type |

Value |

Momentum |

|

RSI |

60.41 |

Neutral |

|

CCI |

48.49 |

Neutral |

|

Williams_R |

-34.74 |

Neutral |

|

UO |

57.57 |

Neutral |

|

Rate of Change |

0.48 |

Bullish |

|

MACD |

5275.60 |

Bullish |

|

ATR |

217.54 |

High Volatility |

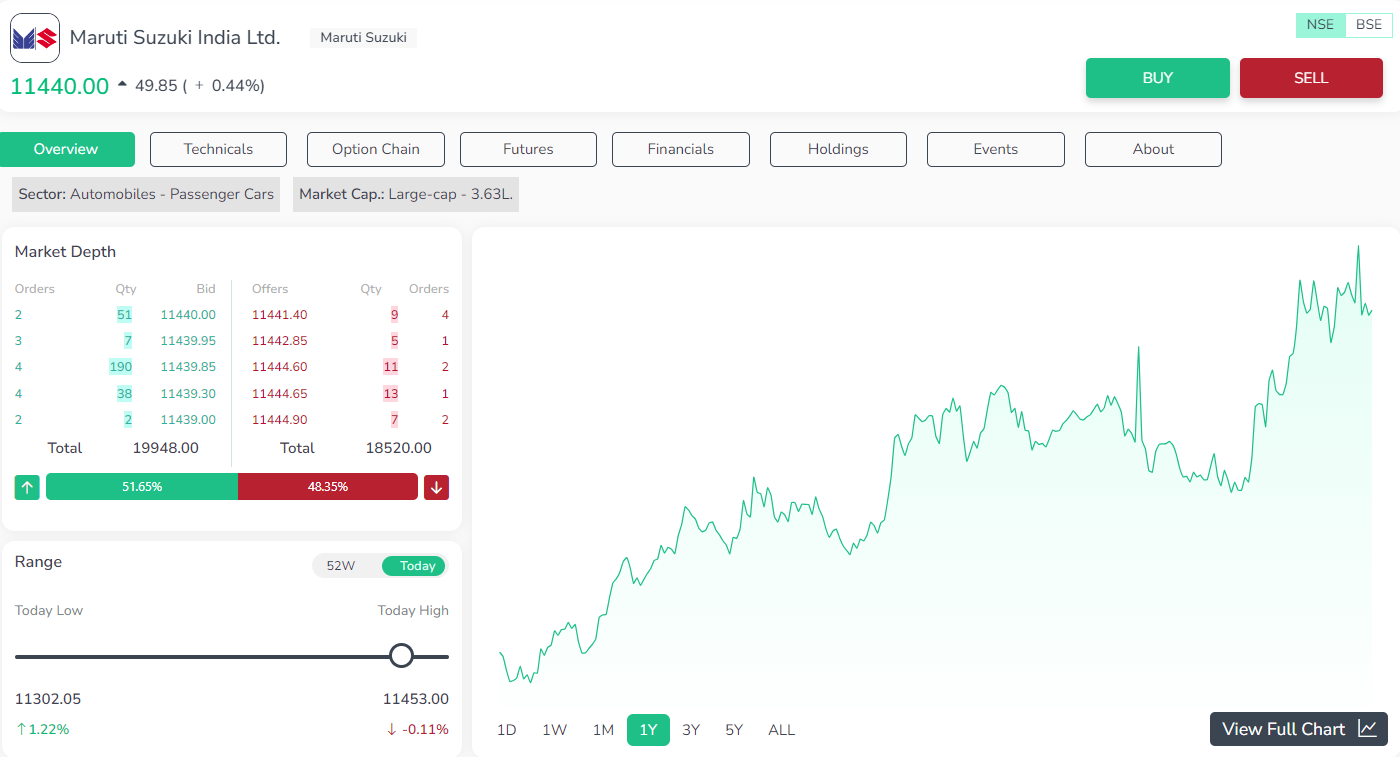

Graphical price chart representation of Maruti Suzuki India Limited.

