Indian IT Sector Q2 FY26 Recovery: Infosys vs Coforge Share Price Analysis

Indian IT Industry Rebounds: Key Insights for Investors

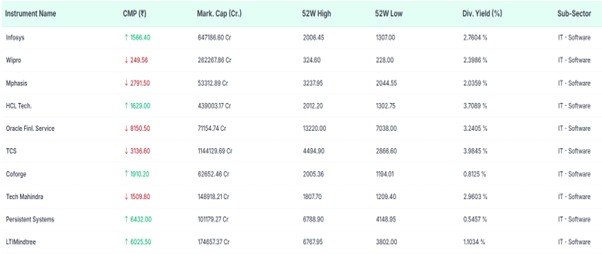

Investors eyeing the Indian IT sector should note a marked rebound in Q2 FY26, led by rapid growth in mid-tier players like Coforge. Smaller and mid-sized technology players, such as those from tier-2 cities, are leading the show with better revenue growth and profitability, while large players like Infosys, Wipro, Tech Mahindra and Tata Consultancy Services are meeting estimates steadily. Sales for the broader corporate landscape, including IT, increased to about 8% year-on-year from 6% earlier in Q2FY2026.

Market-wise, the Nifty IT Index stood at 37,655.25 as of Nov 27,2025 which follows closely with dominant players like Infosys (228.26%), TCS( 21.84%) and HCL Technologies (11.42%) which is accounting for most of the weighting. For the group, the price-to-earnings stands near 28 times, though returns vary widely: outperformers like Coforge gained more than 6% in the last year, while others lag.?

Nifty IT Recent Trend:

Key Constituents by Weightage

Profitability was helped by favourable exchange rates, delayed salary hikes, and fewer one-off charges, with offshore-heavy businesses reporting the largest increases. HCL Tech's consistent EBIT margins stood at 17-18%, while Infosys maintained a 20-22% level. Employee growth is also picking up-Infosys added 8,200 in the best hiring since early 2023-and Cognizant added 6,000-indicating growing customer demand. ? Longer-term, AI tools, cloud shifts and digital upgrades are fuelling pipelines, setting up selective opportunities amid cautious global spending. The combination of improving macros, margin support, and emerging tech themes sets up Indian IT as a steady, though selective, opportunity within the Indian stock market.

Company Profiles & Business Segments

Overview of Infosys, Business Mix, Strategy, and Recent Trends

Infosys started with $250 in seed capital in 1981, and it is now a Top 3 global leader in IT across more than 50 countries and 1900 clients. Key verticals include BFSI-the largest vertical-Retail/Consumer, Communications, Energy/Utilities, Manufacturing, and Public Services. Its portfolio runs the gamut from consulting to AI-the Topaz platform-cloud, and automation for digital transformation. Recent AI-first initiative ensures stable growth; strong cash conversion delights conservative investors.?

Coforge: Overview, Business Mix, Strategy & Recent Trends

Coforge-ex NIIT Tech today is among the top-7 mid-cap companies in India, built through large acquisitions and restructuring. Focus areas: BFSI, TTH, Healthcare/Retail. Digital Engineering, AI/ML, Cloud and Cybersecurity. INR 100M+ large deal aggression, platforms Orion/Quasar drive low attrition to lead 30%+ FY25 CC growth and $1.63B book to next phase.

Infosys vs Coforge Share Price Overview

While comparing Infosys vs Coforge share price trends, Infosys share rate trades at Rs.1,559, up near 2% in the recent past against a proposed Rs. 18,000 crore buyback plans, reflecting investor confidence in its stability.

Meanwhile, Coforge limited share price hovers at around Rs.1,871, rallies more than 2.15% in the latest sessions and 6.7% on a one-year horizon, outpacing broader benchmark indices.?

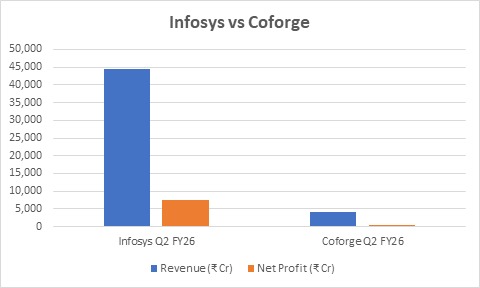

Bengaluru-based global IT powerhouse Infosys reported Q2 FY2026 revenues at Rs.44,490 crore, up 8.6% YoY and 5.2% QoQ, with net profit rising 13% to Rs.7,364 crore and margins at 21%. The company says AI, cloud, and modernization deals are driving steady growth.?

Coforge is a dynamic mid-tier player that has reported stellar Q2 results. Revenues reached Rs.3,986 crore, up 31.7% YoY and 8.1% QoQ, net profit surged 86% to Rs.376 crore, while EBIT margins expanded 251 bps to 14%. Large deal wins of $514 million support its North America focus.?

