Analyzing the Prospects of India's IPO Market

Introduction

The Indian stock market has witnessed an unprecedented surge in Initial Public Offerings (IPOs) in recent times, shaping the financial landscape and attracting a myriad of investors. As we reflect on the events of 2023 and peer into the horizon of 2024, the burning question is whether the IPO rush will continue its exhilarating momentum.

In this exploration, we delve into insights to dissect the factors fueling the IPO frenzy, expert projections, investor considerations, and the shifting dynamics that could determine the course of IPOs in the Indian market.

The 2023 IPO Boom: A Retrospective Analysis

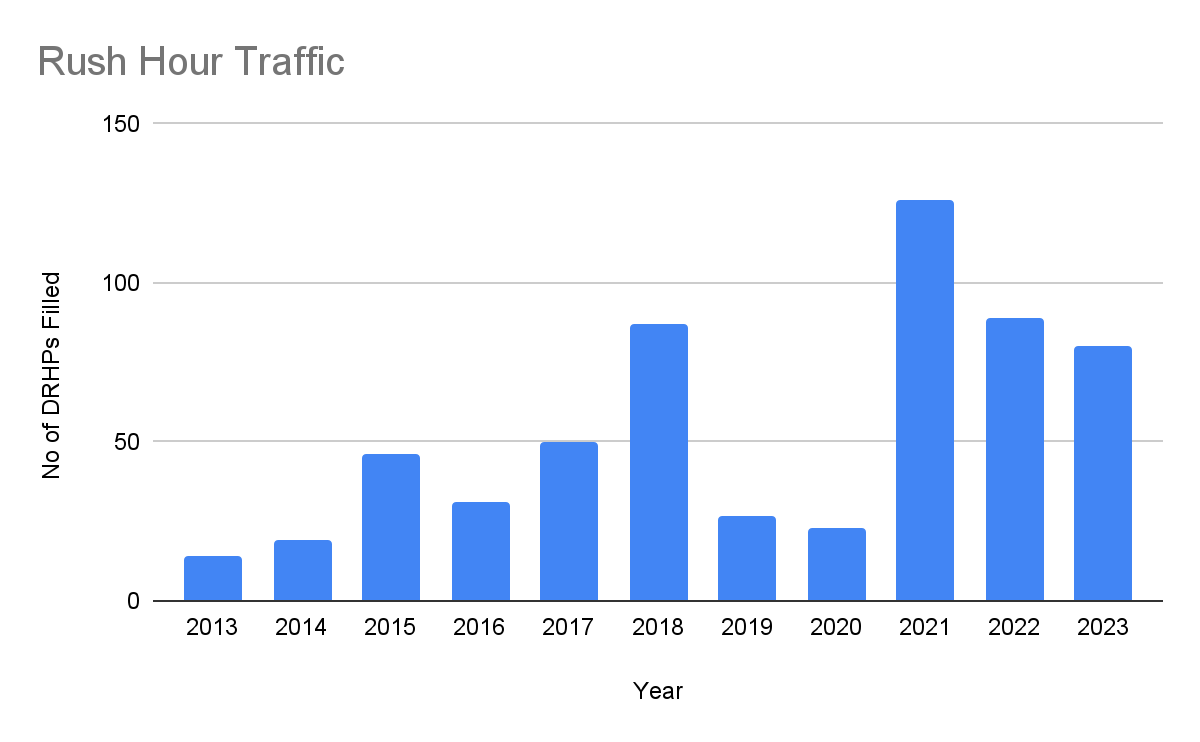

Illustrating the exuberance surrounding IPOs in 2023, a year that witnessed 57 Indian companies accumulating around Rs 49,000 crore through mainboard IPOs, this surge marks the second-highest number in over a decade. Indicating a robust appetite for going public, a substantial 27 companies secured regulatory approval to initiate their public issues, eyeing an additional Rs 29,000 crore. Anticipation heightened as another 29 companies awaited approval, with a cumulative fundraising target of approximately Rs 34,000 crore.

