Top-Rated Gold Stocks in India for May 2024

Introduction:

In India, gold holds a revered position entrenched in tradition and cultural heritage, rendering it an enduring asset cherished nationwide. Boasting a mining legacy spanning over two millennia, India is rich in mineral resources, with substantial reserves of gold contributing to its economic landscape. The gold mining sector serves as a catalyst for economic growth, fostering employment opportunities and attracting both domestic and foreign investments.

Internationally, India ranks second in the global gold market, commanding approximately a quarter of the world's gold demands. To bolster domestic manufacturing and production within the gold industry, the Government of India has launched the 'Make in India in Gold' initiative. This strategic endeavor aims to augment the nation's capacity for producing gold-related goods, spur exports, and catalyze economic growth within the sector.

Highlighting the enduring nature of this precious metal, the World Gold Council (WGC) underscores a steady annual increase of 15% in investment demand for gold stocks since 2001. According to projections by the WGC, India's gold demand is poised for an upward trajectory. As consumers adapt to escalating prices, the demand for gold is expected to surge throughout the year. Specifically, it is anticipated that India’s gold demand, which has plateaued between 700 and 800 metric tons over the past five years, will escalate to between 800 and 900 tons in 2024.

Best Gold Stocks in India in 2024 as per Market Capitalisation

The table below lists the Top gold stocks in India based on market capitalization.

|

S.No. |

Gold Stocks in India (as per market capitalisation) |

PE Ratio |

PB Ratio |

Dividend Yield |

|

1 |

90.62 |

26.61 |

0.31 |

|

|

2 |

19.08 |

3.11 |

1.28 |

|

|

3 |

97.94 |

11.67 |

0.12 |

|

|

4 |

6.45 |

0.63 |

- |

|

|

5 |

44.96 |

9.22 |

0.46 |

Overview of the premier gold stocks in India ranked by market capitalization.

India's gold stock market holds substantial sway in the global gold industry, drawing keen attention from investors and traders worldwide. Here's an in-depth exploration of the gold sector stocks in India, as per market capitalization:

