Stocks under Rs. 100 with High Piotroski Scores to Watch in 2025

Investors looking for value often seek out stocks with strong financial metrics that are also affordably priced. One such reliable metric for identifying financial stability and growth potential is the Piotroski Score. Developed by accounting professor Joseph Piotroski, this scoring system helps investors evaluate a company’s financial strength across nine criteria, with a score closer to 9 indicating healthier financials. A high Piotroski Score can suggest that a company is financially robust, profitable, and more likely to deliver long-term growth.

In this article, we explore a range of affordable stocks, each priced below Rs. 100 and carrying a high Piotroski Score. These are worth watching closely as potential value investments in 2025.

Why the Piotroski Score Matters for Investors

Before examining specific stocks, it's essential to understand why the Piotroski Score has gained traction among value investors. This score evaluates nine criteria across three categories, each of which assesses a different aspect of financial health. Here’s a closer look at these three categories:

-

Profitability: The capacity of a company to consistently produce profits serves as a strong indicator of its financial stability.The Piotroski Score assesses a company’s profitability by looking at metrics such as positive returns on assets, operating cash flow, and trends in net income.

-

Leverage, Liquidity, and Source of Funds: High leverage and inadequate liquidity can pose significant risks, even for otherwise profitable companies. This section assesses a company’s debt reduction efforts, current ratio, and whether the firm has enough cash flow to cover its liabilities without resorting to borrowing.

-

Operating Efficiency: Companies improving their operating efficiency have a stronger capacity to use resources effectively. Metrics like asset turnover rate are used to gauge improvements in operational efficiency.

A high Piotroski Score, ideally between 7 and 9, suggests that a company has a solid foundation and is improving or maintaining strong financial health. For investors, it is an indicator of companies that may offer reliable returns over the long term. Now, let's delve into some top-performing stocks priced below Rs. 100 with high Piotroski Scores in 2025.

Top Stocks under Rs. 100 with High Piotroski Scores

These are some of the top picks under Rs. 100 that boast high Piotroski Scores, which may indicate promising performance.

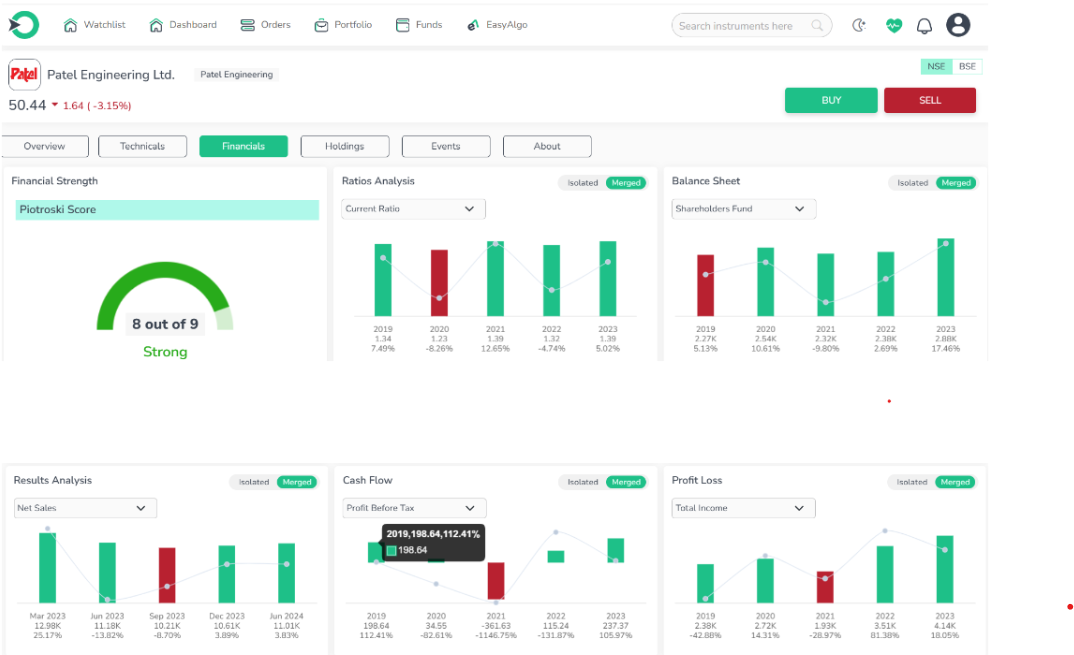

1. Patel Engineering Ltd (NS)

Patel Engineering Ltd is a leader in the Indian infrastructure sector, handling major civil engineering and construction projects. Its primary strengths are in large-scale infrastructure projects, including dams, tunnels, and highways.