|

Year |

No of IPO's |

Amount Raised (Rs Crore) |

|

2010 |

64 |

37534.65 |

|

2011 |

37 |

5966.28 |

|

2012 |

11 |

6835.28 |

|

2013 |

3 |

1283.79 |

|

2014 |

5 |

1200.94 |

|

2015 |

21 |

13614.08 |

|

2016 |

26 |

26493.84 |

|

2017 |

36 |

67147.44 |

|

2018 |

24 |

30959.07 |

|

2019 |

16 |

12361.56 |

|

2020 |

15 |

26612.62 |

|

2021 |

63 |

118723.17 |

|

2022 |

40 |

59301.71 |

|

2023 |

57 |

49351.37 |

|

SEBI approval was received. |

27 |

28440 |

|

The offer document is filled out and is awaiting SEBI Approval |

29 |

33460 |

The fervor of 2023 appears poised to extend into 2024, with an estimated Rs 60,000 crore in share sales on the horizon. Notable industry players who are newbees are anticipated to make their mark in the primary market, creating an atmosphere of excitement and anticipation.

Driving Forces Behind the IPO Surge

Analysts attribute the sustained enthusiasm for IPOs to a combination of factors, delineated as follows:

-

Robust Economic Growth: The buoyancy in the IPO market is underpinned by robust economic growth, creating a favorable environment for companies to seek public listings.

-

Ample Liquidity: The availability of substantial liquidity in the market serves as a catalyst, enticing companies to tap into the buoyant IPO landscape.

-

Anticipated Rate Cuts: Prospects of anticipated rate cuts from global central banks add to the allure of IPOs, as lower interest rates can enhance the attractiveness of these investments.

-

Political Stability Post Lok Sabha Elections: The expected continuity of the current political regime post the Lok Sabha elections provides a sense of stability, bolstering confidence among investors and market participants.

-

Positive Market Performance: The optimistic outlook is further fueled by the impressive performance of key market indices. The benchmark Sensex and Nifty surged nearly 15 percent each in 2023, with substantial gains witnessed in BSE midcap and smallcap indices.

-

Role of Manufacturing Firms: Manufacturing firms play a pivotal role, benefiting from India's increased capital expenditure and a slowdown in industrial activity in China.

-

High-Profile IPO Expectations: The anticipation of high-profile IPOs from industry giants such as Ebixcash, Tata Play, Indegene, Oravel Stays (OYO), Go Digit General Insurance, and TBO Tek adds to the driving forces behind the sustained IPO rush.

As the market eagerly awaits these developments, the emergence of a critical question revolves around whether these driving forces are sustainable or if the current IPO rush is merely a transient phenomenon.

Expert Opinions and Projections

In the financial analysis domain, it is projected that the enthusiasm for IPOs is likely to persist into 2024. Anticipated rate cuts from both the US Federal Reserve and the Reserve Bank of India (RBI), along with the expected victory of the Bharatiya Janata Party (BJP) in the general elections, provide additional momentum to the ongoing rally.

Contrarily, a note of caution is sounded in another analysis, questioning the wisdom of hastily embracing new IPOs. Using instances like Honasa Consumer Ltd., the emphasis is on the realization that the initial excitement surrounding an IPO doesn't always translate into long-term success. This analysis suggests that adopting a more prudent approach and waiting for post-listing clarity when a company's financials, fundamentals, and market performance are more apparent might be a wise strategy.

Investor Considerations: Navigating the IPO Landscape

-

Investors in the IPO rush navigate a nuanced decision-making process, emphasizing caution and prudence.

-

The undeniable allure of participating in a company's initial public offering attracts investors to the dynamic IPO landscape.

-

A recommended strategy involves exercising patience for post-listing clarity, allowing for a comprehensive understanding of a company's actual value and avoiding impulsive decisions driven by IPO hype.

-

Recent analyses highlight cautionary tales of IPOs trading at significant discounts, emphasizing the importance of due diligence and informed decision-making.