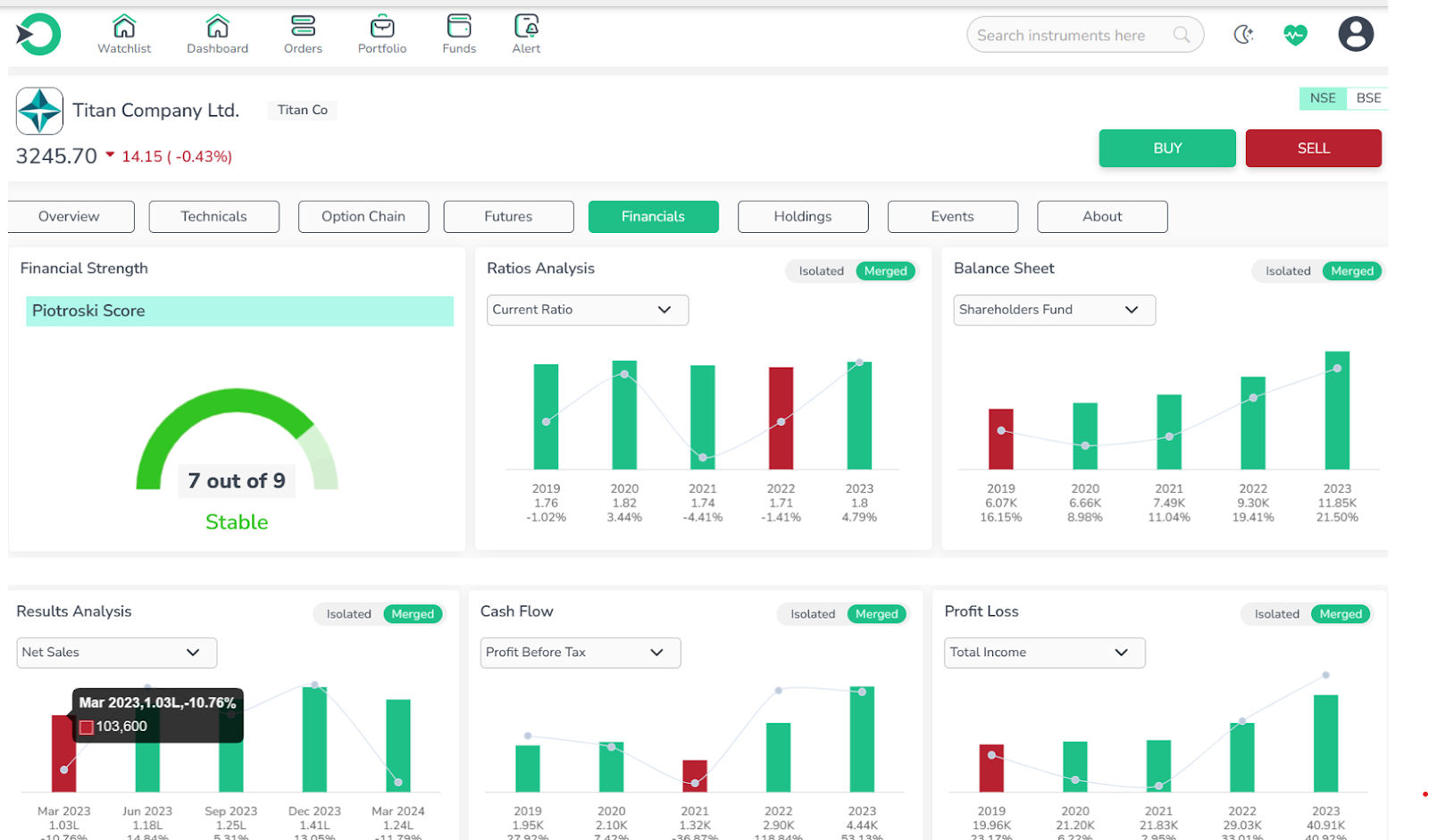

1.Titan Company

Titan Company Ltd. (Titan) emerged as a joint venture between the Tata Group and the Tamil Nadu Industrial Development Corporation (TIDCO). Today, it stands as the fifth largest integrated own-brand watch manufacturer globally. Titan's trajectory unfolds across three decades, characterized by strategic expansion into untapped markets and the establishment of lifestyle brands spanning diverse product categories.

-

Performance: Average price returns, lacking excitement.

-

Valuation: Appears overvalued compared to market averages.

-

Growth: Moderate financial growth over recent years, with revenue increasing at a yearly rate of 20.33%, market share rising from 6.63% to 9.5%, and net income growing at a yearly rate of 23.52%.

-

Profitability: Demonstrating strong signs of profitability and efficiency.

-

Current dividend yield stands at 0.31%, with an expected annual dividend of Rs. 3.09 for a Rs.1,000 investment.

-

Entry point: Stock is averagely priced but not in the overbought zone.

Titan stands out as one of the best gold stocks, supported by its consistent dividend yield and strong profitability. Despite average price returns and a perceived overvaluation, its moderate financial growth, expanding market share, and impressive net income growth underscore its resilience and potential for investors. With its averagely priced entry point and signs of profitability, Titan remains a promising choice in the gold stock market.