-

Financial Highlights:

Revenue Growth: The company saw a notable 27% increase in revenue, rising from Rs. 1,061.01 crores in December to Rs. 1,343.18 crores in March.

Profit Boost: Patel Engineering saw its net profit more than double, increasing from Rs.68.59 crore to Rs. 140.94 crore in the same period.

Return on Equity (RoE): RoE rose from 3.78% in FY 21-22 to 6.78% in FY 22-23.

Return on Capital Employed (RoCE): RoCE climbed from 9.26% to 10.64%, signaling improved capital efficiency.

Notably, Vijay Kedia, a respected figure in the investment community, holds a 1.42% stake in Patel Engineering via Kedia Securities Private Limited, a vote of confidence in the stock.

-

Why Add to Your Watchlist: Patel Engineering's strong fundamentals, significant revenue and profit growth, and high Piotroski Score make it an attractive choice for those looking to add affordable infrastructure stocks to their portfolios. The company's focus on large infrastructure projects aligns with India’s ambitions for infrastructure growth, which adds further potential.

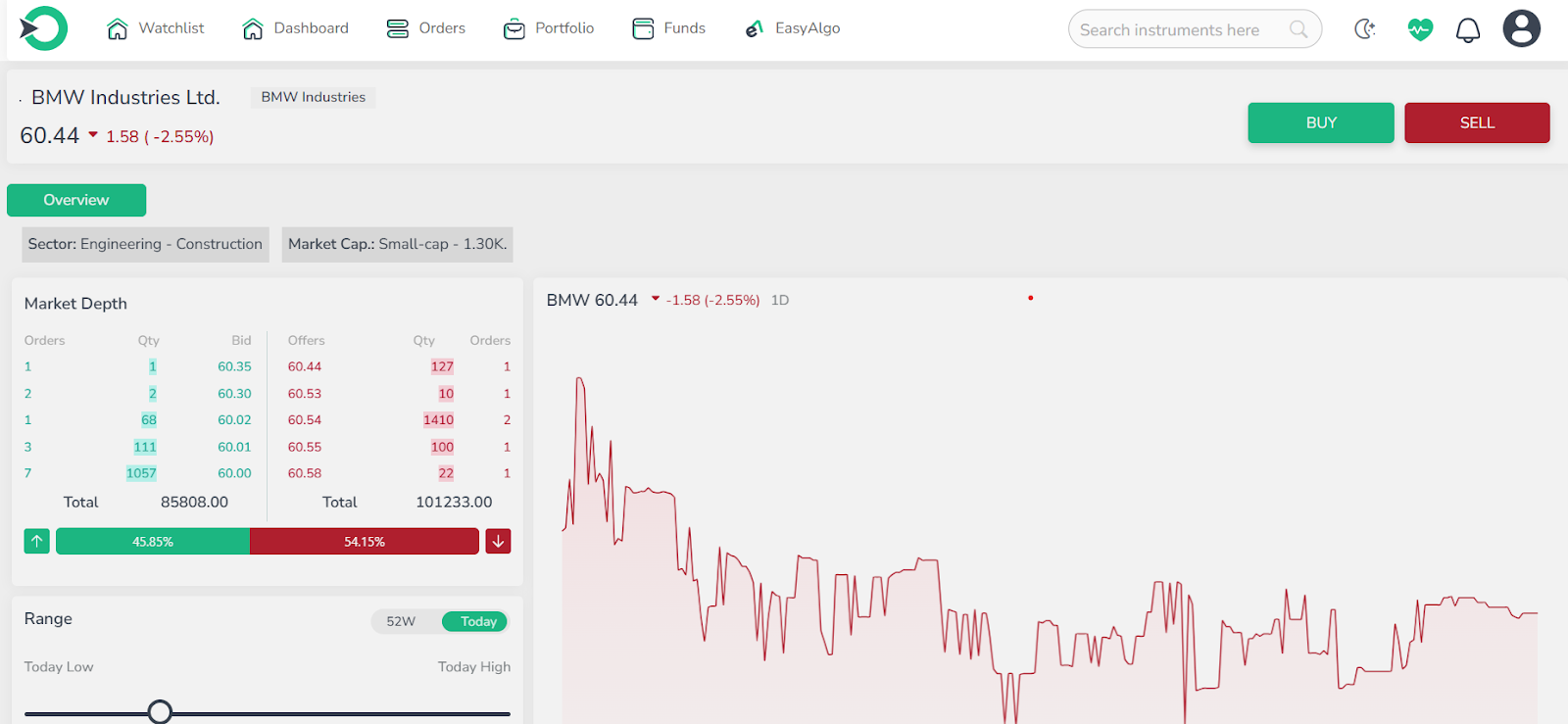

2. BMW Industries Ltd

BMW Industries Ltd is a manufacturer of steel products, serving industries like construction, engineering, and infrastructure.

-

Financial Highlights:

Revenue: BMW Industries reported a slight 5% decrease in revenue, falling from Rs. 143.93 crores in December to Rs. 137.31 crores in March. Despite this dip, the company achieved notable profit growth.

Profit Increase:Net profits saw a significant rise, increasing by 65% from Rs. 11.52 crores to Rs. 19 crores.

Return on Capital Employed (RoCE): RoCE rose from 8.35% to 11.68%, showing better capital efficiency.

-

Why Add to Your Watchlist: BMW Industries’ robust profit growth and high Piotroski Score make it an interesting pick, especially for investors eyeing the steel and infrastructure industries. As the demand for steel remains high in India’s expanding infrastructure sector, the company’s potential for growth strengthens.