-

The narratives underscore the critical significance of conducting thorough due diligence to make informed decisions in the dynamic landscape of IPO investments.

The Changing Face of IPOs: Evolution and Implications

Analysis from different sources highlights the evolving nature of IPOs. While conventionally regarded as a method for companies to secure funds for growth, contemporary IPOs frequently function as an avenue for existing shareholders to exit. This transformation prompts a reassessment of the actual value extended to new investors through IPOs, leading to a reconsideration of the motives for companies opting to go public.

Opportunities for Investors and Traders

As IPO momentum surges into 2024, investors and traders find themselves at a crossroads of opportunities.

-

Diversification: Explore a varied spectrum of companies entering the market, encompassing high-profile entities such as Ola Electric and Swiggy.

-

Market Boost Potential: Analysts foresee a potential market upswing in the first half of 2024, presenting opportunities for lucrative trades.

-

Strategic Investments: Leverage better investor sentiment and the activity of private equity (PE) and venture capital (VC) funds for strategic investments in IPOs or bulk deals, potentially yielding substantial returns.

-

Traditional Sectors: Manufacturing and financial services are anticipated to sustain robust IPO activity, providing stable avenues for investors. This is particularly relevant in light of the benefits accrued by manufacturing firms due to increased capital expenditure in India and a slowdown in industrial activity in China.

-

Global and Political Factors: Stay vigilant regarding global rate cuts, general elections, and other political developments that have the potential to influence market trends. These factors can serve as strategic entry points for informed investment decisions.

Analysts extend their predictions, anticipating a continued strong performance in IPOs within traditional sectors such as manufacturing and financial services in the coming year. The favorability towards manufacturing firms is accentuated by India's escalating capital expenditure and a deceleration in industrial activity in China.

Conclusion

In conclusion, the trajectory of the IPO rush in the Indian stock market appears to be poised for continued excitement in 2024. The confluence of economic factors, political stability, and global monetary policies creates an environment conducive to IPO fervor. However, caution is warranted, as highlighted by cautionary tales and expert opinions. Striking the right balance between seizing opportunities and practicing prudence will be the key to navigating the ever-evolving landscape of IPO investments. The coming year promises excitement, but success will hinge on a balanced and discerning approach. As investors and traders embark on this journey, a thoughtful and informed strategy will be their compass in the dynamic world of IPOs.

Frequently Asked Questions

-

What fueled the surge in IPOs in the Indian stock market in 2023?

The surge was driven by factors like robust economic growth, ample liquidity, anticipated rate cuts, and positive market performance.

-

How many Indian companies participated in mainboard IPOs in 2023?

In 2023, 57 Indian companies participated in mainboard IPOs, accumulating around Rs 49,000 crore.

-

What considerations should investors keep in mind during the IPO rush?

Investors should exercise patience for post-listing clarity, conduct thorough due diligence, and be cautious of IPOs trading at discounts.

-

How has the changing face of IPOs impacted investor decisions?

The evolving nature of IPOs, which serve as an exit avenue for existing shareholders, prompts a reassessment of their actual value for new investors.

-

How did key market indices perform in 2023, and how does this relate to the sustained IPO enthusiasm?

The benchmark Sensex and Nifty surged nearly 15 percent each in 2023, with substantial gains witnessed in BSE midcap and smallcap indices, contributing to positive market performance.

-

How do I invest in upcoming IPOs?

To invest in upcoming IPOs, sign up with Enrich Money, obtain a free Demat account, stay updated on new IPOs, research the company's financials, and apply online.

Related Blogs

Disclaimer: This blog is dedicated exclusively for educational purposes. Please note that the securities and investments mentioned here are provided for informative purposes only and should not be construed as recommendations. Kindly ensure thorough research prior to making any investment decisions. Participation in the securities market carries inherent risks, and it's important to carefully review all associated documents before committing to investments. Please be aware that the attainment of investment objectives is not guaranteed. It's important to note that the past performance of securities and instruments does not reliably predict future performance.