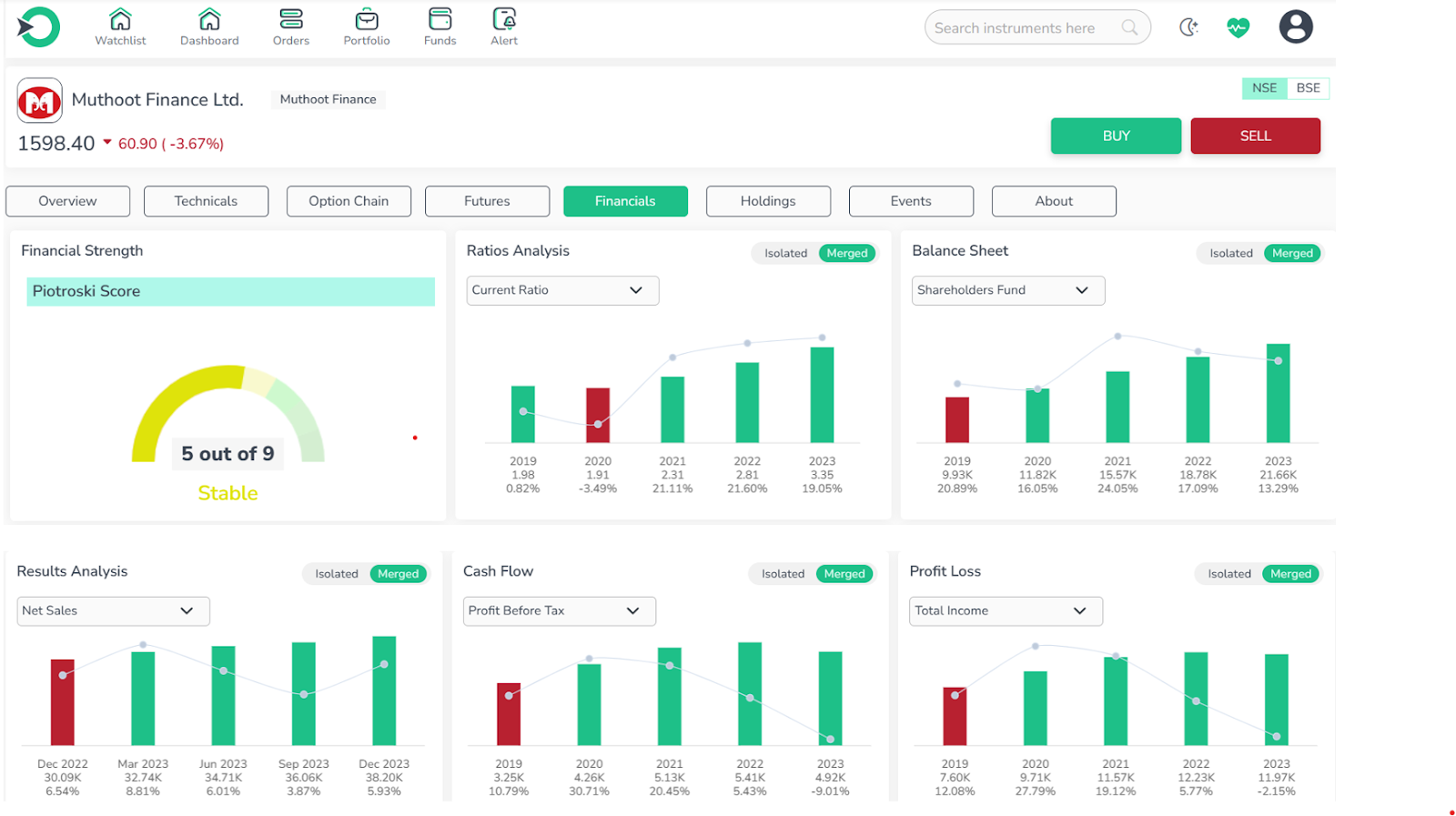

2.Muthoot Finance

Muthoot Finance Limited commenced its journey as a private limited company on March 14, 1997, before transitioning into a public limited company on November 18, 2008. As a leading non-banking financial company (NBFC), it specializes in providing loans against gold jewelry collateral, alongside a range of services including foreign inward money transfers, foreign exchange services, and insurance broking.

-

Performance: Average price returns, lacking excitement.

-

Valuation: High, indicating overvaluation compared to the market average.

-

Growth: Low financial growth, trailing behind the market, with revenue growing at a yearly rate of 12.04% over the last 5 years, below the industry average of 14.19%, and a decrease in market share from 6.78% to 6.65%.

-

Profitability: High, demonstrating good signs of profitability and efficiency, with net income growing at a yearly rate of 14.57% over the last 5 years, although lower than the industry average of 21.55%.

-

Entry point: Good, the stock is underpriced and not in the overbought zone, with a current dividend yield of 1.28%, expected to generate Rs. 12.81 annually for a Rs. 1,000 investment.

Muthoot Finance emerges as a strong contender among gold stocks, backed by its underpriced entry point and consistent profitability despite modest growth rates. While facing challenges such as lower-than-average financial growth, its stable dividend yield and efficient operations position it favorably for investors seeking reliable returns in the gold market.