|

Peer Comparison of Maruti Suzuki India Limited |

|||||

|

Maruti Suzuki |

M&M |

Tata Motors |

Bajaj Auto |

Force Motors |

|

|

1 year Return |

33.35% |

49.36% |

136.15% |

138.49% |

408.69% |

|

PE Ratio |

28.57 |

18.95 |

20.52 |

33.94 |

21.69 |

|

P/B |

5.56 |

3.35 |

43.28 |

25.80 |

4.48 |

|

ROA |

14.18 |

5.33 |

5.77 |

21.06 |

9.57 |

|

ROE |

19.48 |

19.62 |

43.28 |

25.80 |

20.66 |

|

D/E Ratio |

0.0197 |

1.64 |

0.844 |

-0.0080 |

0.509 |

|

Revenue Growth |

33.10% |

34.49% |

24.25% |

9.9% |

55.20% |

|

Net Income Growth |

111.65% |

50.05% |

121.10% |

-0.992% |

246.73% |

The current price of Maruti Suzuki India Limited as on 9th March 2024 is Rs. 11521.40. For a detailed stock analysis of the stock, visit Enrich Money.

Information Technology Sector

For the growth of India, the Indian IT sector would undoubtedly play a crucial role. The IT sector consists of technology stocks especially from software development companies. The Indian IT sector has played an essential role in shaping the Indian economy for the past 20 years. Increasing young population , driving internet usage demand , government initiatives like Digital India and potential overseas clients are paving way for the future growth of the Indian IT sector.

List of Top 5 IT Sector stocks in India in 2024

Tata Consultancy Services Limited

Tata Consultancy Services Limited, an Indian MNC, subsidiary of Tata Group, headquartered in Mumbai, India. As of 2023, around 6 lakh employees globally. The company offers IT services, consulting and outsourcing. As of 2023, TCS has reported a revenue of Rs. 228907 crore and net income of Rs. 42147 crores.

Technical Indicators for TCS Limited.