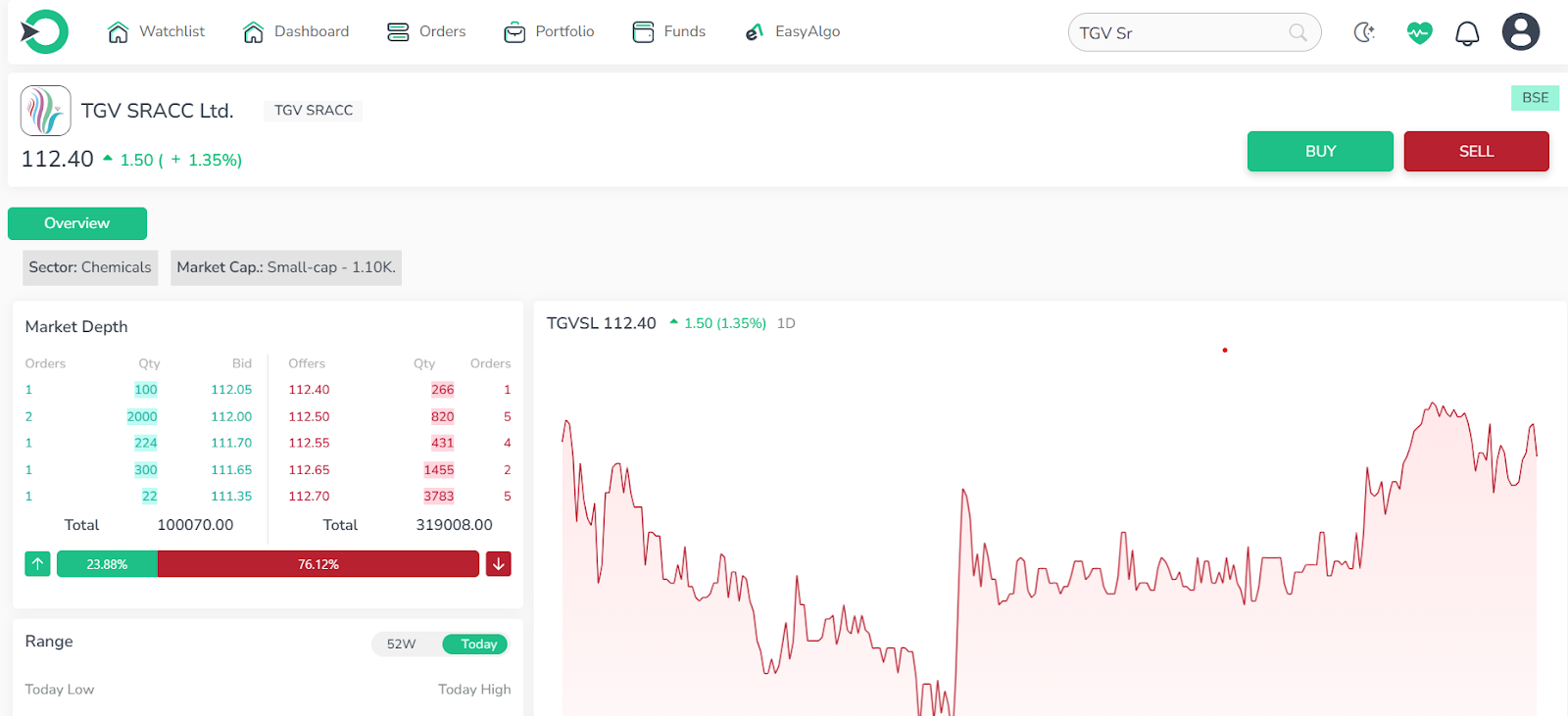

3. TGV Sraac Ltd

TGV Sraac Ltd is a significant player in the chemical industry, specializing in Chlor-Alkali products used across pharmaceuticals, textiles, and agriculture sectors.

-

Financial Highlights:

Revenue Growth: Revenue grew 12% from Rs. 360.35 crores in September to Rs. 402.21 crores in December.

Profit Decrease: Profits dropped by 18% from Rs. 18.6 crores to Rs. 15.21 crores, primarily due to higher operating expenses.

Return on Equity (RoE): Jumped from 19.18% in FY 21-22 to 40.40% in FY 22-23.

Return on Capital Employed (RoCE): Soared from 19.91% to 35.58%, demonstrating strong returns on invested capital.

-

Why Add to Your Watchlist: A Piotroski Score of 9 coupled with impressive ROE and ROCE metrics indicates TGV Sraac Ltd’s resilience and potential. For investors interested in the chemical sector, this stock holds substantial promise.