Infosys offers scale and dividends; Coforge shines in growth and efficiency .The Key contrasts between two stocks in today's IT rally.

Q2 FY2026 Comparison: Infosys vs Coforge

Infosys and Coforge are indicative of two different strengths within the IT sector in India, and this difference becomes even more relevant for investors who are tracking Infosys vs Coforge share price movements. Both benefited in Q2 FY2026 (ended Sept 30, 2025) from AI-led demand and healthier deal flows, but their trajectories were different.

Infosys delivered steady large-scale growth, while Coforge posted fast, high-beta expansion with rapidly improving margins.

Revenue Trends & Growth Drivers

Infosys announced Rs.44,490 crore revenue, which grew by 8.6% YoY and 5.2% QoQ, on the back of $3.1B TCV (Total Contract Value) with strong net-new deal contribution. Such stability usually reflects in the Infosys share price where Infosys usually trades with lower volatility.

Meanwhile, Coforge reported Rs.3,986 crore revenues, representing a growth of 31.7% YoY and 8.1% QoQ. The $514M order intake and $1.63B executable order book underlined its aggressive growth engine. This kind of fast growth often becomes the harbinger of short-term movements .

Profitability & Margin Strength

Infosys posted a net profit of Rs.7,364 crore, up 13.2% YoY, on a stable 21% operating margin, while generating Rs.9,677 crore in free cash flow that allows for strong buyback visibility which is another factor long-term investors consider.

Coforge reported a very strong quarter: 86% YoY growth in net profit, with EBIT margins coming at 14%. Low attrition and better pricing boosted profitability, which often explains why the stock reacts sharply during earnings season .

Key Metrics Snapshot

|

Metric |

YoY Change (Infosys / Coforge) |

||

|

Revenue (Rs. Cr) |

44,490 |

3,986 |

+8.6% / +31.7% |

|

Net Profit (Rs. Cr) |

7,364 |

376 |

+13.2% / +86% |

|

Operating Margin (%) |

21.0 |

14.0 |

-0.1 pts / +2.4 pts |

|

Basic EPS (Rs.) |

17.76 |

~11.21 |

+13.1% / +82% |

|

Deal TCV ($ Mn) |

3,100 |

514 |

— / +26.7% book |

|

Free Cash Flow (Rs. Cr) |

9,677 |

N/A |

+38% / Strong EBITDA |

|

Headcount / Attrition |

Stable / Moderate |

34,896 (+709) / 11.4% |

— / Low |

Strategic Insights and Investor Takeaways

Infosys is in keeping with predictable growth via AI-led solutions, renewals, and diversified geographies. The lower risk profile tends to attract investors.

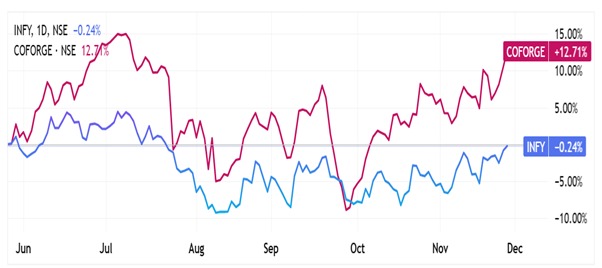

Coforge continues to capitalize on strong deal flow and margin upgrades, but its high-beta nature makes it more volatile. This is why short-term traders pay close attention to it when doing a relative study of Infosys vs Coforge share price movements.

While Infosys offers stable compounding returns for conservative investors, Coforge appeals to growth seekers willing to navigate higher volatility

Infosys vs Coforge share price chart: Stability vs Momentum (Nov 2025)

For those comparing Infosys vs Coforge share price, the decision boils down to risk appetite: Infosys for steady compounding and Coforge for swifter upside potential.

Share Price & Valuation Analysis

Infosys

Infosys market share is trading around Rs.1,559, reflecting the recent 2% rise mainly driven by

-

the approved Rs.18,000 crore share buyback,

-

strong Q2 FY26 earnings with

-

8.6% revenue growth, and

-

a dividend payout of Rs.23 per share.

This stability is supported by favourable rupee depreciation and momentum in the Nifty IT index.

Its valuation multiples include a price-to-earnings (P/E) ratio of 22-25, price-to-book (P/B) ratio between 7-8, and dividend yield of 2-2.5%, appealing to conservative, value-focused investors.

Coforge

Share price of Coforge ltd are trading near Rs.1,871, up about 2.15% in the last day and up 6.7% in the last one year, driven by

-

its strong Q2 results,

-

where revenues rose 31.7% YoY and

-

profits 86%,

-

large deal wins worth US$514 million, and

-

low employee attrition.

Coforge enjoys higher valuation multiples, P/E of 54-102, P/B of 9-10, but a lower dividend yield of 0.23-0.94%, reflecting its growth premium and reinvestment focus.