|

Technical |

||

|

Type |

Value |

Momentum |

|

RSI |

56.21 |

Neutral |

|

CCI |

14.48 |

Neutral |

|

Williams_R |

-26.60 |

Neutral |

|

UO |

51.31 |

Neutral |

|

Rate of Change |

2.78 |

Bullish |

|

MACD |

-11.03 |

Bearish |

|

ATR |

79.56 |

High Volatility |

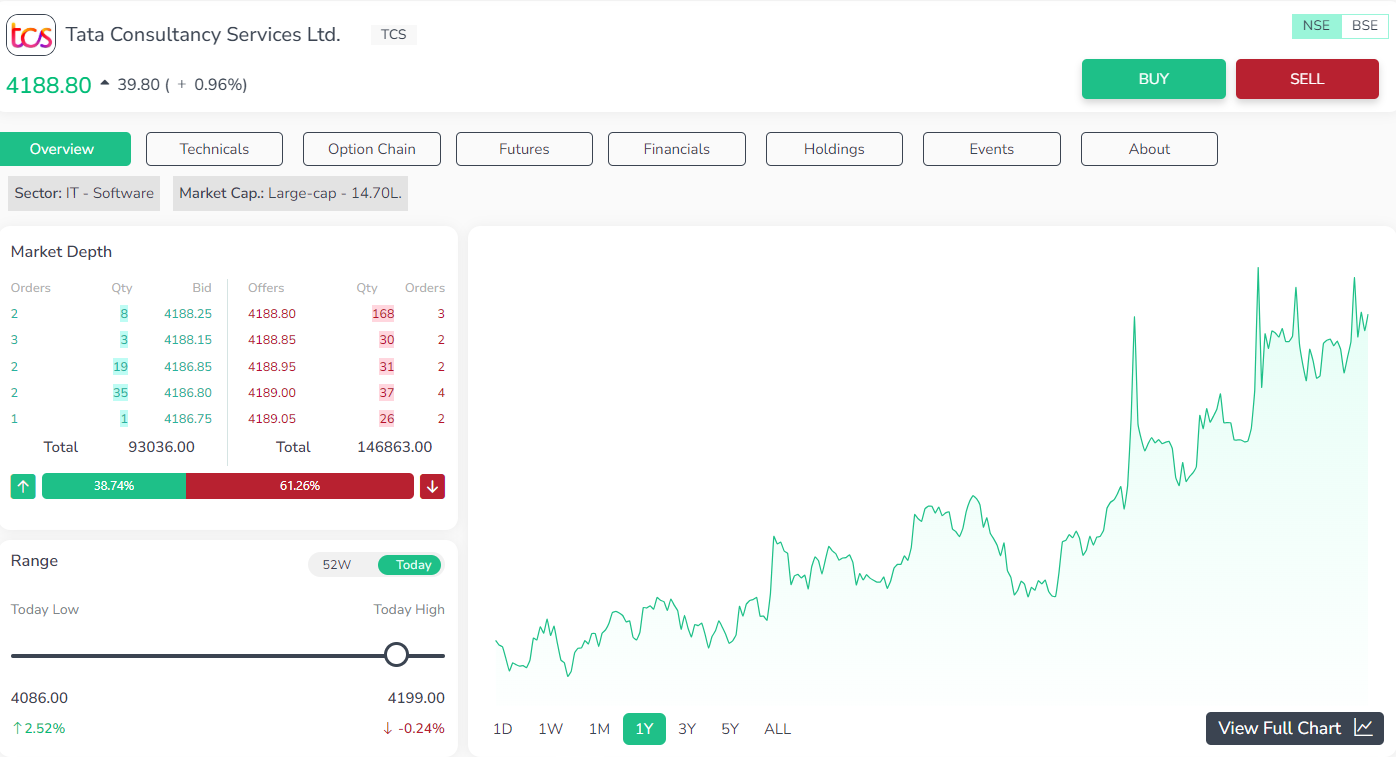

Graphical price chart representation of TCS Limited.

|

Peer Comparison of TCS Limited |

|||||

|

TCS Ltd. |

Infosys Ltd. |

HCL Tech Ltd. |

Wipro Ltd. |

LTI Mindtree Ltd. |

|

|

1 year Return |

21.85% |

7.23% |

45.35% |

30.92% |

6.25% |

|

PE Ratio |

33.42 |

27.44 |

28.32 |

24.46 |

32.99 |

|

P/B |

15.66 |

11.15 |

70.83 |

3.80 |

8.67 |

|

ROA |

29.77 |

23.71 |

175.45 |

9.81 |

18.91 |

|

ROE |

46.92 |

40.63 |

250.10 |

15.71 |

26.29 |

|

D/E Ratio |

0.0164 |

0 |

0.0323 |

0.204 |

0.0213 |

|

Revenue Growth |

17.58% |

20.66% |

18.45% |

14.09% |

111.78% |

|

Net Income Growth |

9.97% |

8.98% |

10.02% |

7.19% |

91.93% |

The current price of Tata Consultancy Services Limited as on 9th March 2024 is Rs. 4102.65. For a detailed stock analysis of the stock, visit Enrich Money.

Banking Sector

Banking sector stocks comprises public listed banks in India like PSU, state run banks, private banks and also small finance banks. Banking stocks play a major part in the performance of the Indian Stock Indices due to its vital role in monitoring the Indian economy. Banking sector major indices are Nifty 50, BSE Sensex, Bank Nifty, BSE Bankex.

List of Top 5 Banking Sector stocks in India in 2024

ICICI Bank

ICICI Bank, an Indian MNC financial services corporate, with its headquarter at Mumbai, India. It offers various banking services to its retail and corporate customers. ICICI Bank has recorded a revenue of Rs. 186178.80 crores and net income of Rs. 34036.64 crore in 2023.