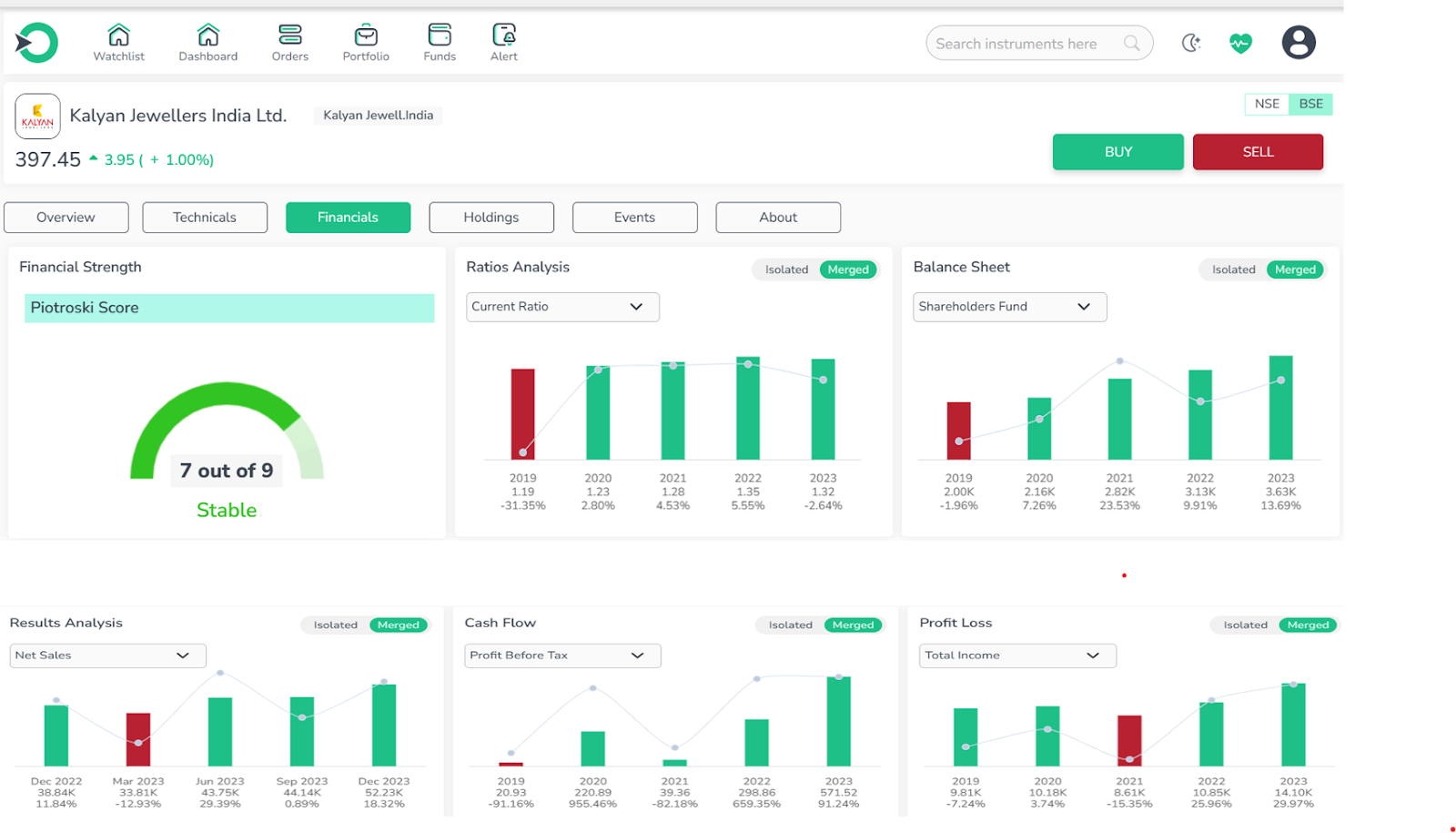

3.Kalyan Jewellers India

Kalyan Jewellers India stands as one of India's leading jewelry companies, originating from a single showroom in Thrissur, Kerala in 1993, and evolving into a nationwide presence. Their commitment lies in addressing diverse customer preferences across different regions, leveraging local market knowledge and tailored marketing strategies to ensure customer satisfaction and market relevance.

-

Performance: Average price returns, lacking excitement.

-

Valuation: High, indicating overvaluation compared to the market average.