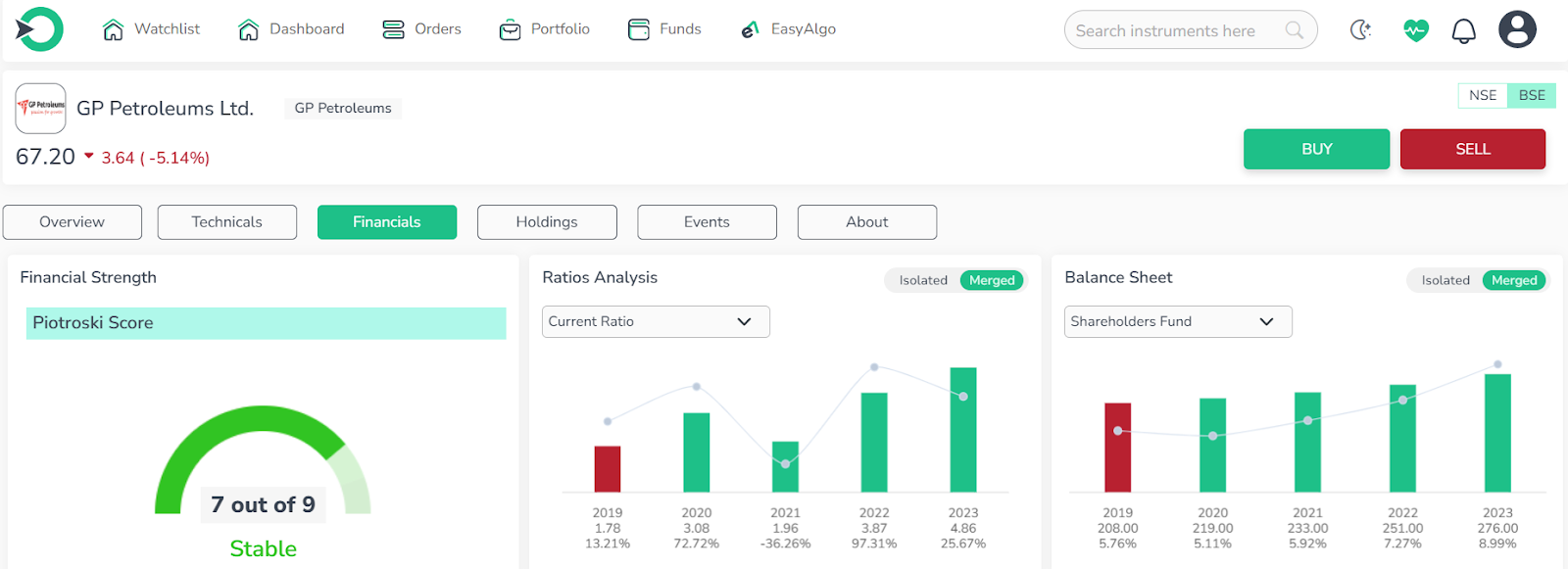

4. GP Petroleums Ltd

GP Petroleums Ltd specializes in automotive lubricants and is a recognized name in the sector, manufacturing a wide range of lubricants for industrial and automotive use.

-

Financial Highlights:

Revenue: The company experienced a 4% decline in revenue from Rs. 161.98 crores in September to Rs. 154.96 crores in December.

Profit Decline: Profitability decreased by 32%, indicating potential challenges in the competitive lubricant market.

Return on Equity (RoE): Rose from 7.82% in FY 21-22 to 9.55% in FY 22-23.

Return on Capital Employed (RoCE): Improved from 8.44% to 11.36%, showing better capital efficiency.

-

Why Add to Your Watchlist: GP Petroleums’ high Piotroski Score and consistent ROE and ROCE improvements make it a viable option for investors interested in the automotive sector.

Conclusion

These high Piotroski Score stocks under Rs. 100 provides diverse options across various sectors, including infrastructure, steel, chemicals, and automotive lubricants. Each of these companies shows strong financial metrics, offering value investors opportunities to invest in affordable yet financially solid stocks. Tracking these stocks’ performances while considering their Piotroski Scores can help investors make well-informed decisions for long-term growth.

Frequently Asked Questions

-

What is the Piotroski Score?

The Piotroski Score is a nine-point scoring system that assesses a company’s financial health. A higher score indicates stronger fundamentals.

-

Why consider stocks under Rs. 100?

Stocks under Rs. 100 are affordable and can offer significant growth potential, especially if they have high Piotroski Scores signaling financial stability.

-

How does the Piotroski Score benefit investors?

It helps investors filter out financially weak companies by focusing on key indicators of profitability, liquidity, and efficiency, aiding in finding value stocks with growth potential.

-

Is a Piotroski Score of 9 the highest?

Yes, 9 is the maximum Piotroski Score, suggesting the company meets all nine financial health criteria.

-

Should I rely solely on the Piotroski Score for investment decisions?

While helpful, the Piotroski Score is best used alongside other analyses and metrics. Diversified research provides a fuller picture of a stock’s investment potential.

Disclaimer: This blog is dedicated exclusively for educational purposes. Please note that the securities and investments mentioned here are provided for informative purposes only and should not be construed as recommendations. Kindly ensure thorough research prior to making any investment decisions. Participation in the securities market carries inherent risks, and it's important to carefully review all associated documents before committing to investments. Please be aware that the attainment of investment objectives is not guaranteed. It's important to note that the past performance of securities and instruments does not reliably predict future performance.