Technical Indicators for ICICI Bank Limited.

|

Technical |

||

|

Type |

Value |

Momentum |

|

RSI |

63.70 |

Neutral |

|

CCI |

10.384 |

Bearish |

|

Williams_R |

-33.06 |

Neutral |

|

UO |

60.63 |

Neutral |

|

Rate of Change |

3.33 |

Bullish |

|

MACD |

-2208.30 |

Bearish |

|

ATR |

21.92 |

High Volatility |

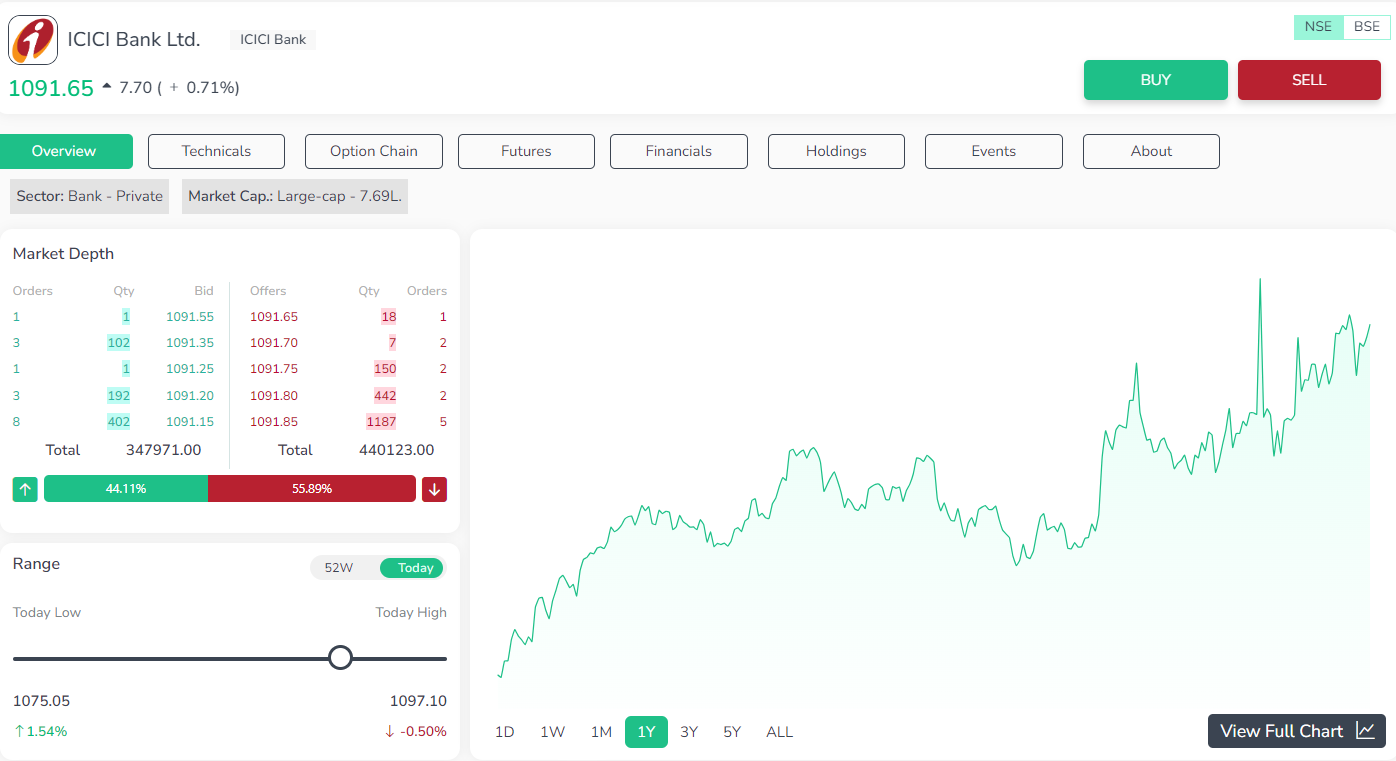

Graphical price chart representation of ICICI Bank Limited.