Analysts maintain a positive view on both Infosys vs Coforge share price target, as Infosys has a “Buy” rating with a target price of approximately Rs.2,150, implying almost 38% upside, while the targets for Coforge average between Rs.1,958 to Rs.2,200, underlining the prospects of high and sustained growth for Coforge, coupled with greater volatility.

Investors who have to make a choice between Infosys and Coforge must weigh stable, dividend-oriented growth against high-growth, high-risk opportunities in the Indian IT space.

Key Driving Factors of Infosys vs Coforge Share Price

Following is a list of the key driving factors affecting Infosys vs Coforge share prices.

Infosys Share Price Driving Factors

-

Strong global client base

-

Digital transformation services like cloud, ai, and automation.

-

Consistent financial performance

-

Large deal wins and renewals

-

Strategic acquisitions

-

Favorable market sentiment

-

Regular dividend policy and periodic buybacks

Coforge Share Price Driving Factors

-

Specialized IT services for niche markets.

-

Strong client relationships

-

Agility and innovation such as cloud migration and automation.

-

Strong order book

-

Mid-cap growth story

-

Geographical expansion

-

Financial discipline

It would, therefore, appear that the Infosys company shares are influenced largely by scale, broad service portfolio, and market reputation, while the share price of Coforge draws strength from niche focus, growth potential, and dynamic client engagements.

Risks and Challenges of Infosys vs Coforge share price

Following are the main risks and challenges that would have a bearing on the Infosys vs Coforge share prices given below in points based on recent market dynamics: ?

Infosys Share Price Risks and Challenges

Macroeconomic Uncertainty: Global slowdowns and subdued client discretionary spending bring down revenue growth, as reflected in revised FY26 guidance to 2-3%.?

Evolving Tech Landscape: The rapid changes in AI and cloud necessitate continuous upskilling, though there is a risk of competitive pressures making margins thin.?

Regulatory Headwinds: Changes to the H1B visa and geopolitical tensions-for example, tariffs-disrupt offshore models and raise onsite costs.?

Valuation: Sector-wide sentiment remains poor due to continued FII outflows and stock underperformance-down ~21% in 2025-despite buybacks.

Margin Pressures: Currency fluctuations and increasing sub-contractor costs are testing operating margins at ~21%?.

Coforge Share Price Risks & Challenges

Client Concentration: Heavy reliance on the BFSI and travel sectors wherein the top clients drive huge revenues exposes it to sector-specific slowdowns.?

High Valuation Premium: Trading at elevated multiples leaves room for de-rating if growth falters, amid volatility from client issues.?

Talent and Wage Inflation: High attrition and increasing salaries are squeezing profitability in a competitive mid-cap space.

Execution Risks: Delays in ramp-ups of large deals or integration of acquisitions could hurt short-term performance and stock momentum.?

Macro and currency volatility: U.S./Europe weakness and INR-U.S. dollar swings amplify earnings sensitivity for this growth-oriented company.

Comparative Insight:

Infosys is a larger-scale player and, therefore, exposes itself to broader macro and regulatory risks but offers relative stability with slower growth.

Coforge has higher execution and concentration risks, thus greater price volatility but upside potential in bull phases.

Conclusion

Indian IT firms rebounded in Q2 FY26 with midcaps outperforming large caps on earnings growth at 26% vs 13%. Infosys offers scale and stability at Rs.1,559 with 21% margins, while Coforge at Rs.1,871, it drives hyper-growth with a revenue of +31.7%. In Infosys vs Coforge share price choices, risk tolerance determines steady compounding or rapid upside.?

Follow these trends in real-time on the Enrich Money platform for live analysis and smart trade decisions.

Frequently Asked Questions

1. Where can we find the latest news on Infosys and Coforge share News?

Coforge surged in Q2 FY26 with 31.7% revenue growth versus 8.6% of Infosys, driven by $514M worth of deals in the recovering IT sector.

2. What is the Infosys share price today?

Infosys stands at Rs.1,559, boosted 2% by Rs.18,000 Cr buyback and solid Q2 results. ?

3. What is the Coforge share price today?

Coforge trades near Rs.1,871, up 2.15% daily and 6.7% yearly after strong earnings.

4. What is the Infosys vs Coforge share price target?

Infosys is targeted to trade at Rs.2,150 (+38%) and Coforge at Rs.1,958-2,200 amidst positive analyst views on IT rebound.?

5. What is the Infosys vs Coforge share price prediction?

Infosys is predicted to give stable returns with P/E 22-25 and Coforge is predicted for higher growth but volatile.

Disclaimer: This blog is dedicated exclusively for educational purposes. Please note that the securities and investments mentioned here are provided for informative purposes only and should not be construed as recommendations. Kindly ensure thorough research prior to making any investment decisions. Participation in the securities market carries inherent risks, and it's important to carefully review all associated documents before committing to investments. Please be aware that the attainment of investment objectives is not guaranteed. It's important to note that the past performance of securities and instruments does not reliably predict future performance.