-

Growth: Low financial growth, lagging behind the market, with revenue growing at a yearly rate of 5.97% over the last 5 years, below the industry average of 11.72%, and a decrease in market share from 4.32% to 3.28%.

-

Profitability: High, showing good signs of profitability and efficiency, with net income growing at a yearly rate of 24.92% over the last 5 years, outperforming the industry average of 9.93%.

-

Entry point: Average, the stock is overpriced but not in the overbought zone.

While Kalyan Jewellers India exhibits average performance and faces challenges in growth and valuation, its high profitability and consistent net income growth position it as a promising choice among gold stocks, appealing to investors seeking stable returns despite market fluctuations.

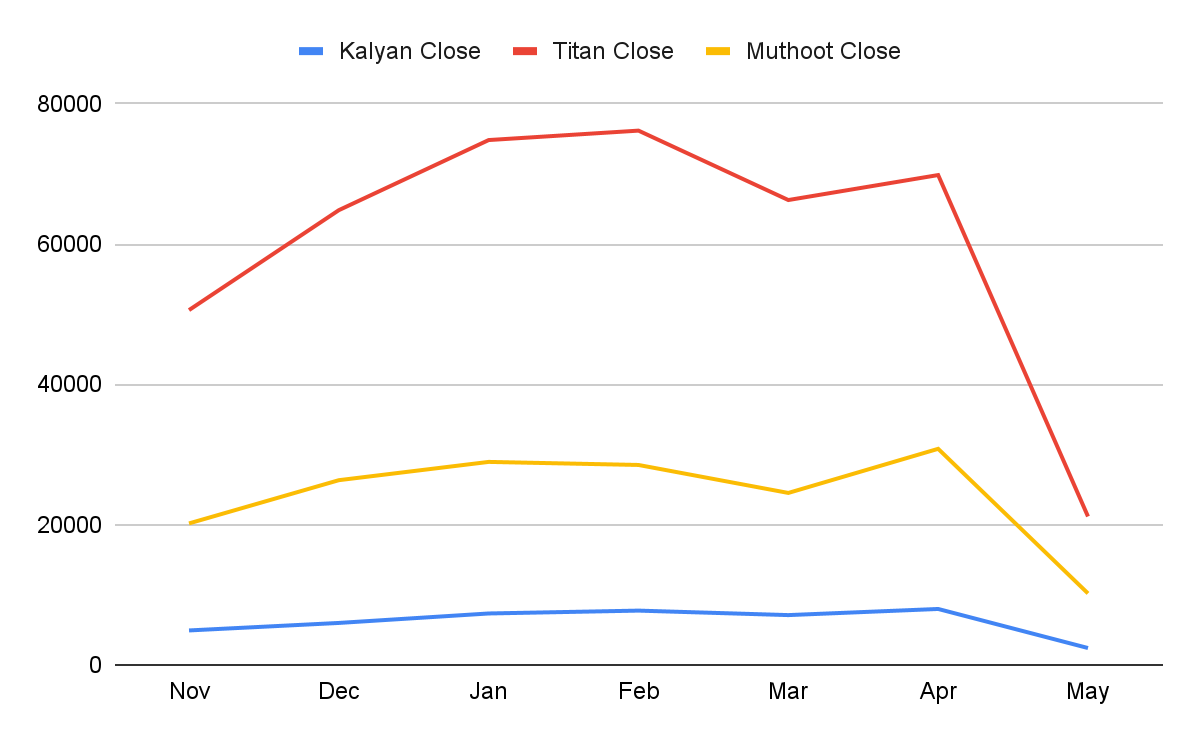

Price comparison of the Three Gold Stocks

-

Kalyan Jewellers India's stock price fluctuates between 313.35 and 433.55 from November to March, showing moderate volatility.The stock experiences a slight decline in April and May, with prices ranging between 401.5 and 412.9.Overall, the stock exhibits moderate fluctuations with no clear trend in the given period.

-

Titan's stock price fluctuates between 3256.35 and 3756 from November to April, indicating moderate volatility.There is a slight decline in April and May, with prices ranging between 3284 and 3605.Overall, the stock shows moderate fluctuations with no significant trend observed during the period.

-

Muthoot Finance's stock price fluctuates between 1273.25 and 1663 from November to April, showing moderate volatility.There is a slight increase in April and May, with prices ranging between 1646 and 1716.45.Overall, the stock exhibits moderate fluctuations with a slight upward trend towards the end of the period.