|

Peer Comparison of ICICI Bank Limited |

|||||

|

ICICI Bank |

HDFC Bank |

SBI |

Kotak |

Axis |

|

|

1 year Return |

25.38% |

-11.14% |

40.30% |

-0.0168% |

29.31% |

|

PE Ratio |

17.95 |

16.14 |

11.04 |

19.91 |

25.50 |

|

P/B |

1.32 |

2.76 |

1.82 |

1.11 |

0.998 |

|

ROA |

2.08 |

1.96 |

1.05 |

2.76 |

0.997 |

|

ROE |

18.93 |

17.25 |

17.12 |

15.30 |

9.69 |

|

D/E Ratio |

0.927 |

1.26 |

1.45 |

0.508 |

1.59 |

|

Revenue Growth |

18.18% |

22.05% |

16.32% |

15.40% |

23.27% |

|

Net Income Growth |

33.66% |

20.96% |

55.57% |

23.87% |

23.38% |

The current price of Tata Consultancy Services Limited as on 9th March 2024 is Rs. 4102.65. For a detailed stock analysis of the stock, visit Enrich Money.

Conclusion

Investing in Indian bank stocks presents a promising opportunity for investors looking to diversify their portfolios and tap into the country's growing economy. Despite challenges, the banking sector offers several strong players to consider. Similarly, the Indian IT sector continues to thrive, fuelled by increased digitization post-COVID. Companies embracing AI, robotics, and cloud computing are poised for growth Additionally, the Indian auto industry offers compelling investment prospects, with several top players worth considering. However, careful analysis of market trends and financial performance is crucial. Investors can seek expert guidance and utilize AMC free trading account with Enrich Money.

Frequently Asked Questions

Factors to consider to invest in IT stocks?

Before investing in technology stocks in India, consider these key factors:

-

Financials: Analyze the company's balance sheet and cash flow statement carefully.

-

Client diversity: Look for companies with clients in diverse locations and strong spending capabilities.

-

Technical analysis: Evaluate factors like valuation, moving averages, and support/resistance levels before making investment decisions.

Factors to consider to invest in Automobile stocks?

Before investing in the Indian auto sector, consider macroeconomic conditions, industry trends, financial performance, valuation metrics, and regulatory norms. Assess how economic factors, such as interest rates and tax changes, impact the industry. Analyze trends like the shift to electric vehicles and changing demand patterns. Evaluate companies' financial health, including revenue, profit, debt levels, and cash flow. Lastly, monitor regulatory changes related to emissions, vehicle safety, and fuel usage, as they can significantly impact auto stocks.

Factors to consider to invest in Banking stocks?

Before investing in banking stocks in India, consider key factors such as macroeconomic conditions, regulatory norms, credit and deposit growth, net interest income (NII), net interest margin (NIM), and non-performing assets (NPAs). These factors can significantly impact the performance and trajectory of banking stocks. Keep a close watch on regulatory changes, economic trends, and financial metrics to make informed investment decisions.

How Can I Trade on Indian stocks?

Traders can utilize the Enrich Money platform to trade efficiently in the Indian Stock Market.

Which are the top stocks in the automobile, IT, and banking sectors in India in 2024?

Some of the top stocks in these sectors include Maruti Suzuki India Limited, Tata Consultancy Services Limited, and ICICI Bank.

Disclaimer: This blog is dedicated exclusively for educational purposes. Please note that the securities and investments mentioned here are provided for informative purposes only and should not be construed as recommendations. Kindly ensure thorough research prior to making any investment decisions. Participation in the securities market carries inherent risks, and it's important to carefully review all associated documents before committing to investments. Please be aware that the attainment of investment objectives is not guaranteed. It's important to note that the past performance of securities and instruments does not reliably predict future performance.