In summary, all three companies experience moderate fluctuations in their stock prices over the given period, with no clear trend observed.

Advantages of Investing in Gold Stocks

-

Gold stocks act as a hedge against inflation, shielding portfolios from purchasing power erosion during inflationary periods.

-

They serve as a safe haven asset, offering stability and security amidst economic uncertainty and market volatility.

-

Investing in gold stocks aids portfolio diversification, spreading risk across various asset classes.

-

Gold stocks are highly liquid, facilitating easy buying and selling on the stock market.

-

They provide exposure to gold price movements, allowing investors to capitalize on potential increases in the precious metal's value.

-

Overall, gold stocks offer investors a unique opportunity to diversify portfolios and potentially benefit from the stability and growth of the gold market.

Key Considerations Before Investing in Gold Stocks

-

Evaluate the risk and potential rewards associated with investing in gold stocks, considering factors like geopolitical events, changes in gold stock prices in India, and company-specific risks, which can contribute to volatility in performance.

-

Analyze the historical performance of gold stocks to identify patterns and trends, but remember that past performance is not a guarantee of future results. Utilize it as a reference rather than a definitive guide.

-

Assess the quality of management in the companies you're considering investing in, considering factors such as experience, track record, strategy, and financial position. Strong management teams and solid financial positions are generally viewed as more attractive investment opportunities.

-

Consider the fees and expenses associated with investing in Indian gold company shares, including management fees charged by ETFs and mutual funds. Compare these costs across different investment options to ensure competitive fees and a favorable value proposition.

Investing in Gold Stocks with Enrich Money

Enrich Money offers an intuitive platform for investing in gold stocks listed on Indian stock exchanges. Here's how to get started:

-

Open a Demat account with Enrich Money (if you haven't already).

-

Conduct thorough research on the gold mining firms that pique your interest.

-

Utilize Enrich Money's ORCA APP research tools and insights to make informed decisions.

-

Purchase shares of the chosen gold stocks through the Enrich Money platform.

Conclusion

Gold maintains its status as a valuable asset across centuries, retaining strong appeal as an investment avenue. Assessing the gold company share prices in India from various gold mining firms is crucial for investors, given the multitude of factors impacting the gold stock market.

Furthermore, the gold price in the stock market is susceptible to fluctuations, underscoring the importance of comprehensive research and analysis. Before committing to any gold stock, it's imperative to ensure alignment with one's financial objectives and risk tolerance. Historically, gold has proven to be a dependable long-term investment, making it a favorable inclusion in a diversified portfolio.

Frequently Asked Questions

-

How can I invest in Gold sector stocks?

Three popular avenues to invest in Gold Stocks include direct investment in gold mining firms, utilizing gold exchange-traded funds, or selecting gold mutual funds.

-

Is it a good time to invest in Gold stocks?

The finite global supply of gold products assures a potential price increase with rising demand, notably given its indispensable role in electronics, a trend expected to persist. Nonetheless, investors should assess their investment objectives and risk tolerance before delving into Gold stocks.

-

What are sovereign gold bonds?

Sovereign Gold Bonds (SGBs) represent government securities providing an alternative to physical gold ownership, denominated in grams of gold.

-

Can Gold stocks be profitable for investors?

Gold is a favored investment due to its ability to diversify portfolios, acting as a hedge against inflation and a safe haven during market volatility. However, investors should understand both the growth prospects and challenges associated with Gold Stocks before making investment decisions.

-

Do I need to consult a financial advisor before investing in gold stocks?

Seeking advice from a financial advisor can be beneficial, especially if you're new to investing.Discover the guidance and expertise you need to navigate your gold stock investments confidently with Enrich Money's personalized financial advisory services.

Disclaimer: This blog is dedicated exclusively for educational purposes. Please note that the securities and investments mentioned here are provided for informative purposes only and should not be construed as recommendations. Kindly ensure thorough research prior to making any investment decisions. Participation in the securities market carries inherent risks, and it's important to carefully review all associated documents before committing to investments. Please be aware that the attainment of investment objectives is not guaranteed. It's important to note that the past performance of securities and instruments does not reliably predict future performance.